India Fast Food Market Outlook to 2030

Region:Asia

Author(s):Shubham

Product Code:KROD6049

November 2024

91

About the Report

India Fast Food Market Overview

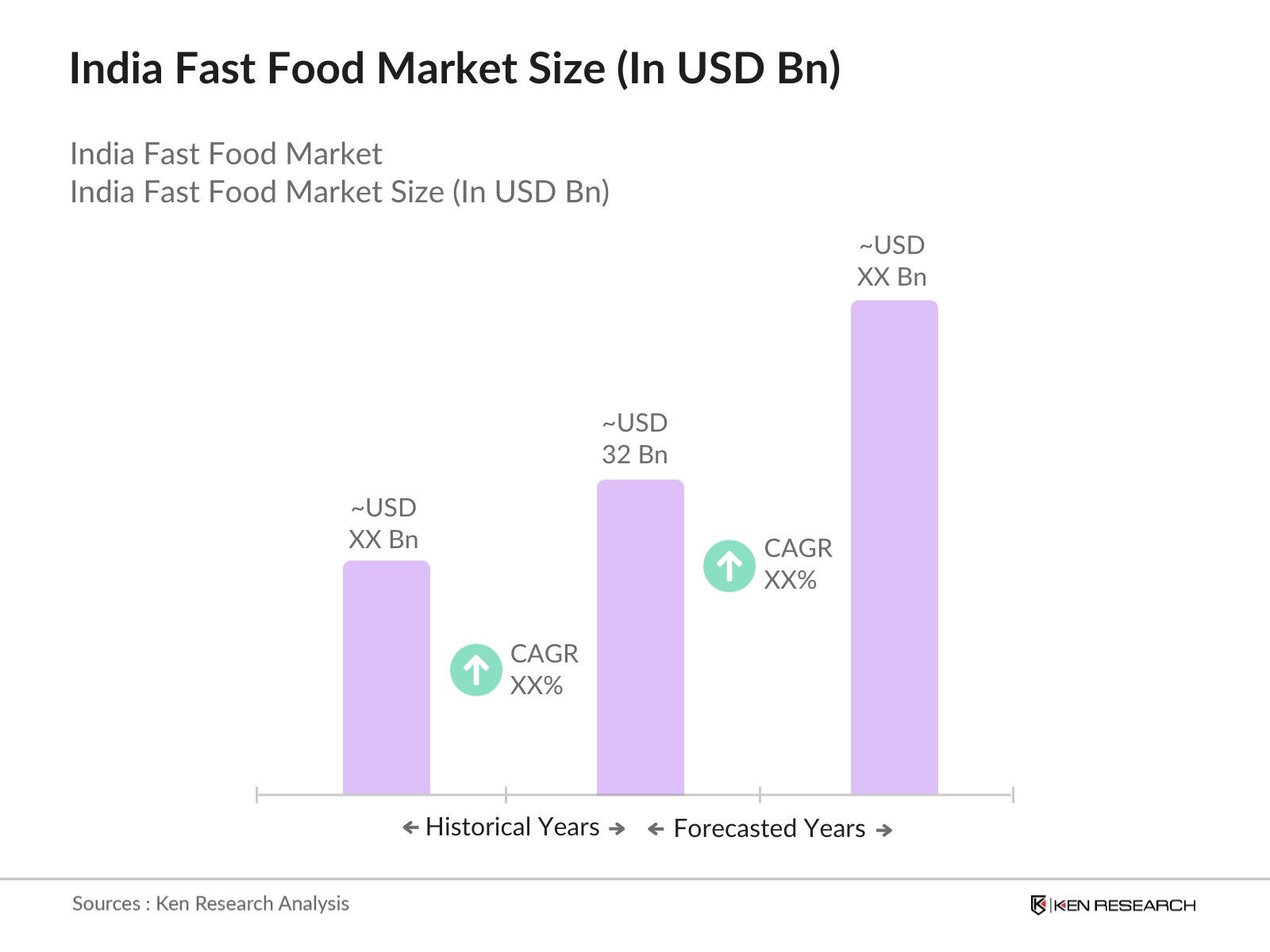

- The India Fast Food Market is currently valued at USD 32 billion, with significant growth driven by rising urbanization, evolving consumer lifestyles, and a strong preference for convenient dining options. Fast food has become an integral part of the dining culture, especially among young urban dwellers who favor affordable and quick meal solutions. The markets expansion is further supported by the growth of digital food delivery platforms, which have simplified access to a variety of fast food options across Indias major cities.

- Cities like Delhi, Mumbai, and Bangalore dominate the fast food market in India due to their high population density, cultural receptiveness to global cuisines, and higher disposable incomes. These metropolitan areas are home to a substantial number of multinational fast-food chains, as well as well-established domestic brands. The presence of a robust IT sector in cities like Bangalore further fuels demand as fast-paced lifestyles favor quick dining options, solidifying the market's growth in these regions.

- The FSSAI enforces strict standards for food safety across fast-food outlets in India. In 2024, thousands of inspections were conducted to ensure compliance, focusing on hygiene and food safety standards. Compliance with these regulations is mandatory, and non-compliance leads to financial penalties and possible closures, compelling QSRs to adopt stringent quality control measures. The regulatory framework ensures consumer safety while adding compliance costs for brands.

India Fast Food Market Segmentation

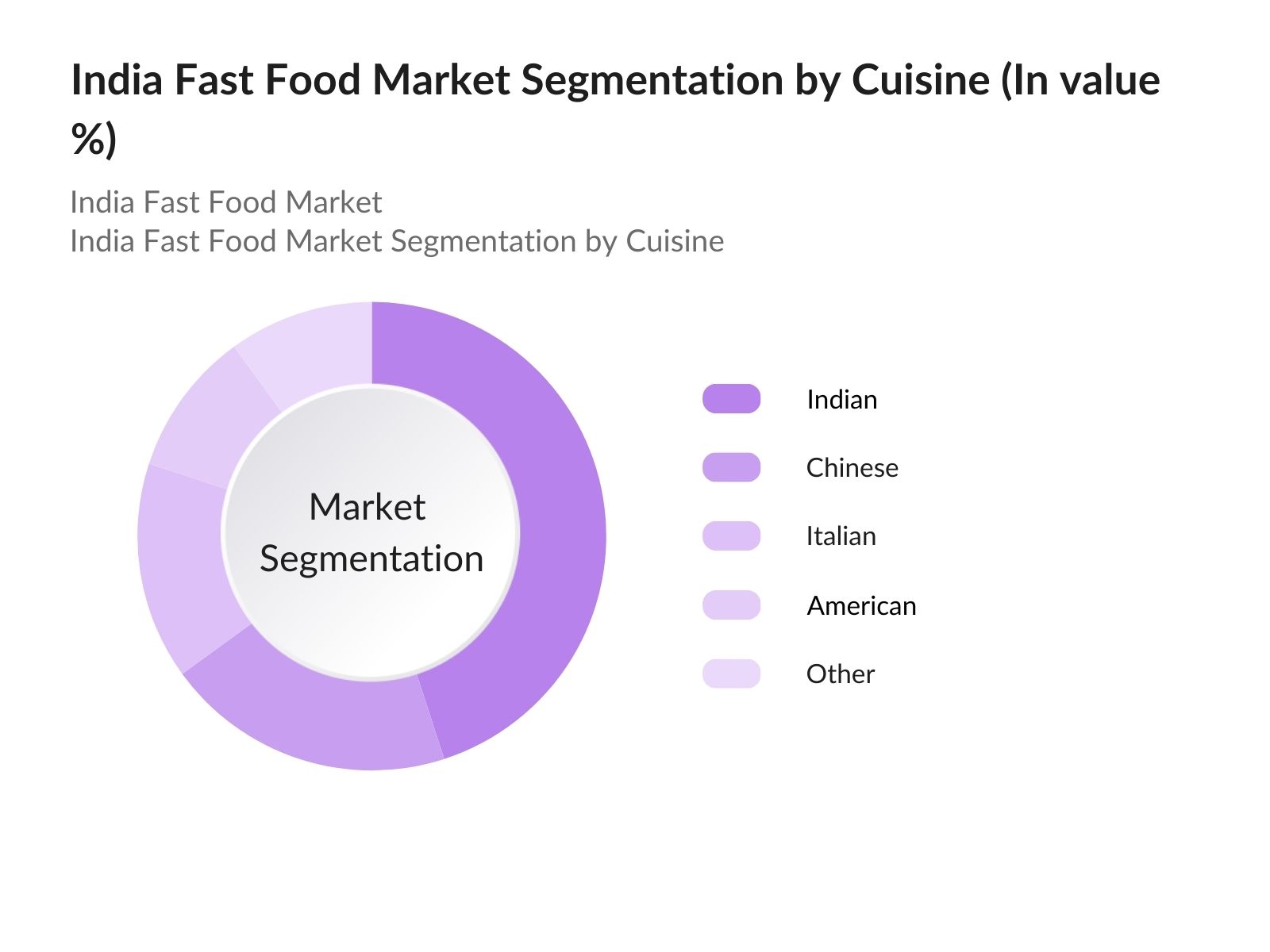

- By Type of Cuisine: The Market is segmented by type of cuisine into Indian, Chinese, Italian, American, and others. Indian cuisine leads this segment, largely due to its deep cultural significance and strong preference among local consumers. Items such as samosas, dosas, and chaat have been adapted into fast food formats and are widely accepted across age groups. This popularity is fueled by both traditional tastes and the availability of Indian fast food across diverse geographic regions, making it the preferred choice within this segment.

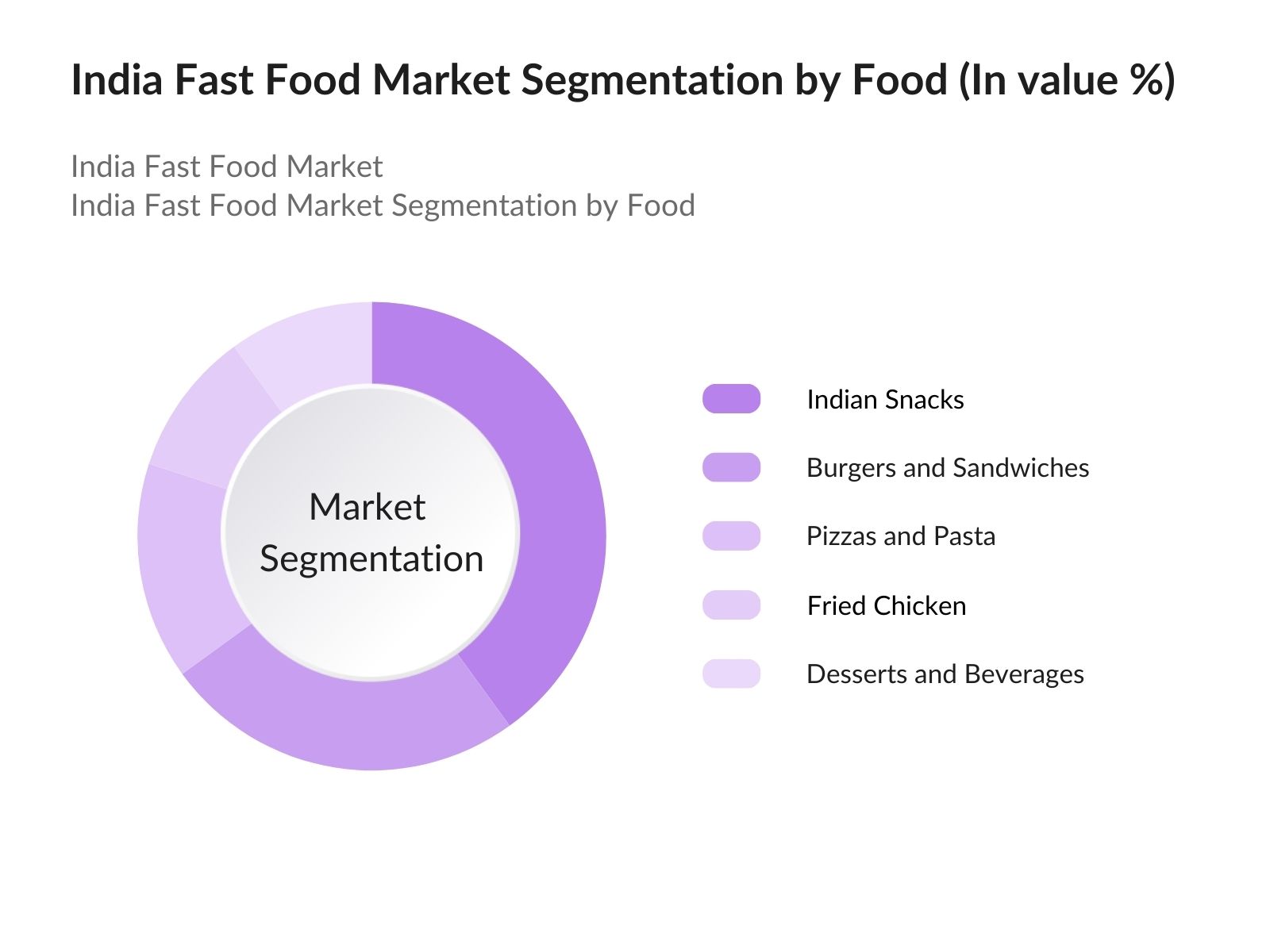

- By Food Type: The market is further segmented by food type into burgers and sandwiches, pizzas and pasta, fried chicken, Indian snacks, and desserts and beverages. Indian snacks hold a dominant position due to their popularity and affordability, offering a variety of options like vada pav, kachori, and bhature. These items resonate well with local taste preferences and are often chosen over other types of fast food due to their widespread availability and flavor, establishing Indian snacks as the leading sub-segment in this category.

India Fast Food Market Competitive Landscape

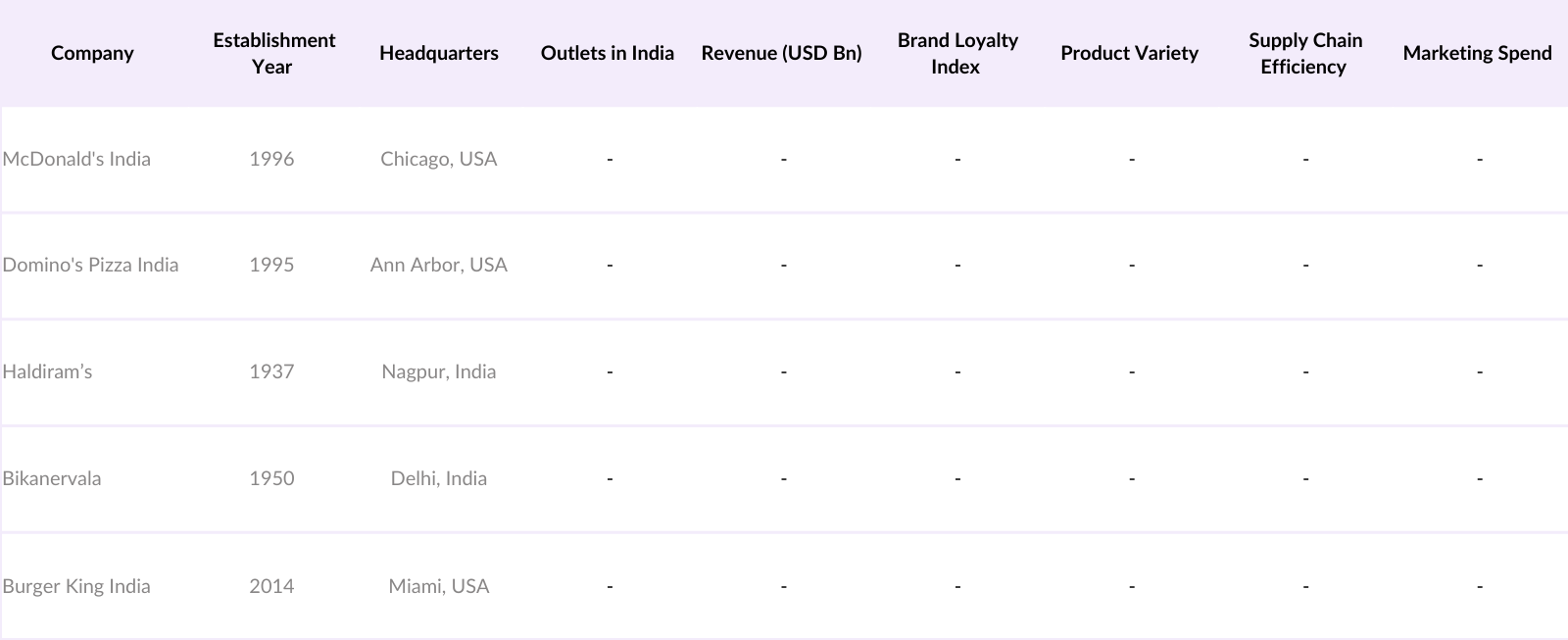

The India Fast Food Market is characterized by both domestic and international players who have established a strong brand presence. The competitive environment is shaped by multinational chains like McDonald's and Dominos, alongside established domestic players such as Haldirams and Bikanervala. This diverse mix allows consumers a broad choice of cuisines and meal types, supporting the markets continued expansion.

India Fast Food Market Analysis

Growth Drivers

- Evolving Consumer Preferences: Indias fast-food landscape is influenced by evolving preferences toward international cuisines and innovative meal options. As of 2024, over 50% of consumers in urban centers report preferring fast food due to flavor variety and convenience, as noted in National Family Health Survey data. This change is notably prominent among younger demographics aged 18-34, who prefer global flavors adapted to local palates, such as pizza and burgers. Growing demand for customization in fast-food orders has led to a surge in QSRs offering personalized menus, fueling the industry's innovation.

- Increase in Disposable Income: Indias per capita disposable income has seen significant growth, with estimates placing it at INR 2,14,000 in 2024, a notable rise from INR 1,98,000 in 2022, according to Reserve Bank of India reports. Higher disposable incomes mean more spending on non-essential goods, with fast food capturing a major share. This is particularly seen in urban regions where working professionals and middle-income households prefer convenience-based dining options. Increased disposable income has catalyzed a greater market share for fast-food brands, contributing to sector growth.

- Expansion of Quick Service Restaurant (QSR) Chains: India has witnessed a substantial increase in QSR chains, with leading brands opening nearly 500 new outlets in 2024, particularly in urban areas, according to the Ministry of Corporate Affairs. This expansion reflects both foreign and local brands capitalizing on rising demand, with metropolitan areas seeing significant increases. Bengaluru, accounted for most number of new QSR establishments. Such expansion directly contributes to job creation, further enhancing economic growth in urban sectors.

Challenges

- Intense Competition from Local Food Vendors: Local food vendors dominate Indias fast-food market, offering diverse, regionally flavored street foods that resonate culturally. Approximately 20 million street vendors operate in India, catering to budget-conscious consumers who find local foods cheaper than QSR options, according to the Ministry of Labor and Employment. This intense competition presents a challenge for larger fast-food brands in attracting a similar market base, particularly in Tier 2 and 3 cities where affordability is crucial.

- Regulatory Hurdles: Indias fast-food sector must comply with stringent Food Safety and Standards Authority of India (FSSAI) regulations, focusing on hygiene, packaging, and food labeling standards. In 2024, over 12,000 regulatory inspections were conducted across QSR outlets to enforce compliance, according to FSSAI data. Non-compliance risks include fines and temporary closures, adding operational costs for fast-food brands. The enforcement of these regulations, though essential for consumer health, imposes challenges in terms of time and resources for fast-food chains.

India Fast Food Market Future Outlook

The India Fast Food Market is expected to experience sustained growth through 2028, driven by factors such as increasing consumer preference for convenience, rapid urbanization, and technological advancements in food delivery systems. Demand is likely to rise in both urban and semi-urban areas, as digital platforms expand, offering wider access to a variety of fast-food options. Additionally, healthier and plant-based food alternatives are anticipated to emerge as significant trends, aligning with evolving consumer preferences for more sustainable dining options.

Future Market Opportunities

- Growth of Online Food Delivery Platforms: Indias online food delivery market has seen substantial growth, with over 660 million orders fulfilled by delivery apps in 2024, reported by the Telecom Regulatory Authority of India. This growth supports fast-food brands by expanding their reach to customers who prefer doorstep service. The emergence of digital payment systems further simplifies the process, contributing to seamless delivery experiences. Leading platforms like Swiggy and Zomato account for majority of these orders, providing opportunities for fast-food chains to connect with a tech-savvy consumer base.

- Expansion into Tier 2 and Tier 3 Cities: Fast-food brands increasingly target Tier 2 and Tier 3 cities, where the demand for QSRs is growing among middle-class families. According to the Ministry of Urban Development, over 300 new QSR outlets are projected to open in smaller cities in 2024, driven by changing dining habits and higher disposable incomes. Cities like Bhopal, Surat, and Jaipur report rising consumer spending on quick-service dining options, making them lucrative markets for expansion. This opportunity aligns with rising income levels and a preference for modern dining experiences.

Scope of the Report

|

Type of Cuisine |

- Indian - Chinese - Italian - American - Others |

|

By Food Type |

Burgers and Sandwiches Pizzas and Pasta Fried Chicken Indian Snacks Desserts and Beverages |

|

By Service Type |

Dine-In Takeaway Delivery Drive-Thru |

|

By Customer Demographics |

Kids and Teens Adults (18-35) Middle-aged (35-55) Seniors (55+) |

|

By Region |

North South East West |

Products

Key Target Audience

Fast Food Chains and Franchisees

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Government and Regulatory Bodies (e.g., Food Safety and Standards Authority of India)

Food Delivery Service Providers

Restaurant Equipment Suppliers

Packaging Material Manufacturers

Food Ingredients Suppliers

Companies

Players Mentioned in the Report

McDonald's India

Domino's Pizza India

Subway India

Burger King India

Pizza Hut India

KFC India

Caf Coffee Day

Haldirams

Bikanervala

Goli Vada Pav

Faasos

Wow! Momo

Taco Bell India

Barbeque Nation

Chaayos

Table of Contents

1. India Fast Food Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. India Fast Food Market Size (In INR Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. India Fast Food Market Analysis

3.1 Growth Drivers

3.1.1 Urbanization Trends

3.1.2 Evolving Consumer Preferences

3.1.3 Increase in Disposable Income

3.1.4 Expansion of Quick Service Restaurant (QSR) Chains

3.2 Market Challenges

3.2.1 Intense Competition from Local Food Vendors

3.2.2 Regulatory Hurdles

3.2.3 Rising Health Consciousness

3.3 Opportunities

3.3.1 Growth of Online Food Delivery Platforms

3.3.2 Expansion into Tier 2 and Tier 3 Cities

3.3.3 Introduction of Healthier Fast Food Alternatives

3.4 Trends

3.4.1 Rise in Demand for Plant-Based Fast Foods

3.4.2 Shift Towards Sustainable Packaging

3.4.3 Increased Focus on Localized Menus

3.5 Government Regulations

3.5.1 FSSAI Standards and Compliance

3.5.2 Food Safety and Labeling Requirements

3.5.3 Incentives for Sustainable Practices

3.6 Competitive Landscape (SWOT Analysis)

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. India Fast Food Market Segmentation

4.1 By Type of Cuisine (In Value %)

4.1.1 Indian

4.1.2 Chinese

4.1.3 Italian

4.1.4 American

4.1.5 Others

4.2 By Food Type (In Value %)

4.2.1 Burgers and Sandwiches

4.2.2 Pizzas and Pasta

4.2.3 Fried Chicken

4.2.4 Indian Snacks

4.2.5 Desserts and Beverages

4.3 By Service Type (In Value %)

4.3.1 Dine-In

4.3.2 Takeaway

4.3.3 Delivery

4.3.4 Drive-Thru

4.4 By Customer Demographics (In Value %)

4.4.1 Kids and Teens

4.4.2 Adults (18-35)

4.4.3 Middle-aged (35-55)

4.4.4 Seniors (55+)

4.5 By Region (In Value %)

4.5.1 North

4.5.2 South

4.5.3 East

4.5.4 West

5. India Fast Food Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 McDonalds India

5.1.2 Dominos Pizza India

5.1.3 Subway India

5.1.4 Burger King India

5.1.5 Pizza Hut India

5.1.6 KFC India

5.1.7 Caf Coffee Day

5.1.8 Haldirams

5.1.9 Bikanervala

5.1.10 Goli Vada Pav

5.1.11 Faasos

5.1.12 Wow! Momo

5.1.13 Taco Bell India

5.1.14 Barbeque Nation

5.1.15 Chaayos

5.2 Cross Comparison Parameters (Headquarters, Revenue, No. of Outlets, Market Share, Brand Awareness, Customer Ratings, Innovation Index, Supply Chain Efficiency)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Private Equity and Venture Capital Funding

5.8 Government Subsidies and Grants

5.9 Franchisee Analysis

6. India Fast Food Market Regulatory Framework

6.1 Food Safety and Standards Authority of India (FSSAI) Guidelines

6.2 Health and Hygiene Compliance

6.3 Advertisement and Promotion Regulations

6.4 Licensing and Registration Processes

7. India Fast Food Market Future Market Size (In INR Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Growth

8. India Fast Food Market Future Market Segmentation

8.1 By Type of Cuisine (In Value %)

8.2 By Food Type (In Value %)

8.3 By Service Type (In Value %)

8.4 By Customer Demographics (In Value %)

8.5 By Region (In Value %)

9. India Fast Food Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Segmentation and Targeting

9.3 Innovation and Product Differentiation

9.4 Marketing Initiatives and Brand Positioning

9.5 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase involves mapping the ecosystem of the India Fast Food Market, encompassing all primary stakeholders. Through extensive desk research, a combination of secondary and proprietary databases is used to gather in-depth industry information, defining variables such as market drivers, challenges, and consumer preferences.

Step 2: Market Analysis and Construction

During this phase, historical data is compiled and analyzed to assess market penetration and revenue streams in the India Fast Food Market. Service quality and consumer satisfaction statistics are also reviewed to ensure accuracy in the revenue projections, providing a robust foundation for analysis.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are constructed and validated through structured interviews with industry experts, representing diverse companies across the fast food landscape. This step offers operational insights, enhancing the reliability of market estimates.

Step 4: Research Synthesis and Final Output

In the final step, direct engagement with multiple fast food chains and suppliers is undertaken to obtain detailed insights into market trends, consumer behavior, and key growth areas, which are then incorporated to create a well-rounded, validated market analysis.

Frequently Asked Questions

01. How big is the India Fast Food Market?

The India Fast Food Market, valued at USD 32 billion, is primarily driven by the rise in urban population, increasing income levels, and a shift toward convenient dining options across major urban areas.

02. What are the main challenges in the India Fast Food Market?

The India Fast Food Marketfaces challenges such as competition from street food vendors, high regulatory standards, and rising health awareness among consumers, which could influence the demand for traditional fast-food options.

03. Who are the major players in the India Fast Food Market?

Key players in the India Fast Food Marketinclude McDonald's India, Domino's Pizza India, Haldirams, Bikanervala, and KFC India. Their strong distribution networks and brand loyalty contribute to their market leadership.

04. What factors are driving growth in the India Fast Food Market?

The growth of the India Fast Food Market is supported by increasing disposable incomes, an expanding delivery ecosystem, and a growing demand for quick and affordable meal options across urban areas.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.