India Hosiery Market Outlook to 2030

By product type – (Body Stockings, Socks, Knee Highs, Hold-Ups, and Other Product Types), By End user (Men wear and Women wear) and By Regional Split (North/East/West/South)

Region:Asia

Author(s):Shambhavi Awasthi

Product Code:KROD246

September 2023

85

About the Report

India hosiery Market Overview

The India hosiery market is a dynamic and growing sector of the country's textile industry. Hosiery products, which include socks, stockings, and undergarments, have gained popularity due to their comfort and affordability. With a burgeoning population and increasing disposable income, the demand for hosiery products in India has surged. This market is characterized by a diverse range of products, catering to various age groups and preferences. India has been an hotspot for hosiery due to various factors like increasing penetration of online sales. Attraction of youth towards yoga and work out which need hosiery clothes. Changing lifestyles and demographic factors are bringing changes in demand patterns for hosiery.

The segment of dry type transformer is expected to continue to grow over the next five years. The investments in hosiery market would further drive this segment. Revenue is expected to show an annual growth rate (CAGR 2022-2028) of ~12%.

The domestic and international players which cater India Hosiery Lux Industries Ltd., Rupa & Co. Ltd., Dollar Industries Ltd., Bhartiya International Ltd., Bodycare Creations Ltd., Enamor, Jockey India are the top players offering transformer services.

India Hosiery Market Analysis

India Hosiery market has been an evolving industry, which is constantly growing with major launches and innovations in clothing from different companies. Government initiatives and projects where clothing projects are concerned are the major areas where there is a need of India Hosiery market.

- The India Hosiery market is growing at the CAGR rate of ~12% during the forecast years 2022-2028.

- Changing lifestyles and demographic factors are bringing changes in demand patterns for hosiery. Urban demand is expected to remain stable, while a well distributed monsoon and probable inflation moderation should boost rural demand, leading to a recovery of 35-40 per cent in volume.

- Potential export opportunities, especially to Gulf countries, has bumped up the market volume further.

- Also due to the rise in disposable income and more number of the working population of women, the demand for fashion and luxury items is increasing in the country which also includes clothing items.

Key Trends by Market Segment:

By Product Type: The India Hosiery market is segmented by type into Body Stockings, Socks, Knee Highs, Hold-Ups, and Other Product Types. The socks segment dominant in the product type in India Hosiery market in 2022.

socks are considered essential everyday wear, ensuring a consistent demand. Additionally, the fashion industry's influence has led to the popularity of various sock styles, from casual to sportswear, further driving sales. Furthermore, the affordability of socks makes them accessible to a wide consumer base, particularly in a price-sensitive market like India. As a result, the socks segment continued to thrive and capture a significant share of the hosiery market in 2022.

By End user applications: The India Hosiery market is segmented into men and women.

The Men dominate the segment of end user application in India Hosiery market in 2022.

Men in India are more inclined towards wearing hosiery products, such as socks and undergarments, on a daily basis for comfort and functionality. Moreover, changing fashion trends and a growing awareness of style have also led to an increased demand for men's hosiery products. As a result, the men's segment commanded a substantial share of the market, reflecting the strong preference for hosiery among male consumers in 2022.

By Geography: The India Hosiery market is segmented in to north, south, east and west region of India.

The dominant region in the India Hosiery market in the year 2022 is the west region

- The western region of India is an economic powerhouse, home to major metropolitan cities like Mumbai and Pune. These cities serve as significant commercial and industrial hubs, contributing to higher consumer purchasing power. As a result, consumers in the west have more disposable income to spend on hosiery products.

- Western India is known for its fashion-forward population. The region is home to several fashion-conscious individuals who are keen on keeping up with the latest trends. This has driven the demand for hosiery products, including socks, leggings, and innerwear, as they are an integral part of everyday fashion.

- The western region has witnessed rapid urbanization and modernization, leading to lifestyle changes. As people in urban areas adopt Western clothing styles, the demand for hosiery items has increased significantly, especially among the younger population.

- Several renowned hosiery manufacturers and brands have their presence and manufacturing units in the western region. This strategic presence allows for better distribution and accessibility of hosiery products to consumers across India, boosting the market's growth.

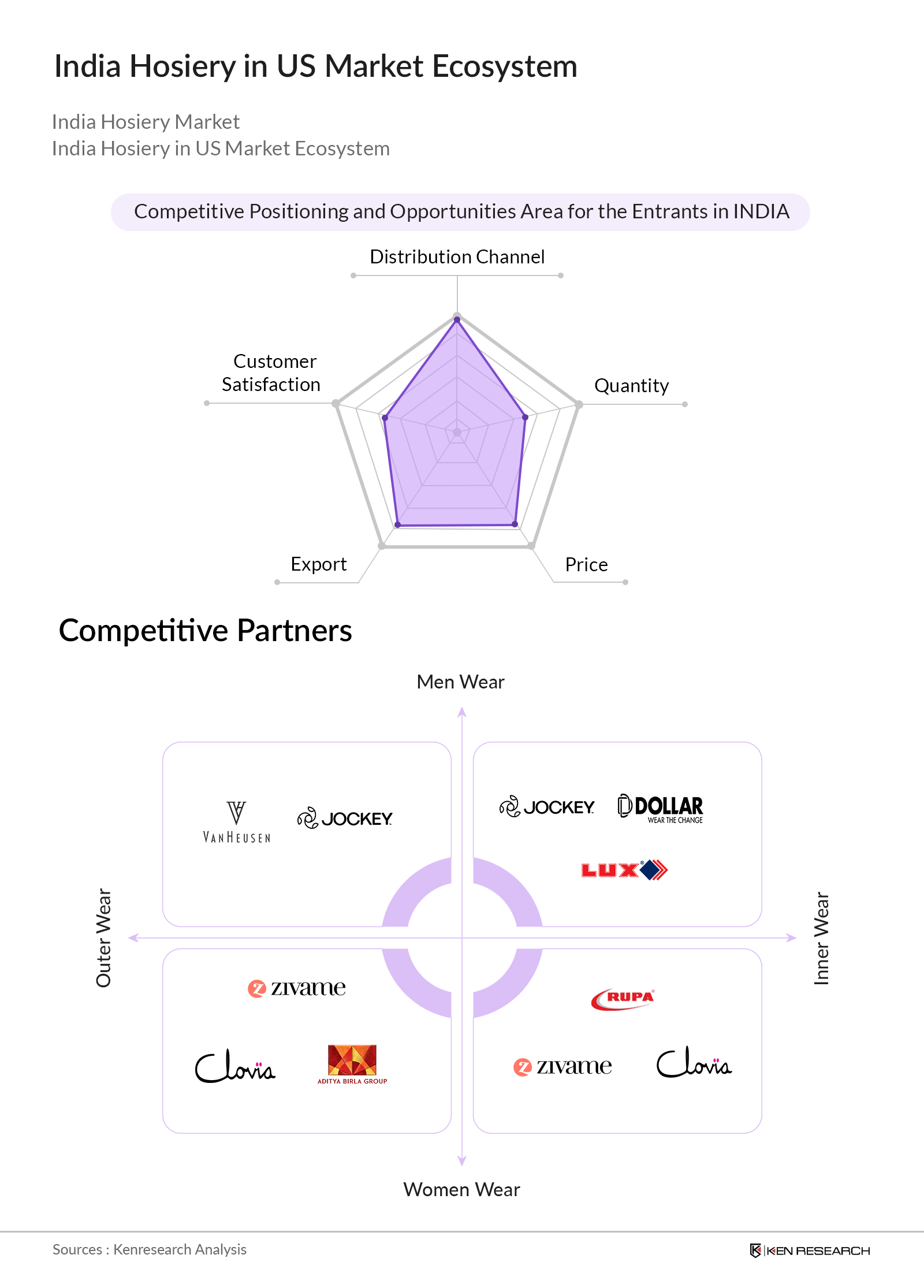

Competitive Landscape:

There are about more than ~500 India Hosiery service provider companies in India with majority of them offering their services in the country. India Hosiery market is moderately fragmented with ~25-30 players are dominant. Players like Lux Industries Ltd., Rupa & Co. Ltd., Dollar Industries Ltd., are competing on dominance over large customer base.

Bhartiya International Ltd. and Bodycare Creations Ltd. are expanding their market sixe. Enamor, Jockey India are expanding their international value and emerging as popular competitors in the dry type transformer market. These players are the top tier players that are giving tough competition in the market.

Recent Developments:

-

-

- In May 2022, Falke Introduced New Pressure-Free Running Socks. Falke's new Pressure-Free sock incorporates a unique design feature to reduce the potential hotspot across the bridge of the foot. Falke has inserted a striated pad of channels on top of the foot that may move dynamically in response to foot movements. This helps to spread movement pressure and relieve pressure buildup in this area.

- In October 2021, The Heist Studios brand unveiled four novel sustainable tights in its AW21 product range. Each product has been sustainably manufactured with the help of recycled Elastane and Polyamide to sustain the brand's essence.

- In September 2021, SKIMS, the shapewear brand, launched its first sock collection. The socks come in four different fabrics and styles. There are four categories: Hosiery, Everyday, Sport, and Slouch. The socks will also be available in various lengths, including ankle, mid-calf, and crew, as well as multiple colors.

-

Future Outlook:

-

-

- India Hosiery market has expected CAGR in future outlook is ~12% from forecast year of 2022-2028.

- India’s Comprehensive Economic Partnership Agreement with the United Arab Emirates could also boost textile exports in the sector, especially of hosiery.

- Backed by a revival in rural demand, the hosiery industry in India is expected to see 18-20 per cent revenue growth this fiscal, reaching a figure of ₹36,000 crore, according to a report by CRISIL Ratings.

- Amid strong demand pull, Indian hosiery manufacturers will reduce spending on advertising and marketing. A rise in operating leverage from higher capacity utilisation will aid profitability as well, hence, operating margin will improve to the pre-pandemic level of 12-14 per cent.

-

Scope of the Report

|

India Hosiery Market Segmentation |

|

|

By Product type |

Body Stockings Socks Knee Highs Hold-Ups Other Product |

|

By end user application |

Men wear Women wear |

|

By regional areas |

East West North South |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Clothing distribution Companies

Third-Party hosiery clothing Providers

Potential Market Entrants

Indian Hosiery Companies

Hosiery clothing manufacturers Companies

Industry Associations

Consulting Agencies

Government Regulating Authorities

Capitalist ventures and investment authorities

Time Period Captured in the Report:

Historical Period: 2017-2022

Base Year: 2022

Forecast Period: 2022-2028

Companies

Major Players Mentioned in the Report:

Lux Industries Ltd.,

Rupa & Co. Ltd.,

Dollar Industries Ltd.,

Bhartiya International Ltd.

Bodycare Creations Ltd.,

Enamor

Jockey India

Table of Contents

1. Executive Summary

2. India Hosiery market Overview

2.1 Taxonomy of the Market

2.2 Industry Value Chain

2.3 Ecosystem

2.4 Government Regulations/Initiatives for the Market

2.5 Growth Drivers of the India Hosiery market

2.6 Issues and Challenges of the India Hosiery market

2.7 Impact of COVID-19 on the India Hosiery market

2.8 SWOT Analysis

3. India Hosiery Market Size, 2017 – 2022

4. India Hosiery Market Segmentation

4.1 By Product Type, 2017 - 2022

4.2 By end user application, 2017 - 2022

4.3 By Regional Split, 2017 - 2022

5. Competitive Landscape

5.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

5.2 Strategies Adopted by Leading Players

5.3 Company Profiles

5.4 Lux Industries Ltd.,

5.5 Rupa & Co. Ltd.,

5.6 Dollar Industries Ltd.,

5.7 Bhartiya International Ltd.

5.8 Bodycare Creations Ltd.,

5.9 Enamor

5.10 Jockey India

6. India Hosiery Future Market Size, 2022 – 2028

7. India Hosiery Future Market Segmentation

7.1 By Product type, 2022 - 2028

7.2 By End user Application, 2022 - 2028

7.3 By Regional Split, 2022 - 2028

8. Analyst Recommendations

9. Research Methodology

10. Disclaimer

11. Contact us

Research Methodology

Step: 1Â Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on India Hosiery Sales over the years, penetration of marketplaces and service provider’s ratio to compute revenue generated for India Hosiery. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry exerts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research output:

Our team has approached multiple dry type transformer services providing channels and understand nature of product segments and sales, consumer preference and other parameters, which supported India validate statistics derived through bottom to top approach from India Hosiery providers.

Frequently Asked Questions

01 How big is the India hosiery market?

The India hosiery market was valued at Market size of USD 22 billion in 2021, with growth rate of 3%.

02 Which state in india is famous for hosiery ?

Ludhiana. It is the largest district in Punjab and is located in the Malwa region. This district is very famous for its Hosiery industries. The winter garments like sweaters, socks, gloves, and shawls that are produced in this district are very popular.

03 Which are the major hosiery industry hub in India?

EVER GREEN HOSIERY INDUSTRIES

SETHI ENTERPRISES. DELHIÂ

JAINEX HOSIERY. INDOREÂ

LAVEENA HOSIERYÂ

NARVIN CHEMICALSÂ

04 Why is Ludhiana famous for hosiery in india ?

The city boasts of a rich history of Winter Hosiery Products Pan-India. According to a Business Standard report,"" The relevance of hosiery industry in Ludhiana could be gauged from the fact that 90% demand of the woolen market in India is fed by Ludhiana industry.

05 What items are inclded in  hosiery market in india ?

Broadly, it indicates various kinds of knitwear and garments like gengis, vests, drawers, pullovers, slipovers, jerseys and sportswear. The term includes footwear items like socks, hose and stockings, and also stockinette used for wrapping meat.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.