India Food Additives Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD8141

December 2024

81

About the Report

India Food Additives Market Overview

- The India Food Additives Market is valued at USD 3.2 billion, driven primarily by the expanding food and beverage industry. The increasing consumer demand for processed and convenience foods, coupled with the rising awareness of food safety and preservation, has contributed to the markets growth. Additionally, the growing trend of incorporating natural and organic additives is gaining traction, influencing the production processes of major food manufacturers.

- Indias urban centers, particularly Mumbai, Delhi, and Bangalore, dominate the food additives market. These cities are major hubs for the food processing industry, supported by strong infrastructure and proximity to both domestic and international markets. The presence of large food manufacturing plants and a growing consumer base with a preference for packaged and processed foods has led to the dominance of these cities in the market.

- Indias import and export guidelines for food additives are strictly regulated by FSSAI and Customs authorities. In 2023, new rules were introduced requiring imported food products to adhere to Indias standards on permissible additives. The import of food products containing non-approved additives remains a significant challenge for international companies looking to enter the Indian market. The government is also aligning its regulations with international Codex standards to facilitate smoother trade.

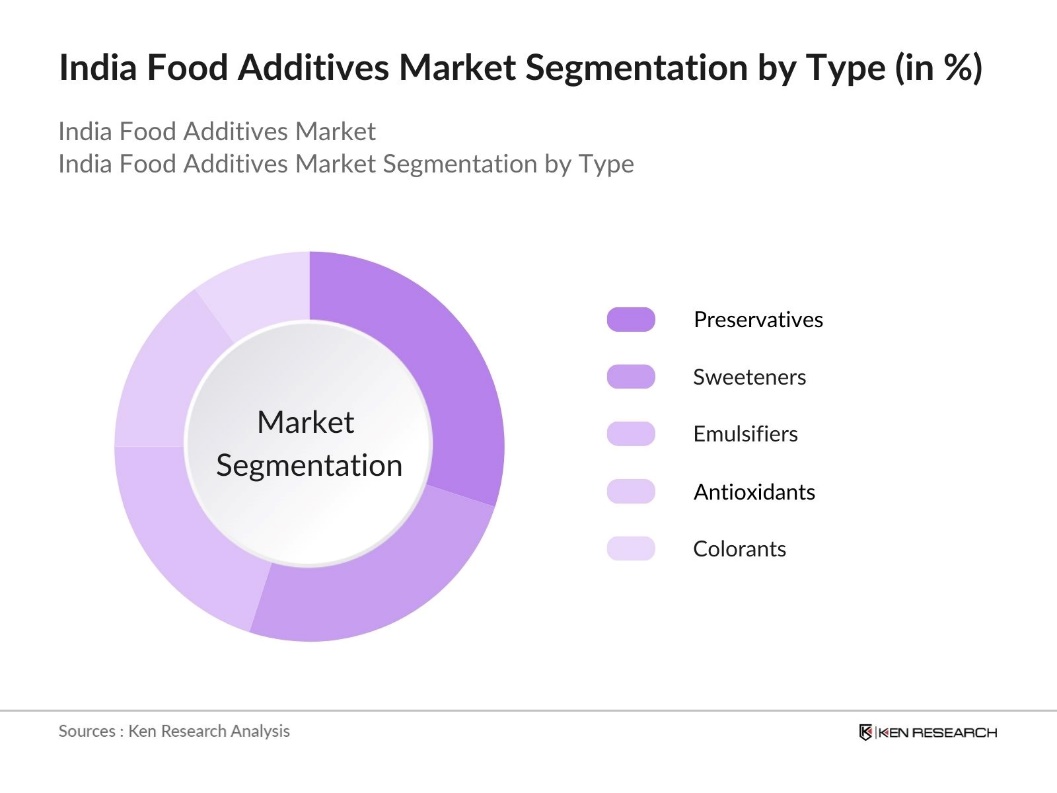

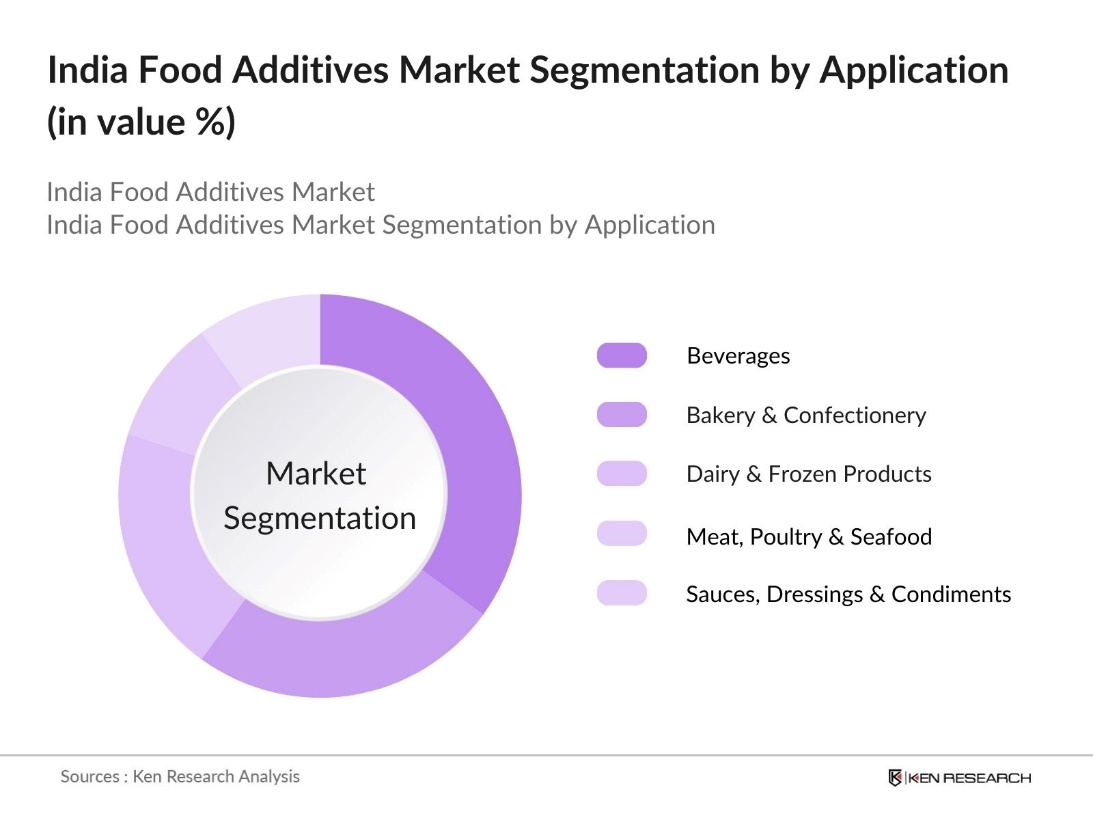

India Food Additives Market Segmentation

By Type: The India food additives market is segmented by type into preservatives, sweeteners, emulsifiers, antioxidants, and colorants. Among these, preservatives hold a dominant share in the market due to their essential role in extending the shelf life of processed foods. In India, where a significant portion of the population relies on packaged and processed foods, preservatives are widely used by food manufacturers to maintain product stability and safety. The demand for natural preservatives, such as rosemary extract and vitamin E, has also surged as consumers seek cleaner label ingredients.

By Application: The India food additives market is segmented by application into beverages, bakery & confectionery, dairy & frozen products, meat, poultry & seafood, and sauces, dressings & condiments. The beverages segment dominates the market due to the rising consumption of soft drinks, energy drinks, and flavored water. With changing lifestyles and growing urbanization, the demand for beverages that are both convenient and healthy has increased, driving the use of additives such as sweeteners, preservatives, and flavor enhancers.

India Food Additives Market Competitive Landscape

The India food additives market is dominated by both domestic and international players, with companies focusing on product innovation and expansion of their distribution networks. Companies like Cargill India and BASF India are expanding their portfolio to include more natural and organic additives in response to changing consumer preferences. The presence of global giants like ADM and DuPont in the Indian market underscores the competitive nature of the industry.

|

Company Name |

Establishment Year |

Headquarters |

Revenue |

Number of Employees |

Product Range |

R&D Investments |

Partnerships |

Distribution Network |

|

Cargill India |

1865 |

Gurgaon |

||||||

|

BASF India |

1865 |

Mumbai |

||||||

|

DuPont India |

1802 |

Gurugram |

||||||

|

Kerry Group |

1972 |

Trivandrum |

||||||

|

Ajinomoto India |

1909 |

Delhi |

India Food Additives Industry Analysis

Growth Drivers

- Increasing Consumer Preference for Processed Foods: The demand for processed foods in India is on the rise due to urbanization, changing dietary habits, and growing disposable incomes The food processing sector is a major employer, accounting for about 12.02% of total employment in organized manufacturing. The growth of e-commerce and food delivery platforms has further contributed to the demand for processed foods, which require additives for preservation and flavor enhancement.

- Expanding Food & Beverage Industry: India's food and beverage industry has been expanding rapidly, making it a critical driver of the food additives market. As of FY 2023-24, the industrial sector's contribution to India's GDP is approximately 28.3%. Growth in both domestic consumption and exports has fueled the demand for various food additives, particularly in processed foods and beverages. The sectors consistent growth is expected to continue boosting the demand for food additives.

- Rising Demand for Natural Food Additives: Rising consumer health awareness in India is driving demand for natural food additives, such as plant-based colorants and preservatives. This shift towards clean-label products, free from synthetic chemicals, is especially prominent in urban areas. Government initiatives like the National Programme for Organic Production (NPOP) further support organic farming, boosting the availability of natural additives in processed foods, meeting consumer preferences for healthier and more natural ingredients.

Market Challenges

- Strict Food Safety Regulations: Indias food safety regulations, primarily governed by the Food Safety and Standards Authority of India (FSSAI), impose strict controls on the use of additives. These regulations require thorough compliance checks, making the approval process for new additives complex and time-consuming. Violations of these rules can result in significant penalties, adding operational challenges for manufacturers in the food additives sector. This regulatory environment creates hurdles for companies seeking to introduce new innovations.

- High Cost of Natural Additives: Natural food additives are more expensive than their synthetic counterparts, posing challenges for manufacturers. The higher production costs and limited availability of natural additives make it difficult for small- and medium-sized producers to adopt them. This cost disparity restricts the widespread use of natural additives, despite growing consumer demand for healthier and more natural ingredients.

India Food Additives Market Future Outlook

Over the next five years, the India food additives market is expected to witness steady growth driven by the increasing demand for processed foods and beverages. The growing preference for natural and organic additives, along with government regulations supporting food safety standards, will further drive market expansion. Innovations in food preservation techniques and the development of multifunctional additives will also contribute to the growth of the market.

Market Opportunities

- Growing Health and Wellness Trends: The growing focus on health and wellness in India offers significant opportunities for the food additives market. Consumers are increasingly favoring products that promote health benefits, such as fortified foods and beverages. This shift has driven manufacturers to explore natural and bio-based additives, especially in clean-label products that minimize synthetic ingredients. Functional additives like omega-3 fatty acids and plant-based proteins are gaining traction as consumers seek healthier, more nutritious food options.

- Innovations in Food Preservation: Advancements in food preservation techniques are opening new avenues for the food additives industry. Technologies such as nanotechnology-based preservatives and natural antioxidants are gaining attention for their ability to extend product shelf life without compromising quality. These innovations are crucial for addressing food wastage, enabling longer storage times and reducing spoilage in processed foods, thereby supporting sustainability in the food supply chain.

Scope of the Report

|

Type |

Preservatives Sweeteners Emulsifiers Antioxidants Colorants |

|

Application |

Beverages Bakery & Confectionery Dairy & Frozen Products Meat Poultry & Seafood Sauces Dressings & Condiments |

|

Source |

Natural Additives Synthetic Additives |

|

Function |

Flavor Enhancers Texturizers Preservatives |

|

Region |

North South East West |

Products

Key Target Audience

Food & Beverage Manufacturers

Packaging Companies

Organic Food Manufacturers

E-commerce Platforms

Government and Regulatory Bodies (FSSAI)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Cargill India

BASF India

Archer Daniels Midland (ADM)

Chr. Hansen Holding

Kerry Group

DuPont India

Corbion

Ajinomoto India

Tate & Lyle India

DSM Nutritional Products

Table of Contents

1. India Food Additives Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (in Volume and Value)

1.4. Market Segmentation Overview (By Type, Application, Source, Region)

2. India Food Additives Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis (Volume & Value)

2.3. Key Market Developments and Milestones (Product Launches, Regulatory Changes, Technological Advancements)

3. India Food Additives Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Consumer Preference for Processed Foods

3.1.2. Rising Demand for Natural Food Additives

3.1.3. Expanding Food & Beverage Industry

3.1.4. Government Support and Initiatives

3.2. Market Challenges

3.2.1. Strict Food Safety Regulations

3.2.2. High Cost of Natural Additives

3.2.3. Consumer Misconceptions about Food Additives

3.3. Opportunities

3.3.1. Growing Health and Wellness Trends

3.3.2. Innovations in Food Preservation

3.3.3. Untapped Rural Markets

3.4. Trends

3.4.1. Shift towards Clean Label Products

3.4.2. Increasing Use of Bio-based Additives

3.4.3. Development of Multifunctional Additives

3.5. Government Regulations (FSSAI, Codex Standards, etc.)

3.5.1. Food Additive Regulation Updates

3.5.2. Import/Export Guidelines

3.5.3. Compliance with FSSAI Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. India Food Additives Market Segmentation

4.1. By Type (In Value %)

4.1.1. Preservatives

4.1.2. Sweeteners

4.1.3. Emulsifiers

4.1.4. Antioxidants

4.1.5. Colorants

4.2. By Application (In Value %)

4.2.1. Beverages

4.2.2. Bakery & Confectionery

4.2.3. Dairy & Frozen Products

4.2.4. Meat, Poultry & Seafood

4.2.5. Sauces, Dressings & Condiments

4.3. By Source (In Value %)

4.3.1. Natural Additives

4.3.2. Synthetic Additives

4.4. By Function (In Value %)

4.4.1. Flavor Enhancers

4.4.2. Texturizers

4.4.3. Preservatives

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

5. India Food Additives Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Cargill India

5.1.2. BASF India

5.1.3. Archer Daniels Midland (ADM)

5.1.4. Chr. Hansen Holding

5.1.5. Kerry Group

5.1.6. DuPont India

5.1.7. Corbion

5.1.8. Ajinomoto India

5.1.9. Tate & Lyle India

5.1.10. DSM Nutritional Products

5.1.11. Givaudan India

5.1.12. Ingredion India

5.1.13. Sensient Technologies

5.1.14. Kancor Ingredients

5.1.15. Camlin Fine Sciences

5.2. Cross Comparison Parameters (Revenue, Product Portfolio, R&D Investments, Market Share, No. of Patents, Supply Chain Strength, Partnerships, Distribution Networks)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Food Additives Market Regulatory Framework

6.1. FSSAI Guidelines and Food Safety Standards

6.2. Import/Export Regulations

6.3. Labeling Requirements and Compliance

6.4. Certifications (Organic, Clean Label, etc.)

7. India Food Additives Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Food Additives Future Market Segmentation

8.1. By Type (In Value %)

8.2. By Application (In Value %)

8.3. By Source (In Value %)

8.4. By Function (In Value %)

8.5. By Region (In Value %)

9. India Food Additives Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. White Space Opportunities

9.3. Product Positioning Strategies

9.4. Go-to-Market Strategies

Research Methodology

Step 1: Identification of Key Variables

The initial phase of research involves constructing a comprehensive map of stakeholders in the India food additives market. Extensive desk research is conducted using both secondary and proprietary databases to identify and define the variables that influence market trends and growth.

Step 2: Market Analysis and Construction

Historical data for the India food additives market is compiled and analyzed, focusing on market penetration and revenue generation. An assessment of key market dynamics, such as the growth of processed food consumption and trends in clean-label products, is included.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts are consulted through interviews and surveys to validate the data and market assumptions. These consultations provide valuable insights into market operations, financial performance, and product innovations.

Step 4: Research Synthesis and Final Output

Final synthesis involves detailed analysis of market segments, competitive landscape, and consumer preferences. This phase also includes validation of all statistics, ensuring accuracy and completeness in the final report.

Frequently Asked Questions

01. How big is India Food Additives Market?

The India Food Additives Market is valued at USD 3.2 billion, driven by the expanding food and beverage sector, which has increased the demand for preservatives, flavor enhancers, and emulsifiers.

02. What are the challenges in India Food Additives Market?

Challenges in India Food Additives Market include strict food safety regulations and the rising cost of natural additives, which impact both manufacturers and consumers. Additionally, consumer misconceptions about synthetic additives pose hurdles for market growth.

03. Who are the major players in India Food Additives Market?

Key players in the India Food Additives Market include Cargill India, BASF India, ADM, Kerry Group, and Ajinomoto India. These companies have a strong presence in the market due to their extensive product range and R&D investments.

04. What are the growth drivers of India Food Additives Market?

The India Food Additives Market is propelled by the increasing demand for processed foods, rising awareness of food safety, and the growing trend towards natural and organic additives.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.