India GLP-1 Receptor Agonist Market Outlook to 2030

Region:Asia

Author(s):Shreya

Product Code:KROD7590

December 2024

85

About the Report

India GLP-1 Receptor Agonist Market Overview

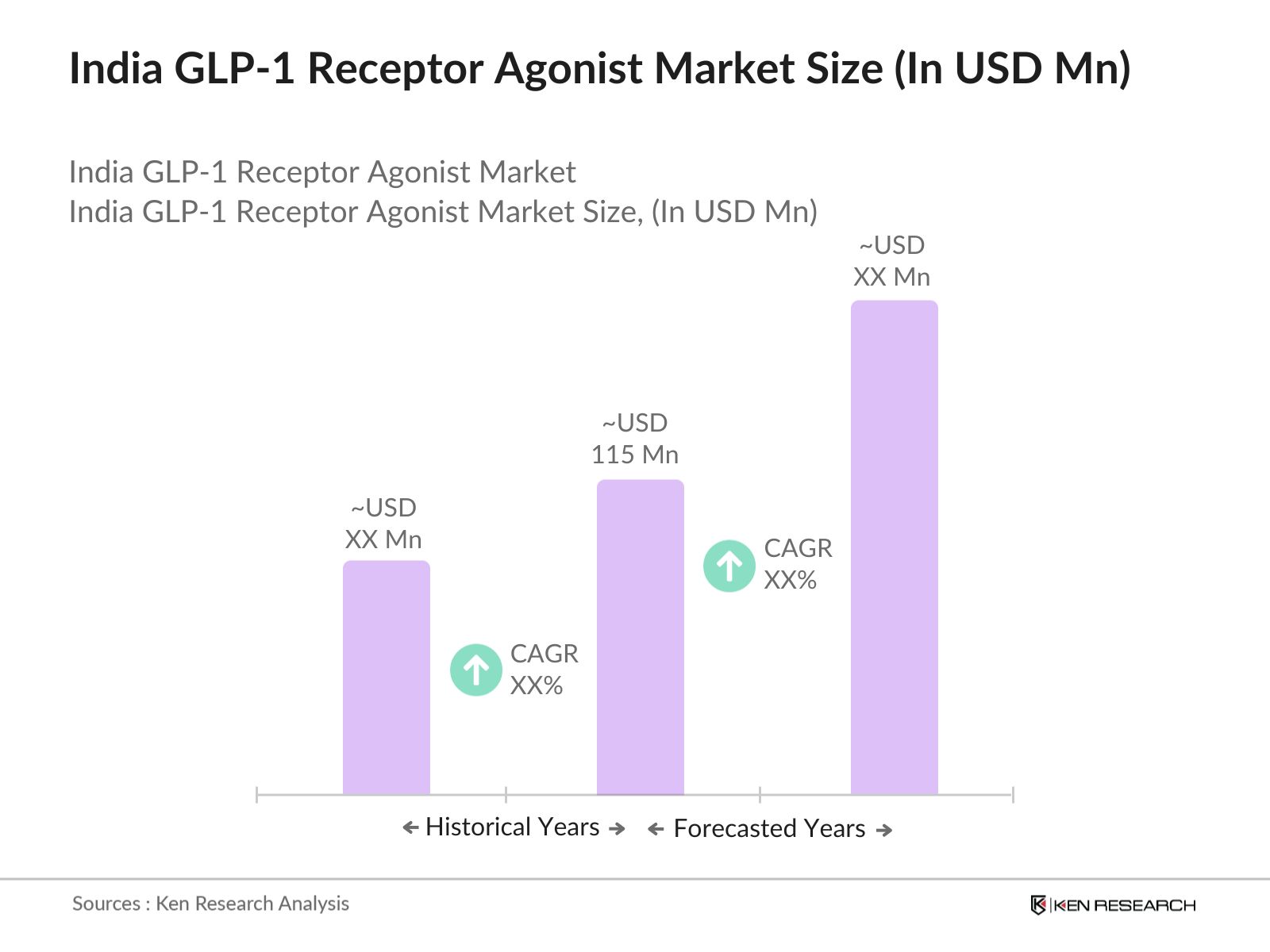

- The India GLP-1 Receptor Agonist market is valued at USD 115 million, showing robust growth due to the increasing prevalence of diabetes and obesity. The demand for GLP-1 receptor agonists has been on the rise as these medications are considered effective in both glycemic control and weight management. This demand is also fueled by a growing awareness of diabetes management options, alongside advancements in drug delivery methods, such as the development of oral GLP-1 receptor agonists.

- Metropolitan cities such as Mumbai, Delhi, and Bangalore are pivotal in driving the demand for GLP-1 receptor agonists. These cities lead due to higher awareness levels, accessibility to specialized healthcare, and a greater concentration of diabetic and obese populations. The higher disposable income in these regions also supports the demand for advanced treatment options, which drives the adoption of GLP-1 receptor agonists.

- The regulatory framework governing drug approvals and clinical trials in India is overseen by the Central Drugs Standard Control Organization (CDSCO). The CDSCO has established guidelines to ensure the safety, efficacy, and quality of pharmaceutical products entering the market. For GLP-1 receptor agonists, companies must conduct rigorous clinical trials adhering to Good Clinical Practice (GCP) standards. The approval process involves multiple phases, including pre-clinical studies, clinical trials, and post-mark

India GLP-1 Receptor Agonist Market Segmentation

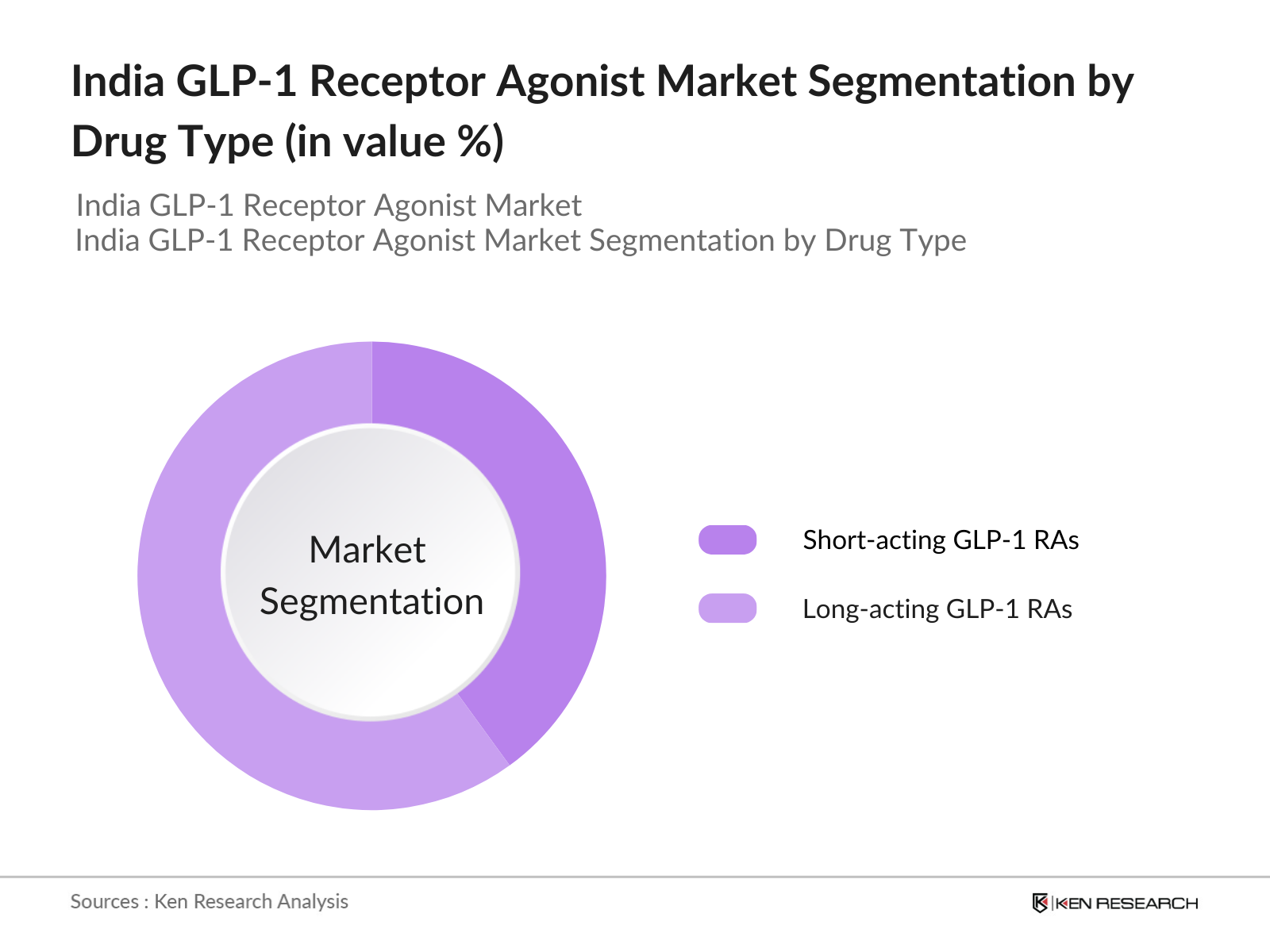

By Drug Type: The market is segmented by drug type into short-acting GLP-1 RAs and long-acting GLP-1 RAs. Long-acting GLP-1 RAs hold a dominant share due to their convenience, as they require fewer injections, thus enhancing patient compliance. Leading options in this category are embraced by patients and healthcare providers due to sustained efficacy in blood sugar control and weight management, making them a preferred treatment option.

By Application: The market is also segmented by application into diabetes treatment, obesity management, and cardiovascular protection. Diabetes treatment dominates this segmentation as GLP-1 RAs are widely prescribed for patients with Type 2 diabetes, helping to regulate blood glucose levels effectively. The steady increase in diabetes prevalence across India has solidified this segment's dominance, with an emphasis on patient education and adherence to treatment plans further supporting growth.

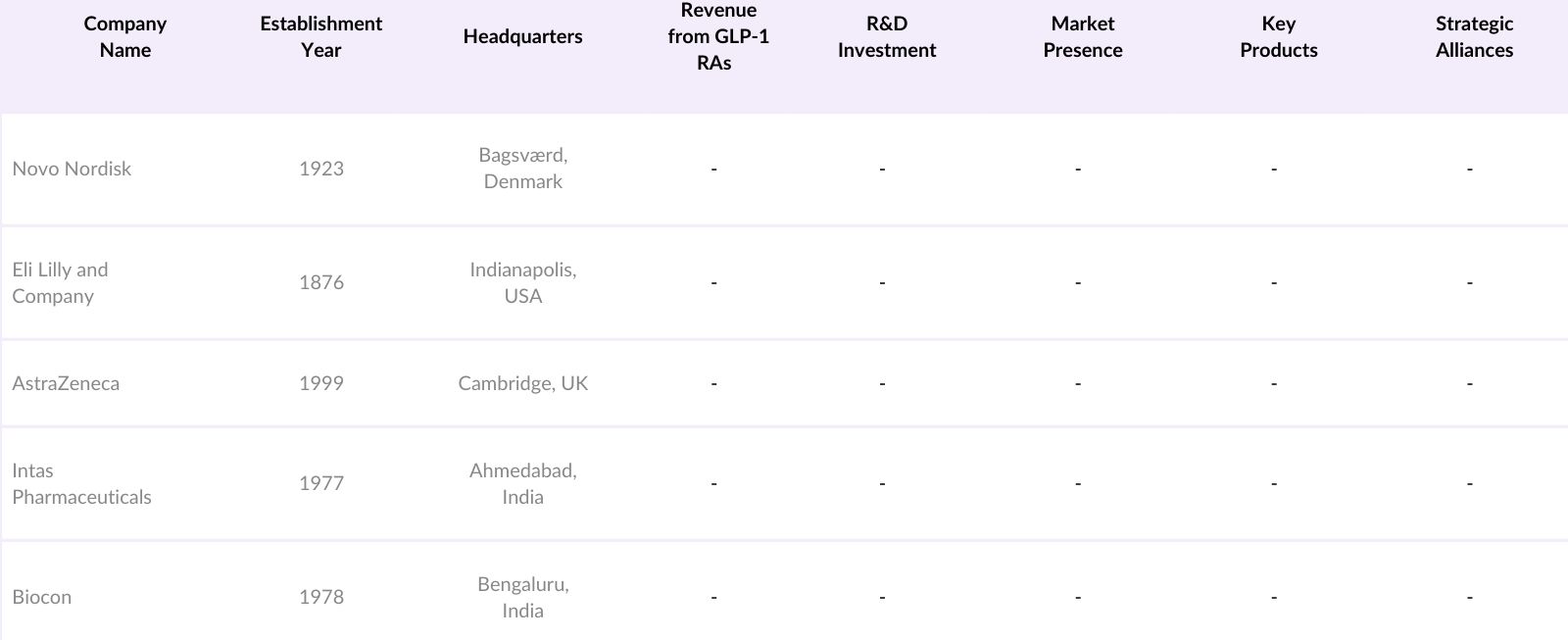

India GLP-1 Receptor Agonist Market Competitive Landscape

The India GLP-1 Receptor Agonist market is characterized by a competitive landscape dominated by both domestic and international players. Key companies hold substantial market shares, given their established product portfolios and widespread distribution networks.

India GLP-1 Receptor Agonist Industry Analysis

Growth Drivers

- Rising Prevalence of Diabetes and Obesity: India is experiencing a significant increase in diabetes and obesity cases. The World Health Organization (WHO) estimates that approximately 77 million Indian adults are living with type 2 diabetes, with an additional 25 million classified as prediabetic. This surge in metabolic disorders is largely attributed to urbanization, sedentary lifestyles, and dietary changes. The escalating number of individuals affected by these conditions underscores the growing demand for effective treatments, such as GLP-1 receptor agonists, to manage and mitigate associated health risks.

- Increasing Awareness on Diabetes Management: There is a growing awareness among the Indian population regarding the importance of diabetes management. Government initiatives and public health campaigns have been instrumental in educating individuals about the risks of uncontrolled diabetes and the benefits of early intervention. For instance, the Indian Council of Medical Research (ICMR) has conducted extensive studies highlighting the prevalence and impact of diabetes, thereby encouraging proactive health measures. This heightened awareness is leading to increased adoption of advanced therapeutic options, including GLP-1 receptor agonists, among patients and healthcare providers.

- Growing Adoption of Novel Drug Delivery Technologies: The Indian pharmaceutical market is witnessing a shift towards innovative drug delivery systems. The introduction of oral GLP-1 receptor agonists offers a more convenient alternative to traditional injectable forms, enhancing patient compliance. This advancement is particularly significant in India, where needle phobia and the inconvenience of injections can deter patients from adhering to prescribed treatments. The availability of oral formulations is expected to drive higher adoption rates of GLP-1 receptor agonists, improving overall diabetes management outcomes.

Market Challenges

- High Cost of GLP-1 RA Drugs: The affordability of GLP-1 receptor agonists remains a significant barrier in India. These medications are often priced higher than other antidiabetic drugs, making them less accessible to a large segment of the population. The high cost can lead to reduced adherence to prescribed therapies, adversely affecting patient health outcomes. Addressing this challenge requires strategies to reduce manufacturing costs and implement pricing policies that make these treatments more affordable for Indian patients.

- Limited Insurance Coverage and Reimbursement Issues: In India, the healthcare insurance sector is still developing, with many insurance plans offering limited coverage for chronic disease treatments, including diabetes. The lack of comprehensive reimbursement policies for GLP-1 receptor agonists means that patients often bear the full cost of these medications out-of-pocket. This financial burden can deter patients from initiating or continuing therapy, thereby limiting the market penetration of these drugs. Enhancing insurance coverage and establishing clear reimbursement guidelines are essential to improve patient access to GLP-1 receptor agonists.

India GLP-1 Receptor Agonist Market Future Outlook

Over the coming years, the India GLP-1 Receptor Agonist market is expected to experience steady growth driven by increased healthcare expenditure, ongoing R&D for oral formulations, and heightened awareness of advanced diabetes management options. The market is likely to witness innovation in drug delivery systems and the introduction of combination therapies that integrate GLP-1 receptor agonists with other anti-diabetic agents, enhancing the treatment landscape for patients with complex conditions.

Future Market Opportunities

- Development of Oral GLP-1 Receptor Agonists: The development of oral GLP-1 receptor agonists presents a significant opportunity in the Indian market. Oral formulations eliminate the need for injections, addressing patient concerns related to needle use and improving adherence to therapy. Pharmaceutical companies are investing in research and development to create effective oral GLP-1 receptor agonists, aiming to capture a larger share of the diabetes treatment market. The successful introduction of these products could revolutionize diabetes management in India, offering patients a more convenient and acceptable treatment option.

- Expansion in Tier-II and Tier-III Cities: The prevalence of diabetes is not confined to India's major urban centers; smaller cities and rural areas are also witnessing a rise in cases. Expanding the availability of GLP-1 receptor agonists to Tier-II and Tier-III cities can tap into an underserved market segment. This expansion requires strategic distribution networks and targeted awareness campaigns to educate healthcare providers and patients about the benefits of these therapies. By reaching these regions, pharmaceutical companies can significantly increase their market presence and contribute to better diabetes management across the country.

Scope of the Report

|

Type |

- Short-Acting Agonists |

|

Route of Administration |

- Injectable |

|

Indication |

- Type 2 Diabetes |

|

Distribution Channel |

- Hospitals |

|

Region |

- North |

Products

Key Target Audience

Pharmaceutical Manufacturers

Distributors and Wholesalers

Healthcare Providers (Endocrinologists, Diabetologists)

Medical Research Organizations

Hospitals and Specialty Diabetes Clinics

Regulatory Bodies (CDSCO, DCGI)

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Health & Family Welfare)

Companies

Major Players in the Market

Novo Nordisk

Eli Lilly and Company

AstraZeneca

Sanofi

Intas Pharmaceuticals

Dr. Reddys Laboratories

Glenmark Pharmaceuticals

Lupin Pharmaceuticals

Sun Pharmaceutical Industries

Mankind Pharma

Biocon Ltd.

Cipla

Zydus Cadila

Alkem Laboratories

Torrent Pharmaceuticals

Table of Contents

India GLP-1 Receptor Agonist Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy (GLP-1 RA Drugs, Biosimilars, Combination Therapies)

1.3 Market Growth Rate

1.4 Market Segmentation Overview

India GLP-1 Receptor Agonist Market Size (in USD Mn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

India GLP-1 Receptor Agonist Market Dynamics

3.1 Growth Drivers

3.1.1 Rising Prevalence of Diabetes and Obesity

3.1.2 Increasing Awareness on Diabetes Management

3.1.3 Growing Adoption of Novel Drug Delivery Technologies

3.2 Market Challenges

3.2.1 High Cost of GLP-1 RA Drugs

3.2.2 Limited Insurance Coverage and Reimbursement Issues

3.3 Opportunities

3.3.1 Development of Oral GLP-1 Receptor Agonists

3.3.2 Expansion in Tier-II and Tier-III Cities

3.4 Trends

3.4.1 Patient Preference for Long-acting Injectables

3.4.2 Collaborations between Pharma Companies for Co-marketing

3.5 Regulatory Landscape

3.5.1 Drug Approval and Clinical Trial Regulations

3.5.2 Safety Guidelines for Injectable Medications

3.6 Competitive Analysis Parameters

3.6.1 Product Launches and Innovations

3.6.2 Pricing Strategies and Market Penetration

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

India GLP-1 Receptor Agonist Market Segmentation

4.1 By Drug Type (In Value %)

4.1.1 Short-acting GLP-1 RAs

4.1.2 Long-acting GLP-1 RAs

4.2 By Delivery Method (In Value %)

4.2.1 Subcutaneous Injections

4.2.2 Oral Formulations

4.3 By Application (In Value %)

4.3.1 Diabetes Treatment

4.3.2 Obesity Management

4.3.3 Cardiovascular Protection

4.4 By End-user (In Value %)

4.4.1 Hospitals and Clinics

4.4.2 Specialty Diabetes Centers

4.4.3 Retail and Online Pharmacies

4.5 By Region (In Value %)

4.5.1 North

4.5.2 South

4.5.3 East

4.5.4 West

India GLP-1 Receptor Agonist Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Novo Nordisk

5.1.2 Eli Lilly and Company

5.1.3 AstraZeneca

5.1.4 Sanofi

5.1.5 Intas Pharmaceuticals

5.1.6 Dr. Reddys Laboratories

5.1.7 Glenmark Pharmaceuticals

5.1.8 Lupin Pharmaceuticals

5.1.9 Sun Pharmaceutical Industries

5.1.10 Mankind Pharma

5.1.11 Biocon Ltd.

5.1.12 Cipla

5.1.13 Zydus Cadila

5.1.14 Alkem Laboratories

5.1.15 Torrent Pharmaceuticals

5.2 Cross Comparison Parameters (Revenue from GLP-1 RA, Market Share, R&D Investment, Growth Rate, Product Portfolio Diversity, Targeted Applications, Sales Channel Distribution, Strategic Partnerships)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

India GLP-1 Receptor Agonist Market Regulatory Framework

6.1 Clinical Trial Approval Process

6.2 Pricing and Reimbursement Regulations

6.3 Import and Export Controls

6.4 Patient Safety and Pharmacovigilance

India GLP-1 Receptor Agonist Future Market Size (in USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

India GLP-1 Receptor Agonist Future Market Segmentation

8.1 By Drug Type (In Value %)

8.2 By Delivery Method (In Value %)

8.3 By Application (In Value %)

8.4 By End-user (In Value %)

8.5 By Region (In Value %)

India GLP-1 Receptor Agonist Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Go-to-Market Strategies

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying and defining the primary variables impacting the India GLP-1 Receptor Agonist market. This includes assessing factors like diabetes prevalence, healthcare infrastructure, and drug pricing policies.

Step 2: Market Analysis and Construction

Historical data on the market is analyzed to understand trends in adoption rates, treatment patterns, and patient demographics. This step also includes revenue estimation and market penetration analysis, forming a basis for further projections.

Step 3: Hypothesis Validation and Expert Consultation

To validate hypotheses, in-depth interviews with industry experts, such as endocrinologists and pharmaceutical executives, are conducted. These insights are critical to refining the reports data accuracy and providing a market-specific analysis.

Step 4: Research Synthesis and Final Output

The final phase includes synthesizing findings and consolidating them into a comprehensive report, with validation from industry practitioners. This step ensures that the reports insights are reliable, data-driven, and ready for actionable use.

Frequently Asked Questions

01. How big is the India GLP-1 Receptor Agonist Market?

The India GLP-1 Receptor Agonist Market is valued at USD 115 million, with growth driven by the rising prevalence of diabetes and increased awareness of effective diabetes management solutions.

02. What are the challenges in the India GLP-1 Receptor Agonist Market?

Challenges in the India GLP-1 Receptor Agonist Market include the high cost of GLP-1 receptor agonists, limited insurance coverage, and low penetration in rural areas, which restricts accessibility for a broader patient base.

03. Who are the major players in the India GLP-1 Receptor Agonist Market?

Key players in the India GLP-1 Receptor Agonist Market include Novo Nordisk, Eli Lilly, AstraZeneca, and Indian companies like Biocon and Intas Pharmaceuticals. These firms dominate due to strong distribution networks and R&D focus on advanced drug formulations.

04. What are the growth drivers of the India GLP-1 Receptor Agonist Market?

The India GLP-1 Receptor Agonist Markets growth is propelled by an increase in diabetes prevalence, higher health awareness, and the development of long-acting and oral GLP-1 receptor agonists, enhancing patient compliance.

05. Which segment holds the largest share in the India GLP-1 Receptor Agonist Market?

The diabetes treatment segment holds the largest share in the India GLP-1 Receptor Agonist Market, driven by the high demand for GLP-1 RAs as an effective treatment for Type 2 diabetes, backed by growing patient and healthcare provider adoption.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.