India EV Market Outlook to 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD2799

December 2024

92

About the Report

India EV Market Overview

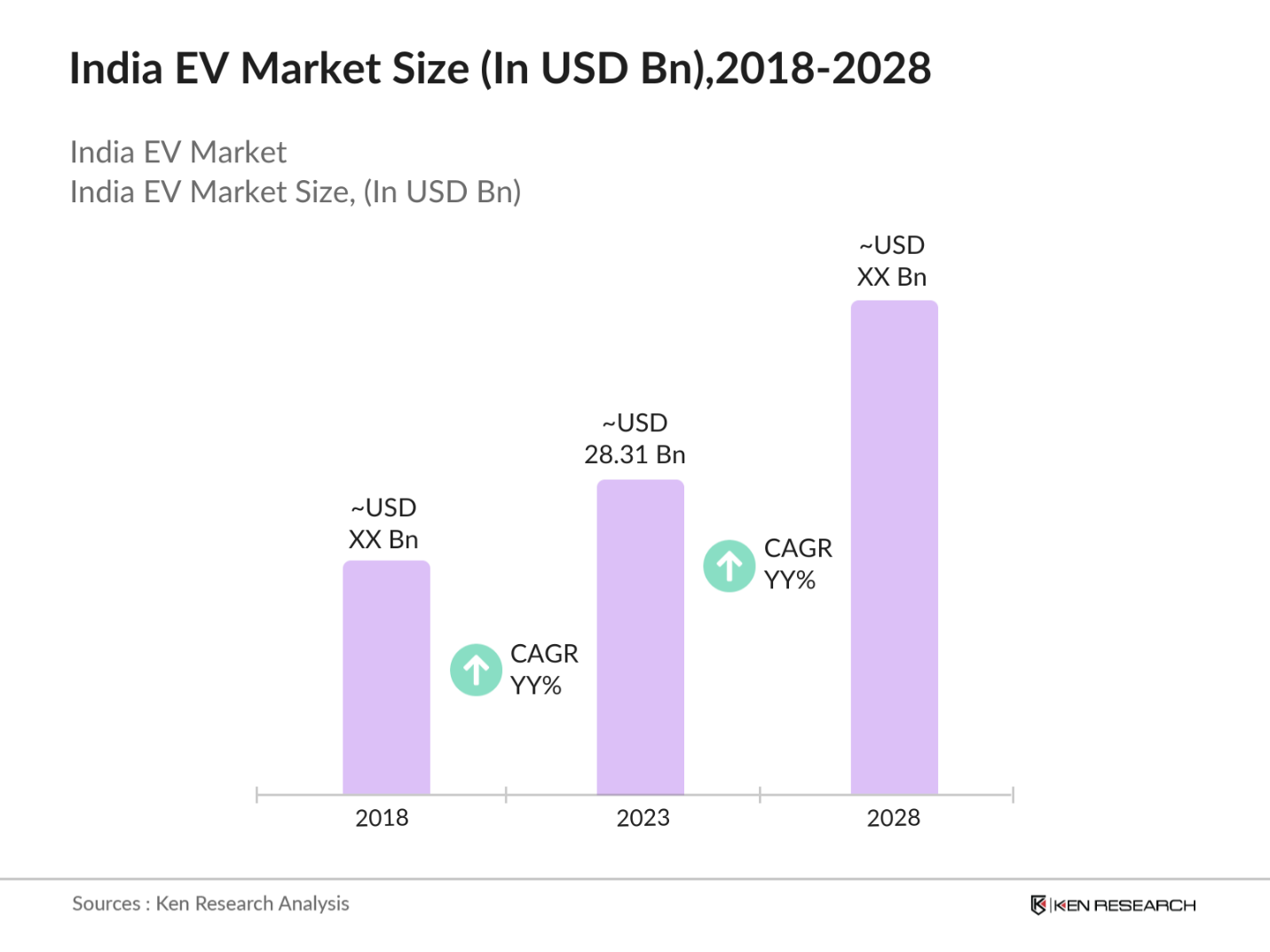

- The India EV market has experienced significant growth, reaching a valuation of USD 28.31 billion in 2023. This growth is fueled by strong government initiatives, increased adoption of electric vehicles, and a shift toward sustainability. The demand for electric two-wheelers and four-wheelers has risen sharply as consumers seek eco-friendly alternatives, further accelerating market expansion.

- Prominent players in the India EV market include Tata Motors, Mahindra Electric, Hero Electric, Ola Electric, and Ather Energy. These companies are leading the charge in the electric mobility revolution. Tata Motors dominates the four-wheeler segment with its popular Nexon EV, while Hero Electric and Ola Electric are at the forefront of the two-wheeler market, capitalizing on domestic production and competitive pricing to meet the growing demand for electric vehicles.

- In 2023, Tata Motors announced an investment of INR 15,000 crore aimed at ramping up its EV production over the next five years, with a goal to introduce 10 new electric vehicles by 2025. This strategic move is part of Tata's effort to strengthen its position in the growing Indian EV market. Tatas aggressive investment and focus on expanding its EV portfolio signal the companys intent to dominate the market further.

- Cities like New Delhi, Bengaluru, Mumbai, and Pune dominate the India EV market due to their advanced charging infrastructure, higher disposable incomes, and increasing awareness of sustainable mobility. New Delhi, in particular, has seen robust growth in EV adoption due to favorable government policies, subsidies, and strict emissions regulations. Bengaluru and Pune, with their burgeoning tech industries and progressive population, have also become EV hubs.

India EV Market Segmentation

The India EV Market is divided into the following segments:

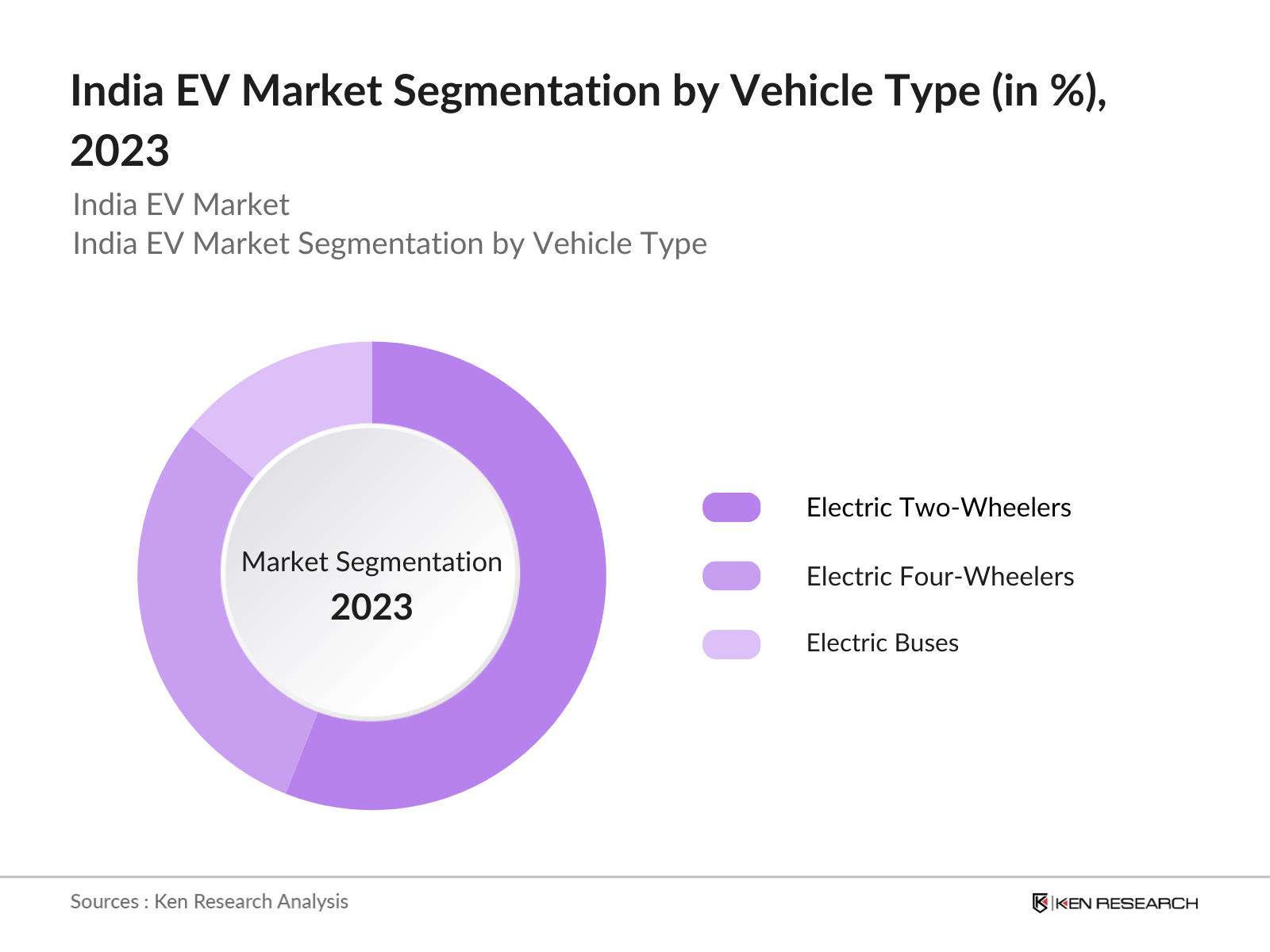

By Vehicle Type: The India EV market is segmented by vehicle type into electric two-wheelers, electric four-wheelers, and electric buses. In 2023, electric two-wheelers held the dominant market share. This dominance is due to their affordability, growing availability of charging infrastructure, and ease of use in congested urban environments. Brands like Ola Electric and Hero Electric have expanded their reach across India, making electric two-wheelers increasingly accessible and popular among consumers.

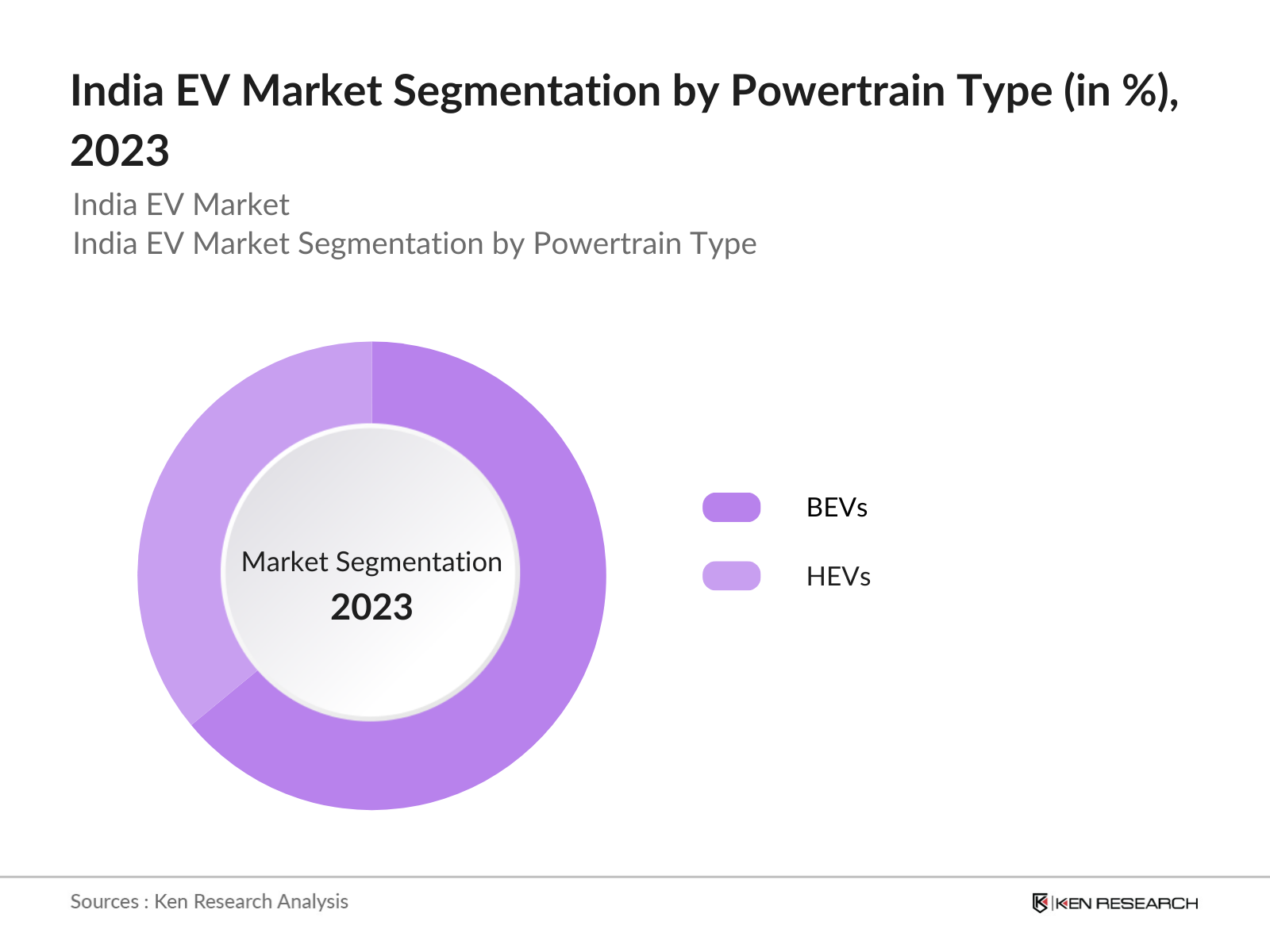

By Powertrain Type: In 2023, Battery Electric Vehicles (BEVs) indeed held a dominant market share, significantly outpacing Hybrid Electric Vehicles (HEVs). This trend is largely attributed to the Indian government's strong support for fully electric solutions and substantial investments in charging infrastructure. Major players in the market, such as Tata Motors and Mahindra Electric, have prioritized BEV technology to meet the growing consumer demand for zero-emission vehicles, thus reinforcing BEVs as the preferred option in the Indian EV market.

By Region: The India EV market is regionally segmented into North, South, East, and West. The North region, including Delhi and Punjab, is indeed a significant player in the Indian EV market. It has been noted for having a strong EV policy framework, generous subsidies, and an extensive charging network, which contribute to its market share. Delhi, in particular, has been proactive in adopting EVs, supported by ambitious targets and favorable policies aimed at promoting electric mobility.

India EV Market Competitive Landscape

|

Player Name |

Year Established |

Headquarters |

|

Tata Motors |

1945 |

Mumbai, India |

|

Mahindra Electric |

1994 |

Bengaluru, India |

|

Hero Electric |

1956 |

New Delhi, India |

|

Ola Electric |

2017 |

Bengaluru, India |

|

Ather Energy |

2013 |

Bengaluru, India |

- Tata Motors Recent Development (2023): Tata Motors announced a strategic partnership with Tata Power in 2023 to install over 25,000 EV charging stations across India by 2025. The companys focus on developing the necessary infrastructure to support EV adoption has made it a leading player in the EV market.

- Mahindra Electric Recent Development (2023): In 2023, Mahindra Group has indeed partnered with Jio-bp, a joint venture between Reliance Industries and BP Plc, to explore electric vehicle (EV) product manufacturing and services. This collaboration aims to enhance electric mobility in India by developing high-performance and swappable batteries, which could help address range anxiety among consumers. The partnership also includes evaluating EV charging solutions for Mahindra's electric vehicles, including three-wheelers and small commercial vehicles.

India EV Market Analysis

India EV Market Growth Drivers

- FAME-II Scheme Driving Adoption of EVs: The Indian governments Faster Adoption and Manufacturing of Electric Vehicles (FAME-II) scheme, introduced in 2019, has been a key driver in the widespread adoption of EVs. In 2023, over 2.8 lakh electric vehicles have benefitted from subsidies under this scheme. The scheme offers incentives for electric two-wheelers, three-wheelers, and four-wheelers, with a significant portion of the INR 10,000 crore outlay aimed at reducing vehicle costs.

- Expansion of EV Charging Infrastructure: The growth of Indias EV market is significantly driven by the rapid expansion of EV charging stations across major cities. As of mid-2024, the Ministry of Power reported that over 15,000 public charging stations have been established nationwide, up from around 6,000 in 2022. The Indian governments push towards green mobility includes creating a robust infrastructure network, ensuring that every 3 km in urban areas and 25 km on highways have an EV charging point, thus addressing range anxiety and promoting higher EV sales.

- Battery Cost Reduction Through PLI Scheme: The Production-Linked Incentive (PLI) scheme for Advanced Chemistry Cell (ACC) batteries has incentivized local battery manufacturing, reducing dependence on imports and lowering battery costs, which are a significant component of an EVs total cost. By 2024, domestic battery production had ramped up, driven by government funding of INR 18,100 crore under this initiative. Lower battery costs have directly led to a reduction in EV prices, making electric vehicles more accessible to a wider audience, particularly in tier-2 and tier-3 cities.

India EV Market Challenges

- Inadequate Battery Recycling Infrastructure: As of 2023, India's recycling capabilities for electric vehicle (EV) batteries remain underdeveloped, with only a small fraction of the growing number of batteries being recycled. The Ministry of Environment, Forest and Climate Change has highlighted this concern, especially given the anticipated increase in EVs, which is expected to exceed 10 million by 2025. This surge will lead to a significant rise in end-of-life batteries, exacerbating the risks associated with improper disposal and environmental harm.

- High Initial Costs for Commercial EVs: Commercial electric vehicles, particularly electric buses and trucks, face high upfront costs, which deter fleet operators from transitioning from traditional ICE vehicles. Despite government subsidies, the high capital investment required for commercial EVs slows their adoption, especially in regions with lower economic activity and fewer public transport investments.

India EV Market Government Initiatives

- Extension of FAME-II Till 2024: The FAME-II scheme, which was initially set to end on March 31, 2024, has been extended only until July 31, 2024, providing an additional four months of support. This extension includes an extra allocation of 500 crore aimed at incentivizing electric two-wheelers and three-wheelers. As of 2023, more than 3,000 electric buses had been deployed in state transport systems, reducing CO2 emissions by over 15,000 metric tonnes annually, according to the Ministry of Heavy Industries.

- Implementation of Green Hydrogen Mission: In 2023, Implementation of Green Hydrogen Mission: In 2023, the Indian government approved the National Green Hydrogen Mission with a budget of approximately INR 19,744 crore (around $2.4 billion) allocated from FY 2023-24. The mission aims to promote the production of green hydrogen, facilitating the decarbonization of the transport sector. Green hydrogen-powered commercial EVs could reduce dependency on imported fossil fuels and lower operating costs for fleet operators.

India EV Market Outlook

The India EV market is poised for rapid transformation by 2028, driven by the expansion of charging infrastructure, advancements in battery technology, and supportive government policies. As the market continues to evolve, new opportunities are expected to arise, particularly in the penetration of electric vehicles in smaller cities and the electrification of commercial fleets.

Future Trends

- Growth in EV Penetration in Tier-2 and Tier-3 Cities: By 2028, electric vehicle penetration is expected to rise significantly in tier-2 cities are emerging as significant growth centers for electric vehicles, especially electric two-wheelers. Reports indicate that in some tier-2 markets, electric two-wheeler sales have already surpassed those in metropolitan areas, highlighting a shift in consumer preference towards electric alternatives in these regions.

- Shift Towards EVs in Commercial Fleet Operations: By 2028, the commercial vehicle sector is projected to experience a substantial shift towards electric mobility, particularly in logistics and public transport. The government's mandate for state transportation units to adopt electric buses will drive this transition, reducing fuel consumption and emissions on a national scale.

Scope of the Report

|

By Vehicle Type |

Electric Two-Wheelers Electric Four-Wheelers AElectric Buses |

|

By Powertrain Type |

BEVs HEVs |

|

By Region |

North South East West |

Products

Key Target Audience

Electric Vehicle Manufacturers

Battery Manufacturers

EV Charging Infrastructure Providers

Automotive OEMs

Government and Regulatory Bodies (MoRTH)

Transportation and Logistics Companies

Fleet Operators

Investment and Venture Capitalist Firms

Electric Mobility Service Providers

Energy Storage Solution Providers

Companies

Players Mentioned in the Report:

Tata Motors

Mahindra Electric

Hero Electric

Ola Electric

Ather Energy

TVS Motors

Bajaj Auto

Hyundai Motors India

Ashok Leyland

Revolt Motors

JBM Auto

MG Motors

BYD India

Piaggio Vehicles Pvt. Ltd.

Exide Industries

Table of Contents

01. India EV Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. India EV Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. India EV Market Analysis

3.1. Growth Drivers

3.1.1. Government Initiatives and Policies

3.1.2. Expansion of Charging Infrastructure

3.1.3. Battery Cost Reduction through Local Manufacturing

3.2. Challenges

3.2.1. High Cost of Commercial EVs

3.2.2. Limited Charging Infrastructure in Rural Areas

3.2.3. Battery Recycling Concerns

3.3. Opportunities

3.3.1. Increased EV Penetration in Tier-2 and Tier-3 Cities

3.3.2. Growth in Electric Two-Wheelers Segment

3.3.3. Commercial Fleet Electrification

3.4. Trends

3.4.1. Rise in Electric Two-Wheeler Sales

3.4.2. Expansion of Domestic Battery Manufacturing

3.4.3. Increased Investments in EV Startups

3.5. Government Initiatives

3.5.1. Extension of FAME-II Scheme

3.5.2. PLI Scheme for EV Components and Batteries

3.5.3. National Green Hydrogen Mission

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

04. India EV Market Segmentation, 2023

4.1. By Vehicle Type (in Value %)

4.1.1. Electric Two-Wheelers

4.1.2. Electric Four-Wheelers

4.1.3. Electric Buses

4.2. By Powertrain Type (in Value %)

4.2.1. Battery Electric Vehicles (BEVs)

4.2.2. Hybrid Electric Vehicles (HEVs)

4.3. By Region (in Value %)

4.3.1. North

4.3.2. South

4.3.3. East

4.3.4. West

05. India EV Market Competitive Landscape

5.1. Detailed Profiles of Major Companies

5.1.1. Tata Motors

5.1.2. Mahindra Electric

5.1.3. Hero Electric

5.1.4. Ola Electric

5.1.5. Ather Energy

5.1.6. TVS Motors

5.1.7. Bajaj Auto

5.1.8. Hyundai Motors India

5.1.9. Ashok Leyland

5.1.10. Revolt Motors

5.1.11. JBM Auto

5.1.12. MG Motors

5.1.13. BYD India

5.1.14. Piaggio Vehicles Pvt. Ltd.

5.1.15. Exide Industries

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

06. India EV Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

07. India EV Market Regulatory Framework

7.1. EV Policy Standards

7.2. Compliance Requirements

7.3. Certification Processes

08. India EV Market Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

09. India EV Market Future Market Segmentation, 2028

9.1. By Vehicle Type (in Value %)

9.2. By Powertrain Type (in Value %)

9.3. By Region (in Value %)

10. India EV Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on the India EV Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for the India EV Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple EV and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from EV.

Frequently Asked Questions

01. How big is India EV market?

The India EV market was valued at USD 28.31 billion in 2023, driven by the increasing adoption of electric two-wheelers, supportive government policies, and the expansion of EV charging infrastructure across major urban centers.

02. What are the challenges in India EV market?

Challenges in the India EV market include the high cost of commercial electric vehicles, inadequate battery recycling infrastructure, and limited charging facilities in rural areas. These obstacles slow down the widespread adoption of EVs outside major cities.

03. Who are the major players in the India EV market?

Key players in the India EV market include Tata Motors, Mahindra Electric, Hero Electric, Ola Electric, and Ather Energy. These companies dominate due to their early market entry, robust product portfolios, and investments in EV technology and infrastructure.

04. What are the growth drivers of India EV market?

The India EV market is propelled by the governments FAME-II scheme, the expansion of EV charging infrastructure, and local battery manufacturing initiatives. These factors, combined with growing consumer awareness about environmental benefits, have accelerated the markets growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.