India Facial Recognition Software Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD6910

December 2024

96

About the Report

India Facial Recognition Software Market Overview

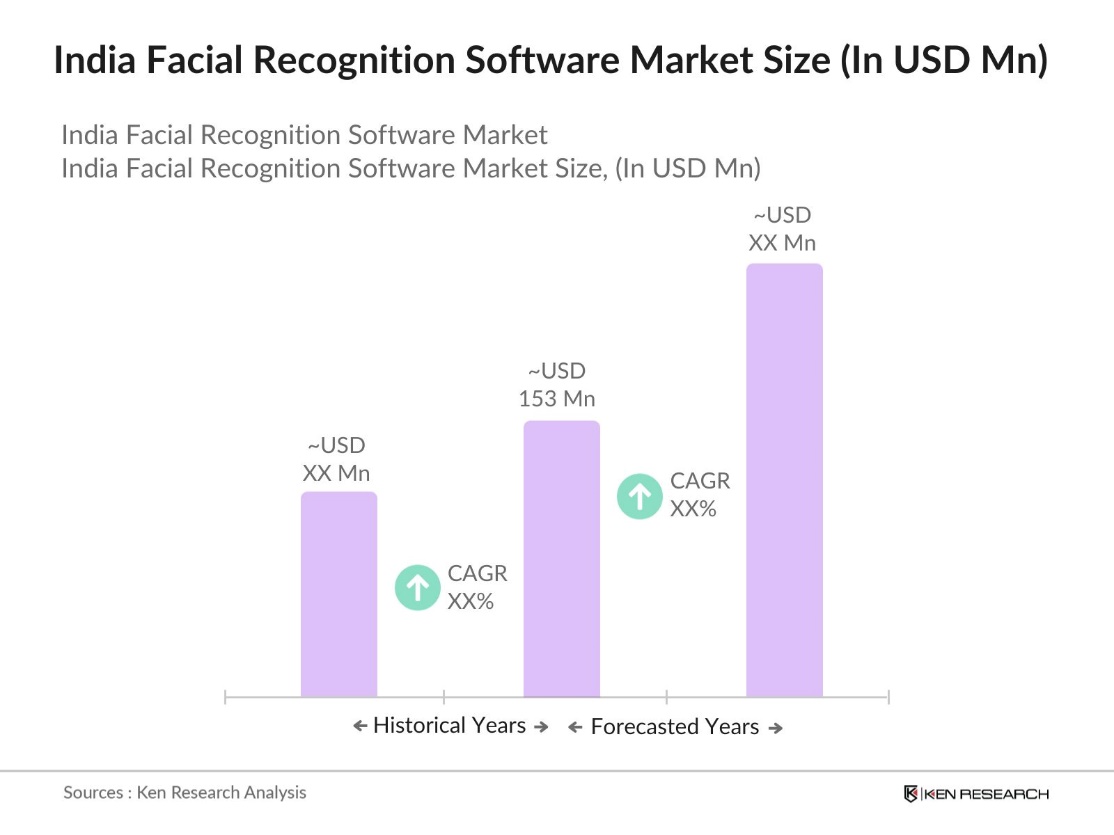

- The India Facial Recognition Software Market is valued at USD 153 million, driven by increasing demand for biometric authentication in law enforcement, banking, and retail sectors. Government initiatives, such as smart city projects, and the growing focus on public surveillance systems have significantly fueled this market. Moreover, the rising integration of artificial intelligence and machine learning technologies in facial recognition systems is improving accuracy and reliability, further accelerating market growth.

- Major cities like Mumbai, Delhi, and Bengaluru dominate the facial recognition market in India due to their advanced infrastructure, heavy urbanization, and large-scale governmental projects like smart cities and public safety initiatives. These cities also see higher investments in technology and surveillance due to population density, which increases the need for robust security measures. These factors make them prime locations for the deployment of facial recognition solutions in both public and private sectors.

- Indias regulatory landscape for facial recognition technology is shaped by the Personal Data Protection Bill and the IT Act. The Personal Data Protection Bill, introduced in 2023, aims to regulate the collection and use of biometric data, including facial recognition. The bill places restrictions on how companies can store and process personal data, offering more control to users over their personal information. This legal framework is complemented by the IT Act, which governs the use of digital technologies and ensures data security across various sectors.

India Facial Recognition Software Market Segmentation

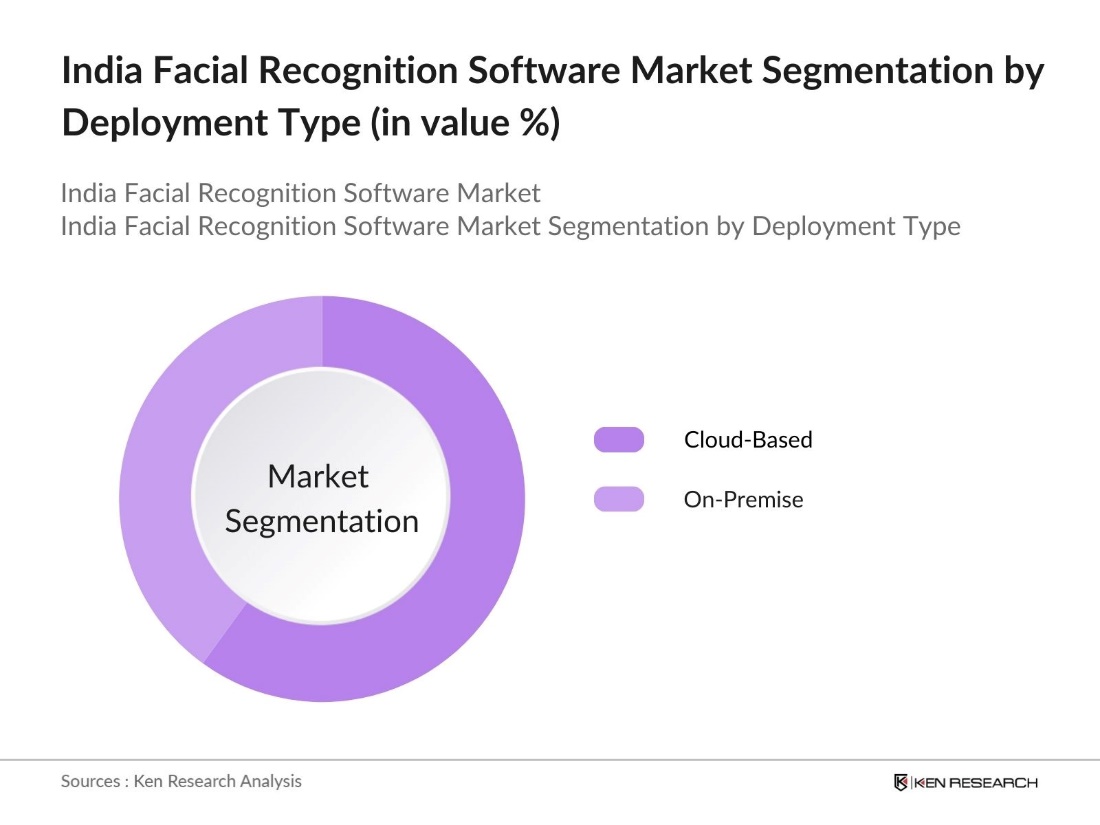

By Deployment Type: Indias facial recognition software market is segmented by deployment type into on-premise and cloud-based solutions. Recently, cloud-based solutions have gained dominance in the market, driven by the rising demand for scalability, flexibility, and remote accessibility. Companies in India are increasingly preferring cloud-based deployment as it reduces infrastructure costs and ensures faster implementation. The growing number of startups and SMEs also favor cloud-based systems due to their cost-efficiency and ease of integration.

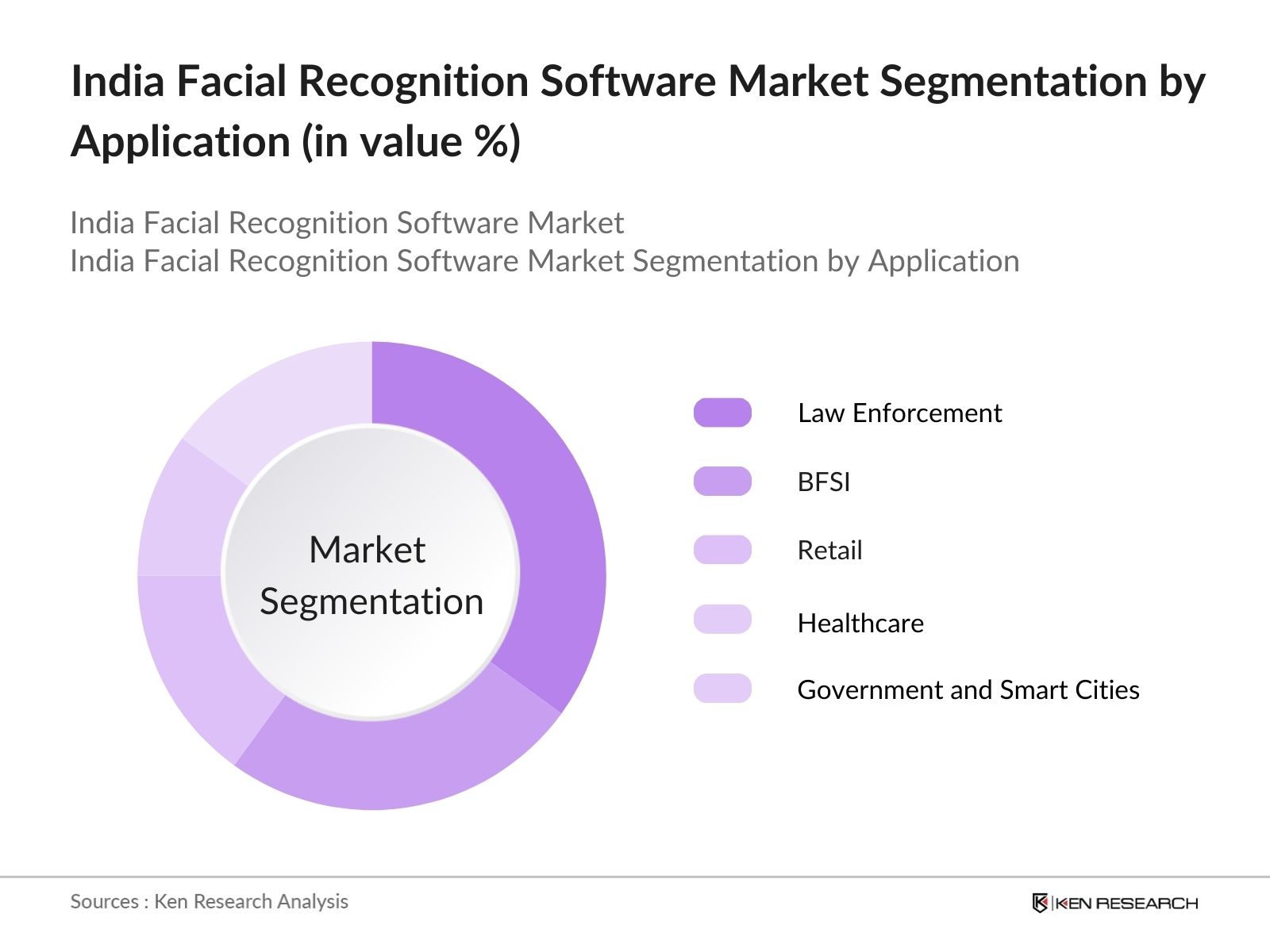

By Application: The market is also segmented by application into law enforcement, banking, financial services, and insurance (BFSI), retail, healthcare, and government and smart cities. Among these, the law enforcement segment dominates the market. This is largely due to the increasing government focus on public security and surveillance, particularly in large cities where maintaining public safety is a priority. Biometric facial recognition is increasingly used for criminal investigations, border control, and national identification programs, contributing to the dominance of this segment.

India Facial Recognition Software Market Competitive Landscape

The India facial recognition software market is dominated by several major players that have established a strong presence through technological advancements, strategic partnerships, and government collaborations. The competitive landscape is shaped by both global giants and domestic players, who are actively working on enhancing the accuracy, speed, and usability of facial recognition technologies.

|

Company |

Year Established |

Headquarters |

Market Share |

R&D Spending |

Key Clients |

Key Products |

Partnership Ecosystem |

|

NEC Corporation |

1899 |

Japan |

|

|

|

|

|

|

FaceFirst |

2007 |

USA |

|

|

|

|

|

|

Cognitec Systems |

2002 |

Germany |

|

|

|

|

|

|

Idemia |

2007 |

France |

|

|

|

|

|

|

Herta Security |

2010 |

Spain |

|

|

|

|

|

India Facial Recognition Software Industry Analysis

Growth Drivers

- Adoption in Public Security (Key Market: Law Enforcement): Facial recognition technology is becoming integral to India's law enforcement, particularly in public security. In 2023, the Indian government increased its surveillance infrastructure with AI-driven facial recognition systems for tracking criminals and managing public order. For instance, The Delhi Police have upgraded their AI-based facial recognition system ahead of the G20 Summit, improving its accuracy to a 90% success rate. The National Crime Records Bureau also started implementing real-time facial recognition systems across the country, significantly improving crime prevention efforts.

- Expansion in Retail and Banking Sectors: The use of facial recognition software in Indias retail and banking sectors has surged, particularly for customer verification and security. Leading banks, such as SBI and ICICI, have implemented facial recognition for KYC (Know Your Customer) processes, enhancing the speed and security of transactions. Similarly, major retailers like Reliance Digital have integrated facial recognition to offer personalized shopping experiences.

- Growing Use in Smart Cities: Facial recognition technology is a key component of Indias smart city projects. Over 100 cities are part of the governments Smart Cities Mission, with significant resources allocated to improving urban security through technology. Facial recognition systems are being deployed for monitoring traffic, reducing crime, and enhancing citizen safety. By 2023, cities like Pune and Hyderabad had integrated these systems into their public surveillance networks

Market Challenges

- Privacy Concerns (GDPR, Local Regulations): Indias facial recognition market faces increasing privacy concerns. The Personal Data Protection Bill of 2023 seeks to regulate biometric data usage, including facial recognition. Compliance with global regulations like GDPR adds complexity, particularly for companies operating across borders. As privacy debates intensify, balancing technological advancement with data protection becomes a significant challenge for technology providers in India.

- High Implementation Costs for SMEs: While large enterprises adopt facial recognition technology, small and medium enterprises (SMEs) in India struggle with high implementation costs, often reaching several lakhs. These expenses, coupled with limited digital infrastructure in rural areas, hinder broader adoption. For many SMEs, which form a crucial part of Indias economy, these financial barriers restrict access to advanced facial recognition systems.

India Facial Recognition Software Market Future Outlook

The India facial recognition software market is set to experience significant growth in the coming years, driven by continuous advancements in AI technologies, growing demand for biometric authentication, and government-led initiatives aimed at enhancing public safety. The ongoing digital transformation in sectors such as banking, healthcare, and retail is expected to further increase the adoption of facial recognition systems, while the expansion of smart cities will also fuel market growth.

Market Opportunities

- Integration with Cloud-Based Solutions (Cloud, SaaS): Indias facial recognition market presents significant growth opportunities through the integration of cloud-based solutions, such as Software-as-a-Service (SaaS). Cloud services offer scalable and cost-effective facial recognition, reducing the reliance on expensive hardware. This integration allows real-time data processing and storage, making it easier for businesses to deploy facial recognition technology. The flexibility and affordability of cloud solutions are driving their increasing adoption across various industries, offering a significant market expansion potential for technology providers.

- Emerging Demand for Contactless Solutions (Healthcare, Airports): The demand for contactless solutions in India is rising, particularly in sectors like healthcare and airports. Facial recognition technology is being adopted for touchless processes such as patient identification and airport check-ins, enhancing both safety and efficiency. This trend has gained momentum, especially in post-pandemic scenarios, where contactless systems are critical. The adoption of facial recognition in these sectors is expected to grow further, driven by the need for increased security and seamless user experiences.

Scope of the Report

|

Deployment Type |

On-Premise Cloud-Based |

|

Application |

Law Enforcement BFSI Healthcare Retail Government and Smart Cities |

|

Technology |

2D Facial Recognition 3D Facial Recognition Facial Analytics |

|

End-User Industry |

Government and Public Sector Enterprise Sector Education Consumer Electronics |

|

Region |

North South East West |

Products

Key Target Audience

Ride-Hailing and Transport Companies

E-commerce Platforms

Telecommunication Companies

Hospitality Industry

Investors and venture capital Firms

Banks and Financial Institutions

Government and Regulatory Bodies (Ministry of Home Affairs, Ministry of Electronics and IT)

Companies

Players Mentioned in the Report

NEC Corporation

Cognitec Systems GmbH

Herta Security

Tech5

Idemia

AnyVision

Face++

Innovatrics

iProov

Daon

Table of Contents

1. India Facial Recognition Software Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Facial Recognition Software Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Facial Recognition Software Market Analysis

3.1. Growth Drivers

3.1.1. Adoption in Public Security (Key Market: Law Enforcement)

3.1.2. Expansion in Retail and Banking Sectors

3.1.3. Increasing Government Investments in AI and Surveillance

3.1.4. Growing Use in Smart Cities

3.2. Market Challenges

3.2.1. Privacy Concerns (GDPR, Local Regulations)

3.2.2. High Implementation Costs for SMEs

3.2.3. Technological Limitations in Accuracy (Biometric Matching Algorithms)

3.3. Opportunities

3.3.1. Integration with Cloud-Based Solutions (Cloud, SaaS)

3.3.2. Emerging Demand for Contactless Solutions (Healthcare, Airports)

3.3.3. Partnerships Between Private Sector and Government

3.4. Trends

3.4.1. Shift Towards 3D Recognition Technologies

3.4.2. Increasing Use in Mobile Payment Systems

3.4.3. Adoption of Multi-Factor Authentication

3.5. Government Regulations

3.5.1. Data Protection and Privacy Laws (Personal Data Protection Bill, IT Act)

3.5.2. Regulatory Standards for Biometric Authentication

3.5.3. Surveillance Regulations in Smart Cities

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. India Facial Recognition Software Market Segmentation

4.1. By Deployment Type (In Value %)

4.1.1. On-Premise

4.1.2. Cloud-Based

4.2. By Application (In Value %)

4.2.1. Law Enforcement

4.2.2. Banking, Financial Services, and Insurance (BFSI)

4.2.3. Healthcare

4.2.4. Retail

4.2.5. Government and Smart Cities

4.3. By Technology (In Value %)

4.3.1. 2D Facial Recognition

4.3.2. 3D Facial Recognition

4.3.3. Facial Analytics

4.4. By End-User Industry (In Value %)

4.4.1. Government and Public Sector

4.4.2. Enterprise Sector

4.4.3. Education

4.4.4. Consumer Electronics

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Facial Recognition Software Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. NEC Corporation

5.1.2. Ayonix Corporation

5.1.3. FaceFirst

5.1.4. Cognitec Systems GmbH

5.1.5. Herta Security

5.1.6. Tech5

5.1.7. Idemia

5.1.8. Gemalto

5.1.9. AnyVision

5.1.10. Face++

5.1.11. Innovatrics

5.1.12. iProov

5.1.13. Aware Inc.

5.1.14. Daon

5.1.15. TrueFace

5.2. Cross Comparison Parameters (Revenue, Headquarters, R&D Spending, Market Share, No. of Employees, Partnership Ecosystem, Key Products, Major Clients)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Facial Recognition Software Market Regulatory Framework

6.1. Data Protection and Privacy Laws

6.2. Biometric Authentication Standards

6.3. Certification Processes

7. India Facial Recognition Software Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Facial Recognition Software Future Market Segmentation

8.1. By Deployment Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By End-User Industry (In Value %)

8.5. By Region (In Value %)

9. India Facial Recognition Software Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In this initial phase, we developed an ecosystem map to include all major stakeholders of the India facial recognition software market. Our focus was on identifying the key factors that drive adoption in sectors like law enforcement and BFSI.

Step 2: Market Analysis and Construction

We compiled historical data and analyzed the market penetration of facial recognition software across different sectors, assessing revenue contributions and technology adoption levels in public and private sectors.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through interviews with industry experts and representatives from companies operating within this space. This step ensured that our revenue estimates and market growth assumptions were reliable.

Step 4: Research Synthesis and Final Output

Our final output was synthesized by cross-verifying data from both primary and secondary sources, including face-to-face consultations with facial recognition software providers, ensuring the accuracy of market segmentation, growth drivers, and competitive analysis.

Frequently Asked Questions

01 How big is the India facial recognition software market?

The India Facial Recognition Software Market is valued at USD 153 million, driven by the growing need for biometric identification in law enforcement and public safety sectors, as well as increased adoption in banking and retail sectors.

02 What are the key challenges in the India facial recognition software market?

Key challenges in India Facial Recognition Software Market include privacy concerns, high implementation costs for smaller enterprises, and regulatory scrutiny, especially around the use of personal data for facial recognition.

03 Who are the major players in the India facial recognition software market?

The major players in India Facial Recognition Software Market include NEC Corporation, Cognitec Systems, Herta Security, Tech5, and Idemia, who dominate due to their technological innovations, strong R&D investments, and government collaborations.

04 What drives the growth of the India facial recognition software market?

The India Facial Recognition Software Market growth is primarily driven by government initiatives like smart city projects, increasing security concerns, and the growing use of biometric systems in BFSI and healthcare sectors for enhanced security and authentication.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.