India Forklift Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD3830

November 2024

92

About the Report

India Forklift Market Overview

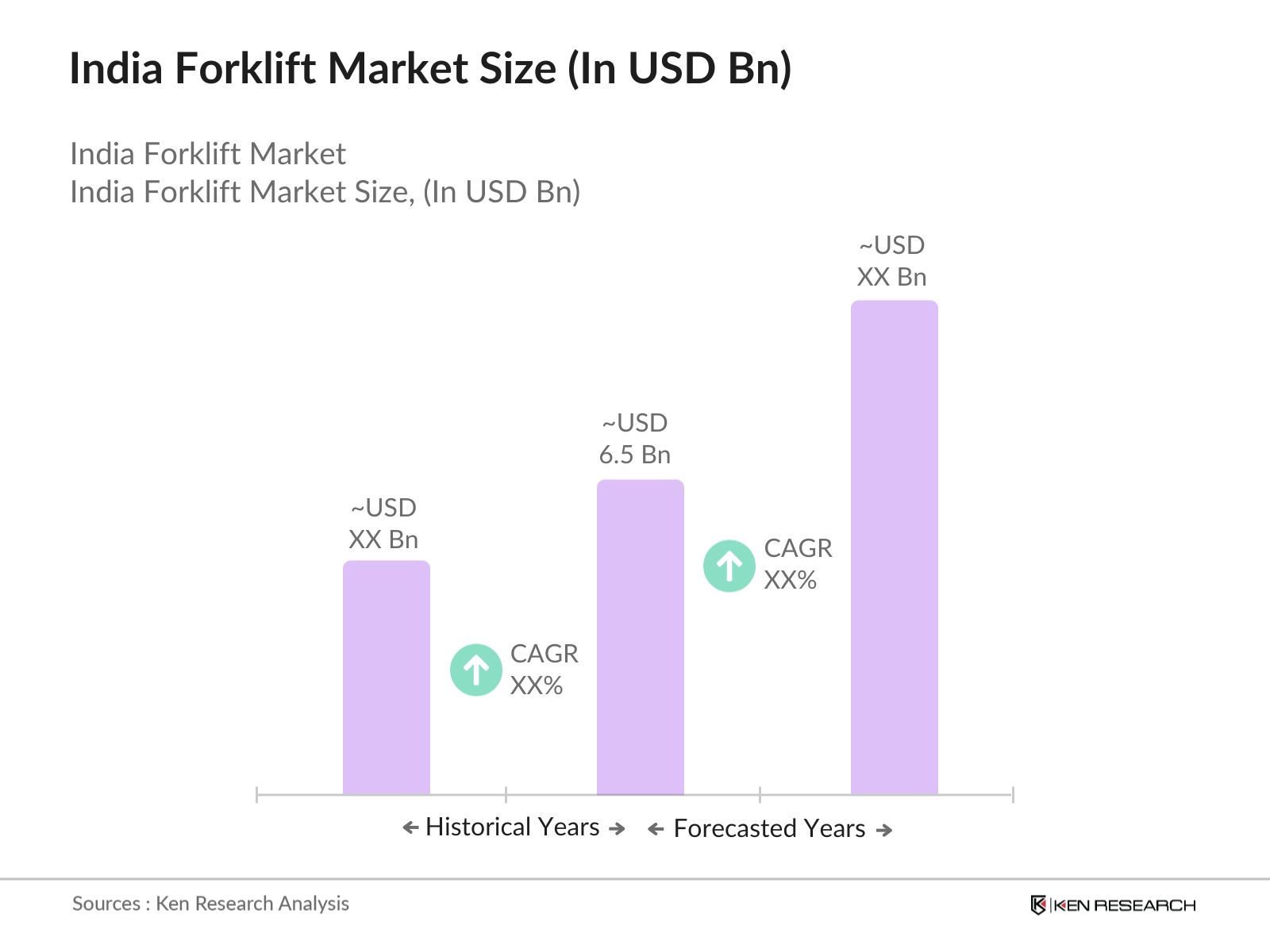

- The India Forklift Market is currently valued at USD 6.5 billion, based on a five-year historical analysis. This market has been significantly driven by the rapid expansion of infrastructure projects, e-commerce, and manufacturing activities across the country. Government initiatives such as the National Infrastructure Pipeline and "Make in India" are major catalysts, contributing to an increase in industrial output, warehousing, and logistics demands, all of which directly influence the forklift market's growth.

- Dominant regions in the forklift market include Maharashtra, Gujarat, and Tamil Nadu. These states dominate due to their well-established industrial hubs, expansive manufacturing capacities, and large-scale infrastructure developments. Furthermore, Maharashtra and Gujarat are home to several automotive and warehousing industries, increasing the demand for forklifts to streamline logistics and industrial operations, thereby solidifying their leadership in the market.

- Hyundai Construction Equipment Co. has taken initiative to develop small-sized forklift trucks powered by hydrogen fuel cells in collaboration with S-Fuelcell Co. in 2023. This aligns with the increasing demand for high-tech and sustainable forklifts in India's expanding logistics and warehousing sectors, especially as the country sees a surge in infrastructure and e-commerce growth. Additionally, government investments in infrastructure are fueling forklift adoption for material handling across various sectors.

India Forklift Market Segmentation

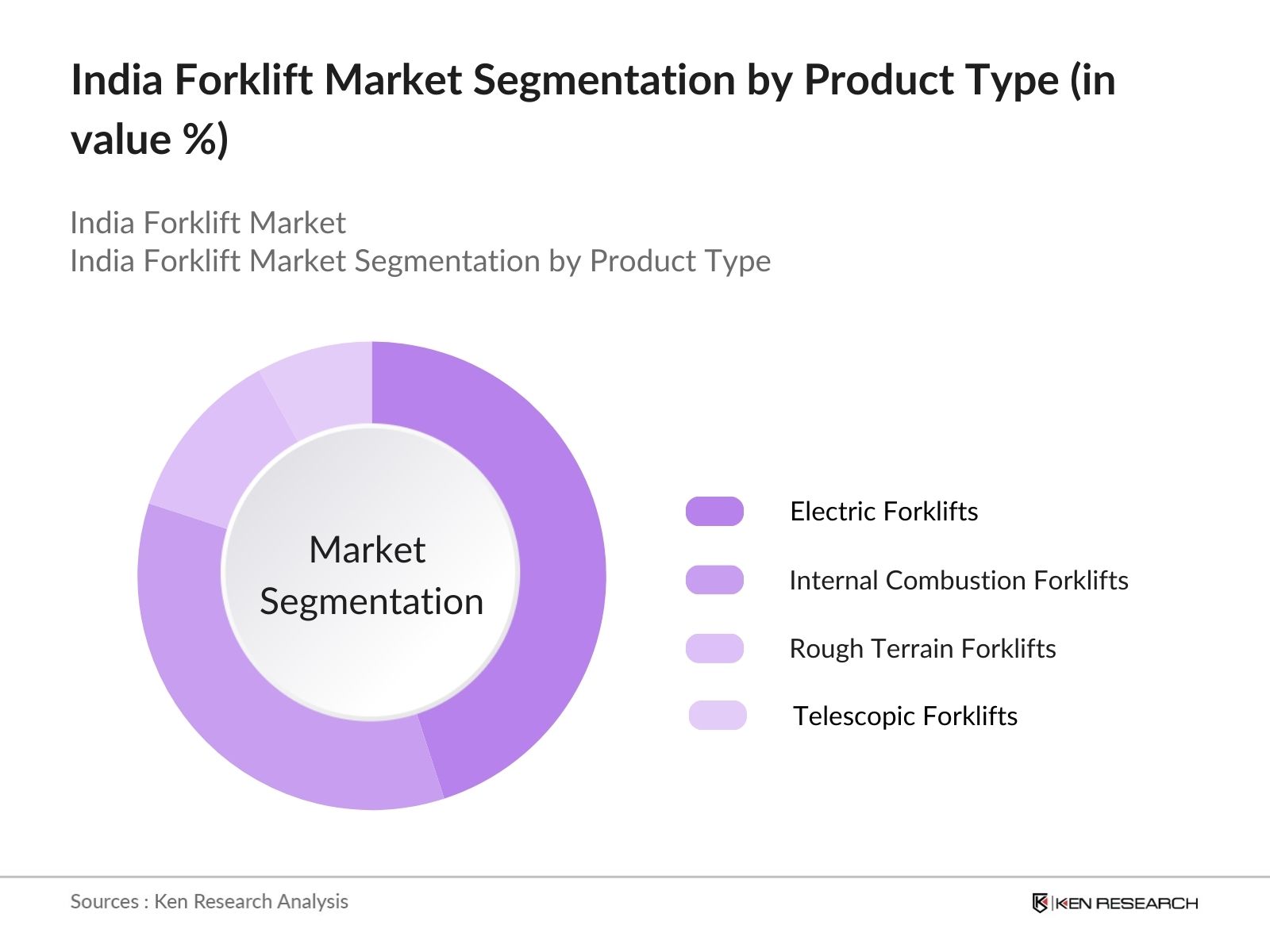

By Product Type: The India Forklift Market is segmented by product type into Electric Forklifts, Internal Combustion Forklifts, Rough Terrain Forklifts, and Telescopic Forklifts. Recently, Electric Forklifts have gained a dominant market share within the segmentation due to the rising preference for sustainability and lower operating costs. Businesses are increasingly adopting electric forklifts, particularly in warehousing and logistics, where operational efficiency and reduced environmental impact are becoming critical factors. Additionally, government incentives for electric vehicles have further boosted the uptake of electric forklifts.

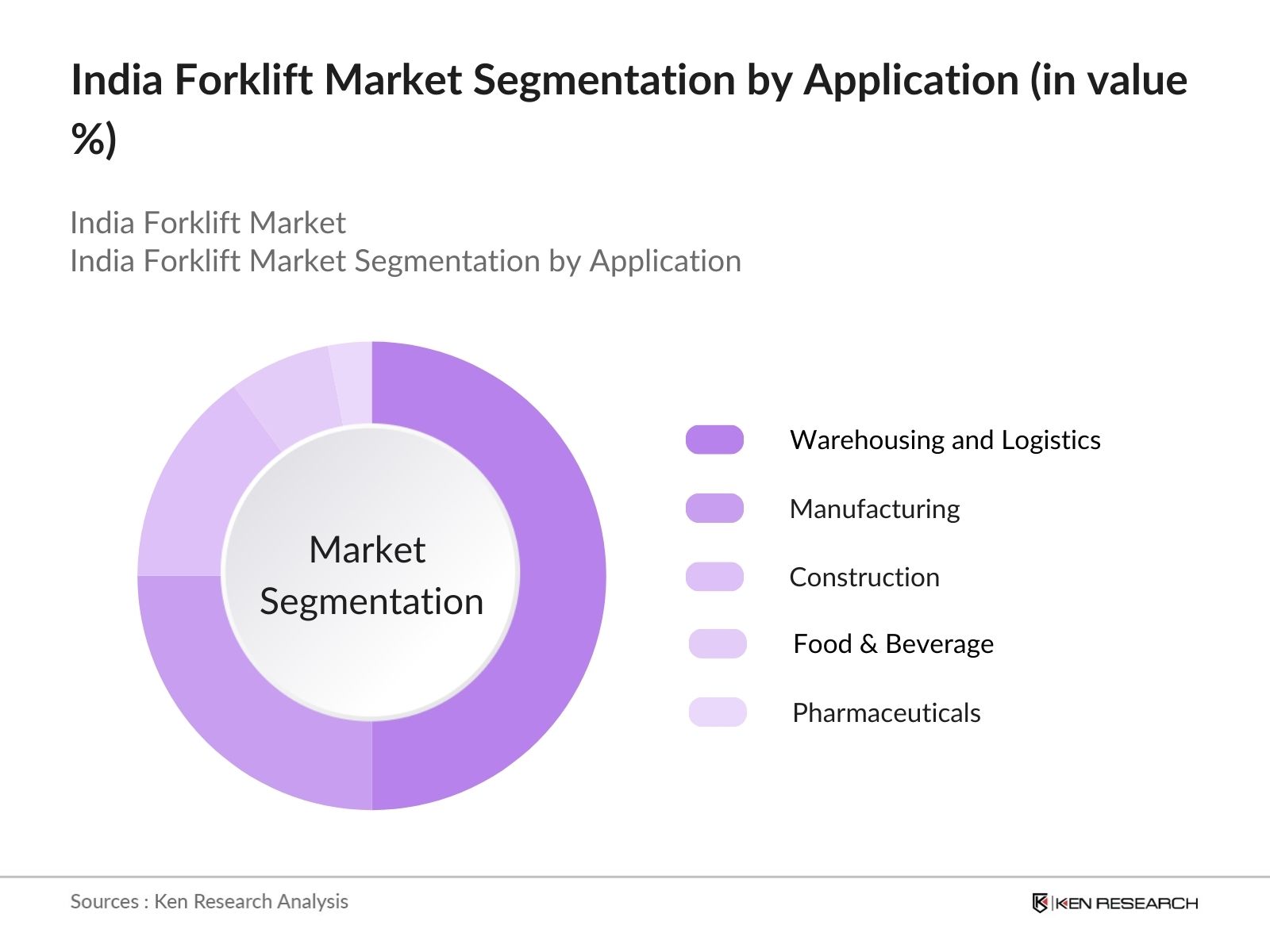

By Application: The India Forklift Market is also segmented by application into Manufacturing, Warehousing and Logistics, Construction, Food & Beverage, and Pharmaceuticals. Within this segment, Warehousing and Logistics holds a dominant market share due to the rapid growth of e-commerce in India, which has led to a significant increase in the demand for streamlined warehousing solutions. Forklifts are indispensable for material handling and storage optimization in large-scale logistics operations.

India Forklift Market Competitive Landscape

The India Forklift Market is characterized by the presence of several domestic and international players. The market is highly competitive, with companies competing on the basis of product innovation, cost-effectiveness, and after-sales services. Some key players include Godrej & Boyce Mfg. Co. Ltd., Toyota Material Handling India, and Hyundai Construction Equipment India, among others. The domestic players maintain a strong foothold due to their understanding of local market needs, while international companies bring advanced technology and superior product quality.

|

Company Name |

Establishment Year |

Headquarters |

Number of Employees |

Product Lines |

Key Markets |

Annual Revenue |

Technology Adoption |

Service Network |

|

Godrej & Boyce Mfg. Co. Ltd. |

1897 |

Mumbai, India |

- |

- |

- |

- |

- |

- |

|

Toyota Material Handling India |

1992 |

Bengaluru, India |

- |

- |

- |

- |

- |

- |

|

Hyundai Construction Equipment India |

2007 |

Pune, India |

- |

- |

- |

- |

- |

- |

|

KION India Pvt. Ltd. |

2011 |

Pune, India |

- |

- |

- |

- |

- |

- |

|

Jost's Engineering Company Ltd. |

1907 |

Mumbai, India |

- |

- |

- |

- |

- |

- |

India Forklift Market Analysis

Growth Drivers

- Infrastructure Development: India's infrastructure sector is experiencing significant growth, with the National Infrastructure Pipeline allocating USD 1,332 billion for improvements. Key initiatives like Bharatmala, Pariyojana are creating multi-modal logistics hubs, driving forklift demand across roads, railways, and ports. The logistics sector is poised to absorb considerable material handling equipment, with forklifts being integral to supporting these operations.

- Manufacturing Sector Growth: India's manufacturing sector is projected to contribute approximately USD 500 billion to the GDP by 2025. The "Make in India" initiative has resulted in the establishment of specialized industrial zones, which require advanced material handling equipment, including forklifts, for seamless operations. Key sectors like automotive and electronics are increasingly dependent on forklifts for transporting raw materials and finished goods.

- Adoption of Electric Forklifts: India is shifting towards electric forklifts due to sustainability goals and operational cost savings. With a government target of 30% electrification of the vehicle market by 2030, electric forklifts are gaining traction in sectors like warehousing, where zero emissions and noise reduction are essential. Additionally, electric forklifts offer cost savings in fuel consumption, contributing to their growing adoption.

Market Challenges

- High Initial Investment: The cost of acquiring forklifts, particularly electric models, represents a high initial capital outlay for businesses. The substantial procurement, installation, and maintenance costs are barriers, especially for SMEs, which face financing challenges. As a result, many small-scale industries prefer manual labor due to limited access to affordable financing options.

- Skilled Labor Shortage: India's logistics sector faces a shortage of skilled forklift operators, with an estimated gap of over 2 million trained workers. While initiatives are in place to train forklift operators, retention remains a challenge, particularly in Tier 2 and Tier 3 cities. The lack of accessible training facilities and awareness further exacerbates the shortage of skilled labor in forklift operations.

India Forklift Market Future Outlook

Over the next five years, the India Forklift Market is expected to show considerable growth driven by advancements in automation, sustainability initiatives, and increased demand from logistics and e-commerce sectors. The adoption of electric forklifts and smart technology integration, such as IoT-based fleet management systems, will be key drivers. Furthermore, ongoing government infrastructure projects and the shift towards organized warehousing will propel market growth.

Market Opportunities

- Technological Advancements: AI and IoT technologies are rapidly being integrated into forklifts, offering automation and operational efficiency improvements. IoT-enabled forklifts equipped with sensors can monitor performance, preventing breakdowns, while AI-driven fleet management systems optimize usage and reduce downtime. These advancements are driving the adoption of smart forklifts in various industries.

- Growth of Cold Chain Logistics: Indias cold chain logistics sector, essential for pharmaceuticals and food, is expanding with significant investments. Forklifts specifically designed for cold storage environments are critical for maintaining the integrity of temperature-sensitive goods. The increase in vaccine distribution and export of perishable food items has created a heightened demand for specialized forklifts in cold chain logistics.

Scope of the Report

|

By Product Type |

Electric Forklifts Internal Combustion Forklifts Rough Terrain Forklifts Telescopic Forklifts |

|

By Application |

Manufacturing Warehousing and Logistics Construction Food & Beverage Pharmaceuticals |

|

By Load Capacity |

Below 5 Tons 5-10 Tons Above 10 Tons |

|

By Power Source |

Electric (Battery-Operated) Diesel-Powered Gasoline/LPG Powered |

|

By Region |

North South West East |

Products

Key Target Audience

Manufacturers of Forklifts

Warehousing and Logistics Companies

Construction Companies

Food & Beverage Processing Companies

Pharmaceutical Manufacturers

Cold Chain Logistics Companies

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Heavy Industries, Ministry of Road Transport and Highways)

Companies

Players Mentioned in the report:

Godrej & Boyce Mfg. Co. Ltd.

Toyota Material Handling India

Hyundai Construction Equipment India

KION India Pvt. Ltd.

Josts Engineering Company Limited

Manitou Equipment India Pvt. Ltd.

Mitsubishi Forklift Trucks

Voltas Limited

Doosan Corporation Forklifts

Komatsu India Pvt. Ltd.

Hyster-Yale Group

Clark Material Handling India Pvt. Ltd.

Crown Equipment India Pvt. Ltd.

Mahindra Construction Equipment

Action Construction Equipment Ltd.

Table of Contents

1. India Forklift Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Forklift Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Forklift Market Analysis

3.1. Growth Drivers

3.1.1. Infrastructure Development (Government Initiatives, National Infrastructure Pipeline)

3.1.2. E-commerce Expansion (Demand in Logistics and Warehousing)

3.1.3. Manufacturing Sector Growth (Make in India Initiative)

3.1.4. Adoption of Electric Forklifts (Sustainability and Cost Efficiency)

3.2 Market Challenges

3.2.1. High Initial Investment

3.2.2. Skilled Labor Shortage

3.2.3. Infrastructure Constraints

3.3 Opportunities

3.3.1. Technological Advancements

3.3.2. Growth of Cold Chain Logistics

3.3.3. Increased Automation in Warehousing

3.4 Trends

3.4.1. Electrification of Forklifts

3.4.2. Adoption of Fuel Cell Forklifts

3.4.3. Expansion into Tier II and Tier III Cities

3.5 Government Regulation

3.5.1. Import Duties on Forklifts

3.5.2. Incentives for Electric Vehicles

3.5.3. Safety Standards

3.6 SWOT Analysis

3.7. Porters Five Forces

3.8. Competition Ecosystem

4. India Forklift Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Electric Forklifts

4.1.2. Internal Combustion Forklifts

4.1.3. Rough Terrain Forklifts

4.1.4. Telescopic Forklifts

4.2 By Application (In Value %)

4.2.1. Manufacturing

4.2.2. Warehousing and Logistics

4.2.3. Construction

4.2.4. Food & Beverage

4.2.5. Pharmaceuticals

4.3By Load Capacity (In Value %)

4.3.1. Below 5 Tons

4.3.2. 5-10 Tons

4.3.3. Above 10 Tons

4.4By Power Source (In Value %)

4.4.1. Electric (Battery-Operated)

4.4.2. Diesel-Powered

4.4.3. Gasoline/LPG Powered

4.4By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. West India

4.5.4. East India

5. India Forklift Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Godrej & Boyce Mfg. Co. Ltd.

5.1.2. KION India Pvt. Ltd.

5.1.3. Toyota Material Handling India Pvt. Ltd.

5.1.4. Hyundai Construction Equipment India Pvt. Ltd.

5.1.5. Action Construction Equipment Ltd.

5.1.6. Josts Engineering Company Limited

5.1.7. Manitou Equipment India Pvt. Ltd.

5.1.8. Mitsubishi Forklift Trucks

5.1.9. Voltas Limited

5.1.10. Doosan Corporation Forklifts

5.1.11. Komatsu India Pvt. Ltd.

5.1.12. Hyster-Yale Group

5.1.13. Clark Material Handling India Pvt. Ltd.

5.1.14. Crown Equipment India Pvt. Ltd.

5.1.15. Mahindra Construction Equipment

5.2Cross Comparison Parameters (Number of Employees, Revenue, Manufacturing Units, Export Destinations)

5.3. Market Share Analysis (By Value and Volume)

5.4. Strategic Initiatives (Collaborations, Expansion Plans, New Product Launches)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Subsidies

5.8. Private Equity Investments

6. India Forklift Market Regulatory Framework

6.1. Import Regulations (Duties and Levies on Imported Forklifts)

6.2. Safety Standards (IS Standards for Forklifts)

6.3. Environmental Compliance (Emissions and Noise Control)

7. India Forklift Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Forklift Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Load Capacity (In Value %)

8.4. By Power Source (In Value %)

8.5. By Region (In Value %)

9. India Forklift Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. White Space Opportunity Analysis

9.3. Marketing Initiatives

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

In the first phase, key stakeholders in the India Forklift Market were mapped out through extensive desk research. This included suppliers, distributors, manufacturers, and logistics operators. The critical variables influencing the market were identified, such as technology adoption, demand in logistics, and regulations around safety and emissions.

Step 2: Market Analysis and Construction

Historical data for the forklift market was compiled and analyzed. Metrics such as market penetration, the ratio of forklifts to warehousing space, and the operational efficiency of various types of forklifts were evaluated. Additionally, data on logistics and manufacturing growth was incorporated to construct an accurate market model.

Step 3: Hypothesis Validation and Expert Consultation

Several hypotheses were developed regarding the market growth, and these were validated through interviews with industry experts, including manufacturers, distributors, and operators in warehousing and logistics. The consultations provided insights into trends like the adoption of electric forklifts and smart technology in the industry.

Step 4: Research Synthesis and Final Output

The final stage involved integrating insights from primary interviews and secondary research to develop a comprehensive report. Multiple validation checks were performed through engagement with manufacturers and technology providers, ensuring accuracy in projections and market data.

Frequently Asked Questions

01.How big is the India Forklift Market?

The India Forklift Market was valued at USD 6.5 billion, driven by rapid industrialization, growth in e-commerce logistics, and government infrastructure projects across the country.

02.What are the challenges in the India Forklift Market?

Challenges in the India Forklift Markett include high initial capital investment for advanced electric forklifts, a shortage of skilled operators, and regulatory compliance issues related to emissions and safety standards.

03.Who are the major players in the India Forklift Market?

Key players in the India Forklift Market include Godrej & Boyce, Toyota Material Handling India, Hyundai Construction Equipment, KION India, and Jost's Engineering. These companies dominate due to their extensive service networks and advanced product offerings.

04.What are the growth drivers of the India Forklift Market?

Growth in the India Forklift Market is driven by the expansion of warehousing and logistics sectors, increased demand for material handling in construction and manufacturing, and the growing preference for electric forklifts due to sustainability concerns.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.