India Healthcare Business Intelligence Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD1999

June 2025

90

About the Report

India Healthcare Business Intelligence Market Overview

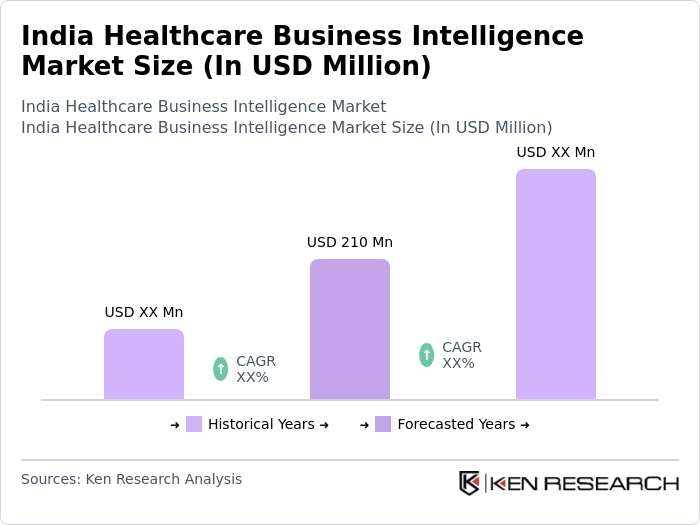

- The India Healthcare Business Intelligence Market was valued at USD 210 million, based on a five-year historical analysis. Current growth is driven by accelerated adoption of AI-powered analytics platforms and integration of machine learning for clinical decision support. The market benefits from increased healthcare digitization and demand for operational efficiency in hospital management systems.

- Major technology hubs including Bengaluru, Hyderabad, and Mumbai continue leading market development through concentrated healthcare IT innovation clusters. These regions host 68% of India's health tech startups specializing in data analytics solutions.

- Government initiatives promoting health data standardization and interoperability frameworks are creating foundational infrastructure for BI adoption. Recent policy measures emphasize secure health data exchange protocols aligned with international standards.

India Healthcare Business Intelligence Market Segmentation

By Source: The market is segmented by source into Primary Data Sources and Secondary Data Sources. Primary Data Sources dominate as they provide real-time, granular information directly from hospitals, laboratories, electronic health records, and clinical trials. This direct access enables healthcare BI solutions to deliver actionable insights on patient outcomes, treatment efficacy, and resource utilization. As Indian healthcare providers prioritize data-driven decision-making, investment in systems that capture and integrate primary clinical data—such as patient vitals, diagnostic results, and treatment protocols—has surged, reinforcing the dominance of this segment over secondary, aggregated reports.

By Application: The market is segmented by application into Clinical Analytics, Operational Analytics, Financial Analytics, and Population Health Management. Clinical Analytics dominates because healthcare organizations are increasingly focused on improving patient outcomes and reducing readmission rates. By leveraging BI tools that analyze clinical workflows, treatment patterns, and diagnostic data, providers can identify care gaps, optimize protocols, and implement evidence-based interventions. As hospitals and specialty clinics in metropolitan centers like Mumbai, Bengaluru, and Delhi adopt advanced clinical BI platforms, this application segment has outpaced others in terms of investment and implementation.

India Healthcare Business Intelligence Market Competitive Landscape

The competitive environment features global cloud analytics providers partnering with domestic EHR vendors to deliver localized solutions. Market leaders are investing in natural language processing capabilities for unstructured clinical note analysis.

India Healthcare Business Intelligence Market Industry Analysis

Growth Drivers

- Increasing Demand for Data-Driven Decision Making: The healthcare sector in India is increasingly shifting towards data-driven decision-making, driven by rising healthcare expenditure and government initiatives like the National Digital Health Mission (NDHM). This mission aims to create an integrated digital health ecosystem, enhancing data accessibility and utilization across hospitals, insurers, and clinics. Over 80% of pharmaceutical and life sciences companies have adopted AI on some scale, with more than half having dedicated AI budgets. Predictive analytics is improving patient outcomes, operational efficiency, and resource allocation, while healthcare providers are expected to increase adoption of business intelligence tools significantly in the coming years.

- Rising Adoption of Advanced Analytics in Healthcare: The adoption of advanced analytics in the Indian healthcare sector is on the rise, driven by the need for improved operational efficiency and patient care. According to Kenresearch, the healthcare analytics market in India is expected to grow to exceptionally in the forecasted period. This growth is fueled by the increasing availability of electronic health records (EHRs) and the integration of artificial intelligence (AI) in healthcare analytics. In 2024, it is estimated that majority of healthcare organizations in India will utilize advanced analytics to enhance clinical decision-making and operational processes.

- Growing Focus on Patient-Centric Care Models: The shift towards patient-centric care models is a significant growth driver for the healthcare business intelligence market in India. The Indian healthcare system is increasingly prioritizing patient engagement and personalized care, with a focus on improving patient experiences and outcomes. A report by the Indian Ministry of Health and Family Welfare indicates that patient-centric initiatives can lead to a remarkable increase in patient satisfaction scores. As healthcare providers adopt BI tools to analyze patient data and preferences, they can tailor services to meet individual needs. This trend is expected to drive the demand for BI solutions, with an estimated majority of healthcare organizations planning to implement patient-centric analytics by 2025, thereby enhancing their service delivery and operational efficiency.

Market Challenges

- Data Privacy and Security Concerns: One of the primary challenges facing the India healthcare business intelligence market is the growing concern over data privacy and security. With the increasing digitization of health records, the risk of data breaches has escalated. According to a report by the Cybersecurity and Infrastructure Security Agency (CISA), healthcare organizations in India experienced a substantial increase in cyberattacks in 2023. The implementation of the Personal Data Protection Bill in India, which mandates strict compliance for data handling, poses additional challenges for healthcare providers. Organizations must invest significantly in cybersecurity measures to protect sensitive patient data, which can divert resources away from BI implementation.

- High Implementation Costs: The high costs associated with implementing healthcare business intelligence solutions present a significant barrier to market growth. Many healthcare organizations, particularly smaller facilities, struggle to allocate sufficient budgets for BI tools and infrastructure. A survey conducted by the Healthcare Information and Management Systems Society (HIMSS) revealed that majority of healthcare providers cite budget constraints as a major obstacle to adopting advanced analytics.

India Healthcare Business Intelligence Market Future Outlook

The future of the India healthcare business intelligence market is poised for transformative growth, driven by technological advancements and an increasing emphasis on data-driven healthcare solutions. As organizations continue to prioritize patient-centric models and operational efficiency, the integration of AI and machine learning will play a crucial role in shaping the landscape of healthcare analytics.

Market Opportunities

- Expansion of Telehealth Services: The rapid expansion of telehealth services presents a significant opportunity for the healthcare business intelligence market in India. The COVID-19 pandemic accelerated the adoption of telemedicine, with a reported 150% increase in telehealth consultations in 2023. As telehealth becomes a permanent fixture in the healthcare landscape, the need for robust analytics to monitor patient outcomes and service efficiency will grow. Healthcare providers are expected to invest in BI tools that can analyze telehealth data, leading to improved patient engagement and satisfaction.

- Integration of AI and Machine Learning Technologies: The integration of AI and machine learning technologies into healthcare business intelligence solutions offers a promising avenue for growth. These technologies can enhance predictive analytics capabilities, enabling healthcare providers to anticipate patient needs and optimize resource allocation. By 2030, it is estimated that 30% of healthcare organizations in India will adopt AI-driven analytics tools, which can lead to a 25% improvement in operational efficiency.

Scope of the Report

| By Source |

Primary data sources Secondary data sources |

| By Application |

Clinical analytics Operational analytics Financial analytics Population health management |

| By Deployment Mode |

On-premise Cloud-based |

| By End User |

Healthcare providers Healthcare payers Pharmaceutical companies Research organizations |

| By Region |

North India South India East India West India |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Health and Family Welfare, National Health Authority)

Healthcare Providers and Hospitals

Pharmaceutical Companies

Health Insurance Companies

Medical Device Manufacturers

Healthcare IT Solution Providers

Public Health Organizations

Companies

Players Mentioned in the Report:

IBM Watson Health

Oracle Corporation

Philips Healthcare

Siemens Healthineers

McKesson Corporation

HealthInsights Analytics

MedData Solutions

CareVision Analytics

BioStat Innovations

HealthIQ Technologies

Table of Contents

1. India Healthcare Business Intelligence Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Healthcare Business Intelligence Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Healthcare Business Intelligence Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Data-Driven Decision Making

3.1.2. Rising Adoption of Advanced Analytics in Healthcare

3.1.3. Growing Focus on Patient-Centric Care Models

3.2. Market Challenges

3.2.1. Data Privacy and Security Concerns

3.2.2. High Implementation Costs

3.2.3. Lack of Skilled Workforce

3.3. Opportunities

3.3.1. Expansion of Telehealth Services

3.3.2. Integration of AI and Machine Learning Technologies

3.3.3. Increasing Investment in Healthcare IT Infrastructure

3.4. Trends

3.4.1. Shift Towards Predictive Analytics

3.4.2. Growing Use of Cloud-Based Solutions

3.4.3. Emphasis on Real-Time Data Access and Reporting

3.5. Government Regulation

3.5.1. Overview of Healthcare Regulations Impacting BI

3.5.2. Data Protection Laws and Compliance

3.5.3. Guidelines for Health Information Exchange

3.5.4. Regulatory Framework for Telemedicine and Digital Health

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. India Healthcare Business Intelligence Market Segmentation

4.1. By Source

4.1.1. Primary Data Sources

4.1.2. Secondary Data Sources

4.2. By Application

4.2.1. Clinical Analytics

4.2.2. Operational Analytics

4.2.3. Financial Analytics

4.3. By Deployment Mode

4.3.1. On-Premise

4.3.2. Cloud-Based

4.4. By End User

4.4.1. Healthcare Providers

4.4.2. Healthcare Payers

4.4.3. Pharmaceutical Companies

4.4.4. Research Organizations

4.5. By Region

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Healthcare Business Intelligence Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. IBM Watson Health

5.1.2. Oracle Corporation

5.1.3. Philips Healthcare

5.1.4. Siemens Healthineers

5.1.5. McKesson Corporation

5.1.6. HealthInsights Analytics

5.1.7. MedData Solutions

5.1.8. CareVision Analytics

5.1.9. BioStat Innovations

5.1.10. HealthIQ Technologies

5.2. Cross Comparison Parameters

5.2.1. Market Share

5.2.2. Revenue Growth Rate

5.2.3. Product Portfolio Diversity

5.2.4. Customer Satisfaction Ratings

5.2.5. Innovation Index

5.2.6. Geographic Presence

5.2.7. Strategic Partnerships and Alliances

5.2.8. Research and Development Investment

6. India Healthcare Business Intelligence Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. India Healthcare Business Intelligence Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Healthcare Business Intelligence Market Future Market Segmentation

8.1. By Source

8.1.1. Primary Data Sources

8.1.2. Secondary Data Sources

8.2. By Application

8.2.1. Clinical Analytics

8.2.2. Operational Analytics

8.2.3. Financial Analytics

8.3. By Deployment Mode

8.3.1. On-Premise

8.3.2. Cloud-Based

8.4. By End User

8.4.1. Healthcare Providers

8.4.2. Healthcare Payers

8.4.3. Pharmaceutical Companies

8.4.4. Research Organizations

8.5. By Region

8.5.1. North India

8.5.2. South India

8.5.3. East India

8.5.4. West India

9. India Healthcare Business Intelligence Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Healthcare Business Intelligence Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the India Healthcare Business Intelligence Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India Healthcare Business Intelligence Market.

Frequently Asked Questions

01. How big is the India Healthcare Business Intelligence Market?

The India Healthcare Business Intelligence Market is valued at USD 210 million, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the India Healthcare Business Intelligence Market?

Key challenges in the India Healthcare Business Intelligence Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the India Healthcare Business Intelligence Market?

Major players in the India Healthcare Business Intelligence Market include IBM Watson Health, Oracle Corporation, Philips Healthcare, Siemens Healthineers, McKesson Corporation, among others.

04. What are the growth drivers for the India Healthcare Business Intelligence Market?

The primary growth drivers for the India Healthcare Business Intelligence Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.