India Female Hygiene Market

Region:Asia

Author(s):Shivani Mehra

Product Code:KROD2422

November 2024

90

About the Report

India Female Hygiene Market Overview

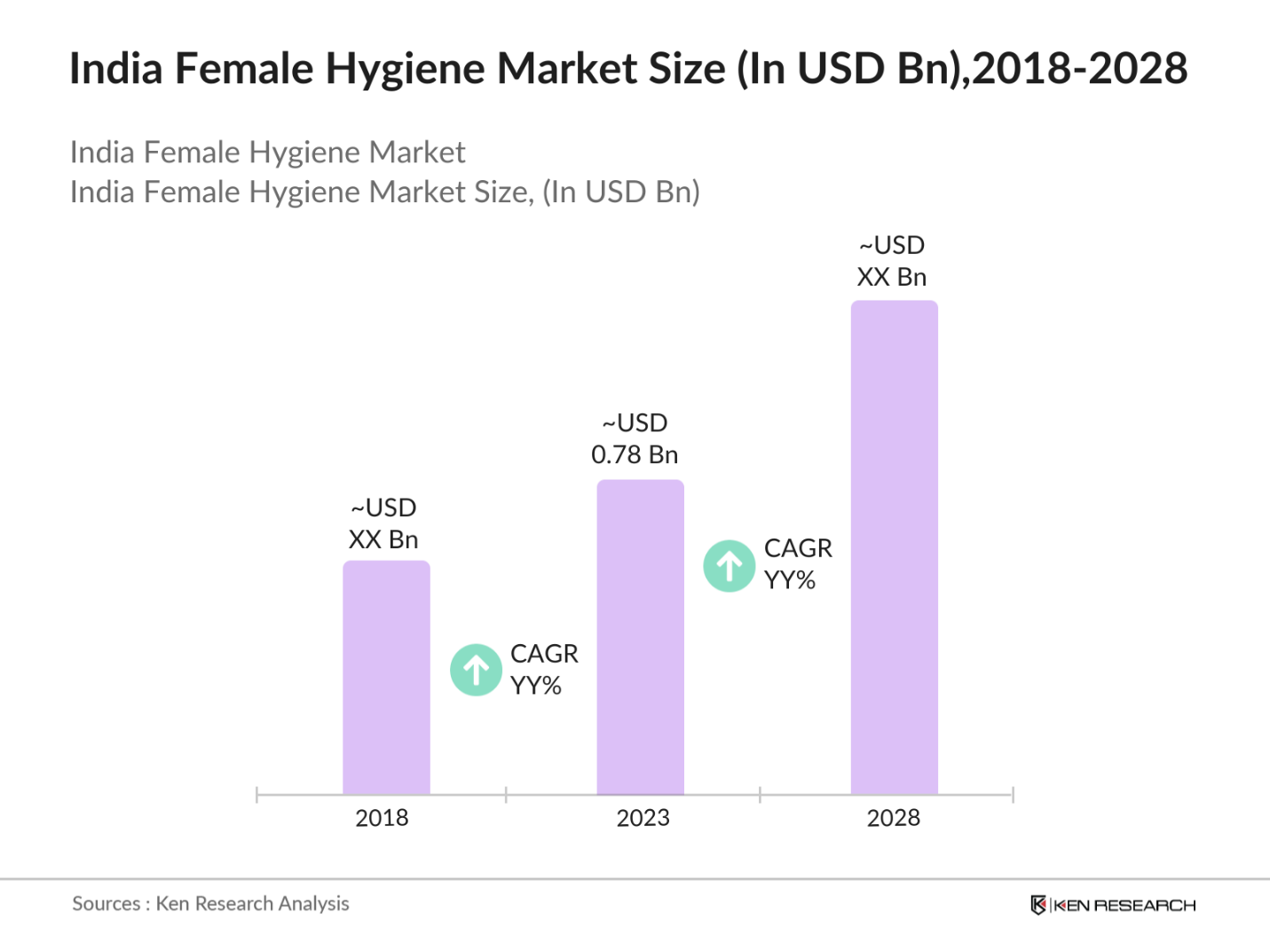

- The Indian female hygiene market was valued at approximately USD 0.78 billion in 2023. This growth has been primarily driven by increased awareness, improved distribution channels, and government initiatives that promote menstrual health and hygiene. Increased disposable incomes and urbanization have further bolstered the demand for sanitary products such as sanitary napkins, menstrual cups, and tampons, especially in Tier 1 and Tier 2 cities. The expansion of e-commerce has also contributed significantly to accessibility, driving further market penetration.

- The Indian female hygiene market is dominated by key players such as Procter & Gamble (P&G) with its flagship brand Whisper, Johnson & Johnsons Stayfree, Unicharm's Sofy, and Kimberly-Clarks Kotex. These companies hold a substantial share in the market due to their extensive distribution networks, aggressive marketing campaigns, and innovations in product design. Additionally, domestic brands like Niine and Paree are gaining traction, especially in rural areas, by offering affordable sanitary products.

- In May 2023, Niine introduced India's first PLA-based biodegradable sanitary napkins. These products are made from a blend of wooden pulp, bio-based resins, and 100% biodegradable materials derived from plant starches. They are designed to decompose significantly faster than traditional pads, with over 90% decomposing within 175 days.

- Cities like Mumbai, Delhi, Bangalore, and Chennai dominate the female hygiene market in India. These cities have higher awareness levels, better access to healthcare products, and a larger base of working women who are more inclined to invest in premium hygiene products. Additionally, these cities have robust e-commerce penetration, making it easier for consumers to access a variety of products, including international brands. The higher purchasing power in these cities is also a critical factor driving market dominance.

India Female Hygiene Market Segmentation

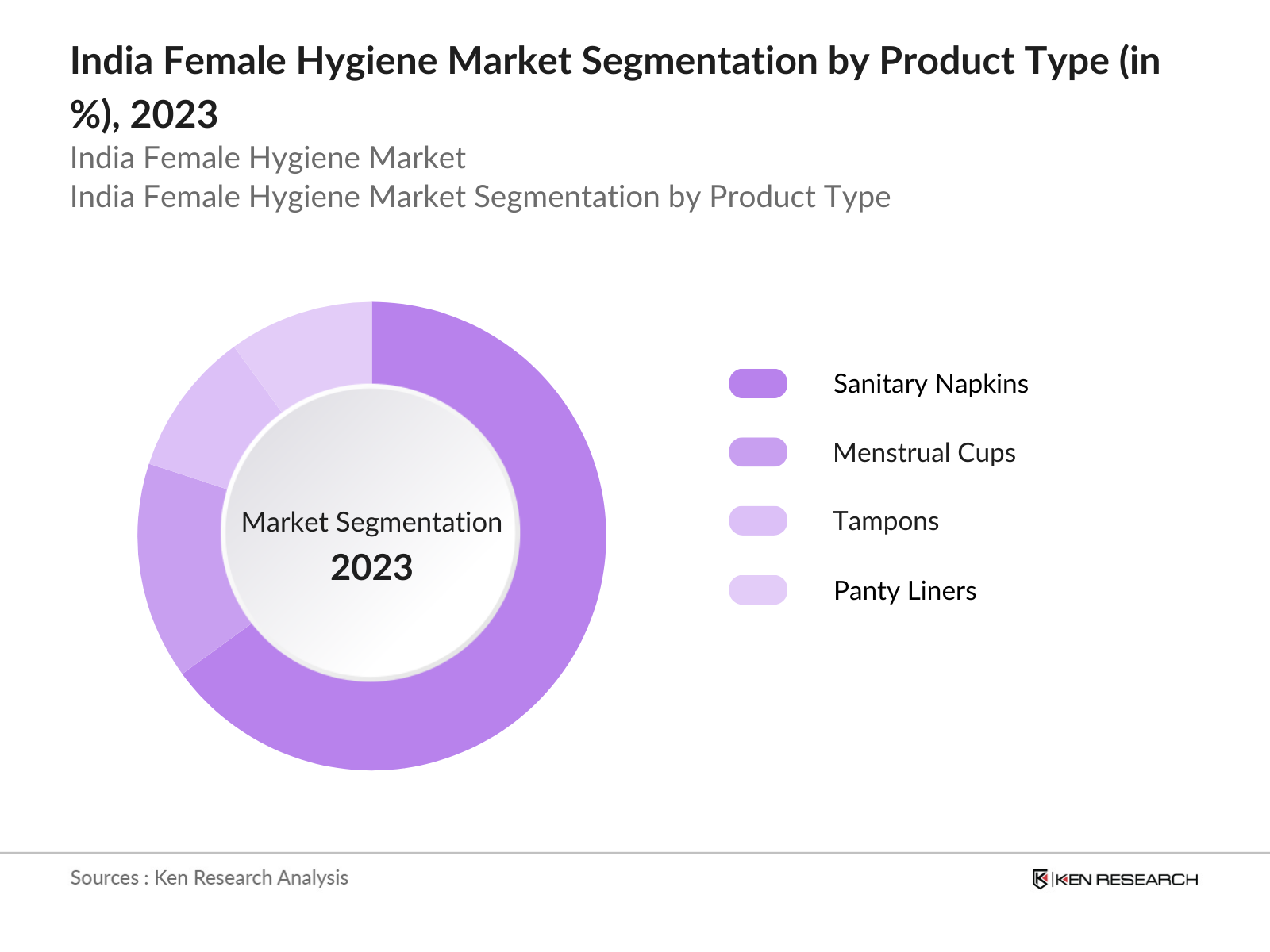

By Product Type: The India female hygiene market is segmented by product type into sanitary napkins, tampons, menstrual cups, and panty liners. In 2023, sanitary napkins held the dominant market share in India due to their affordability and widespread availability, especially in rural and semi-urban areas. Brands like Whisper and Stayfree have built strong brand recognition over the years, making sanitary napkins the go-to product for most women. However, menstrual cups are gradually gaining popularity among urban consumers, driven by environmental and cost-saving benefits.

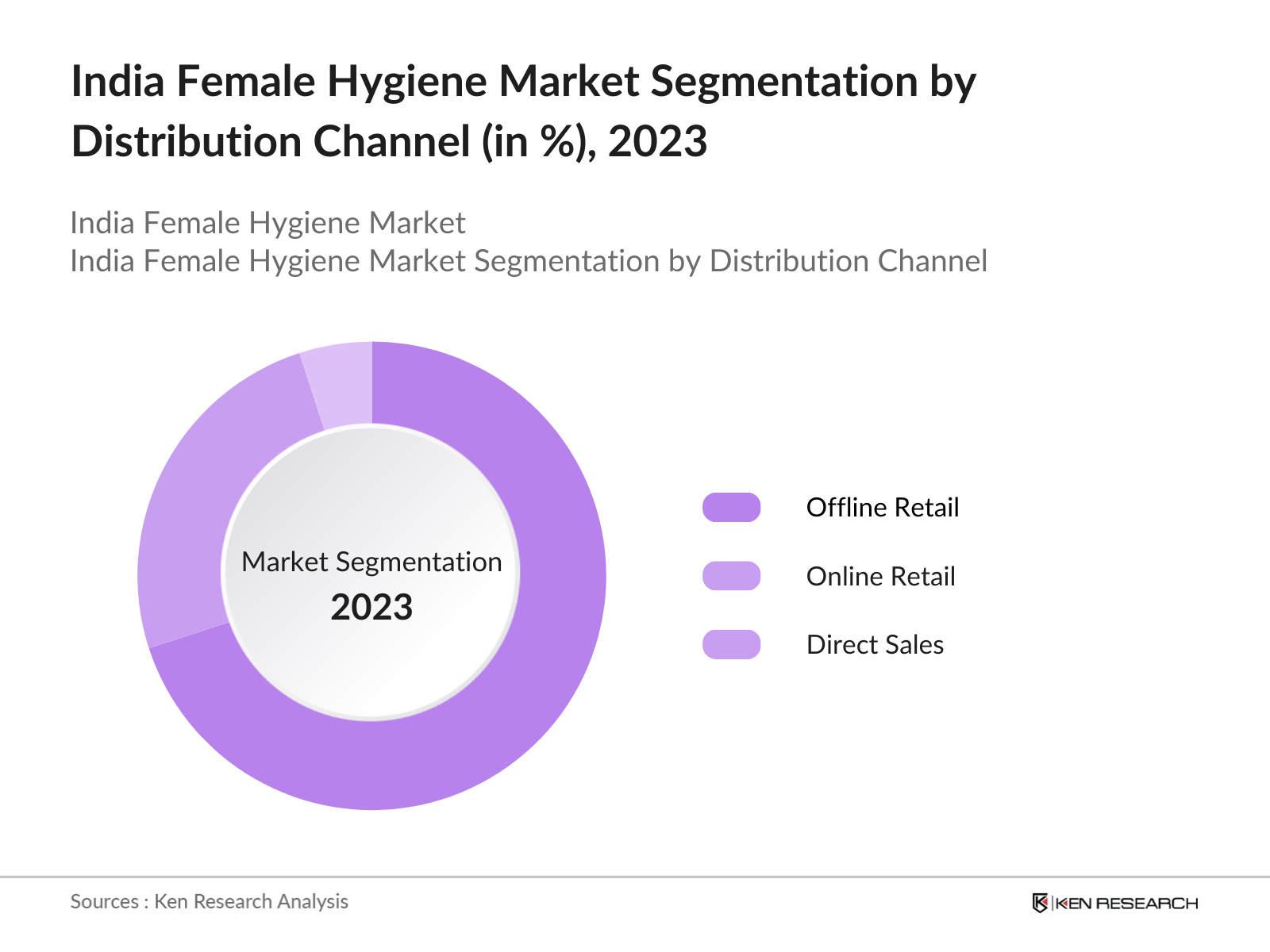

By Distribution Channel: The India female hygiene market is segmented by distribution channel into offline retail, online retail, and direct sales. In 2023, offline retail channels, such as supermarkets, pharmacies, and convenience stores, held the largest market share due to their accessibility and established consumer trust. However, online retail is witnessing rapid growth, fueled by rising internet penetration and the convenience of home delivery. Platforms like Amazon, Flipkart, and Nykaa have played a crucial role in the expansion of premium and eco-friendly hygiene products, particularly in Tier 1 and Tier 2 cities.

By Region: The India female hygiene market is segmented regionally into North, South, East, and West India. In 2023, South India held the largest market share, driven by higher literacy rates, better healthcare infrastructure, and progressive attitudes towards menstrual health. Government-backed initiatives in states like Tamil Nadu and Kerala have further promoted the use of female hygiene products. Additionally, urban hubs like Bangalore and Chennai are witnessing a growing demand for premium products such as tampons and menstrual cups, reflecting shifting consumer preferences in these areas.

India Female Hygiene Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Procter & Gamble (Whisper) |

1837 |

Cincinnati, USA |

|

Johnson & Johnson (Stayfree) |

1886 |

New Jersey, USA |

|

Unicharm (Sofy) |

1961 |

Tokyo, Japan |

|

Kimberly-Clark (Kotex) |

1872 |

Texas, USA |

|

Niine |

2018 |

Uttar Pradesh, India |

- Procter & Gamble (Whisper): In 2023, P&G India launched an initiative focused on menstrual hygiene awareness in rural schools, aiming to reach over 10 million girls by 2024. The initiative is part of their CSR activity and seeks to increase the penetration of sanitary napkins in underdeveloped areas.

- Johnson & Johnson (Stayfree): In 2023, Johnson & Johnson announced a collaboration with the Indian government under the Udaan Initiative to supply affordable menstrual hygiene products in rural schools. They also launched Stayfree biodegradable sanitary napkins in Tier 2 and Tier 3 cities.

India Female Hygiene Market Analysis

India Female Hygiene Market Growth Drivers

- Rising Awareness of Menstrual Health: Increased government campaigns, such as the "Menstrual Hygiene Scheme" launched by the Indian government in 2023, have significantly driven awareness and adoption of female hygiene products. As part of the scheme, over 50 million women and adolescent girls across India received education and access to sanitary products. This initiative also led to collaborations with NGOs and private sector companies, resulting in improved hygiene practices, especially in rural and semi-urban regions.

- Shift Toward Sustainable Hygiene Products: A significant driver in the female hygiene market is the growing consumer preference for sustainable products, particularly biodegradable sanitary napkins and menstrual cups. By 2024, demand for these products grew by 30%, driven by eco-conscious consumers and environmental policies that discourage single-use plastics. The Indian government also implemented plastic bans in several states, further promoting the adoption of eco-friendly alternatives in the market, This shift aligns with global trends emphasizing environmental sustainability in consumer goods.

- Expansion of E-commerce and Distribution Networks: The rapid expansion of e-commerce in India is playing a pivotal role in making female hygiene products accessible to a larger audience, particularly in Tier 2 and Tier 3 cities. Online platforms like Amazon, Flipkart, and Nykaa have introduced subscription services for sanitary products, simplifying access and driving consistent demand in both rural and urban markets. This shift has significantly boosted market penetration, making menstrual hygiene products more convenient to purchase and replenishing supplies regularly for consumers.

India Female Hygiene Market Challenges

- Limited Access in Rural Areas: Despite growing awareness, access to female hygiene products remains a significant challenge in rural India. The lack of affordable and accessible sanitary products in these areas is compounded by social stigma, inadequate infrastructure, and insufficient healthcare outreach, which continue to limit market penetration in these regions.

- Cost Sensitivity Among Low-Income Consumers: Affordability remains a significant barrier to growth in the female hygiene market, particularly for low-income households. Despite initiatives to provide low-cost or free sanitary products, adoption rates remain low due to the high cost of branded products like Whisper or Stayfree. Many women in low-income groups continue to rely on cloth or homemade alternatives, highlighting the cost disparity between branded and local products.

India Female Hygiene Market Government Initiatives

- Suvidha Scheme (2023):This initiative aims to provide biodegradable sanitary napkins at a subsidized rate of 1 per pad through approximately 6,000 Jan Aushadhi Kendras across India. The scheme specifically targets low-income women, particularly in rural areas, with the goal of reaching over 20 million beneficiaries by the end of 2024. This initiative is expected to significantly enhance the adoption of menstrual hygiene products among economically disadvantaged populations, thereby promoting better health and hygiene practices.

- Plastic Ban and Promotion of Biodegradable Products (2023): In response to rising environmental concerns, the government implemented a ban on single-use plastics in several states in 2023, directly impacting the female hygiene market. The ban encouraged companies to develop biodegradable sanitary products, with several brands introducing eco-friendly pads made from bamboo, cotton, or other natural materials. This policy has significantly boosted the demand for biodegradable products, reshaping the market toward more sustainable alternatives.

India Female Hygiene Market Outlook

The Indian female hygiene market is poised for significant transformation over the next five years, driven by sustainability, accessibility, and increasing consumer awareness. Market players are expected to focus on addressing the growing demand for eco-friendly alternatives, improving access to menstrual hygiene products in rural areas, and introducing reusable products to cater to environmentally conscious consumers.

Future Trends

- Adoption of Biodegradable Products: The Indian female hygiene market is expected to see a major shift toward biodegradable and eco-friendly products, driven by both consumer demand and government regulations. As more states adopt plastic bans, companies are increasingly focusing on introducing sustainable alternatives such as biodegradable sanitary napkins, tampons, and menstrual cups. This trend is anticipated to significantly reshape the market, with biodegradable products gaining a larger share in the coming years.

- Increased Demand for Menstrual Cups and Reusable Products (2028): Reusable products, including menstrual cups, are expected to witness strong growth by 2028, particularly among the environmentally conscious younger population. Driven by long-term cost savings and rising awareness of environmental benefits, brands that focus on sustainable packaging and reusable materials are expected to lead this segment.

Scope of the Report

|

By Product Type |

Sanitary Napkins Tampons Menstrual Cups Panty Liners |

|

By Distribution Channel |

Offline Retail Online Retail Direct Sales |

|

By Region |

South India North India West India East India |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Government and Regulatory Bodies (MoHFW)

Healthcare Providers

Hospitals and Clinics

Retail and Distribution Companies

Womens Health NGOs

Feminine Hygiene Product Manufacturers

Pharmaceutical Companies

Investments and Venture Capitalist Firms

Schools and Educational Institutions

Social Impact Organizations

E-commerce Platforms

Environmental Organizations

Companies

Players Mentioned in the Report:

Procter & Gamble (Whisper)

Johnson & Johnson (Stayfree)

Unicharm (Sofy)

Kimberly-Clark (Kotex)

Niine

Paree

SheWings

Carmesi

Saathi Eco

Sirona

Table of Contents

01. India Female Hygiene Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. India Female Hygiene Market Size (in Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. India Female Hygiene Market Analysis

3.1. Growth Drivers

3.1.1. Government Initiatives

3.1.2. Growing Consumer Awareness

3.1.3. Demand for Sustainable Products

3.2. Challenges

3.2.1. Cultural Taboos

3.2.2. Limited Rural Access

3.2.3. Affordability Issues

3.3. Opportunities

3.3.1. Expansion in E-commerce

3.3.2. Introduction of Biodegradable Products

3.3.3. Corporate Social Responsibility (CSR) Initiatives

3.4. Trends

3.4.1. Growth in Subscription-Based Models

3.4.2. Increased Demand for Reusable Products

3.4.3. Biodegradable Product Penetration

3.5. Government Initiatives

3.5.1. Suvidha Scheme

3.5.2. Menstrual Hygiene Scheme

3.5.3. Plastic Ban and Biodegradable Promotion

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

04. India Female Hygiene Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Sanitary Napkins

4.1.2. Tampons

4.1.3. Menstrual Cups

4.1.4. Panty Liners

4.2. By Distribution Channel (in Value %)

4.2.1. Offline Retail

4.2.2. Online Retail

4.2.3. Direct Sales

4.3. By Region (in Value %)

4.3.1. North India

4.3.2. South India

4.3.3. West India

4.3.4. East India

05. India Female Hygiene Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Procter & Gamble (Whisper)

5.1.2. Johnson & Johnson (Stayfree)

5.1.3. Unicharm (Sofy)

5.1.4. Kimberly-Clark (Kotex)

5.1.5. Niine

5.1.6. Paree

5.1.7. Saathi Eco

5.1.8. Sirona

5.1.9. Pee Safe

5.1.10. Carmesi

5.2. Cross Comparison Parameters (Revenue, Headquarters, Market Share)

06. India Female Hygiene Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

07. India Female Hygiene Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

08. India Female Hygiene Market Future Outlook, 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Growth

09. India Female Hygiene Market Future Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Region (in Value %)

9.3. By Distribution Channel (in Value %)

10. Analysts Recommendations

10.1. White Space Opportunity Analysis

10.2. Marketing Strategies

10.3. Customer Cohort Analysis

Disclaimer

Contact Us

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on India Female Hygiene Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India Female Hygiene Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple Female Hygiene and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Female Hygiene.

Frequently Asked Questions

01. How big is the India Female Hygiene Market?

The India female hygiene market was valued at approximately USD 0.78 billion in 2023, driven by increased awareness, expanding e-commerce platforms, and various government initiatives promoting menstrual health and hygiene in rural and urban areas.

02. What are the challenges in the India Female Hygiene Market?

Challenges in the India female hygiene market include limited access to sanitary products in rural areas, cultural taboos surrounding menstruation, and affordability issues for low-income consumers. These factors continue to impede the widespread adoption of female hygiene products.

03. Who are the major players in the India Female Hygiene Market?

Key players in the India female hygiene market include Procter & Gamble (Whisper), Johnson & Johnson (Stayfree), Unicharm (Sofy), Kimberly-Clark (Kotex), and Niine. These companies lead the market due to their strong distribution networks, product innovation, and large-scale marketing campaigns.

04. What are the growth drivers of the India Female Hygiene Market?

Growth in the India female hygiene market is driven by increased awareness of menstrual health, rising demand for biodegradable and eco-friendly products, and the expansion of e-commerce platforms. Government initiatives promoting menstrual hygiene education also play a crucial role.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.