India Halal Food Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD10281

November 2024

91

About the Report

India Halal Food Market Overview

- The India halal food market, valued at USD 19 billion, is largely driven by the increasing Muslim population, which comprises a significant portion of Indias demographic, and the rising demand for halal-certified products among non-Muslim consumers who view halal products as ethically sourced and healthier. The expansion of the halal food industry has been bolstered by the growth in online retail platforms, where consumers find access to a wide variety of halal-certified products ranging from meat to processed foods. Additionally, the surge in demand for convenience foods, including halal options, contributes to the market's steady growth.

- Dominant cities in the halal food market include Hyderabad, Lucknow, and Mumbai due to their large Muslim populations and vibrant food cultures that cater to both domestic and export markets. These cities have established supply chains, making them key hubs for halal-certified products. Additionally, the export-oriented nature of businesses based in these regions, particularly in Hyderabad, supports the dominance of these cities. Export opportunities to Gulf Cooperation Council (GCC) countries further cement their role in the halal food ecosystem.

- The Indian governments Agricultural and Processed Food Products Export Development Authority (APEDA) continues to provide support for Halal food exporters through subsidies and certification assistance. In 2023, over 500 crore was allocated to support exporters of Halal products, specifically targeting markets in the GCC and Southeast Asia. These initiatives aim to boost Indias Halal food exports and strengthen the countrys presence in global Halal markets.

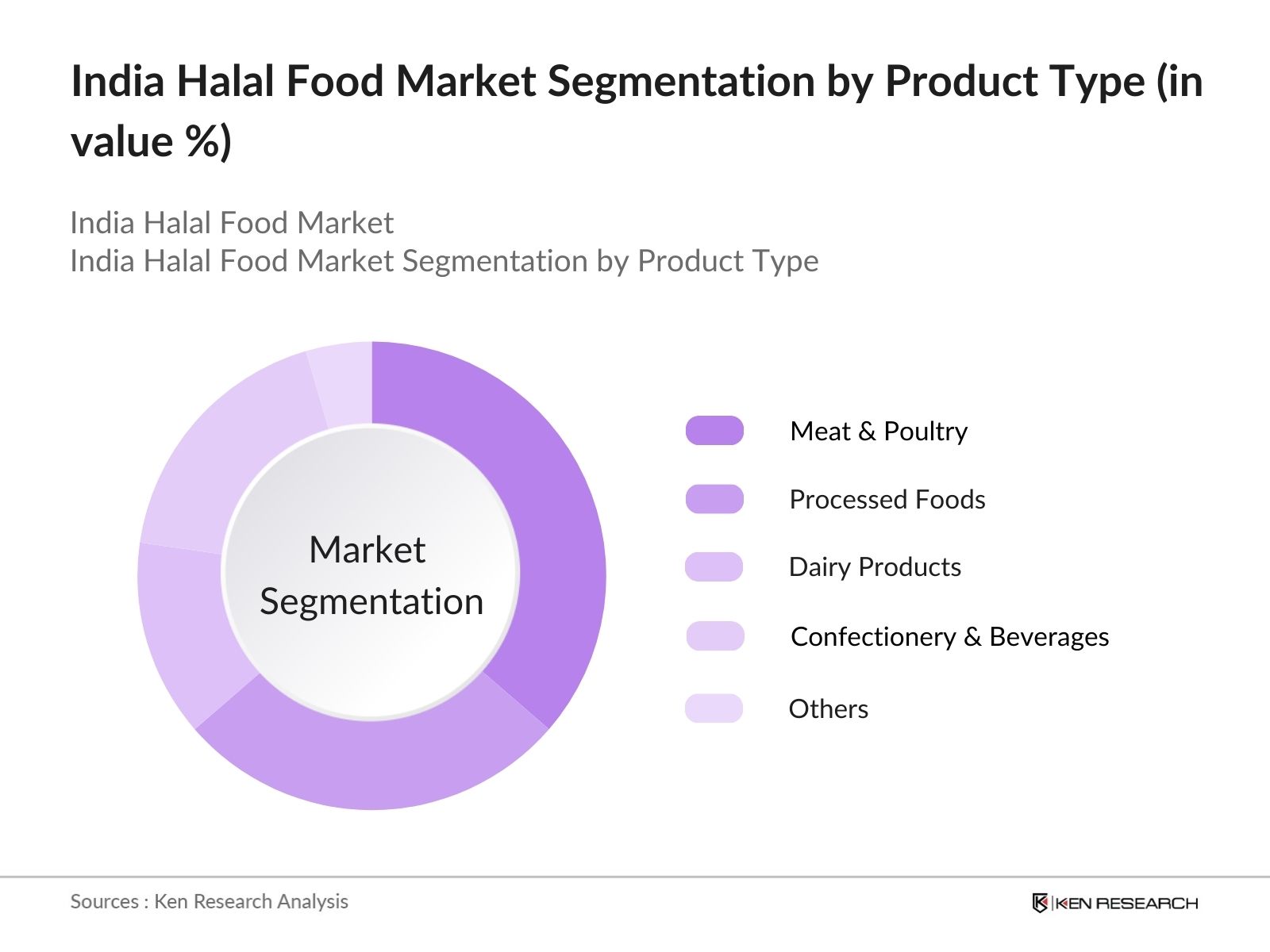

India Halal Food Market Segmentation

By Product Type: Indias halal food market is segmented by product type into meat & poultry, processed foods, dairy products, confectionery & beverages, and others. Recently, the meat & poultry segment has had a dominant market share under this segmentation. This is due to the deep-rooted cultural and religious importance of halal-certified meat for the Muslim population in India. Additionally, there is a rising preference for halal-certified meat among health-conscious consumers, who associate halal slaughtering methods with higher hygiene standards and ethical animal treatment. The popularity of meat-based processed products further drives this segments dominance.

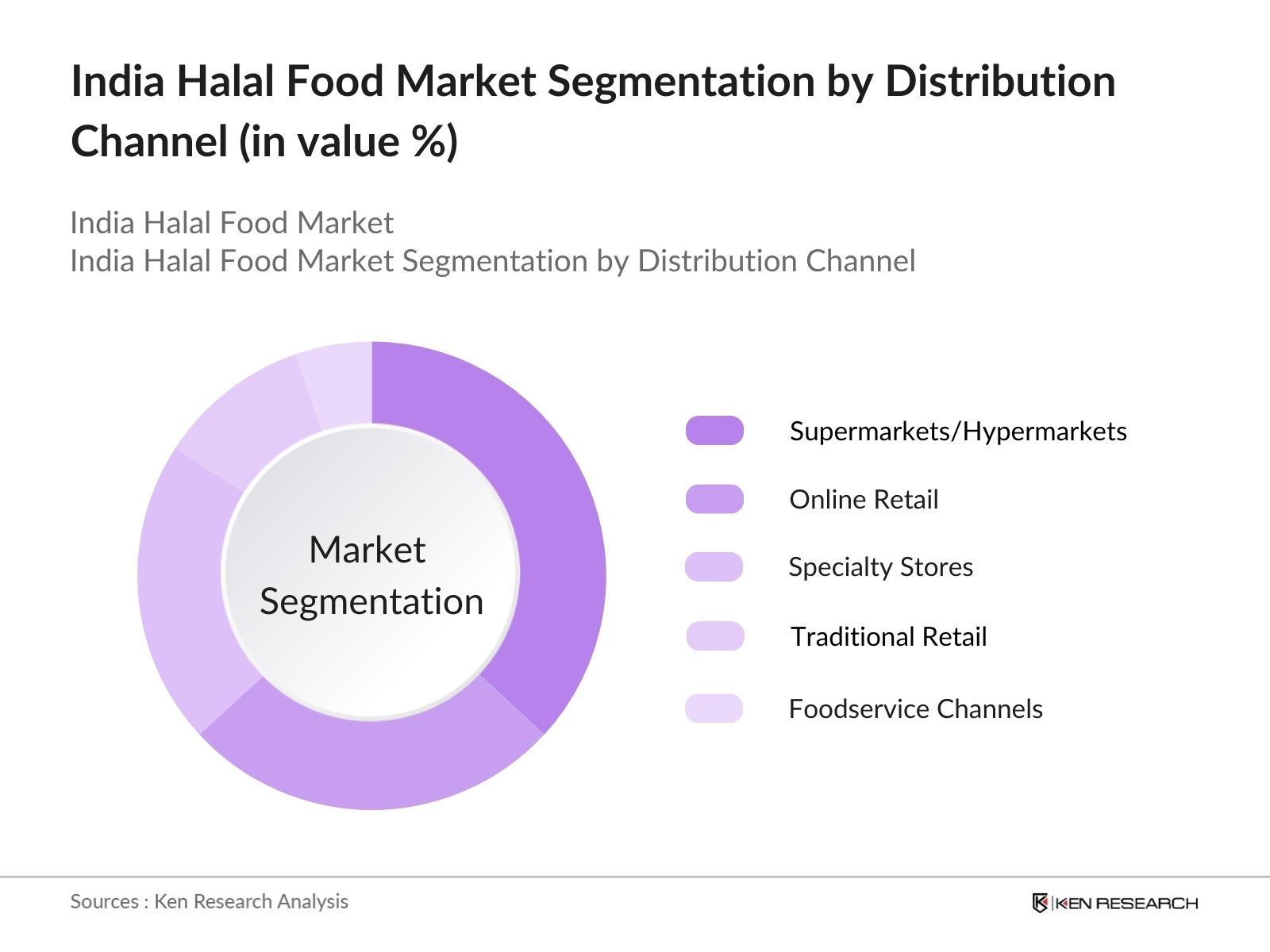

By Distribution Channel: India's halal food market is also segmented by distribution channels into online retail, supermarkets/hypermarkets, specialty stores, traditional retail, and foodservice channels. The supermarkets/hypermarkets segment currently holds the dominant share in the distribution channel segmentation. This is because these outlets offer a wide range of halal-certified products that are readily available to a diverse consumer base. Consumers prefer supermarkets for their accessibility, convenience, and the assurance of quality and certification standards that these retail giants maintain. Supermarkets also support product visibility and brand-building efforts, which attract new consumers.

India Halal Food Market Competitive Landscape

The Indian halal food market is highly competitive, with a mix of domestic and international players. This consolidation highlights the significant influence of key companies that have established halal-certified food processing facilities, strong distribution networks, and export capabilities. Companies like Allanasons Pvt. Ltd. and Al Kabeer Group dominate the meat and poultry sector, while other players focus on processed foods and dairy products. The competition in the market is also driven by increasing consumer awareness of halal certifications and the rising demand for premium, ethically sourced products.

India Halal Food Market Analysis

Growth Drivers

- Rising demand for Halal-certified products: The demand for Halal-certified products in India has increased significantly, driven by both Muslim and non-Muslim consumers. According to industry data, there is a rise in the number of food processing companies seeking Halal certification, with over 5,000 companies receiving certification in 2023 alone. This surge is fueled by consumer awareness regarding the quality, safety, and ethical considerations associated with Halal certification. The government-backed export schemes have also bolstered certification demand in international markets such as the GCC and Southeast Asia.

- Increasing Muslim population and dietary regulations: India's Muslim population, which currently stands at over 200 million, adheres to strict dietary regulations in accordance with Islamic laws. This demographic growth has spurred increased demand for Halal food products, with approximately 25% of the food industry now catering specifically to Muslim consumers. Halal foods popularity is extending into the mainstream as more consumers embrace it for ethical and health-related reasons, supporting the growth of the market.

- Government incentives and export opportunities: The Indian government has introduced several export incentives to boost the Halal food sector, focusing on expanding into Middle Eastern and Southeast Asian markets. According to trade data, India exported around 1.2 million tons of Halal meat in 2023, a number expected to grow due to increasing government efforts, such as the Make in India initiative for food processing. Additionally, the government is negotiating trade agreements with GCC countries, further facilitating access to these high-demand markets.

Market Challenges

- Difficulty in maintaining a certified supply chain: Maintaining a Halal-certified supply chain is challenging in India due to the fragmentation of the agricultural and livestock sectors. The Halal certification process requires strict adherence to specific handling, processing, and slaughtering methods, which can be difficult to monitor across thousands of small suppliers. Data from the Indian Agricultural Ministry indicates that over 60% of small suppliers face certification challenges due to insufficient infrastructure and technology, creating bottlenecks in the supply chain.

- Regulatory complexities and certification standards: Indias Halal food market faces hurdles in navigating regulatory compliance, especially with multiple certification bodies operating without standardized procedures. The lack of a uniform national Halal certification body creates discrepancies in certification processes, which can be a deterrent for both domestic companies and exporters. Industry data from 2023 shows that nearly 30% of companies seeking certification faced delays due to regulatory complications, further exacerbating market entry barriers.

India Halal Food Market Future Outlook

Over the next five years, the India halal food market is expected to experience steady growth, driven by the increasing demand for halal-certified products among both Muslim and non-Muslim populations. Factors such as rising health consciousness, ethical sourcing preferences, and expanding online retail platforms will continue to support market expansion. Additionally, government incentives for halal certification processes and the increasing global demand for Indian halal products will further contribute to the market's upward trajectory. The growth is also likely to be propelled by innovations in product diversification, with companies expanding their offerings into ready-to-eat meals, halal snacks, and beverages.

Market Opportunities

- Expanding exports to GCC countries and Southeast Asia: The Indian Halal food market is witnessing increasing opportunities for export, particularly to GCC countries and Southeast Asia. Indias agricultural export to the GCC reached 1.8 million metric tons in 2023, with Halal-certified meat and dairy products accounting for a significant portion. Growing demand from these regions for Halal-certified goods presents an enormous opportunity for Indian exporters, with further expansion anticipated in 2024, especially through government-led trade negotiations.

- Growth in online halal food retail platforms: The rise of e-commerce and digital platforms presents a major opportunity for the Halal food market. In 2023, online sales of Halal food products grew by 35%, driven by platforms such as BigBasket and Amazon India, which have introduced dedicated sections for Halal products. This trend is expected to continue, with more e-commerce companies entering the market and reaching consumers across urban and rural regions, providing significant growth avenues.

Scope of the Report

|

By Product Type |

Meat & Poultry Processed Foods Dairy Products Confectionery & Beverages Others |

|

By Distribution Channel |

Online Retail Supermarkets/Hypermarkets Specialty Stores Traditional Retail Foodservice Channels |

|

By Certification Type |

FSSAI Certification APEDA Certification Private Certification Bodies |

|

By Consumer Group |

Muslims Non-Muslims (Health & Ethical Consumers) |

|

By Region |

North South East West |

Products

Key Target Audience

Halal food certification bodies (FSSAI, APEDA)

Exporters and importers of halal products

Retailers and supermarkets with halal sections

Online halal food platforms

Restaurants and food service providers

Meat and poultry processors

Investors and venture capital firms

Government and regulatory bodies (Ministry of Food Processing Industries)

Companies

Players Mentioned in the Report:

Allanasons Pvt. Ltd.

Al Kabeer Group

Amara Halal Foods

BRF S.A.

Nestle S.A.

QL Foods

Saffron Road

Janan Meat

Midamar Corporation

Kawan Foods

Table of Contents

1. India Halal Food Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Halal Food Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Halal Food Market Analysis

3.1. Growth Drivers (Certification Demand, Islamic Population Growth, Government Support, Consumer Preferences)

3.1.1. Rising demand for Halal-certified products

3.1.2. Increasing Muslim population and dietary regulations

3.1.3. Government incentives and export opportunities

3.1.4. Growing preference for health and ethical food options

3.2. Market Challenges (Supply Chain Barriers, Regulatory Compliance, Market Fragmentation)

3.2.1. Difficulty in maintaining a certified supply chain

3.2.2. Regulatory complexities and certification standards

3.2.3. Fragmentation and lack of organized players

3.2.4. Limited consumer awareness in non-Muslim regions

3.3. Opportunities (International Expansion, Online Retail, Health Trends)

3.3.1. Expanding exports to GCC countries and Southeast Asia

3.3.2. Growth in online halal food retail platforms

3.3.3. Increased demand for organic and health-conscious products

3.3.4. Expansion of halal food services in hospitality and tourism sectors

3.4. Trends (Product Diversification, Technology Integration, Sustainability Focus)

3.4.1. Innovation in halal ready-to-eat and convenience foods

3.4.2. Digital platforms enhancing transparency in halal certification

3.4.3. Sustainability in halal food production processes

3.4.4. Growing halal restaurant and hospitality services

3.5. Government Regulations (FSSAI, APEDA, Export Norms)

3.5.1. FSSAIs halal food regulations and standards

3.5.2. Certification bodies recognized by APEDA

3.5.3. Export regulations and trade agreements with OIC countries

3.5.4. Government incentives for halal product certifications

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. India Halal Food Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Meat & Poultry

4.1.2. Processed Foods

4.1.3. Dairy Products

4.1.4. Confectionery & Beverages

4.1.5. Others

4.2. By Distribution Channel (In Value %)

4.2.1. Online Retail

4.2.2. Supermarkets/Hypermarkets

4.2.3. Specialty Stores

4.2.4. Traditional Retail

4.2.5. Foodservice Channels

4.3. By Certification Type (In Value %)

4.3.1. FSSAI Certification

4.3.2. APEDA Certification

4.3.3. Private Certification Bodies

4.4. By Consumer Group (In Value %)

4.4.1. Muslims

4.4.2. Non-Muslims (Health & Ethical Consumers)

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Halal Food Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Al Islami Foods

5.1.2. Amara Halal Foods

5.1.3. BRF S.A.

5.1.4. Nestle S.A.

5.1.5. Al Kabeer Group

5.1.6. Janan Meat

5.1.7. Saffron Road

5.1.8. Allanasons Pvt. Ltd.

5.1.9. Midamar Corporation

5.1.10. Kawan Foods

5.1.11. QL Foods

5.1.12. Tahira Foods

5.1.13. Sadia S.A.

5.1.14. Al Barakah Dates Factory

5.1.15. Prima Agri-Products

5.2. Cross Comparison Parameters (Product Portfolio, Certification Status, Distribution Reach, Key Markets, Sales Revenue, Operational Presence, Production Capacity, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Joint Ventures and Collaborations

5.8. Government Support Programs

5.9. Private Equity and Venture Capital Funding

6. India Halal Food Market Regulatory Framework

6.1. FSSAI Guidelines

6.2. Halal Certification Processes

6.3. APEDA Standards for Halal Exports

6.4. International Halal Standards Compliance

7. India Halal Food Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Halal Food Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Certification Type (In Value %)

8.4. By Consumer Group (In Value %)

8.5. By Region (In Value %)

9. India Halal Food Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Behaviour Insights

9.3. Branding and Marketing Strategies

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In the first step, we identified critical variables affecting the India halal food market, such as consumer behavior, halal certification processes, and distribution channels. This was achieved through secondary research using proprietary databases and government reports.

Step 2: Market Analysis and Construction

Next, we compiled historical data on market trends, focusing on product consumption, distribution channels, and export patterns. This analysis provided a clear understanding of market dynamics, supply chains, and competitive structures.

Step 3: Hypothesis Validation and Expert Consultation

Through expert consultations with halal food manufacturers, industry stakeholders, and certification authorities, we validated market hypotheses related to consumer preferences, certification demand, and market segmentation.

Step 4: Research Synthesis and Final Output

In the final stage, we synthesized data from various sources to produce a comprehensive market analysis. This included validation of data on key segments, competitive analysis, and projections for future market developments.

Frequently Asked Questions

1. How big is the India Halal Food Market?

The India halal food market was valued at USD 19 billion and is driven by increasing demand from Muslim consumers, as well as health-conscious non-Muslim consumers who prefer ethically sourced food products.

2. What are the challenges in the India Halal Food Market?

Challenges in the India halal food market include regulatory compliance with halal certification standards, maintaining certified supply chains, and consumer awareness of halal certifications, particularly in non-Muslim regions of the country.

3. Who are the major players in the India Halal Food Market?

Key players in the India halal food market include Allanasons Pvt. Ltd., Al Kabeer Group, Amara Halal Foods, BRF S.A., and Nestle S.A. These companies dominate the market due to their robust supply chains, export capabilities, and brand recognition.

4. What are the growth drivers of the India Halal Food Market?

The India halal food market is propelled by the rising demand for halal-certified products, increasing Muslim population, ethical food preferences among non-Muslims, and expanding online retail platforms for halal products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.