India Hydrocolloids Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD2130

October 2024

86

About the Report

India Hydrocolloids Market Overview

- The India Hydrocolloids Market was valued at USD 142 million. The market is expanding due to its wide applications in food and beverages, pharmaceuticals, cosmetics, and agriculture. The growing consumer demand for clean-label products and natural ingredients has been a major factor driving market growth.

- Major players in the market include Cargill India, Kerry Group, CP Kelco, DuPont Nutrition & Biosciences, and Ashland Inc. These companies dominate the market through a combination of strategic partnerships, innovative product development, and a focus on catering to the growing demand for natural and plant-based hydrocolloids.

- In December 2023, Cargill Indias Innovation Center launched several food solutions tailored for the Indian market, including "Protex DS," a wheat gluten substitute for bakers, and "Elite Choice," Indias first flavored, aerated cookie shortening. These innovations reflect Cargill's commitment to leveraging global expertise for local market needs.

- Maharashtra emerged as the leading region for hydrocolloids production, due to the state's well-established food processing industry, extensive agricultural base, and access to raw materials such as guar and locust bean gum. The presence of major food manufacturers and a strong export infrastructure.

India Hydrocolloids Market Segmentation

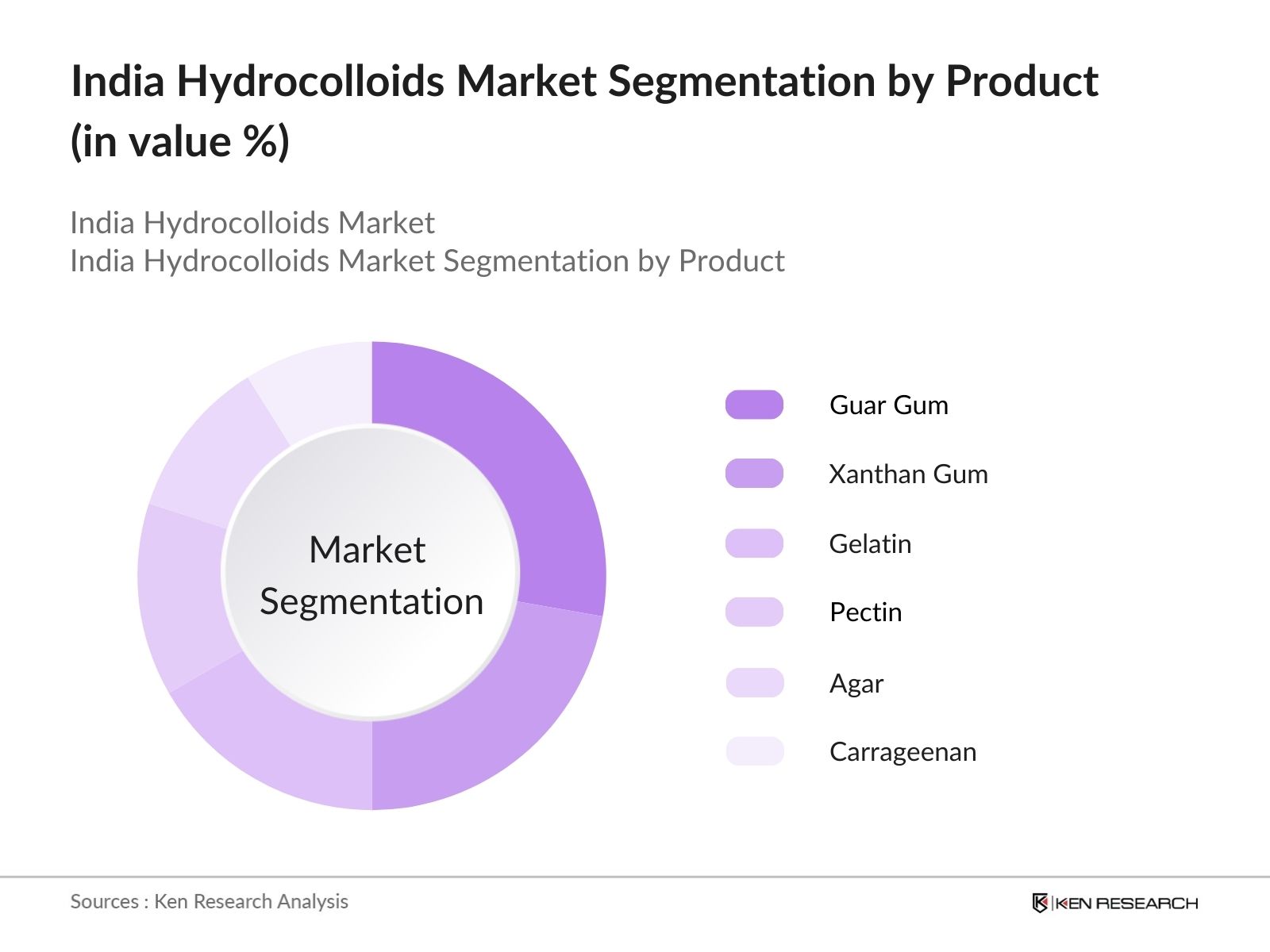

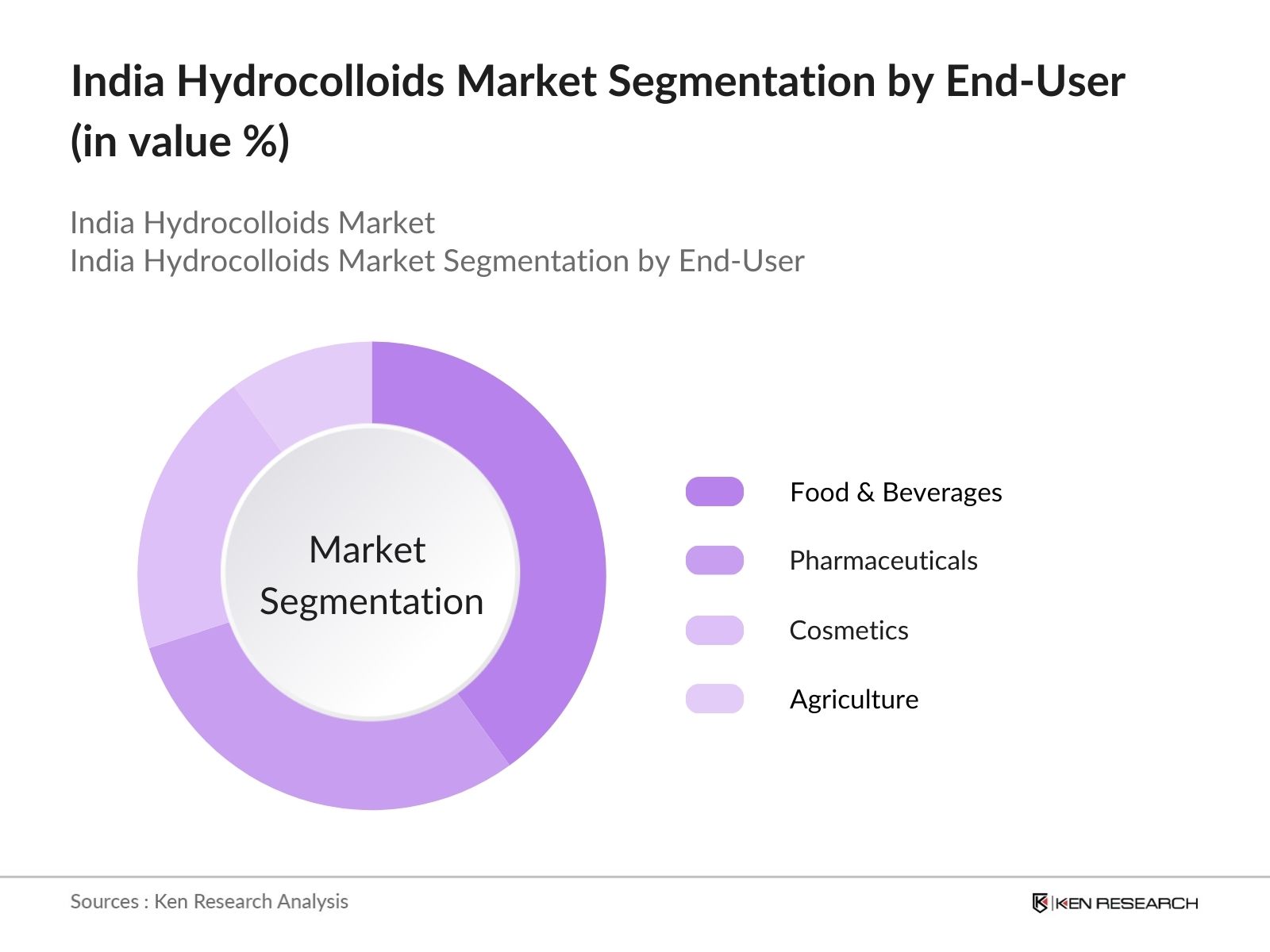

The market is segmented into various factors like product, end-user, and region.

By Product: The market is segmented by product into Gelatin, Pectin, Agar, Carrageenan, Xanthan Gum, and Guar Gum. Guar Gum held the largest market share due to its wide use in the food and beverage industry for its gelling, thickening, and stabilizing properties.

By End-User: The market is segmented by end-user into Food & Beverages, Pharmaceuticals, Cosmetics, and Agriculture. The Food & Beverages segment held the largest market share, by the growing need for natural stabilizers and thickeners in processed foods.

By Region: The market is segmented by region into North, South, East, and West. The West region, held the largest market share due to its strong food processing industry. The presence of major food manufacturers and a strong export infrastructure has helped Maharashtra maintain its position as a key player in the market.

India Hydrocolloids Market Competitive Landscape

|

Company Name |

Established |

Headquarters |

|

Cargill India |

1987 |

Gurgaon, India |

|

Kerry Group |

1972 |

Tralee, Ireland |

|

CP Kelco |

2000 |

Atlanta, USA |

|

DuPont Nutrition |

1802 |

Wilmington, USA |

|

Ashland Inc. |

1924 |

Covington, USA |

- Cargill India: In October 2023, Cargill partnered with Japanese companies Unitec Foods and Fuji Nihon Seito Corporation to expand food ingredient solutions across the Asia-Pacific region. This collaboration will focus on integrating expertise from Cargill's Innovation Center and Japanese facilities to enhance pectin-based product offerings in Southeast Asia.

- Nexira: In August 2022, Nexira acquired UNIPEKTIN Ingredients AG, a Swiss company specializing in natural hydrocolloids and premium ingredients. This acquisition is a strategic move to enhance Nexira's product portfolio in the food, nutrition, and health industries, enabling further growth and expansion into high-value markets.

India Hydrocolloids Market Analysis

Market Growth Drivers

- Rising Demand for Natural Food Additives: In July 2024, the Ministry of Food Processing Industries approved 588 food processing units and 399 cold chain projects under the Pradhan Mantri Kisan SAMPADA Yojana. This initiative enhances the hydrocolloids market by improving infrastructure, reducing agricultural waste, and promoting processed food exports.

- Expanding Pharmaceutical Industry: India's pharmaceutical sector continues to be a key driver of the hydrocolloids market, with over 3,000 pharma companies and 10,500 manufacturing facilities fueling demand for hydrocolloids like gelatin in drug formulations. In 2024, India's pharmaceutical market is expected to generate significant revenue, contributing to robust growth in hydrocolloid usage in drug delivery systems.

- Growing Focus on Functional Foods: The health-conscious consumer base in India is rapidly expanding, with functional food consumption increased in 2024. This shift is driving the use of hydrocolloids like pectin and guar gum, which are critical in low-fat, low-sugar, and fiber-rich food products. Hydrocolloids play a crucial role in enhancing the texture and nutritional value of these foods, contributing to the markets sustained growth.

Market Challenges

- Limited Awareness Among End-Users: Despite the increasing demand for natural and functional food products, there is still limited awareness among Indian consumers and manufacturers regarding the full potential of hydrocolloids. In rural and semi-urban areas, hydrocolloids are not widely used in food processing, which limits the markets growth potential.

- Competition from Synthetic Alternatives: Although the demand for natural hydrocolloids is rising, synthetic alternatives, such as modified starches and cellulose, continue to pose strong competition. In 2024, the synthetic alternatives market reached INR 4,000 crore, which affects the hydrocolloids industry share, particularly in the pharmaceutical and cosmetics industries, where cost-effective alternatives are highly sought after.

Government Initiatives

- National Seaweed Mission (2023): The Indian government launched the ambitious Seaweed Mission in 2021 to promote sustainable seaweed cultivation along its 7,500-km coastline. The mission aims to increase seaweed production from the current 30,000 tonnes to 11 million tonnes by 2025, creating employment for 50 million people and contributing to the national GDP.

- Production-Linked Incentive Scheme (2024): The Indian governments Production-Linked Incentive (PLI) scheme for the food processing sector, is encouraging the adoption of innovative food ingredients, including natural hydrocolloids. This scheme incentivizes manufacturers to invest in R&D for new product formulations using hydrocolloids, further expanding their market application.

India Hydrocolloids Market Future Outlook

The market is expected to witness increased adoption of plant-based hydrocolloids, growth in pharmaceutical applications, a focus on sustainability, and technological innovations in production processes over the next five years.

Future Market Trends

- Growth in Pharmaceutical Applications: Hydrocolloids like gelatin and carrageenan will play an increasingly critical role in Indias pharmaceutical industry. With the continued expansion of the sector, these hydrocolloids will be integral to the development of new drug formulations, particularly in tablet binding and controlled-release technologies.

- Technological Innovations in Production: Technological advancements in hydrocolloid extraction and processing will drive market growth over the next five years. By 2028, innovations in the extraction of pectin and carrageenan from natural sources like fruit peels and seaweed will reduce production costs and improve the efficiency of the supply chain, contributing to market expansion.

Scope of the Report

|

By Product |

Gelatin Pectin Agar Carrageenan Xanthan Gum Guar Gum |

|

By End-User |

Food & Beverages Pharmaceuticals Cosmetics Agriculture |

|

By Region |

North East West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Banks and Financial Institutions

Food & Beverage Manufacturers

Pharmaceutical Companies

Cosmetics Manufacturers

Agricultural Product Manufacturers

Government Regulatory Bodies

Venture Capitalist

Companies

Players Mentioned in the Report:

Cargill India

Kerry Group

CP Kelco

DuPont Nutrition & Biosciences

Ashland Inc.

Archer Daniels Midland Company (ADM)

Ingredion Incorporated

Tate & Lyle

Nexira

Royal DSM

Palsgaard A/S

Riken Vitamin Co. Ltd.

AVEBE U.A.

BASF SE

FMC Corporation

Table of Contents

1. India Hydrocolloids Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Hydrocolloids Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Hydrocolloids Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for Clean Label Products

3.1.2. Expanding Pharmaceutical Industry

3.1.3. Focus on Sustainable Food Processing

3.1.4. Increased Health-Conscious Consumer Base

3.2. Restraints

3.2.1. Raw Material Price Fluctuations

3.2.2. Regulatory Hurdles

3.2.3. Limited Awareness Among End-Users

3.3. Opportunities

3.3.1. Technological Innovations in Extraction

3.3.2. Expansion into Nutraceuticals and Functional Foods

3.3.3. Government Incentives for Sustainable Agriculture

3.4. Trends

3.4.1. Rising Use of Plant-Based Hydrocolloids

3.4.2. Increased Application in Pharmaceuticals

3.4.3. Growth in Organic and Natural Cosmetics Market

3.5. Government Regulation

3.5.1. FSSAI Regulations on Food Additives

3.5.2. Clean Label Initiative

3.5.3. National Seaweed Mission

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competitive Ecosystem

4. India Hydrocolloids Market Segmentation, 2023

4.1. By Product Type (in Value%)

4.1.1. Guar Gum

4.1.2. Xanthan Gum

4.1.3. Gelatin

4.1.4. Pectin

4.2. By Application (in Value%)

4.2.1. Food & Beverages

4.2.2. Pharmaceuticals

4.2.3. Cosmetics

4.2.4. Agriculture

4.3. By Region (in Value%)

4.3.1. North India

4.3.2. South India

4.3.3. East India

4.3.4. West India

5. India Hydrocolloids Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Cargill India

5.1.2. Kerry Group

5.1.3. CP Kelco

5.1.4. DuPont Nutrition

5.1.5. Ashland Inc.

5.1.6. Ingredion Incorporated

5.1.7. Archer Daniels Midland Company

5.1.8. BASF SE

6. India Hydrocolloids Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Government Grants for Agricultural Production

6.4.2. Private Equity Investments in Hydrocolloid Production

7. India Hydrocolloids Market Regulatory Framework

7.1. FSSAI Compliance

7.2. Certification for Hydrocolloid Products

7.3. Government Support for Sustainable Farming Practices

8. India Hydrocolloids Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. India Hydrocolloids Future Market Segmentation, 2028

9.1. By Product Type (in Value%)

9.2. By Application (in Value%)

9.3. By Region (in Value%)

10. India Hydrocolloids Market Analysts Recommendations

10.1. Customer Cohort Analysis

10.2. Marketing Initiatives

10.3. Expansion Opportunities in Pharmaceuticals

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step:1 Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step:2 Market Building

Collating statistics on this industry over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India Hydrocolloids Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step:3 Validating and Finalizing

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step:4 Research output

Our team will approach multiple hydrocolloids companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such hydrocolloids companies.

Frequently Asked Questions

01 How big is the India Hydrocolloids Market?

The India Hydrocolloids Market was valued at USD 142 million. The market is expanding due to its wide applications in food and beverages, pharmaceuticals, cosmetics, and agriculture

02 What are the challenges in the India Hydrocolloids Market?

Major challenges in the India Hydrocolloids Market include raw material price volatility, regulatory hurdles, competition from synthetic alternatives, and limited awareness among small-scale manufacturers.

03 Who are the major players in the India Hydrocolloids Market?

Major players in the India Hydrocolloids Market include Cargill India, Kerry Group, CP Kelco, DuPont Nutrition & Biosciences, and Ashland Inc.

04 What are the main growth drivers of the India Hydrocolloids Market?

Key drivers of the India Hydrocolloids Market include growing demand for natural and clean-label food products, expansion of the pharmaceutical industry, and the government's promotion of sustainable agriculture are key drivers in the India Hydrocolloids market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.