India Hydrogen Fuel Cell Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD10196

October 2024

97

About the Report

India Hydrogen Fuel Cell Market Overview

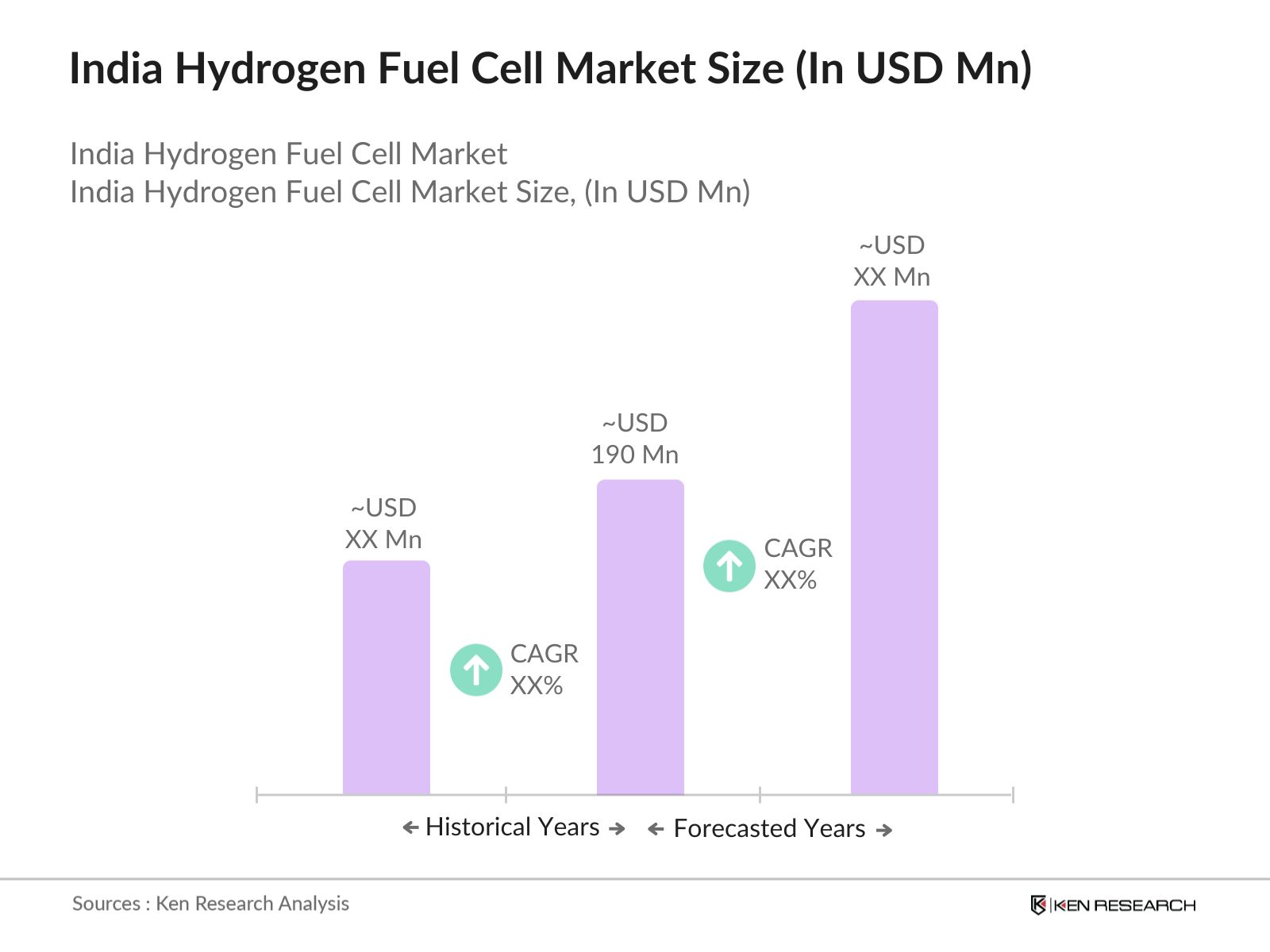

- The India Hydrogen Fuel Cell market is valued at USD 190 million, driven by the country's efforts to shift toward renewable energy solutions and decarbonize various industries. This surge is bolstered by government initiatives such as the National Hydrogen Energy Mission, encouraging the use of hydrogen as a cleaner fuel. The increasing demand for hydrogen fuel cells in the automotive and industrial sectors has significantly contributed to the market's growth. Moreover, Indias strategic focus on energy diversification to meet sustainability goals plays a critical role in driving market expansion.

- Key players in the hydrogen fuel cell market include prominent cities and states like Gujarat, Maharashtra, and Tamil Nadu, which dominate the market due to their progressive industrial policies, infrastructure development, and active participation in green energy projects. These regions benefit from government incentives and subsidies aimed at promoting the adoption of hydrogen-based energy solutions, which are crucial for decarbonizing sectors like transportation and heavy industries.

- The National Hydrogen Energy Mission (NHEM) is Indias flagship policy for hydrogen energy, launched in 2021 to promote the production and utilization of green hydrogen. By 2023, the government had rolled out several initiatives under the NHEM, including financial support for hydrogen production facilities and fuel cell R&D. The mission is designed to reduce Indias dependency on fossil fuels, with a focus on creating a hydrogen economy that aligns with the countrys clean energy targets.

India Hydrogen Fuel Cell Market Segmentation

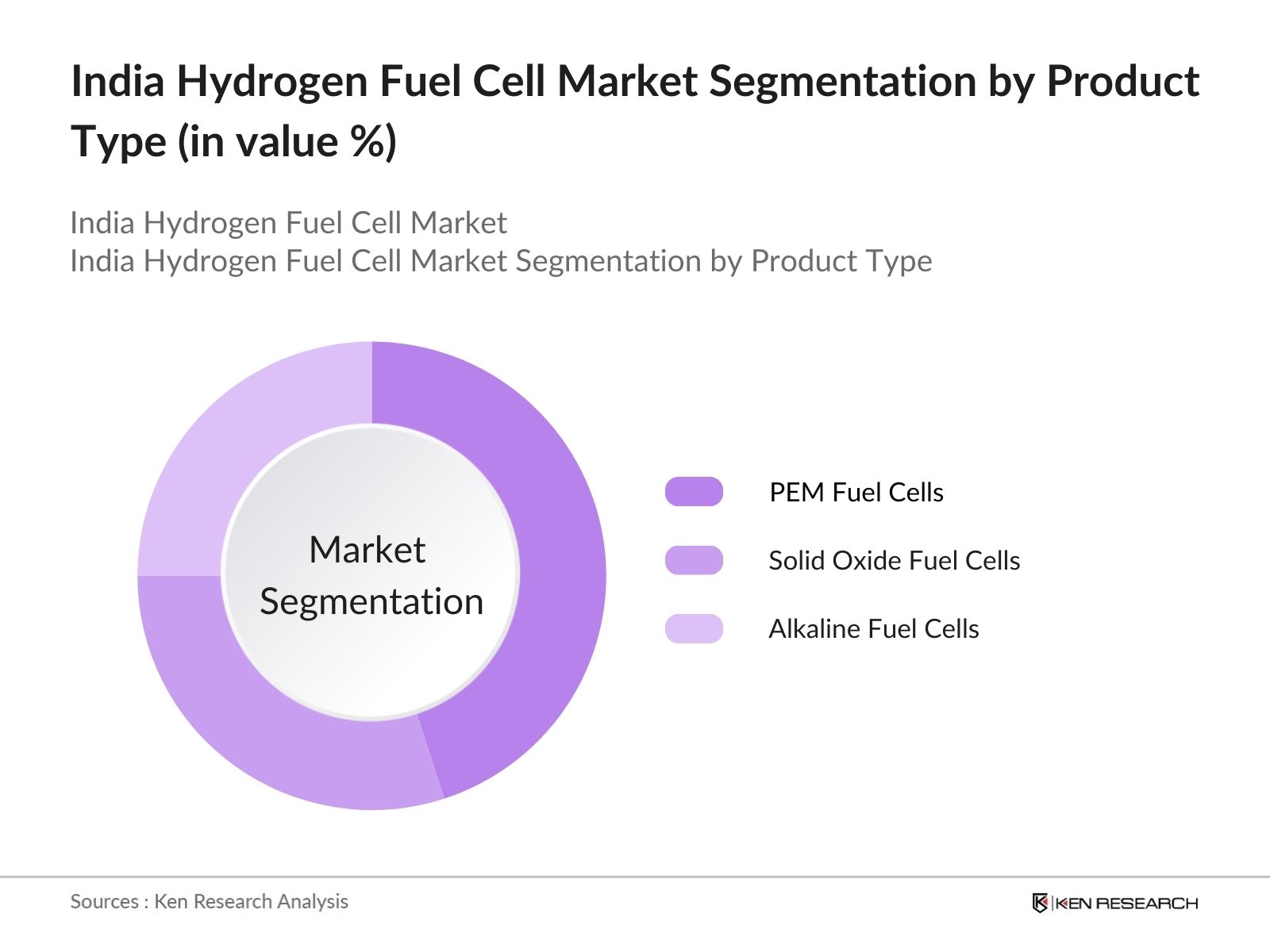

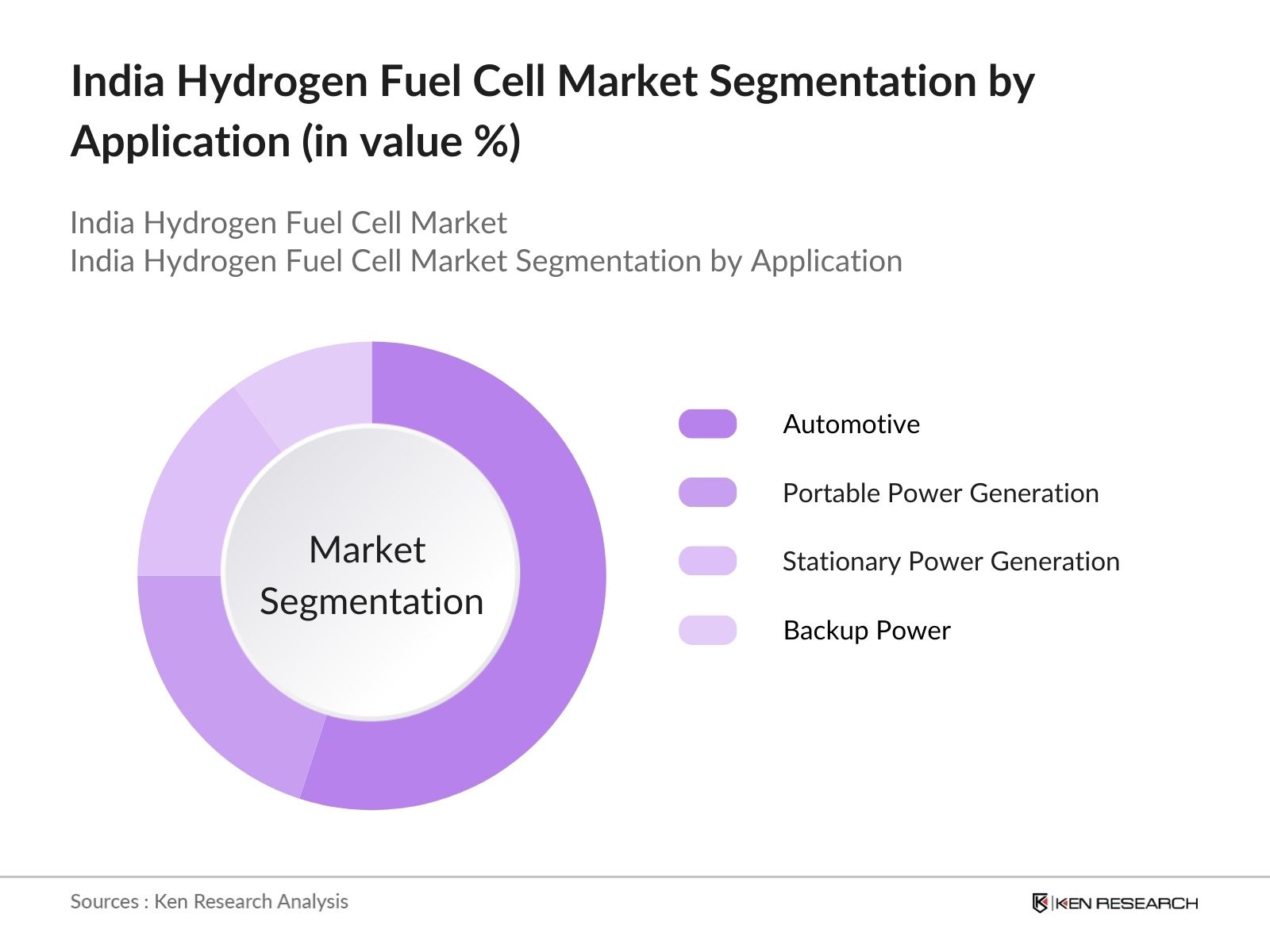

Indias hydrogen fuel cell market is segmented by product type and by application.

- By Product Type: Indias hydrogen fuel cell market is segmented by product type into Proton Exchange Membrane (PEM) Fuel Cells, Solid Oxide Fuel Cells (SOFC), and Alkaline Fuel Cells (AFC). Recently, Proton Exchange Membrane (PEM) Fuel Cells have dominated the market under this segmentation. This dominance is due to their versatility and wide range of applications, especially in the automotive and portable power sectors. PEM fuel cells are highly efficient, operate at relatively low temperatures, and offer quick start-up times, making them suitable for vehicles and backup power systems. Furthermore, significant investments by automakers like Tata Motors in PEM fuel cells have boosted their adoption.

- By Application: The hydrogen fuel cell market in India is also segmented by application into Automotive, Portable Power Generation, Stationary Power Generation, and Backup Power. Among these, the Automotive segment holds a dominant share, primarily due to the rising demand for cleaner energy sources in transportation. With government policies such as Faster Adoption and Manufacturing of Electric Vehicles (FAME), automakers are increasingly incorporating hydrogen fuel cell technology in commercial vehicles to meet stringent emission standards. Moreover, the high efficiency and long-range benefits of hydrogen-powered vehicles make them ideal for long-haul transportation.

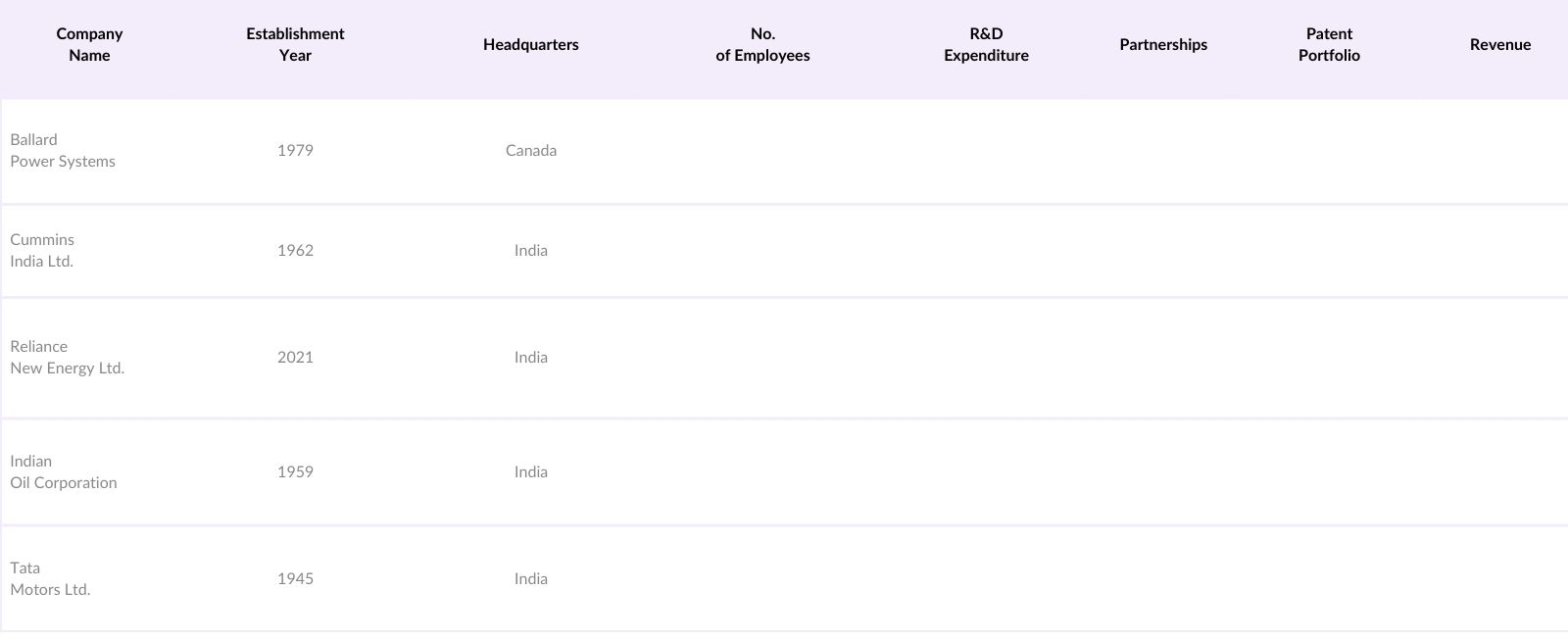

India Hydrogen Fuel Cell Market Competitive Landscape

The India Hydrogen Fuel Cell market is primarily dominated by key players who have significantly invested in research, development, and partnerships with the government to promote hydrogen technology. The competitive landscape includes domestic and global players actively shaping the market. The hydrogen fuel cell market in India is dominated by these key players who are actively collaborating with governmental bodies, investing in R&D, and expanding their infrastructure for hydrogen production and storage. This consolidation highlights the strategic focus of these companies in driving the hydrogen economy forward.

India Hydrogen Fuel Cell Market Analysis

Growth Drivers

- Government Initiatives in Green Energy [Policy Support]: India's National Hydrogen Energy Mission, launched in 2021, aims to position India as a global leader in green hydrogen. By 2024, the government has allocated INR 19,744 crores to promote the production and adoption of hydrogen fuel technologies, creating a significant push towards hydrogen-based clean energy. The Ministry of New and Renewable Energy is offering various incentives for green hydrogen production, including tax reliefs and subsidies. India is targeting the generation of 5 million tons of green hydrogen annually by 2030, fostering rapid growth in hydrogen fuel cell markets.

- Technological Advancements in Hydrogen Fuel Cells [Innovation]

Indias research and development sector has made significant strides in hydrogen fuel cell technology. By 2023, India had invested over INR 1,500 crores into hydrogen production technologies, such as Proton Exchange Membrane (PEM) fuel cells. In particular, the Indian Space Research Organization (ISRO) has been advancing hydrogen technologies for space missions, with potential civilian applications being explored. These innovations are critical in reducing the costs and improving the efficiency of fuel cells, allowing faster adoption across multiple industries. - Increased Adoption in Automotive Sector [Industry Shift]: India's automotive industry, valued at over INR 7.2 lakh crore in 2022, is witnessing an accelerated shift towards hydrogen-powered vehicles. Tata Motors and Indian Oil Corporation are actively collaborating on hydrogen fuel cell buses, with trials expected to be scaled up by 2024. India's Hydrogen Fuel Cell Electric Vehicle (HFCEV) initiatives are also supported by the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, which provides subsidies for clean vehicles, including hydrogen-powered ones.

Market Challenges

- High Cost of Hydrogen Fuel Cells [Cost Structure]: The cost of hydrogen fuel cells in India remains a significant challenge, with current prices ranging from INR 6,000 to INR 12,000 per kilowatt. Although production costs have been reduced by 50% in the last decade, they are still prohibitive for widespread adoption, particularly in the automotive and industrial sectors. Scaling production to reduce costs will require significant investments, projected at INR 15,000 crores (USD 1.8 billion) over the next few years, highlighting the cost-related obstacles that continue to impede market growth.

- Lack of Hydrogen Refueling Infrastructure [Infrastructure Gap]

Indias hydrogen refueling infrastructure is currently underdeveloped, with fewer than 10 operational hydrogen refueling stations nationwide as of 2023. Building the infrastructure required to support the widespread use of hydrogen fuel cells, especially in transportation, requires an estimated INR 2.5 lakh crore (USD 30 billion) investment. This gap presents a major bottleneck to market growth, as industries and automotive manufacturers hesitate to commit without the necessary refueling infrastructure in place.

India Hydrogen Fuel Cell Market Future Outlook

Over the next five years, the India Hydrogen Fuel Cell market is expected to show significant growth driven by increasing government investments in hydrogen infrastructure, advancements in fuel cell technology, and growing interest from the private sector in renewable energy solutions. Additionally, India's vision of becoming a global leader in green hydrogen production will further enhance the adoption of hydrogen fuel cells across different industries.

As the market evolves, we can expect an expansion in the usage of fuel cells beyond the automotive sector, especially in industrial applications, power generation, and rural electrification initiatives. Moreover, advancements in hydrogen storage and distribution technologies are likely to support the widespread adoption of hydrogen as a clean fuel.

Market Opportunities

- Growing Collaboration with International Companies [Global Partnerships]: International collaborations are a key driver in the expansion of India's hydrogen fuel cell market. In 2023, India partnered with Japans New Energy and Industrial Technology Development Organization (NEDO) to develop a hydrogen supply chain. This collaboration has facilitated technology transfer and joint ventures, with INR 10,000 crores (USD 1.2 billion) being invested in shared R&D projects. These partnerships provide India with access to advanced technologies, propelling the domestic hydrogen fuel cell market forward.

- Expansion into Off-Grid Power Solutions: Indias rural electrification program, which aims to provide power to the remaining 14% of rural households, offers significant opportunities for hydrogen fuel cells. Off-grid power solutions using hydrogen fuel cells are seen as an alternative to traditional energy sources in remote areas. As of 2023, the government has earmarked INR 6,000 crores (USD 720 million) to fund clean energy initiatives in these regions, creating new avenues for hydrogen adoption, particularly in decentralized power generation.

Scope of the Report

|

Proton Exchange Membrane (PEM) Fuel Cells Solid Oxide Fuel Cells Alkaline Fuel Cells Direct Methanol Fuel Cells |

|

|

By Flavor |

Automotive Portable Power Generation Stationary Power Generation Backup Power |

|

By Ingredients |

Automotive and Transportation Industrial Applications Energy & Utilities Residential and Commercial Buildings |

|

By Distribution Channel |

Hydrogen Generation Hydrogen Storage Hydrogen Distribution Hydrogen End-use |

|

By Region |

North East West South |

Products

Key Target Audience

Automotive Manufacturers

Energy and Utility Companies

Government and Regulatory Bodies (Ministry of New and Renewable Energy, Department of Heavy Industries)

Hydrogen Production Companies

Fuel Cell Technology Providers

Industrial Manufacturers

Investors and Venture Capitalist Firms

Research and Development Institutions

Companies

Players mention in the Report:

Ballard Power Systems

Cummins India Ltd.

Reliance New Energy Ltd.

Indian Oil Corporation Ltd.

Tata Motors Ltd.

NTPC Ltd.

Bharat Heavy Electricals Ltd. (BHEL)

Adani Green Energy Ltd.

Larsen & Toubro Ltd.

Air Products & Chemicals

ITM Power

Plug Power

Hydrogenics Corporation

Bloom Energy

Doosan Fuel Cell Co. Ltd.

Table of Contents

1. India Hydrogen Fuel Cell Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Hydrogen Fuel Cell Market Size (In INR Crore)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Hydrogen Fuel Cell Market Analysis

3.1. Growth Drivers

3.1.1. Government Initiatives in Green Energy [Policy Support]

3.1.2. Technological Advancements in Hydrogen Fuel Cells [Innovation]

3.1.3. Increased Adoption in Automotive Sector [Industry Shift]

3.1.4. Rising Demand for Clean Energy [Sustainability]

3.2. Market Challenges

3.2.1. High Cost of Hydrogen Fuel Cells [Cost Structure]

3.2.2. Lack of Hydrogen Refueling Infrastructure [Infrastructure Gap]

3.2.3. Safety Concerns Related to Hydrogen Usage [Regulatory Hurdles]

3.3. Opportunities

3.3.1. Growing Collaboration with International Companies [Global Partnerships]

3.3.2. Expansion into Off-Grid Power Solutions [Rural Electrification]

3.3.3. Potential in Industrial Applications [Diversification]

3.4. Trends

3.4.1. Integration with Renewable Energy Sources [Hybrid Systems]

3.4.2. Growth in Hydrogen Production Technology [Green Hydrogen]

3.4.3. Increasing Investment in R&D [Innovation Funding]

3.5. Government Regulation

3.5.1. National Hydrogen Energy Mission [Policy Framework]

3.5.2. Incentives for Green Hydrogen Production [Financial Support]

3.5.3. Hydrogen Energy Storage Guidelines [Safety and Standards]

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. India Hydrogen Fuel Cell Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Proton Exchange Membrane (PEM) Fuel Cells

4.1.2. Solid Oxide Fuel Cells

4.1.3. Alkaline Fuel Cells

4.1.4. Direct Methanol Fuel Cells

4.2. By Application (In Value %)

4.2.1. Automotive

4.2.2. Portable Power Generation

4.2.3. Stationary Power Generation

4.2.4. Backup Power

4.3. By End-User Industry (In Value %)

4.3.1. Automotive and Transportation

4.3.2. Industrial Applications

4.3.3. Energy & Utilities

4.3.4. Residential and Commercial Buildings

4.4. By Technology (In Value %)

4.4.1. Hydrogen Generation

4.4.2. Hydrogen Storage

4.4.3. Hydrogen Distribution

4.4.4. Hydrogen End-use

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. West

4.5.4. East

5. India Hydrogen Fuel Cell Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Ballard Power Systems

5.1.2. Cummins India Ltd.

5.1.3. Reliance New Energy Ltd.

5.1.4. Adani Green Energy Ltd.

5.1.5. Indian Oil Corporation Ltd.

5.1.6. NTPC Ltd.

5.1.7. Tata Motors Ltd.

5.1.8. Larsen & Toubro Ltd.

5.1.9. Bharat Heavy Electricals Ltd. (BHEL)

5.1.10. Air Products & Chemicals

5.1.11. ITM Power

5.1.12. Plug Power

5.1.13. Hydrogenics Corporation

5.1.14. Bloom Energy

5.1.15. Doosan Fuel Cell Co. Ltd.

5.2. Cross Comparison Parameters (No. of Employees, Market Share, Revenue, R&D Expenditure, Headquarters, Strategic Partnerships, Patent Portfolio, Product Diversification)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Subsidies

5.9. Private Equity Investments

6. India Hydrogen Fuel Cell Market Regulatory Framework

6.1. Energy Standards and Policies

6.2. Hydrogen Production and Safety Regulations

6.3. Environmental Compliance and Certification

6.4. Government Funding Schemes for Clean Energy

6.5. Import-Export Regulations for Hydrogen Fuel Cells

7. India Hydrogen Fuel Cell Market Future Size (In INR Crore)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Growth

7.3. Emerging Hydrogen Infrastructure

8. India Hydrogen Fuel Cell Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By End-User Industry (In Value %)

8.4. By Technology (In Value %)

8.5. By Region (In Value %)

9. India Hydrogen Fuel Cell Market Analysts Recommendations

9.1. Total Addressable Market (TAM) Analysis

9.2. Serviceable Available Market (SAM) Analysis

9.3. Serviceable Obtainable Market (SOM) Analysis

9.4. Customer Cohort Analysis

9.5. White Space Opportunity Analysis

9.6. Strategic Marketing Initiatives

9.7. Investment Recommendations

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Hydrogen Fuel Cell Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data related to the India Hydrogen Fuel Cell Market. This includes assessing market penetration, the ratio of hydrogen producers to fuel cell manufacturers, and resultant revenue generation. Furthermore, an evaluation of production statistics is conducted to ensure the accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through interviews with industry experts from key companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple hydrogen producers and automotive manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the data derived from the bottom-up approach, thereby ensuring a comprehensive and validated analysis of the India Hydrogen Fuel Cell Market.

Frequently Asked Questions

01. How big is the India Hydrogen Fuel Cell Market?

The India Hydrogen Fuel Cell market is valued at USD 190 million, driven by significant investments in hydrogen infrastructure and clean energy initiatives across various industries.

02. What are the challenges in the India Hydrogen Fuel Cell Market?

The India Hydrogen Fuel Cell market faces challenges like high costs associated with hydrogen fuel cell production, limited hydrogen refueling infrastructure, and safety concerns related to hydrogen storage and usage.

03. Who are the major players in the India Hydrogen Fuel Cell Market?

Key players in the India Hydrogen Fuel Cell market include Ballard Power Systems, Cummins India Ltd., Reliance New Energy Ltd., Indian Oil Corporation Ltd., and Tata Motors Ltd., all of which dominate due to their advanced technology and strong market presence.

04. What are the growth drivers of the India Hydrogen Fuel Cell Market?

Growth drivers in India Hydrogen Fuel Cell market include increasing government support for green hydrogen production, technological advancements in fuel cells, and the growing demand for cleaner energy in transportation and industrial applications.

05. What are the key applications of hydrogen fuel cells in India?

Key applications in India Hydrogen Fuel Cell market include automotive fuel cells, portable power generation, stationary power systems, and backup power solutions, with the automotive segment holding the largest market share.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.