India Heavy Load Moving Equipment Market Outlook to 2029

Region:Asia

Author(s):Harsh Saxena

Product Code:KR1512

July 2025

90

About the Report

India Heavy Load Moving Equipment Market Overview

- The India Heavy Load Moving Equipment Market was valued at USD 1.70 million. This value reflects the broader construction and material handling equipment segments, which are driven by the rapid expansion of the construction and logistics sectors, increasing demand for heavy machinery and equipment. The surge in infrastructure projects—including roads, bridges, and warehouses—continues to fuel market growth as companies seek efficient solutions for moving heavy loads.

- Key cities dominating this market include Mumbai, Delhi, and Bengaluru, primarily due to their roles as major industrial and commercial hubs. These cities have a high concentration of construction activities and logistics operations, necessitating the use of heavy-load moving equipment. The presence of numerous manufacturing units and warehouses in these regions further contributes to their market dominance.

- In 2023, the Indian government approved eight new railway projects across 14 districts, adding 900 km of new lines. This initiative aims to enhance rail connectivity and reduce logistics costs, with an estimated cost of $2.8 billion. These projects are expected to drive strong demand for heavy-load moving equipment—especially rollers, jacks, and material transport systems—as infrastructure upgrades and station construction intensify under schemes like Amrit Bharat for network modernization.

India Heavy Load Moving Equipment Market Segmentation

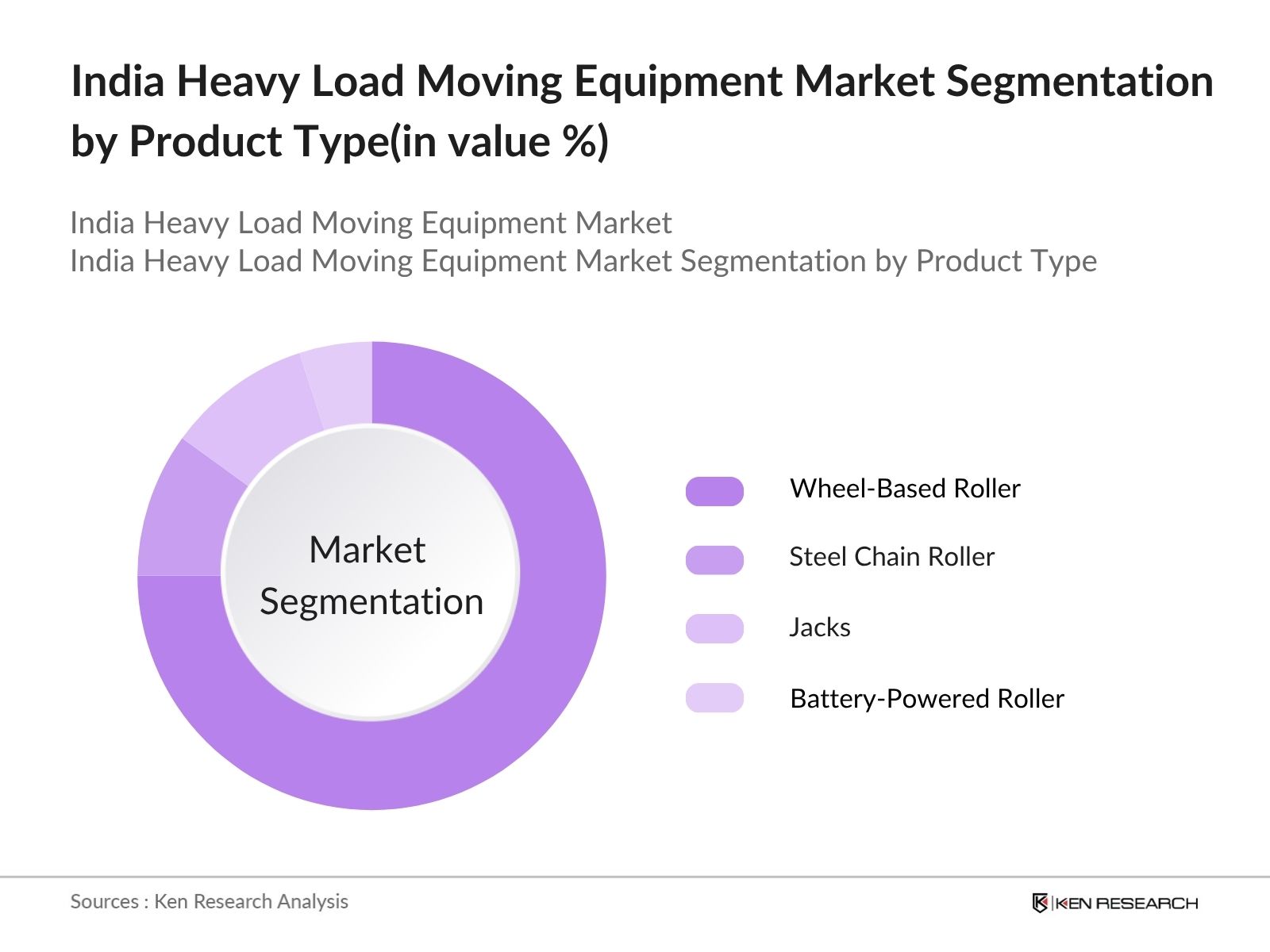

By Product Type: The heavy load moving equipment market is segmented into wheel-based rollers, steel chain rollers, and jacks, and battery-powered rollers. Wheel-based rollers hold the largest share, favored for their mobility, ease of use, and versatility in moving heavy machinery across flat surfaces. Steel chain rollers are commonly used in high-load and industrial settings requiring durability and load stability. Jacks battery-powered rollers are gaining traction due to their automation, efficiency, and suitability for precision movement in constrained spaces. The shift toward powered and ergonomic solutions reflects growing demand for safer and more efficient heavy-load handling systems.

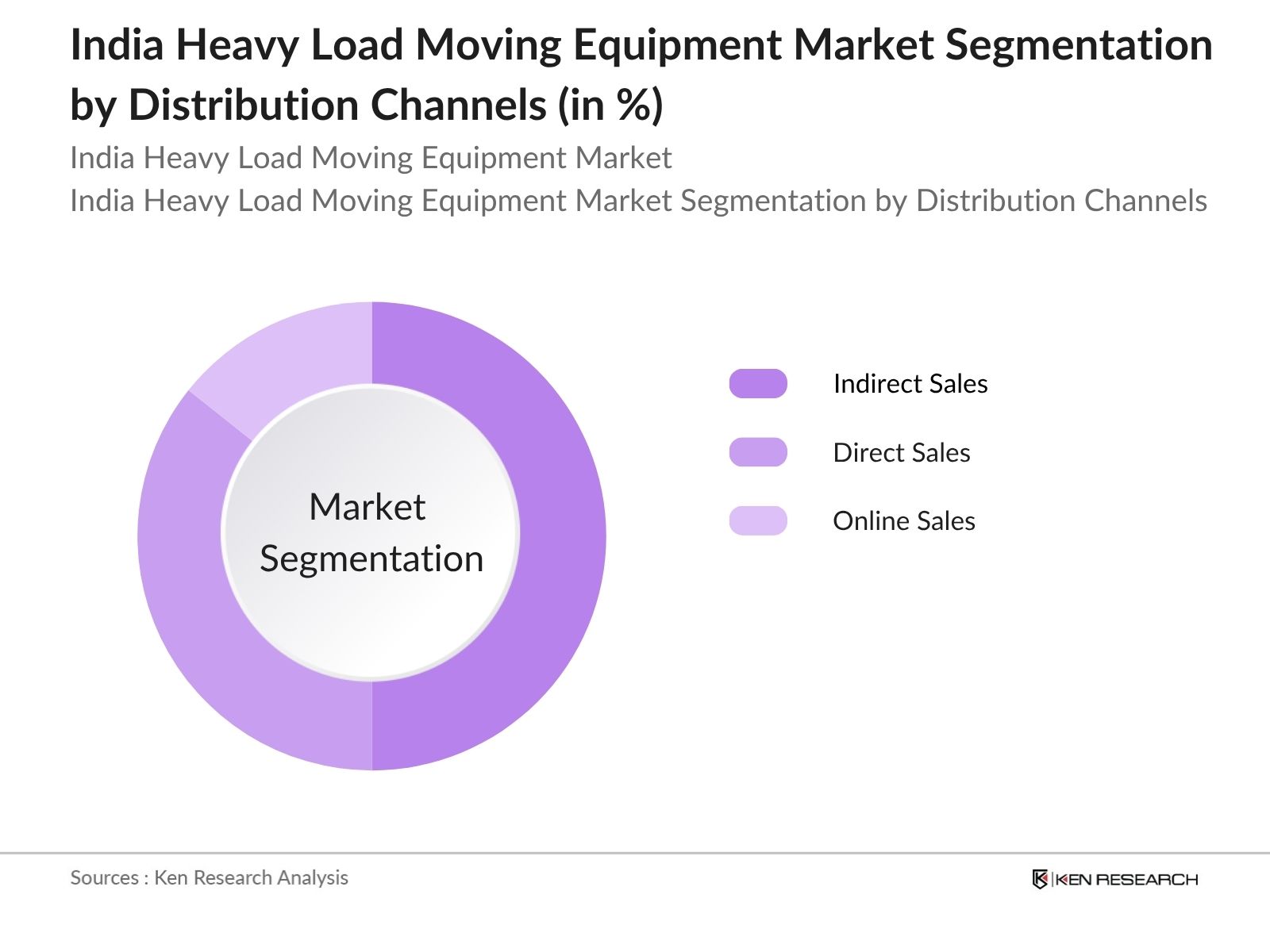

By Distribution Channels: The market can also be segmented based on distribution channels, including indirect sales, direct sales, and online sales. Indirect sales lead the market, supported by a strong network of dealers, distributors, and rental agencies that provide reach and localized support. Direct sales are prominent among large enterprises seeking customized equipment solutions and long-term contracts. Online sales are emerging rapidly, driven by digital platforms offering transparent pricing, product comparisons, and ease of booking, particularly appealing to SMEs and short-term renters looking for convenience and quick turnaround.

India Heavy Load Moving Equipment Market Competitive Landscape

The India Heavy Load Moving Equipment Market is characterized by a competitive landscape with several key players, including SARP Steel, Borkey Gmbha, and Easy Shifter. These companies are known for their innovative solutions and extensive product portfolios, catering to various industries. The market is moderately concentrated, with both local and international players striving to enhance their market presence through technological advancements and strategic partnerships.

India Heavy Load Moving Equipment Market Industry Analysis

Growth Drivers

- Accelerated Infrastructure Development Initiatives: India’s infrastructure investments are intensifying, with targets to expand 10,000 km of highways and develop 35 Multi-Modal Logistics Parks by FY’2030. These projects are enhancing freight corridors and port-road connectivity, increasing demand for heavy-load moving equipment such as rollers and jacks. Efficient logistics support is essential to execute large-scale construction and transport operations within timelines, fueling equipment uptake.

- Manufacturing-Led Industrial Growth: India’s ambition to achieve USD 1 trillion in manufacturing exports by 2030 is driving rapid industrialization. With abundant raw materials and supportive policies, new manufacturing hubs are emerging across the country. These facilities require dependable and scalable material handling solutions—including chain rollers and wheel-based movers—to streamline operations and reduce downtime, driving strong market demand.

- Refinery Expansion and Component Handling Needs: India’s refining capacity is projected to rise from 254 MMTPA in 2022 to over 450 MMTPA by 2030. This expansion, including major projects like the $14 Bn HPCL Rajasthan Refinery, demands frequent movement of reactors, modules, and columns. Specialized heavy-load movers are critical for safe and timely equipment transfer across sites, making refinery development a key demand driver.

Market Challenges

- High Import Tariffs and Cost Pressures: Imported heavy-load moving equipment faces elevated duties, customs taxes, and logistics charges, raising landed costs significantly for mid-sized Indian manufacturers. This creates affordability challenges, especially for SMEs. As a result, many companies hesitate to procure high-quality global products, slowing innovation and limiting access to technologically advanced equipment in India.

- Low Automation and Digitization Adoption: India lags behind global peers in integrating automation and IoT-driven systems into heavy load movement solutions. Battery-powered rollers remain underutilized due to cost concerns and limited awareness. With low adoption of remote-controlled and AI-driven technologies, labor dependence remains high—causing operational inefficiencies and stunting modernization efforts across the sector.

India Heavy Load Moving Equipment Market Future Outlook

The future of the India heavy load moving equipment market appears promising, driven by ongoing infrastructure projects and the increasing adoption of automation technologies. As companies seek to enhance efficiency and reduce costs, the demand for advanced equipment is expected to rise. Additionally, the shift towards eco-friendly solutions will likely influence equipment design and manufacturing processes, aligning with global sustainability trends. Overall, the market is poised for significant growth, supported by favorable government policies and industry innovations.

Market Opportunities

- Policy-Driven Infrastructure Boost: With a government allocation of USD 130.3 billion toward infrastructure in FY’2025–26 under programs like NLP and PLI, the demand for heavy-load moving equipment is expected to surge. These policy initiatives aim to enhance manufacturing and logistics capacities, offering suppliers opportunities to scale operations and meet the growing equipment needs across infrastructure projects.

- Export Market Growth Potential: India's exports are projected to reach USD 870 billion by FY’26, driven by competitive manufacturing costs compared to Western markets. This positions Indian heavy-load equipment providers to tap into global demand. Expansion into export markets offers a strategic growth avenue, enabling Indian manufacturers to diversify revenue streams and enhance their global footprint.

Scope of the Report

| By Product Type |

Wheel-Based Roller Steel Chain Roller Jacks Battery-Powered Roller |

| By Distribution Channels |

Indirect Sales Direct Sales Online Sales |

| By Region |

South West North East |

| By End Users |

Infrastructure General Manufacturing Rigging Energy Medical |

| By Product Origin |

Domestic Imported |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Heavy Industries and Public Enterprises, Bureau of Indian Standards)

Manufacturers and Producers

Distributors and Retailers

Construction and Infrastructure Companies

Logistics and Transportation Firms

Mining and Resource Extraction Companies

Financial Institutions

Companies

Players Mentioned in the Report:

SARP Steel

Borkey Gmbh

Easy Shifter

Enerpac

GKS

Hilman

HTS Direct

KION Group

- Nido Machinery

- New National Hydraulics

Table of Contents

1. Market Overview of India Heavy Load Moving Equipment for Concrete and Track Market

1.1 Country Overview

1.2 India Industrial Landscape

1.3 Ecosystem of India Heavy Load Moving Equipment for Concrete and Track Market

1.4 Industrial Landscape: Product Overview

1.4 Value Chain Analysis

2. Industry Analysis of India Heavy Load Moving Equipment for Concrete and Track Market

2.1 Growth Driver of India Heavy Load Moving Equipment for Concrete and Track Market

2.2 Government Initiative for India Heavy Load Moving Equipment for Concrete and Track Market

2.3 Challenges and Restraints

2.4 SWOT Analysis for India Heavy Load Moving Equipment for Concrete and Track Market

3. Regulatory Framework for India Heavy Load Moving Equipment for Concrete and Track Market

3.1 Standardization of Roller

3.2 Regulatory Framework

4. India Heavy Load Moving Equipment for Concrete and Track Market Sizing & Segmentation

4.1 Executive Summary: India Heavy Load Moving Equipment for Concrete and Track Market

4.2 Heavy Load Moving Equipment for Concrete & Track Market Size

4.3 Heavy Load Moving Equipment for Concrete & Track Market By Type

4.4 Heavy Load Moving Equipment for Concrete & Track Market By Distribution Channels

4.5 Heavy Load Moving Equipment for Concrete & Track Market by Region

4.6 Heavy Load Moving Equipment for Concrete & Track Market by End Users

4.7 Heavy Load Moving Equipment for Concrete & Track Market by Product Origin

5. India Steel Chain Roller Market Sizing & Segmentation

5.1 India Steel Chain Roller Market Size

5.2 India Steel Chain Roller Market Segmentation by Distribution Channel

5.3 India Steel Chain Roller Market Segmentation by End User

6. India Wheel-Based Roller Market Size

6.1 India Wheel-Based Roller Market Size

6.2 India Wheel-Based Roller Market Segmentation by Distribution Channels

6.3 India Wheel-Based Roller Market Segmentation by End Users

6.4 India Wheel-Based Roller Market Segmentation by Product Type

7. India Battery-Powered Roller Market Sizing & Segmentation

7.1 India Battery-Powered Roller Market Size

7.2 India Battery-Powered Roller Market Segmentation by Distribution Channels

7.3 India Battery-Powered Roller Market Segmentation by End User

8. India Tow Jacks for Heavy Load Moving Rollers Market Size & Segmentation

8.1 India Jack for Heavy Load Moving Equipment for Concrete & Track Market Size

8.2 India Jack for Heavy Load Moving Equipment for Concrete & Track Market Segmentation by Distribution Channels

8.3 India Jack for Heavy Load Moving Equipment for Concrete & Track Segmentation by End User

9. Competition Analysis of India Heavy Load Moving Equipment for Concrete and Track

9.1 Product Categorization by Brand

9.2 Company Profile: SARP Steel

9.3 Competition Analysis: Key Strategies by Major Player

9.4 Market Competitiveness of Chinese, Indian, and Other Competitors

9.5 Competition Analysis: Competition Benchmarking

9.6 Competition Analysis: Steel Chain Roller Market Share Analysis

9.7 Competition Analysis: Wheel-Based Roller Market Share Analysis

9.8 Scenario of Online Players

10. Consumer Behavior Study

10.1 Consumer Behavior Study Analysis

11. Analyst Recommendation

11.1 Analyst Recommendation: Gap Analysis

11.2 Analyst Recommendations: Distribution Strategy

11.3 Analyst Recommendations: TAM, SAM & SOM Analysis

12. Research Methodology

12.1 Market Definition

12.2 Research Methodology for Market Assessment

12.3 Research Methodology for Consumer Behavior Study

13. Disclaimer

14. Contact US

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Heavy Load Moving Equipment Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the India Heavy Load Moving Equipment Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India Heavy Load Moving Equipment Market.

Frequently Asked Questions

01. How big is the India Heavy Load Moving Equipment Market?

The India Heavy Load Moving Equipment Market is valued at USD 1.70 Million, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the India Heavy Load Moving Equipment Market?

Key challenges in the India Heavy Load Moving Equipment Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the India Heavy Load Moving Equipment Market?

Major players in the India Heavy Load Moving Equipment Market include KION Group, Toyota Industries Corporation, JCB India Ltd, Volvo Construction Equipment, Mahindra & Mahindra Ltd, among others.

04. What are the growth drivers for the India Heavy Load Moving Equipment Market?

The primary growth drivers for the India Heavy Load Moving Equipment Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.