India Gaming Market Outlook to 2030

Region:Asia

Author(s):Samanyu

Product Code:KROD5158

October 2024

80

About the Report

India Gaming Market Overview

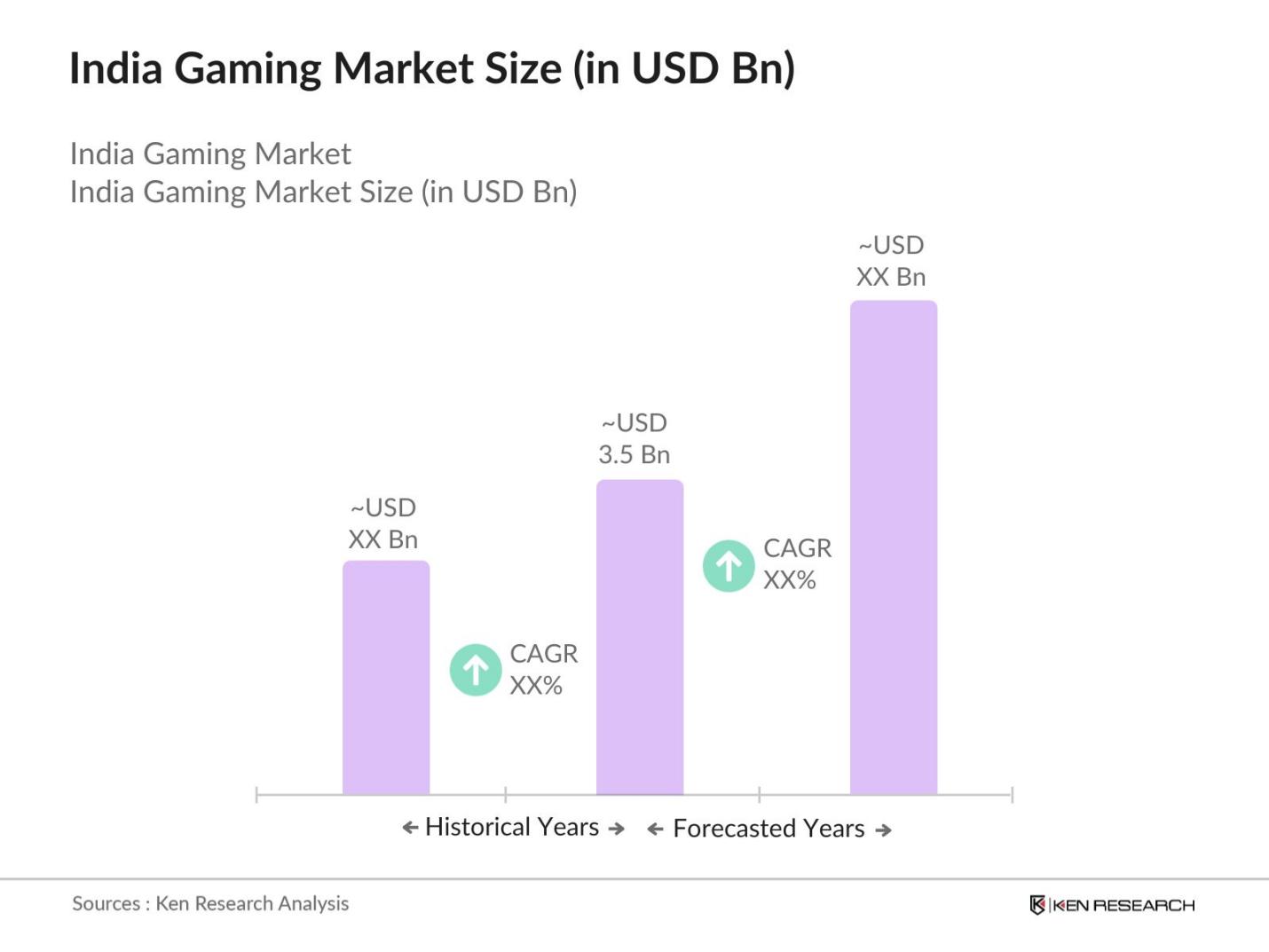

- The India Gaming market is valued at USD 3.5 Bn, driven by increasing smartphone penetration, affordable internet access, and a growing young population. Major gaming platforms, such as mobile games, dominate the market, largely due to widespread smartphone adoption and free-to-play models with in-game purchases. The advent of 5G and cloud gaming has also contributed to the growth, allowing gamers access to high-quality gaming experiences without the need for expensive hardware.

- Indias gaming dominance is concentrated in key regions like Mumbai, Bangalore, and Delhi, which serve as hubs for the gaming industry. These cities have a higher concentration of tech talent, better internet infrastructure, and a younger demographic that is more inclined towards gaming. Additionally, Bangalore is known for being a technology and startup hub, which has resulted in significant investment in gaming startups, while Delhi and Mumbai have robust consumer markets.

- The Indian government, through the Ministry of Information and Broadcasting, is working on formalizing online gaming licensing regulations, particularly for real-money games. As of 2024, multiple state governments have already implemented licensing regimes for skill-based games, and discussions are underway to create a unified national framework. States like Maharashtra and Nagaland have issued licenses to real-money gaming platforms, setting a precedent for the rest of the country. The government also aims to curb illegal online gambling by tightening regulatory oversight, improving consumer protection, and formalizing taxation on gaming revenues.

India Gaming Market Segmentation

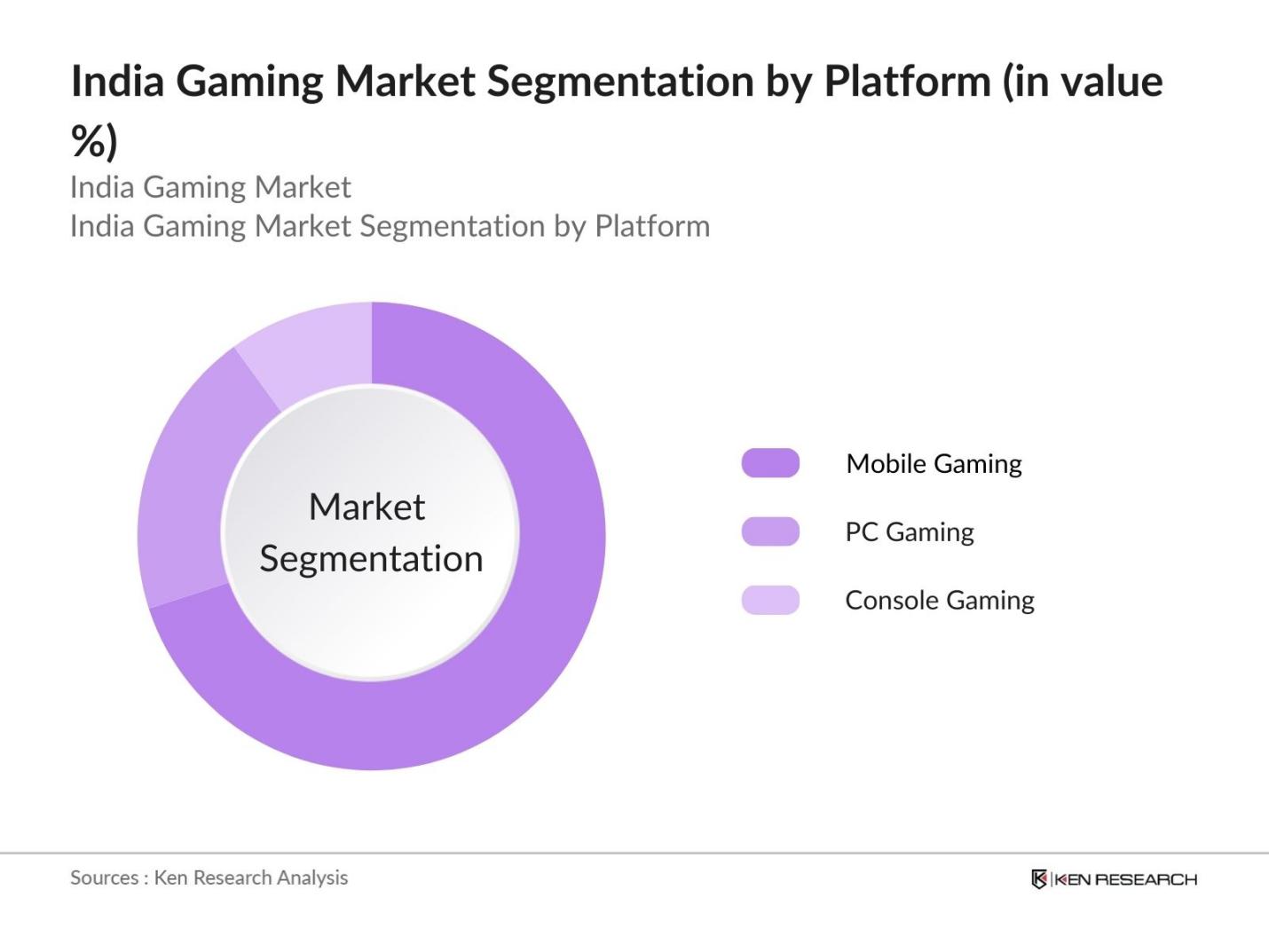

By Platform: The market is segmented by platform into mobile gaming, PC gaming, and console gaming. Mobile gaming has a dominant market share due to its accessibility and affordability. The rise in smartphone penetration and availability of budget devices have fueled mobile gaming's dominance. Popular mobile games such as "PUBG Mobile" and "Free Fire" have garnered massive user bases, primarily driven by their free-to-play models combined with microtransactions. Additionally, mobile gaming appeals to a broad demographic, including casual and hardcore gamers.

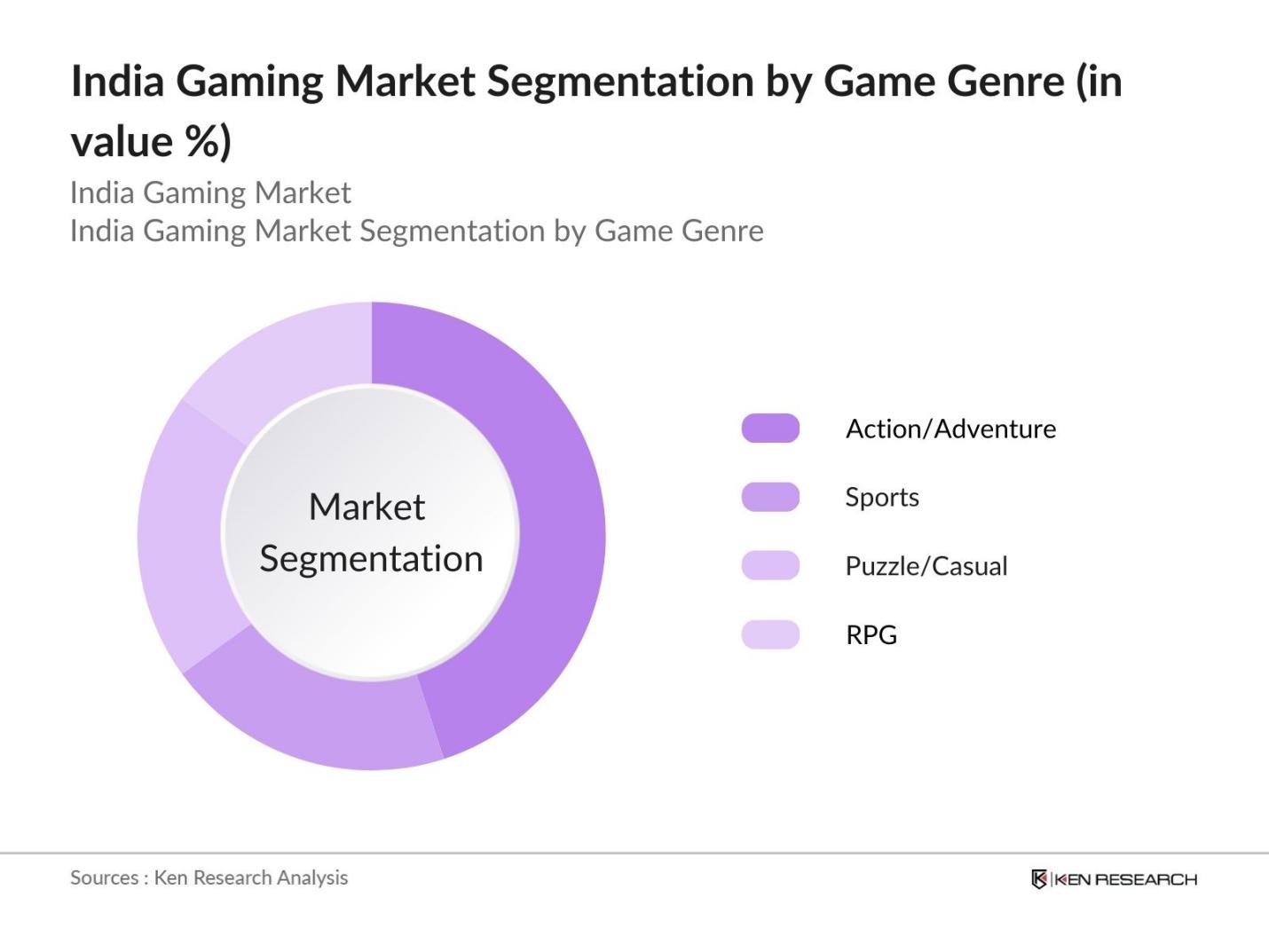

By Game Genre: Market is also segmented by game genre into action/adventure, sports, role-playing games (RPGs), and puzzle/casual games. The action/adventure genre dominates due to its immersive experiences and engaging gameplay. Popular titles like "Call of Duty: Mobile" and "BGMI" have significantly contributed to the growth of this segment. Indian gamers are drawn to high-octane action games that offer multi-player options and frequent updates, keeping them engaged over time.

India Gaming Market Competitive Landscape

The India gaming market is dominated by a few major players such as Nazara Technologies and Dream11, alongside international companies like Ubisoft and EA Sports. These players benefit from significant capital investments, strategic partnerships, and the ability to adapt to local consumer preferences, leading to a competitive and rapidly evolving market.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Employees |

Key Game Titles |

Key Technology |

Mobile Gaming Focus |

E-sports Presence |

|

Nazara Technologies |

2000 |

Mumbai, India |

||||||

|

Dream11 |

2008 |

Mumbai, India |

||||||

|

Ubisoft India |

2008 |

Pune, India |

||||||

|

Electronic Arts (EA) India |

1991 |

Hyderabad, India |

||||||

|

Mobile Premier League (MPL) |

2018 |

Bangalore, India |

India Gaming Industry Analysis

Growth Drivers

-

Rise in Smartphone Penetration: India has witnessed an exponential increase in smartphone users, driven by a robust macroeconomic environment. As of 2024, India has over 700 million smartphone users, according to Telecom Regulatory Authority of India (TRAI) data. This surge provides a significant user base for mobile gaming platforms. The affordability of smartphones, with models available under INR 10,000, has led to increased accessibility. With rising income levels and urbanization, a younger demographic, comprising 50% of the population under the age of 25, is increasingly using smartphones for entertainment, including gaming.

- Affordable Internet Connectivity: India's internet affordability, driven by the world's lowest data costs, is a major growth driver for the gaming industry. The average cost per GB of data in India stands at just INR 10, as per government data. With over 825 million internet users (TRAI), the expansion of 4G networks and emerging 5G services contribute to seamless online gaming experiences. Broadband subscriptions have surged, with over 900 million broadband users in 2024, further enabling gaming accessibility. Digital infrastructure investments under the Digital India program have significantly improved rural internet penetration, promoting gaming in tier-2 and tier-3 cities.

- Increasing Interest in E-sports: India's e-sports market is gaining traction due to high youth involvement and increasing participation in global tournaments. Over 150 million people actively engage in e-sports in 2024, primarily driven by mobile e-sports titles such as PUBG and Free Fire. The Indian Ministry of Youth Affairs recognizes e-sports as a sport, leading to professionalization of the sector. The country also hosted over 200 regional and national e-sports events in 2023, reflecting its growing prominence on the global stage. Cash prize pools have grown, with winnings surpassing INR 10 crore in high-profile competitions, motivating further participation.

Market Challenges

-

High Competition from International Markets: Despite Indias strong domestic gaming ecosystem, the market faces competition from well-established international gaming companies like Tencent and Sony. Games developed abroad dominate app stores, with foreign games accounting for over 60% of Indias top mobile games in 2024. Local developers struggle to compete in terms of resources, global appeal, and marketing. The country imports significant amounts of high-end gaming hardware, which further increases reliance on international brands. The weak intellectual property protections for domestic developers in the gaming space exacerbate this competition, leading to lower revenue retention within the country.

- Regulatory Hurdles: Indias ambiguous legal framework regarding online gaming, particularly in areas like betting and gambling, poses a significant challenge. Various states have imposed restrictions on real-money games, with recent bans in Tamil Nadu and Kerala. This inconsistency hampers growth for platforms offering skill-based games that operate on real-money mechanisms. The legal challenges also discourage international investment in these gaming segments, slowing market development. Government agencies, including the Ministry of Home Affairs, are scrutinizing the sector for potential regulatory reforms, but as of 2024, the industry continues to operate in a grey area.

India Gaming Market Future Outlook

The India gaming market is poised for significant growth over the next five years, fueled by rising internet connectivity, increasing mobile penetration, and growing consumer spending on entertainment. With government initiatives aimed at boosting digital infrastructure and the development of new gaming technologies, India is expected to emerge as one of the leading gaming markets globally. Cloud gaming, esports, and regional language content will be pivotal in driving future growth, while gaming startups and established players will continue to innovate to capture the expanding market.

Future Market Opportunities

-

AR and VR Adoption: Augmented Reality (AR) and Virtual Reality (VR) are emerging opportunities in the Indian gaming market. The Indian governments push for AR/VR in education and entertainment, including initiatives under the Ministry of Skill Development and Entrepreneurship, has encouraged startups to explore AR/VR gaming. By 2024, there are over 500 AR/VR gaming developers in India. Affordable VR headsets from brands like Oculus and Sony PlayStation are driving consumer adoption. With over 10 million VR headsets sold in the country as of 2024, AR/VR gaming experiences are becoming increasingly accessible.

- Expansion of Cloud Gaming Services: Indias nascent cloud gaming industry holds significant potential, driven by expanding 5G coverage. Major players like Jio and Airtel have launched cloud gaming services that do not require high-end hardware, reducing barriers to entry. Over 50 million users have access to 5G in 2024, offering low-latency gaming experiences. Data centers are expanding, with the government investing over INR 12,000 crore into digital infrastructure, aiding the growth of cloud gaming. The introduction of affordable cloud gaming subscription services, starting at INR 99, offers an opportunity for consumers to play AAA titles on budget devices.

Scope of the Report

|

By Platform |

Mobile Gaming PC Gaming Console Gaming |

|

By Game Genre |

Action/Adventure Sports and Racing Role-Playing Games Simulation Puzzle/Casual |

|

By Business Model |

Freemium Pay-to-Play Subscription-based In-game Purchases |

|

By Device Type |

Smartphones PCs/Laptops Consoles AR/VR Devices |

|

By Region |

North South East West |

Products

Key Target Audience

Game Developers and Publishers

Mobile Network Operators

Smartphone Manufacturers

Investment and Venture Capitalist Firms

Esports Platforms and Organizers

Banks and Financial Institutes

Government and Regulatory Bodies (e.g., Ministry of Information and Broadcasting, Ministry of Electronics & IT)

Game Streaming Services

Payment Gateway Providers

Companies

Players Mentioned in the Report:

Nazara Technologies

Dream11

Mobile Premier League (MPL)

Games2win

JetSynthesys

Moonfrog Labs

SuperGaming

nCore Games

Ubisoft India

Electronic Arts (EA) India

Rockstar Games India

Octro

Gametion

WinZO Games

Paytm First Games

Table of Contents

1. India Gaming Market Overview

1.1. Definition and Scope (Gaming platforms, gaming devices, online and offline modes)

1.2. Market Taxonomy (PC games, Console games, Mobile games, AR/VR games)

1.3. Market Growth Rate (CAGR analysis, Market revenue)

1.4. Market Segmentation Overview (Gaming segments, Player demographics, Game genres)

2. India Gaming Market Size (In USD Bn)

2.1. Historical Market Size (Revenue growth, Consumer spending trends)

2.2. Year-On-Year Growth Analysis (Growth drivers, market disruptions)

2.3. Key Market Developments and Milestones (Launch of major gaming platforms, E-sports growth, Government policy impacts)

3. India Gaming Market Analysis

3.1. Growth Drivers

3.1.1. Rise in Smartphone Penetration

3.1.2. Affordable Internet Connectivity

3.1.3. Increasing Interest in E-sports

3.1.4. Government Initiatives (e.g., Skill Development in Gaming)

3.2. Restraints

3.2.1. High Competition from International Markets

3.2.2. Regulatory Hurdles (e.g., online betting and gambling restrictions)

3.2.3. Limited Infrastructure for High-End Gaming

3.3. Opportunities

3.3.1. AR and VR Adoption

3.3.2. Expansion of Cloud Gaming Services

3.3.3. Growing Demand for Regional Language Games

3.4. Trends

3.4.1. Increase in Hyper-casual Gaming

3.4.2. Growth of Blockchain and NFT-based Games

3.4.3. Integration of AI in Game Development

3.5. Government Regulation

3.5.1. Online Gaming Licensing Regulations

3.5.2. E-sports Recognition and Policy Framework

3.5.3. Digital India and Gaming Industry Synergies

3.6. SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.7. Stakeholder Ecosystem (Developers, Publishers, Distribution Platforms, Payment Gateways)

3.8. Porters Five Forces

3.8.1. Threat of New Entrants

3.8.2. Bargaining Power of Suppliers

3.8.3. Bargaining Power of Buyers

3.8.4. Threat of Substitutes

3.8.5. Industry Rivalry

3.9. Competition Ecosystem (Top competitors, Market positioning)

4. India Gaming Market Segmentation

4.1. By Platform (In Value %)

4.1.1. Mobile Gaming

4.1.2. PC Gaming

4.1.3. Console Gaming

4.2. By Game Genre (In Value %)

4.2.1. Action/Adventure

4.2.2. Sports and Racing

4.2.3. Role-Playing Games (RPG)

4.2.4. Puzzle/Casual

4.3. By Business Model (In Value %)

4.3.1. Freemium

4.3.2. Pay-to-Play

4.3.3. Subscription-based

4.3.4. In-game Purchases (Microtransactions)

4.4. By Device Type (In Value %)

4.4.1. Smartphones

4.4.2. PCs/Laptops

4.4.3. Consoles

4.4.4. AR/VR Devices

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

5. India Gaming Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Nazara Technologies

5.1.2. Mobile Premier League (MPL)

5.1.3. Paytm First Games

5.1.4. Dream11

5.1.5. Games2win

5.1.6. JetSynthesys

5.1.7. Moonfrog Labs

5.1.8. SuperGaming

5.1.9. nCore Games

5.1.10. Gametion

5.1.11. Octro

5.1.12. WinZO Games

5.1.13. Ubisoft India

5.1.14. Rockstar India

5.1.15. EA Sports India

5.2 Cross Comparison Parameters(No. of Employees, Headquarters, Revenue, Games Portfolio, Market Share)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Partnerships, Expansions, Collaborations)

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. India Gaming Market Regulatory Framework

6.1 Online Gaming Laws and Regulations

6.2 Taxation Policies on Gaming Revenue

6.3 Compliance with Advertising Standards

7. India Gaming Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. India Gaming Market Future Segmentation

8.1 By Platform (In Value %)

8.2 By Game Genre (In Value %)

8.3 By Business Model (In Value %)

8.4 By Device Type (In Value %)

8.5 By Region (In Value %)

9. India Gaming Market Analysts' Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In the first phase, we developed an ecosystem map of the India gaming market, identifying all critical stakeholders such as game developers, publishers, telecom operators, and government bodies. This step involved extensive secondary research from proprietary databases and industry reports to highlight key market variables like revenue streams, user base, and technology adoption rates.

Step 2: Market Analysis and Construction

Using historical data, we analyzed revenue patterns, market trends, and the penetration of mobile gaming platforms across various regions. The market size was constructed using industry benchmarks and growth projections based on past performance. This phase also included evaluating the number of active gamers and their gaming preferences.

Step 3: Hypothesis Validation and Expert Consultation

To validate our market hypotheses, we conducted expert consultations with stakeholders including gaming developers, publishers, and technology service providers. These interviews helped refine our estimates and provided insights into future technological innovations, investment trends, and regulatory impacts.

Step 4: Research Synthesis and Final Output

Finally, we synthesized data from multiple sources, combining bottom-up and top-down approaches to estimate the India gaming market's future outlook. Detailed segmentation analysis was carried out to forecast growth in various gaming genres and platforms.

Frequently Asked Questions

01. How big is the India Gaming Market?

The India gaming market is valued at USD 3.5 Bn, driven by widespread smartphone adoption, affordable data rates, and the emergence of mobile gaming platforms.

02. What are the challenges in the India Gaming Market?

Challenges in India gaming market include regulatory uncertainty, especially around online betting, and the high cost of game development. Additionally, the lack of infrastructure for high-end gaming limits the markets potential in certain segments.

03. Who are the major players in the India Gaming Market?

Key players in India gaming market include Nazara Technologies, Dream11, Mobile Premier League (MPL), Ubisoft India, and Electronic Arts (EA) India. These companies have built strong consumer bases and are investing heavily in the Indian gaming ecosystem.

04. What are the growth drivers of the India Gaming Market?

Growth drivers in India gaming market include the increasing penetration of smartphones, growing interest in esports, and rising disposable income among the younger population. The introduction of 5G and cloud gaming is also expected to contribute to future growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.