India Health & Wellness Market Outlook to 2030

Healthier Choices, Stronger India

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD6619

November 2024

95

About the Report

India Health & Wellness Market Overview

- The India Health & Wellness Market has seen rapid growth, valued at USD 78 billion, based on a five-year historical analysis. This growth is primarily driven by increased awareness of health and wellness, a growing middle-class population, and rising disposable incomes. Government initiatives such as Ayushman Bharat and the growing influence of digital health platforms have also contributed to market expansion, making healthcare and wellness more accessible to a broader demographic.

- Cities such as Mumbai, Bengaluru, and Delhi dominate the market due to a combination of high population density, a tech-savvy consumer base, and better access to healthcare facilities. These metropolitan areas are home to several wellness centers, fitness clubs, and health-focused enterprises.

- The Ayushman Bharat scheme, aimed at promoting preventive healthcare, has been expanded to include wellness programs. In 2023, over 20,000 Health and Wellness Centres (HWCs) were set up across India, benefitting nearly 350 million individuals by providing affordable wellness and fitness services. This initiative is expected to further scale up in 2024.

India Health & Wellness Market Segmentation

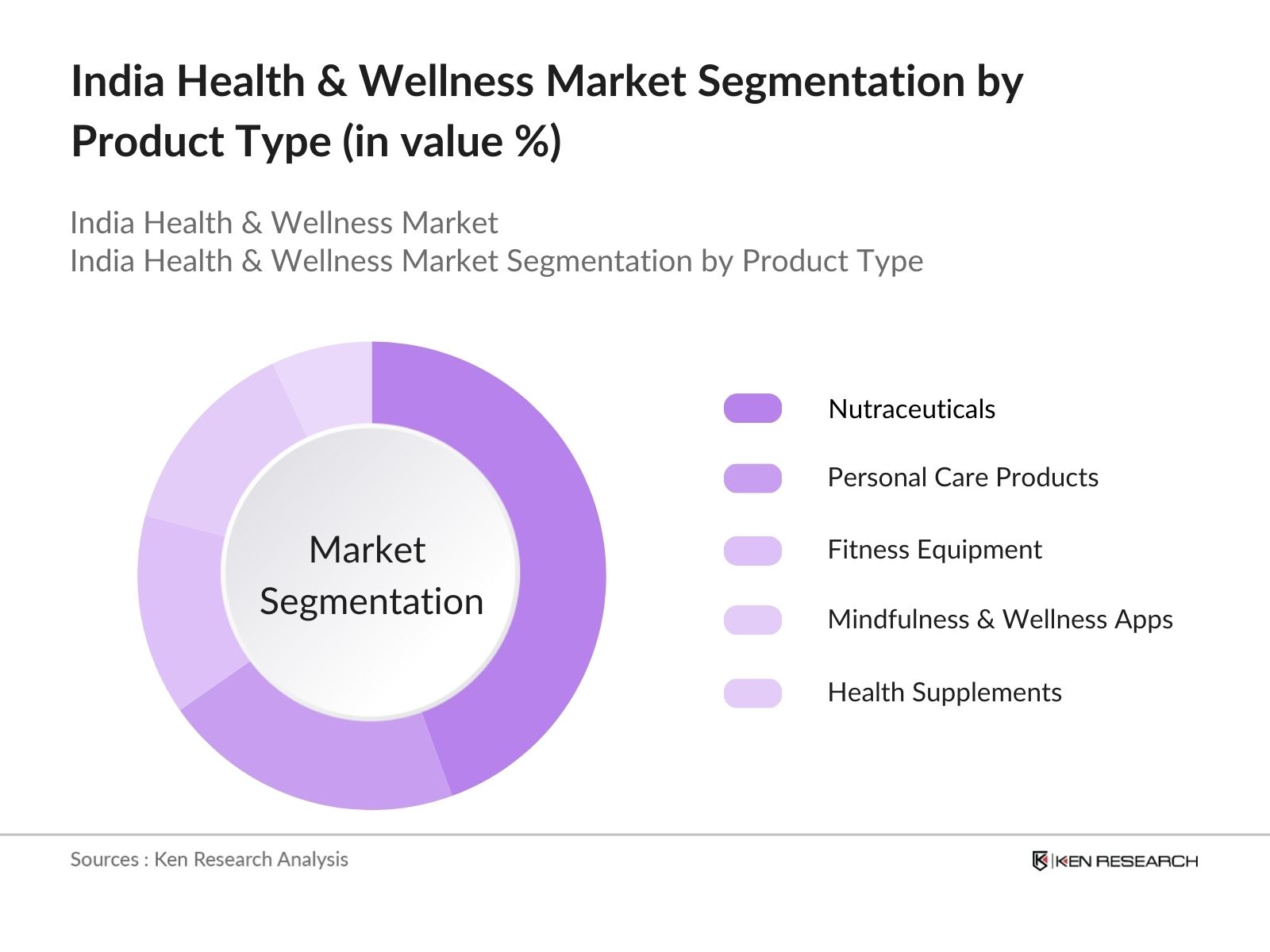

By Product Type: The market is segmented by product type into Nutraceuticals, Personal Care Products, Fitness Equipment, Mindfulness & Wellness Apps, and Health Supplements. Among these, Nutraceuticals hold a dominant market share. This dominance is due to the increasing consumer preference for dietary supplements and functional foods to boost immunity and overall health. Companies like Himalaya and Patanjali have capitalized on this trend by offering a wide range of herbal and Ayurvedic supplements.

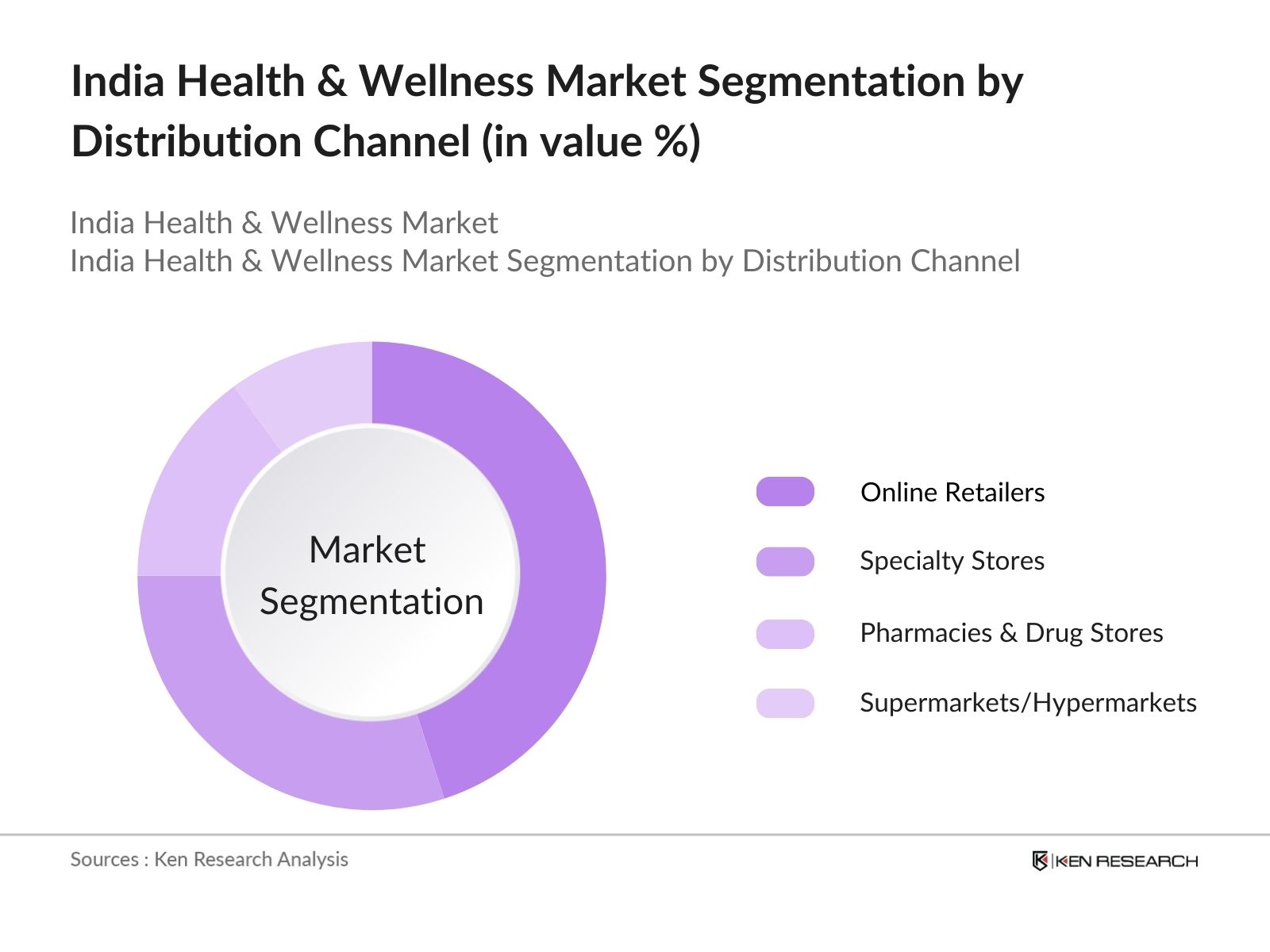

By Distribution Channel: The market is also segmented by distribution channel into Online Retailers, Specialty Stores, Pharmacies & Drug Stores, and Supermarkets/Hypermarkets. Online Retailers dominate the distribution channel. The convenience of e-commerce platforms like Amazon and Flipkart, coupled with the availability of a wide range of health and wellness products at competitive prices, has significantly driven online sales. The rise of digital health and wellness platforms, offering personalized products and services, has further boosted the market share of online channels.

India Health & Wellness Market Competitive Landscape

The market is dominated by a mix of global and domestic players. Companies like Himalaya Wellness Company, Patanjali Ayurved, Dabur India Ltd., and Amway India Enterprises Pvt. Ltd. have a strong presence, along with emerging digital wellness platforms. These companies maintain a competitive edge by leveraging strong brand recognition, expanding product portfolios, and adopting innovative marketing strategies, such as partnerships with fitness apps and wellness influencers.

|

Company |

Establishment Year |

Headquarters |

Revenue (INR Billion) |

Product Range |

Number of Employees |

Global Reach |

Key Partnerships |

Market Position |

Technological Innovations |

|

Himalaya Wellness Company |

1930 |

Bengaluru |

|||||||

|

Patanjali Ayurved |

2006 |

Haridwar |

|||||||

|

Dabur India Ltd. |

1884 |

Ghaziabad |

|||||||

|

Amway India Enterprises |

1995 |

Gurgaon |

|||||||

|

VLCC Health Care Ltd. |

1989 |

New Delhi |

India Health & Wellness Market Analysis

Market Growth Drivers

- Increased Health Consciousness: With rising incidences of lifestyle-related diseases, over 75 million Indians now have diabetes, according to the International Diabetes Federation. This has led to a surge in demand for preventive healthcare products such as fitness equipment, dietary supplements, and organic food. The National Family Health Survey 2023 showed an increase in awareness, with over 30 million individuals now engaging in some form of physical activity for health reasons, up from 18 million in 2018.

- Expanding Middle-Class Population: The burgeoning middle-class population in India, which currently stands at around 350 million, has driven the demand for wellness services, such as yoga centers and spas. Reports from India's Ministry of Statistics highlight that middle-class households are allocating nearly 12% of their annual expenditure to health and wellness products, compared to just 5 million households a decade ago.

- Rise in Health Tourism: India's wellness tourism industry is expanding rapidly, with 2023 estimates indicating that around 2.3 million foreign tourists visited India primarily for wellness treatments. Ayurveda, yoga, and naturopathy centers have particularly benefited, contributing over INR 18,000 crore to the economy, according to the Ministry of Tourisms 2023 report.

Market Challenges

- Fragmented Market Structure: Indias health and wellness market is fragmented, with over 75,000 small and medium-sized enterprises (SMEs) operating alongside major players. This fragmentation leads to inconsistent quality control and supply chain inefficiencies, according to the Indian Association of Wellness Enterprises (IAWE).

- Limited Infrastructure in Rural Areas: While urban areas have seen a surge in wellness facilities, 70% of India's population resides in rural areas, where health infrastructure is inadequate. A report from the Ministry of Health in 2023 noted that only 5,000 wellness centers serve rural areas, creating a gap in access to wellness products and services.

India Health & Wellness Market Future Outlook

Over the next five years, the India Health & Wellness industry is expected to experience growth. This growth will be driven by increasing consumer health consciousness, rising investments in wellness infrastructure, and continued government support for wellness programs.

Future Market Opportunities

- Growth in Wellness Tourism: India is expected to solidify its position as a global wellness tourism hub. By 2028, foreign tourist arrivals for wellness purposes are projected to exceed 4 million, contributing over INR 30,000 crore to the economy. This will be fueled by the expansion of wellness resorts, Ayurveda centers, and health retreats across the country.

- Shift Toward Holistic Wellness Solutions: A growing focus on mental health and holistic well-being will redefine the health and wellness market. By 2028, holistic wellness centers that integrate mental, physical, and spiritual health services are expected to serve nearly 70 million Indians, responding to an increased societal focus on overall well-being rather than just physical health.

Scope of the Report

|

By Product Type |

Nutraceuticals Personal Care Products Fitness Equipment Mindfulness & Wellness Apps Health Supplements |

|

By Distribution Channel |

Online Retailers Specialty Stores Pharmacies & Drug Stores Supermarkets/Hypermarkets |

|

By Wellness Sector |

Fitness and Exercise Mental Wellbeing Nutrition and Weight Management Personal Care Beauty Anti-aging |

|

By Region |

North India South India East India West India |

|

By Consumer Demographic |

Urban Consumers Rural Consumers Millennials Elderly Population |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Health & Family Welfare, Ayush Ministry)

Health & Wellness Product Manufacturers

Banks and Financial Institutions

Nutraceutical Companies

Beauty and Personal Care Brands

Digital Health Startups

Companies

Players Mentioned in the Report:

Himalaya Wellness Company

Patanjali Ayurved

Dabur India Ltd.

Amway India Enterprises Pvt. Ltd.

VLCC Health Care Ltd.

Nestl India Ltd.

Abbott India Ltd.

Zandu Realty Limited

Procter & Gamble Health Limited

Herbalife Nutrition Ltd.

Table of Contents

1. India Health & Wellness Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

1.5. Market Maturity and Lifecycle Stage

1.6. Adoption Rate of Health and Wellness Practices (Urban, Rural)

2. India Health & Wellness Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Market Expansion Factors

2.4. Key Developments and Milestones

3. India Health & Wellness Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Disposable Income

3.1.2. Health Consciousness and Lifestyle Changes

3.1.3. Government Initiatives and Schemes (Ayushman Bharat, Fit India Movement)

3.1.4. Rise of E-commerce in Wellness Product Sales

3.2. Market Challenges

3.2.1. High Product Pricing

3.2.2. Lack of Awareness in Rural Areas

3.2.3. Regulatory Hurdles for New Product Launches

3.3. Opportunities

3.3.1. Emergence of Wellness Tourism

3.3.2. Growth in Digital Health Platforms

3.3.3. Partnerships with Global Wellness Brands

3.4. Trends

3.4.1. Rise of Ayurvedic and Organic Products

3.4.2. Increasing Popularity of Mindfulness Apps

3.4.3. Fitness Subscription Models (Gyms, Fitness Apps)

3.5. Government Regulations and Policies

3.5.1. National Health Policy

3.5.2. Nutraceutical Regulation

3.5.3. Ayurveda and Traditional Medicine Promotion

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem (Market Share by Competitor)

4. India Health & Wellness Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Nutraceuticals

4.1.2. Personal Care Products

4.1.3. Fitness Equipment

4.1.4. Mindfulness & Wellness Apps

4.1.5. Health Supplements

4.2. By Distribution Channel (In Value %)

4.2.1. Online Retailers

4.2.2. Specialty Stores

4.2.3. Pharmacies & Drug Stores

4.2.4. Supermarkets/Hypermarkets

4.3. By Wellness Sector (In Value %)

4.3.1. Fitness and Exercise

4.3.2. Mental Wellbeing

4.3.3. Nutrition and Weight Management

4.3.4. Personal Care, Beauty, and Anti-aging

4.4. By Region (In Value %)

4.4.1. North India

4.4.2. South India

4.4.3. East India

4.4.4. West India

4.5. By Consumer Demographic (In Value %)

4.5.1. Urban Consumers

4.5.2. Rural Consumers

4.5.3. Millennials

4.5.4. Elderly Population

5. India Health & Wellness Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Himalaya Wellness Company

5.1.2. Patanjali Ayurved

5.1.3. Dabur India Ltd.

5.1.4. Amway India Enterprises Pvt. Ltd.

5.1.5. VLCC Health Care Ltd.

5.1.6. Nestl India Ltd.

5.1.7. Abbott India Ltd.

5.1.8. Zandu Realty Limited

5.1.9. Procter & Gamble Health Limited

5.1.10. Herbalife Nutrition Ltd.

5.1.11. ITC Limited (Personal Care)

5.1.12. Johnson & Johnson India

5.1.13. Bajaj Consumer Care Ltd.

5.1.14. Glenmark Pharmaceuticals Ltd.

5.1.15. Biocon Limited

5.2. Cross Comparison Parameters (Revenue, Employee Count, Distribution Reach, Key Product Offerings, Market Share, Partnerships, Innovations, Regional Strengths)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment and Funding Analysis

5.7. Joint Ventures and Collaborations

6. India Health & Wellness Market Regulatory Framework

6.1. Government Policies on Wellness Products

6.2. Health & Wellness Standards

6.3. Certification and Compliance (FSSAI, Ayush Certification)

7. India Health & Wellness Future Market Size (In USD Billion)

7.1. Market Growth Forecast

7.2. Key Factors Impacting Future Growth

8. India Health & Wellness Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Wellness Sector (In Value %)

8.4. By Region (In Value %)

8.5. By Consumer Demographic (In Value %)

9. India Health & Wellness Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Behavior Analysis

9.3. Product Development Recommendations

9.4. Brand Positioning and Differentiation Strategies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the health and wellness ecosystem in India, identifying key stakeholders, such as product manufacturers, service providers, and regulatory bodies. Comprehensive desk research is conducted to gather industry data, focusing on variables like consumer demand, pricing, and distribution channels.

Step 2: Market Analysis and Construction

Historical data is compiled to evaluate trends in the market, particularly focusing on consumer preferences and the growth of digital platforms. Additionally, revenue generation and market penetration statistics are scrutinized to ensure accurate estimations of the market's performance.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through expert consultations, including interviews with industry professionals from leading health and wellness brands. These consultations provide valuable insights into operational challenges, market strategies, and future trends.

Step 4: Research Synthesis and Final Output

In the final phase, the synthesized research is compiled and verified through direct engagement with key players in the health and wellness sector, ensuring a comprehensive and validated analysis. The bottom-up approach, combined with top-down verification, ensures the accuracy of the market data.

Frequently Asked Questions

01. How big is the India Health & Wellness Market?

The India Health & Wellness Market was valued at USD 78 billion, driven by a growing consumer focus on health, fitness, and well-being, alongside increasing disposable income and urbanization.

02. What are the challenges in the India Health & Wellness Market?

The India Health & Wellness Market faces challenges such as high competition among local and global players, regulatory hurdles for new products, and a lack of awareness in rural areas, which limits penetration beyond major cities.

03. Who are the major players in the India Health & Wellness Market?

Key players in the India Health & Wellness Market include Himalaya Wellness Company, Patanjali Ayurved, Dabur India Ltd., Amway India Enterprises Pvt. Ltd., and VLCC Health Care Ltd. These companies lead the market due to their strong brand presence and diversified product offerings.

04. What are the growth drivers of the India Health & Wellness Market?

Growth in the India Health & Wellness Market is driven by factors such as increasing health awareness, government initiatives promoting wellness, the rise of e-commerce, and advancements in fitness technology.

05. What trends are shaping the India Health & Wellness Market?

Key trends in the India Health & Wellness Market include the rise of Ayurvedic and organic products, increasing digital health solutions, and the growing popularity of mental health and mindfulness practices across urban and rural populations.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.