India Fresh Fruits Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD6956

December 2024

84

About the Report

India Fresh Fruits Market Overview

- The India Fresh Fruits Market is valued at USD 100 billion, driven by rising health consciousness among consumers, the increasing penetration of organized retail, and expanding demand for organic fruits. Urbanization and a growing middle-class population have further fueled the demand for fresh and exotic fruits, especially in urban areas. Government initiatives promoting the agricultural sector, along with the push for cold chain infrastructure, have supported the markets expansion, ensuring a consistent supply of fresh fruits across the country.

- Cities such as Mumbai, Delhi, and Bangalore dominate the fresh fruits market due to their large urban populations and high disposable income. These metropolitan areas have a well-established network of supermarkets, hypermarkets, and premium grocery stores, catering to consumer demand for fresh, high-quality fruits. Additionally, these cities benefit from better infrastructure and proximity to ports, making them key hubs for both domestic consumption and exports.

- The National Horticulture Mission has been instrumental in promoting the growth of the fresh fruit sector in India. With an allocated budget of INR 5,000 crore in 2023, the mission has provided financial assistance to farmers for cultivating fruit crops, establishing nurseries, and adopting modern cultivation techniques. The program aims to enhance fruit production, improve post-harvest management, and reduce losses. As a result, India has seen a consistent increase in fruit production, which reached 100 million metric tons in 2023.

India Fresh Fruits Market Segmentation

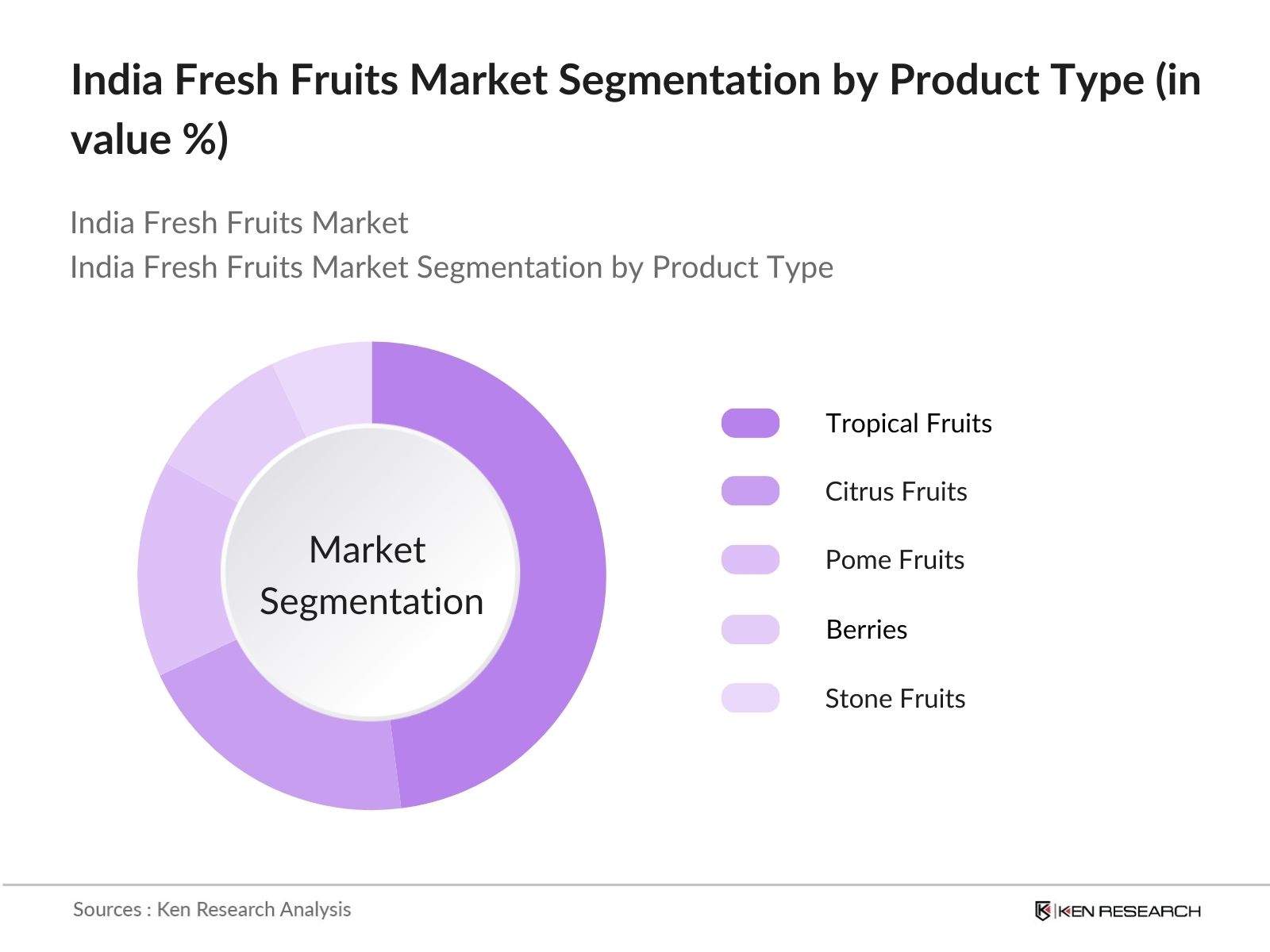

- By Product Type: Indias fresh fruits market is segmented by product type into citrus fruits, berries, pome fruits, stone fruits, and tropical fruits. Tropical fruits hold a dominant share in this segment, primarily due to their year-round availability and cultural importance in the Indian diet. Fruits like bananas and mangoes are staple products in India and enjoy high consumption due to their affordability and nutritional value. Additionally, tropical fruits are grown widely across various regions, ensuring consistent supply and market dominance.

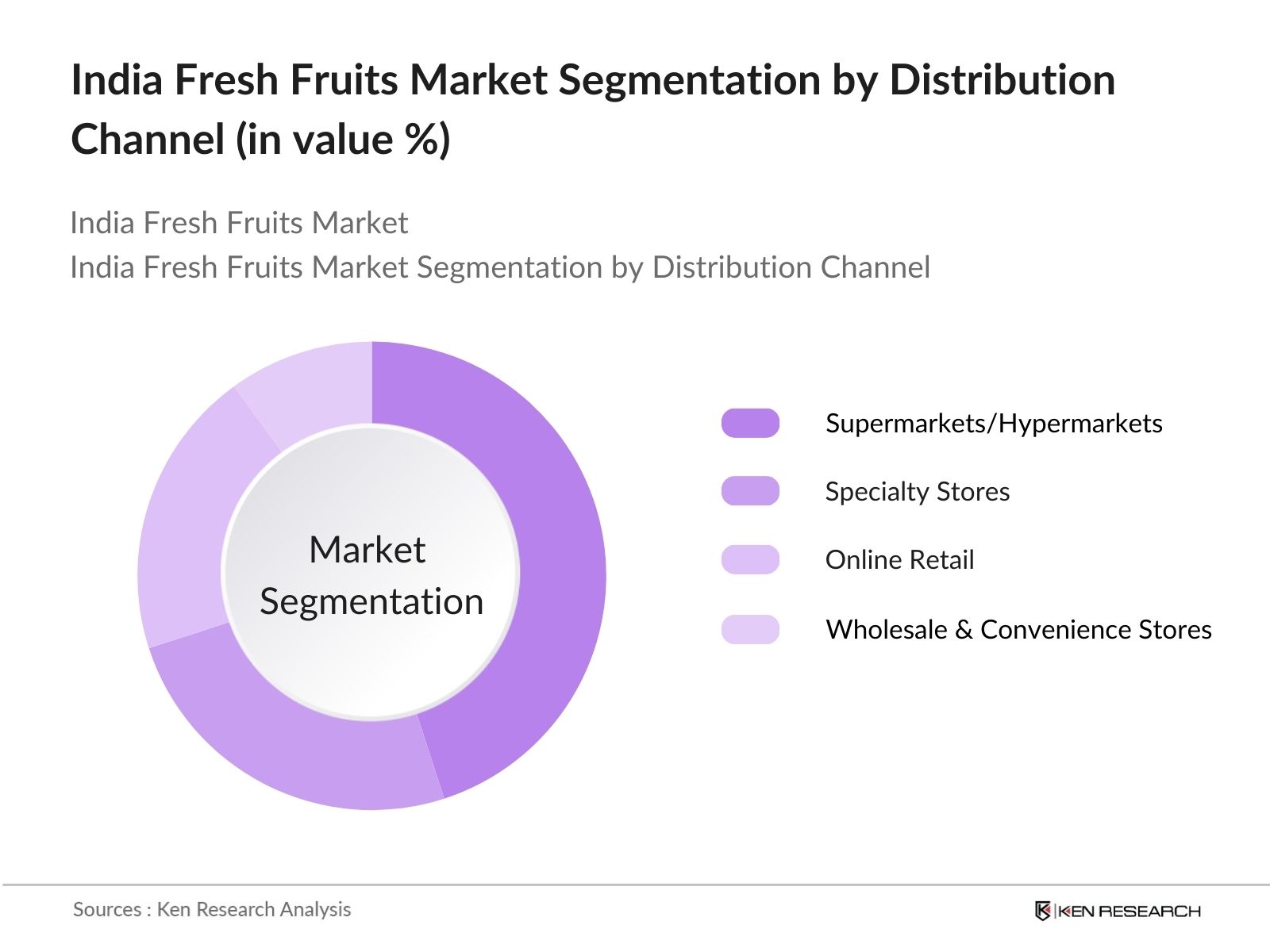

- By Distribution Channel: The market is also segmented by distribution channels into supermarkets/hypermarkets, specialty stores, online retail, and wholesale & convenience stores. Supermarkets and hypermarkets dominate this segment, accounting for the largest share of the market. This is due to the increasing urban population and consumer preference for one-stop shopping experiences that offer a variety of fruits under one roof. Additionally, organized retail chains have developed strong relationships with suppliers, ensuring a consistent and diverse selection of fresh fruits.

India Fresh Fruits Market Competitive Landscape

The India Fresh Fruits Market is characterized by the presence of both large corporate players and numerous small-scale farmers. Companies such as Mahindra Agribusiness and Adani Agri Fresh Ltd. have developed strong supply chains, leveraging cold storage and export opportunities. These larger players have focused on quality control and certifications, making their products more appealing both domestically and internationally.

|

Company |

Establishment Year |

Headquarters |

Revenue |

Cold Chain Infrastructure |

Export Partnerships |

Product Variety |

R&D Investment |

Market Reach |

Sustainability Practices |

|

Mahindra Agribusiness |

2000 |

Mumbai, India |

- |

- |

- |

- |

- |

- |

- |

|

Mother Dairy Fruit & Veg |

1974 |

Noida, India |

- |

- |

- |

- |

- |

- |

- |

|

Adani Agri Fresh Ltd. |

2006 |

Ahmedabad, India |

- |

- |

- |

- |

- |

- |

- |

|

Bigbasket |

2011 |

Bengaluru, India |

- |

- |

- |

- |

- |

- |

- |

|

FreshToHome |

2015 |

Bengaluru, India |

- |

- |

- |

- |

- |

- |

- |

India Fresh Fruits Market Analysis

India Fresh Fruits Market Growth Drivers

- Rising Health Consciousness: India's fresh fruit consumption is witnessing a boost due to increasing health awareness among its population. As of 2024, India's urban population reached 500 million, with a growing emphasis on consuming nutritious, fresh produce as part of a balanced diet. This shift is backed by government health campaigns promoting fruit intake for reducing lifestyle diseases like diabetes and heart conditions. Furthermore, consumer spending on health and wellness products, including fresh fruits, has surged by INR 1.2 trillion in recent years, reflecting this shift in consumer behaviour.

- Expanding Retail and E-Commerce Penetration: The retail and e-commerce sectors in India have expanded rapidly, directly contributing to the availability and distribution of fresh fruits. In 2023, India had over 1.2 billion internet users, and online grocery platforms have seen over 100 million active customers purchasing fruits and vegetables. With companies like BigBasket and Grofers, along with retailers like Reliance Fresh, the distribution network for fresh fruits has strengthened. Government policies facilitating seamless trade have further fueled this growth. Fresh fruit sales through these channels have grown substantially due to easy accessibility.

- Increasing Urbanization: Urbanization is a crucial factor driving the demand for fresh fruits in India. By 2024, over 34% of the population resides in urban areas, leading to a rise in demand for convenient and healthy food options like fresh fruits. Urban dwellers have increased disposable incomes, with average per capita income reaching INR 1,97,000 in 2024, allowing greater spending on premium and exotic fruits. As urban centers grow, the demand for fresh, accessible produce continues to increase, supported by improved supply chain infrastructure.

India Fresh Fruits Market Challenges

- Perishable Nature of Fruits: The perishable nature of fruits poses a major challenge for the fresh fruit market in India. Each year, around 15% of fruit produce, equating to nearly 11 million tons, is lost due to inefficient supply chains. India lacks sufficient cold storage facilities, with only 35 million metric tons of capacity for the entire agriculture sector, much less than required. The limited cold chain infrastructure severely impacts the shelf life of fresh fruits, leading to substantial post-harvest losses and affecting farmers income.

- Price Volatility Due to Seasonal Variations: Seasonal variations in fruit production lead to price fluctuations, particularly in tropical fruits like mangoes and bananas. In 2023, the average wholesale price of mangoes varied from INR 50 per kilogram during the peak season to INR 120 per kilogram during the off-season. Such volatility makes it challenging for traders and consumers to maintain a steady supply and demand balance. Unpredictable weather patterns, especially the late arrival of monsoons, exacerbate this issue, resulting in inconsistent pricing for fresh fruits.

India Fresh Fruits Market Future Outlook

Over the next five years, the India Fresh Fruits Market is expected to experience growth, driven by increasing consumer demand for healthier food options, government support for agriculture, and advancements in cold chain logistics. The rising trend of organic fruit consumption, along with a shift towards sustainable farming practices, will also contribute to the expansion of the market. As more consumers turn to premium and exotic fruits, the market is poised to grow at a steady pace, benefiting from increased investments in agriculture and logistics.

India Fresh Fruits Market Opportunities

- Adoption of Organic Farming Practices: Organic farming is gaining momentum in India, offering a lucrative opportunity for the fresh fruit market. By 2023, the area under organic farming reached 3 million hectares, with fruits constituting a notable portion of the produce. Organic fruits, like papayas and guavas, are increasingly popular among health-conscious consumers. Indian states like Sikkim have pioneered organic farming, with the state becoming fully organic in 2023. The organic fresh fruit segment is expected to benefit from increasing domestic and global demand for pesticide-free, organic produce.

- Rising Demand for Exotic Fruits: The demand for exotic fruits, such as dragon fruits and kiwis, has surged in India, driven by the country's affluent consumers. In 2023, India imported 25,000 metric tons of exotic fruits, marking a 20% increase from the previous year. Urban centers such as Delhi and Mumbai are the largest consumers of these premium fruits, with average annual household spending on exotic fruits reaching INR 5,000 in metropolitan cities. This presents an opportunity for local farmers to cater to the growing domestic market for high-end, premium fruits.

Scope of the Report

|

Product Type |

Citrus Fruits Berries Pome Fruits Stone Fruits Tropical Fruits |

|

Distribution Channel |

Supermarkets/Hypermarkets Specialty Stores Online Retail Wholesale & Convenience Stores |

|

Farming Technique |

Conventional Farming Organic Farming Greenhouse Farming |

|

End-User |

Households Food Service Institutional Buyers |

|

Region |

North India South India East India West India |

Products

Key Target Audience

Retailers and Supermarket Chains

Fresh Fruit Distributors

Food Processing Companies

Organic Farming Cooperatives

Banks and Financial Institutions

Cold Chain Logistics Providers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Agriculture & Farmers Welfare)

Exporters and Importers

Companies

Players Mentioned in the Report

Mahindra Agribusiness

Mother Dairy Fruit & Vegetable Pvt. Ltd.

TATA Agrico

Adani Agri Fresh Ltd.

Sahyadri Farms

Jain Irrigation Systems Ltd.

Patanjali Ayurved Ltd.

Bigbasket

FreshToHome

Reliance Fresh

Table of Contents

1. India Fresh Fruits Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. India Fresh Fruits Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. India Fresh Fruits Market Analysis

3.1 Growth Drivers

3.1.1 Rising Health Consciousness (Consumer Awareness)

3.1.2 Expanding Retail and E-Commerce Penetration (Distribution Channel)

3.1.3 Government Policies on Agriculture and Trade (Policy Support)

3.1.4 Increasing Urbanization (Demographic Shift)

3.2 Market Challenges

3.2.1 Perishable Nature of Fruits (Supply Chain Efficiency)

3.2.2 Price Volatility Due to Seasonal Variations (Cost Factors)

3.2.3 Lack of Cold Chain Infrastructure (Logistics)

3.3 Opportunities

3.3.1 Adoption of Organic Farming Practices (Organic Segment Growth)

3.3.2 Rising Demand for Exotic Fruits (Premium Segment)

3.3.3 Export Opportunities Due to Growing Global Demand (International Trade)

3.4 Trends

3.4.1 Increasing Consumer Preference for Fresh-Cut Fruits (Convenience Trend)

3.4.2 Demand for Organic and Locally Sourced Fruits (Health & Wellness)

3.4.3 Expansion of Direct-to-Consumer (D2C) Sales Channels (New Retail Models)

3.5 Government Regulation

3.5.1 National Horticulture Mission (Government Initiative)

3.5.2 Minimum Support Price (MSP) Programs (Price Regulation)

3.5.3 Trade Agreements for Fruit Exports (Export Policy)

3.5.4 Cold Chain Development Schemes (Infrastructure Support)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. India Fresh Fruits Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Citrus Fruits

4.1.2 Berries

4.1.3 Pome Fruits

4.1.4 Stone Fruits

4.1.5 Tropical Fruits

4.2 By Distribution Channel (In Value %)

4.2.1 Supermarkets/Hypermarkets

4.2.2 Specialty Stores

4.2.3 Online Retail

4.2.4 Wholesale and Convenience Stores

4.3 By Farming Technique (In Value %)

4.3.1 Conventional Farming

4.3.2 Organic Farming

4.3.3 Greenhouse Farming

4.4 By End-User (In Value %)

4.4.1 Households

4.4.2 Food Service (Hotels/Restaurants)

4.4.3 Institutional Buyers

4.5 By Region (In Value %)

4.5.1 North India

4.5.2 South India

4.5.3 East India

4.5.4 West India

5. India Fresh Fruits Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Mahindra Agribusiness

5.1.2 Mother Dairy Fruit & Vegetable Pvt. Ltd.

5.1.3 TATA Agrico

5.1.4 Adani Agri Fresh Ltd.

5.1.5 Sahyadri Farms

5.1.6 Jain Irrigation Systems Ltd.

5.1.7 Patanjali Ayurved Ltd.

5.1.8 Bigbasket

5.1.9 FreshToHome

5.1.10 Reliance Fresh

5.1.11 ITC Limited

5.1.12 Namdharis Fresh

5.1.13 Natures Basket

5.1.14 Frugivore India Private Limited

5.1.15 Keventer Agro Ltd.

5.2 Cross Comparison Parameters (Revenue, Product Portfolio, Market Presence, Distribution Network, Sustainability Practices, Certifications, R&D Investments, Market Share)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Joint Ventures and Collaborations

6. India Fresh Fruits Market Regulatory Framework

6.1 Agricultural Standards and Quality Regulations

6.2 Food Safety and Standards Authority of India (FSSAI) Compliance

6.3 Certifications and Labels (Organic, Fair Trade)

7. India Fresh Fruits Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. India Fresh Fruits Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Distribution Channel (In Value %)

8.3 By Farming Technique (In Value %)

8.4 By End-User (In Value %)

8.5 By Region (In Value %)

9. India Fresh Fruits Market Analysts Recommendations

9.1 Supply Chain Optimization

9.2 Branding and Marketing Strategy

9.3 Entry Strategy for New Entrants

9.4 Export Potential and Global Market Expansion

Research Methodology

Step 1: Identification of Key Variables

The initial step involves mapping the stakeholders of the India Fresh Fruits Market. Desk research, supplemented by proprietary databases, provides insights into key variables like market growth drivers and supply chain dynamics. Identifying these factors is essential to understanding market behaviour.

Step 2: Market Analysis and Construction

During this phase, historical data for the India Fresh Fruits Market is analyzed, including market penetration rates and distribution efficiency. The goal is to construct an accurate model that reflects market performance based on supply chain metrics and consumer demand patterns.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested through interviews with industry stakeholders, including fruit exporters, supermarket chains, and logistics providers. This validation process ensures the accuracy of market estimates and provides valuable insights into operational challenges and opportunities.

Step 4: Research Synthesis and Final Output

The final step consolidates the data collected from primary and secondary sources into a comprehensive market report. This includes detailed segmentation, competitor analysis, and projections, offering a complete picture of the India Fresh Fruits Markets future trajectory.

Frequently Asked Questions

01. How big is the India Fresh Fruits Market?

The India Fresh Fruits Market is valued at USD 100 billion, with growth driven by increasing consumer demand for fresh, organic, and exotic fruits. The markets consistent expansion can be attributed to a growing middle-class population and rising health awareness.

02. What are the challenges in the India Fresh Fruits Market?

The primary challenges in the India Fresh Fruits Market include the perishable nature of fresh fruits, which makes supply chain management crucial, and the lack of advanced cold chain infrastructure in many parts of the country. Seasonal price fluctuations also add uncertainty for both producers and consumers.

03. Who are the major players in the India Fresh Fruits Market?

Major players in the India Fresh Fruits Market include Mahindra Agribusiness, Mother Dairy Fruit & Vegetable Pvt. Ltd., Adani Agri Fresh Ltd., Bigbasket, and FreshToHome. These companies have strong distribution networks and partnerships, helping them maintain a leading position in the market.

04. What are the growth drivers of the India Fresh Fruits Market?

The India Fresh Fruits Market growth is driven by factors such as rising health consciousness, increasing urbanization, government support for agriculture, and the growing popularity of organic and exotic fruits. Organized retail expansion is also playing a key role in market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.