India Ground Support Equipment Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD2060

November 2024

92

About the Report

India Ground Support Equipment Market Overview

- The India Ground Support Equipment (GSE) market is valued at USD 800 million, driven by the rapid expansion of the aviation sector. Investments in airport infrastructure and government policies focused on enhancing air travel accessibility are crucial drivers. The Ministry of Civil Aviations emphasis on boosting regional air connectivity, alongside private sector investments in ground support services, significantly fuels market growth. Increasing passenger volumes and freight activities further stimulate the demand for advanced GSE.

- Major airports in cities like Delhi, Mumbai, and Bangalore lead in GSE deployment due to high air traffic, extensive airport expansions, and regional connectivity initiatives. These urban centers house large international and domestic airports with the highest annual passenger and cargo movement, driving the need for efficient ground handling solutions. The dominance of these regions is reinforced by significant government funding and their status as primary hubs for both international and regional air travel.

- The DGCA enforces stringent safety protocols for GSE operations, mandating regular inspections, operator training, and compliance with national safety guidelines. These regulations, effective since 2022, require equipment to meet specific safety standards, ensuring passenger and employee safety at airports. Compliance is mandatory for operational licensing, with DGCA audits becoming more frequent, which has spurred GSE providers to prioritize quality and safety in equipment handling.

India Ground Support Equipment Market Segmentation

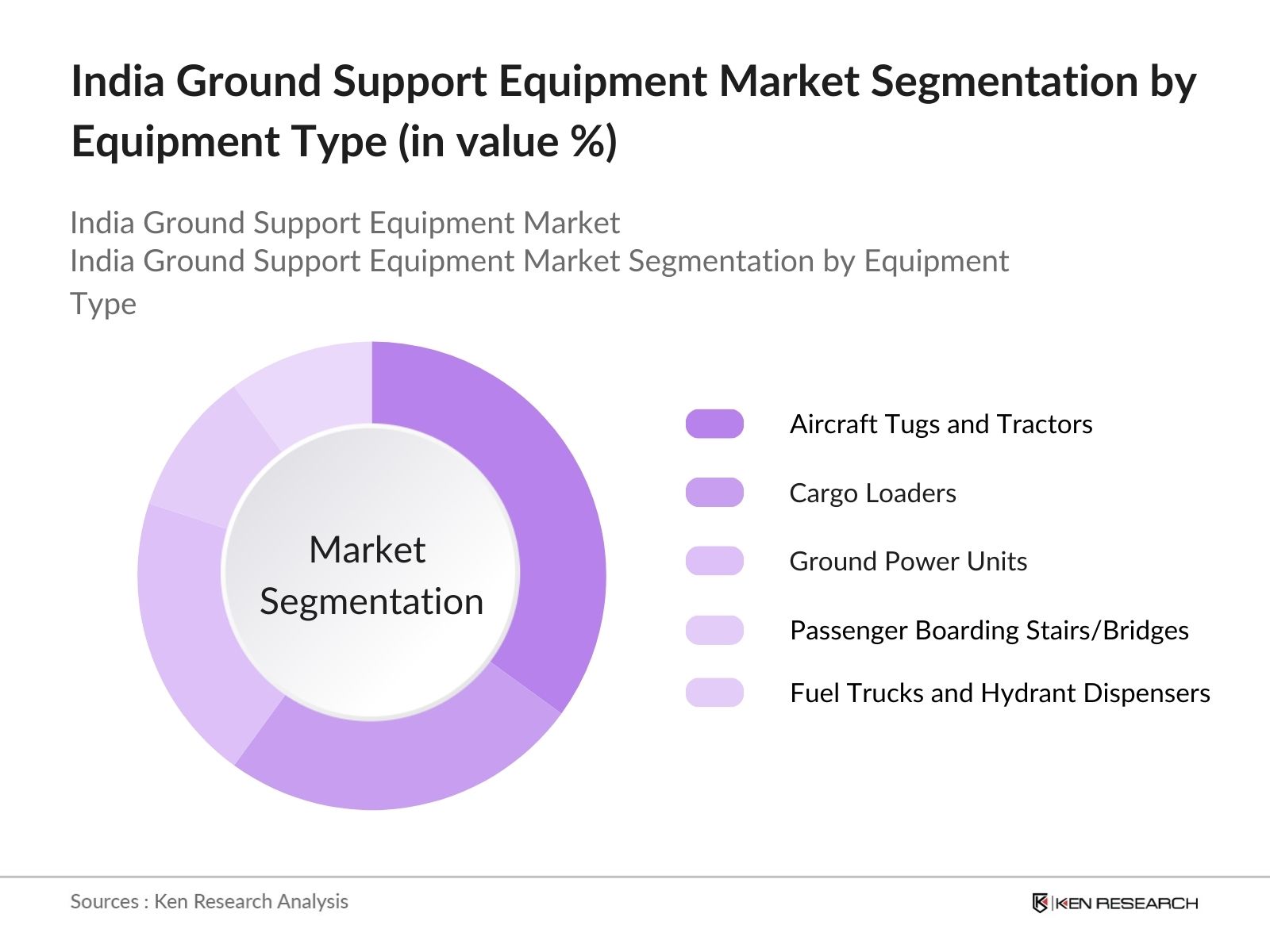

The India GSE market is segmented by equipment type and by power source.

- By Equipment Type: The India GSE market is segmented by equipment type into Aircraft Tugs and Tractors, Cargo Loaders, Ground Power Units, Passenger Boarding Stairs and Bridges, and Fuel Trucks and Hydrant Dispensers. Recently, Aircraft Tugs and Tractors have a dominant market share within this segmentation due to their essential role in maneuvering aircraft in congested airport environments. The demand for electric variants is rising, driven by airports' efforts to reduce emissions, thereby promoting environmentally sustainable operations. Major suppliers cater to the sector's requirements, enhancing operational efficiency and supporting airport expansion.

- By Power Source: The India GSE market, based on power source, includes Electric and Non-Electric (Diesel, Gasoline) options. Electric GSE dominates due to a growing emphasis on environmental responsibility and compliance with stringent emissions standards. Airport operators are increasingly adopting electric-powered equipment to meet regulatory norms and decrease fuel costs. Government incentives and policies supporting electrification further drive the adoption of electric GSE, positioning it as a preferred choice among major airports.

India Ground Support Equipment Market Competitive Landscape

The India GSE market features a few dominant players who maintain strong market positions through innovative products, strategic partnerships, and customer-centric services. The competitive landscape comprises a blend of domestic and international manufacturers, leading to a highly competitive environment where technological advancements and customer-focused solutions are key differentiators. The market's consolidation highlights the significant influence of these major players, each bringing unique technological expertise and established infrastructure for extensive operations.

India Ground Support Equipment Market Analysis

Growth Drivers

- Surge in Aviation Infrastructure Development: The Indian government has increased airport infrastructure investments, with approximately 200 airports expected to be operational by 2025, as stated by the Ministry of Civil Aviation. These expansions respond to a growing demand in urban and regional air travel, particularly with government projects like the National Civil Aviation Policy. India's aviation infrastructure spending has surged, with the AAI investing 20,000 crores in airport upgrades from 20222025, supporting advanced ground support equipment (GSE) deployment. Increased infrastructure aligns with passenger growth and necessitates extensive GSE across new and expanded airports.

- 3.1.2 Increase in Domestic and International Passenger Traffic: Domestic and international air travel in India experienced a marked rise, with passenger counts reaching 123 million for domestic and 51 million for international sectors in early 2024, according to AAI. Growing middle-class travel demand boosts airport operations, with GSE required to manage high passenger and cargo volumes effectively. Additionally, growth in budget airlines has made air travel accessible, driving higher GSE demand in areas with new flight routes and more frequent airport activity.

- Government Initiatives (e.g., UDAN Scheme): The UDAN scheme, part of Indias Regional Connectivity Scheme (RCS), targets affordable and accessible air travel by introducing over 400 regional routes by 2025. This initiative, funded with an annual 4,500 crore budget allocation, has catalyzed demand for GSE across smaller airports. The scheme has stimulated a 22% increase in regional flight traffic since 2022, necessitating specialized ground support equipment in underserved regions to enhance passenger and cargo operations.

Market Challenges

- High Capital Expenditure and Maintenance Costs: Ground support equipment in India requires significant capital investment, with initial costs for airport GSE installation averaging 1,000-5,000 crore, according to the Directorate General of Civil Aviation. Additionally, the maintenance costs are steep, particularly for imported GSE. High costs for upkeep, repair, and specialized labor add to the financial burden, constraining growth in smaller airports or regions with limited funding. These costs impact profitability and restrict GSE advancements in the Indian aviation industry.

- Dependency on Import-Driven Supply Chain: India relies heavily on foreign suppliers for high-quality GSE components, creating a dependency that can delay operations during geopolitical disruptions. With 70% of GSE equipment imported, the volatile global supply chain impacts availability and increases costs, according to the Ministry of Commerce. Currency fluctuations also affect procurement budgets, further complicating the GSE landscape as equipment prices rise amidst dependency on external suppliers.

India Ground Support Equipment Market Future Outlook

Over the next five years, the India Ground Support Equipment market is set to witness substantial growth, driven by the expansion of the aviation sector, increasing air traffic, and a shift towards sustainable airport operations. Initiatives to modernize airports and increase regional connectivity will further boost demand for advanced and eco-friendly ground support equipment, positioning the market for continued growth.

Market Opportunities

- Demand for Fuel-Efficient and Electric Ground Support Equipment: Rising environmental concerns and energy costs push demand for fuel-efficient and electric GSE. In 2024, the Ministry of Environment forecasted a national reduction target of 33-35% in carbon emissions intensity, highlighting electric GSE as critical to sustainable aviation operations. As airports like Delhis IGI and Mumbais Chhatrapati Shivaji focus on greener initiatives, demand for electric GSE has grown by 15% year-over-year, promoting industry-wide adoption of cleaner, energy-efficient ground support options.

- Partnerships for Technology Transfer: India's increasing collaborations with global technology firms aim to localize GSE manufacturing and reduce reliance on imports. Recently, partnerships with European and American companies have enabled technology transfers for hybrid and electric GSE in India. Through these collaborations, local production capacity for GSE is expected to improve, facilitating cost-effective and advanced equipment availability. The Ministry of Industry reported a 20% increase in joint ventures and partnerships in 2024, focusing on indigenous GSE innovation to meet market demand.

Scope of the Report

|

Aircraft Tugs and Tractors Cargo Loaders Ground Power Units Passenger Boarding Stairs and Bridges Fuel Trucks and Hydrant Dispensers |

|

|

By Power Source |

Electric Non-Electric (Diesel, Gasoline) |

|

By Airport Type |

International Airports Domestic Airports Regional and Cargo Airports |

|

By Application |

Commercial Military |

|

By Region |

North East West South |

Products

Key Target Audience

Airlines and Airport Operators

Ground Support Service Providers

Equipment Manufacturers and Suppliers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Directorate General of Civil Aviation, Ministry of Civil Aviation)

Aviation Fuel Suppliers

Environmental Compliance and Certification Agencies

Fleet Management and Technology Providers

Companies

Players Mention in the Report:

John Bean Technologies Corp.

TLD Group SAS

Toyota Industries Corp.

Mallaghan Engineering Ltd.

Weihai Guangtai

AERO Specialties, Inc.

Cavotec SA

Tug Technologies Corporation

Tronair, Inc.

ITW GSE

Avia Equipment Pte Ltd.

Jiangsu Tianyi Airport Special Equipment Co., Ltd.

MULAG Fahrzeugwerk

Sinepower Lda

Gate GSE

Table of Contents

1. India Ground Support Equipment Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Industry Standards and Compliance Requirements

1.4 Market Segmentation Overview

2. India Ground Support Equipment Market Size (In INR Cr.)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Milestones and Key Developments

3. India Ground Support Equipment Market Analysis

3.1 Growth Drivers

3.1.1 Surge in Aviation Infrastructure Development

3.1.2 Increase in Domestic and International Passenger Traffic

3.1.3 Government Initiatives (e.g., UDAN Scheme)

3.2 Market Challenges

3.2.1 High Capital Expenditure and Maintenance Costs

3.2.2 Dependency on Import-Driven Supply Chain

3.3 Opportunities

3.3.1 Demand for Fuel-Efficient and Electric Ground Support Equipment

3.3.2 Partnerships for Technology Transfer

3.4 Trends

3.4.1 Shift Towards Electric and Hybrid Equipment

3.4.2 Integration of IoT for Fleet Management

3.5 Regulatory Landscape

3.5.1 Safety Regulations by Directorate General of Civil Aviation (DGCA)

3.5.2 Environmental Compliance Standards

4. India Ground Support Equipment Market Segmentation

4.1 By Equipment Type (In Value %)

4.1.1 Aircraft Tugs and Tractors

4.1.2 Cargo Loaders

4.1.3 Ground Power Units

4.1.4 Passenger Boarding Stairs and Bridges

4.1.5 Fuel Trucks and Hydrant Dispensers

4.2 By Power Source (In Value %)

4.2.1 Electric

4.2.2 Non-Electric (Diesel, Gasoline)

4.3 By Airport Type (In Value %)

4.3.1 International Airports

4.3.2 Domestic Airports

4.3.3 Regional and Cargo Airports

4.4 By Application (In Value %)

4.4.1 Commercial

4.4.2 Military

4.5 By Region (In Value %)

4.5.1 North

4.5.2 South

4.5.3 West

4.5.4 East

5. India Ground Support Equipment Competitive Analysis

5.1 Company Profiles of Major Competitors

5.1.1 John Bean Technologies (JBT) Corporation

5.1.2 AERO Specialties, Inc.

5.1.3 Cavotec SA

5.1.4 Mallaghan Engineering Ltd.

5.1.5 TLD Group SAS

5.1.6 Tug Technologies Corporation

5.1.7 Toyota Industries Corporation

5.1.8 Tronair, Inc.

5.1.9 Weihai Guangtai Airport Equipment Co., Ltd.

5.1.10 ITW GSE

5.1.11 Avia Equipment Pte Ltd.

5.1.12 Jiangsu Tianyi Airport Special Equipment Co., Ltd.

5.1.13 MULAG Fahrzeugwerk

5.1.14 Sinepower Lda

5.1.15 Gate GSE

5.2 Cross Comparison Parameters (Revenue, Market Share, Fleet Size, Airport Partnerships, Global Presence, Fleet Electrification Ratio, R&D Investment, Customer Satisfaction Ratings)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers & Acquisitions

5.6 Investment Analysis

6. India Ground Support Equipment Market Regulatory Framework

6.1 DGCA Safety Standards

6.2 Environmental Regulations (Emission Standards)

6.3 Certification Processes

6.4 Infrastructure Development Policies (Airport Capacity Expansion)

7. India Ground Support Equipment Future Market Size (In INR Cr.)

7.1 Projected Market Size Growth

7.2 Key Factors Driving Future Growth

8. India Ground Support Equipment Future Market Segmentation

8.1 By Equipment Type (In Value %)

8.2 By Power Source (In Value %)

8.3 By Airport Type (In Value %)

8.4 By Application (In Value %)

8.5 By Region (In Value %)

9. India Ground Support Equipment Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Innovation and Product Differentiation

9.3 Green Technology Adoption

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This stage involves the identification of all key stakeholders and variables influencing the India Ground Support Equipment Market. Data collection is conducted through secondary research and proprietary databases to establish core market dynamics.

Step 2: Market Analysis and Construction

The historical performance and penetration of GSE in India are assessed, considering the growth ratio across key airports and major airline service requirements. This analysis forms the foundation of market revenue and growth estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through direct consultations with industry stakeholders, including equipment suppliers and airport operators. Interviews provide insight into operational strategies and market trends.

Step 4: Research Synthesis and Final Output

The final step synthesizes data from primary interviews and secondary research, verifying statistics and refining insights to ensure a comprehensive analysis of the India GSE market.

Frequently Asked Questions

01. How big is the India Ground Support Equipment Market?

The India Ground Support Equipment Market is valued at USD 800 million, propelled by expanding airport infrastructure and rising passenger traffic.

02. What are the challenges in the India Ground Support Equipment Market?

Challenges in India Ground Support Equipment Market include high operational costs, dependency on imports for key components, and the high capital investment required for electrification of ground support fleets.

03. Who are the major players in the India Ground Support Equipment Market?

Key players in India Ground Support Equipment Market include John Bean Technologies Corp., TLD Group SAS, Toyota Industries Corp., and Mallaghan Engineering Ltd., each with strong brand loyalty and infrastructure support.

04. What drives the growth of the India Ground Support Equipment Market?

The India Ground Support Equipment Market growth is driven by government initiatives promoting regional air connectivity, demand for eco-friendly GSE, and the increasing number of domestic and international flights.

05. What are the technological trends in the India Ground Support Equipment Market?

Technological advancements like IoT-enabled fleet management, automated ground support operations, and electric-powered equipment are reshaping the market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.