India Freeze-Drying Equipment Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD6219

December 2024

93

About the Report

India Freeze-Drying Equipment Market Overview

- The India freeze-drying equipment market is valued at USD 520 million, driven by the increasing demand from pharmaceutical and biotechnology sectors. The market has experienced substantial growth due to rising demand for lyophilized products in drug development and food preservation. Pharmaceutical manufacturers are adopting freeze-drying technology for developing biologics and vaccines, pushing the equipment demand. The focus on retaining product quality, particularly in temperature-sensitive products like vaccines, food, and biotechnology applications, continues to expand the market.

- In India, cities like Mumbai, Bengaluru, and Hyderabad dominate the freeze-drying equipment market. These cities house some of the largest pharmaceutical companies, biotechnology firms, and research institutions. Their dominance is attributed to the high concentration of R&D centers and manufacturing facilities for drugs, particularly in the production of vaccines and biosimilars. Furthermore, the availability of skilled labor and government support in these regions adds to their market strength, making them key hubs for freeze-drying equipment demand.

- India's pharmaceutical industry is regulated by the Central Drugs Standard Control Organization (CDSCO), which enforces stringent standards for manufacturing, including freeze-drying processes. In 2022, over 2,000 drug manufacturing units were inspected to ensure compliance with freeze-drying requirements for sensitive drugs like biologics and vaccines. These regulations are aimed at ensuring that freeze-drying equipment used in pharmaceutical production adheres to international standards.

India Freeze-Drying Equipment Market Segmentation

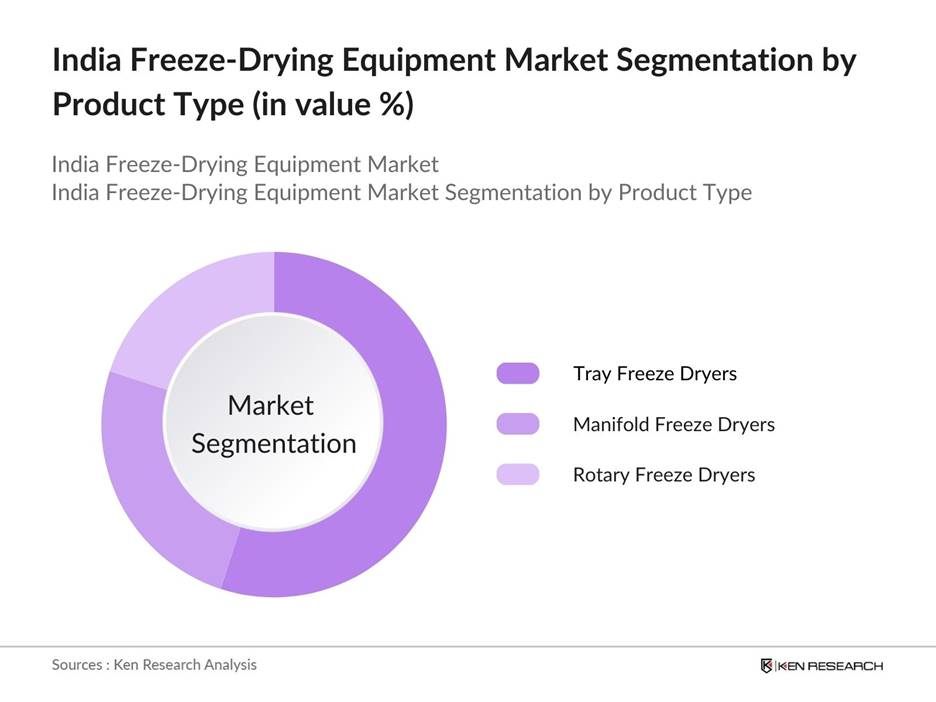

By Product Type: The market is segmented by product type into tray freeze dryers, manifold freeze dryers, and rotary freeze dryers. Recently, tray freeze dryers hold a dominant market share under the product type segmentation. This dominance is primarily due to their extensive use in the pharmaceutical and food industries, where bulk freeze-drying is required for sensitive materials. Tray freeze dryers offer precise control over drying processes, which is crucial for maintaining the structural integrity and stability of pharmaceutical products, further strengthening their dominance in the market.

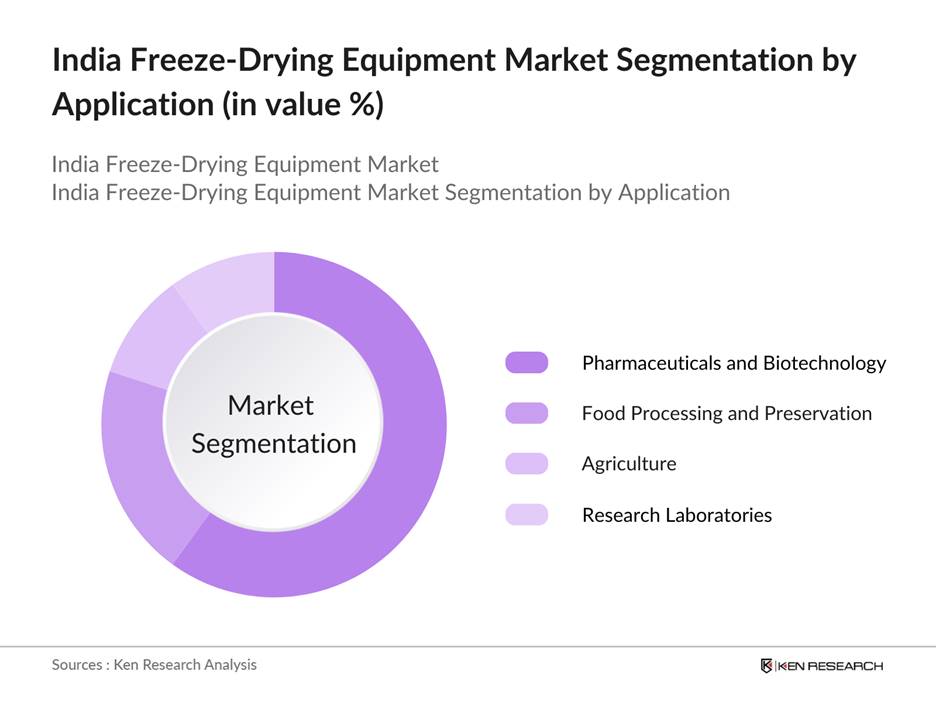

By Application: The market in India is segmented by application into pharmaceuticals and biotechnology, food processing and preservation, agriculture, and research laboratories. The pharmaceutical and biotechnology sector holds a dominant market share under this segmentation. This sector's dominance is driven by the increasing need for freeze-dried drugs, vaccines, and biologics. Freeze-drying ensures the long-term preservation of sensitive drugs, especially those used in clinical trials and large-scale production. Additionally, the COVID-19 pandemic has accelerated demand for lyophilization in the vaccine development process.

India Freeze-Drying Equipment Market Competitive Landscape

The India freeze-drying equipment market is dominated by several key players, both domestic and international. These players are constantly innovating and enhancing their product portfolios to cater to the evolving needs of the market, particularly in the pharmaceutical and food industries. The major players are characterized by their strong manufacturing capabilities, distribution networks, and partnerships with end-users.

|

Company |

Established |

Headquarters |

Annual Revenue |

Product Portfolio |

R&D Expenditure |

Market Share |

Geographic Reach |

Key Patents |

|

Martin Christ |

1946 |

Germany |

|

|

|

|

|

|

|

Tofflon Science and Tech |

1993 |

China |

|

|

|

|

|

|

|

GEA Group AG |

1881 |

Germany |

|

|

|

|

|

|

|

SP Industries, Inc. |

1947 |

USA |

|

|

|

|

|

|

|

Labconco Corporation |

1925 |

USA |

|

|

|

|

|

|

India Freeze-Drying Equipment Industry Analysis

Growth Drivers

- Increasing Demand from Pharmaceuticals: The pharmaceutical sector in India has witnessed growth due to the expanding demand for freeze-dried drugs, especially biologics and vaccines, which require long-term stability. In 2022, the Indian pharmaceutical industry was valued at $42 billion, making it one of the largest producers of generic medicines globally. Freeze-drying (lyophilization) is increasingly used to maintain the stability and shelf life of sensitive pharmaceutical products. The government's Production Linked Incentive (PLI) scheme further supports local manufacturing of complex medicines, boosting demand for freeze-drying equipment. India exports pharmaceutical products worth over $24 billion annually.

- Growth in Biotechnology Sector: India's biotechnology industry has grown rapidly, driven by investments in R&D and innovation in life sciences. In 2023, the biotech sector's market size reached $100 billion, with biopharmaceuticals comprising a significant portion of this. Freeze-drying is critical for preserving biological samples and biopharmaceutical products like vaccines and biosimilars. With rising investment in biosimilars and biologics, the demand for advanced freeze-drying systems has surged. The government has also launched initiatives like the Biotechnology Industry Research Assistance Council (BIRAC) to boost innovation in the field.

- Rising Application in Food Preservation: India is witnessing a surge in the use of freeze-drying technology in food preservation to maintain nutritional value and extend the shelf life of products like fruits, vegetables, and spices. In 2023, India’s processed food exports were valued at $42 billion, showing growing international demand. Freeze-dried products are becoming popular in international markets due to their longer shelf life and lightweight nature, making transportation efficient. This trend, supported by rising food exports, is driving the demand for freeze-drying equipment across India’s food industry.

Market Challenges

- Energy-Intensive Process: Freeze-drying is an energy-intensive process that requires substantial electricity for both freezing and vacuum drying stages. In India, the average energy consumption for freeze-drying equipment is approximately 25 kWh per cycle, which can significantly increase operational costs. In 2022, the average commercial electricity tariff in India was around ?7.5 per kWh, making energy expenses a major concern for manufacturers using this technology. High energy consumption also poses challenges in terms of environmental sustainability, especially with stricter energy efficiency regulations emerging globally.

- Lack of Technical Expertise: Operating freeze-drying equipment requires specialized knowledge, particularly in industries like pharmaceuticals and biotechnology. In India, a shortage of trained professionals in lyophilization processes has been reported, limiting the adoption of advanced freeze-drying technology. The Indian pharmaceutical industry, employing over 2.7 million people, still faces gaps in advanced technical training, which affects the optimization and maintenance of freeze-drying equipment. This lack of expertise often leads to operational inefficiencies and longer lead times.

India Freeze-Drying Equipment Market Future Outlook

Over the next five years, the India freeze-drying equipment market is expected to experience significant growth. This growth will be driven by rising investments in biotechnology, increasing demand for lyophilization in pharmaceuticals, and technological advancements in freeze-drying systems. With a growing pharmaceutical industry and demand for high-quality food preservation, freeze-drying equipment will continue to be a key technology in both sectors. Additionally, increasing government initiatives aimed at enhancing domestic production capacities will further fuel market growth.

Future Market Opportunities

- Expansion in Contract Manufacturing: India's contract development and manufacturing organization (CDMO) market is expanding, driven by global outsourcing trends in pharmaceuticals and biotechnology. Freeze-drying is a critical component in the manufacturing of drugs, vaccines, and biological products. As of 2023, the Indian CDMO market was valued at over $19.63 billion, with companies investing in specialized equipment like freeze-dryers to meet international standards. The growth in CDMO services is expected to increase the demand for advanced freeze-drying technology.

- Rising Export of Freeze-Dried Products: India is becoming a leading exporter of freeze-dried products, especially in the food and pharmaceutical industries. In 2023, India exported over $1.5 billion worth of freeze-dried fruits and vegetables, driven by the rising global demand for natural and long-lasting food products. Indian pharmaceutical exports, including freeze-dried formulations, are also gaining traction in regulated markets like the US and Europe. This export growth is expected to bolster investments in freeze-drying technology across sectors.

Scope of the Report

|

Product Type |

Tray Freeze Dryers Manifold Freeze Dryers Rotary Freeze Dryers |

|

Application |

Pharmaceuticals Biotechnology Food Processing Agriculture Research Labs |

|

Technology |

Conventional Automated Continuous Freeze-Drying Systems |

|

Capacity |

Small-Scale Pilot-Scale Industrial-Scale Equipment |

|

Region |

North India South India East India West India |

Products

Key Target Audience

Pharmaceutical Manufacturers

Biotech Firms

Food and Beverage Manufacturers

Research and Development Laboratories

Contract Manufacturing Organizations (CMOs)

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (CDSCO, FSSAI)

Pharmaceutical Equipment Suppliers

Companies

Major Players in the Market

- Martin Christ

- Tofflon Science and Technology Co., Ltd.

- GEA Group AG

- Azbil Telstar

- Labconco Corporation

- Millrock Technology, Inc.

- OPTIMA Packaging Group GmbH

- SP Industries, Inc.

- IMA Group

- HOF Sonderanlagenbau GmbH

- Scala Scientific

- Zirbus Technology GmbH

- Cuddon Freeze Dry

- Yamato Scientific Co., Ltd.

- Freezedry Specialties, Inc.

Table of Contents

India Freeze-Drying Equipment Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

India Freeze-Drying Equipment Market Size (In INR Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

India Freeze-Drying Equipment Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand from Pharmaceuticals

3.1.2. Growth in Biotechnology Sector

3.1.3. Rising Application in Food Preservation

3.1.4. Government Incentives for Life Sciences and Manufacturing

3.2. Market Challenges

3.2.1. High Initial Investment

3.2.2. Energy-Intensive Process

3.2.3. Lack of Technical Expertise (for equipment handling)

3.3. Opportunities

3.3.1. Technological Innovations in Freeze-Drying Systems

3.3.2. Expansion in Contract Manufacturing (CDMOs)

3.3.3. Rising Export of Freeze-Dried Products

3.4. Trends

3.4.1. Use of Vacuum Drying and Lyophilization in R&D

3.4.2. Integration with IoT (Remote Monitoring and Diagnostics)

3.4.3. Focus on Energy-Efficient Systems

3.5. Government Regulations

3.5.1. Indian GMP and Regulatory Compliance

3.5.2. Pharmaceutical Industry Regulations

3.5.3. FSSAI Guidelines for Food Preservation

3.5.4. Environmental Norms for Freeze-Drying Equipment Manufacturing

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Equipment Manufacturers, Suppliers, and End-Users)

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

India Freeze-Drying Equipment Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Tray Freeze Dryers

4.1.2. Manifold Freeze Dryers

4.1.3. Rotary Freeze Dryers

4.2. By Application (In Value %)

4.2.1. Pharmaceuticals and Biotechnology

4.2.2. Food Processing and Preservation

4.2.3. Agriculture

4.2.4. Research Laboratories

4.3. By Technology (In Value %)

4.3.1. Conventional Freeze-Drying

4.3.2. Automated Freeze-Drying Systems

4.3.3. Continuous Freeze-Drying Technology

4.4. By Capacity (In Value %)

4.4.1. Small-Scale Equipment

4.4.2. Pilot-Scale Equipment

4.4.3. Industrial-Scale Equipment

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

India Freeze-Drying Equipment Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Martin Christ

5.1.2. Tofflon Science and Technology Co., Ltd.

5.1.3. GEA Group AG

5.1.4. Azbil Telstar

5.1.5. Labconco Corporation

5.1.6. Millrock Technology, Inc.

5.1.7. OPTIMA Packaging Group GmbH

5.1.8. SP Industries, Inc.

5.1.9. IMA Group

5.1.10. HOF Sonderanlagenbau GmbH

5.1.11. Scala Scientific

5.1.12. Zirbus Technology GmbH

5.1.13. Cuddon Freeze Dry

5.1.14. Yamato Scientific Co., Ltd.

5.1.15. Freezedry Specialties, Inc.

5.2. Cross Comparison Parameters (Employee Count, Revenue, Manufacturing Footprint, R&D Spend, Export Share, Market Penetration, Certifications, Global Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Private Equity and Venture Capital Investments

5.8. Government Grants and Funding

India Freeze-Drying Equipment Market Regulatory Framework

6.1. Pharmaceutical and Biotechnology Regulatory Approvals

6.2. Food Safety Standards

6.3. Environmental and Energy Regulations

6.4. Industry Compliance Certifications

India Freeze-Drying Equipment Future Market Size (In INR Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

India Freeze-Drying Equipment Future Market Segmentation

8.1. By Product Type

8.2. By Application

8.3. By Technology

8.4. By Capacity

8.5. By Region

India Freeze-Drying Equipment Market Analyst Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Product Development Strategies

9.3. M&A Opportunities

9.4. Go-to-Market Strategy for New Entrants

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping the key stakeholders in the India freeze-drying equipment market. Extensive desk research was conducted to gather industry-specific data from secondary sources and proprietary databases. This stage is crucial in identifying the major factors influencing market dynamics, such as product demand, supply chain factors, and technology trends.

Step 2: Market Analysis and Construction

This phase includes a detailed analysis of historical data for the India freeze-drying equipment market. Market penetration across various sectors such as pharmaceuticals, food, and biotechnology was evaluated. Additionally, data on the ratio of production to distribution was analyzed to validate market revenue and the overall industry landscape.

Step 3: Hypothesis Validation and Expert Consultation

To validate our research hypotheses, industry experts from pharmaceutical, biotech, and food manufacturing companies were consulted. These consultations were conducted using CATIs and helped refine market data, particularly on growth drivers and technology adoption.

Step 4: Research Synthesis and Final Output

The final research phase involved verifying data through direct consultations with freeze-drying equipment manufacturers and end-users. Insights gained from these interactions were incorporated to ensure an accurate and comprehensive analysis of the India freeze-drying equipment market.

Frequently Asked Questions

01. How big is the India Freeze-Drying Equipment Market?

The India freeze-drying equipment market is valued at USD 520 million, driven by the pharmaceutical and biotechnology sectors' growing reliance on lyophilization technologies for drug and vaccine development.

02. What are the challenges in the India Freeze-Drying Equipment Market?

Challenges in the India freeze-drying equipment market include high capital costs, energy-intensive processes, and the need for highly skilled operators to manage the equipment efficiently.

03. Who are the major players in the India Freeze-Drying Equipment Market?

Major players in the India freeze-drying equipment market include Martin Christ, Tofflon Science and Technology Co., Ltd., GEA Group AG, SP Industries, and Labconco Corporation, which dominate due to their technological advancements and strong market presence.

04. What are the growth drivers of the India Freeze-Drying Equipment Market?

Key growth in the India freeze-drying equipment market drivers include rising demand for lyophilized drugs, the expansion of biotechnology research, and increasing applications of freeze-drying technology in food preservation and pharmaceutical manufacturing.

05. How is the regulatory environment affecting the India Freeze-Drying Equipment Market?

The regulatory environment in India, particularly in pharmaceuticals and food safety, is strengthening the adoption of freeze-drying technology by mandating stringent quality standards for drug production and food preservation in the India freeze-drying equipment market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.