India Fish Farming Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD3281

November 2024

88

About the Report

India Fish Farming Market Overview

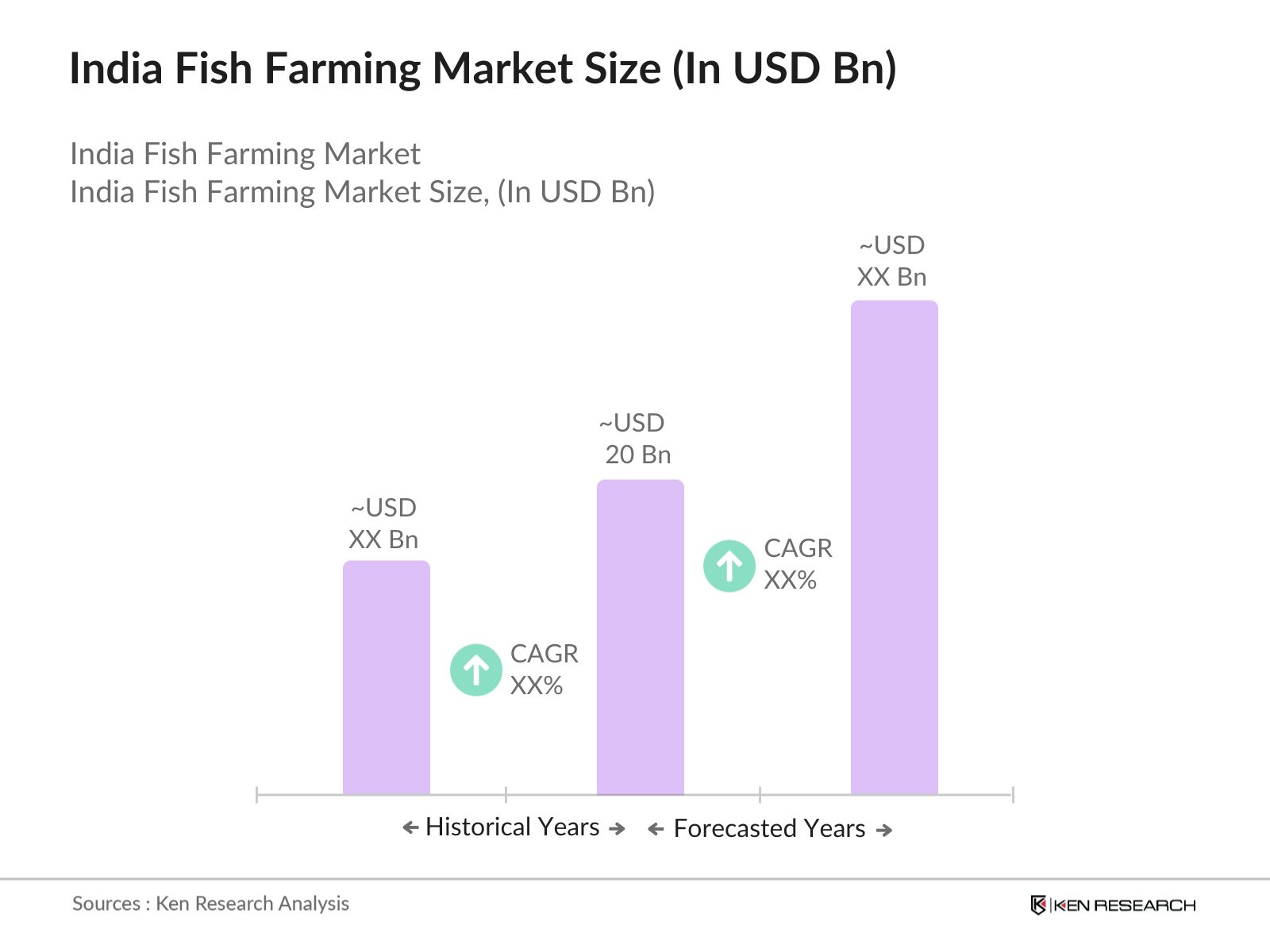

- The India fish farming market is valued at USD 20 billion, driven by the growing demand for protein-rich diets, government support, and technological advancements. With increasing consumer awareness about the health benefits of fish consumption, the market continues to thrive. Programs like the Blue Revolution and Pradhan Mantri Matsya Sampada Yojana (PMMSY) have played a significant role in boosting fish production by offering financial incentives and infrastructure support. Additionally, advancements in biofloc and recirculating aquaculture systems are improving efficiency and productivity.

- Southern regions, such as Andhra Pradesh and Tamil Nadu, dominate the market due to favorable climatic conditions, access to vast inland and coastal water bodies, and robust aquaculture infrastructure. These states benefit from efficient logistics systems and higher adoption rates of modern farming techniques, making them leaders in both domestic production and exports.

- Launched in 2020, the Pradhan Mantri Matsya Sampada Yojana (PMMSY) is a flagship scheme by the Government of India aimed at bringing about a Blue Revolution through sustainable and responsible development of the fisheries sector. With a total investment of 20,050 crore, PMMSY seeks to enhance fish production to 22 million tonnes by 2024-25, thereby increasing the sector's contribution to agricultural Gross Value Added (GVA) and doubling the incomes of fishers and fish farmers. The scheme encompasses various components, including the development of critical infrastructure, modernization of fishing practices, and strengthening of the value chain.

India Fish Farming Market Segmentation

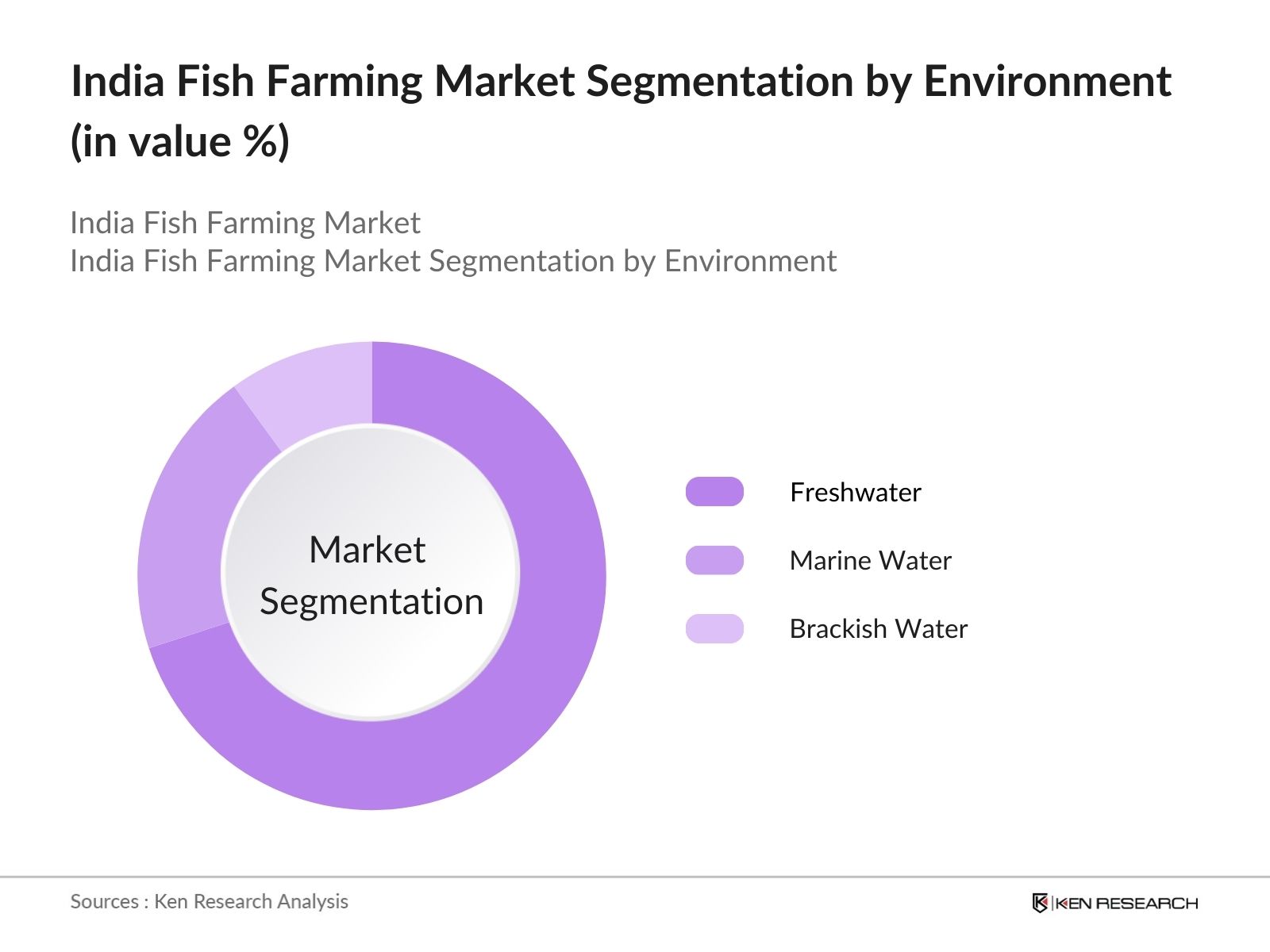

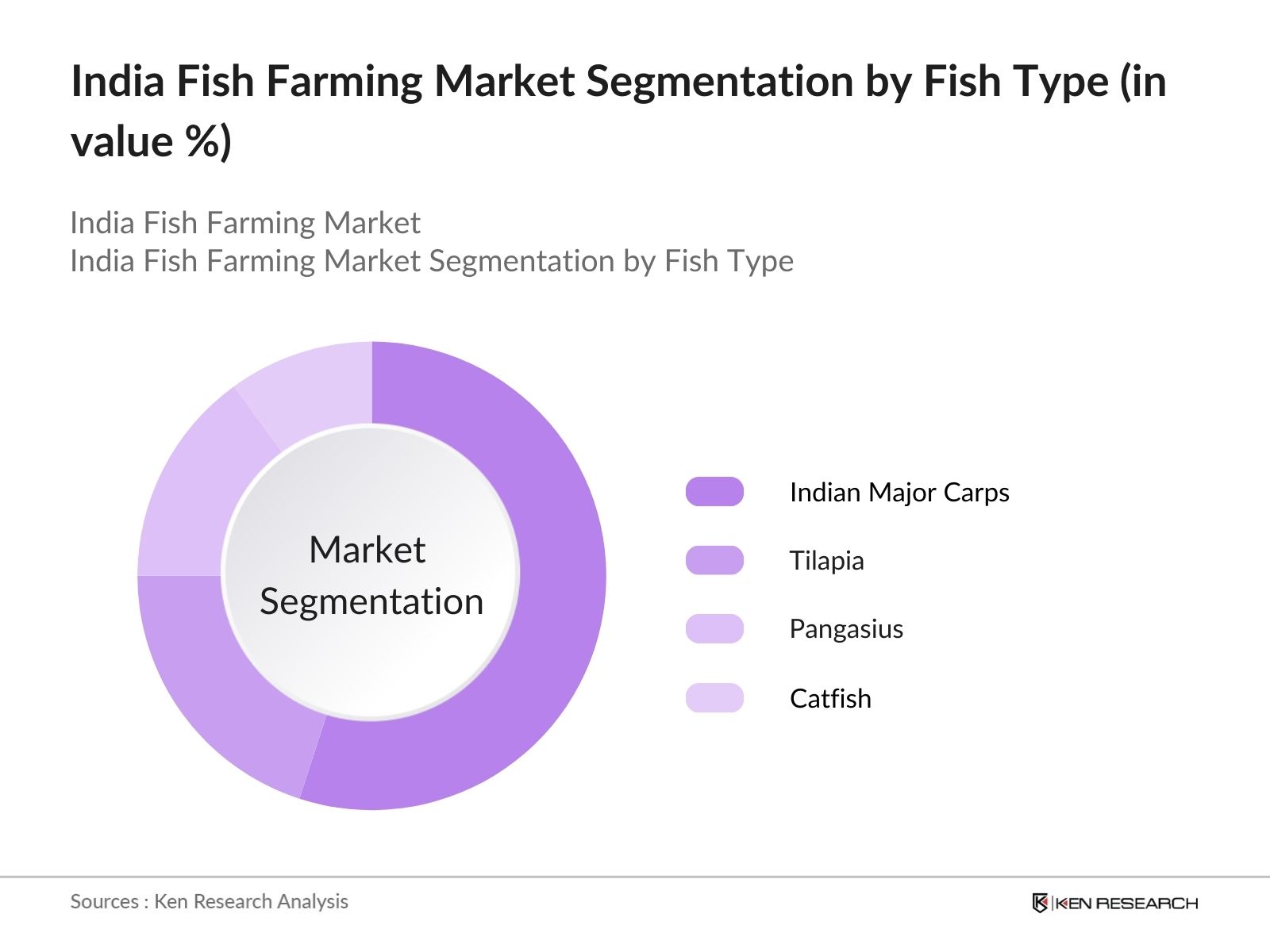

The India fish farming market is segmented by environment and by fish type.

- By Environment: The India fish farming market is segmented by environment into freshwater, marine water, and brackish water. Freshwater aquaculture accounts for the largest share, supported by Indias vast inland water resources. States like West Bengal, Bihar, and Uttar Pradesh lead in freshwater fish production due to their access to rivers, ponds, and tanks. This segment benefits from the popularity of Indian major carps, which are a staple in local diets. Freshwater aquaculture dominates due to lower capital requirements and the availability of abundant water bodies. Fish species like Rohu, Catla, and Mrigal are widely cultivated, catering to domestic consumption. Moreover, government training programs for small-scale farmers encourage large-scale adoption of freshwater aquaculture.

- By Fish Type: The market is further segmented by fish type into Indian major carps (Rohu, Catla, Mrigal), Tilapia, Pangasius, Catfish. Indian major carps dominate the market because they are culturally ingrained in Indian cuisine and are relatively easy to farm. Andhra Pradesh leads in carp production due to its advanced farming practices and efficient resource utilization. Indian major carps dominate because of their economic viability and high market demand. Tilapia and Pangasius are gaining prominence for their faster growth rates and export potential. The introduction of high-yielding species and improved feed quality further boosts this segment's growth.

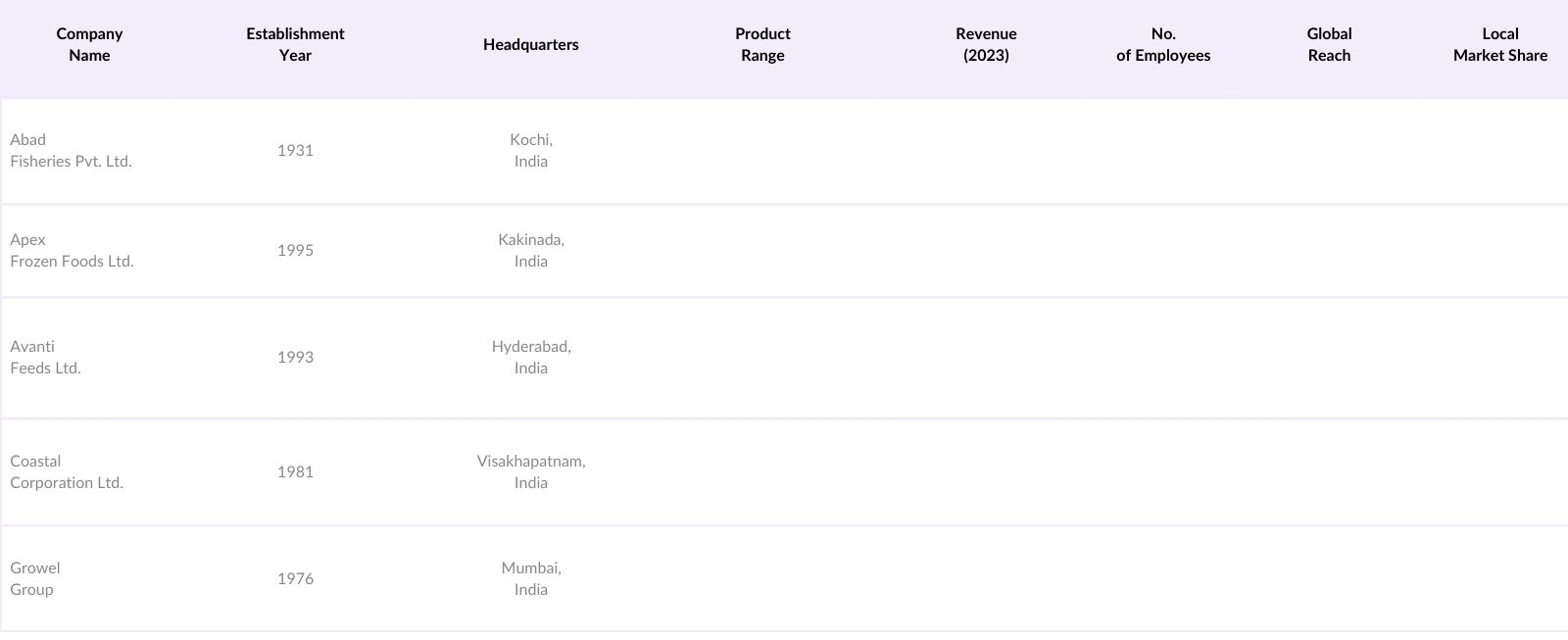

India Fish Farming Market Competitive Landscape

The India fish farming market is characterized by a mix of domestic and global players who compete on production efficiency, technological adoption, and export capabilities. These companies are actively investing in sustainable aquaculture practices and disease management technologies to gain a competitive edge. The market is dominated by a few key players with extensive production and distribution networks. Companies like Avanti Feeds Ltd. and Apex Frozen Foods have established themselves as leaders in both domestic and international markets, owing to their technological advancements and focus on sustainability.

India Fish Farming Market Analysis

Growth Drivers

- Rising Demand for Protein-Rich Food Sources: India's fish production has been a cornerstone in meeting the dietary protein needs of its 1.4 billion population. In 2022-23, fish production reached an impressive 17.4 million tonnes, contributing significantly to the food supply chain. The increasing prevalence of non-communicable diseases and growing health awareness have led to a shift toward high-protein diets, where fish serves as an affordable and efficient source of nutrition. This demand aligns with India's status as the second-largest fish-producing nation globally, emphasizing its importance in ensuring national food security. The fisheries sector accounted for 1.09% of India's Gross Value Added (GVA) in 2022, highlighting its economic and nutritional significance.

- Technological Advancements in Aquaculture: The Indian aquaculture sector has embraced transformative technologies like Recirculating Aquaculture Systems (RAS) and Biofloc technology to improve yield and environmental sustainability. RAS allows water recycling and precise monitoring of fish health, while Biofloc enhances water quality using beneficial microorganisms. These advancements enable farmers to optimize space, maintain better control of farm conditions, and minimize risks associated with disease outbreaks. Government initiatives, including funding and training, have further catalyzed this shift, ensuring that modern methods are accessible to a broader base of fish farmers. These changes position India as a hub of innovation in aquaculture.

- Government Initiatives and Support: The Pradhan Mantri Matsya Sampada Yojana (PMMSY), launched in 2020 with an outlay of 20,050 crore, underscores the governments commitment to scaling up fisheries. The schemes primary goal is to increase fish production to 22 million tonnes by 2024-25. This initiative has supported the development of hatcheries, aquaculture systems, and modernized fishing techniques. Additionally, over 28 million fishers and farmers have benefited from subsidies and financial aid. The sector's growth also aligns with India's export targets for seafood, reinforcing its dual role as a domestic food provider and international supplier.

Market Challenges

- Environmental Concerns and Sustainability Issues: India's aquaculture sector faces sustainability challenges stemming from water pollution, habitat destruction, and the overuse of natural resources. Intensive farming practices exacerbate these issues, leading to ecological imbalances. The government has enforced environmental compliance standards and promoted eco-friendly practices, including the adoption of organic aquaculture and technologies like Biofloc. These measures aim to balance productivity with environmental responsibility, addressing critical concerns raised by climate-focused entities and fisheries experts.

- Disease Management in Aquaculture: Disease outbreaks remain a critical risk factor in aquaculture, leading to significant economic losses. Common diseases like white spot syndrome and fin rot can decimate fish stocks if not addressed promptly. To mitigate these risks, the government has introduced awareness programs, subsidized access to veterinary services, and funded research on disease-resistant fish strains. In 2023, several workshops organized by fisheries departments trained over 50,000 farmers on preventive measures and the use of organic treatments.

India Fish Farming Market Future Outlook

The India fish farming market is expected to witness robust growth in the next five years, driven by innovations in aquaculture practices, increasing export opportunities, and strong government support. The adoption of technologies such as Recirculating Aquaculture Systems (RAS) and biofloc systems will play a pivotal role in improving efficiency and reducing environmental impact. Furthermore, the expansion of cold chain logistics and processing infrastructure is expected to enhance the market's growth potential.

Market Opportunities

- Export Potential to International Markets: Indias seafood exports reached 46,589 crore in 2022, targeting markets like the U.S., China, and the European Union. Shrimp remains the top export product, contributing over 40% to total revenue. With government-backed certification programs ensuring adherence to international quality standards, India aims to boost seafood exports by diversifying into value-added products and expanding to emerging markets in Africa and the Middle East.

- Development of Value-Added Fish Products: The demand for ready-to-cook and ready-to-eat fish products is rising due to urbanization and evolving consumer preferences. Processed fish items like fillets, fish pickles, and canned products present lucrative opportunities. The introduction of advanced processing units under PMMSY and financial incentives for entrepreneurs in this domain have catalyzed growth in value-added product development.

Scope of the Report

Products

Key Target Audience

Fish Farming Equipment Manufacturers

Cold Storage and Logistics Providers

Fish Feed Producers

Export-Oriented Fish Processing Units

Retailers and Distributors in Seafood

Research & Development Organizations

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Fisheries, NFDB)

Companies

Players Mention in the Report:

Abad Fisheries Pvt. Ltd.

Apex Frozen Foods Ltd.

Avanti Feeds Ltd.

Coastal Corporation Ltd.

Growel Group

The Waterbase Ltd.

Zeal Aqua Ltd.

Kings Infra Ventures Ltd.

BMR Group

Munnujii Foods International Pvt. Ltd.

Silver Sea Food

Seasaga Group

Geo Seafood

Kirti Foods

Oceans Secret

Table of Contents

1. India Fish Farming Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Fish Farming Market Size (In USD Million)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Fish Farming Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for Protein-Rich Food Sources

3.1.2. Technological Advancements in Aquaculture

3.1.3. Government Initiatives and Support

3.1.4. Expansion of Cold Chain Logistics

3.2. Market Challenges

3.2.1. Environmental Concerns and Sustainability Issues

3.2.2. Disease Management in Aquaculture

3.2.3. High Initial Investment Costs

3.3. Opportunities

3.3.1. Export Potential to International Markets

3.3.2. Development of Value-Added Fish Products

3.3.3. Integration of IoT and Smart Farming Techniques

3.4. Trends

3.4.1. Adoption of Recirculating Aquaculture Systems (RAS)

3.4.2. Increasing Use of Biofloc Technology

3.4.3. Growth in Organic Fish Farming Practices

3.5. Government Regulations

3.5.1. Pradhan Mantri Matsya Sampada Yojana (PMMSY)

3.5.2. Blue Revolution Scheme

3.5.3. Environmental Compliance Standards

3.5.4. Subsidies and Financial Assistance Programs

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. India Fish Farming Market Segmentation

4.1. By Environment (In Value %)

4.1.1. Freshwater

4.1.2. Marine Water

4.1.3. Brackish Water

4.2. By Fish Type (In Value %)

4.2.1. Indian Major Carps (Rohu, Catla, Mrigal)

4.2.2. Tilapia

4.2.3. Pangasius

4.2.4. Catfish

4.2.5. Others

4.3. By Culture System (In Value %)

4.3.1. Pond Culture

4.3.2. Cage Culture

4.3.3. Integrated Fish Farming

4.3.4. Biofloc Systems

4.4. By End-User (In Value %)

4.4.1. Domestic Consumption

4.4.2. Export Markets

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

5. India Fish Farming Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Abad Fisheries Pvt. Ltd.

5.1.2. Apex Frozen Foods Ltd.

5.1.3. Avanti Feeds Ltd.

5.1.4. Coastal Corporation Ltd.

5.1.5. The Waterbase Ltd.

5.1.6. Zeal Aqua Ltd.

5.1.7. Growel Group

5.1.8. Kings Infra Ventures Ltd.

5.1.9. BMR Group

5.1.10. Munnujii Foods International Pvt. Ltd.

5.1.11. Silver Sea Food

5.1.12. Seasaga Group

5.1.13. Geo Seafood

5.1.14. Kirti Foods

5.1.15. Oceans Secret

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Production Capacity, Export Markets, Product Portfolio, Technological Adoption)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

6. India Fish Farming Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. India Fish Farming Market Future Size (In USD Million)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Fish Farming Market Future Segmentation

8.1. By Environment (In Value %)

8.2. By Fish Type (In Value %)

8.3. By Culture System (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. India Fish Farming Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase involves mapping all stakeholders within the India Fish Farming Market. Extensive desk research is conducted using secondary and proprietary databases to identify critical variables such as production efficiency, feed quality, and logistics.

Step 2: Market Analysis and Construction

In this phase, historical and current market data are analyzed to determine growth trends, market penetration, and revenue generation. Particular focus is placed on evaluating aquaculture systems and their adoption rates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through expert interviews and consultations with industry leaders. These insights ensure the reliability and accuracy of the findings.

Step 4: Research Synthesis and Final Output

Final analysis integrates primary and secondary data to provide actionable insights. The output includes detailed segmentation, competitive landscape, and market dynamics, ensuring a comprehensive report.

Frequently Asked Questions

01. How big is the India Fish Farming Market?

The India Fish Farming Market is valued at USD 20 billion, driven by rising protein demand, government initiatives, and advanced farming techniques.

02. What are the challenges in the India Fish Farming Market?

India Fish Farming Market Challenges include high investment costs, disease management, environmental concerns, and fluctuating feed prices, impacting profitability and sustainability.

03. Who are the major players in the India Fish Farming Market?

India Fish Farming Market Key players include Abad Fisheries Pvt. Ltd., Apex Frozen Foods Ltd., Avanti Feeds Ltd., Coastal Corporation Ltd., and Growel Group, known for their robust production and export capabilities.

04. What are the growth drivers of the India Fish Farming Market?

The India Fish Farming Market is driven by growing demand for seafood, government support through policies like the Blue Revolution, and technological advancements in farming systems.

What trends dominate the India Fish Farming Market?

India Fish Farming Market Key trends include the adoption of biofloc technology, organic fish farming practices, and Recirculating Aquaculture Systems (RAS) for sustainable and efficient production.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.