India EV Charging Station Market Outlook 2030

Region:Asia

Author(s):Shreya

Product Code:KROD263

June 2024

100

About the Report

India EV Charging Station Market Overview

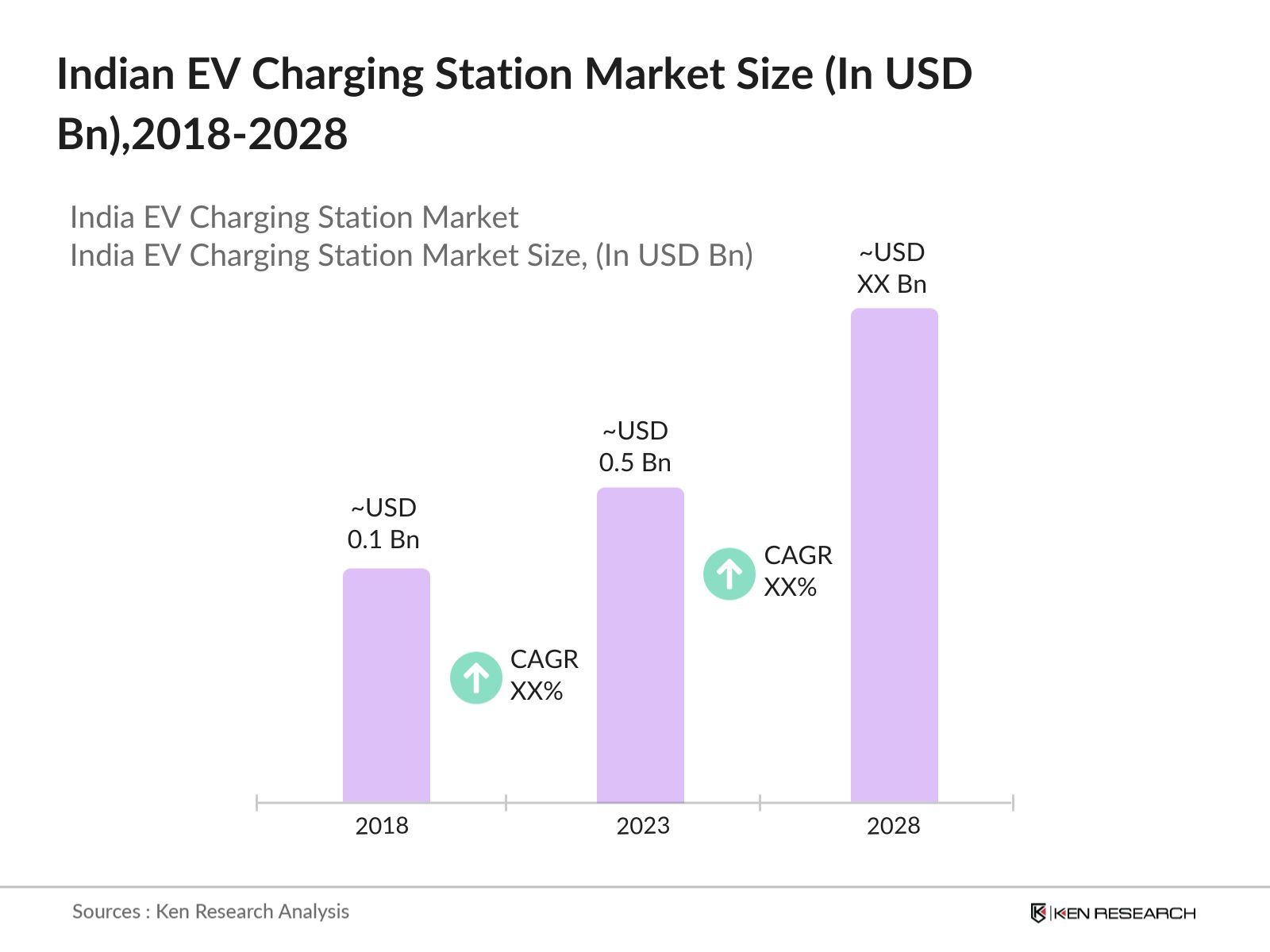

In 2018, the market size was around USD 0.1 billion. The market has experienced substantial growth due to rising environmental awareness and supportive government policies.

The India EV charging station market was valued at USD 0.5 billion in 2023. The market has grown at an exponential CAGR. The expansion of charging infrastructure and increasing EV sales are major contributors to this growth.

Key players in the market include Tata Power, EV Motors India, Fortum India, and ChargeGrid by Magenta Power.

The primary drivers include government incentives, increasing demand for EVs, advancements in charging technology, and growing environmental concerns among consumers.

India EV Charging Station Current Market Analysis

- The market is currently characterized by a rapidly expanding network of EV charging stations, with urban areas witnessing the highest concentration. Public charging stations and home chargers are the most common types.

- Fast chargers are the major product in the market due to their ability to significantly reduce charging time, thus catering to the needs of urban users who require quick recharges.

- Consumers prefer fast and reliable charging solutions, with a growing inclination towards integrated charging networks that offer multiple charging options in one place.

- Public charging stations are the dominant segment, driven by increasing urbanization, government support, and the need for accessible charging options for EV owners.

India EV Charging Station Market Segmentations

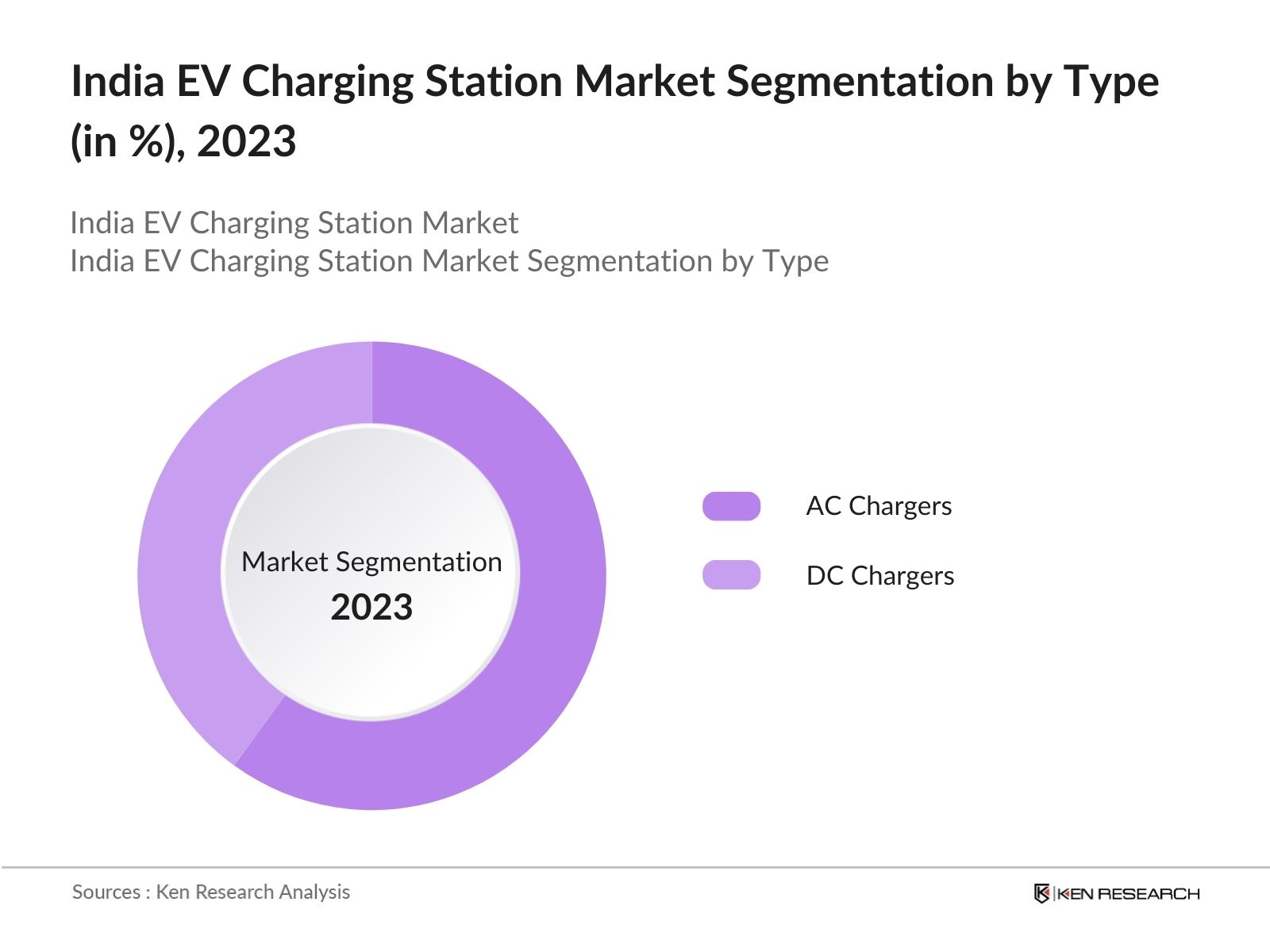

By Charger Type: In India EV Charging Station market, AC chargers dominate in 2023, due to lower costs and their suitability for residential and commercial use. These chargers are widely adopted for their compatibility with existing power systems and ease of installation.

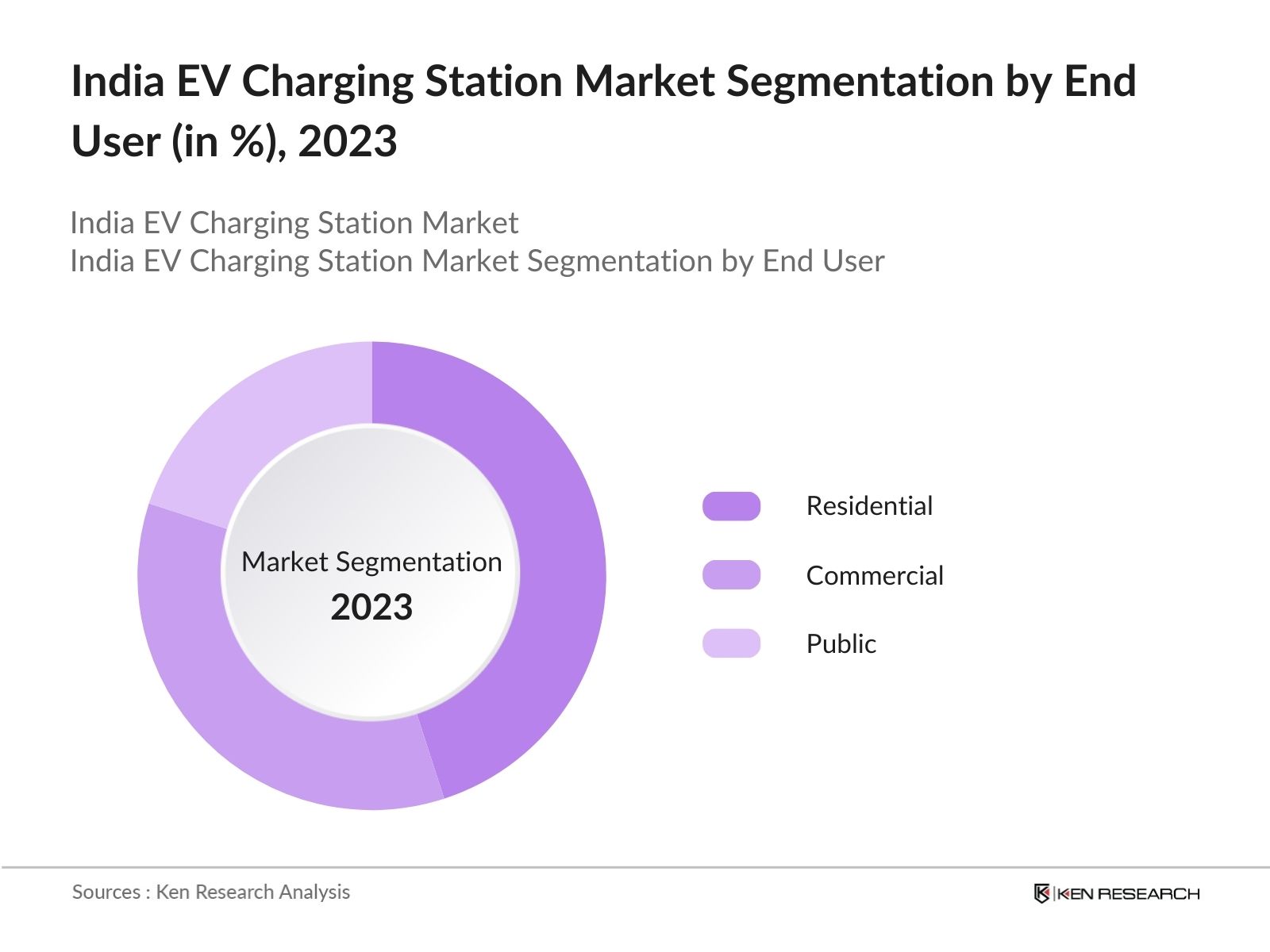

By End-User: In India EV Charging Market, residential charging is dominantly used in 2023, due to the increasing number of individual EV owners who prefer the convenience of home charging. Government incentives and subsidies for home charger installations further boost this segment.

By Application: In India EV Charging Market, private use is dominant in 2023 as many EV owners prefer the convenience and cost-effectiveness of home charging, supported by government policies encouraging residential charger installations. Fleet operations are growing due to the shift towards electric fleets by logistics and transportation companies aiming to reduce operational costs and carbon footprint.

India EV Charging Station Market Competitive Landscape

India EV Charging Station Market competitive landscape is summed up in the following points:

The extent of charging stations network impacts a company's market presence and user convenience. Companies with widespread networks attract more users.

Firms investing in advanced charging technologies, such as fast and ultra-fast chargers, gain a competitive edge by offering superior services.

Collaborations with automotive manufacturers, government bodies, and other stakeholders enhance market reach and credibility.

Competitive pricing strategies for charging services and equipment play a crucial role in attracting price-sensitive consumers and businesses.

India EV Charging Station Industry Analysis

India EV Charging Station Market Growth Drivers:

Government Incentives: Subsidies and incentives for EV purchases and charging infrastructure development significantly drive market growth.

Environmental Regulations: Stricter emission norms and policies promoting clean energy are encouraging the adoption of EVs and the establishment of charging stations.

Urbanization: Increasing urbanization and the need for sustainable urban mobility solutions are driving the demand for EVs and associated charging infrastructure.

Public Awareness: Growing awareness about environmental issues and the benefits of EVs is accelerating market growth as more consumers and businesses shift to electric mobility.

India EV Charging Station Market Trends:

Integration of Renewable Energy: Incorporating solar and wind energy in charging stations is gaining traction, promoting sustainable and cost-effective charging solutions.

Smart Charging Solutions: The development of smart charging infrastructure with features like load management, remote monitoring, and user-friendly interfaces is becoming prevalent.

Battery Swapping Stations: Battery swapping technology is emerging as a viable alternative, offering quick and convenient solutions for EV users, especially in the two-wheeler segment.

Corporate Adoption: Large corporations are investing in EV fleets and charging infrastructure to reduce carbon footprints and operational costs.

India EV Charging Station Market Challenges:

High Initial Costs: The significant initial investment required for setting up charging infrastructure is a major barrier, especially for small and medium enterprises.

Limited Infrastructure in Rural Areas: The lack of charging stations in rural and semi-urban areas restricts the widespread adoption of EVs across the country.

Grid Capacity: The increased load on the electrical grid due to extensive EV charging poses challenges for grid stability and necessitates infrastructure upgrades.

Consumer Awareness: Limited awareness and understanding of EV benefits and charging options among potential consumers impede market growth.

India EV Charging Station Market Recent Developments:

Tata Power has partnered with multiple automotive companies to expand its EV charging network across India, enhancing accessibility for EV users.

Fortum India has announced plans to install hundreds of new charging stations in major cities, aiming to strengthen its market position.

Panasonic India has introduced new smart charging solutions with advanced features like real-time monitoring and user-friendly interfaces.

ABB India has launched new ultra-fast chargers capable of significantly reducing charging times, catering to the growing demand for quick charging solutions.

Hero Electric has announced investments in expanding its charging network and collaborating with various stakeholders to enhance EV adoption.

India EV Charging Station Market Government Initiatives:

FAME II Scheme: The Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME II) scheme provides financial incentives for setting up EV charging infrastructure.

GST Reduction: The government has reduced the GST on EVs and charging equipment, making EVs more affordable and promoting market growth.

Public-Private Partnerships: The government is encouraging public-private partnerships to accelerate the development of a robust charging infrastructure network across the country.

National Electric Mobility Mission Plan (NEMMP): This plan aims to promote electric mobility through incentives and support for charging infrastructure development.

India EV Charging Station Market Future Outlook

-

- The market is expected to grow exponentially by 2028, driven by increasing EV adoption and supportive government policies.

- Future growth will be propelled by advancements in charging technologies, including ultra-fast chargers and smart charging solutions.

- The expansion of the charging infrastructure network in urban and rural areas will be a key growth driver, improving accessibility for EV users.

- Significant investments from both government and private players in the EV charging infrastructure will boost market development and innovation.

Scope of the Report

|

India EV Charging Station Market Segmentation |

|

|

By Charger Type |

AC Chargers DC Fast Chargers |

|

By End User |

Residential Commercial Public |

|

By Application |

Private Use Fleet Operations Public Charging |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Electric Vehicle Manufacturers

Charging Station Providers

Government Agencies and Policymakers

Investment Firms and Financial Institutions

Automotive Industry Analysts

Renewable Energy Companies

Infrastructure Development Companies

Research and Development Organizations

Logistics and Fleet Management Companies

Urban Planning and Smart City Developers

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:Â

Tata Power

EV Motors India

Fortum India

ChargeGrid by Magenta Power

Exicom Power Solutions

Delta Electronics India

ABB India

Panasonic India

Siemens India

Okaya Power Group

PlugNGo

Volttic

Ather Grid

ChargePoint India

Bharat Heavy Electricals Limited (BHEL)

Table of Contents

1. India EV Charging Station Market Overview

1.1 India EV Charging Station Market Taxonomy

2. India EV Charging Station Market Size (in USD Bn), 2018-2023

3. India EV Charging Station Market Analysis

3.1 India EV Charging Station Market Growth Drivers

3.2 India EV Charging Station Market Challenges and Issues

3.3 India EV Charging Station Market Trends and Development

3.4 India EV Charging Station Market Government Regulation

3.5 India EV Charging Station Market Swot Analysis

3.6 India EV Charging Station Market Stake Ecosystem

3.7 India EV Charging Station Market Competition Ecosystem

4. India EV Charging Station Market Segmentation, 2023

4.1 India EV Charging Station Market Segmentation by Charger Type (in value %), 2023

4.2 India EV Charging Station Market Segmentation by End User (in value %), 2023

4.3 India EV Charging Station Market Segmentation by Application (in value %), 2023

5. India EV Charging Station Market Competition Benchmarking

5.1 India EV Charging Station Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. India EV Charging Station Future Market Size (in USD Bn), 2023-2028

7. India EV Charging Station Future Market Segmentation, 2028

7.1 India EV Charging Station Market Segmentation by Charger Type (in value %), 2028

7.2 India EV Charging Station Market Segmentation by End User (in value %), 2028

7.3 India EV Charging Station Market Segmentation by Application (in value %), 2028

8. India EV Charging Station Market Analysts’ Recommendations

8.1 India EV Charging Station Market TAM/SAM/SOM Analysis

8.2 India EV Charging Station Market Customer Cohort Analysis

8.3 India EV Charging Station Market Marketing Initiatives

8.4 India EV Charging Station Market White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Collating statistics on India EV Charging Station Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India EV Charging Station Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research Output:

Our team will approach multiple EV Manufacturers and Charging Station Installers to understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from EV Manufacturing and Automobile companies

Frequently Asked Questions

01 What is the current market size of the India EV charging station market?

The current market size is approximately USD 0.5 billion in 2023.

02 What was the market size of India EV charging station market in 2018?

The market size in 2018 was around USD 0.1 billion.

03 Who are the major players in India EV charging station market?

Major players include Tata Power, EV Motors India, Fortum India, and ChargeGrid by Magenta Power.

04 Which segment is dominant in the India EV charging station market?

Public charging stations are the dominant segment, driven by urbanization and government support.

05 What are the key challenges in the India EV charging station market?

Key challenges include high initial costs, limited rural infrastructure, standardization issues, grid capacity concerns, and consumer awareness.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.