India Flex Fuel Vehicle Market Outlook to 2030

Region:Asia

Author(s):Shreya

Product Code:KROD6933

December 2024

81

About the Report

India Flex Fuel Vehicle Market Overview

- The India Flex Fuel Vehicle Market reached a valuation of USD 600 billion. This growth is largely driven by government policies promoting fuel diversity and the rise in awareness around sustainable vehicle options. Flex Fuel technology enables vehicles to run on a blend of ethanol and gasoline, aligning with the governments aim to reduce crude oil imports and Vehicle bon emissions. Additionally, the availability of ethanol as an alternate fuel source and consumer interest in eco-friendly vehicle solutions are significant contributors to the markets expansion.

- Dominant regions for Flex Fuel Vehicle adoption include Maharashtra, Delhi, and Tamil Nadu, where vehicle adoption rates are high and infrastructure development for alternative fuels is robust. These areas are leading the adoption due to the presence of established refueling stations for ethanol blends, favorable policies, and a consumer base open to adopting alternative fuel vehicles. Their economic development also supports the demand for advanced automotive solutions, making them primary hubs for Flex Fuel Vehicles in India.

- Indias National Biofuel Policy targets a 10% ethanol blend nationwide, with ambitions for 20% in high-consumption regions. This policy framework has mobilized investment in biofuel production, creating a solid regulatory base for Flex Fuel vehicle integration

India Flex Fuel Vehicle Market Segmentation

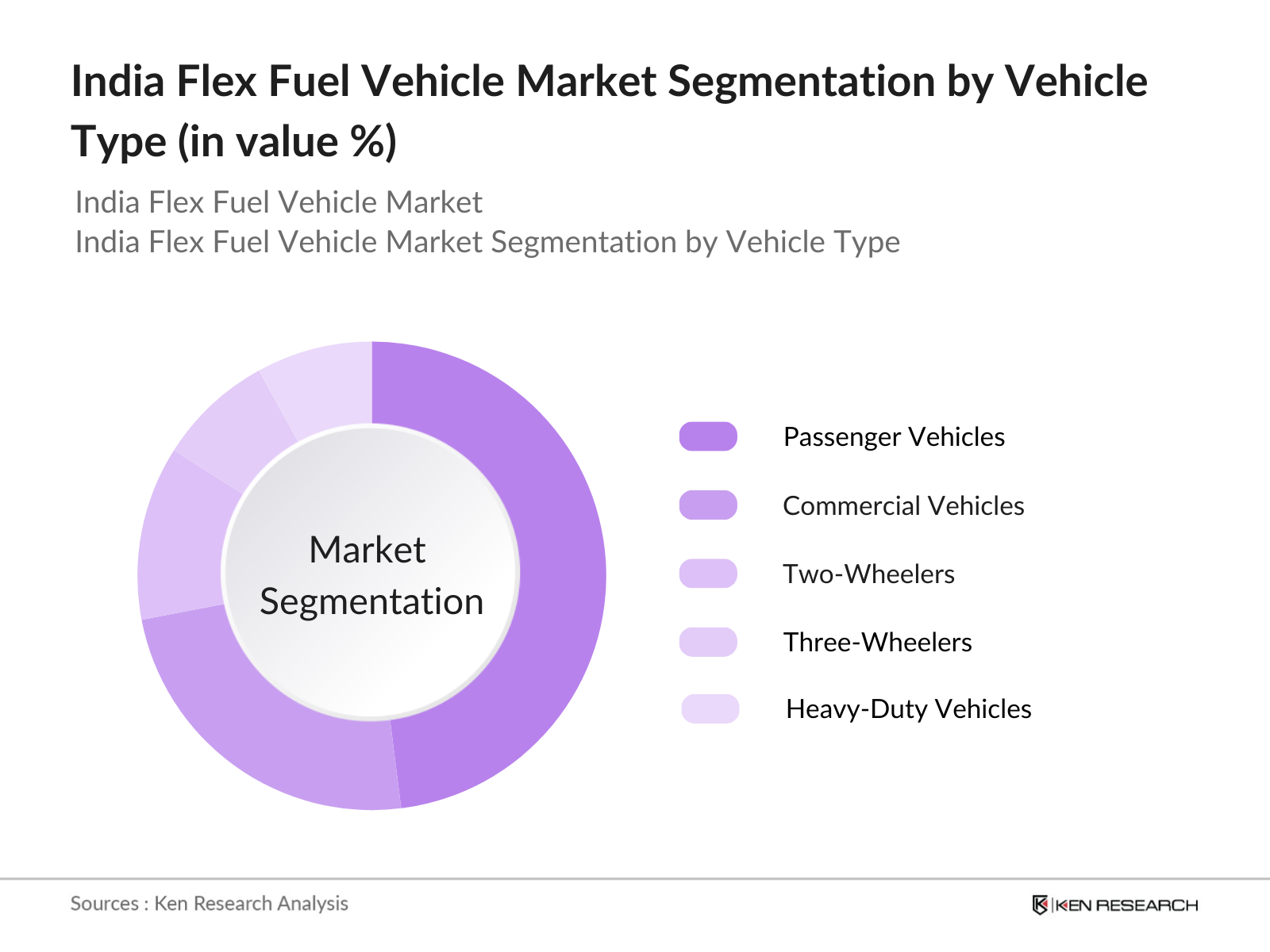

By Vehicle Type: The market is segmented by vehicle type into passenger vehicles, commercial vehicles, two-wheelers, three-wheelers, and heavy-duty vehicles. Passenger vehicles hold a dominant market share within this segment, as the increasing consumer inclination towards eco-friendly personal transportation solutions is rising. Additionally, regulatory support in urban areas for alternative fuel vehicles has encouraged both manufacturers and consumers to lean toward Flex Fuel options in the passenger vehicle category, strengthening the segment's market position.

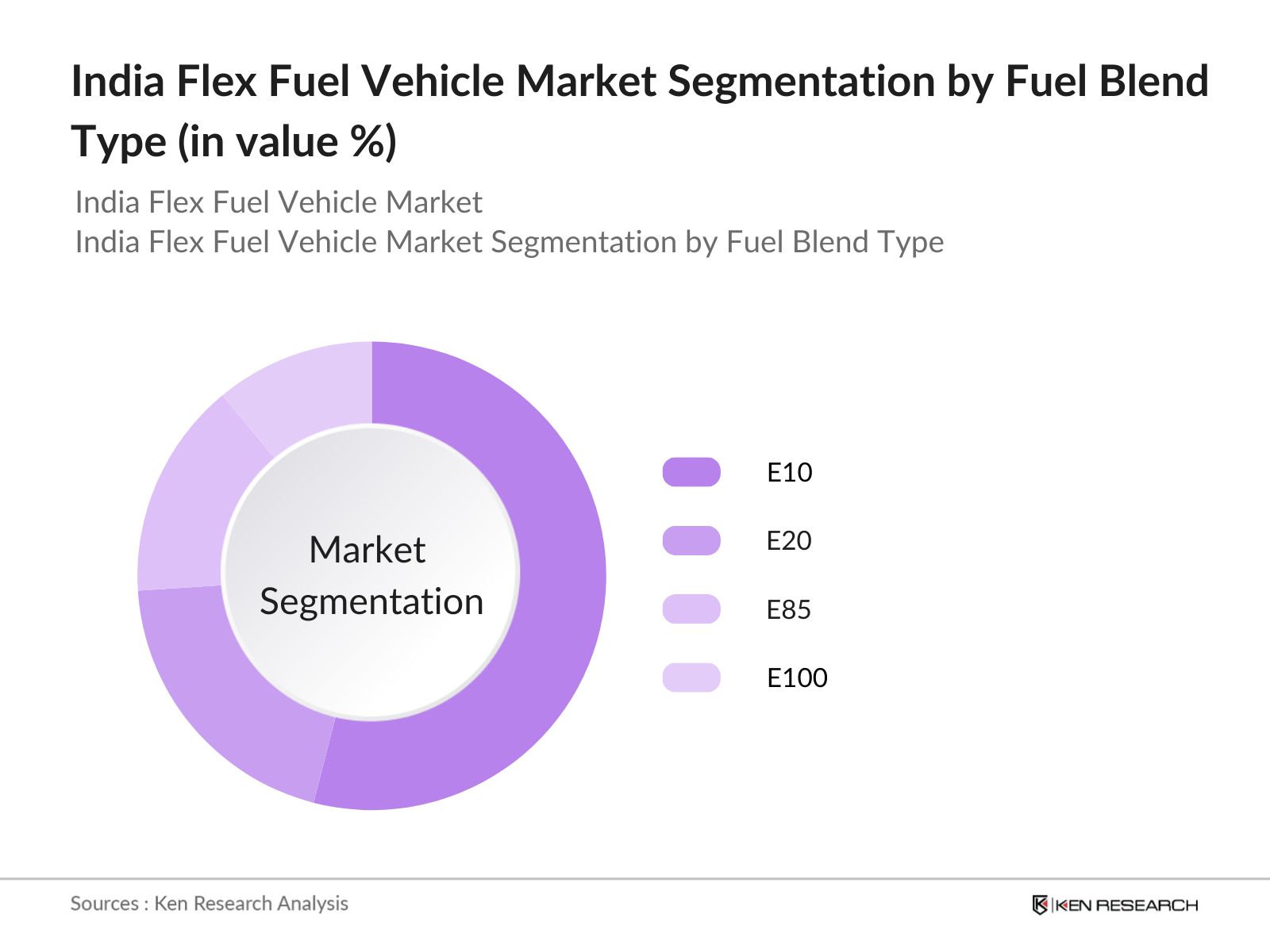

By Fuel Blend Type: The market is further segmented by fuel blend type into E10, E20, E85, and E100. E10 blend vehicles lead the market share due to the current infrastructure supporting this lower ethanol blend, making it easily accessible to the public. The compatibility of E10 with existing fuel station setups, along with favorable government policies, has propelled its use, making it the preferred blend in the market. The gradual adaptation of higher ethanol blends like E20 is underway as infrastructure and policies evolve to support these options.

India Flex Fuel Vehicle Market Competitive Landscape

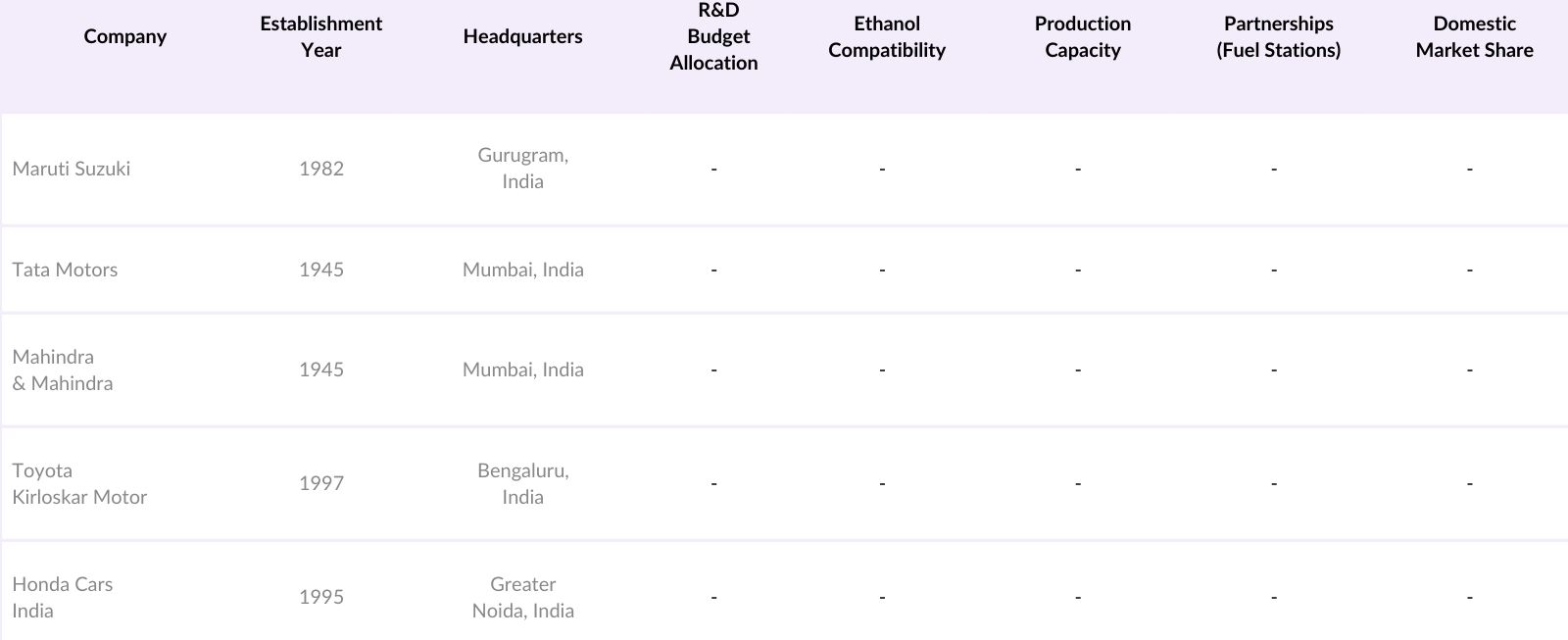

The India Flex Fuel Vehicle Market is characterized by the presence of both established automotive brands and specialized players, creating a competitive and consolidated landscape. The market is dominated by companies like Maruti Suzuki, Tata Motors, and Mahindra & Mahindra, which benefit from strong R&D capabilities, extensive distribution networks, and government-backed initiatives promoting fuel flexibility. International companies like Toyota and Honda are also active in this market, attracted by India's regulatory push towards ethanol-based solutions.

India Flex Fuel Vehicle Industry Analysis

Growth Drivers

- Government Initiatives and Subsidies: Indias government has actively promoted biofuel and fuel diversification policies as part of its National Biofuel Policy. In 2024, the government aims to implement E20 (20% ethanol blend) across states, with 4,600 kilometers of new highways planned under Bharatmala Pariyojana to support Flex Fuel infrastructure growth. The Ministry of Petroleum and Natural Gas has allocated substantial subsidies for ethanol producers, further easing biofuel integration across automotive applications.

- Rising Environmental Awareness: With Indias emission targets set for substantial reduction by 2030, Flex Fuel vehicles provide a clear pathway toward reducing transport sector emissions. Indias automotive sector produces approximately 335 million metric tons of CO annually, according to the Ministry of Environment, Forest, and Climate Change. The countrys focus on low-Vehiclebon fuel aligns with global environmental standards, encouraging Flex Fuel adoption.

- Cost Savings: With the rise in global fuel prices, Flex Fuel Vehicles present significant cost-saving potential. E20 fuels have been shown to reduce operational costs by up to 20 rupees per liter compared to regular petrol, as stated by the Indian Oil Corporation. Government tax cuts on ethanol further boost affordability, promoting cost efficiency for end users.

Market Challenges

- High Manufacturing and Conversion Costs: The initial cost of converting existing vehicles to Flex Fuel standards poses a challenge, with costs ranging from 60,000 to 1 lakh rupees for each vehicle. The Automotive Research Association of India highlights that infrastructure development costs for Flex Fuel production also place pressure on the supply chain.

- Limited Availability of Flex Fuel Stations: As of 2024, only around 2,500 stations provide E20 fuel, a stark contrast to the 72,000 stations dispensing regular petrol and diesel, according to Indian Oil Corporation. Expanding this network remains a critical challenge, limiting the reach of Flex Fuel vehicles, particularly in rural and semi-urban areas.

India Flex Fuel Vehicle Market Future Outlook

Over the next five years, the India Flex Fuel Vehicle Market is expected to witness significant growth as government mandates for ethanol blending increase and infrastructure expands. Demand for Flex Fuel vehicles will likely rise as consumer awareness of environmental sustainability and cost-effective fuel alternatives grows. Ongoing developments in Flex Fuel-compatible engine technologies and partnerships with fuel providers are anticipated to enhance the market's adaptability and scalability.

Future Market Opportunities

- Expansion of E20 and E85 Infrastructure: The Indian government plans to add 1,500 new Flex Fuel-compatible fuel stations across the nation by 2025, with an initial focus on states such as Maharashtra and Karnataka. This infrastructure expansion supports growth in Flex Fuel vehicle adoption, providing greater accessibility Source.

- Partnerships with Oil and Gas Companies: Major oil corporations like Indian Oil and Hindustan Petroleum are signing supply agreements to bolster ethanol production and distribution networks. Over 500 crore rupees have been earmarked for these projects, underscoring significant potential for partnership-driven expansion in the Flex Fuel market.

Scope of the Report

|

By Fuel Type |

- E20 (20% Ethanol) |

|

- E85 (85% Ethanol) |

|

|

- Other Blends (Custom Blends) |

|

|

By Vehicle Type |

- Passenger Vehicles |

|

- Light Commercial Vehicles (LCVs) |

|

|

- Heavy Commercial Vehicles (HCVs) |

|

|

- Utility Vehicles (SUVs, MUVs) |

|

|

By Engine Type |

- Spark-Ignition Engines |

|

- Compression-Ignition Engines |

|

|

- Hybrid Engines |

|

|

By Distribution Channel |

- OEM Sales |

|

- Aftermarket Retrofit |

|

|

By Region |

- North |

|

- South |

|

|

- East |

|

|

- West |

Products

Key Target Audience

Vehicle Manufacturers

Automotive Component Suppliers

Ethanol Producers

Fuel Station Operators

Automotive Associations

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Petroleum & Natural Gas, Ministry of Heavy Industries)

Automotive R&D Organizations

Companies

Major Players in the India Flex Fuel Vehicle Market

Maruti Suzuki

Tata Motors

Mahindra & Mahindra

Toyota Kirloskar Motor

Honda Vehicles India

Hyundai Motor India Ltd.

Bajaj Auto Ltd.

Hero MotoCorp Ltd.

Eicher Motors Ltd.

Yamaha Motor India Pvt. Ltd.

Suzuki Motor Corporation

General Motors India

Ashok Leyland Ltd.

Renault India Pvt. Ltd.

Ford India Private Limited

Table of Contents

India Flex Fuel Vehicle Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Flex Fuel Technology Overview

1.4. Market Segmentation Overview

India Flex Fuel Vehicle Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

India Flex Fuel Vehicle Market Analysis

3.1. Growth Drivers

3.1.1. Government Initiatives and Subsidies (Fuel Diversification Policies)

3.1.2. Rising Environmental Awareness (Vehiclebon Footprint Reduction)

3.1.3. Cost Savings (Fuel Efficiency Benefits)

3.1.4. Increasing Vehicle Adoption (Automotive Sector Growth)

3.2. Market Challenges

3.2.1. High Manufacturing and Conversion Costs (Infrastructure and Materials)

3.2.2. Limited Availability of Flex Fuel Stations (Refueling Network Constraints)

3.2.3. Consumer Awareness and Education (Public Perception)

3.2.4. Technological Limitations (Performance at Various Ethanol Blends)

3.3. Opportunities

3.3.1. Expansion of E20 and E85 Infrastructure (Fuel Network Development)

3.3.2. Partnerships with Oil and Gas Companies (Fuel Supply Agreements)

3.3.3. Growth in Rural Demand (Alternate Fuel Accessibility)

3.4. Trends

3.4.1. Adoption of Hybrid Flex Fuel Models (Technology Integration)

3.4.2. Increased Investment in R&D (Innovation in Engine Technology)

3.4.3. Government Regulatory Push (Emission Standards)

3.4.4. Rise in Public-Private Partnerships (Automotive Collaboration)

3.5. Government Regulations

3.5.1. National Biofuel Policy

3.5.2. Emission Standards and Compliance

3.5.3. Flex Fuel Incentives and Subsidies

3.5.4. Import Tariffs and Duties on Ethanol

3.6. SWOT Analysis

3.7. Value Chain and Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

India Flex Fuel Vehicle Market Segmentation

4.1. By Vehicle Type (In Value %)

4.1.1. Passenger Vehicles

4.1.2. Commercial Vehicles

4.1.3. Two-Wheelers

4.1.4. Three-Wheelers

4.1.5. Heavy-Duty Vehicles

4.2. By Fuel Blend Type (In Value %)

4.2.1. E10

4.2.2. E20

4.2.3. E85

4.2.4. E100

4.3. By End-User Segment (In Value %)

4.3.1. Individual Consumers

4.3.2. Fleet Operators

4.3.3. Government Agencies

4.3.4. Commercial Enterprises

4.4. By Distribution Channel (In Value %)

4.4.1. OEMs

4.4.2. Aftermarket

4.4.3. Dealerships

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

India Flex Fuel Vehicle Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Tata Motors

5.1.2. Maruti Suzuki India Ltd.

5.1.3. Mahindra & Mahindra Ltd.

5.1.4. Toyota Kirloskar Motor Pvt. Ltd.

5.1.5. Honda Vehicles India Ltd.

5.1.6. Ford India Private Limited

5.1.7. Hyundai Motor India Ltd.

5.1.8. Bajaj Auto Ltd.

5.1.9. Hero MotoCorp Ltd.

5.1.10. Ashok Leyland Ltd.

5.1.11. General Motors India

5.1.12. Suzuki Motor Corporation

5.1.13. Eicher Motors Ltd.

5.1.14. Yamaha Motor India Pvt. Ltd.

5.1.15. Renault India Pvt. Ltd.

5.2. Cross-Comparison Parameters (Revenue, Manufacturing Base, Ethanol Compatibility, Innovation Score, Product Range, Distribution Network, Market Share, Employee Base)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

India Flex Fuel Vehicle Market Regulatory Framework

6.1. National Flex Fuel Standards and Guidelines

6.2. Certification and Compliance Requirements

6.3. Ethanol Blending Mandates

6.4. Taxation Policies and Exemptions

India Flex Fuel Vehicle Market Future Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Growth

India Flex Fuel Vehicle Market Future Segmentation

8.1. By Vehicle Type (In Value %)

8.2. By Fuel Blend Type (In Value %)

8.3. By End-User Segment (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

India Flex Fuel Vehicle Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Behavior and Cohort Analysis

9.3. Suggested Marketing Strategies

9.4. White Space Analysis and Growth Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase involves mapping out key stakeholders across the India Flex Fuel Vehicle Market, with in-depth research on the automotive ecosystem. The goal is to identify critical market drivers, constraints, and trends.

Step 2: Market Analysis and Construction

We analyze historical data to evaluate Flex Fuel market growth. This stage includes examining market adoption levels, and blending ratios of Flex Fuel vehicles in India to provide accurate revenue and market size estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are verified through telephonic interviews with industry experts from various automotive companies. Insights are gathered on Flex Fuel vehicle demand, fuel compatibility, and market trends.

Step 4: Research Synthesis and Final Output

We engage directly with vehicle manufacturers to gather information on sales performance, product segments, and consumer preferences. This synthesis refines the bottom-up market size estimations and ensures comprehensive, validated analysis.

Frequently Asked Questions

How big is the India Flex Fuel Vehicle Market?

The India Flex Fuel Vehicle Market was valued at USD 600 billion, driven by growing awareness of alternative fuel benefits, government policies, and advancements in Flex Fuel technology.

What are the challenges in the India Flex Fuel Vehicle Market?

Key challenges in the India Flex Fuel Vehicle Market include high production costs, limited refueling infrastructure for higher ethanol blends, and the need for greater consumer awareness regarding Flex Fuel technology.

Who are the major players in the India Flex Fuel Vehicle Market?

Leading companies in the India Flex Fuel Vehicle Market include Maruti Suzuki, Tata Motors, Mahindra & Mahindra, Toyota Kirloskar Motor, and Honda Vehicles India, benefiting from strong market positions and government-backed incentives.

What are the growth drivers of the India Flex Fuel Vehicle Market?

Growth in the India Flex Fuel Vehicle Market is primarily driven by the Indian governments policies on ethanol blending, increasing environmental concerns, and demand for cost-efficient transportation options.

Which segment dominates the India Flex Fuel Vehicle Market?

The passenger vehicle segment dominates the India Flex Fuel Vehicle Market due to high consumer preference for personal eco-friendly transport solutions, supported by incentives for alternative fuel vehicles.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.