India Household Appliances Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD7486

November 2024

83

About the Report

India Household Appliances Market Overview

- The India Household Appliances market is valued at USD 59 billion based on a five-year historical analysis. The markets growth is driven by various factors, including increasing demand for energy-efficient appliances, government initiatives promoting local manufacturing, and a growing middle-class population.

- In terms of regional dominance, metropolitan cities such as Mumbai, Delhi, and Bangalore lead the household appliances market. This dominance is primarily due to their large consumer base, high disposable income, and better access to technological advancements. Additionally, these cities benefit from more extensive retail networks and aggressive marketing strategies by top brands, which enable faster penetration of new products.

- The Indian government introduced a PLI scheme in 2021, offering financial incentives for manufacturing appliances such as air conditioners and LED lights domestically. Under this initiative, the government aims to generate investment worth INR 10,000 crores in the appliance sector by 2024, creating jobs and reducing import dependency.

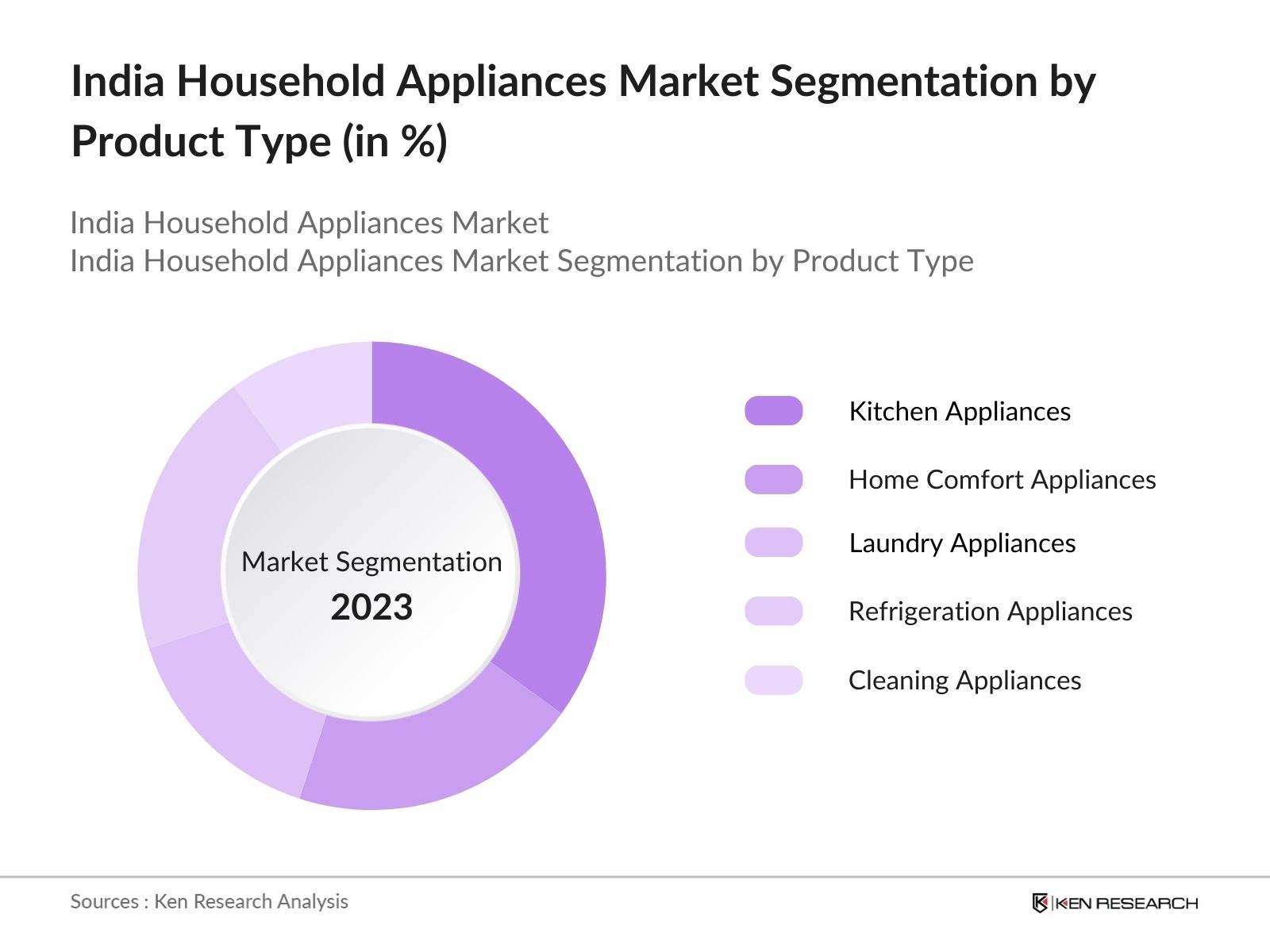

India Household Appliances Market Segmentation

By Product Type: The market is segmented by product type into kitchen appliances, home comfort appliances, laundry appliances, refrigeration appliances, and cleaning appliances. Among these, kitchen appliances hold a dominant market share due to their widespread adoption in both urban and semi-urban households. Popular products like microwaves, induction cooktops, and food processors are highly sought after due to the rising demand for convenience and efficiency in meal preparation.

By Distribution Channel: The market is segmented by distribution channel into online and offline. The offline segment, which includes multi-brand retailers and exclusive brand stores, continues to dominate, contributing significantly to the overall market. Consumers still prefer the offline channel due to the availability of touch-and-feel experiences, immediate product delivery, and the possibility of better negotiation on prices.

India Household Appliances Market Competitive Landscape

The market is dominated by a few key players with strong brand loyalty and extensive distribution networks. These companies compete on innovation, energy efficiency, and after-sales services to capture a larger share of the market.

|

Company |

Year of Establishment |

Headquarters |

Revenue (USD Bn) |

No. of Employees |

Product Range |

Technology Innovation |

Market Share (%) |

R&D Investment |

Service Centers |

|

LG Electronics |

1958 |

Seoul, S. Korea |

|||||||

|

Samsung Electronics |

1969 |

Suwon, S. Korea |

|||||||

|

Whirlpool of India |

1911 |

Pune, India |

|||||||

|

Godrej Appliances |

1897 |

Mumbai, India |

|||||||

|

Voltas Limited |

1954 |

Mumbai, India |

India Household Appliances Market Analysis

Market Growth Drivers

- Increased Government Spending on Infrastructure: The Indian government has ramped up infrastructure investments, particularly in housing projects, under schemes such as Pradhan Mantri Awas Yojana (PMAY). By 2024, the government aims to construct 20 million affordable houses for the urban poor. The increased construction activity is directly boosting demand for household appliances like refrigerators, washing machines, and air conditioners.

- Rural Electrification Driving Appliance Penetration: The Saubhagya Scheme (Pradhan Mantri Sahaj Bijli Har Ghar Yojana) has achieved near-total electrification in rural India, with over 28.1 million households connected to electricity since its launch. This has resulted in a sharp rise in the demand for electrical household appliances, particularly in rural regions, where appliance penetration was historically low.

- Growing Middle-Class Population and Home Ownership: Indias middle-class population is projected to reach over 500 million by 2024, with more households owning homes. Increased home ownership leads to higher purchases of durable appliances, including refrigerators, washing machines, and kitchen appliances, to improve living standards. The housing market data indicates that around 4.5 million homes are sold each year, directly influencing appliance sales as homeowners prioritize upgrading household amenities.

Market Challenges

- High Import Dependence for Components: Indias household appliance industry heavily relies on imported components, particularly for high-tech electronics and compressors used in refrigerators and air conditioners. The Ministry of Commerce reported that over INR 80,000 crores worth of appliance components were imported in 2023, making the industry vulnerable to import tariffs and supply disruptions.

- Environmental Regulations and Compliance Costs: Stringent environmental regulations regarding energy efficiency, waste disposal, and plastic usage have increased compliance costs for manufacturers. By 2024, the appliance industry will face further scrutiny under Indias Extended Producer Responsibility (EPR) guidelines, which mandate the proper disposal of electronic waste.

India Household Appliances Market Future Outlook

Over the next five years, the India Household Appliances industry is expected to show growth, driven by increasing urbanization, the growing influence of technology, and government initiatives promoting energy-efficient products.

Future Market Opportunities

- Growth in Smart Appliance Sales: Smart appliances, such as AI-enabled refrigerators and washing machines, will dominate the Indian market by 2028. According to market projections, sales of smart home appliances will increase to over 10 million units annually, driven by rising consumer interest in automation and connectivity. The demand for smart appliances will be strongest in metro cities, where tech adoption rates are higher.

- Expansion of Local Manufacturing Facilities: With continued government support and favorable policies, India will become a global hub for household appliance manufacturing by 2030. Several leading manufacturers are expected to double their local production capacities, leading to a rise in exports. The government estimates that India will export over 5 million appliances annually by 2028, contributing to the global supply chain.

Scope of the Report

|

By Product Type |

Kitchen Appliances Home Comfort Appliances Laundry Appliances Refrigeration Appliances Cleaning Appliances |

|

By Distribution Channel |

Online Offline |

|

By Energy Efficiency Ratings |

5-Star Rated 4-Star Rated 3-Star and below |

|

By Region |

North South East West |

|

By Technology Adoption |

IoT-Enabled Non-IoT Appliances |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Household Appliance Manufacturers

Banks and Financial Institution

Government and Regulatory Bodies (Bureau of Energy Efficiency, Ministry of Consumer Affairs)

Investors and Venture Capitalist Firms

Appliance Servicing Companies

Private Equity Firms

Companies

Players Mentioned in the Report:

LG Electronics

Samsung Electronics

Whirlpool of India

Godrej Appliances

Haier India

Panasonic India

Voltas Limited

Bajaj Electricals

Philips India

Blue Star Limited

Table of Contents

India Household Appliances Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

India Household Appliances Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

India Household Appliances Market Analysis

3.1. Growth Drivers

3.1.1. Government Incentives on Energy-Efficient Appliances

3.1.2. Rising Demand for Smart Homes (Smart Features Integration)

3.1.3. Rural Electrification Programs (Increased Access to Power)

3.1.4. Increased Consumer Awareness for Eco-friendly Products

3.2. Market Challenges

3.2.1. High Competition in Entry-Level Products

3.2.2. Fluctuating Raw Material Costs (Steel, Plastic, etc.)

3.2.3. Inconsistent Distribution Networks in Rural Areas

3.3. Opportunities

3.3.1. Demand for IoT-Enabled Appliances (Smart Connectivity)

3.3.2. Expansion in Tier II and III Cities (Growing Purchasing Power)

3.3.3. After-sales Service Expansion

3.4. Trends

3.4.1. Shift Towards Energy Efficiency Standards (5-star Ratings)

3.4.2. Emergence of Voice-Controlled Appliances

3.4.3. Growth in E-commerce for Appliances (Online Sales Share)

3.5. Government Regulations

3.5.1. Bureau of Energy Efficiency (BEE) Standards

3.5.2. Import Restrictions and Custom Duty Revisions

3.5.3. Initiatives for Promoting Local Manufacturing (PLI Schemes)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, Distributors, Service Providers)

3.8. Porters Five Forces Analysis (Competitive Rivalry, Supplier Power, etc.)

3.9. Competition Ecosystem

India Household Appliances Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Kitchen Appliances

4.1.2. Home Comfort Appliances

4.1.3. Laundry Appliances

4.1.4. Refrigeration Appliances

4.1.5. Cleaning Appliances

4.2. By Distribution Channel (In Value %)

4.2.1. Online

4.2.2. Offline (Multi-brand Retailers, Exclusive Stores)

4.3. By Energy Efficiency Ratings (In Value %)

4.3.1. 5-Star Rated Appliances

4.3.2. 4-Star Rated Appliances

4.3.3. 3-Star and Below Rated Appliances

4.4. By Region (In Value %)

4.4.1. Northern India

4.4.2. Southern India

4.4.3. Eastern India

4.4.4. Western India

4.5. By Technology Adoption (In Value %)

4.5.1. IoT-Enabled Appliances

4.5.2. Non-IoT Appliances

India Household Appliances Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. LG Electronics India Pvt. Ltd.

5.1.2. Samsung Electronics Co., Ltd.

5.1.3. Whirlpool of India Ltd.

5.1.4. Panasonic India Pvt. Ltd.

5.1.5. Godrej Appliances

5.1.6. Haier India

5.1.7. IFB Industries Ltd.

5.1.8. Voltas Limited

5.1.9. Bajaj Electricals Ltd.

5.1.10. Blue Star Limited

5.1.11. Philips India Ltd.

5.1.12. Crompton Greaves Consumer Electricals Ltd.

5.1.13. Hitachi India Pvt. Ltd.

5.1.14. Havells India Ltd.

5.1.15. Bosch Home Appliances

5.2. Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, Technological Advancements)

5.3. Market Share Analysis (By Major Players)

5.4. Strategic Initiatives (Product Launches, Partnerships, etc.)

5.5. Mergers and Acquisitions

5.6. Investment Analysis (Private Equity, FDI Inflows)

5.7. Venture Capital Funding in Emerging Companies

5.8. Government Grants for Local Manufacturers

5.9. R&D Investments

India Household Appliances Market Regulatory Framework

6.1. Energy Efficiency Standards (BEE)

6.2. Compliance Requirements (Environmental and Safety)

6.3. Certification Processes (IS Standards for Appliances)

India Household Appliances Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

India Household Appliances Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Energy Efficiency Ratings (In Value %)

8.4. By Region (In Value %)

8.5. By Technology Adoption (In Value %)

India Household Appliances Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives for Increased Adoption

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, we constructed an ecosystem map of the India Household Appliances market, utilizing comprehensive desk research through secondary sources, including government databases, industry reports, and proprietary data. This phase identifies key variables such as product demand, distribution networks, and regulatory factors that shape the market.

Step 2: Market Analysis and Construction

This step involved analyzing historical data of the India Household Appliances market, including product sales across various categories. Key factors such as revenue generation, consumer demand trends, and industry penetration were assessed to ensure accurate analysis of the market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

We validated the initial market hypothesis through in-depth interviews with industry experts and professionals from leading appliance manufacturers. These interviews provided insights into emerging trends, market challenges, and operational dynamics directly from practitioners.

Step 4: Research Synthesis and Final Output

In the final phase, we synthesized the gathered data and expert insights to create a detailed market report. The bottom-up approach, combined with industry consultations, ensured the validity of the market size estimates and growth forecasts for the India Household Appliances market.

Frequently Asked Questions

01. How big is India Household Appliances Market?

The India Household Appliances market is valued at USD 59 billion, driven by strong consumer demand for energy-efficient and IoT-enabled products. Rising household incomes and government initiatives have further fueled this market.

02. What are the challenges in India Household Appliances Market?

Key challenges in the India Household Appliances market include fluctuating raw material costs and the intense competition from both global and domestic players. Additionally, inconsistent distribution networks in rural areas present logistical hurdles for manufacturers.

03. Who are the major players in the India Household Appliances Market?

Major players in the India Household Appliances market include LG Electronics, Samsung Electronics, Whirlpool of India, Godrej Appliances, and Haier India. These companies have a strong presence due to their innovation, product variety, and extensive service networks.

04. What are the growth drivers of India Household Appliances Market?

The India Household Appliances market is driven by factors such as increasing consumer demand for energy-efficient appliances, government initiatives to promote local manufacturing, and the growth of smart home technology, which is revolutionizing the appliance sector.

05. What are the key trends in India Household Appliances Market?

Notable trends in the India Household Appliances market include the adoption of IoT-enabled appliances, the rise of e-commerce for appliance sales, and growing consumer preference for eco-friendly and energy-efficient products. These trends are likely to continue driving growth over the next few years.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.