India Household Cleaning Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD8968

December 2024

86

About the Report

India Household Cleaning Market Overview

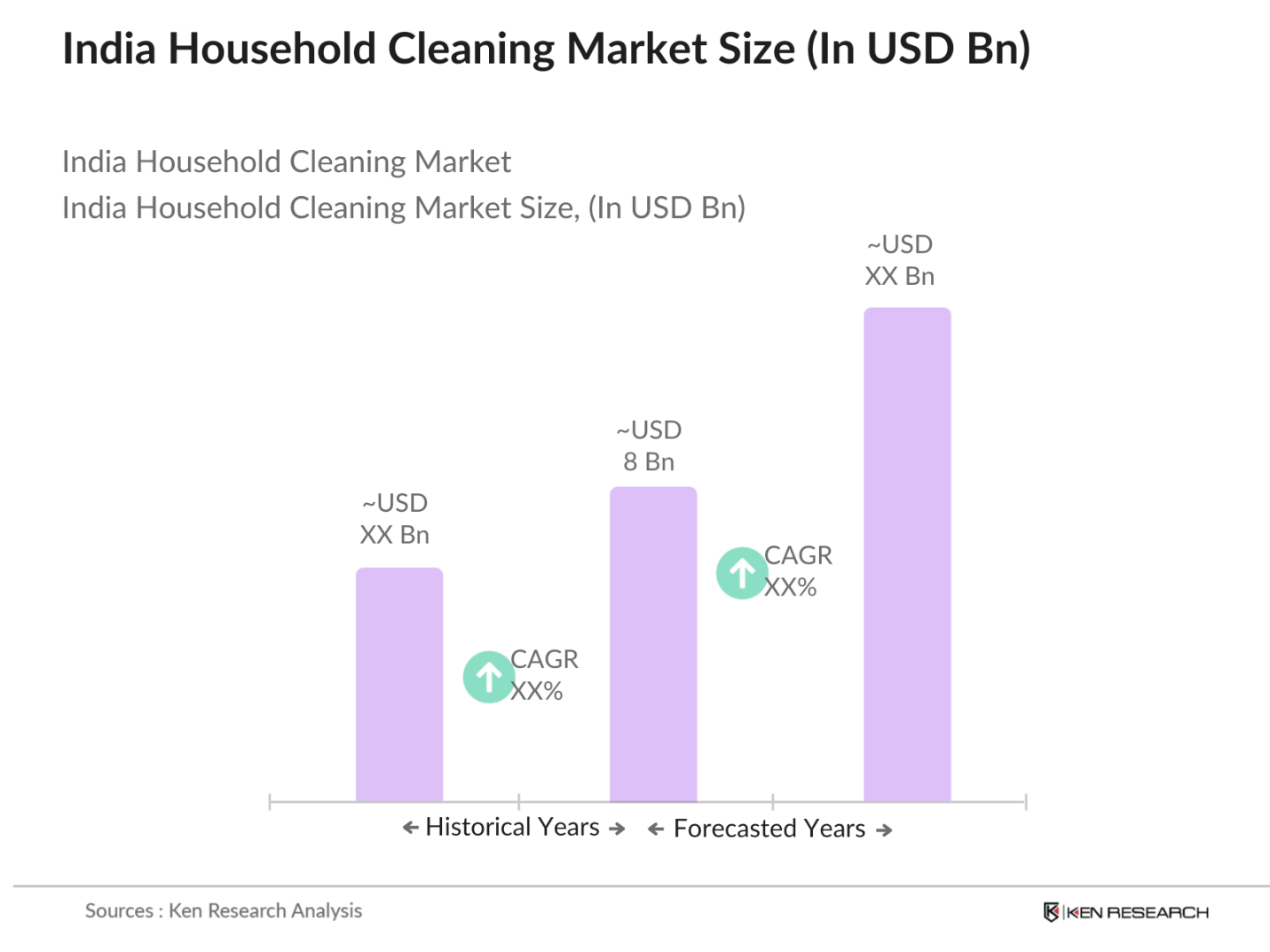

- The India Household Cleaning Market, valued at USD 8 billion, is driven by several factors, including the increasing health and hygiene awareness among consumers and the growing urban population, which enhances the demand for household cleaning products. With a rising inclination towards convenient and effective cleaning solutions, urban households are the primary consumers, pushing the market growth trajectory. The influence of various hygiene campaigns has further bolstered consumer demand for products across multiple cleaning categories.

- In India, metro cities like Mumbai, Delhi, and Bengaluru dominate the household cleaning market due to high population density, higher disposable incomes, and the influence of western lifestyles. These urban centers see substantial adoption of premium and eco-friendly products as consumers are more inclined towards branded and specialized cleaning solutions. Consequently, these cities drive the demand for advanced cleaning products, establishing them as significant contributors to market growth.

- The Indian government has implemented strict standards for chemicals in household cleaning products to ensure consumer safety. The Ministry of Environments updated 2024 regulations require manufacturers to limit the presence of toxic substances like phosphates and VOCs in cleaning agents. These standards aim to reduce adverse health effects and environmental damage, compelling brands to reformulate products while adhering to safety guidelines.

India Household Cleaning Market Segmentation

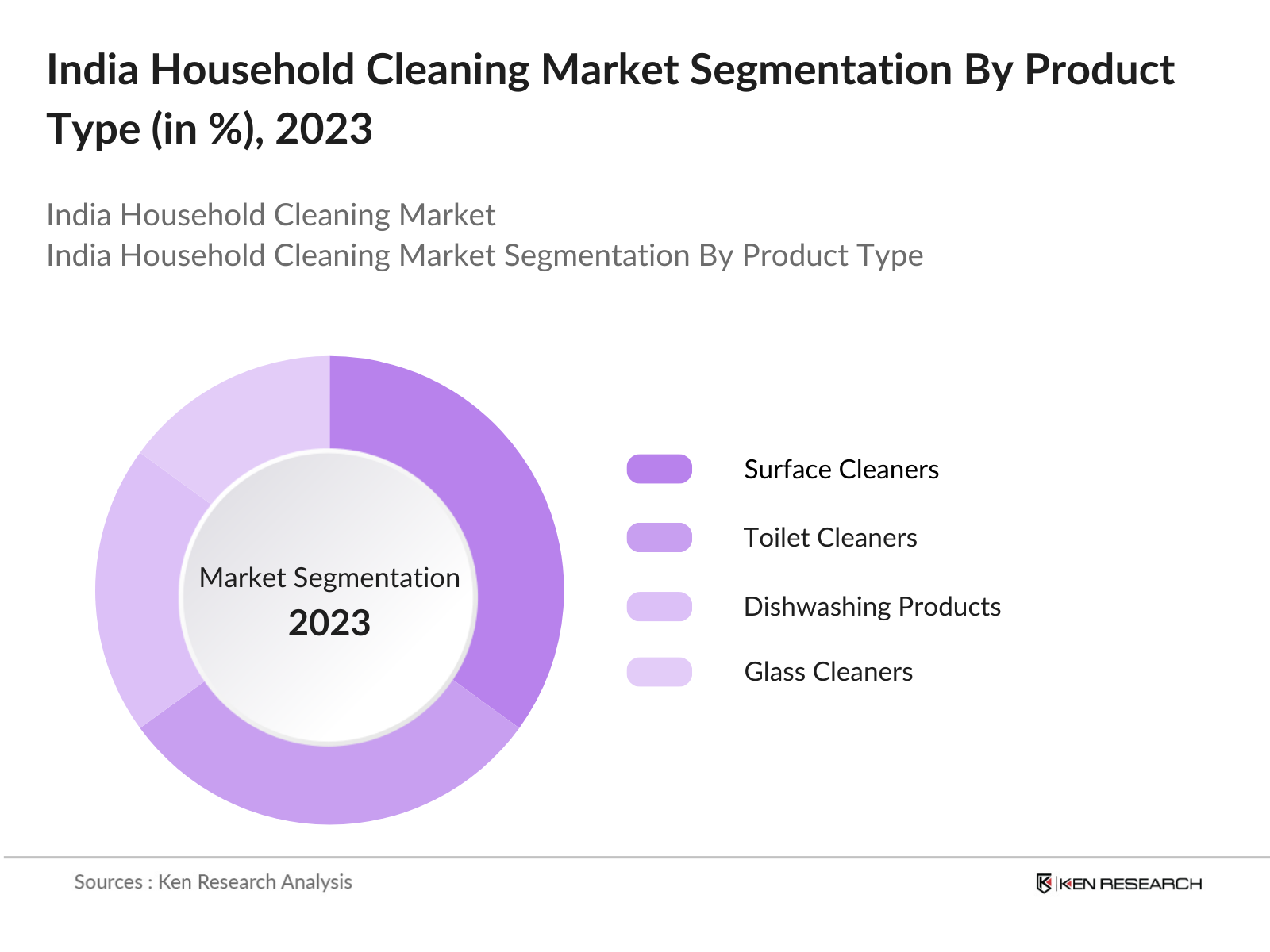

- By Product Type: The India Household Cleaning Market is segmented by product type into surface cleaners, toilet cleaners, dishwashing products, glass cleaners, and specialized cleaning agents. Among these, surface cleaners hold a dominant market share due to their versatility in cleaning multiple surfaces, which makes them highly desirable among consumers. The widespread availability of surface cleaners, combined with strong brand advertising by leading companies, has established them as household essentials.

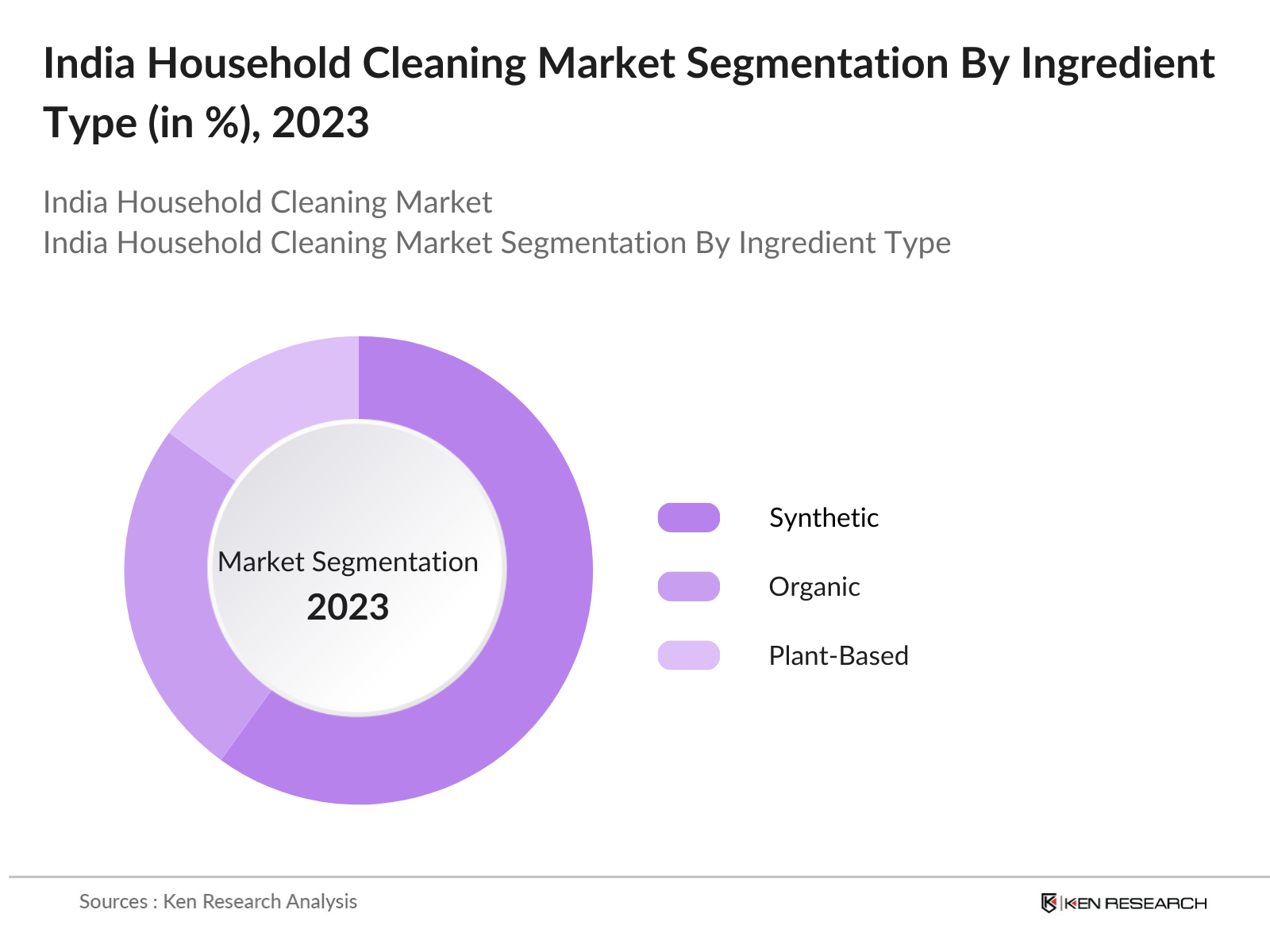

- By Ingredient Type: The market is also segmented by ingredient type into organic, synthetic, and plant-based ingredients. Synthetic cleaners dominate the market share in India due to their strong cleaning efficacy and cost-effectiveness. Consumers in India prioritize cleaning solutions that offer powerful results, which synthetic ingredients often provide. The availability of these cleaners across both offline and online channels further supports their dominance in this segment.

India Household Cleaning Market Competitive Landscape

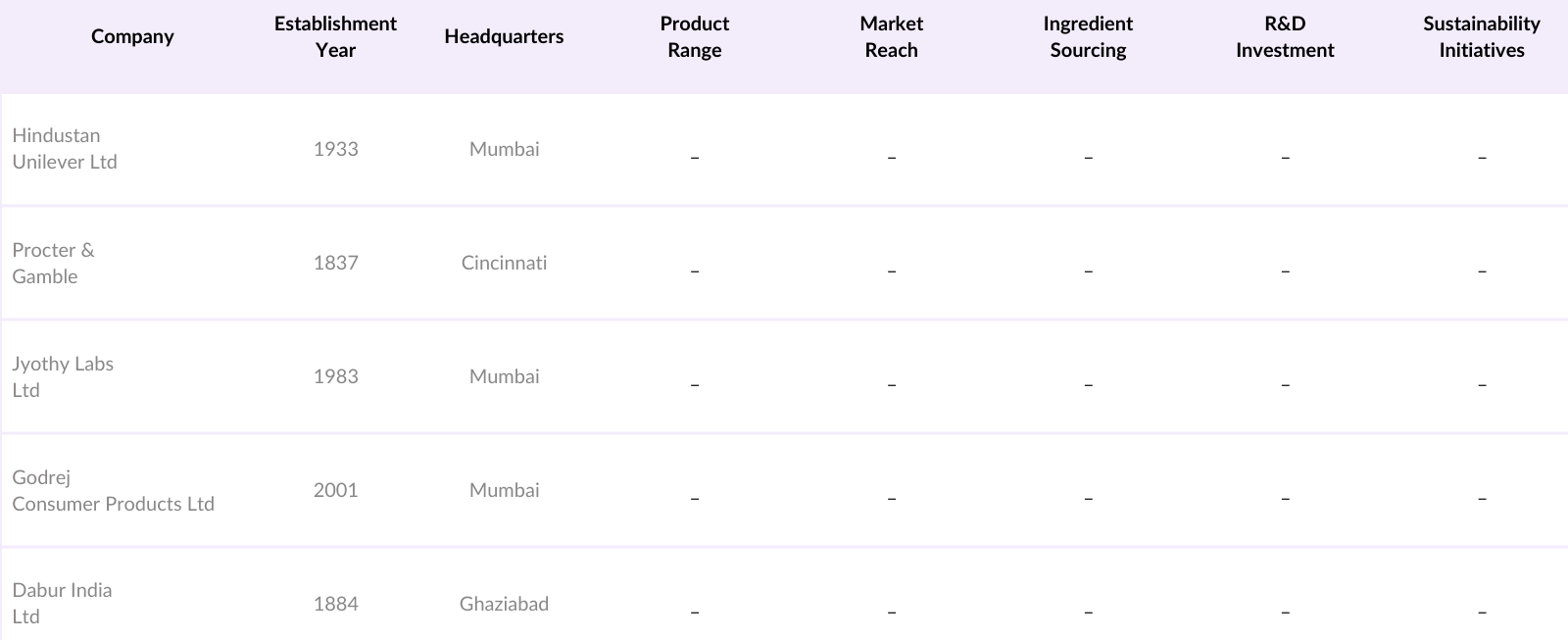

The India Household Cleaning Market is dominated by a few major players, including Hindustan Unilever Ltd, Procter & Gamble, and Jyothy Labs Ltd. These companies have established a robust presence in the market due to their extensive product portfolios, strong distribution networks, and sustained investments in advertising. The presence of both multinational corporations and domestic brands contributes to a highly competitive landscape, where companies frequently introduce new products to attract and retain consumers.

India Household Cleaning Industry Analysis

Market Growth Drivers

- Increasing Urban Household Penetration: Urbanization is driving household cleaning market growth in India, with urban households increasing from 277 million in 2022 to 284 million by 2024, creating higher demand for cleaning products. This shift is fueled by the government's ongoing urban development initiatives under the Pradhan Mantri Awas Yojana (PMAY) and Smart Cities Mission. The average urban household size is decreasing, resulting in higher per capita consumption of household cleaning products as people adopt modern lifestyles that emphasize cleanliness and hygiene.

- Rising Health Awareness: With increasing awareness of health and hygiene post-COVID-19, households are prioritizing cleanliness more than ever. Government surveys report that over 80% of Indian households now consider regular disinfection a priority, and this trend is visible in consumer behavior across urban and semi-urban areas. The Swachh Bharat Abhiyan (Clean India Mission) has also driven substantial public awareness, resulting in increased demand for household cleaning products. The National Sample Survey Office (NSSO) notes that such initiatives have reinforced cleanliness as a daily habit for many.

- Expanding E-commerce Penetration: The e-commerce market in India grew substantially from 2022 to 2024, reaching over 530 million active users, which has boosted sales of household cleaning products through online channels. Platforms like Amazon and Flipkart have expanded their reach even in tier 2 and 3 cities, leading to wider product availability and competitive pricing, which has further propelled demand. The government's Digital India campaign is also a significant factor supporting e-commerce growth, enhancing digital payment systems and internet penetration across the country.

Market Challenges

- Price Sensitivity Among Consumers: India's household cleaning market faces challenges due to price-sensitive consumers, especially in rural and semi-urban areas. According to the Ministry of Rural Development, over 50% of rural households spend cautiously on non-essential goods. This results in slower adoption of branded cleaning products in favor of traditional and locally sourced alternatives. The challenge is compounded by rising inflation, which has impacted consumer purchasing power across the country, necessitating affordable options to sustain market growth.

- Intense Market Competition: The household cleaning sector in India is highly competitive, with both global and local brands competing for market share. The Ministry of Commerce and Industry reported that the entry of multinational brands and local players has heightened price competition and limited premium product penetration. This environment compels brands to differentiate through marketing, packaging, and pricing strategies, which requires substantial investment and impacts profitability.

India Household Cleaning Market Future Outlook

The India Household Cleaning Market is anticipated to experience substantial growth over the next five years, driven by the expanding urban population and an increasing focus on hygiene and wellness. The emergence of eco-friendly products, coupled with sustained consumer demand for effective and affordable cleaning solutions, is expected to propel market growth. Companies will likely continue investing in product innovations and expanding distribution channels to capture a larger share of the evolving market landscape.

Market Opportunities

- Growing Demand for Green Cleaning Products: The demand for eco-friendly cleaning products is on the rise in India, with recent data from the Ministry of Environment, Forest and Climate Change indicating that over 70% of urban consumers prefer products with biodegradable ingredients. This shift towards sustainable options is driven by heightened environmental awareness, supported by initiatives like the Green Good Deeds campaign. Consumers are increasingly opting for green products as they align with environmentally responsible choices, creating significant opportunities for brands offering eco-friendly household cleaners.

- Increasing Adoption in Rural Markets: Indias rural areas, comprising nearly 66% of the population as per the Ministry of Statistics and Programme Implementation, represent a largely untapped market for household cleaning products. Government programs like the Swachh Bharat Mission have positively impacted hygiene awareness, increasing the adoption of cleaning products in rural regions. This presents a growth opportunity for brands focusing on cost-effective, easy-to-use products suited to rural consumers.

Scope of the Report

|

Product Type |

Surface Cleaners Toilet Cleaners Dishwashing Products Glass Cleaners Specialized Cleaning Agents |

|

Ingredient Type |

Organic Synthetic Plant-Based |

|

Application |

Residential Commercial |

|

Distribution Channel |

Offline Online |

|

Region |

North India South India East India West India |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Manufacturers of Household Cleaning Products

Distributor and Wholesaler Industries

E-commerce Platform Companies

Government and Regulatory Bodies (Bureau of Indian Standards, Ministry of Consumer Affairs)

Investor and Venture Capitalist Firms

Raw Material for Cleaning Product Companies

Urban Housing Society and Builder Companies

Companies

Players Mentioned in the Report

Hindustan Unilever Ltd

Procter & Gamble

Jyothy Labs Ltd

Godrej Consumer Products Ltd

Dabur India Ltd

SC Johnson

Marico Ltd

Fena Private Ltd

ITC Limited

Wipro Consumer Care & Lighting

Table of Contents

1. India Household Cleaning Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (Annual Growth Trends, Consumer Demand Metrics)

1.4 Market Segmentation Overview (Product, Ingredient Type, Application, Distribution Channel, Region)

2. India Household Cleaning Market Size (In INR Crore)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Developments and Market Milestones

3. India Household Cleaning Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Urban Household Penetration

3.1.2 Rising Health Awareness (Hygiene Consciousness)

3.1.3 Expanding E-commerce Penetration

3.1.4 Innovation in Product Offerings (Eco-Friendly, Multi-Purpose Solutions)

3.2 Market Challenges

3.2.1 Price Sensitivity Among Consumers

3.2.2 Intense Market Competition

3.2.3 Regulatory Compliance on Chemicals

3.3 Opportunities

3.3.1 Growing Demand for Green Cleaning Products

3.3.2 Increasing Adoption in Rural Markets

3.3.3 Expansion of Online Distribution Channels

3.4 Trends

3.4.1 Rising Popularity of Multipurpose Cleaners

3.4.2 Demand for Sustainable Packaging

3.4.3 Increased Adoption of Biodegradable Ingredients

3.5 Government Regulations

3.5.1 Standards on Household Cleaning Chemicals

3.5.2 Environmental Compliance Regulations

3.5.3 Mandatory Labelling Requirements

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Suppliers, Distributors, Retailers)

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape Ecosystem

4. India Household Cleaning Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Surface Cleaners

4.1.2 Toilet Cleaners

4.1.3 Dishwashing Products

4.1.4 Glass Cleaners

4.1.5 Specialized Cleaning Agents

4.2 By Ingredient Type (In Value %)

4.2.1 Organic

4.2.2 Synthetic

4.2.3 Plant-Based

4.3 By Application (In Value %)

4.3.1 Residential

4.3.2 Commercial

4.4 By Distribution Channel (In Value %)

4.4.1 Offline (Supermarkets, Hypermarkets, Specialty Stores)

4.4.2 Online (E-commerce Platforms, Brand Websites)

4.5 By Region (In Value %)

4.5.1 North India

4.5.2 South India

4.5.3 East India

4.5.4 West India

5. India Household Cleaning Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Hindustan Unilever Ltd

5.1.2 Procter & Gamble

5.1.3 Reckitt Benckiser

5.1.4 Dabur India Ltd

5.1.5 Godrej Consumer Products Ltd

5.1.6 ITC Limited

5.1.7 SC Johnson

5.1.8 Jyothy Labs Ltd

5.1.9 Diversey India Pvt Ltd

5.1.10 Fena Private Ltd

5.1.11 Amway India

5.1.12 Marico Ltd

5.1.13 Colgate-Palmolive (India) Ltd

5.1.14 Henkel Adhesives Technologies India Pvt Ltd

5.1.15 Wipro Consumer Care & Lighting

5.2 Cross Comparison Parameters (Product Range, Ingredient Sourcing, Distribution Reach, Market Share, R&D Investment, Sustainability Initiatives, Consumer Loyalty Programs, Online Presence)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Brand Expansion, Partnerships, Product Innovations)

5.5 Mergers and Acquisitions

5.6 Investment Analysis (Market Expansion Investments)

5.7 Venture Capital Funding

5.8 Government Grants and Support Programs

5.9 Private Equity Investments

6. India Household Cleaning Market Regulatory Framework

6.1 Standards for Household Chemical Composition

6.2 Compliance and Testing Regulations

6.3 Certification Processes and Labeling

7. India Household Cleaning Market Future Size (In INR Crore)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. India Household Cleaning Market Future Segmentation

8.1 By Product Type (In Value %)

8.2 By Ingredient Type (In Value %)

8.3 By Application (In Value %)

8.4 By Distribution Channel (In Value %)

8.5 By Region (In Value %)

9. India Household Cleaning Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Consumer Behavior Insights

9.3 Marketing Strategies

9.4 Market Gaps and White Space Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a comprehensive overview of the India Household Cleaning Market, identifying stakeholders and relevant product categories. Extensive desk research is carried out using industry databases and market reports to capture a holistic view of market dynamics.

Step 2: Market Analysis and Construction

This phase includes compiling and analyzing historical data on sales and revenue for key segments within the India Household Cleaning Market. Data on consumer preferences, product penetration, and distribution channels are reviewed to ensure reliability in the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on market trends and consumer behavior are validated through consultations with industry experts and stakeholders from major companies in the household cleaning sector. These interviews provide insights into market operations, challenges, and growth opportunities.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing findings from the primary and secondary research to create a comprehensive, validated report. Detailed insights on key product categories, consumer preferences, and competitive strategies are incorporated to ensure accuracy in the final market outlook.

Frequently Asked Questions

1. How big is the India Household Cleaning Market?

The India Household Cleaning Market is valued at USD 8 billion, driven by increased hygiene awareness and demand for convenient cleaning products among urban households.

2. What are the challenges in the India Household Cleaning Market?

Challenges include high competition among brands, price sensitivity among consumers, and regulatory compliance regarding chemical ingredients, which can impact product formulations and costs.

3. Who are the major players in the India Household Cleaning Market?

Key players include Hindustan Unilever, Procter & Gamble, and Dabur India, known for their strong product portfolios, extensive distribution networks, and substantial advertising investments.

4. What are the growth drivers of the India Household Cleaning Market?

Growth is fueled by rising urbanization, consumer health awareness, and demand for eco-friendly products. Hygiene campaigns and effective brand advertising further stimulate market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.