India Hydrogen Fueling Stations Market Outlook to 2030

Region:Asia

Author(s):Mukul

Product Code:KROD4476

October 2024

98

About the Report

India Hydrogen Fueling Stations Market Overview

- The India hydrogen fueling stations market is valued at USD 1.2 million, driven primarily by government initiatives, increased focus on green energy, and corporate investments. The National Hydrogen Energy Mission and efforts to reduce carbon emissions in the transportation and industrial sectors have spurred demand for hydrogen infrastructure. Growing investments in hydrogen technologies, including electrolysis-based production and fuel cell technology for vehicles, have further accelerated the market growth. This rise in green energy projects is pushing the demand for hydrogen fueling stations across the country.

- Major cities such as New Delhi, Mumbai, and Chennai, as well as states like Gujarat and Maharashtra, are dominant in the hydrogen fueling station market. These cities hold dominance due to their strategic focus on industrial hydrogen use, advanced transportation networks, and initiatives to decarbonize heavy industries like steel and cement. Additionally, these regions have supportive government policies aimed at scaling hydrogen infrastructure, including public-private partnerships, making them key players in the market.

- The Indian government has introduced grants and subsidies to support the development of hydrogen infrastructure, particularly for refueling stations. As of 2024, several state governments, including Gujarat and Maharashtra, have launched funding initiatives to promote green hydrogen and hydrogen refueling stations. The Central government, through the National Hydrogen Mission, has also provided financial assistance for pilot projects across the country, enabling the development of critical hydrogen infrastructure in both urban and industrial hubs.

India Hydrogen Fueling Stations Market Segmentation

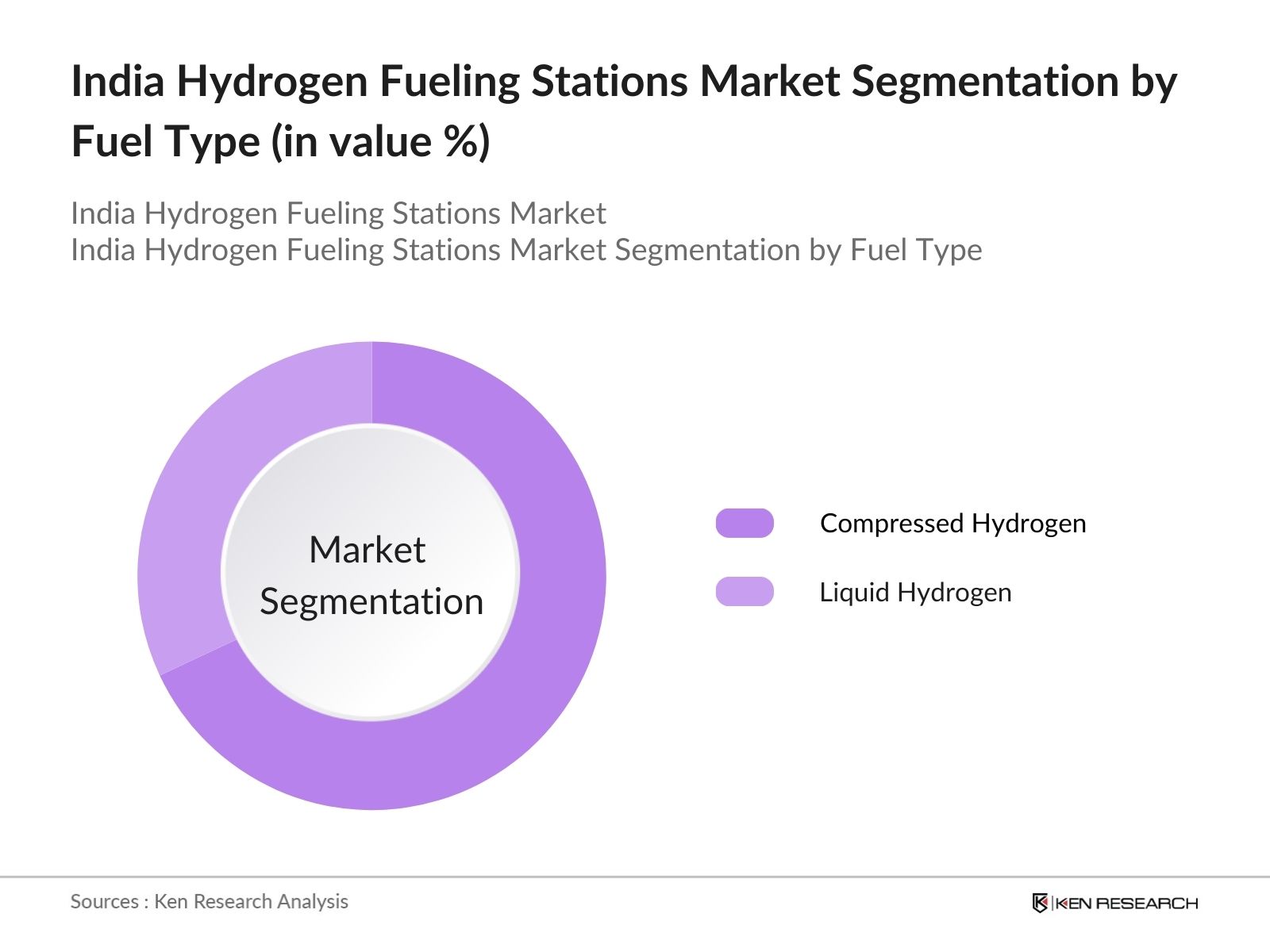

- By Fuel Type: Indias hydrogen fueling stations market is segmented by fuel type into compressed hydrogen and liquid hydrogen. Compressed hydrogen holds the dominant market share due to its widespread application in transportation, particularly in hydrogen fuel cell vehicles. The storage and transportation of compressed hydrogen are more advanced compared to liquid hydrogen, with lower energy consumption required for compression compared to liquefaction. Moreover, the infrastructure for compressed hydrogen stations is relatively more developed, further supporting its dominance in the market.

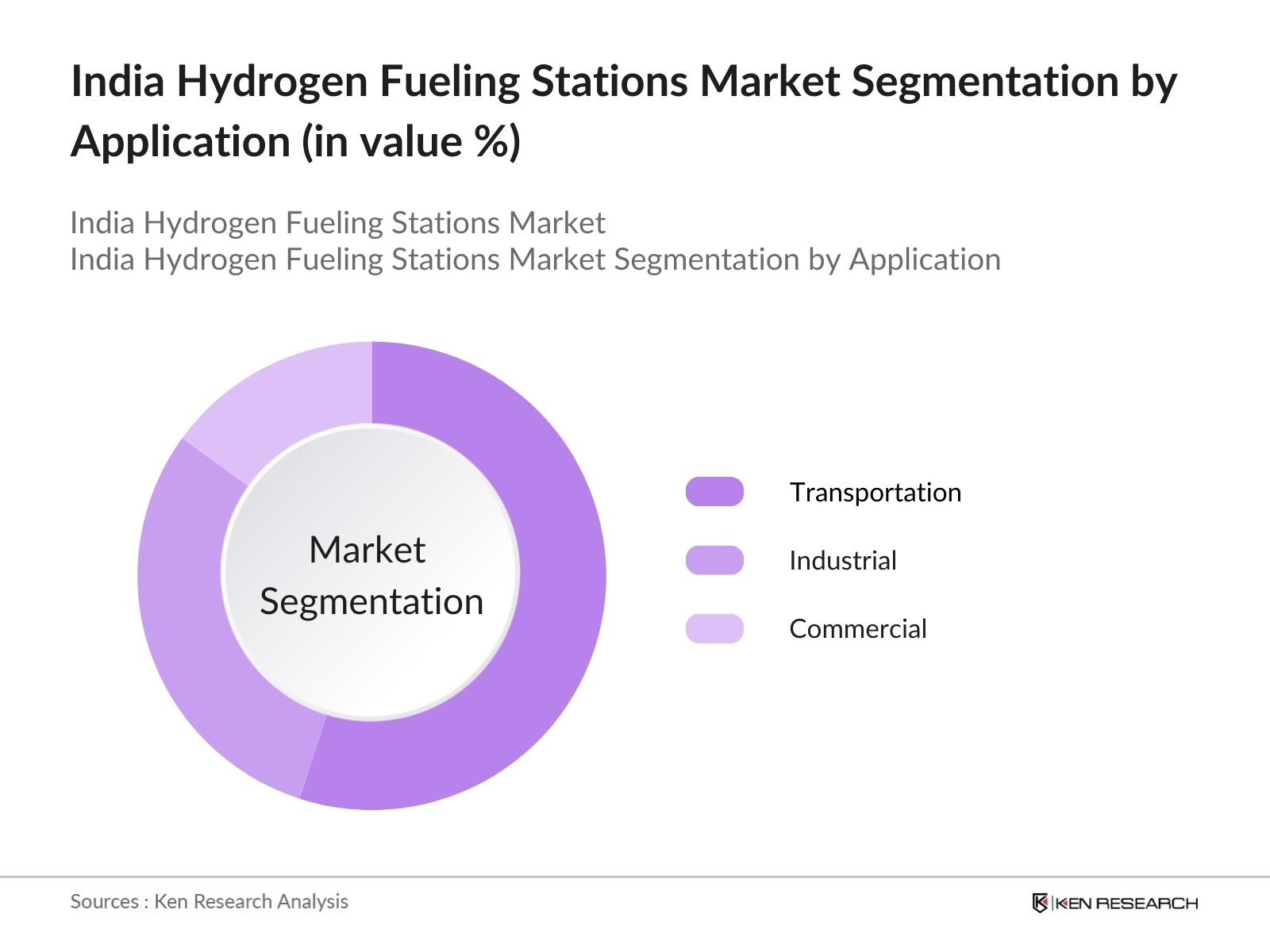

- By Application: Indias hydrogen fueling station market is also segmented by application into transportation, industrial, and commercial uses. Transportation dominates the market as hydrogen-powered vehicles, including buses and trucks, gain traction in Indias efforts to reduce vehicular emissions. Government subsidies and a shift toward sustainable public transportation have led to increasing adoption of hydrogen fuel cells in buses and heavy-duty trucks, solidifying the transportation sectors dominance.

India Hydrogen Fueling Stations Market Competitive Landscape

The India hydrogen fueling stations market is characterized by a mix of domestic and international players, with strong governmental backing and technological partnerships. The market is dominated by major players who have made significant investments in building infrastructure and scaling hydrogen technology. Companies like Indian Oil Corporation and Bharat Petroleum have pioneered the development of hydrogen stations, while international collaborations with companies like Toyota Kirloskar Motors bring in technological expertise.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (INR Bn) |

No. of Hydrogen Stations |

Technology Used |

Market Presence |

Strategic Collaborations |

Sustainability Initiatives |

|

Indian Oil Corporation Ltd. |

1959 |

New Delhi, India |

||||||

|

Bharat Petroleum Corporation Ltd. |

1952 |

Mumbai, India |

||||||

|

GAIL India Ltd. |

1984 |

New Delhi, India |

||||||

|

Adani New Industries Ltd. |

2020 |

Ahmedabad, India |

||||||

|

Reliance Industries Ltd. |

1973 |

Mumbai, India |

India Hydrogen Fueling Stations Industry Analysis

Market Growth Drivers

- Hydrogen Energy Mission, FAME India Scheme: India's National Hydrogen Mission, launched in 2021, aims to produce 5 million tonnes of green hydrogen annually by 2030. By 2024, the Indian government has allocated 800 crores (~$100 million USD) under the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME India Scheme) to promote hydrogen-based vehicle infrastructure, which includes hydrogen fueling stations. These initiatives have led to the establishment of several hydrogen refueling stations across the country, fostering the growth of hydrogen-powered vehicles. This mission aims to decrease India's dependency on fossil fuels and reduce emissions.

- Rising Demand for Clean Energy: India's growing transportation sector is a key driver of hydrogen fuel demand, especially in the heavy vehicle segment. With an estimated 4 million trucks on the road as of 2023, hydrogen-fueled trucks are emerging as a sustainable alternative to diesel, particularly for long-haul transportation. Indias transport sector accounts for 12% of the total energy consumption, and shifting this demand to hydrogen can reduce oil imports by over 15%. In 2024, several hydrogen-powered buses are being trialed in states like Maharashtra and Gujarat, indicating a shift toward clean energy.

- Corporate Adoption: Major Indian automakers, such as Tata Motors and Ashok Leyland, have started investing in hydrogen-powered vehicles. As of 2023, Tata Motors developed India's first hydrogen fuel cell bus, while Ashok Leyland is testing hydrogen fuel for heavy-duty trucks. In the steel sector, companies like JSW Steel are exploring hydrogen-based steel production. Hydrogen usage in industries is expected to decrease CO2 emissions from heavy industries by at least 35%. Corporate adoption of hydrogen is gaining traction, catalyzing hydrogen infrastructure growth in India.

Market Restraints

- Limited Hydrogen Distribution Network: Indias hydrogen distribution network is still in its infancy. As of 2023, there are fewer than 10 operational hydrogen refueling stations nationwide, concentrated primarily in pilot projects. Supply chain constraints, particularly in transporting hydrogen due to its low energy density and storage challenges, limit accessibility. The lack of infrastructure in key industrial hubs and transport corridors increases reliance on fossil fuels. Scaling up hydrogen distribution across Indias vast geography remains a key challenge.

- Lack of Unified Hydrogen Regulations, Safety Standards: The Indian hydrogen sector faces regulatory uncertainty due to a lack of unified guidelines. As of 2023, different ministries oversee hydrogen production, storage, and transportation, causing delays in project approvals. Additionally, India's hydrogen safety standards are not yet in alignment with global best practices, which slows down the deployment of hydrogen infrastructure. The absence of a national hydrogen policy framework impedes private sector investments. Clear and cohesive regulations are essential to the sector's growth.

India Hydrogen Fueling Stations Market Future Outlook

Over the next several years, Indias hydrogen fueling stations market is expected to experience significant growth. Driven by the governments strong push toward clean energy and efforts to position India as a global leader in green hydrogen production, there will be a steady expansion of hydrogen infrastructure. The countrys commitment to reducing carbon emissions, combined with technological advancements in hydrogen production and storage, will further boost the market.

Market Opportunities

- Expansion of Green Hydrogen Production: India has significant opportunities in green hydrogen production, given its abundant renewable energy resources. As of 2024, India has over 167 GW of renewable energy capacity, with solar energy being a major contributor. This renewable capacity supports the production of green hydrogen via electrolysis, where hydrogen is produced by splitting water using renewable electricity. States like Gujarat and Rajasthan are investing in renewable-powered hydrogen production plants. Expansion in this area presents significant growth opportunities for hydrogen fueling stations.

- Strategic Public-Private Partnerships: The Indian government is increasingly fostering public-private partnerships to develop hydrogen infrastructure. For instance, in 2023, NTPC partnered with Gujarat Gas to build Indias largest hydrogen refueling station. Corporate giants such as Reliance and Adani are investing heavily in green hydrogen projects, backed by government subsidies and incentives. These collaborations are key to accelerating the deployment of hydrogen fueling stations and scaling hydrogen distribution networks, providing substantial opportunities for market players.

Scope of the Report

|

By Fuel Type |

Compressed Hydrogen, Liquid Hydrogen |

|

By Application |

Transportation, Industrial, Commercial |

|

By Technology |

Electrolysis-based Production, SMR, Biomass-based Hydrogen |

|

By Station Type |

Mobile Hydrogen Stations, Permanent Hydrogen Stations, Modular Stations |

|

By Region |

North India, South India, West India, East India |

Products

Key Target Audience

Government and Regulatory Bodies (National Hydrogen Energy Board, Ministry of Power)

Hydrogen Production Companies

Automotive Manufacturers (Hydrogen Fuel Cell Vehicles)

Industrial Hydrogen Consumers (Steel, Cement Industries)

Private Sector Investors

Venture Capital and Investment Firms

Public Transportation Authorities (Metro, Bus Systems)

Infrastructure Development Companies

Companies

Players Mentioned in the Report:

Indian Oil Corporation Ltd.

Bharat Petroleum Corporation Ltd.

GAIL India Ltd.

Adani New Industries Ltd.

Reliance Industries Ltd.

Tata Power

NTPC Ltd.

Hindustan Petroleum Corporation Ltd.

Greenko Group

ReNew Power

Larsen & Toubro

Toyota Kirloskar Motors Pvt. Ltd.

Mahindra & Mahindra Ltd.

Brookfield Renewable Partners

Siemens Energy

Table of Contents

1. India Hydrogen Fueling Stations Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (No. of Hydrogen Fueling Stations, Annual Growth %)

1.4 Market Segmentation Overview (Types of Fueling Stations, Key Geographical Regions, Types of Fuel)

2. India Hydrogen Fueling Stations Market Size (In INR Bn)

2.1 Historical Market Size (Installed Capacity, Operational Hydrogen Stations)

2.2 Year-On-Year Growth Analysis (No. of New Stations, Increase in Hydrogen Production Capacity)

2.3 Key Market Developments and Milestones (New Hydrogen Infrastructure, Public and Private Partnerships)

3. India Hydrogen Fueling Stations Market Analysis

3.1 Growth Drivers

3.1.1 Government Initiatives (Hydrogen Energy Mission, FAME India Scheme)

3.1.2 Rising Demand for Clean Energy (Hydrogen Demand Growth in Transportation)

3.1.3 Corporate Adoption (Adoption by Automotive Manufacturers, Heavy Industry Usage)

3.1.4 Technological Advancements (Hydrogen Production Efficiency, Electrolysis Technology)

3.2 Market Challenges

3.2.1 High Initial Capital Investment (Cost of Hydrogen Station Infrastructure, Land Acquisition)

3.2.2 Limited Hydrogen Distribution Network (Infrastructure Gaps, Supply Chain Constraints)

3.2.3 Regulatory Challenges (Lack of Unified Hydrogen Regulations, Safety Standards)

3.3 Opportunities

3.3.1 Expansion of Green Hydrogen Production (Electrolysis, Renewable Energy Integration)

3.3.2 Strategic Public-Private Partnerships (Corporate Investments, Government Collaboration)

3.3.3 Entry of New Market Players (Energy Firms, Start-ups in the Hydrogen Economy)

3.4 Trends

3.4.1 Development of Hydrogen Corridors (Transportation Sector, Heavy Trucking)

3.4.2 Adoption of Hydrogen in Public Transit (Hydrogen-Powered Buses, Metro Networks)

3.4.3 Deployment of Liquid Hydrogen Solutions (Hydrogen Fuel Storage, Cold Storage Technologies)

3.5 Government Regulation

3.5.1 National Hydrogen Energy Mission (Policy Support, Financial Incentives)

3.5.2 Emission Reduction Commitments (Net Zero Targets, Green Hydrogen Mandates)

3.5.3 Hydrogen Safety and Standards (Operational Safety Guidelines, Environmental Standards)

3.5.4 Hydrogen Infrastructure Grants (Funding Mechanisms, State Government Initiatives)

3.6 SWOT Analysis (Specific to Indian Market)

3.7 Stakeholder Ecosystem (Government Bodies, Private Sector Investors, Automotive Manufacturers)

3.8 Porters Five Forces (Supplier Power, Buyer Power, Threat of New Entrants, etc.)

3.9 Competition Ecosystem (Hydrogen Technology Firms, Infrastructure Providers)

4. India Hydrogen Fueling Stations Market Segmentation

4.1 By Fuel Type (In Value %)

4.1.1 Compressed Hydrogen

4.1.2 Liquid Hydrogen

4.2 By Application (In Value %)

4.2.1 Transportation (Heavy-Duty Vehicles, Passenger Cars, Public Transport)

4.2.2 Industrial (Steel, Ammonia Production, Refineries)

4.2.3 Commercial (Fueling Stations, Warehouses)

4.3 By Technology (In Value %)

4.3.1 Electrolysis-based Production

4.3.2 Steam Methane Reforming (SMR)

4.3.3 Biomass-based Hydrogen

4.4 By Station Type (In Value %)

4.4.1 Mobile Hydrogen Stations

4.4.2 Permanent Hydrogen Stations

4.4.3 Modular Hydrogen Stations

4.5 By Region (In Value %)

4.5.1 North India

4.5.2 South India

4.5.3 West India

4.5.4 East India

5. India Hydrogen Fueling Stations Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Indian Oil Corporation Ltd.

5.1.2 Bharat Petroleum Corporation Ltd.

5.1.3 GAIL India Ltd.

5.1.4 National Hydrogen Energy Board (Government of India)

5.1.5 NTPC Ltd.

5.1.6 Adani New Industries Ltd.

5.1.7 Reliance Industries Ltd.

5.1.8 Tata Power

5.1.9 L&T (Larsen & Toubro)

5.1.10 Hindustan Petroleum Corporation Ltd.

5.1.11 Mahindra & Mahindra Ltd.

5.1.12 ReNew Power

5.1.13 Greenko Group

5.1.14 ONGC

5.1.15 Toyota Kirloskar Motor Pvt Ltd.

5.2 Cross Comparison Parameters (Revenue, Installed Capacity, No. of Hydrogen Stations, Technology Use, Strategic Collaborations, Presence in Regions, Sustainability Initiatives, Investment in Hydrogen Technology)

5.3 Market Share Analysis (Company-wise Share of Hydrogen Fueling Stations)

5.4 Strategic Initiatives (Joint Ventures, Expansion of Hydrogen Infrastructure)

5.5 Mergers and Acquisitions (Key Deals in Hydrogen Sector)

5.6 Investment Analysis (Private Sector Investments, Government Funding)

5.7 Venture Capital Funding (Hydrogen Start-ups)

5.8 Government Grants (Subsidies for Hydrogen Station Development)

5.9 Private Equity Investments (Major Stakeholders in Hydrogen Market)

6. India Hydrogen Fueling Stations Market Regulatory Framework

6.1 Environmental Standards (Hydrogen Emission Standards)

6.2 Compliance Requirements (Safety Protocols, Hydrogen Storage Regulations)

6.3 Certification Processes (Safety and Operational Certifications for Hydrogen Stations)

7. India Hydrogen Fueling Stations Future Market Size (In INR Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. India Hydrogen Fueling Stations Future Market Segmentation

8.1 By Fuel Type (In Value %)

8.2 By Application (In Value %)

8.3 By Technology (In Value %)

8.4 By Station Type (In Value %)

8.5 By Region (In Value %)

9. India Hydrogen Fueling Stations Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

In this phase, we map out the India hydrogen fueling stations market by identifying critical stakeholders, including hydrogen producers, automotive manufacturers, and infrastructure developers. Secondary data collection from proprietary databases helps in determining the key variables driving market dynamics.

Step 2: Market Analysis and Construction

Historical data on hydrogen station deployments, production technology, and vehicle adoption are gathered to analyze market penetration. Key metrics include the number of operational hydrogen stations and hydrogen consumption by sector. Revenue generation from hydrogen fuel sales is also assessed.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts, including hydrogen technology providers and infrastructure developers, are consulted via CATIs to validate market growth trends and future potential. Their insights contribute to refining market size and assessing future technological advancements.

Step 4: Research Synthesis and Final Output

The final phase includes collaboration with major hydrogen producers and automotive companies. We acquire real-time data on hydrogen production methods, fueling station performance, and consumer adoption trends to verify the bottom-up estimates.

Frequently Asked Questions

01. How big is the India Hydrogen Fueling Stations Market?

The India hydrogen fueling stations market is valued at USD 1.2 million, supported by government initiatives and increasing corporate investments in green hydrogen technology for transportation and industrial use.

02. What are the challenges in the India Hydrogen Fueling Stations Market?

Challenges include the high initial costs of building hydrogen infrastructure, the need for a widespread hydrogen distribution network, and regulatory complexities regarding safety and hydrogen storage standards.

03. Who are the major players in the India Hydrogen Fueling Stations Market?

Key players in the market include Indian Oil Corporation, Bharat Petroleum Corporation, Reliance Industries, Adani New Industries, and GAIL India. These companies are driving the expansion of hydrogen infrastructure across India.

04. What are the growth drivers of the India Hydrogen Fueling Stations Market?

Key growth drivers include government-backed initiatives like the National Hydrogen Energy Mission, increased focus on decarbonizing transportation, and the expansion of green hydrogen production capabilities.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.