India Executive Education Market Outlook to 2029

Driven by Increasing Demand for Leadership Development, Digital Transformation, and Customized Learning Solutions

Region:Asia

Author(s):Ankit and Pranav

Product Code:KR1448

October 2024

36

About the Report

India Executive Education Market Overview:

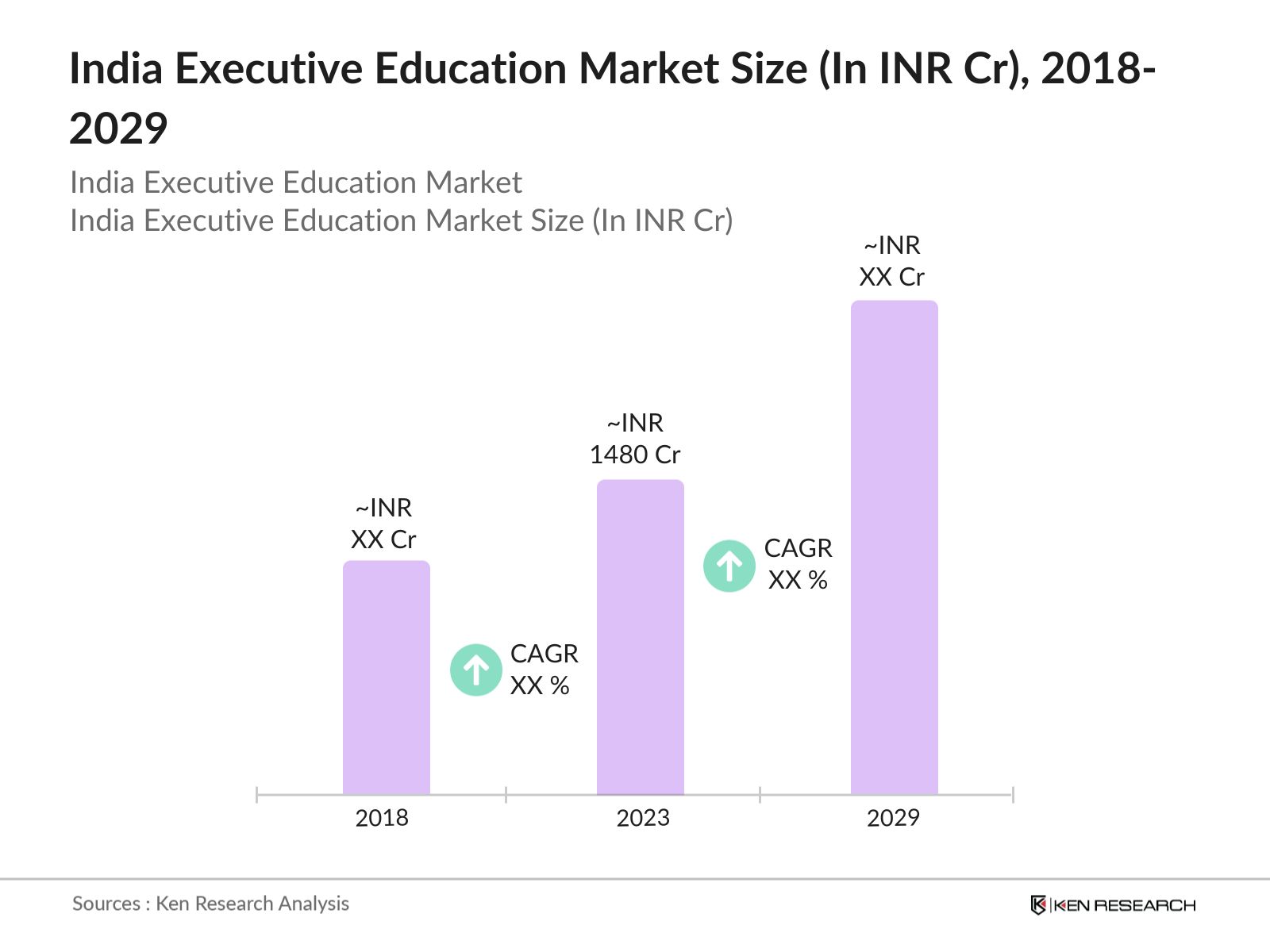

- In 2024, the India Executive Education Market reached a valuation of INR 1480 Cr, driven by the rising demand for leadership development programs among professionals and organizations seeking to enhance their competitive edge. The market's growth is fueled by the increasing adoption of digital platforms, enabling institutions to offer flexible and customized learning experiences.

- Key players in the India Executive Education Market include the Indian School of Business (ISB), Indian Institute of Management (IIM), XLRI Jamshedpur, SP Jain Institute of Management and Research (SPJIMR), and the Indian Institute of Technology (IIT). These institutions have established themselves as leaders by offering a diverse range of executive programs tailored to meet industry demands.

- In 2023, cities like Bangalore, Mumbai, and Delhi NCR emerged as dominant markets for executive education in India. Bangalore's position as the IT capital of India drives demand for executive programs in technology and digital transformation.

- In 2023, ISB launched a new Executive Education Program in collaboration with Coursera, targeting mid-career professionals looking to upskill in areas such as digital transformation, leadership, and strategy. This partnership reflects the growing trend of blending traditional executive education with online platforms to reach a broader audience.

India Executive Education Market Segmentation

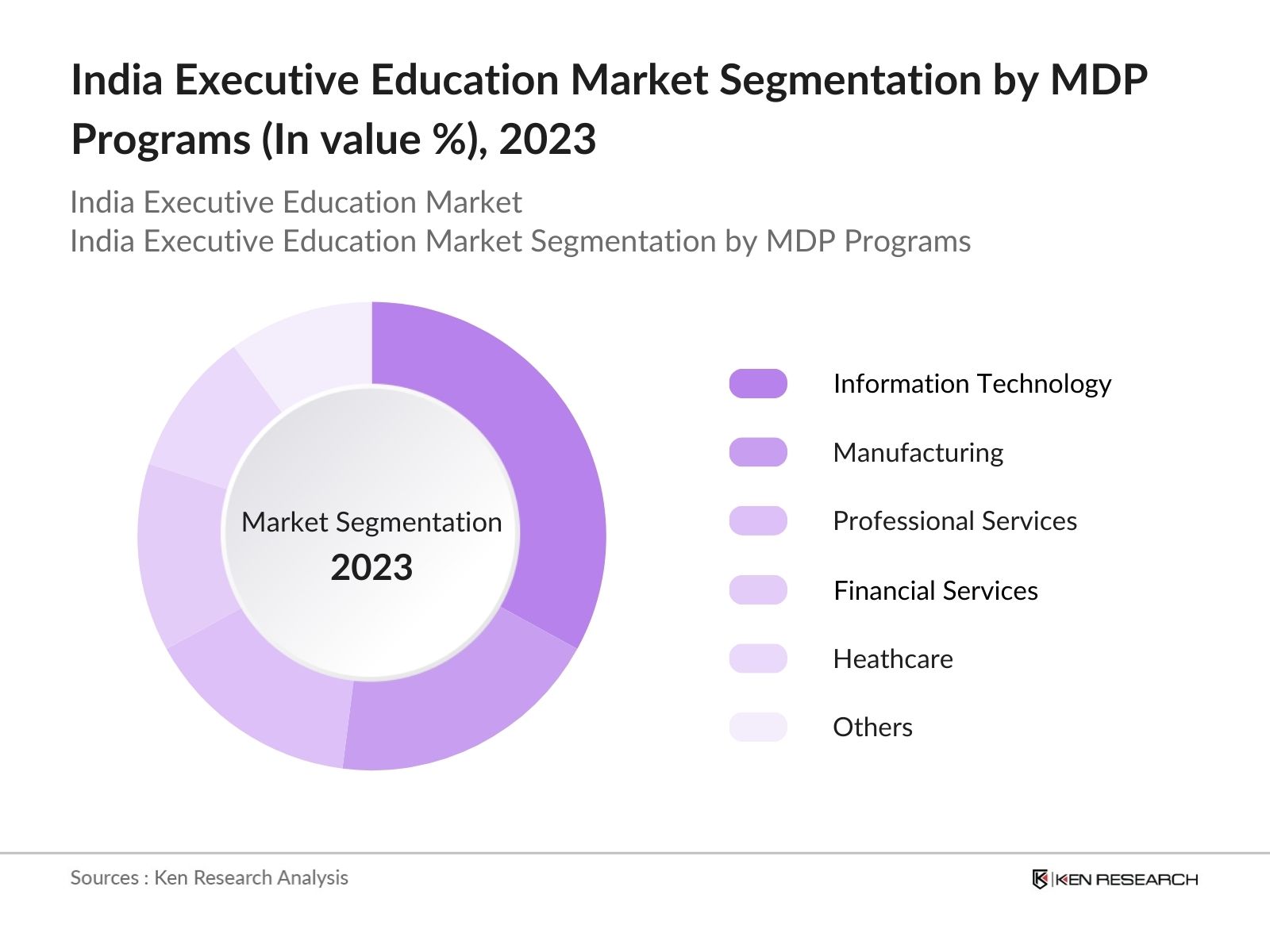

- By MDP Programs: The India executive education market is segmented by MDP programs into information technology, manufacturing, professional services, financial services, healthcare, and others. In 2023, information technology dominated the market. This dominance is primarily due to the rapid pace of technological advancement and the critical need for IT leaders to stay ahead of emerging trends. The IT sector in India is a significant driver of economic growth, with companies heavily investing in upskilling their management teams to navigate the complexities of digital transformation, cybersecurity, and AI.

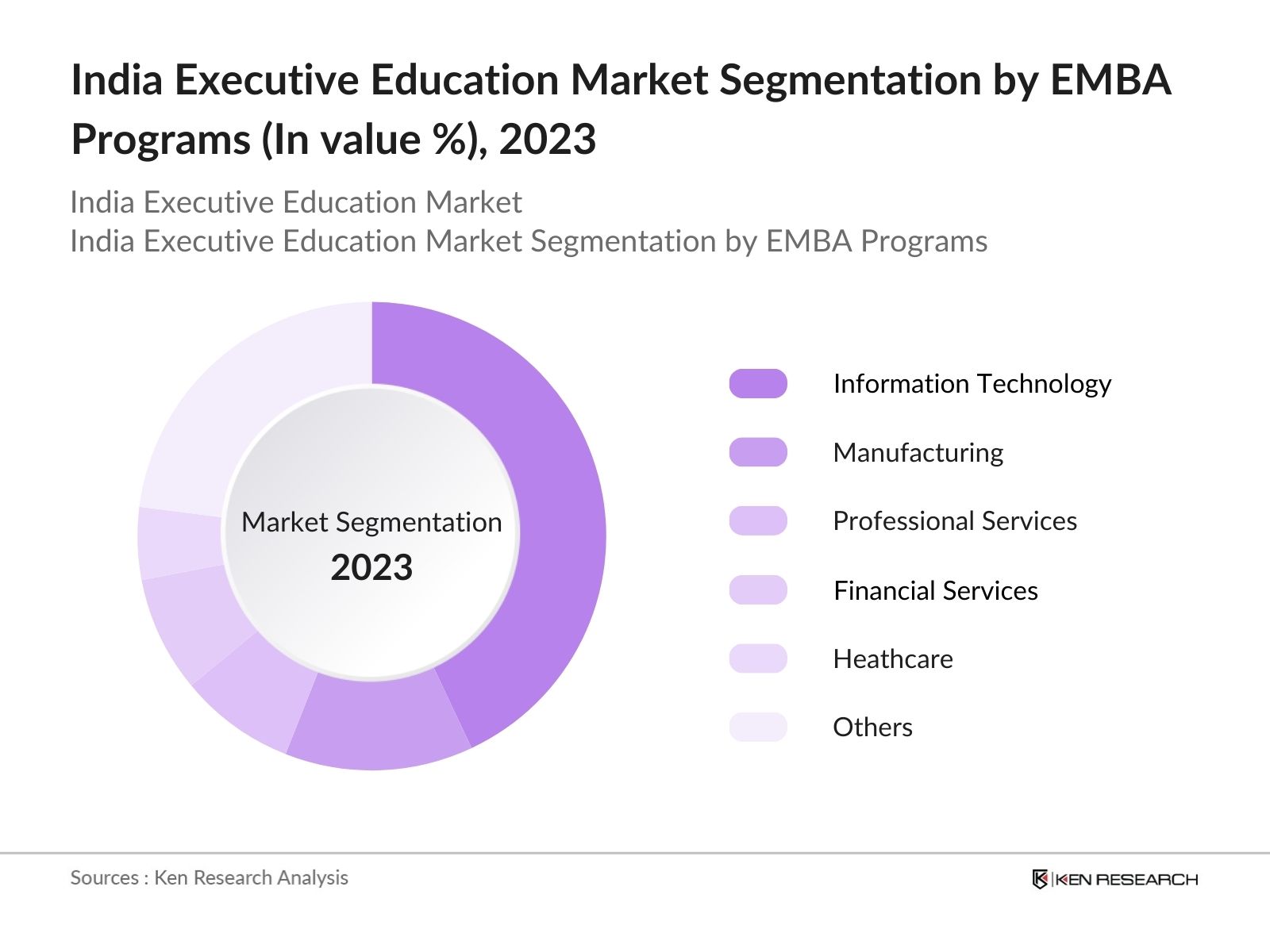

- By EMBA Programs: The India executive education market is segmented by EMBA programs into information technology, manufacturing, professional services, financial services, healthcare, and others. In 2023, information technology dominated the market. This dominance is driven by the critical role that IT plays in the global economy and the rapid pace of innovation in the sector. IT companies, particularly in India, are at the forefront of adopting new technologies such as AI, cloud computing, and cybersecurity.

India Executive Education Market Analysis

India Executive Education Market Growth Drivers

- Digital Transformation Initiatives by Corporations: The increasing focus on digital transformation among Indian corporations is a significant driver for the executive education market. According to a report by the Ministry of Electronics and Information Technology, majority of large enterprises in India are prioritizing digital transformation in their 2024 strategies. This trend has led to a surge in demand for executive education programs focusing on digital leadership, AI, and data analytics. Companies are investing heavily in upskilling their senior management to navigate the complexities of digital change, driving growth in the executive education sector.

- Rising Demand for Industry-Specific Executive Programs: Industry-specific executive education programs have seen substantial growth, particularly in sectors like IT, BFSI, and healthcare. Data from the Indian Ministry of Skill Development and Entrepreneurship indicates that in 2023, there was a substantial increase in enrollments for healthcare management programs. As industries continue to evolve, organizations are seeking specialized executive programs that address sector-specific challenges and opportunities, leading to increased participation and growth in the market.

- Corporate Learning and Development Budgets: Companies in India have significantly increased their budgets for learning and development, particularly for executive education. A survey by the Confederation of Indian Industry (CII) in 2023 revealed that the majority of large enterprises have allocated a substantial portion of their HR budgets to executive training and development. This rise in investment is driven by the need to equip senior management with the skills required to drive business growth in a competitive and rapidly changing environment.

India Executive Education Market Challenges

- High Cost of Executive Programs: The high cost associated with executive education programs remains a significant barrier to market growth. Many mid-sized companies in India find the cost of top-tier executive education programs prohibitive. This challenge is particularly pronounced for smaller organizations that lack the financial resources to invest in expensive executive training, limiting their access to these programs and affecting overall market growth.

- Limited Access to Quality Programs in Tier-2 and Tier-3 Cities: While major metropolitan areas like Bangalore, Mumbai, and Delhi dominate the executive education market, there is a significant gap in the availability of high-quality programs in Tier-2 and Tier-3 cities. The limited access to quality education in smaller cities restricts market expansion and limits opportunities for executives in these regions.

India Executive Education Market Government Initiatives

- National Skill Development Mission: The Indian governments National Skill Development Mission, launched in 2016, aims to upskill professionals by 2025, with a focus on enhancing the leadership capabilities of senior executives. This initiative is expected to provide substantial support to the executive education market by encouraging companies to invest in upskilling their management teams.

- New Education Policy (NEP) 2020: The New Education Policy 2020 is mentioned as one of the government initiatives playing a crucial role in transforming the education landscape in India. The policy aims to overhaul the education system, focusing on areas like vocational training, online learning, and holistic development.

India Executive Education Market Competitive Landscape

|

Major Players |

Establishment Year |

Headquarters |

|

Indian School of Business (ISB) |

2001 |

Hyderabad |

|

Indian Institute of Management (IIM) |

1961 |

Ahmedabad, Bangalore, Kolkata |

|

XLRI Jamshedpur |

1949 |

Jamshedpur |

|

SP Jain Institute of Management and Research (SPJIMR) |

1981 |

Mumbai |

|

Indian Institute of Technology (IIT) |

1951 |

Multiple Locations |

- Indian School of Business (ISB): ISB partnered with Microsoft to enhance its executive education offerings. This collaboration aims to integrate advanced technologies into the curriculum, enabling participants to leverage AI and data analytics in their strategic decision-making processes. This partnership reflects the growing trend of incorporating technology into executive education to prepare leaders for the digital age.

- Indian Institute of Management (IIM): IIMs, particularly IIM Ahmedabad, have expanded their executive education portfolio significantly, offering over 200 programs tailored to various executive needs. These programs are designed to support personal and professional growth across different career stages, from entrepreneurs to CEOs.

India Executive Education Market Future Outlook:

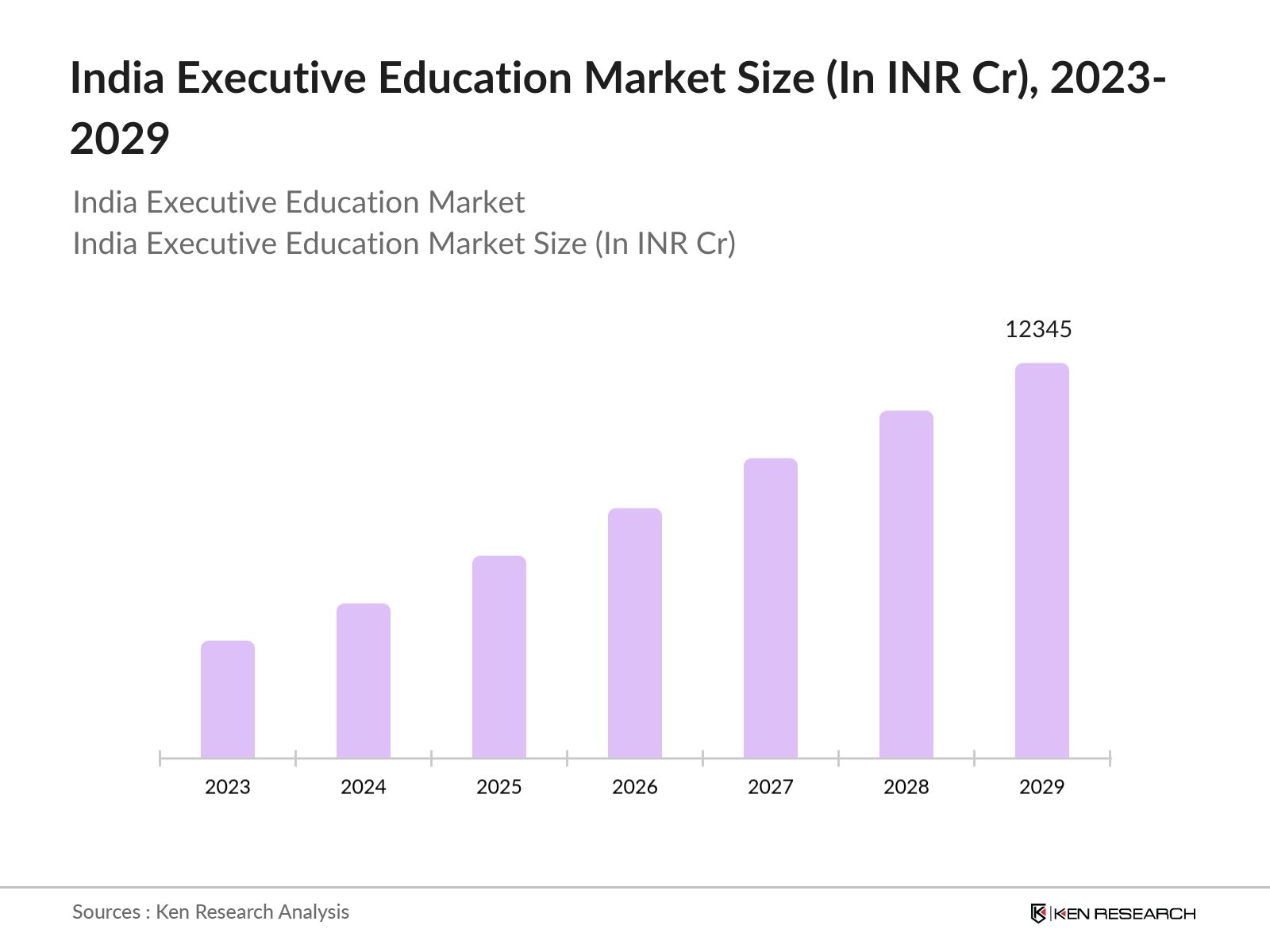

The India Executive Education Market is poised for remarkable growth reaching a market size of INR 2090 Cr by 2029, driven by expansion of executive education in emerging technologies, increased international collaboration and globalization of programs, and rising importance of sustainability and ESG in executive education.

Future Trends

- Expansion of Executive Education in Emerging Technologies: Over the next five years, the India Executive Education Market is expected to see significant growth in programs focused on emerging technologies such as artificial intelligence (AI), blockchain, and cybersecurity. This growth will be driven by the increasing need for technology-savvy leadership in Indian businesses. The shift towards these domains will be supported by continuous advancements in technology and the growing importance of digital transformation across industries.

- Increased International Collaboration and Globalization of Programs: The trend of international collaboration in executive education is set to accelerate, with Indian institutions forming more partnerships with global universities. These collaborations will enhance the global perspective of Indian executives, preparing them for leadership roles in a globalized business environment. The inclusion of international components, such as faculty, curriculum, or study modules abroad, will become increasingly common in executive programs.

Scope of the Report

|

By MDP Programs |

Information Technology Manufacturing Professional Services Financial Services Healthcare Others |

|

By EMBA Programs |

Information Technology Manufacturing Professional Services Financial Services Healthcare Others |

|

By MDP Selection Criteria |

Management Skills Career Advancement Affordable Pricing Entrepreneurship Business Networking |

|

By EMBA Selection Criteria |

Career Advancement Skill Enhancement Business Networking Management Skills Entrepreneurship Shorter Course Duration |

|

By Region |

North South East West |

Products

Key Target Audience:

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Education)

Human Resources (HR) and Learning & Development Departments

Educational Institutions and Universities

Professional Associations and Networks

Technology and IT Firms

Financial Institutions and Banks

Healthcare Organizations

Manufacturing and Industrial Companies

Time Period Captured in the Report:

Historical Period: 2018-2024

Base Year: 2024

Forecast Period: 2024-2029

Companies

Major Players Mentioned in the Report:

- Indian School of Business (ISB)

- ICFAI Business School (IBS) – Hyderabad

- Great Lakes Institute of Management, Chennai

- AIMA

- XLRI

- IIM Ahmedabad

- IIM Bangalore

- XLRI

- IIM Lucknow

- Fore School of Management

- IIM Ahmedabad

- IIM Indore

- IIM Shillong

Table of Contents

1. India Executive Education Market | Market Sizing and Segmentation

1.1 India Executive Education Market Size (2019, 2024 & 2029)

1.2 Segmentation on the basis of Enterprises 2024 (Working Professionals Enrollments)

1.3 Segmentation on the basis of Industry vertical 2024 (Working Professionals Enrollments)

1.4 Student Selection Criteria of Executive Education Programs

1.5 India Executive Education Market Evolution

2. Competitive Outlook (Key Players)

2.1 India Executive Education Market Ecosystem

3. Company Profiling (IIM Ahmedabad & IIM Bangalore)

3.1 Business & Financial KPIs, Operational KPIs, Marketing KPIs (incl. Total Enrollments)

3.2 Key Differentiators

3.3 Executive Education Course Dynamics

3.4 Popular Courses & Curriculum Alignment / Pricing Scenario

3.5 Faculty KPIs (Selection Criteria, Total Faculty etc.)

3.6 Curriculum Alignment, Customer Perception.

4. Key Takeaways

4.1 Key Recommendations for Launching New Executive Courses and Certifications

Next Steps

5. Additional Information Requested

5.1 Duke University Partnership

5.2 Regulatory Body Involvement in MDP Courses, CXO Forum, Institute Placement Assist.

6. Analyst Recommendations

Disclaimer

Contact Us

Research Methodology

Step 1: Data Collection from Primary Sources

A structured survey was distributed to corporate executives, HR managers, and L&D heads across various industries, including IT, manufacturing, financial services, and healthcare. The survey gathered quantitative data on the demand for executive education, program preferences, budget allocations, and perceived effectiveness. Conducted Computer-Assisted Telephone Interviews (CATIs) with senior executives from top educational institutions and corporate sectors to collect quantitative data on enrollment numbers, program completion rates, and market share distribution.

Step 2: Secondary Data Analysis

Extracted relevant data from industry reports, government publications, and educational statistics databases. This included historical data on the number of executive programs, institutional capacities, and market revenues from sources like AICTE, UGC, and NSSO.

Step 3: Data Integration and Market Sizing

Integrated the data collected from primary and secondary sources to create a consolidated dataset. Market sizing was performed by aggregating the total revenues of executive education providers, using a bottom-up approach to ensure accuracy.

Step 4: Validation and Review

The final dataset and projections were cross-verified with industry experts and stakeholders to ensure consistency and reliability. Data triangulation was used to compare different sources and validate the findings. The validated data was compiled into the final report, with detailed tables, charts, and market forecasts.

Frequently Asked Questions

01 How big is the India Executive Education Market?

The India Executive Education Market was valued at INR 1480 Cr in 2023, driven by increasing demand for leadership development, digital transformation programs, and customized learning solutions tailored to industry-specific needs.

02 What are the challenges in the India Executive Education Market?

Challenges in the India Executive Education Market include the high cost of programs, limited access to quality education in Tier-2 and Tier-3 cities, and the difficulty for executives to balance work commitments with educational pursuits.

03 Who are the major players in the India Executive Education Market?

Key players in the market include the Indian School of Business (ISB), Indian Institute of Management (IIM) Ahmedabad, XLRI Jamshedpur, SP Jain Institute of Management and Research (SPJIMR), and Great Lakes Institute of Management. These institutions lead due to their strong industry connections and diverse program offerings.

04 What are the growth drivers of the India Executive Education Market?

The market is driven by the rising demand for digital transformation initiatives, the need for industry-specific executive programs, and increased corporate investments in learning and development, particularly for senior management teams.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.