India Green Coffee Market Outlook to 2030

Region:Asia

Author(s):Samanyu

Product Code:KROD5315

November 2024

85

About the Report

India Green Coffee Market Overview

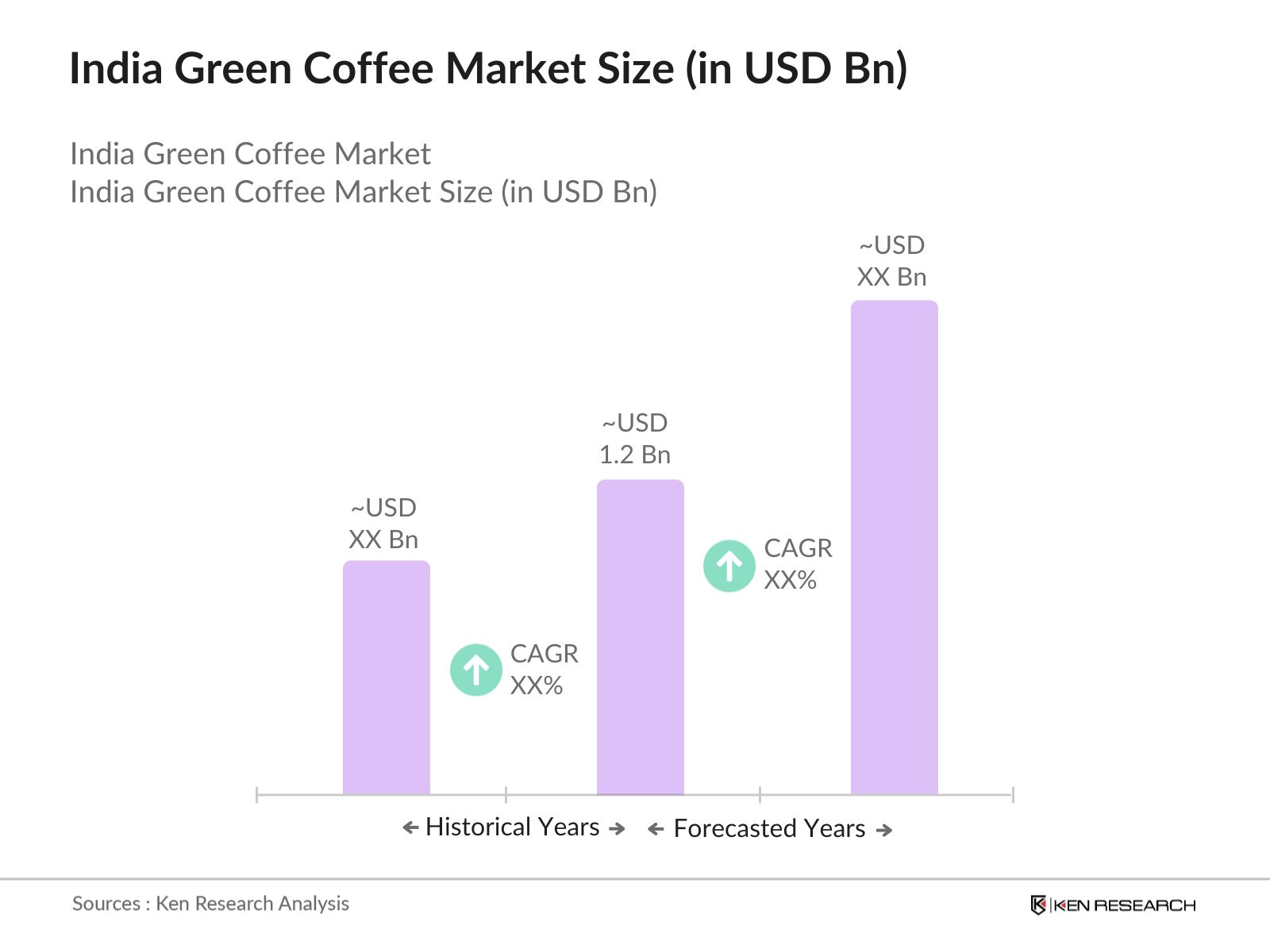

- The India Green Coffee market is valued at USD 1.2 Bn, driven by an increasing preference for health-conscious products and the demand for unroasted coffee beans due to their perceived benefits in weight loss and other health advantages. As consumers become more aware of the benefits of green coffee over regular roasted coffee, the market has seen substantial growth in the past few years. Moreover, the rise of specialty coffee outlets and the trend of artisanal coffee consumption is playing a key role in driving the market.

- Market is dominated by regions like Karnataka, Kerala, and Tamil Nadu, which are the prime coffee-producing states due to their favorable climatic conditions. Additionally, Indias green coffee exports are significant, with major buyers in countries such as the United States and Germany, which dominate the market due to their high consumption of specialty coffee products. These regions are also seeing growth in demand due to the rise of specialty coffee chains and the growing cafe culture.

- Decaffeinated green coffee is witnessing increasing demand, particularly among health-conscious consumers who are looking to reduce caffeine intake. With Indias decaffeinated coffee segment growing in popularity, decaf green coffee is gaining a foothold in urban markets. Consumers in cities like Mumbai and Delhi, driven by wellness trends and the rising prevalence of caffeine sensitivity (estimated at 18% of urban population in 2024), are gravitating towards this option. Decaffeinated green coffee offers an alternative for those looking to enjoy coffees health benefits without the stimulating effects, contributing to the broader trend of health-oriented beverage consumption.

India Green Coffee Market Segmentation

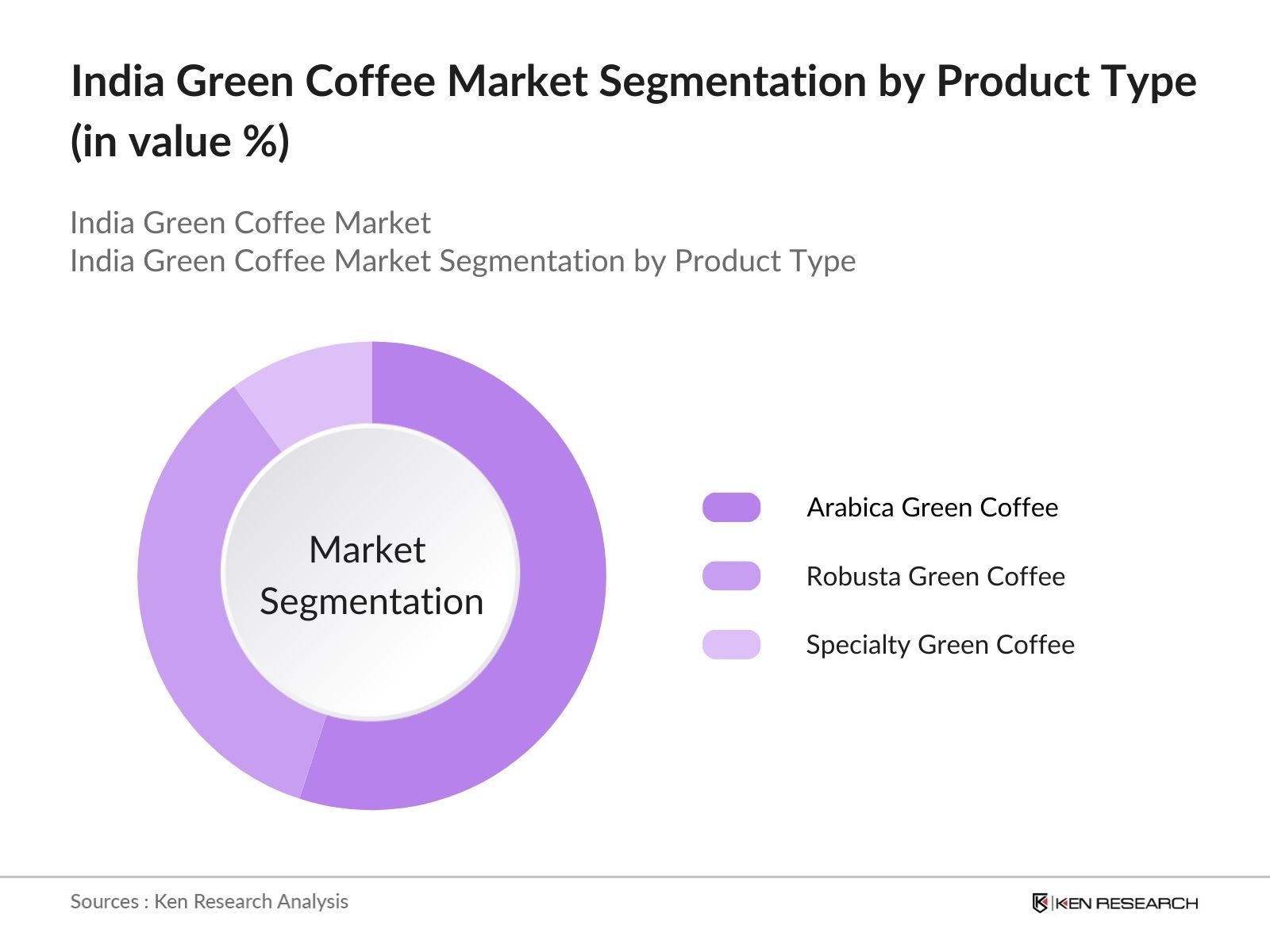

By Product Type: The market is segmented by product type into Arabica Green Coffee, Robusta Green Coffee, and Specialty Green Coffee. Among these, Arabica Green Coffee holds the largest market share due to its premium quality, low acidity, and higher price point. Its rich flavor and popularity in international markets make it the dominant sub-segment. Additionally, global demand for Arabica beans in specialty coffee chains continues to push its dominance.

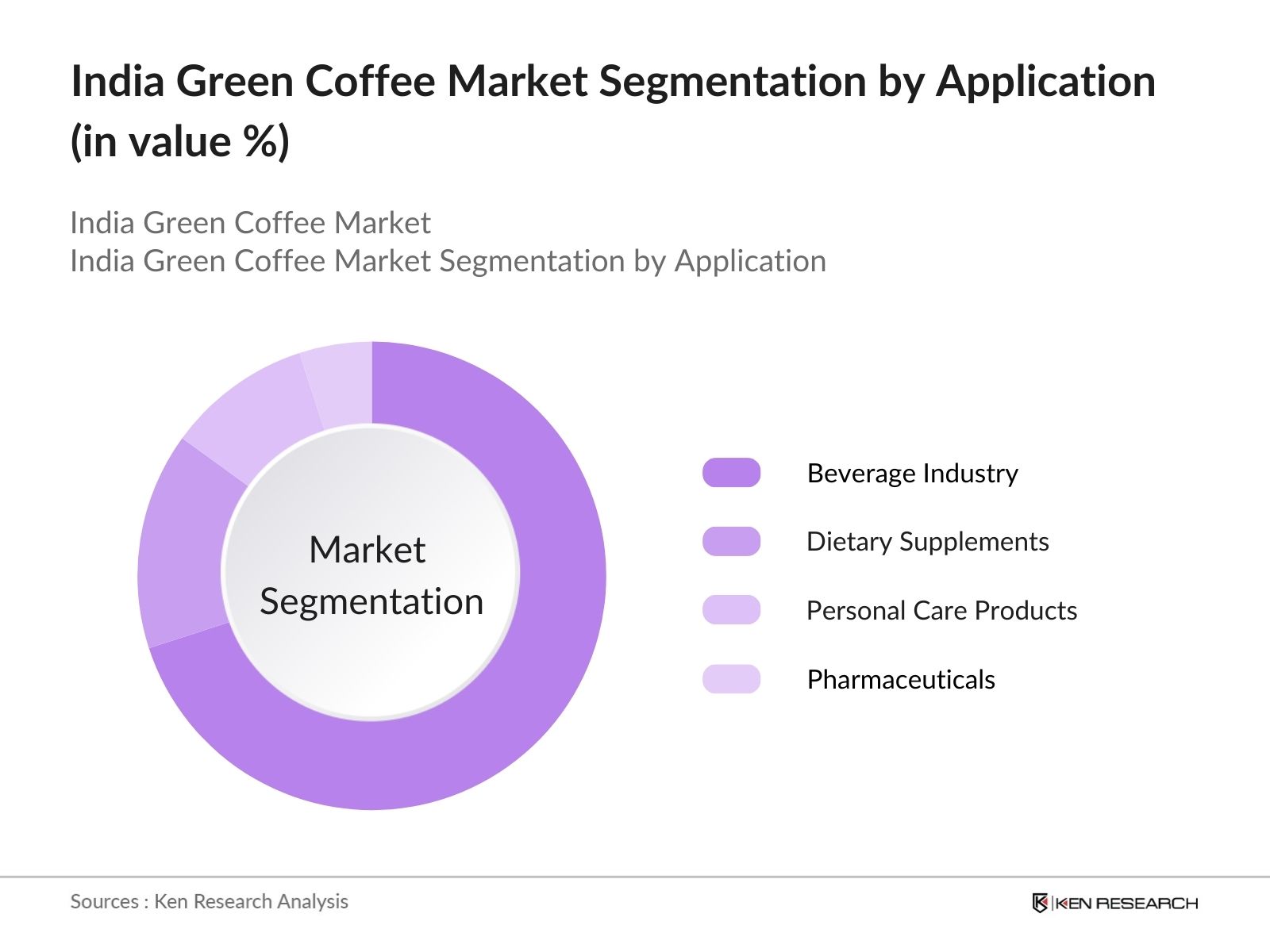

By Application: The market is segmented by application into Beverage Industry, Dietary Supplements, Personal Care Products, and Pharmaceuticals. The Beverage Industry is the largest application of green coffee beans, driven by the rise of specialty cafes and the growing popularity of cold brews, espresso blends, and artisanal coffee among consumers. Green coffees use in health beverages and emerging demand for sustainable, organic, and fair-trade coffee further supports this segment's dominance.

India Green Coffee Market Competitive Landscape

The India Green Coffee market is consolidated, with a few key players holding significant market share. The competition is driven by the ability to maintain high-quality production, sustainable farming practices, and strong distribution networks. Leading players focus on exports and premium coffee products to cater to international markets.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Employees |

Production Capacity |

Strategic Initiatives |

Export Volume |

Organic Certifications |

|

Tata Coffee |

1922 |

Bangalore, India |

||||||

|

NKG India Coffee Pvt. Ltd. |

1998 |

Mangalore, India |

||||||

|

CCL Products (India) Ltd. |

1994 |

Hyderabad, India |

||||||

|

Olam Agro India Limited |

1989 |

Chennai, India |

||||||

|

Blue Tokai Coffee Roasters |

2012 |

New Delhi, India |

India Green Coffee Industry Analysis

Growth Drivers

- Increasing Health Consciousness: As health awareness rises across India, consumers are increasingly focusing on products that offer health benefits. Green coffee, known for its antioxidants and weight management properties, is gaining traction. Indias health and wellness industry, valued at USD 90 billion in 2024, is driving demand for unroasted coffee. Consumption of healthy beverages, including green coffee, has surged in urban areas, especially among young professionals. The shift toward natural health remedies has resulted in an uptick in green coffee sales in metropolitan regions like Bangalore, Delhi, and Mumbai, with consumer preference data reflecting this trend.

- Rise in Specialty Coffee Consumption: Specialty coffee consumption in India has seen a notable rise due to the proliferation of premium coffee shops and cafes, influenced by the growing middle-class population. With over 4,000 specialty coffee outlets across the country in 2024, urban Indians are more inclined towards high-quality coffee experiences. Specialty green coffee is a key segment within this trend. Indias per capita income, reaching USD 2,300 in 2024, along with a shift toward premium and luxury food products, contributes to the increase in specialty coffee consumption. This is driving demand for niche, unroasted green coffee beans that offer distinct flavors and health benefits.

- Growing Cafes and Coffee Culture: India's urban centers are experiencing a burgeoning caf culture, primarily due to increasing exposure to Western lifestyles. The rise of coffee chains like Caf Coffee Day and international brands such as Starbucks, with over 350 and 300 outlets respectively by 2024, indicates the growing preference for coffee consumption. This trend has extended into the consumption of green coffee, particularly among young, health-conscious consumers. Evolving consumer habits in cities like Pune, Hyderabad, and Kolkata, supported by higher disposable incomes, are driving the popularity of both roasted and unroasted coffee, positioning green coffee as a healthy alternative in this space.

Market Challenges

- Price Sensitivity in Domestic Market: Indias coffee market, while growing, remains highly price-sensitive. Green coffee, typically more expensive than its roasted counterpart due to its niche positioning, often sees slower adoption in middle-income groups. India's median household income of USD 5,600 in 2024 reflects the constrained budgets of many consumers, limiting the widespread purchase of higher-priced green coffee products. Despite the growing health consciousness, the majority of Indian consumers prioritize affordability over premium, health-oriented products, particularly in rural areas and small towns, restricting the potential reach of green coffee.

- Low Awareness about Green Coffee: In 2024, a considerable portion of Indias population remains unaware of the benefits and uses of green coffee. While urban centers exhibit growing awareness, rural regions and smaller cities lag in understanding the health advantages associated with green coffee consumption. This is reflected in survey data from India's Food Safety and Standards Authority, which indicates that less than 10% of the population in non-metropolitan areas is familiar with green coffee. Additionally, the cultural preference for traditional forms of tea and coffee further limits consumer knowledge about the unroasted form, impeding its domestic growth.

India Green Coffee Market Future Outlook

Over the next few years, the India Green Coffee market is expected to show significant growth driven by increasing consumer demand for healthier beverage alternatives, advancements in sustainable farming practices, and the rise of specialty coffee culture. The expansion of e-commerce platforms, enabling easier access to premium green coffee products, is also expected to boost market growth. As awareness of the health benefits of green coffee increases, the market will witness more innovations in product offerings and packaging.

Future Market Opportunities

- Export Potential: India's green coffee holds significant export potential, particularly in markets such as the Middle East, North America, and Europe. With coffee exports from India totaling 400,000 metric tons in 2024 (APEDA), there is growing demand for Indian green coffee in health-conscious markets abroad. Countries like the UAE and Saudi Arabia have seen rising demand for green coffee due to the increasing popularity of specialty beverages and health trends. North American and European markets, known for their preference for organic and ethically sourced products, represent substantial opportunities for Indian green coffee, especially when aligned with fair-trade and organic certifications.

- Partnerships with International Coffee Chains: Collaborations between Indian coffee producers and international coffee chains represent a significant opportunity for market growth. As international brands expand their presence in India, green coffee suppliers can leverage partnerships to introduce unroasted beans to a broader audience. Coffee giants like Starbucks, which sources coffee beans from Indian estates, offer a platform for promoting India-grown green coffee to a global consumer base. Such partnerships, supported by Indias booming hospitality industry, valued at USD 75 billion in 2024 (World Bank), can facilitate green coffee's entry into both domestic and export markets through enhanced brand visibility and distribution networks.

Scope of the Report

|

By Product Type |

Arabica Green Coffee Robusta Green Coffee Specialty Green Coffee |

|

By Application |

Beverage Industry Dietary Supplements Personal Care Products Pharmaceuticals |

|

By End-User |

HoReCa Household Industrial/Commercial |

|

By Distribution Channel |

Online Retail Supermarkets/Hypermarkets Specialty Stores Direct Sales |

|

By Region |

South North West East |

Products

Key Target Audience

Coffee Roasters and Processors

Coffee Traders and Exporters

Coffee Retailers and Cafe Chains

Beverage Industry Stakeholders

Dietary Supplement Manufacturers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Commerce, Coffee Board of India)

Organic and Fair-Trade Certification Bodies

Companies

Major Players

Tata Coffee

NKG India Coffee Pvt. Ltd.

CCL Products (India) Limited

Olam Agro India Limited

Blue Tokai Coffee Roasters

The Coffee Bean & Tea Leaf

Lavazza India

Karnataka Coffee Plantation

Nestl India

Devans Modern Breweries Ltd.

SLN Coffee Pvt. Ltd.

Aspretto (Aramark)

The Flying Squirrel

Coffee Day Global Limited

Bili Hu Coffees

Table of Contents

1. India Green Coffee Market Overview

1.1. Definition and Scope (Green Coffee Bean, Organic Coffee, Conventional Coffee, Caffeine Content)

1.2. Market Taxonomy (Arabica, Robusta, Specialty Green Coffee)

1.3. Market Growth Rate (CAGR, Market Volume Growth, Value in USD, Tonnes)

1.4. Market Segmentation Overview (Product Type, Application, End-User, Distribution Channel, Region)

2. India Green Coffee Market Size (In USD Mn & Tonnes)

2.1. Historical Market Size (Green Coffee Bean Imports, Domestic Production)

2.2. Year-On-Year Growth Analysis (Market Volume, Price Trends)

2.3. Key Market Developments and Milestones (Introduction of Premium Brands, Expansion of Coffee Chains, Demand for Specialty Green Coffee)

3. India Green Coffee Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Health Consciousness (Demand for Unroasted Coffee)

3.1.2. Rise in Specialty Coffee Consumption

3.1.3. Growing Cafes and Coffee Culture (Impact of Western Lifestyle)

3.1.4. Expansion of E-Commerce Channels

3.2. Restraints

3.2.1. Price Sensitivity in Domestic Market

3.2.2. Low Awareness about Green Coffee

3.2.3. Inconsistent Quality of Green Coffee Beans

3.3. Opportunities

3.3.1. Organic and Fair-Trade Certification Growth

3.3.2. Export Potential (Middle-East, North America, Europe)

3.3.3. Partnerships with International Coffee Chains

3.4. Trends

3.4.1. Demand for Decaffeinated Green Coffee

3.4.2. Innovation in Packaging (Sustainability, Biodegradable)

3.4.3. Increasing Focus on Direct Trade and Ethical Sourcing

3.5. Government Regulation

3.5.1. Import-Export Policies

3.5.2. Subsidies and Incentives for Organic Coffee Farming

3.5.3. Quality Standards and Certification Requirements (FSSAI, APEDA)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Farmers, Coffee Traders, Roasters, Retailers)

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. India Green Coffee Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Arabica Green Coffee

4.1.2. Robusta Green Coffee

4.1.3. Specialty Green Coffee

4.2. By Application (In Value %)

4.2.1. Beverage Industry

4.2.2. Dietary Supplements

4.2.3. Personal Care Products

4.2.4. Pharmaceuticals

4.3. By End-User (In Value %)

4.3.1. HoReCa (Hotels, Restaurants, Cafes)

4.3.2. Household

4.3.3. Industrial/Commercial

4.4. By Distribution Channel (In Value %)

4.4.1. Online Retail

4.4.2. Supermarkets/Hypermarkets

4.4.3. Specialty Stores

4.4.4. Direct Sales

4.5. By Region (In Value %)

4.5.1. South India

4.5.2. North India

4.5.3. West India

4.5.4. East India

4.5.5. Central India

5. India Green Coffee Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Tata Coffee

5.1.2. NKG India Coffee Pvt. Ltd.

5.1.3. CCL Products (India) Limited

5.1.4. The Coffee Bean & Tea Leaf

5.1.5. Lavazza India

5.1.6. Karnataka Coffee Plantation

5.1.7. Olam Agro India Limited

5.1.8. Nestl India

5.1.9. Devans Modern Breweries Ltd.

5.1.10. SLN Coffee Pvt. Ltd.

5.1.11. Aspretto (Aramark)

5.1.12. The Flying Squirrel

5.1.13. Coffee Day Global Limited

5.1.14. Blue Tokai Coffee Roasters

5.1.15. Bili Hu Coffees

5.2. Cross Comparison Parameters (Production Capacity, Market Presence, Certifications, Revenue)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants and Support

5.8. Venture Capital Investments

5.9. Private Equity Investments

6. India Green Coffee Market Regulatory Framework

6.1. Import-Export Policies (Green Coffee Bean Tariffs, Non-Tariff Barriers)

6.2. Certification Processes (Organic, Fair Trade, Rainforest Alliance)

6.3. Compliance Requirements (Packaging, Labeling Standards)

7. India Green Coffee Market Future Size (In USD Bn & Tonnes)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Rising Demand in Health & Wellness, Growing Exports)

8. India Green Coffee Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By End-User (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. India Green Coffee Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis (Health-Conscious Consumers, Specialty Coffee Enthusiasts)

9.3. Marketing Initiatives (Sustainability Campaigns, Consumer Awareness Programs)

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first phase involves constructing an ecosystem map that includes all major stakeholders within the India Green Coffee market. This step is supported by extensive desk research using both secondary and proprietary databases to collect comprehensive industry data, with the primary goal of identifying critical market variables.

Step 2: Market Analysis and Construction

During this phase, historical data is compiled and analyzed, focusing on factors like market penetration, distribution channels, and production volumes. This phase includes an assessment of green coffee exports and domestic consumption to ensure the accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through expert consultations. Industry specialists provide valuable insights into the operational and financial dynamics of the market, ensuring the reliability of the data. These interviews are conducted using a mix of telephone and face-to-face interviews.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing data from various coffee manufacturers and industry stakeholders to finalize market projections. This step ensures that the findings are accurate, verified, and reflect real-world industry conditions.

Frequently Asked Questions

01 How big is Indias Green Coffee Market?

Indias green coffee market is valued at USD 1.2 billion, driven by the rising health-conscious consumer base and increasing demand for unroasted coffee beans for both domestic and international markets.

02 What are the key challenges in the India Green Coffee Market?

Key challenges in Indias green coffee market include fluctuating coffee prices, low consumer awareness of green coffee benefits, and the high costs associated with organic certifications and sustainable farming practices.

03 Who are the major players in the India Green Coffee Market?

Major players in Indias green coffee market include Tata Coffee, NKG India Coffee Pvt. Ltd., CCL Products (India) Limited, and Olam Agro India Limited, which dominate through their strong distribution networks and export capabilities.

04 What are the growth drivers for the India Green Coffee Market?

The Indias green coffee market is driven by rising health awareness, increasing exports of green coffee, and the growing popularity of specialty coffee chains that prioritize premium green coffee beans.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.