India Hernia Mesh Devices Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD3282

December 2024

92

About the Report

India Hernia Mesh Devices Market Overview

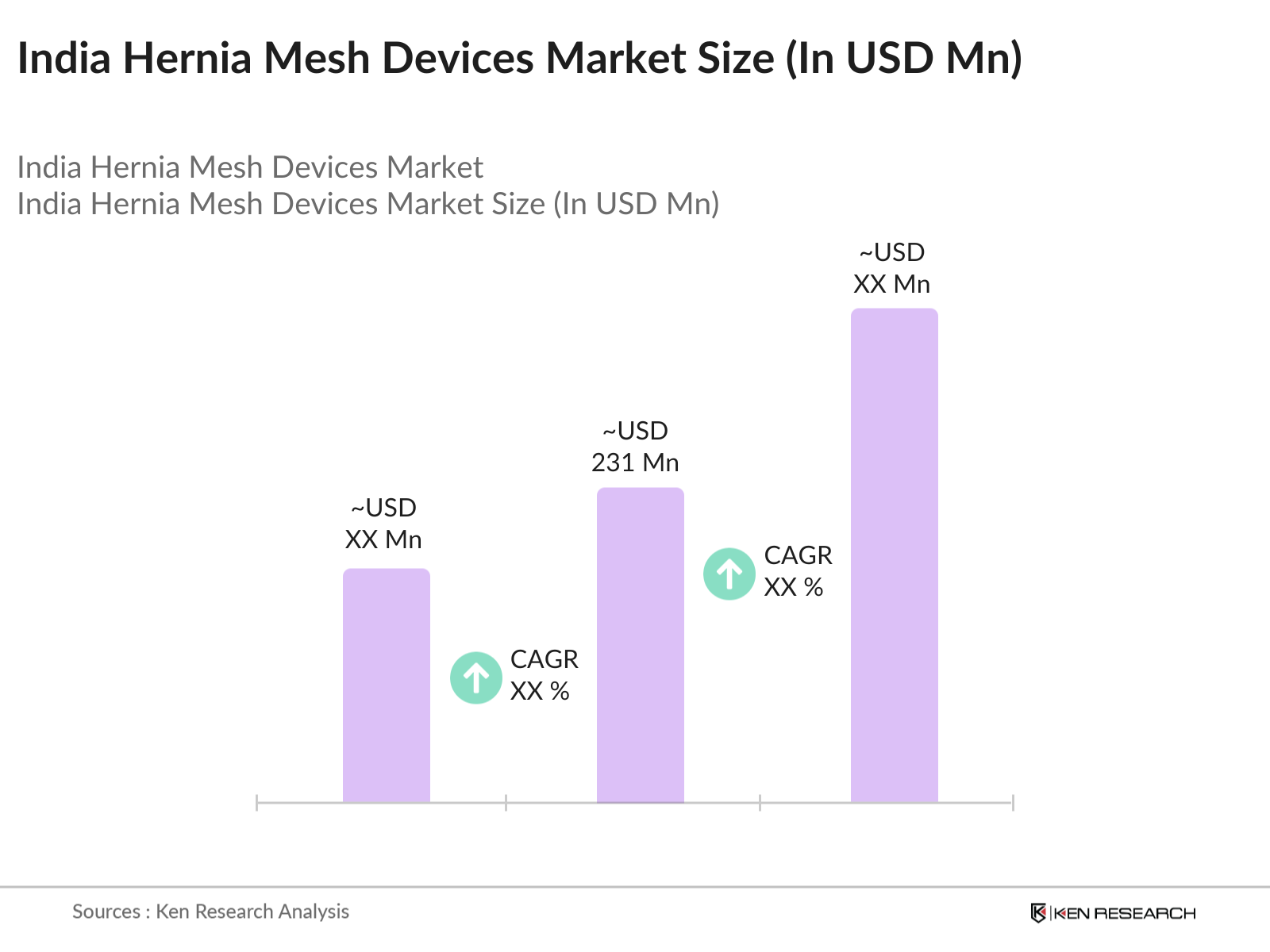

- The India Hernia Mesh Devices market is valued at USD 231 million, driven primarily by the increasing number of hernia surgeries due to the rise in the elderly population and lifestyle factors such as obesity and physical inactivity. This market growth is further propelled by advancements in medical technology, specifically in laparoscopic and minimally invasive surgeries, leading to higher adoption of advanced hernia mesh products in the healthcare sector.

- Key cities like Mumbai, Delhi, and Bangalore dominate the market due to the high concentration of advanced medical facilities, skilled surgeons, and the presence of major healthcare institutions. Additionally, these cities serve as hubs for medical tourism, attracting patients both domestically and internationally. The robust infrastructure and access to modern healthcare technologies in these regions make them prominent in the hernia mesh devices market.

- Medical devices in India, including hernia mesh products, are regulated under the Medical Devices Rules of 2023, which have been revised to address growing concerns around product safety and quality. As of 2023, all medical devices are classified based on their risk profile, and hernia meshes fall under the "moderate risk" category, requiring stringent documentation and approval processes. The National Health Authority (NHA) reported that regulatory approval for medical devices takes between 12 to 18 months due to the need for clinical trials and certification.

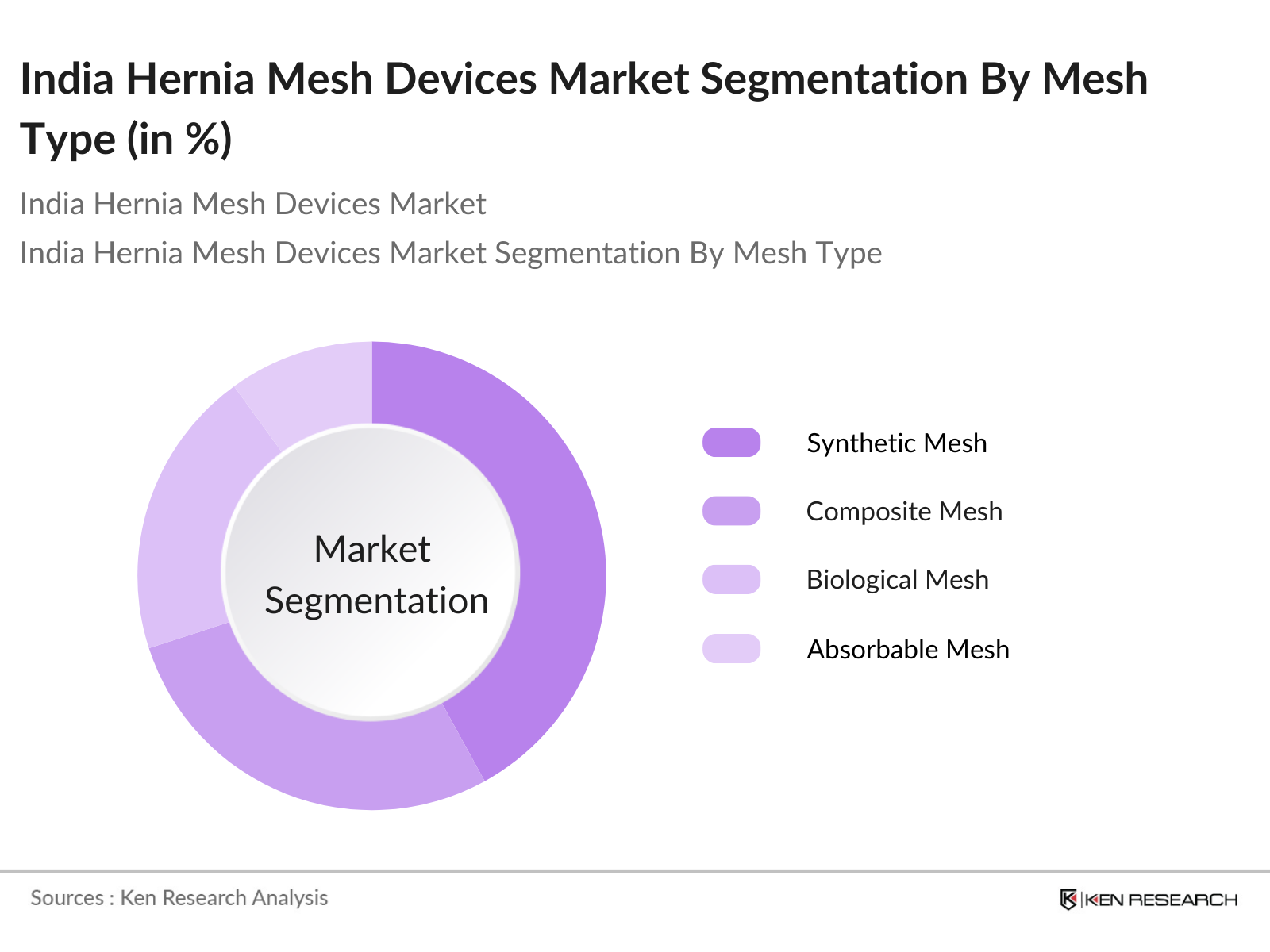

India Hernia Mesh Devices Market Segmentation

By Mesh Type: The market is segmented by mesh type into Synthetic Mesh, Composite Mesh, Biological Mesh, and Absorbable Mesh. Synthetic mesh holds the dominant market share in India under the segmentation of mesh type. The key reasons behind its dominance include its cost-effectiveness and widespread availability. Surgeons also prefer synthetic mesh due to its established track record of high success rates and reduced postoperative complications compared to other materials.

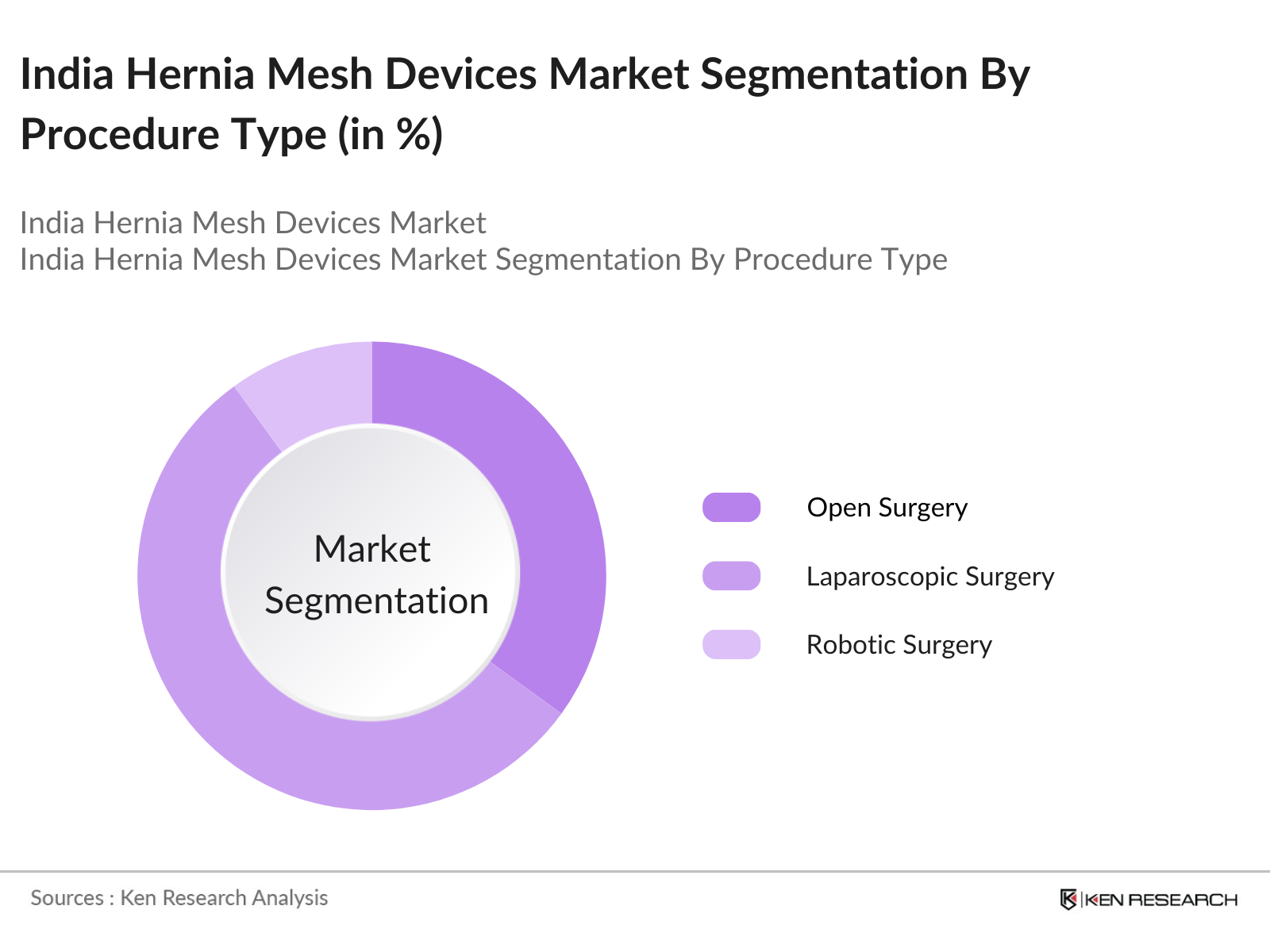

By Procedure Type: The market is also segmented by procedure type into Open Surgery, Laparoscopic Surgery, and Robotic Surgery. Laparoscopic surgery dominates the market share in this segment due to its minimally invasive nature, leading to faster recovery times and fewer postoperative complications. This technique is highly preferred in urban hospitals and is growing in rural areas as well due to increased awareness and training of healthcare professionals.

India Hernia Mesh Devices Market Competitive Landscape

The India Hernia Mesh Devices market is dominated by both global and local players, with companies focusing on expanding their product portfolios and adopting new technologies to enhance patient outcomes. The major players in this market include:

India Hernia Mesh Devices Industry Analysis

Growth Drivers

- Rising Hernia Cases (Increasing Prevalence of Hernia): India has witnessed an alarming rise in hernia cases due to sedentary lifestyles and a lack of access to preventive healthcare. In 2022, the Ministry of Health and Family Welfare reported that India had over 1.5 million hernia repair surgeries annually, with a noticeable increase in cases attributed to inguinal hernias, especially among middle-aged and elderly men.

- Advancements in Surgical Techniques (Introduction of Laparoscopic Surgery): In recent years, laparoscopic surgery has become the preferred method for hernia repair in India. In 2023, over 70% of hernia surgeries were performed using laparoscopic techniques, according to data from the Indian Association of Gastrointestinal Endosurgeons (IAGES). This shift towards minimally invasive procedures has reduced patient recovery time and hospital stays, thus increasing the demand for advanced hernia mesh devices.

- Increasing Geriatric Population (Demographic Shifts): Indias geriatric population is rapidly increasing, with projections from the National Statistical Office (NSO) showing that by 2024, individuals aged 60 years and above will represent 12% of the total population. Hernia incidence is significantly higher among this demographic due to age-related muscle degeneration, making them a key target group for hernia mesh device manufacturers.

Market Challenges

- High Costs of Hernia Mesh Devices (Price Sensitivity of Indian Market): The high cost of hernia mesh devices remains a significant barrier in the Indian market, particularly in rural areas where healthcare expenditure per capita remains low. As per the Reserve Bank of India (RBI), the average monthly per capita healthcare expenditure in rural areas stood at just INR 318 in 2022, compared to INR 809 in urban regions.

- Availability of Counterfeit Products (Unregulated Market Risks): Counterfeit hernia mesh devices have become a growing concern in India, particularly in non-urban areas where regulatory enforcement is weaker. A report from the Directorate General of Health Services (DGHS) in 2023 indicated that nearly 15% of hernia mesh devices sold in tier 2 and tier 3 cities were counterfeit, leading to an increase in post-operative complications and device failure.

India Hernia Mesh Devices Market Future Outlook

Over the next five years, the India Hernia Mesh Devices market is expected to witness significant growth, driven by the increasing prevalence of hernia conditions, rising geriatric population, and the growing adoption of minimally invasive surgical techniques. Technological advancements in mesh materials, including 3D and biologic mesh, will play a key role in shaping the future of this market.

Market Opportunities

- Growth of Medical Tourism (India as a Hub for Affordable Surgeries): Indias medical tourism sector has grown substantially, with over 2 million international patients seeking medical treatment in 2023. The Ministry of Tourism highlights those medical procedures in India cost between 30% to 40% less than in Western countries, making it a preferred destination for affordable surgeries, including hernia repairs. With the increasing global focus on affordable yet high-quality healthcare, India's hernia mesh market stands to benefit significantly from this influx of foreign patients seeking low-cost, advanced surgical options.

- Focus on Minimally Invasive Surgeries (Increased Adoption of Laparoscopy): India has seen a marked shift towards minimally invasive surgeries, with laparoscopic procedures for hernia repairs rising by 15% in 2023, as reported by the Indian Council of Medical Research (ICMR). This trend is driven by the advantages of quicker recovery times, reduced post-operative pain, and fewer complications compared to open surgeries.

Scope of the Report

|

By Mesh Type |

Synthetic Mesh Composite Mesh Biological Mesh Absorbable Mesh |

|

By Hernia Type |

Inguinal Hernia Incisional Hernia Femoral Hernia Umbilical Hernia Other Hernias |

|

By Procedure Type |

Open Surgery Laparoscopic Surgery Robotic Surgery |

|

By End User |

Hospitals Ambulatory Surgical Centers Clinics |

|

Region |

North India South India East India West India |

Products

Key Target Audience

Hernia Mesh Manufacturers

Hospitals and Ambulatory Surgical Centers

Distributors and Wholesalers of Medical Devices

Government and Regulatory Bodies (CDSCO, Ministry of Health and Family Welfare)

Private and Public Healthcare Institutions

Investment and Venture Capital Firms

Medical Device Importers and Exporters

Medical Research Institutions

Companies

Players Mentioned in the Report

Johnson & Johnson Pvt. Ltd.

Medtronic India Pvt. Ltd.

B. Braun Medical India Pvt. Ltd.

W. L. Gore & Associates

Cook Medical India

C. R. Bard India

Hernimesh India Pvt. Ltd.

Atrium Medical Corporation

Aesculap India Pvt. Ltd.

Ethicon India

Lifecare Devices Pvt. Ltd.

Viking Surgical India Pvt. Ltd.

Maquet India Pvt. Ltd.

Jullundur Surgical Works (JSW)

Stryker India Pvt. Ltd.

Table of Contents

1. India Hernia Mesh Devices Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Market CAGR, growth momentum, Y-o-Y growth)

1.4. Market Segmentation Overview

2. India Hernia Mesh Devices Market Size (In INR and USD Mn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis (Revenue-based growth trajectory)

2.3. Key Market Developments and Milestones (Technological advancements, product launches, and regulatory approvals)

3. India Hernia Mesh Devices Market Analysis

3.1. Growth Drivers

3.1.1. Rising Hernia Cases (Increasing prevalence of hernia)

3.1.2. Advancements in Surgical Techniques (Introduction of laparoscopic surgery)

3.1.3. Increasing Geriatric Population (Demographic shifts)

3.1.4. Growing Healthcare Expenditure (Government and private healthcare investments)

3.2. Market Challenges

3.2.1. High Costs of Hernia Mesh Devices (Price sensitivity of Indian market)

3.2.2. Regulatory Compliance (Complications in obtaining medical device approvals)

3.2.3. Availability of Counterfeit Products (Unregulated market risks)

3.3. Opportunities

3.3.1. Growth of Medical Tourism (India as a hub for affordable surgeries)

3.3.2. Focus on Minimally Invasive Surgeries (Increased adoption of laparoscopy)

3.3.3. Expansion into Tier 2 and Tier 3 Cities (Untapped rural markets)

3.4. Trends

3.4.1. Adoption of 3D and Biologic Mesh (Preference for biocompatible materials)

3.4.2. Increasing R&D on Mesh Fixation Techniques (Innovations in self-fixating meshes)

3.4.3. Integration with AI-based Surgical Tools (Data-driven surgical procedures)

3.5. Government Regulation

3.5.1. Central Drugs Standard Control Organization (CDSCO) Guidelines

3.5.2. Medical Device Regulations in India (Regulatory hurdles)

3.5.3. Product Approval and Certification Requirements (Compliance standards for mesh devices)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem (Distribution networks, strategic alliances)

4. India Hernia Mesh Devices Market Segmentation

4.1. By Mesh Type (In Value %)

4.1.1. Synthetic Mesh

4.1.2. Composite Mesh

4.1.3. Biological Mesh

4.1.4. Absorbable Mesh

4.2. By Hernia Type (In Value %)

4.2.1. Inguinal Hernia

4.2.2. Incisional Hernia

4.2.3. Femoral Hernia

4.2.4. Umbilical Hernia

4.2.5. Other Hernias

4.3. By Procedure Type (In Value %)

4.3.1. Open Surgery

4.3.2. Laparoscopic Surgery

4.3.3. Robotic Surgery

4.4. By End User (In Value %)

4.4.1. Hospitals

4.4.2. Ambulatory Surgical Centers

4.4.3. Clinics

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Hernia Mesh Devices Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Johnson & Johnson Pvt. Ltd.

5.1.2. Medtronic India Pvt. Ltd.

5.1.3. B. Braun Medical India Pvt. Ltd.

5.1.4. W. L. Gore & Associates

5.1.5. Cook Medical India

5.1.6. C. R. Bard India

5.1.7. Hernimesh India Pvt. Ltd.

5.1.8. Atrium Medical Corporation

5.1.9. Aesculap India Pvt. Ltd.

5.1.10. Ethicon India

5.1.11. Lifecare Devices Pvt. Ltd.

5.1.12. Viking Surgical India Pvt. Ltd.

5.1.13. Maquet India Pvt. Ltd.

5.1.14. Jullundur Surgical Works (JSW)

5.1.15. Stryker India Pvt. Ltd.

5.2. Cross Comparison Parameters

(Headquarters, Number of Employees, Revenue, Product Portfolio, R&D Expenditure, Market Share, Distribution Network, Strategic Partnerships)

5.3. Market Share Analysis (By revenue, product segmentation)

5.4. Strategic Initiatives (Product launches, partnerships, geographic expansions)

5.5. Mergers and Acquisitions (Key recent deals in the market)

5.6. Investment Analysis (Private equity, venture capital investments)

5.7. Government Grants and Initiatives (Schemes to promote medical device manufacturing)

6. India Hernia Mesh Devices Market Regulatory Framework

6.1. Medical Device Regulations

6.2. Compliance Requirements (Approvals required for hernia mesh devices)

6.3. Certification Processes

7. India Hernia Mesh Devices Future Market Size (In INR and USD Mn)

7.1. Future Market Size Projections (Revenue-based estimates)

7.2. Key Factors Driving Future Market Growth (Technological advancements, government support)

8. India Hernia Mesh Devices Future Market Segmentation

8.1. By Mesh Type (In Value %)

8.2. By Hernia Type (In Value %)

8.3. By Procedure Type (In Value %)

8.4. By End User (In Value %)

8.5. By Region (In Value %)

9. India Hernia Mesh Devices Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2. White Space Opportunity Analysis

9.3. Marketing Initiatives and Positioning Strategies

9.4. Market Entry and Expansion Strategies

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first stage involves mapping out key market stakeholders in the India Hernia Mesh Devices Market. Extensive desk research is conducted to capture vital information from proprietary databases and secondary sources. This step identifies the primary variables driving market dynamics, including product types, procedure methods, and distribution channels.

Step 2: Market Analysis and Construction

In this phase, historical market data is gathered and analyzed to understand revenue trends, the penetration rate of hernia mesh devices, and the competitive landscape. This involves studying market segmentation across mesh types, procedures, and regions to ensure accuracy in the revenue projections.

Step 3: Hypothesis Validation and Expert Consultation

After constructing initial hypotheses, they are validated through expert consultations via interviews and industry reports. These experts provide direct insights into sales performance, product demand, and technological advancements, enhancing the report's accuracy.

Step 4: Research Synthesis and Final Output

The final step synthesizes all acquired data into a cohesive market report. This stage involves the triangulation of data points from various sources and direct engagement with medical device manufacturers. This process ensures a complete, accurate, and validated analysis of the market.

Frequently Asked Questions

01. How big is the India Hernia Mesh Devices market?

The India Hernia Mesh Devices market was valued at USD 231 million and is primarily driven by an increase in hernia surgeries, technological advancements, and improved healthcare infrastructure.

02. What are the key challenges in the India Hernia Mesh Devices market?

The India Hernia Mesh Devices market challenges include the high cost of advanced mesh devices, regulatory hurdles for product approvals, and the presence of counterfeit products that hinder market growth.

03. Who are the major players in the India Hernia Mesh Devices market?

The India Hernia Mesh Devices market major players in the market include Johnson & Johnson, Medtronic, B. Braun Medical, C. R. Bard, and W. L. Gore & Associates, which dominate due to strong product portfolios and strategic partnerships.

04. What are the growth drivers of the India Hernia Mesh Devices market?

The India Hernia Mesh Devices market growth drivers include the rising prevalence of hernia cases, increasing adoption of minimally invasive surgeries, and growing healthcare investments by both the government and private sectors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.