India Household Essentials Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD5710

December 2024

94

About the Report

India Household Essentials Market Overview

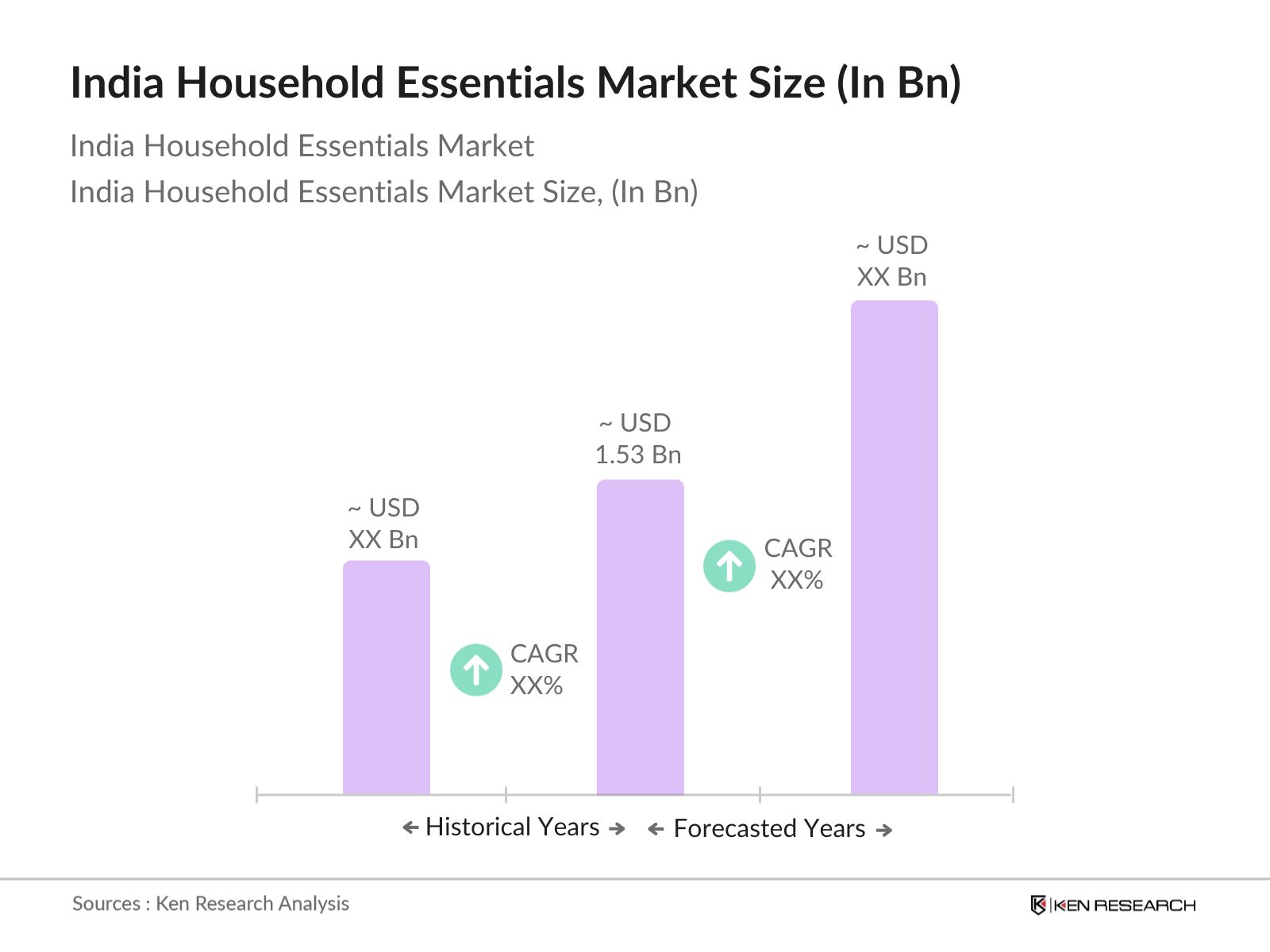

- The India Household Essentials Market is valued at USD 1.53 billion, driven by a rising middle-class population, increased disposable income, and the growing influence of e-commerce. A five-year historical analysis highlights consistent growth, fueled by urbanization and shifting consumer preferences toward convenience and quality in household products. Major brands have strengthened their market presence by expanding distribution channels, while the rising awareness of hygiene has boosted the demand for cleaning and sanitation products.

- The dominant cities in the India Household Essentials Market include Delhi, Mumbai, and Bengaluru, largely due to their high population density, urbanization, and greater purchasing power. These cities lead in consumer adoption of branded and premium household products, supported by a robust distribution network and strong marketing campaigns. Additionally, the e-commerce penetration in these regions is higher, further propelling sales of household essentials.

- Indias Consumer Protection Act of 2019, enforced in 2020, mandates stringent guidelines on labelling and packaging for consumer goods, including household essentials. By 2023, the Bureau of Indian Standards (BIS) reported a compliance rate of 85% for labelling norms across all FMCG products, including household essentials. These standards require clear disclosure of ingredients, expiry dates, and manufacturing details, helping consumers make informed choices and ensuring product safety. Brands failing to comply face penalties, ensuring greater accountability in the sector.

India Household Essentials Market Segmentation

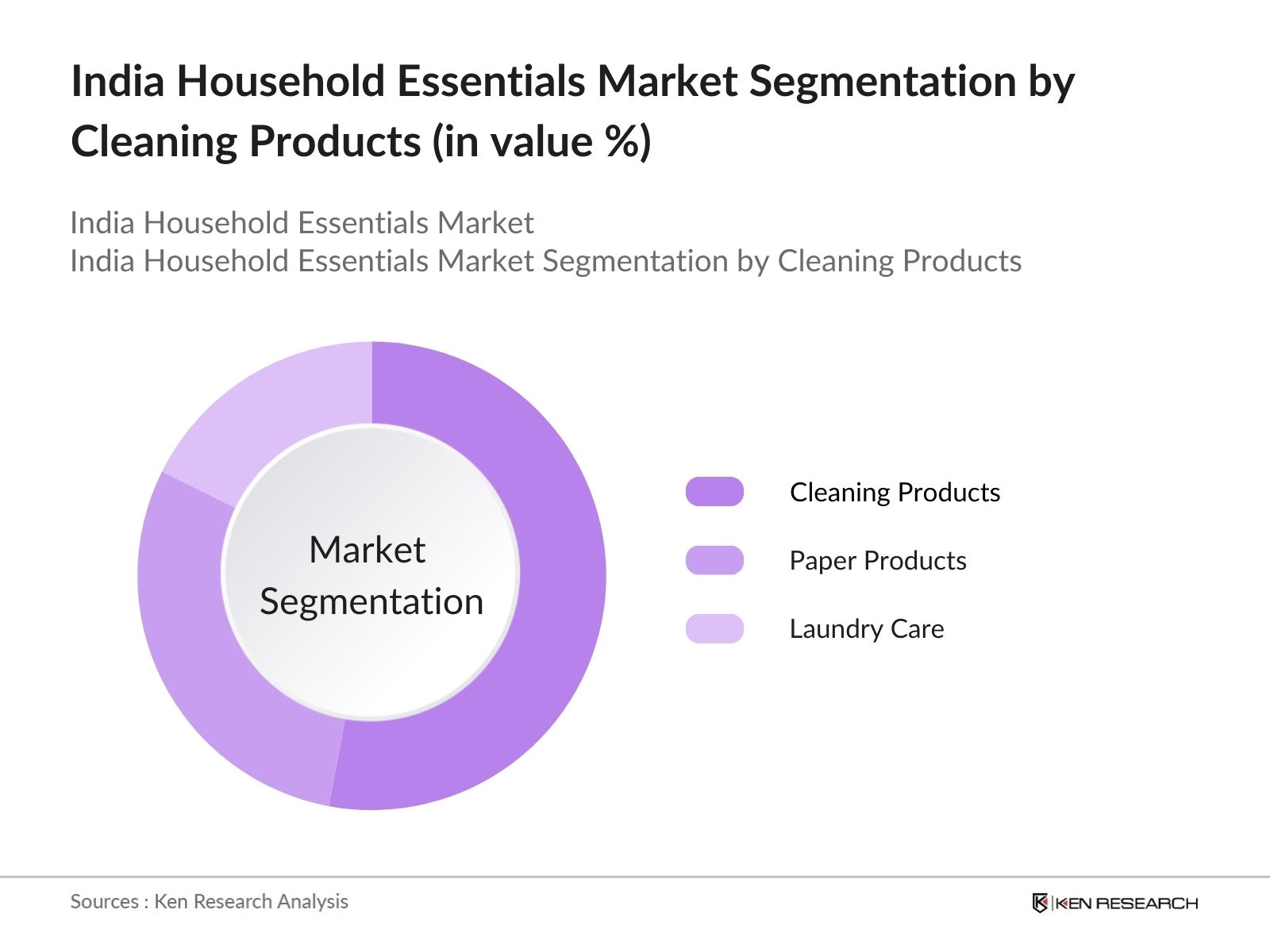

- By Cleaning Products: The India Household Essentials Market is segmented By Cleaning Products into cleaning products, paper products, and laundry care. Among these, cleaning products, including surface cleaners and disinfectants, hold the largest market share. This dominance can be attributed to the heightened consumer awareness regarding cleanliness and hygiene, especially post-pandemic. Brands like Hindustan Unilever and Godrej have capitalized on this trend with frequent product launches and aggressive marketing strategies, reinforcing their market leadership.

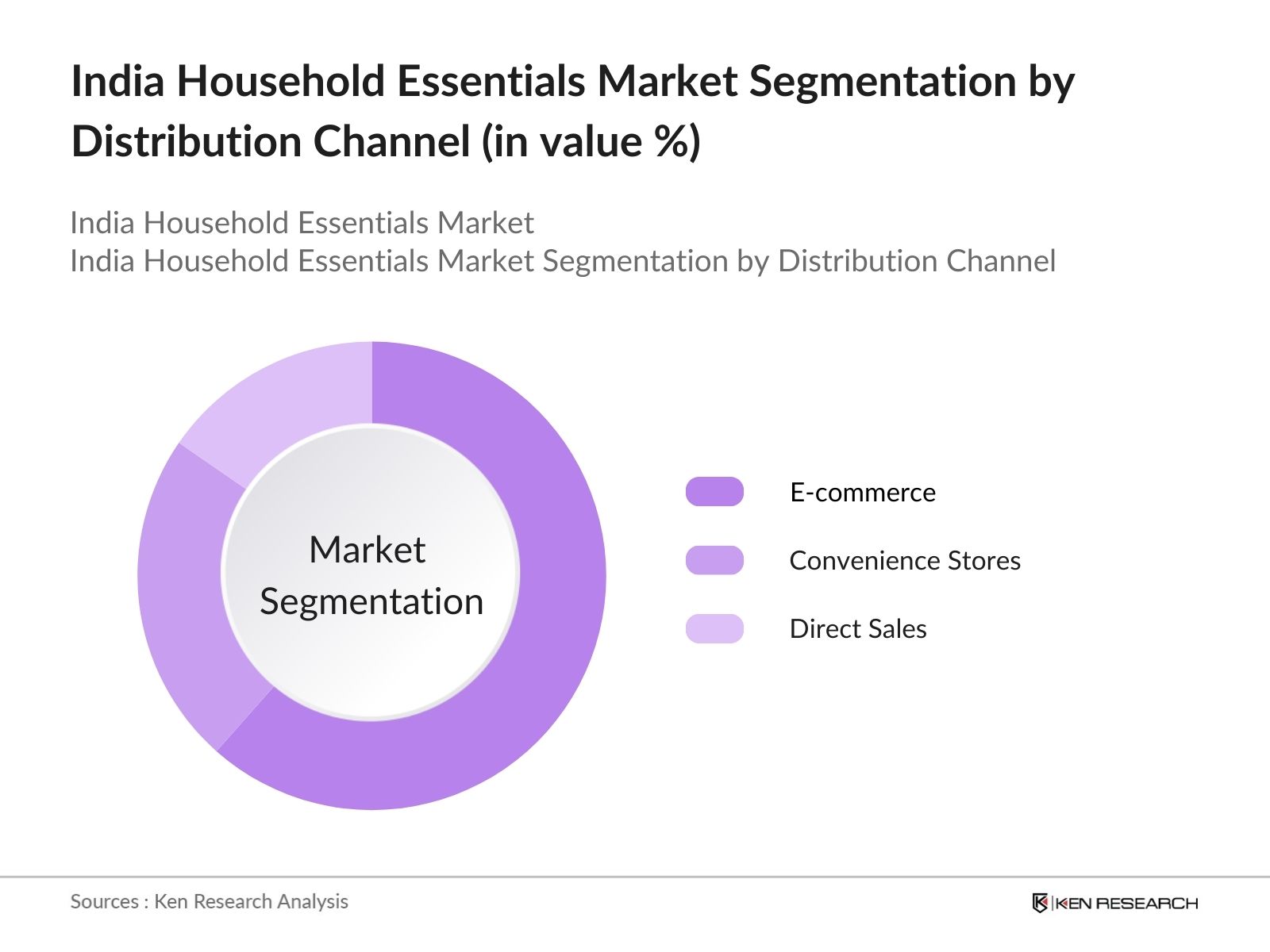

- By Distribution Channel: The market is also segmented by distribution channel, which includes hypermarkets/supermarkets, convenience stores, e-commerce, and direct sales. E-commerce has emerged as the fastest-growing channel, accounting for the highest market share. The convenience of online shopping, coupled with attractive discounts and a wide variety of choices, has driven consumers to opt for e-commerce platforms like Amazon and Flipkart. This shift is more pronounced in urban areas, where internet penetration is higher.

India Household Essentials Market Competitive Landscape

The India Household Essentials Market is highly competitive, with several key players dominating different segments of the market. Local players like Hindustan Unilever and Godrej lead in terms of distribution and brand loyalty, while international players like Procter & Gamble and Reckitt Benckiser also have a substantial presence. The competition is primarily driven by product differentiation, innovation, and marketing strategies.

|

Company |

Establishment Year |

Headquarters |

Revenue (USD) |

Market Penetration |

Sustainability Initiatives |

R&D Spending |

Key Products |

Retail Partnerships |

|

Hindustan Unilever Ltd. |

1933 |

Mumbai, India |

- |

- |

- |

- |

- |

- |

|

Godrej Consumer Products |

2001 |

Mumbai, India |

- |

- |

- |

- |

- |

- |

|

Procter & Gamble |

1837 |

Cincinnati, USA |

- |

- |

- |

- |

- |

- |

|

Reckitt Benckiser |

1819 |

Slough, UK |

- |

- |

- |

- |

- |

- |

|

ITC Limited |

1910 |

Kolkata, India |

- |

- |

- |

- |

- |

- |

India Household Essentials Market Analysis

India Household Essentials Market Growth Drivers

- Rising Disposable Income: Indias GDP per capita has seen steady growth, increasing to $2,170 in 2023 from $1,988 in 2020, driven by a robust economy and rising wages. This surge in disposable income is fueling consumer spending on household essentials. According to the World Bank, household consumption in India accounted for 59.2% of the GDP in 2023, showcasing a shift toward premium products in the essentials market. Middle-income households are increasingly purchasing branded goods, reducing demand for unbranded alternatives. Rising wages in urban areas further contribute to this trend.

- Increased Consumer Awareness: Consumer awareness regarding environmental impact and health has grown substantially, with 58% of Indian households reportedly shifting to sustainable or organic household products by 2023, according to the Ministry of Environment, Forest and Climate Change. The government's Green India initiative and increased social media influence have further amplified this movement. Households are increasingly opting for eco-friendly products, driven by a preference for reducing their carbon footprint and improving health. This awareness is more prominent in urban centers like Delhi, Mumbai, and Bengaluru, where disposable income and education levels are higher.

- E-commerce Penetration: E-commerce channels in India have experienced explosive growth, with over 200 million households now actively shopping online for household essentials as of 2023, according to the Department for Promotion of Industry and Internal Trade (DPIIT). The increasing penetration of smartphones, which reached 700 million users in 2023, has bolstered e-commerce adoption. Around 45% of household essential purchases now occur via e-commerce platforms, with top-tier cities contributing to over 60% of this figure, while rural areas see increasing adoption due to improving internet access.

India Household Essentials Market Challenges

- High Competition from Unorganized Sector: The Indian household essentials market is still dominated by the unorganized sector, which accounts for nearly 60% of sales in 2023, according to the Ministry of Commerce. Local manufacturers offer products at lower prices, making it challenging for organized players to capture a larger market share. Although urban consumers are shifting toward branded goods, rural areas remain heavily reliant on unorganized players, where price sensitivity prevails. The low cost of production and distribution for unorganized players gives them a competitive edge, posing a major challenge for organized brands.

- Price Sensitivity of Indian Consumers: Indias median annual household income is estimated at $3,168 in 2023, as per World Bank data. Given the relatively low-income levels, Indian consumers remain highly price-sensitive, especially in the rural and semi-urban regions, where 66% of the population resides. This price sensitivity limits the market penetration of premium and branded household products. Consumers in these segments prioritize price over quality, which often leads to a preference for locally produced, affordable alternatives over costlier, branded products.

India Household Essentials Market Future Outlook

Over the next five years, the India Household Essentials Market is expected to witness substantial growth, driven by a surge in demand for sustainable and eco-friendly products, increased penetration of e-commerce platforms, and an expanding middle-class population. As consumers become more health-conscious, the demand for organic and biodegradable household essentials is likely to rise. Companies are expected to focus more on sustainability, innovation in product packaging, and expanding their rural market reach to tap into the growing demand.

India Household Essentials Market Opportunities

- Expansion of Organized Retail in Rural Markets: Rural India, home to 850 million people, offers vast potential for the expansion of organized retail, which remains underpenetrated at just 8% in 2023, according to data from the Ministry of Rural Development. The governments initiatives to improve rural infrastructure, including roads and internet connectivity, are opening new avenues for household essentials in these areas. Retail giants are setting up organized retail outlets in rural markets, facilitating access to branded and quality household products that were previously unavailable.

- Innovation in Sustainable Packaging: With India generating over 26,000 tonnes of plastic waste daily in 2023, sustainable packaging has emerged as a key area for innovation. The government has mandated Extended Producer Responsibility (EPR) for packaging waste, which encourages manufacturers to adopt eco-friendly solutions. Companies in the household essentials market are now exploring biodegradable and recyclable materials, reducing their reliance on conventional plastic packaging. The shift to sustainable packaging is gaining momentum, particularly among environmentally conscious urban consumers, presenting a major growth opportunity for brands that lead this change.

Scope of the Report

|

Product Type |

Cleaning Products Paper Products Air Care Laundry Care Others |

|

Distribution Channel |

Hypermarkets/Supermarkets Convenience Stores E-commerce Department Stores Direct Sales |

|

Demographic |

Urban Rural |

|

Consumer Type |

Premium Segment Mass Segment |

|

Region |

North India South India East India West India |

Products

Key Target Audience

FMCG Manufacturers

Distributors and Retailers

E-commerce Platforms

Logistics and Supply Chain Providers

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (Bureau of Indian Standards, Ministry of Consumer Affairs)

Packaging and Labelling Companies

Banks and Financial Institutions

Raw Material Suppliers

Companies

Players Mentioned in the Market

Hindustan Unilever Ltd.

Godrej Consumer Products Ltd.

ITC Limited

Procter & Gamble

Reckitt Benckiser (India) Ltd.

Colgate-Palmolive (India) Ltd.

Jyothy Laboratories Ltd.

Marico Ltd.

SC Johnson

Patanjali Ayurved Ltd.

Table of Contents

1. India Household Essentials Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Household Essentials Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Household Essentials Market Analysis

3.1. Growth Drivers

3.1.1. Rising Disposable Income

3.1.2. Increased Consumer Awareness (Sustainability, Organic Products)

3.1.3. E-commerce Penetration (Channel-wise Contribution)

3.1.4. Urbanization and Changing Lifestyle

3.2. Market Challenges

3.2.1. High Competition from Unorganized Sector

3.2.2. Price Sensitivity of Indian Consumers

3.2.3. Supply Chain Disruptions (Logistics, Raw Material Availability)

3.3. Opportunities

3.3.1. Expansion of Organized Retail in Rural Markets

3.3.2. Innovation in Sustainable Packaging

3.3.3. Adoption of Subscription-based Sales Models

3.4. Trends

3.4.1. Rise of Private Labels

3.4.2. Increasing Demand for Eco-friendly Products

3.4.3. Customization and Personalized Household Products

3.5. Government Regulations

3.5.1. Consumer Protection Act (Labelling and Packaging Standards)

3.5.2. Import Tariffs and Duties on Raw Materials

3.5.3. GST and Tax Reforms Impacting Consumer Goods

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, Distributors, Retailers, E-commerce Players)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. India Household Essentials Market Segmentation

4.1. By Cleaning Products (In Value %)

4.1.1. Cleaning Products (Detergents, Dishwashing, Surface Cleaners)

4.1.2. Paper Products (Tissues, Napkins, Paper Towels)

4.1.3. Air Care (Air Fresheners, Fragrance Dispensers)

4.1.4. Laundry Care (Fabric Conditioners, Laundry Additives)

4.1.5. Others (Mops, Brushes, Garbage Bags)

4.2. By Distribution Channel (In Value %) 4.2.1. Hypermarkets/Supermarkets

4.2.2. Convenience Stores

4.2.3. E-commerce

4.2.4. Department Stores

4.2.5. Direct Sales

4.3. By Demographic (In Value %) 4.3.1. Urban

4.3.2. Rural

4.4. By Consumer Type (In Value %) 4.4.1. Premium Segment

4.4.2. Mass Segment

4.5. By Region (In Value %) 4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Household Essentials Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Hindustan Unilever Ltd.

5.1.2. ITC Limited

5.1.3. Dabur India Ltd.

5.1.4. Godrej Consumer Products Ltd.

5.1.5. Procter & Gamble

5.1.6. Colgate-Palmolive (India) Ltd.

5.1.7. Reckitt Benckiser (India) Ltd.

5.1.8. Jyothy Laboratories Ltd.

5.1.9. Marico Ltd.

5.1.10. SC Johnson

5.1.11. Patanjali Ayurved Ltd.

5.1.12. Amway India Enterprises Pvt. Ltd.

5.1.13. AmazonBasics (Private Label)

5.1.14. Emami Limited

5.1.15. Nirma Limited

5.2. Cross Comparison Parameters (Revenue, Product Portfolio Breadth, Distribution Reach, Sustainability Initiatives, R&D Spending, Consumer Trust Index, Online Presence, Retail Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, Product Launches, Advertising Campaigns)

5.5. Mergers and Acquisitions

5.6. Investment Analysis (FMCG Sector Investment Trends)

5.7. Venture Capital and Private Equity Investments

6. India Household Essentials Market Regulatory Framework

6.1. Quality Standards (Bureau of Indian Standards for Consumer Goods)

6.2. Certification Processes (ISI Mark, Eco-Mark for Sustainable Products)

6.3. Compliance with Environmental Regulations (Plastic Use, Waste Management)

7. India Household Essentials Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Household Essentials Future Market Segmentation

8.1. By Cleaning Products (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Demographic (In Value %)

8.4. By Consumer Type (In Value %)

8.5. By Region (In Value %)

9. India Household Essentials Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Behavior Analysis

9.3. Channel Strategy Recommendations

9.4. Market Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involves developing an ecosystem map, which outlines all the key stakeholders in the India Household Essentials Market. This map is created through extensive desk research utilizing multiple secondary sources and proprietary databases. The objective of this phase is to identify key variables, such as consumer preferences, product innovation, and distribution channels, that affect the market.

Step 2: Market Analysis and Construction

In this phase, historical data is compiled and analyzed to assess market trends and market share for each sub-segment. Revenue generation from each segment and its contribution to overall market growth are also examined. Additionally, product availability and penetration in various distribution channels are evaluated.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses developed in the previous stages are validated through interviews with industry experts, including FMCG manufacturers, distributors, and retailers. These consultations are critical in gathering insights into market drivers, challenges, and consumer preferences, ensuring a well-rounded and validated analysis.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing all the data and insights gathered from various sources and presenting it in a comprehensive report. The research findings are further validated through consultations with key industry players and an analysis of their product portfolios, marketing strategies, and distribution networks.

Frequently Asked Questions

01. How big is the India Household Essentials Market?

The India Household Essentials Market is valued at USD 1.53 billion, driven by rising consumer awareness about hygiene, the growth of e-commerce platforms, and increasing urbanization.

02. What are the challenges in the India Household Essentials Market?

Key challenges in the India Household Essentials Market include competition from unorganized players, high price sensitivity among consumers, and logistical issues that affect the distribution of household essentials, particularly in rural areas.

03. Who are the major players in the India Household Essentials Market?

Major players in the India Household Essentials Market include Hindustan Unilever Ltd., ITC Limited, Godrej Consumer Products, and Procter & Gamble, who dominate the market due to their strong distribution networks, brand loyalty, and focus on innovation.

04. What are the growth drivers of the India Household Essentials Market?

Growth drivers in the India Household Essentials Market include increasing disposable incomes, rising consumer awareness about cleanliness and hygiene, and the rapid penetration of e-commerce, which has made household essentials more accessible to consumers across India.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.