India Healthy Beverages Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD4872

November 2024

97

About the Report

India Healthy Beverages Market Overview

- The India healthy beverages market is valued at USD 4.5 billion, based on a five-year historical analysis. This market is driven by increasing consumer health consciousness, a growing focus on wellness, and the rise of lifestyle-related diseases such as obesity and diabetes. With a large population seeking healthier alternatives to sugary drinks, the market has gained traction. Additionally, government initiatives promoting healthier lifestyles and campaigns to reduce the consumption of sugary drinks have further supported market growth.

- Among Indian cities, Mumbai, Delhi, and Bengaluru dominate the healthy beverages market. These metropolitan areas lead due to their higher disposable incomes, greater health awareness, and urban lifestyles that prioritize convenience and wellness. Additionally, the presence of numerous retail outlets, both online and offline, combined with a strong influence of global health trends, has reinforced their leadership in this market.

- The Food Safety and Standards Authority of India (FSSAI) plays a critical role in regulating the ingredients, packaging, and labeling of healthy beverages. Compliance with FSSAI standards is mandatory for all manufacturers operating in the market. In 2023, the authority introduced new regulations concerning sugar content, promoting healthier beverage options. These guidelines require companies to display clear nutritional information on packaging, particularly highlighting sugar levels. Non-compliance can lead to product recalls or penalties. FSSAI's regulatory framework ensures the safety and transparency of healthy beverages available in the market.

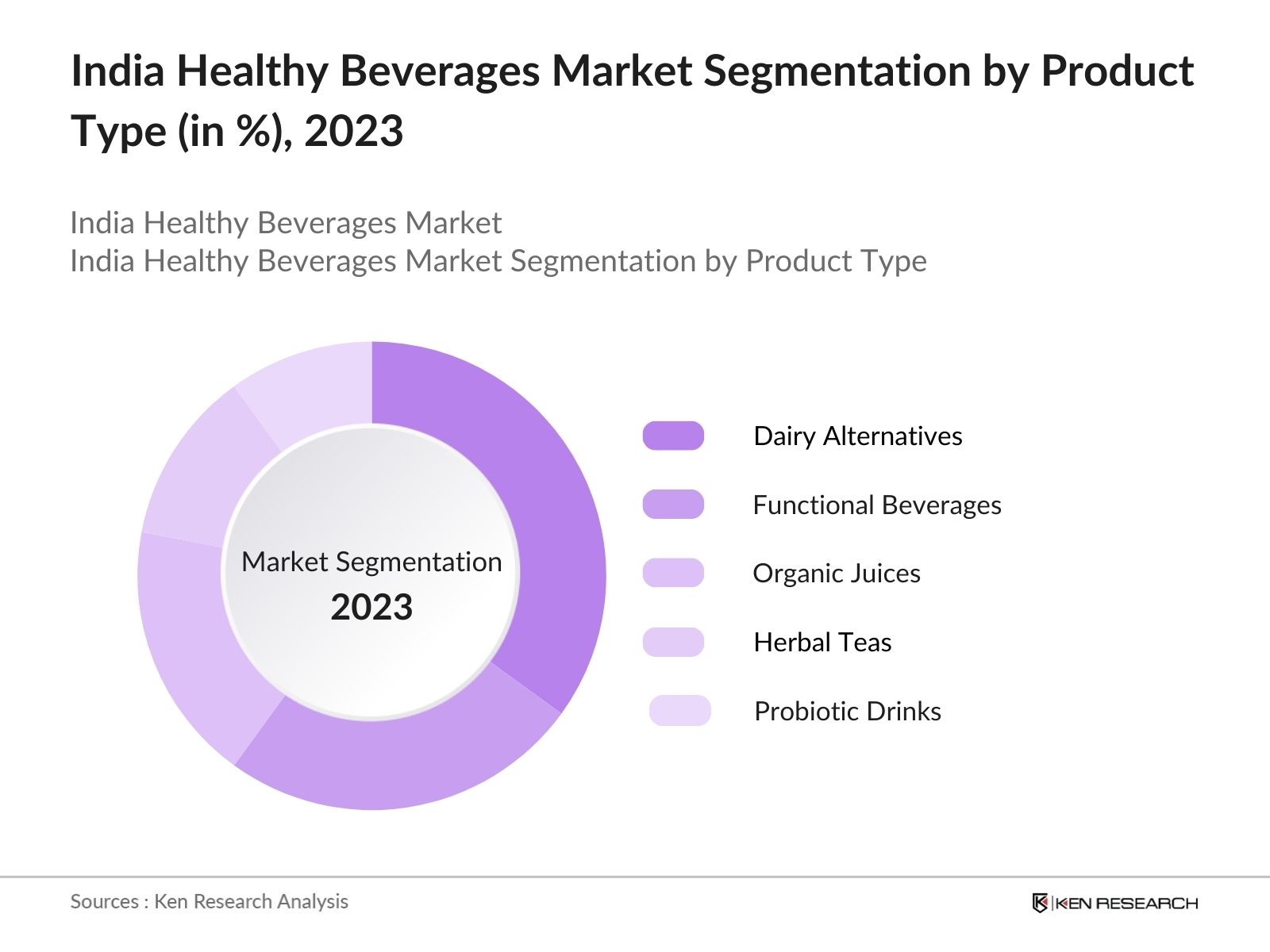

India Healthy Beverages Market Segmentation

By Product Type: The market is segmented by product type into functional beverages, organic juices, dairy alternatives, herbal teas, and probiotic drinks. Currently, dairy alternatives such as almond, soy, and oat milk have a dominant market share in this segment. This growth is largely attributed to the rise in lactose intolerance and dairy allergies, which has fueled consumer demand for plant-based beverages. Furthermore, dairy alternatives align with the global shift towards vegan and environmentally conscious consumption, thus bolstering their market presence.

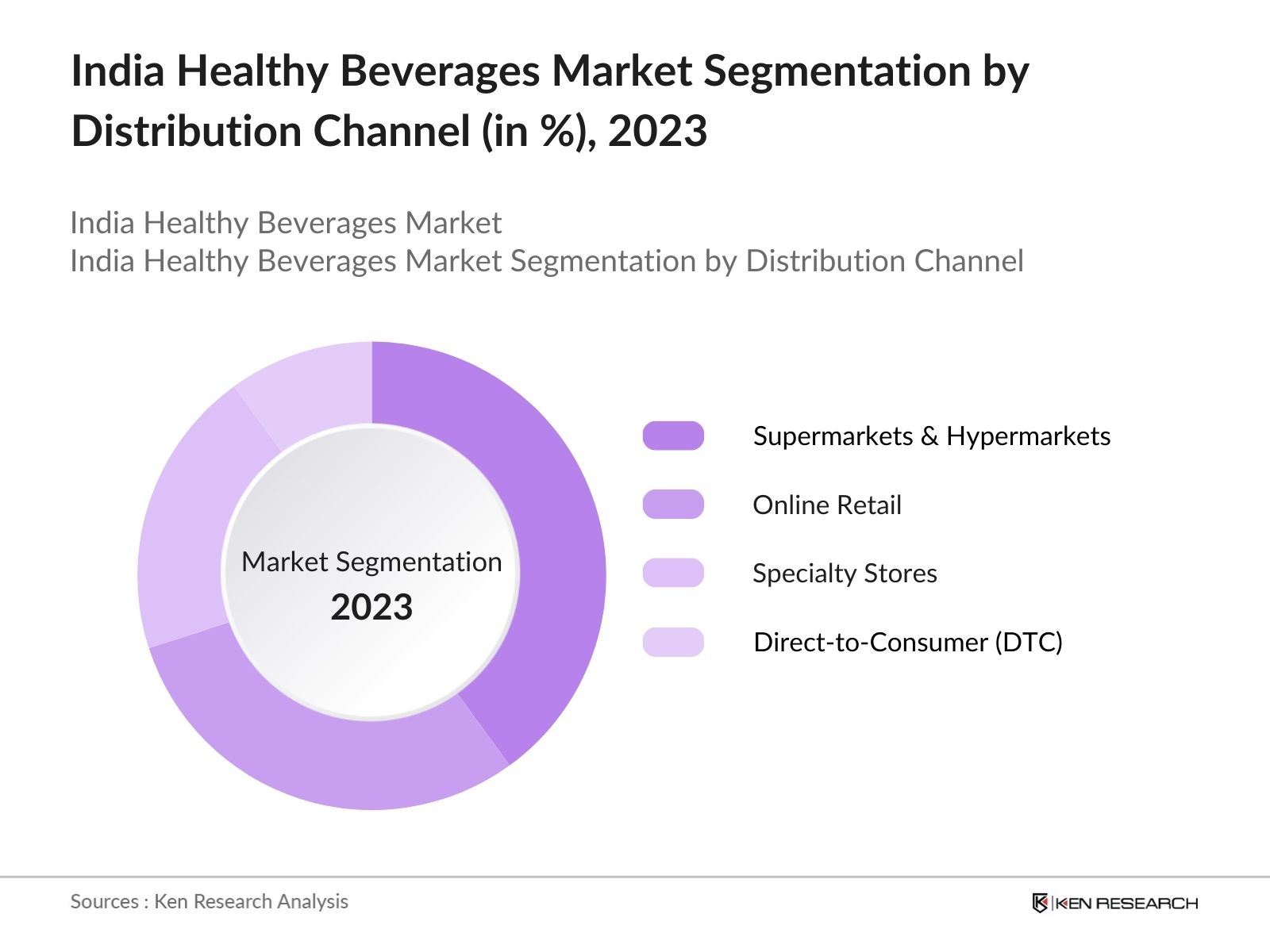

By Distribution Channel: The market is also segmented by distribution channel into supermarkets & hypermarkets, specialty stores, online retail, and direct-to-consumer channels. Supermarkets and hypermarkets dominate this segment, primarily due to their widespread presence across the country, especially in urban centers. Consumers prefer these stores as they offer a wide variety of healthy beverages and provide convenience. The availability of exclusive deals and the ability to physically inspect products before purchase further drive consumer preference toward this channel.

India Healthy Beverages Market Competitive Landscape

The India healthy beverages market is dominated by both domestic and international players. Companies like Dabur India, ITC Limited, and Tata Consumer Products hold market share, leveraging their extensive distribution networks and strong brand portfolios. Additionally, global giants like PepsiCo and Coca-Cola have entered the healthy beverages sector, focusing on product innovation and expanding their healthy beverage offerings in response to consumer demand. The competition is further intensified by the presence of emerging players like Raw Pressery and Paper Boat, who have capitalized on the increasing demand for organic and natural beverages.

|

Company Name |

Establishment Year |

Headquarters |

Product Range |

Revenue (2023) |

Distribution Channels |

R&D Investment |

Innovation Focus |

Sustainability Initiatives |

|

PepsiCo India |

1989 |

Gurugram, Haryana |

||||||

|

Dabur India Ltd. |

1884 |

Ghaziabad, UP |

||||||

|

Tata Consumer Products |

1964 |

Mumbai, Maharashtra |

||||||

|

ITC Limited |

1910 |

Kolkata, West Bengal |

||||||

|

Paper Boat (Hector Beverages) |

2010 |

Bengaluru, Karnataka |

India Healthy Beverages Industry Analysis

Growth Drivers

- Rising Health Consciousness: Health consciousness among Indian consumers is a driver for the healthy beverages market. In 2024, the emphasis on health and wellness has increased, partly due to the rise in non-communicable diseases like diabetes and cardiovascular conditions. According to the World Health Organization (WHO), 77 million adults in India have diabetes, leading to greater demand for low-sugar and functional beverages. Additionally, India's healthcare expenditure rose to $162 billion in 2023, reflecting the growing importance of health in lifestyle choices. This shift is motivating consumers to opt for beverages with functional benefits like detoxification and immunity boosting.

- Expansion of Urbanization: Urbanization has been a key contributor to the expansion of the healthy beverages market in India. According to the World Bank, 35% of Indias population now resides in urban areas, up from 33% in 2018. This migration has led to a shift in consumer behavior, with urban dwellers opting for convenience and health-focused products, including ready-to-drink (RTD) and functional beverages. Urban regions also exhibit higher disposable incomes, driving the purchase of premium healthy beverages. This trend is further supported by the increasing availability of these products in urban retail formats like supermarkets and online platforms.

- Increasing Disposable Income: Increasing disposable income has had a substantial impact on the demand for healthy beverages in India. The average per capita income in India rose to $2,379 in 2023, up from $1,964 in 2020, according to the Ministry of Statistics and Programme Implementation (MOSPI). This growth has enabled consumers to spend more on health-conscious products. As more middle-class consumers in urban and semi-urban areas prioritize health and wellness, the market for functional drinks, organic beverages, and low-calorie options is expanding. The rise in disposable income allows for premiumization within the beverage sector.

Market Challenges

- Lack of Consumer Awareness in Rural Areas: While urban consumers are increasingly health-conscious, rural areas in India still exhibit a lack of awareness about the benefits of healthy beverages. According to the 2023 National Family Health Survey (NFHS), only 42% of rural households actively seek health and wellness products. Limited access to information, coupled with restricted distribution channels, hampers market penetration in these areas. Furthermore, low disposable incomes in rural regions limit the affordability of premium health beverages, creating a barrier for manufacturers trying to expand their presence beyond urban centers.

- Regulatory Restrictions on Ingredients: Regulatory restrictions on ingredients used in healthy beverages pose a challenge to market growth. The Food Safety and Standards Authority of India (FSSAI) imposes strict guidelines on the permissible use of natural and synthetic ingredients. For example, limits on artificial sweeteners and preservatives have increased the complexity of formulating long-shelf-life products that meet consumer health expectations. In 2022, over 150 beverage products were either recalled or reformulated to comply with new FSSAI guidelines on additives. This regulatory oversight, while ensuring consumer safety, adds complexity and cost to the manufacturing process.

India Healthy Beverages Market Future Outlook

Over the next five years, the India healthy beverages market is expected to experience substantial growth. Factors driving this growth include increasing consumer health consciousness, the rise of e-commerce, and innovations in product offerings such as plant-based and functional beverages. Additionally, supportive government initiatives aimed at reducing sugar consumption and promoting healthier dietary habits will likely contribute to further expansion. As companies continue to invest in research and development, new products that cater to specific dietary needs and preferences are expected to enter the market, driving overall market performance.

Future Market Opportunities

- Growing Demand for Ready-to-Drink Beverages: The demand for ready-to-drink (RTD) healthy beverages has surged, driven by urban consumers seeking convenience alongside health benefits. According to data from the Ministry of Commerce, India saw a 20% year-on-year increase in RTD beverage imports in 2023, reflecting a growing consumer shift towards convenience foods and drinks. RTD beverages, particularly those with functional benefits like hydration and energy enhancement, are becoming popular among working professionals and young consumers in metropolitan areas. This shift presents opportunities for domestic producers to introduce competitive offerings tailored to local tastes and health preferences.

- Market Expansion in Tier-2 and Tier-3 Cities: There is a growing opportunity for the expansion of the healthy beverages market in India's Tier-2 and Tier-3 cities, where disposable incomes have steadily increased. According to the National Sample Survey Office (NSSO), per capita consumption in these regions grew by 15% in 2023, indicating a rising ability to purchase health-oriented products. Companies targeting these cities can capitalize on the growing demand for nutritious and functional beverages, particularly in formats that align with local preferences, such as affordable single-serve packaging. The expansion of organized retail and e-commerce channels further supports this opportunity.

Scope of the Report

|

Product Type |

Functional Beverages Organic Juices Dairy Alternatives (Almond, Soy, Oat) Herbal Teas Probiotic Drinks |

|

Distribution Channel |

Supermarkets & Hypermarkets Specialty Stores Online Retail Direct-to-Consumer (DTC) |

|

Packaging Type |

Bottles (Glass, PET) Cans Cartons Pouches |

|

Consumer Age Group |

Children & Teenagers Young Adults Middle-aged Adults Seniors |

|

Region |

North South West East |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FSSAI, Ministry of Health and Family Welfare)

Beverage Manufacturers

Retail Chains and Supermarkets

E-commerce Platforms

Dairy and Non-dairy Alternative Producers

Functional Beverage Brands

Packaging and Bottling Companies

Companies

Major Players

PepsiCo India

Dabur India Ltd.

Tata Consumer Products

ITC Limited

The Coca-Cola Company

Amul (GCMMF)

Parle Agro Pvt. Ltd.

Paper Boat (Hector Beverages)

Himalaya Wellness

Marico Limited

Raw Pressery

Patanjali Ayurved Ltd.

Mother Dairy

Bisleri International

Manpasand Beverages

Table of Contents

1. India Healthy Beverages Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Healthy Beverages Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Healthy Beverages Market Analysis

3.1. Growth Drivers

3.1.1. Rising Health Consciousness (consumer behavior trends)

3.1.2. Expansion of Urbanization (urbanization impact on consumption)

3.1.3. Increasing Disposable Income (disposable income influence)

3.1.4. Government Initiatives for Health Promotion (regulatory framework)

3.2. Market Challenges

3.2.1. High Production Costs (cost structure analysis)

3.2.2. Lack of Consumer Awareness in Rural Areas (market penetration challenges)

3.2.3. Regulatory Restrictions on Ingredients (regulatory challenges)

3.3. Opportunities

3.3.1. Product Innovations (functional beverages, organic offerings)

3.3.2. Growing Demand for Ready-to-Drink Beverages (consumer preference shifts)

3.3.3. Market Expansion in Tier-2 and Tier-3 Cities (regional opportunity mapping)

3.4. Trends

3.4.1. Shift Toward Plant-Based Beverages (consumer lifestyle changes)

3.4.2. Growth in E-commerce Distribution Channels (e-commerce penetration)

3.4.3. Increasing Focus on Natural Sweeteners (product differentiation strategies)

3.5. Government Regulation

3.5.1. Food Safety and Standards Authority of India (FSSAI) Regulations (compliance overview)

3.5.2. Taxation Policies on Sugary Drinks (policy impacts on healthy beverage consumption)

3.5.3. Public-Private Partnerships in Promoting Nutrition (collaborative market efforts)

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. India Healthy Beverages Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Functional Beverages

4.1.2. Organic Juices

4.1.3. Dairy Alternatives (Almond, Soy, Oat)

4.1.4. Herbal Teas

4.1.5. Probiotic Drinks

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets & Hypermarkets

4.2.2. Specialty Stores

4.2.3. Online Retail

4.2.4. Direct-to-Consumer (DTC)

4.3. By Packaging Type (In Value %)

4.3.1. Bottles (Glass, PET)

4.3.2. Cans

4.3.3. Cartons

4.3.4. Pouches

4.4. By Consumer Age Group (In Value %)

4.4.1. Children & Teenagers

4.4.2. Young Adults

4.4.3. Middle-aged Adults

4.4.4. Seniors

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. West

4.5.4. East

5. India Healthy Beverages Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. PepsiCo India

5.1.2. Dabur India Ltd.

5.1.3. Tata Consumer Products

5.1.4. ITC Limited

5.1.5. The Coca-Cola Company

5.1.6. Amul (GCMMF)

5.1.7. Parle Agro Pvt. Ltd.

5.1.8. Paper Boat (Hector Beverages)

5.1.9. Himalaya Wellness

5.1.10. Marico Limited

5.1.11. Raw Pressery

5.1.12. Patanjali Ayurved Ltd.

5.1.13. Mother Dairy

5.1.14. Bisleri International

5.1.15. Manpasand Beverages

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Product Range, Market Share, Distribution Network, Product Innovation)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Healthy Beverages Market Regulatory Framework

6.1. Food and Safety Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. India Healthy Beverages Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Healthy Beverages Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Packaging Type (In Value %)

8.4. By Consumer Age Group (In Value %)

8.5. By Region (In Value %)

9. India Healthy Beverages Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, the research focuses on constructing a comprehensive map of the India healthy beverages market by identifying all relevant stakeholders. This involves extensive desk research using industry databases, reports, and publicly available information to gather insights into consumer preferences, regulatory frameworks, and major market drivers.

Step 2: Market Analysis and Construction

This phase involves analyzing historical market data, including production, consumption, and distribution statistics. The market analysis focuses on understanding trends in product segments like dairy alternatives and functional beverages, as well as evaluating market penetration in various regions across India.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are formed based on the gathered data and are validated through consultations with industry experts. These consultations help refine the research by providing insights on market trends, consumer behavior, and operational challenges faced by beverage manufacturers.

Step 4: Research Synthesis and Final Output

The final phase synthesizes data from primary and secondary sources, with a specific focus on verifying statistics through a bottom-up approach. This includes direct engagement with major players in the healthy beverage sector, ensuring the accuracy and relevance of the final market analysis.

Frequently Asked Questions

01 How big is the India Healthy Beverages Market?

The India healthy beverages market is valued at USD 4.5 billion, driven by rising consumer health consciousness, increasing disposable income, and growing demand for plant-based and functional beverages.

02 What are the challenges in the India Healthy Beverages Market?

Challenges in the market include high production costs, regulatory hurdles related to ingredient approvals, and limited consumer awareness in rural areas, making market penetration more difficult.

03 Who are the major players in the India Healthy Beverages Market?

Major players in the market include PepsiCo India, Dabur India Ltd., Tata Consumer Products, ITC Limited, and Paper Boat. These companies have a strong presence due to their wide distribution networks and focus on product innovation.

04 What are the growth drivers of the India Healthy Beverages Market?

The market is driven by rising health consciousness, the growth of e-commerce, and product innovations such as plant-based beverages. Government campaigns promoting healthier dietary choices also play a crucial role in market expansion.

05 Which product segment is dominating the India Healthy Beverages Market?

Dairy alternatives, such as almond, soy, and oat milk, currently dominate the market due to the increasing prevalence of lactose intolerance and consumer interest in vegan and plant-based diets.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.