India Hard Seltzer Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD7500

December 2024

94

About the Report

India Hard Seltzer Market Overview

- The India Hard Seltzer market, valued at USD 173 million, has seen growth driven by rising health consciousness, increased demand for low-calorie alcoholic beverages, and a shift towards unique, flavored alcoholic options. The preference among younger demographics for beverages that offer variety, convenience, and lower calorie content is a primary driver of the market's growth.

- The market is predominantly dominated by major metropolitan cities such as Mumbai, Delhi, and Bengaluru, where the younger population with higher disposable incomes resides. These cities lead in market dominance due to their developed urban infrastructure, high density of modern retail outlets, and the growing popularity of lifestyle and social drinking trends. This urban-centric demand supports the presence of both domestic and international brands in these key regions, ensuring a robust distribution network.

- Several Indian states have allowed online sales of alcoholic beverages, with Maharashtra and West Bengal leading the change. In 2024, over 10 million consumers in these states gained access to legal online alcohol purchases, a favorable development for hard seltzer brands aiming to capture digital-savvy consumers.

India Hard Seltzer Market Segmentation

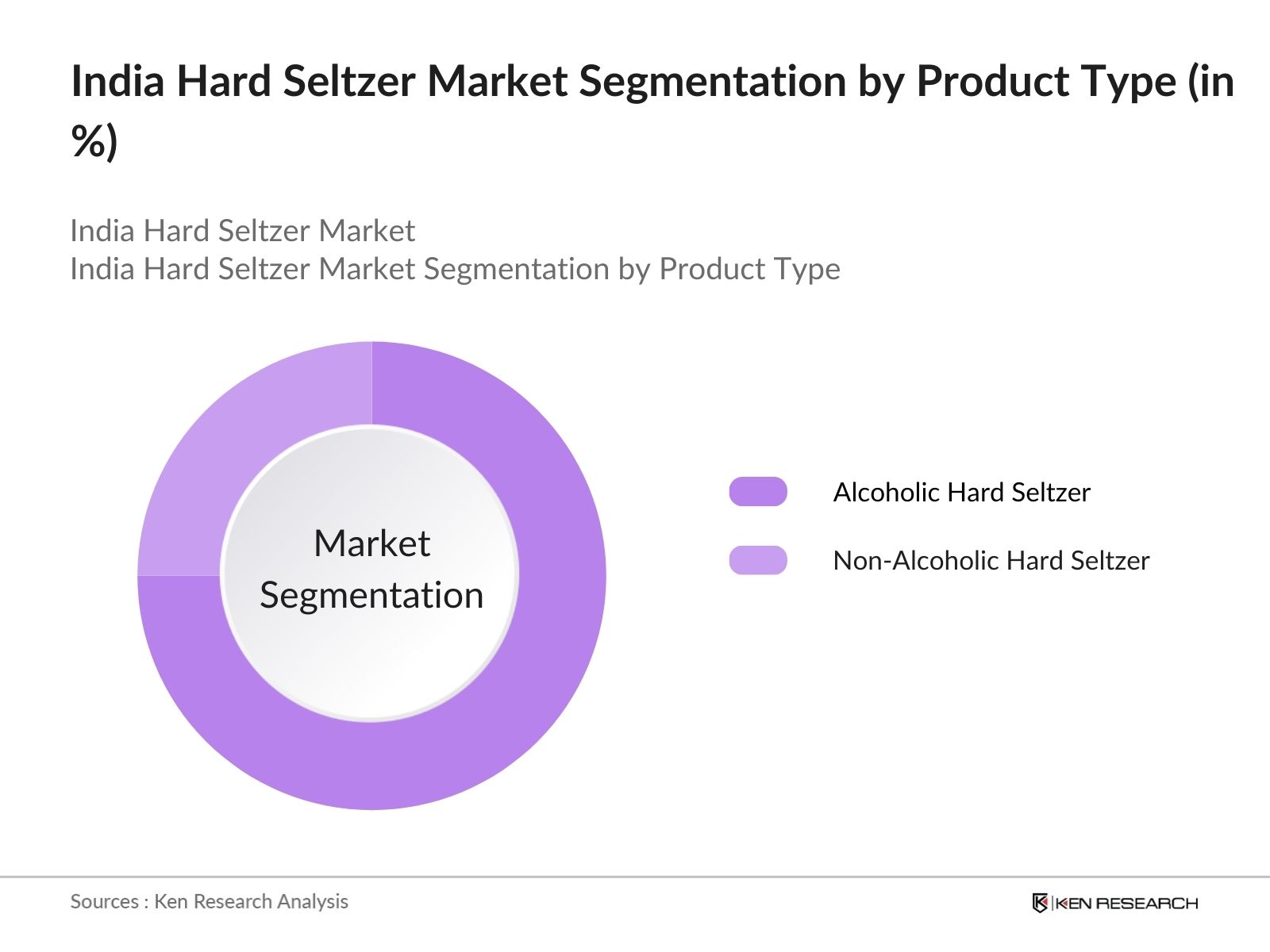

By Product Type: The market is segmented by product type into alcoholic hard seltzer and non-alcoholic hard seltzer. Recently, alcoholic hard seltzers have secured a dominant market share within this segmentation. This trend is attributed to the shift among consumers seeking alternative alcoholic options that align with health-focused preferences, such as low-calorie and low-sugar content. Popular brands have capitalized on this trend by offering a wide variety of flavors that appeal to young, urban drinkers looking for modern and refreshing beverages.

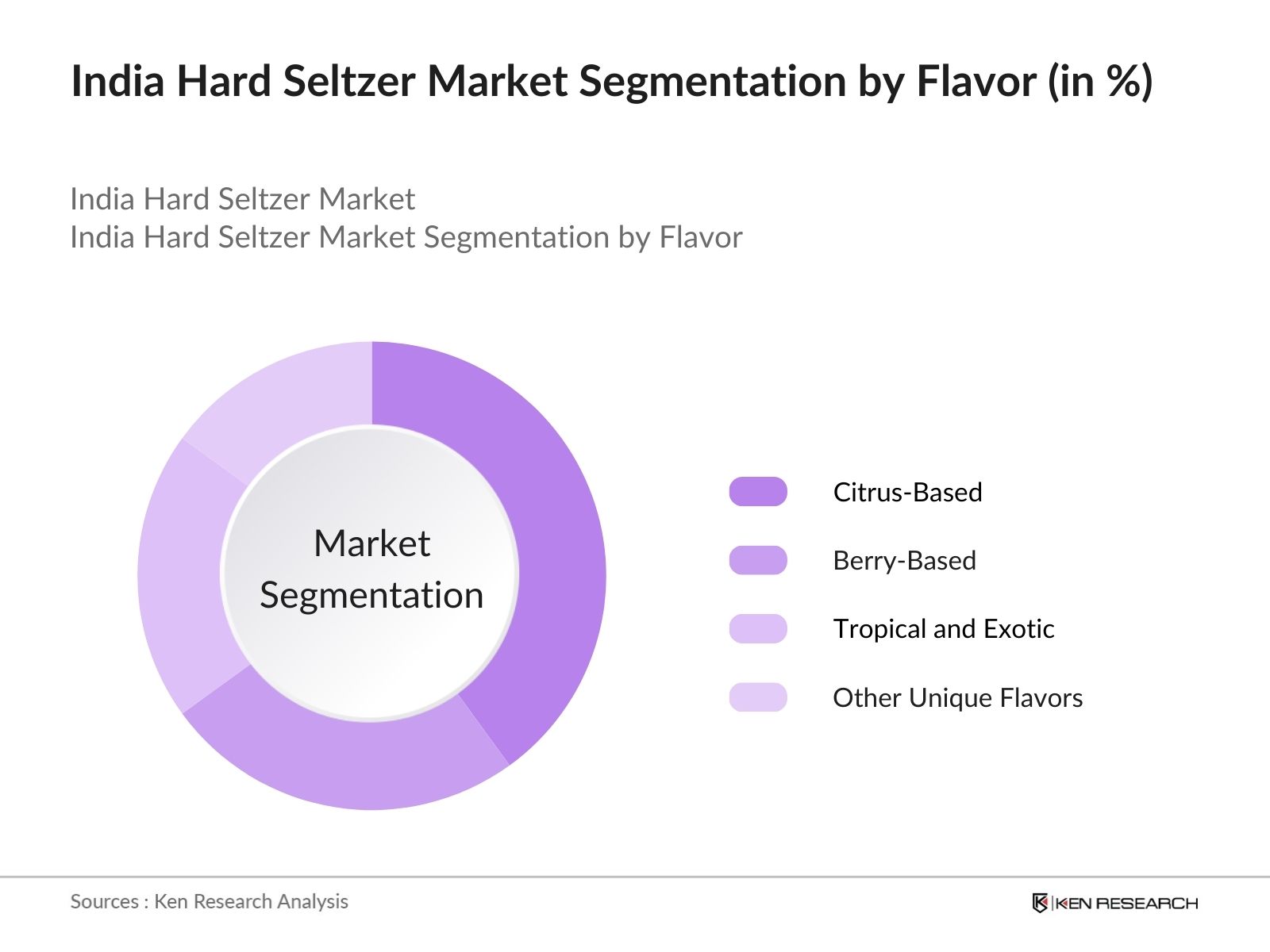

By Flavor: The market is further segmented by flavor into citrus-based, berry-based, tropical and exotic, and other unique flavors. Citrus-based hard seltzers currently lead in this category due to their refreshing appeal and high consumer preference for familiar yet distinct flavor profiles. These flavors not only resonate with consumers' taste preferences but are also associated with health and wellness, as they align with natural and vitamin-rich imagery, enhancing their market attractiveness.

India Hard Seltzer Market Competitive Landscape

The market is dominated by a mix of domestic and international brands. The competition is intense, with each company vying for a substantial market share by focusing on product innovation, extensive marketing campaigns, and strategic partnerships.

India Hard Seltzer Market Analysis

Market Growth Drivers

- Health and Wellness Trends in Beverages: With a growing number of Indian consumers prioritizing health-conscious choices, hard seltzers, which offer low-calorie and low-sugar content, have gained traction. In 2024, over 30 million urban middle-class Indians indicated a preference for healthier alcoholic beverages, reflecting a shift away from traditional high-calorie options. This inclination towards wellness products drives the demand for hard seltzers as a healthier alcoholic alternative.

- Expansion of Alcoholic Beverage Outlets and Accessibility: India has witnessed the rapid expansion of alcoholic beverage outlets across Tier 1 and Tier 2 cities, with over 10,000 licensed outlets now serving a variety of beverages, including new hard seltzer brands. The increased accessibility and visibility of these products cater to consumers seeking novelty, contributing to rising sales volumes and brand awareness.

- Growing Presence of E-Commerce for Alcohol: With recent regulatory relaxations, online alcohol sales in India have surged, with an estimated 5 million customers purchasing alcoholic products online as of 2024. This digital expansion allows hard seltzer brands to reach a broader audience, particularly tech-savvy young consumers who prefer the convenience of e-commerce, significantly boosting market demand.

Market Challenges

- Stringent Alcohol Regulations and State-Specific Policies: Despite market interest, hard seltzer producers face regulatory challenges due to Indias stringent alcohol laws, which vary across states. Over 15 states maintain restrictive policies, creating complexities in distribution and branding efforts. This fragmented regulatory landscape impedes nationwide growth and limits consumer access in certain regions.

- High Taxation on Alcoholic Beverages: Hard seltzers in India are subject to substantial excise taxes, contributing to higher prices than comparable non-alcoholic beverages. For example, excise taxes can add over 40% to the retail price, reducing affordability, especially for price-sensitive consumers in Tier 2 and 3 cities. These taxation challenges create barriers to competitive pricing and market penetration.

India Hard Seltzer Market Future Outlook

Over the next five years, the India Hard Seltzer industry is expected to experience robust growth, fueled by changing consumer preferences, increased awareness of health and wellness, and ongoing product innovations.

Future Market Opportunities

- Expansion into Non-Urban Markets Through Digital Channels: By 2029, it is anticipated that rural penetration for hard seltzers will increase, driven by improved digital infrastructure and e-commerce availability. Projections estimate that over 10 million rural consumers will have access to alcoholic e-commerce platforms, broadening market reach and expanding the consumer base.

- Growth of Premium and Super-Premium Hard Seltzer Segments: As disposable incomes rise, there will likely be an increased demand for premium hard seltzer products. The premium segment is expected to experience robust growth, with around 20 million consumers anticipated to explore premium beverage options by 2029, catering to affluent, taste-conscious consumers seeking higher quality products.

Scope of the Report

|

Product Type |

Alcoholic Hard Seltzer |

|

Non-Alcoholic Hard Seltzer |

|

|

Flavor |

Citrus-Based |

|

Berry-Based |

|

|

Tropical and Exotic |

|

|

Other Unique Flavors |

|

|

Packaging Type |

Bottles |

|

Cans |

|

|

Others |

|

|

Distribution Channel |

Online Sales |

|

Offline Retail |

|

|

Horeca |

|

|

Region |

North India |

|

South India |

|

|

East India |

|

|

West India |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Alcoholic Beverage Manufacturers

Retail Chains and Supermarkets

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (FSSAI, State Excise Departments)

Distributors and Wholesalers

Restaurants, Bars, and Cafs (HoReCa)

Digital and E-commerce Platforms

Packaging and Labeling Firms

Companies

Players Mentioned in the Report:

White Owl Brewery

Bira 91

Simba Brewery

AB InBev India

United Breweries Limited

Bacardi India

Radico Khaitan

Mohan Meakin

Arbor Brewing Company India

Sula Vineyards

Table of Contents

1. India Hard Seltzer Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Growth Rate Analysis

1.4. Market Segmentation Overview

2. India Hard Seltzer Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Hard Seltzer Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Urbanization and Shift to Alcohol Alternatives

3.1.2. Rising Disposable Income

3.1.3. Youth and Millennial Preferences

3.1.4. Health-Conscious Trends

3.2. Market Challenges

3.2.1. Regulatory Restrictions

3.2.2. High Competition from Other Alcoholic Beverages

3.2.3. Price Sensitivity of Consumers

3.3. Opportunities

3.3.1. Expansion of Flavors and Product Lines

3.3.2. Increased Availability in Tier 2 and Tier 3 Cities

3.3.3. Private Label Opportunities

3.4. Trends

3.4.1. Popularity of Low-Calorie Beverages

3.4.2. Eco-Friendly Packaging

3.4.3. Digital and E-commerce Sales Channels

3.5. Government Regulations

3.5.1. Alcohol Sales and Marketing Laws

3.5.2. Quality and Labeling Standards

3.5.3. Advertising Restrictions

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porter’s Five Forces Analysis

3.9. Consumer Insights and Preferences Analysis

4. India Hard Seltzer Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Alcoholic Hard Seltzer

4.1.2. Non-Alcoholic Hard Seltzer

4.2. By Flavor (In Value %)

4.2.1. Citrus-Based

4.2.2. Berry-Based

4.2.3. Tropical and Exotic

4.2.4. Other Unique Flavors

4.3. By Packaging Type (In Value %)

4.3.1. Bottles

4.3.2. Cans

4.3.3. Others

4.4. By Distribution Channel (In Value %)

4.4.1. Online Sales

4.4.2. Offline Retail (Hypermarkets, Supermarkets)

4.4.3. Horeca (Hotels, Restaurants, Cafes)

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Hard Seltzer Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. White Owl Brewery

5.1.2. Bira 91

5.1.3. Simba Brewery

5.1.4. AB InBev India

5.1.5. United Breweries Limited

5.1.6. Bacardi India

5.1.7. Radico Khaitan

5.1.8. Mohan Meakin

5.1.9. Arbor Brewing Company India

5.1.10. Sula Vineyards

5.1.11. Grover Zampa Vineyards

5.1.12. Kingfisher Radler

5.1.13. Tapped Seltzer

5.1.14. Tilt Cocktails

5.1.15. Som Distilleries

5.2. Cross-Comparison Parameters (Annual Revenue, Market Share, Product Line Variants, Target Demographic, Distribution Reach, Marketing Spend, Brand Perception, Innovation Index)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. New Product Launches and Collaborations

5.8. Social Media and Digital Marketing Strategies

6. India Hard Seltzer Market Regulatory Framework

6.1. FSSAI and Licensing Requirements

6.2. Labeling and Packaging Guidelines

6.3. Compliance with Alcohol Regulations

6.4. Environmental and Sustainability Standards

7. India Hard Seltzer Future Market Size (In USD Mn)

7.1. Market Size Projections

7.2. Key Drivers for Future Growth

8. India Hard Seltzer Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Flavor (In Value %)

8.3. By Packaging Type (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. India Hard Seltzer Market Analysts’ Recommendations

9.1. Total Addressable Market (TAM) Analysis

9.2. Serviceable Available Market (SAM) Analysis

9.3. Serviceable Obtainable Market (SOM) Analysis

9.4. Customer Targeting and Segmentation Strategy

9.5. White Space Opportunity Analysis

9.6. Marketing and Positioning Strategies

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

This phase involves mapping the hard seltzer market ecosystem in India, including major stakeholders. Extensive desk research using a combination of secondary and proprietary databases identifies the critical variables influencing market trends, consumption patterns, and distribution strategies.

Step 2: Market Analysis and Construction

This step entails analyzing historical data related to the Indian hard seltzer market, covering market size, growth rate, and geographical distribution. A thorough examination of consumer preferences, urban penetration, and product positioning helps establish reliable revenue estimates for the market.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through interviews with industry experts across beverage companies, distributors, and retailers. These insights from experienced professionals provide a clear understanding of operational dynamics and potential growth areas.

Step 4: Research Synthesis and Final Output

This final step involves compiling data obtained from industry players to gain insights into key segments, flavor trends, and emerging consumer demographics. These insights ensure a comprehensive and accurate analysis of the Indian hard seltzer market, confirming the data with a bottom-up approach.

Frequently Asked Questions

01. How big is the India Hard Seltzer Market?

The India Hard Seltzer market, valued at USD 173 million, is primarily driven by urbanization, health-conscious trends, and consumer demand for low-calorie alcoholic options.

02. What are the main challenges in the India Hard Seltzer Market?

Challenges in the India Hard Seltzer market include regulatory compliance, high competition from established alcoholic beverages, and price sensitivity among consumers. The lack of awareness in smaller cities also poses a constraint.

03. Who are the major players in the India Hard Seltzer Market?

Key players in the India Hard Seltzer market include White Owl Brewery, Bira 91, Simba Brewery, and Bacardi India, with these companies leading due to their extensive distribution and strong brand reputation.

04. What factors drive the India Hard Seltzer Market growth?

The India Hard Seltzer market is driven by rising health consciousness, the preference for low-calorie beverages, and urbanization. The appeal of varied flavors and convenience also contributes to its growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.