India Fabric Processing Market Outlook to 2029

Region:Asia

Author(s):Shashank Kashyap

Product Code:KR1513

July 2025

90

About the Report

India Fabric Processing Market Overview

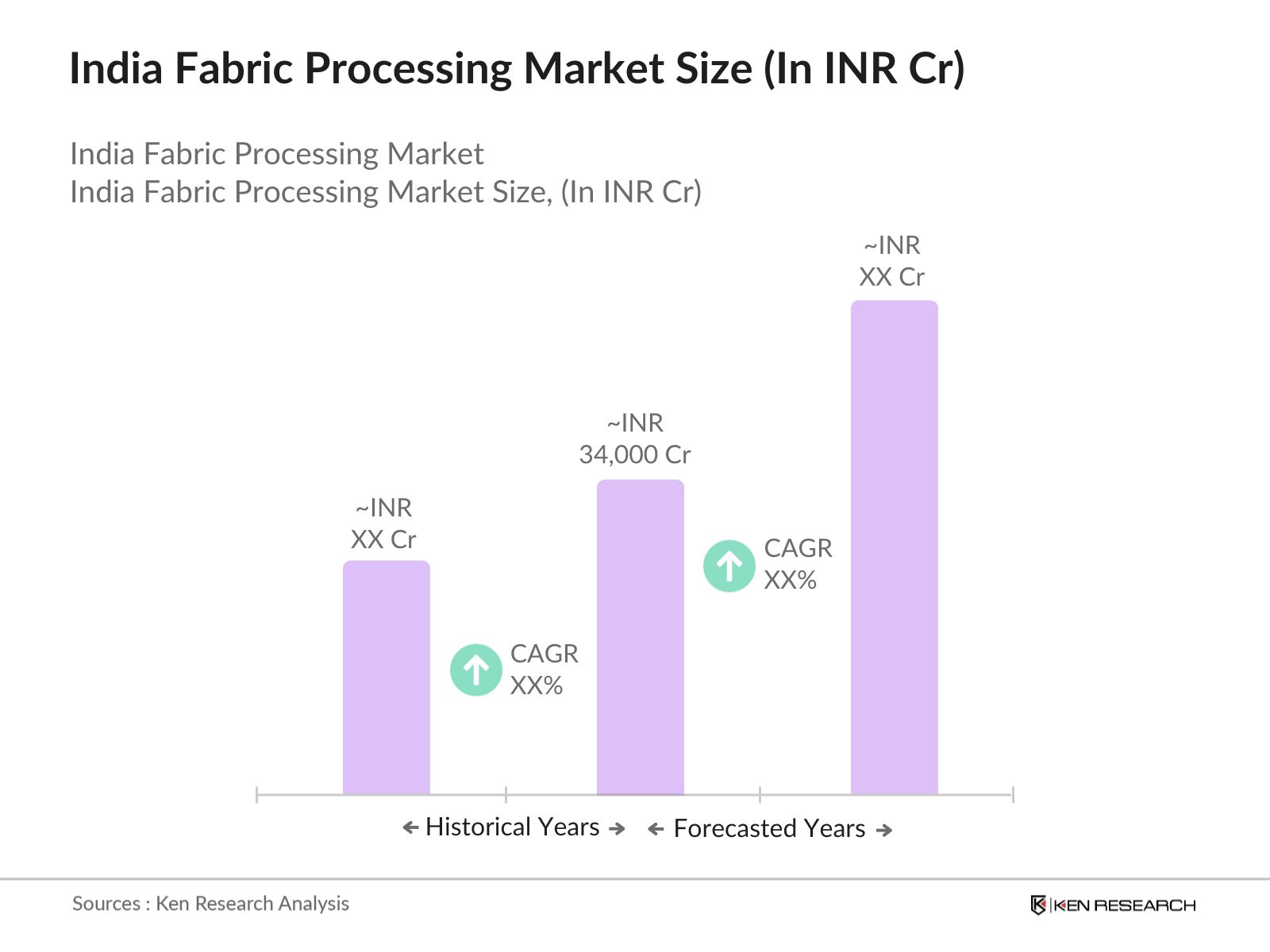

- The India Fabric Processing Market is valued at INR 34,00 crore, based on a five-year historical analysis of the broader textile manufacturing sector, which encompasses fabric processing as a major segment. This growth is primarily driven by the increasing demand for processed fabrics in apparel, home textiles, and industrial applications. Key growth drivers include rising disposable income, urbanization, and evolving consumer preferences toward high-quality, sustainable, and innovative fabrics. The sector is also benefiting from rapid expansion in e-commerce, government incentives, and a growing focus on eco-friendly production methods.

- Key players in this market include cities such as Surat, Ahmedabad, and Tirupur, which dominate due to their established textile manufacturing infrastructure and skilled labor force. Surat is recognized for its synthetic textile production, Ahmedabad is a major hub for cotton processing, and Tirupur is renowned for its knitwear manufacturing. These cities remain pivotal centers within the Indian fabric processing landscape.

- In 2023, the Indian government implemented the Production-Linked Incentive (PLI) scheme for the textile sector, aiming to boost domestic manufacturing and exports. This initiative provides financial incentives for companies that enhance production capabilities and adopt sustainable practices, thereby promoting growth, innovation, and global competitiveness in the fabric processing industry.

India Fabric Processing Market Segmentation

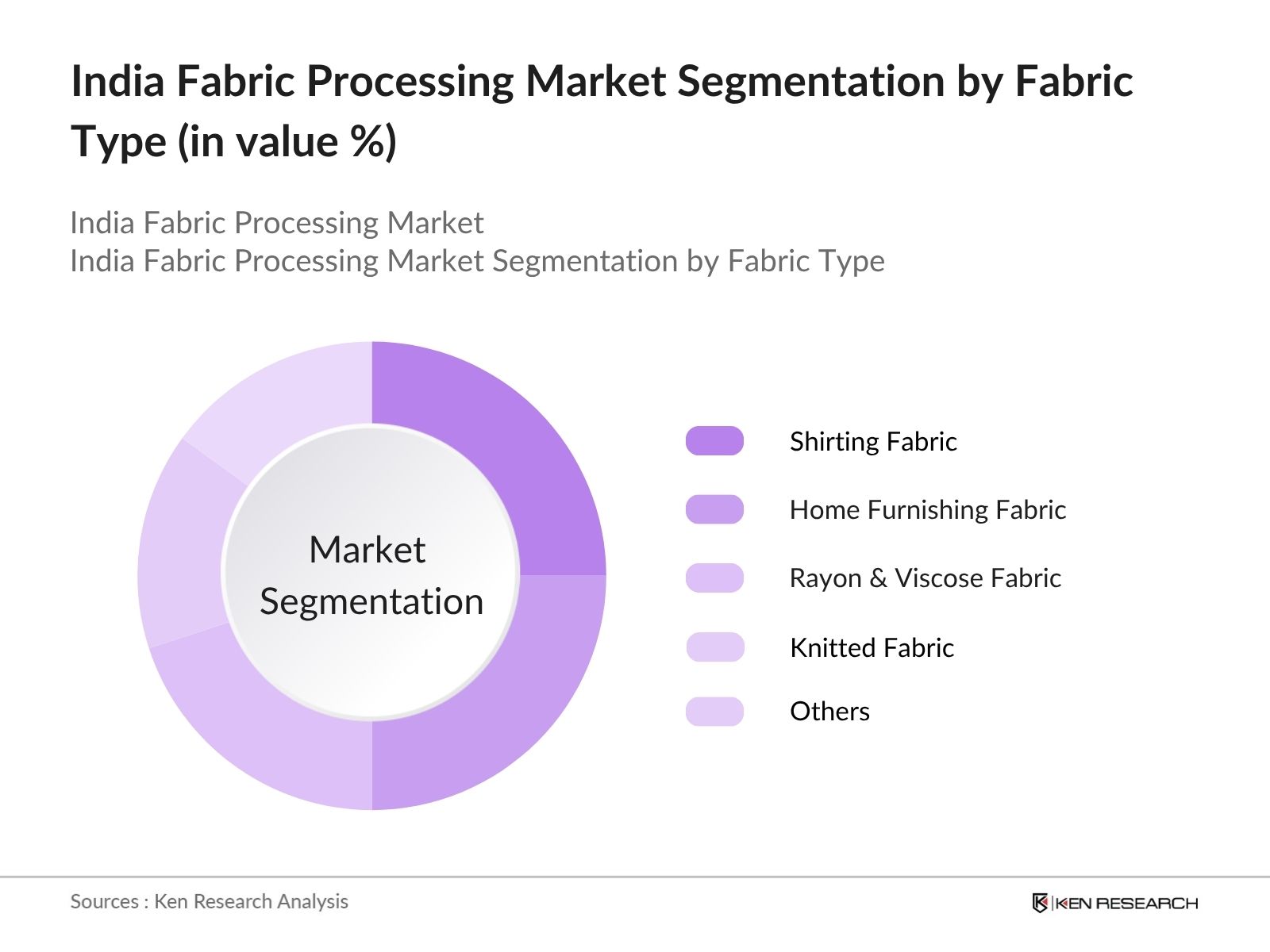

By Fabric Type: The market is segmented by fabric type into Shirting Fabric, Home Furnishing Fabric, Rayon & Viscose Fabric, Others (Technical Fibers, Denim etc.), and Knitted Fabric. Shirting Fabric leads the market, supported by strong demand from the formal and casual apparel segment, especially in menswear, and increasing focus on comfort, style, and versatility. Home Furnishing Fabric follows, driven by growth in the interior décor, real estate, and hospitality sectors.

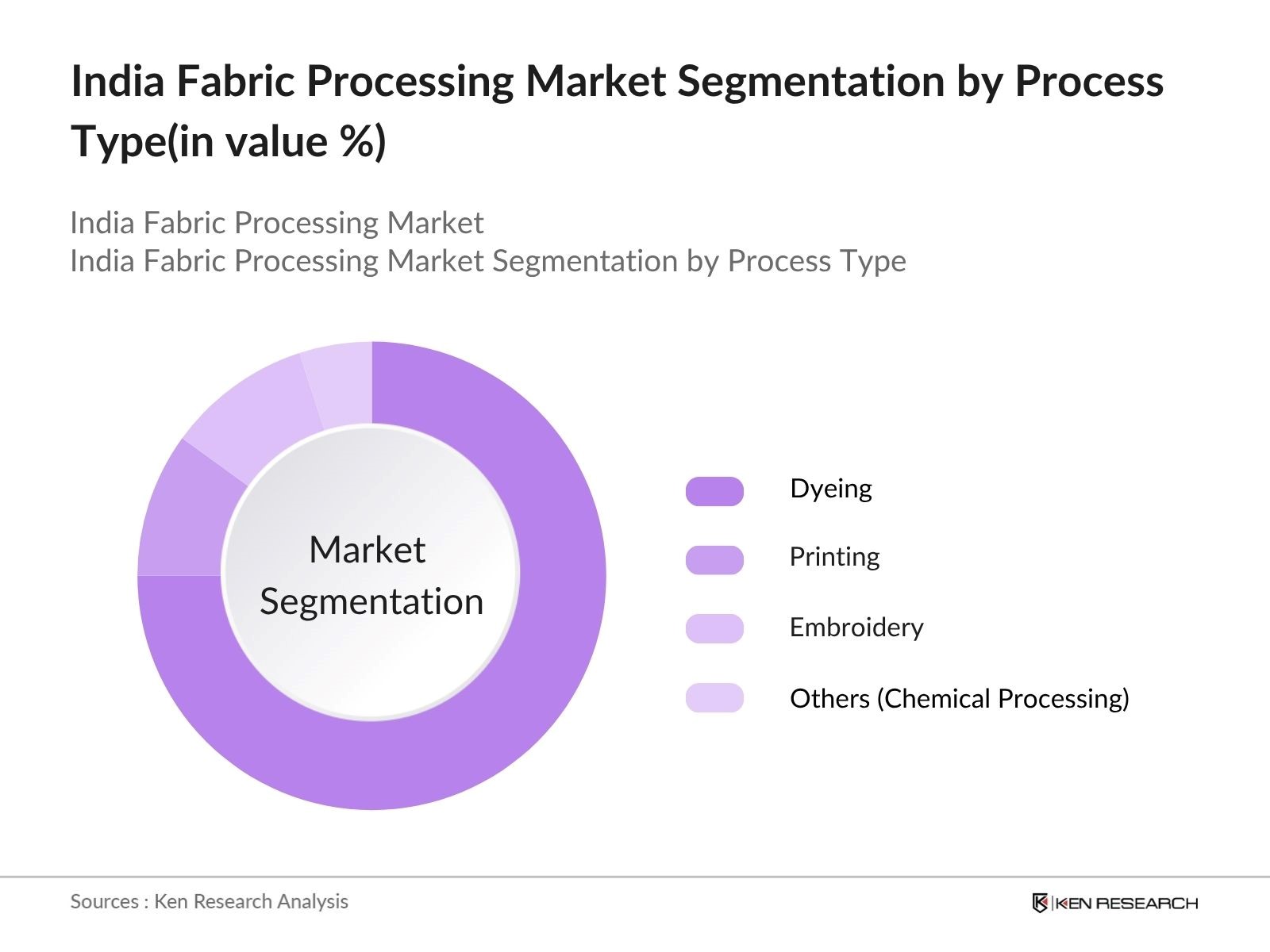

By Process Type: The market is segmented by process type into Dyeing, Printing, Embroidery, and Others (Chemical Processing). Dyeing dominates the fabric processing market, driven by its essential role in textile finishing and the growing demand for vibrant, durable colors across both apparel and industrial textiles. Printing follows closely, fueled by fashion innovation and the rise of digital textile printing for short-run and customized production.

India Fabric Processing Market Competitive Landscape

The India Fabric Processing Market is characterized by a competitive landscape with several key players, including D’Decor Home Fabrics Pvt Ltd., GM Fabrics Pvt Ltd, and Orbit Exports Ltd. These companies are known for their extensive product portfolios and strong market presence. The market is moderately concentrated, with a mix of large-scale manufacturers and small to medium enterprises contributing to the overall dynamics.

India Fabric Processing Market Industry Analysis

Growth Drivers

- Increasing Demand for Sustainable Fabrics: A key growth driver in the Indian fabric processing market is the rising demand for sustainable fabrics, fueled by heightened environmental consciousness and innovative manufacturing. India’s leadership in organic cotton production—supported by over 300 GOTS-certified units—alongside the adoption of water-saving dyeing, renewable energy, and recycled fibers, positions sustainability at the forefront of industry expansion. With urban millennials and Gen Z showing strong preferences for sustainable brands, this trend is accelerating, mirroring global consumer shifts toward eco-conscious textiles.

- Technological Advancements in Fabric Processing: The adoption of advanced technologies in fabric processing is enhancing efficiency and quality. In the future, investments in automation and smart technologies are expected to exceed millions, facilitating faster production cycles and reduced waste. The integration of AI and IoT in manufacturing processes is projected to improve operational efficiency by 25%, enabling companies to meet the rising demand for high-quality fabrics while minimizing environmental impact.

- Growth of the Textile and Apparel Industry: The textile and apparel industry in India is anticipated to grow to 29 lakh crores in the future, driven by increasing domestic consumption and export opportunities. This growth is bolstered by rising disposable incomes, with a projected increase of 12% in urban areas. The expanding middle class, which is expected to reach 700 million in the future, is significantly contributing to the demand for diverse fabric products, thereby stimulating the fabric processing sector.

Market Challenges

- High Competition from Low-Cost Imports: The Indian fabric processing market faces intense competition from low-cost imports, particularly from countries like China and Bangladesh. In the future, imports are expected to account for 35% of the market share, posing a significant challenge to local manufacturers. This influx of cheaper fabrics undermines pricing strategies and profitability for domestic producers, compelling them to innovate and enhance quality to maintain market relevance.

- Environmental Regulations and Compliance Costs: Stringent environmental regulations are imposing significant compliance costs on fabric processing companies. In the future, the average compliance cost is projected to rise to 250 crores per company, driven by the need for sustainable practices and waste management. These regulations, while essential for environmental protection, can strain the financial resources of smaller firms, limiting their ability to compete effectively in the market.

India Fabric Processing Market Future Outlook

The future of the India fabric processing market appears promising, driven by technological innovations and a shift towards sustainability. As consumer preferences evolve, companies are likely to invest more in eco-friendly practices and digital technologies. The anticipated growth in online retail channels will further enhance market accessibility, allowing manufacturers to reach a broader audience. Additionally, collaborations with fashion brands for unique designs will likely foster creativity and innovation, positioning the industry for robust growth in the coming years.

Market Opportunities

- Expansion into Emerging Markets: The potential for expansion into emerging markets presents a significant opportunity for Indian fabric processors. With a projected increase in demand for textiles in Southeast Asia, companies can leverage this growth by establishing strategic partnerships and distribution networks, potentially increasing their market share by 20% in these regions.

- Adoption of Automation and Smart Technologies: The ongoing trend towards automation and smart technologies offers a lucrative opportunity for efficiency gains. By investing in these technologies, companies can reduce production costs by up to 30%, enhance product quality, and respond more swiftly to market demands, thereby improving their competitive edge in the fabric processing sector.

Scope of the Report

| By Process Type |

Dyeing Printing Embroidery Others (Chemical Processing) |

| By Fabric Type |

Shirting Fabric Home Furnishing Fabric Rayon & Viscose Fabric Others (Technical Fibers, Denim etc.) |

| By Region |

North East Central West South |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Textiles, Bureau of Indian Standards)

Manufacturers and Producers

Distributors and Retailers

Textile Machinery Suppliers

Industry Associations (e.g., The Cotton Textiles Export Promotion Council)

Financial Institutions

Importers and Exporters

Companies

Players Mentioned in the Report:

D’Decor Home Fabrics Pvt Ltd.

GM Fabrics Pvt Ltd

Orbit Exports Ltd

Himatsingka Seide Ltd

Shree Karni Fabcom

Arvind Limited

Vardhman Textiles

Welspun India

Raymond Limited

Trident Group

Table of Contents

1. Macroeconomic Overview

1.1. Global Macroeconomic Scenario

1.2. Indian Economic Outlook

2. Indian Home Textile Market

2.1. Indian Home Textile Industry Taxonomy

2.2. India’s Home Textile Industry Overview and Size, FY20–FY25 & FY25–FY31F

2.3. Market Genesis of Fabrics and Upholstery in India

2.4. Size of India’s Fabric Processing for The Domestic Home Textile Market.

3. Value Chain and Process Flow of Fabric Processing Market

3.1. Textile Industry Value Chain

3.2. Product Flow For Fabric Processing

3.3. Business Model Comparison: Fully Integrated vs Asset-Light Textile Manufacturers

4. India’s Domestic Fabric Processing Market

4.1. India’s Domestic Fabric Processing Market Size and Segmentation, FY20–FY25 & FY25–FY31F

5. Industry Analysis

5.1. Curtain Market Regional Clusters in India

5.2. Market Trends and Developments

5.3. Market Challenges and Threats

5.4. Regulatory Landscape

6. Competitive Landscape

6.1. Key Factors Shaping Competition in the Sector

6.2. Ecosystem of Entities Present in the Sector

6.3. Cross-Comparison of Peers in the India Fabric Processing Market

7. Conclusion – Way Forward

8. Research Methodology

8.1. Market Definitions

8.2. Abbreviations

8.3. Market Sizing and Modeling

Consolidated Research Approach

Limitations

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Fabric Processing Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the India Fabric Processing Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India Fabric Processing Market.

Frequently Asked Questions

What is the current value of the India Fabric Processing Market?

The India Fabric Processing Market is valued at approximately INR 34,000 crore, reflecting significant growth driven by increasing demand for processed fabrics across various sectors, including apparel, home textiles, and industrial applications.

What are the key growth drivers of the India Fabric Processing Market?

Key growth drivers include rising disposable incomes, urbanization, evolving consumer preferences for high-quality and sustainable fabrics, and the rapid expansion of e-commerce, supported by government incentives aimed at boosting domestic manufacturing.

Which cities are the major hubs for fabric processing in India?

Surat, Ahmedabad, and Tirupur are major hubs in the India Fabric Processing Market. Surat specializes in synthetic textiles, Ahmedabad is known for cotton processing, and Tirupur is recognized for its knitwear manufacturing capabilities.

How does the Production-Linked Incentive (PLI) scheme impact the fabric processing sector?

Implemented in 2023, the PLI scheme aims to enhance domestic manufacturing and exports in the textile sector by providing financial incentives to companies that improve production capabilities and adopt sustainable practices, fostering growth and innovation.

What types of fibers dominate the India Fabric Processing Market?

The market is primarily segmented into natural and synthetic fibers, with synthetic fibers leading due to their versatility, durability, and cost-effectiveness, aligning with the fast fashion trend and demand for innovative textiles.

What applications drive the demand in the India Fabric Processing Market?

The primary applications include apparel, home textiles, and industrial textiles. The apparel segment is the largest contributor, driven by consumer demand for trendy clothing and the growth of online retail channels.

What challenges does the India Fabric Processing Market face?

Challenges include intense competition from low-cost imports, particularly from countries like China and Bangladesh, and rising compliance costs due to stringent environmental regulations, which can strain the financial resources of smaller firms.

What is the future outlook for the India Fabric Processing Market?

The future outlook is promising, with anticipated growth driven by technological innovations, a shift towards sustainability, and the expansion of online retail channels, allowing manufacturers to reach a broader audience effectively.

How significant is the trend towards sustainable fabrics in India?

The trend towards sustainable fabrics is significant, with a projected market for sustainable textiles expected to reach 1,500 crores, reflecting a 20% increase, as consumers increasingly prefer brands that prioritize eco-friendly practices.

What role do technological advancements play in fabric processing?

Technological advancements enhance efficiency and quality in fabric processing. Investments in automation and smart technologies are expected to exceed 700 crores, improving operational efficiency by 25% and reducing waste in production processes.

Which companies are key players in the India Fabric Processing Market?

Key players include Arvind Limited, Vardhman Textiles, Welspun India, and Raymond Limited, among others. These companies are recognized for their extensive product portfolios and strong market presence in the fabric processing sector.

What are the market opportunities for fabric processors in India?

Opportunities include expansion into emerging markets, adoption of automation and smart technologies, and increasing consumer preference for eco-friendly products, which can enhance competitive advantage and market share for fabric processors.

How does the fabric processing market segment by end-user?

The fabric processing market segments by end-user into apparel, home textiles, technical textiles, and others. The apparel segment is the largest, driven by rising consumer demand for fashionable and premium clothing options.

What are the sustainability practices in the fabric processing industry?

Sustainability practices include eco-friendly processing methods, waterless dyeing technologies, and the use of recycled fabrics. These practices are increasingly influencing consumer choices and are essential for compliance with environmental regulations.

What is the impact of e-commerce on the fabric processing market?

The rapid expansion of e-commerce significantly impacts the fabric processing market by enhancing accessibility for manufacturers and consumers, facilitating the growth of online retail channels, and driving demand for diverse fabric products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.