India Hospital Beds Market Outlook to 2029

Region:Asia

Author(s):Shashank, Harshit

Product Code:KR1496

April 2025

80-100

About the Report

India Hospital Beds Market Overview

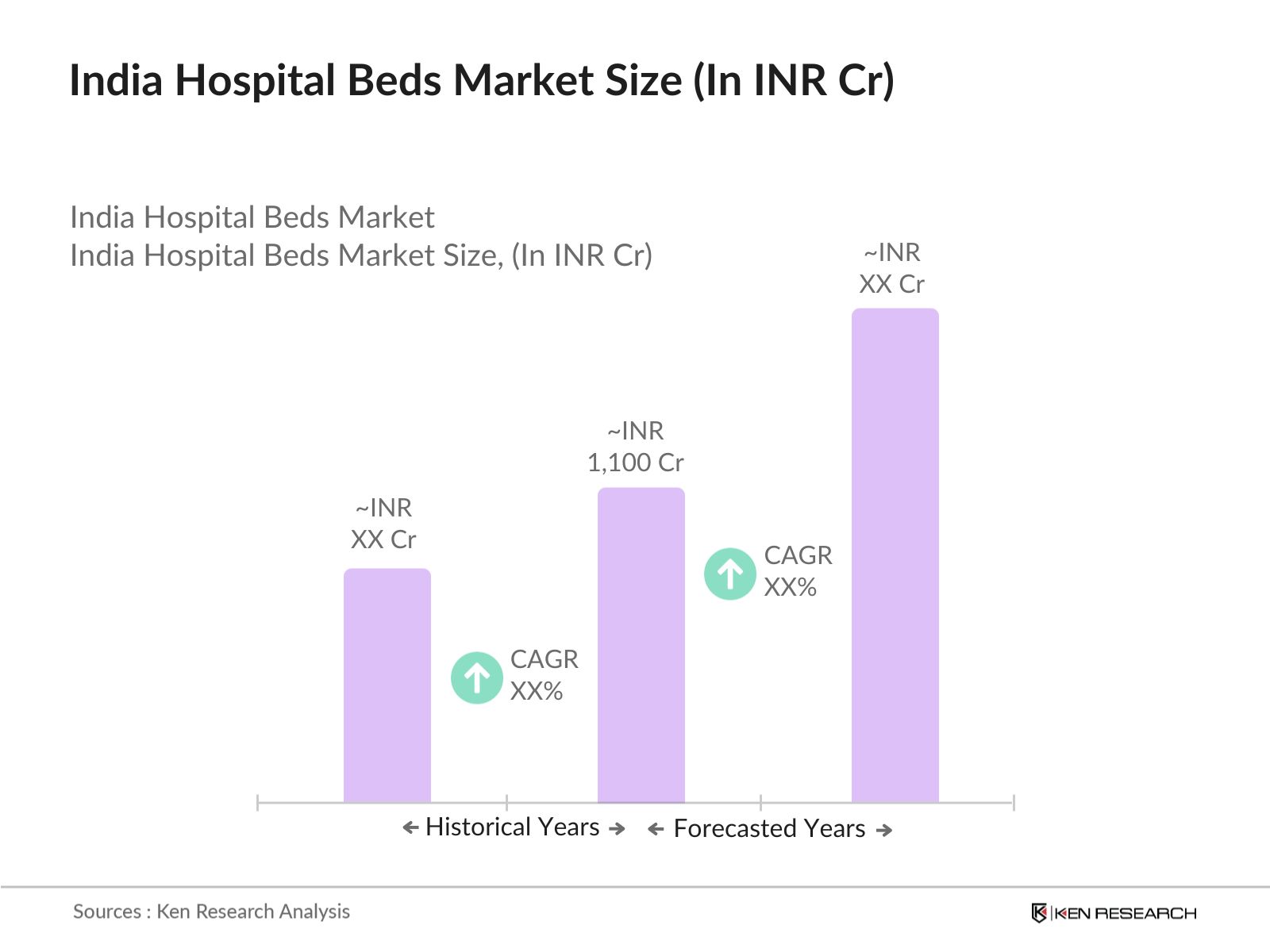

- The India hospital beds market is valued at INR 1,100 crore, based on a five-year historical analysis. This value reflects consistent demand growth driven by government-led healthcare infrastructure expansion, rising chronic disease burden, and a rapid increase in private hospital chains across the country. The market's demand has also been influenced by a significant increase in intensive care needs, greater penetration of smart beds, and an emerging trend toward AI-assisted monitoring systems.

- The market is dominated by metro cities such as Delhi, Mumbai, and Bengaluru. These cities have become hubs due to the concentration of tertiary care hospitals, specialty centers, and private multi-specialty institutions. The dominance is also a result of increased patient inflow, stronger financial capabilities for advanced infrastructure, and the availability of trained healthcare professionals.

- The Central Drugs Standard Control Organization (CDSCO) classifies hospital beds under Class A medical devices. As per CDSCO compliance guidelines updated in 2023, all hospital bedsparticularly electric and adjustable typesmust meet safety standards under the Medical Devices Rules, 2017. Further, the Bureau of Indian Standards (BIS) mandates that hospital beds in public tenders require ISI certification. Under the PM-Ayushman Bharat Health Infrastructure Mission, over INR 5,500 crore has been allocated to support infrastructure standardization across rural public hospitals. These regulatory measures ensure safety, quality assurance, and uniformity across procurement, especially in government hospital projects.

India Hospital Beds Market Segmentation

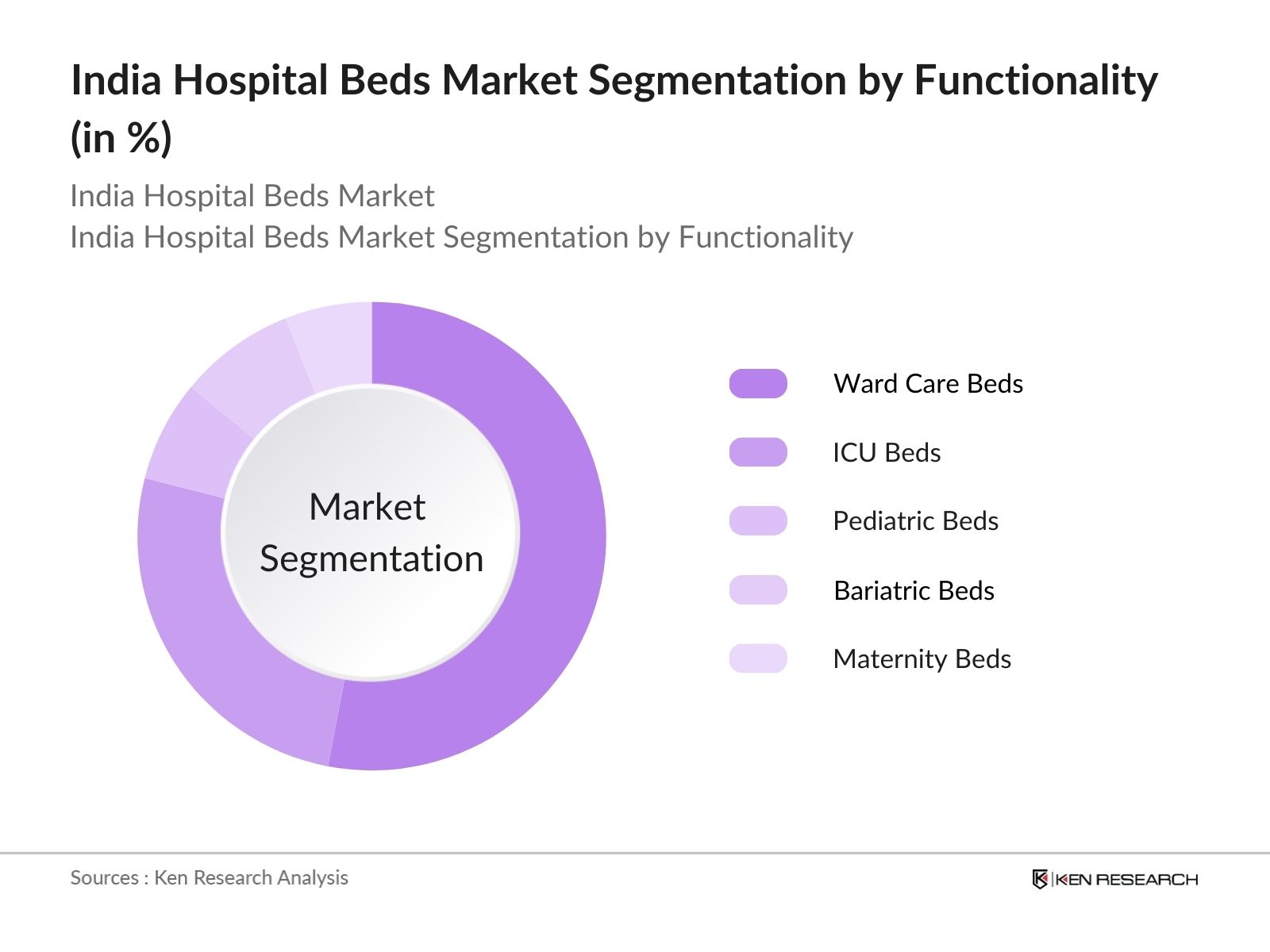

By Functionality: The India hospital beds market is segmented by functionality into ward care beds, ICU beds, pediatric beds, bariatric beds, and maternity beds. Ward care beds currently hold the highest market share due to their indispensable role in general healthcare wards, especially in public and low-cost hospitals. These beds are affordable, easy to maintain, and suitable for a wide variety of inpatient settings, making them the default choice across urban and rural health centers.

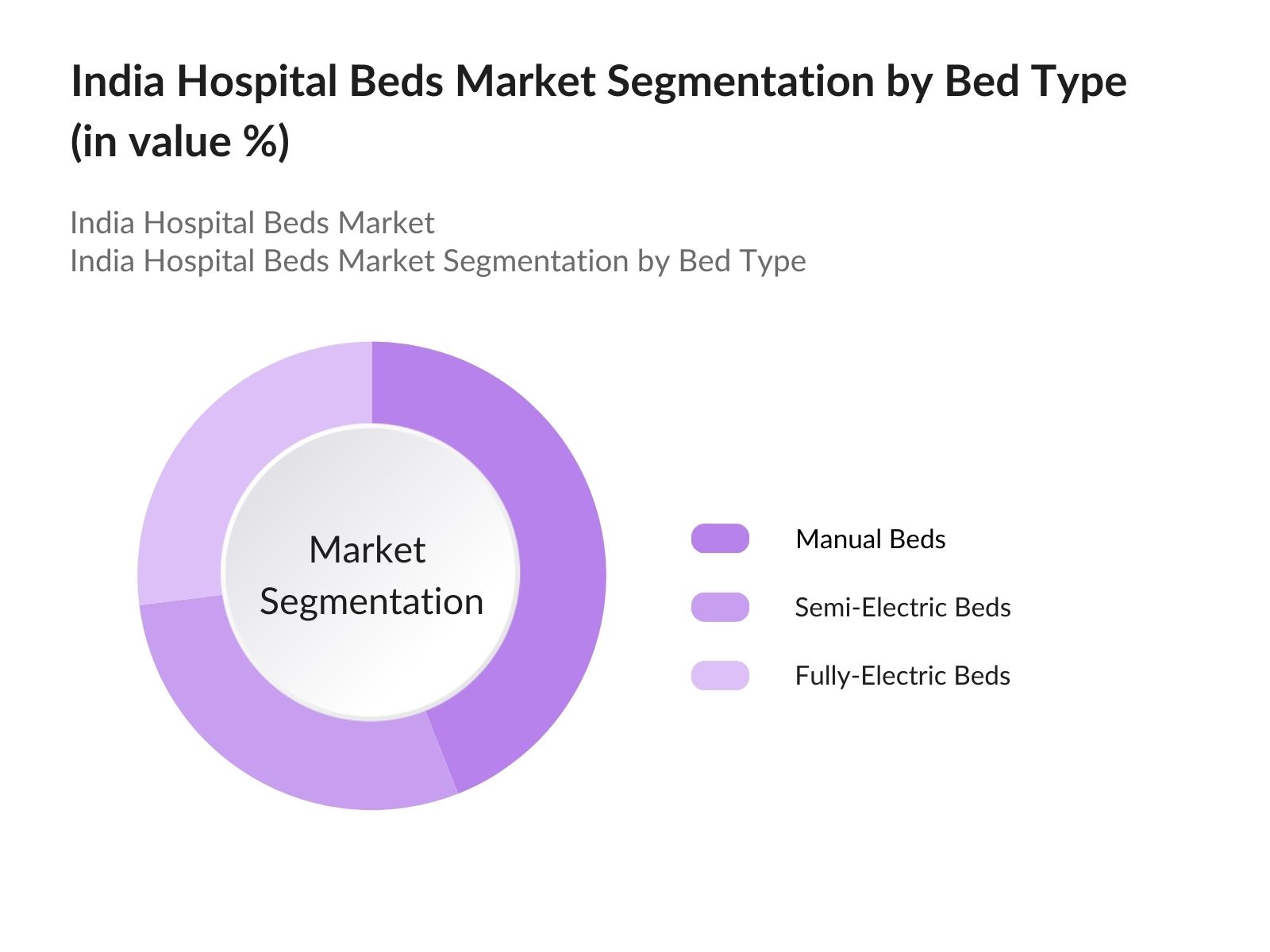

By Bed Type: The India hospital beds market is segmented by bed type into manual beds, semi-electric beds, and fully electric beds. Manual beds have the highest market share, largely due to their affordability and suitability for rural and tier-2 healthcare centers. Their low maintenance cost and operational simplicity continue to make them the first choice for government tenders and budget-conscious facilities.

India Hospital Beds Market Competitive Landscape

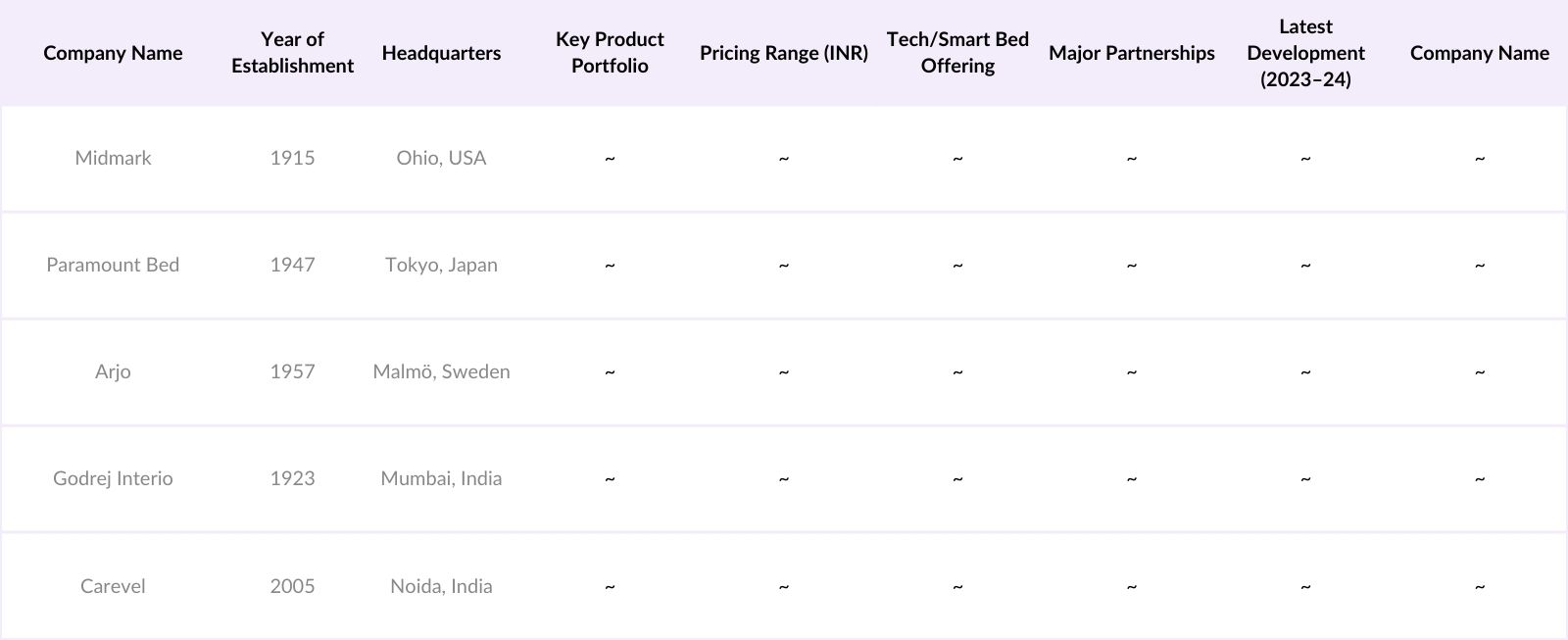

The India hospital beds market is moderately consolidated, with top players like Midmark, Paramount Bed, Arjo, Godrej Interio, and Carevel leading in product innovation and price range diversity. The presence of both international and domestic manufacturers has created a healthy balance between premium and budget offerings, tailored to public procurement and private hospital expansion.

India Hospital Beds Market Analysis

Growth Drivers

- Expansion of Hospital Infrastructure: The government allocated approximately INR 90,000 crore under the health ministry's budget to upgrade hospitals and expand capacity. This includes funding for ICU clusters, emergency wards, and smart infrastructure in rural districts. The 10-Bed ICU Project alone has supported over 200 new rural clusters, directly contributing to rising hospital bed procurement across India.

- Rising Infant Population and Maternity Care Demand: India recorded over 2 crore births in 2022, as per the MoHFW. Programs like JSSK and NHM ensure institutional deliveries, leading to increased maternity and pediatric ward usage. Over 9,000 government-supported delivery centers create rising demand for neonatal, pediatric, and postnatal recovery beds, especially in public facilities across Uttar Pradesh, Bihar, and Rajasthan.

- Growth in Medical Tourism: India saw over 7 lakh international medical tourists in 2023, according to the Ministry of Tourism. Medical tourists seek complex surgeries requiring longer recovery periods, increasing ICU and semi-electric bed demand. Cities like Chennai and Delhi have expanded premium bed capacity in private hospitals, enabling high-value recovery services and attracting global patients seeking affordable care.

Market Challenges

- Import Dependency on Critical Components: India imports a significant portion of medical devices and key components like actuators and smart control units, primarily from China. This overreliance causes supply delays and higher procurement costs, impairing scalability for local manufacturers and increasing the financial burden on rural or government-run hospitals purchasing advanced hospital beds.

- Accessibility Constraints in Rural Logistics: Many rural health facilities lack reliable transport access, which, combined with high equipment costs and a shortage of technicians, delays bed delivery and maintenance. Semi-electric and smart beds often remain unusable due to missing installation support, especially in regions like Chhattisgarh, Jharkhand, and Northeast states, widening the public-private infrastructure gap.

India Hospital Beds Market Future Outlook

Over the next five years, the India hospital beds market is expected to witness sustained growth driven by public hospital infrastructure expansion, growth in the ICU and maternity bed segments, and increased adoption of semi-electric and smart beds. Financial allocations under national health schemes and evolving standards for patient comfort and monitoring will further push demand, particularly in tier-2 and tier-3 cities.

Market Opportunities

- Smart Beds Integration with AI-Driven Nursing: AI-driven smart beds can reduce nurse workload by 10-15% and save INR 2,150 crore annually, per MeitY. With features like automated vitals tracking and position adjustment, hospitals like Apollo are integrating such beds into ICUs and critical wards. These developments align with the National Digital Health Mission, encouraging wider adoption across metros.

- Increased Budget Allocations for Tier-2 Health Centers: India is revamping approximately 158,000 health centers with increased funding under PM-Ayushman Bharat. These facilities, primarily in Tier-2 regions, are tendering mid-tier and semi-electric beds. The Ministry of Health's rural infrastructure push promotes procurement through government e-marketplaces, supporting affordable bed distribution in underserved states like Odisha, Madhya Pradesh, and Assam.

Scope of the Report

|

Bed Type |

Manual Beds |

|

Functionality |

Ward Care Beds |

|

End User |

Government Hospitals |

|

Price Range |

Budget Beds |

|

Region |

North |

Products

Key Target Audience

Government and Regulatory Bodies (CDSCO, NABH, BIS)

Private Hospital Chains

Public Sector Procurement Agencies (GeM, NHM)

Medical Device Importers and Distributors

Hospital Infrastructure Developers

AI and Smart Device Technology Providers

Investments and Venture Capitalist Firms

State-Level Health Authorities (like NHM Rajasthan, NRHM Tamil Nadu)

Companies

Players Mentioned in the Report

Midmark

Paramount Bed

Arjo

Godrej Interio

Carevel

Table of Contents

1. India Hospital Beds Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Hospital Beds Market Size (In INR Crore)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Hospital Beds Market Analysis

3.1. Growth Drivers

3.1.1. Government Infrastructure Expansion

3.1.2. Increase in Institutional Deliveries

3.1.3. Rise in Medical Tourism

3.2. Restraints

3.2.1. Import Dependency on Smart Components

3.2.2. Rural Supply Chain Limitations

3.3. Opportunities

3.3.1. AI-Integrated Smart Beds

3.3.2. Budget Boost for Tier-2 Facilities

3.4. Trends

3.4.1. Smart Nurse Station Compatibility

3.4.2. Motorized Bed Automation for ICU & Ward Use

3.4.3. Shift Toward Home Healthcare Bed Rentals

3.5. Government Regulation

3.5.1. CDSCO Classification (Class A Medical Device)

3.5.2. BIS Certification Compliance for Public Procurement

3.5.3. NABH Bed Standards for Patient Safety

3.5.4. Procurement Rules under PM-ABHIM & GeM Portal

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. India Hospital Beds Market Segmentation

4.1. By Bed Type (In Volume and Value%)

4.1.1. Manual Beds

4.1.2. Semi-Electric Beds

4.1.3. Fully Electric Beds

4.2. By Functionality (In Volume and Value%)

4.2.1. Ward Care Beds

4.2.2. ICU Beds

4.2.3. Pediatric Beds

4.2.4. Bariatric Beds

4.2.5. Maternity Beds

4.3. By End User (In Volume and Value %)

4.3.1. Government Hospitals

4.3.2. Private Hospitals

4.3.3. Specialty Clinics

4.3.4. Home Healthcare Providers

4.3.5. Ambulatory Care Centers

4.4. By Price Range (In Volume and Value%)

4.4.1. Budget Beds

4.4.2. Mid-Tier Beds

4.4.3. Premium Beds

4.5. By Region (In Volume and Value %)

4.5.1. North India

4.5.2. South India

4.5.3. West India

4.5.4. East India

4.5.5. Central India

5. India Hospital Beds Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Midmark

5.1.2. Paramount Bed

5.1.3. Arjo

5.1.4. Godrej Interio

5.1.5. Carevel

5.1.6. United Surgical

5.1.7. Meditek Engineers

5.1.8. PMT Healthcare

5.1.9. GPC Medical

5.1.10. Steelcraft

5.1.11. DiaMedical

5.1.12. Stryker

5.1.13. Vissco

5.1.14. Baxter (Hillrom)

5.1.15. Interio

5.2. Cross Comparison Parameters (Bed Type Specialization, AI Integration, In-House Manufacturing, Tender Win Rate, Regional Reach, Private/Public Mix, Smart Bed Capability)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investor Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Hospital Beds Market Regulatory Framework

6.1. CDSCO Licensing Pathway

6.2. BIS Mandatory Certification Updates

6.3. NABH Guidelines for Equipment Safety

6.4. GeM Registration and Procurement Eligibility

6.5. PM-ABHIM Allocation and Compliance Norms

7. India Hospital Beds Future Market Size (In INR Crore)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Hospital Beds Future Market Segmentation

8.1. By Bed Type (In Volume and Value %)

8.2. By Functionality (In Volume and Value% )

8.3. By End User (In Volume and Value %)

8.4. By Price Range (In Volume and Value% )

8.5. By Region (In Volume and Value %)

9. India Hospital Beds Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Hospital Beds Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compiled and analyzed historical data pertaining to the India Hospital Beds Market. This includes assessing market penetration, hospital infrastructure expansion, and government health spending. An evaluation of smart bed adoption and ICU capacity gaps was also conducted to ensure the reliability of revenue and unit estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through direct interviews and consultations with procurement heads of hospitals, government officials, and device manufacturers. These sessions provided granular insights into product usage trends, pricing preferences, and challenges in bed installation and service logistics.

Step 4: Research Synthesis and Final Output

The final phase involved integrating supplier-side data with buyer-side perspectives. Multiple manufacturer interactions and on-ground pricing analysis helped confirm retail vs. tender pricing gaps, technology usage, and demand by bed functionality. This ensured a well-rounded, verified market overview.

Frequently Asked Questions

Q1. How big is the India Hospital Beds Market?

The India Hospital Beds Market is valued at INR 1,166.9 crore. This valuation is based on a historical analysis of demand across government and private healthcare institutions, with a consistent CAGR driven by ICU expansion, home care needs, and procurement reforms.

Q2. What is driving the growth of the India Hospital Beds Market?

India Hospital Beds Market Key drivers include increased ICU bed demand, expansion of public healthcare infrastructure under national health missions, and rising smart bed installations in private hospitals. Medical tourism and higher public expenditure on health are further contributing factors.

Q3. Which segment leads in the India Hospital Beds Market by bed type?

In India Hospital Beds Market Manual beds dominate the market by bed type due to affordability, suitability for rural and budget healthcare facilities, and long-standing government procurement patterns under tender-based systems.

Q4. Which cities are key demand hubs for the India Hospital Beds Market?

Metro cities like Delhi, Mumbai, and Bengaluru lead the India Hospital Beds Market due to better infrastructure, availability of specialty care, and higher adoption of advanced and smart hospital beds.

Q5. What role does government policy play in the India Hospital Beds Market?

Government initiatives in India Hospital Beds Market such as PM-Ayushman Bharat Health Infrastructure Mission and increased health budgets significantly influence procurement and expansion, especially in underserved regions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.