India Food Processing Market Outlook to 2030

Region:Asia

Author(s):Meenakshi

Product Code:KROD11038

November 2024

87

About the Report

India Food Processing Market Overview

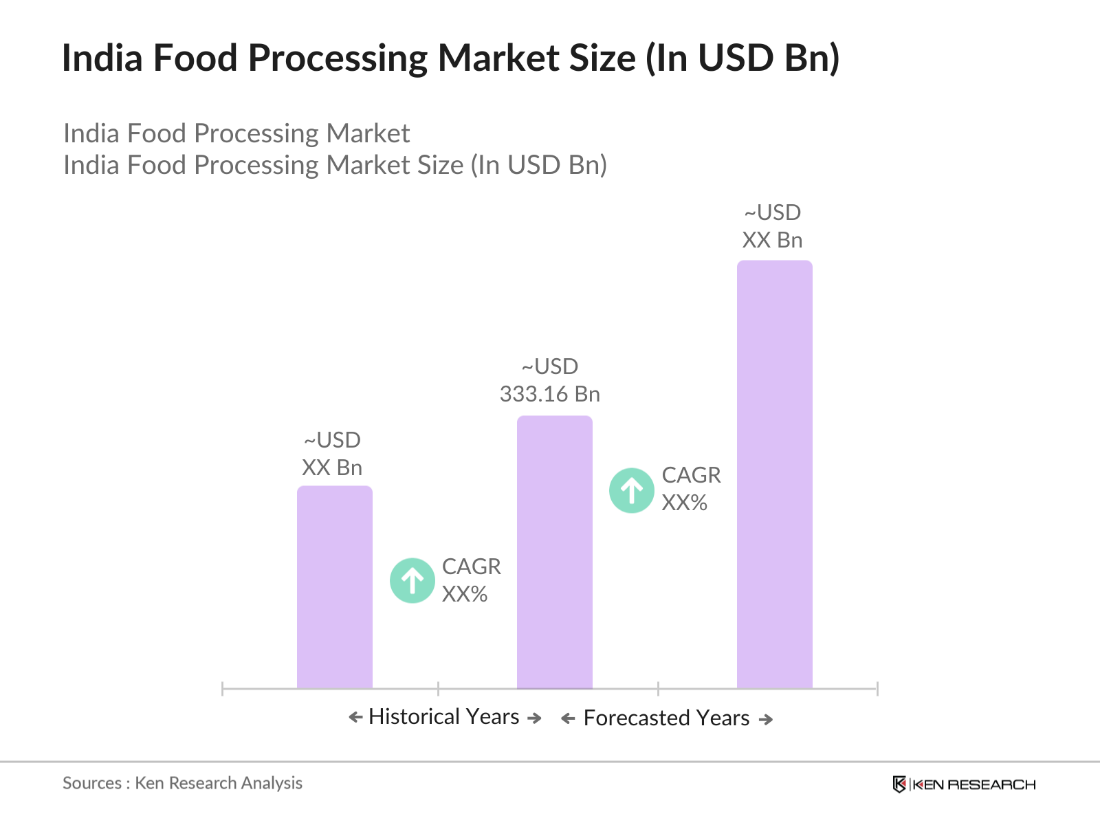

- The India Food Processing Market is valued at USD 333.16 billion, driven by significant growth across segments including dairy, beverages, meat, and ready-to-eat products. This growth is propelled by a combination of factors: rising consumer demand for convenient and packaged foods, increased urbanization, and supportive government policies like the Pradhan Mantri Kisan SAMPADA Yojana, which offers incentives for the establishment of food processing units.

- Key regions in India, such as Maharashtra, Uttar Pradesh, and Gujarat, dominate the food processing market. Maharashtra, with its vast urban population and industrial base, is a leader in processed dairy, fruits, and packaged foods. Uttar Pradesh, known for its agricultural productivity, has a robust supply chain for grain and vegetable processing, while Gujarat benefits from well-established dairy and snack processing industries.

- The Indian government offers financial incentives and subsidies to support food processing infrastructure development. In 2023, were provided subsidies under the MoFPIs various schemes, enabling companies to establish and expand processing facilities. These incentives aim to reduce operational costs and encourage the adoption of advanced technologies, facilitating sector growth and rural employment.

India Food Processing Market Segmentation

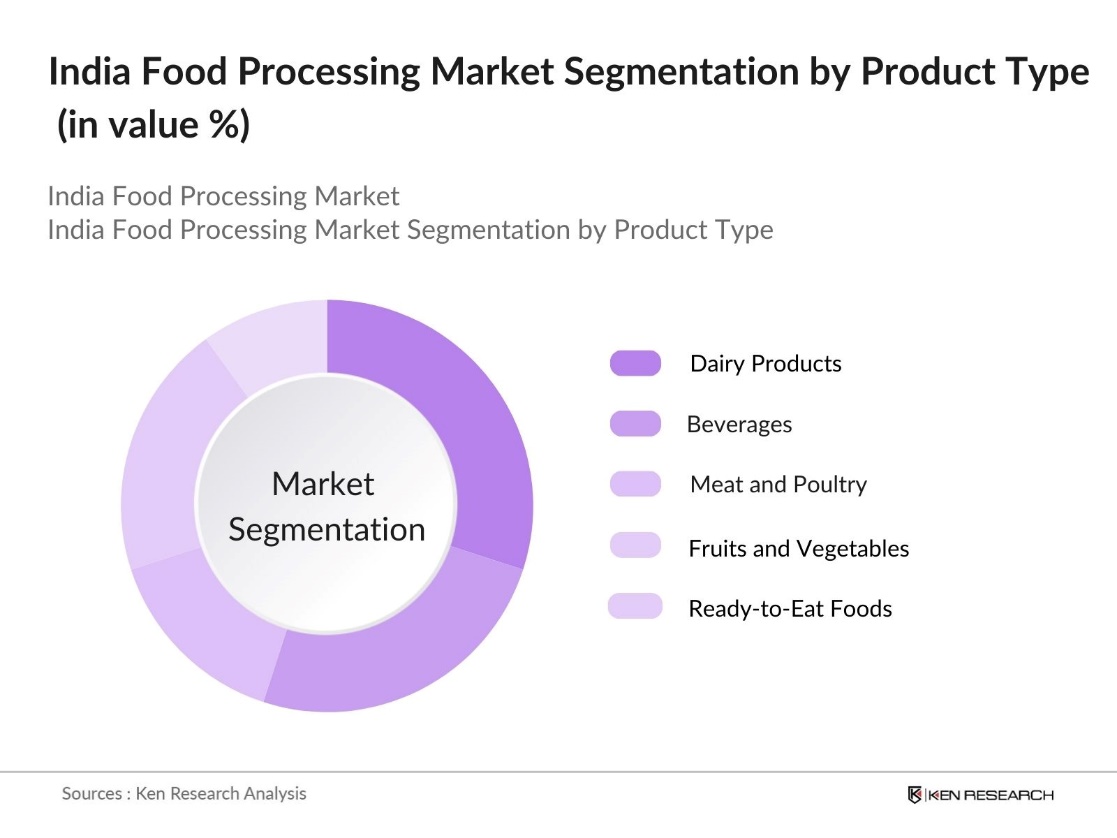

By Product Type: The market is segmented by product type into dairy products, beverages, meat and poultry, fruits and vegetables, and ready-to-eat foods. Dairy products hold a dominant position due to their longstanding popularity and nutritional value among Indian consumers. Leading brands like Amul and Nestl have captured this segment, with high demand for packaged milk, cheese, and yogurt. The availability of milk as a raw material and the wide distribution networks of these brands contribute to the dominance of this segment.

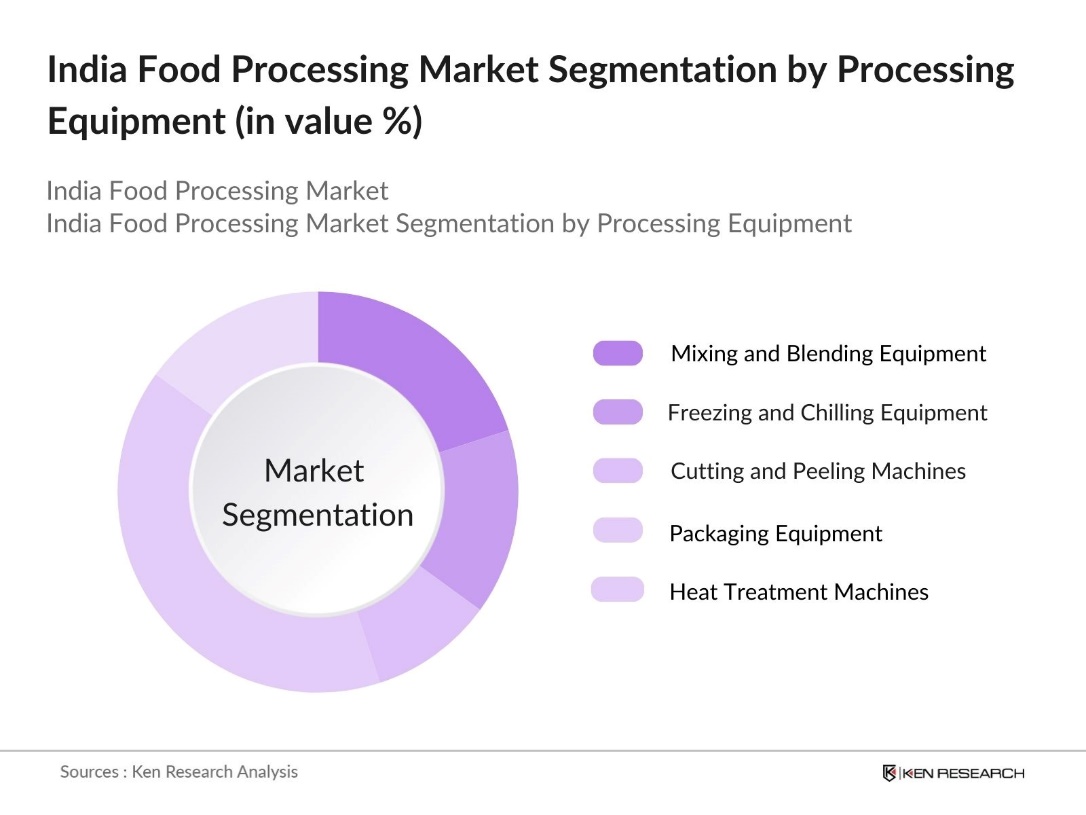

By Processing Equipment: The market is segmented by processing equipment, including mixing and blending equipment, freezing and chilling equipment, cutting and peeling machines, packaging equipment, and heat treatment machines. Packaging equipment leads in market share, as the packaging is crucial in ensuring food safety, extending shelf life, and providing aesthetic appeal to attract consumers. Investment in advanced packaging technologies by companies like ITC Limited and Britannia also boosts this segment.

India Food Processing Market Competitive Landscape

The India Food Processing Market is consolidated, with major players such as Amul, ITC, Britannia, and Nestl dominating through extensive distribution networks, strong brand recall, and product innovation. Their hold on the market is further strengthened by their ability to adapt to changing consumer preferences and compliance with regulatory standards. The competition in the market is intense, with players focused on expanding their reach into tier-2 and tier-3 cities and increasing investments in new processing and packaging technologies.

India Food Processing Industry Analysis

Growth Drivers

- Urbanization and Rising Consumer Demand: India's rapid urbanization has fueled consumer demand for processed foods. This growth in urban population is expected to continue driving demand for convenient and shelf-stable food products, as urban residents have higher disposable incomes. The food processing sector benefits from increased per capita income, supporting the shift toward packaged and processed food items. Urban households are showing an increased preference for processed products due to limited time for meal preparation.

- Advancements in Cold Chain Infrastructure: Indias cold chain infrastructure has expanded significantly, with the government investing INR 1,678.79 billion (around 20 billion USD) in 2023. The cold storage units were operational, reducing food wastage and supporting processed food distribution. This infrastructure is essential for maintaining food quality, especially for dairy, fruits, and vegetables. Enhanced cold chain networks contribute to economic growth, ensuring that products reach urban and rural markets efficiently.

- Demand for Processed and Packaged Foods: The demand for processed and packaged foods in India is rising due to changing lifestyles, especially in urban areas where accessibility is higher. With a growing workforce and more dual-income households, convenient ready-to-eat options have become essential. This trend not only meets consumer needs but also stimulates job creation across manufacturing, distribution, and retail, significantly supporting economic growth through increased productivity and employment.

Market Challenges

- High Capital Investment Requirements: India's food processing sector demands significant capital investment, often posing challenges for small and medium enterprises (SMEs) that may lack sufficient resources. High costs for technology, equipment, and adherence to stringent safety standards can deter new entrants, slowing sector growth and innovation. While government financing programs exist, their complex application processes can limit accessibility for smaller players, restricting broader industry participation and expansion.

- Complex Regulatory Environment: India's food processing industry operates under multiple regulatory bodies, such as FSSAI, enforcing rigorous standards for safety, labeling, and exports. These layered regulations can create bureaucratic challenges, making compliance costly and time-consuming, particularly for small businesses. The complexity of the regulatory landscape discourages new entrants and limits growth potential for existing players, impacting the overall efficiency and competitiveness of the sector.

India Food Processing Market Future Outlook

The India Food Processing Market is projected to maintain significant growth, supported by the governments focus on enhancing food security and increasing export potential. The sectors expansion is also driven by consumer demand for nutritious and convenient food options, as well as technological advancements that improve food safety and efficiency. With companies continuing to innovate in the areas of packaging, logistics, and automation, the market is poised for steady growth across all segments.

Market Opportunities

- Emerging Technologies in Food Processing (IoT, AI): Innovative technologies like the Internet of Things (IoT) and Artificial Intelligence (AI) are transforming Indias food processing sector by enhancing traceability, quality control, and automation. IoT enables real-time monitoring of conditions such as temperature and humidity, essential for cold storage, while AI improves efficiency in sorting and grading processes. These advancements help reduce costs and waste, allowing the industry to meet increasing consumer demand effectively.

- Expanding Export Markets: India's food processing sector has seen significant growth in exports, driven by global demand for products like snacks, spices, and ready-to-eat foods. Government policies supporting export-import processes have enabled easier access to international markets, strengthening Indias position in the global food processing arena. Rising exports not only provide an economic boost but also increase India's competitiveness in this expanding global industry.

Scope of the Report

|

By Product Type |

Dairy Products |

|

By Processing Equipment |

Mixing and Blending Equipment |

|

By Distribution Channel |

Hypermarkets/Supermarkets |

|

By Application |

Bakery and Confectionery |

|

By Region |

North South |

Products

Key Target Audience

Large Food Processing Companies

Packaged Food Manufacturers

Equipment Manufacturers

Export and Trade Agencies

Government and Regulatory Bodies (FSSAI, Ministry of Food Processing Industries)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Amul

ITC Limited

Britannia Industries Ltd.

Nestl India Ltd.

Dabur India Ltd.

PepsiCo India Holdings

Parle Products Pvt. Ltd.

Hindustan Unilever Ltd.

Godrej Agrovet Ltd.

Patanjali Ayurved Ltd.

Table of Contents

1. India Food Processing Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. India Food Processing Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. India Food Processing Market Analysis

3.1 Growth Drivers

3.1.1 Urbanization and Rising Consumer Demand

3.1.2 Government Support Programs (e.g., Pradhan Mantri Kisan SAMPADA Yojana)

3.1.3 Advancements in Cold Chain Infrastructure

3.1.4 Demand for Processed and Packaged Foods

3.2 Market Challenges

3.2.1 High Capital Investment Requirements

3.2.2 Complex Regulatory Environment

3.2.3 Lack of Skilled Labor in Rural Areas

3.2.4 Fragmented Supply Chain

3.3 Opportunities

3.3.1 Emerging Technologies in Food Processing (IoT, AI)

3.3.2 Expanding Export Markets

3.3.3 Organic and Plant-Based Product Growth

3.3.4 Untapped Rural Market Potential

3.4 Trends

3.4.1 Increased Demand for Ready-to-Eat Products

3.4.2 Adoption of Sustainable Packaging Solutions

3.4.3 Growth of E-commerce and Direct-to-Consumer Channels

3.4.4 Rise in Health and Wellness-Oriented Foods

3.5 Government Regulations

3.5.1 FSSAI Compliance and Standards

3.5.2 Export-Import Policy for Processed Foods

3.5.3 Licensing and Registration Norms

3.5.4 Financial Incentives and Subsidies

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. India Food Processing Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Dairy Products

4.1.2 Meat and Poultry

4.1.3 Fruits and Vegetables

4.1.4 Grains and Cereals

4.1.5 Ready-to-Eat Foods

4.2 By Processing Equipment (In Value %)

4.2.1 Mixing and Blending Equipment

4.2.2 Freezing and Chilling Equipment

4.2.3 Cutting and Peeling Machines

4.2.4 Packaging Equipment

4.2.5 Heat Treatment Machines

4.3 By Distribution Channel (In Value %)

4.3.1 Hypermarkets/Supermarkets

4.3.2 Convenience Stores

4.3.3 Online Retailers

4.3.4 Specialty Stores

4.3.5 Food Service Outlets

4.4 By Application (In Value %)

4.4.1 Bakery and Confectionery

4.4.2 Beverages

4.4.3 Dairy Processing

4.4.4 Meat Processing

4.4.5 Snack Foods

4.5 By Region (In Value %)

4.5.1 North

4.5.2 South

4.5.3 East

4.5.4 West

4.5.5 Central

5. India Food Processing Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Nestl India Ltd.

5.1.2 ITC Limited

5.1.3 Britannia Industries Ltd.

5.1.4 Amul (Gujarat Cooperative Milk Marketing Federation)

5.1.5 Hindustan Unilever Ltd.

5.1.6 Parle Products Pvt. Ltd.

5.1.7 PepsiCo India Holdings

5.1.8 Dabur India Ltd.

5.1.9 Godrej Agrovet Ltd.

5.1.10 Patanjali Ayurved Ltd.

5.1.11 Emami Agrotech Limited

5.1.12 Parag Milk Foods Ltd.

5.1.13 Mondelez India Foods Pvt. Ltd.

5.1.14 Tasty Bite Eatables Ltd.

5.1.15 Varun Beverages Ltd.

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Market Share, Production Capacity, Distribution Network)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. India Food Processing Market Regulatory Framework

6.1 Food Safety Standards (FSSAI)

6.2 Compliance Requirements (Labeling, Packaging)

6.3 Certification Processes (ISO, HACCP)

6.4 Export-Import Licensing and Policies

7. India Food Processing Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. India Food Processing Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Processing Equipment (In Value %)

8.3 By Distribution Channel (In Value %)

8.4 By Application (In Value %)

8.5 By Region (In Value %)

9. India Food Processing Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This step involves identifying major players, consumer preferences, and regulatory requirements in the India Food Processing Market. Key variables are compiled through in-depth desk research and secondary sources to frame a comprehensive view of the sector.

Step 2: Market Analysis and Construction

Historical data is analyzed to evaluate trends in revenue, production capacities, and consumption patterns. Statistical tools are used to estimate market penetration across various product types and regions.

Step 3: Hypothesis Validation and Expert Consultation

To validate hypotheses, expert interviews are conducted with industry practitioners, including executives from leading food processing companies and trade associations. This approach ensures data reliability and alignment with market dynamics.

Step 4: Research Synthesis and Final Output

In the final stage, data from interviews and secondary sources are synthesized to present an accurate and verified analysis of the India Food Processing Market. This report also includes expert insights on growth areas and strategic recommendations for stakeholders.

Frequently Asked Questions

01. How big is the India Food Processing Market?

The India Food Processing Market is valued at USD 333.16 billion, reflecting robust demand for processed foods due to urbanization and shifting consumer preferences toward convenience.

02. What are the challenges in the India Food Processing Market?

Challenges in India Food Processing Market include high capital requirements, complex regulatory landscapes, and a fragmented supply chain, which affect efficiency and scalability.

03. Who are the major players in the India Food Processing Market?

Key players in India Food Processing Market include Amul, ITC Limited, Britannia, and Nestl India, which dominate due to their strong distribution networks, innovative product offerings, and compliance with regulatory standards.

04. What are the growth drivers of the India Food Processing Market?

Growth drivers in India Food Processing Market include government support through initiatives like the Pradhan Mantri Kisan SAMPADA Yojana, increasing demand for packaged foods, and advancements in food processing technology.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.