India Hydropower Market Outlook to 2030

Region:Asia

Author(s):Shambhavi

Product Code:KROD2085

December 2024

90

About the Report

India Hydropower Market Overview

- The India hydropower market reached an installed capacity of 176 bn kWh contributing significantly to the countrys energy matrix. The market has been driven by the country's increasing demand for clean, renewable energy, as well as its vast water resources, particularly from rivers in the north and northeast regions. Additionally, the push for decarbonization and India's commitment to reducing carbon emissions by 1 billion tonnes by 2030 are major drivers for expanding hydropower infrastructure.

- Prominent players in the Indian hydropower sector include NHPC Limited, SJVN Limited, Tata Power, JSW Energy, and Reliance Power. NHPC is the largest hydropower producer with a total installed capacity of 7,071 MW. SJVN and Tata Power are also significant players, contributing 2,074 MW and 1,389 MW, respectively, through various projects. These companies dominate the market, benefiting from established infrastructure and government partnerships.

- In 2023, the government inaugurated the 2,880 MW Dibang Multipurpose Project in Arunachal Pradesh, the largest hydropower project ever to be developed in India. This initiative is expected to strengthen the country's renewable energy portfolio and enhance water management in the region. Additionally, in August 2023, Tata Power completed the 225 MW Sorang Hydroelectric Project in Himachal Pradesh, contributing significantly to regional electricity supply.

- Himachal Pradesh, Uttarakhand, and Arunachal Pradesh are contributing the highest share of in hydropower generation. The dominance of these regions is due to the presence of fast-flowing rivers like the Ganges and Brahmaputra, which provide significant water resources for hydropower projects.

India Hydropower Market Segmentation

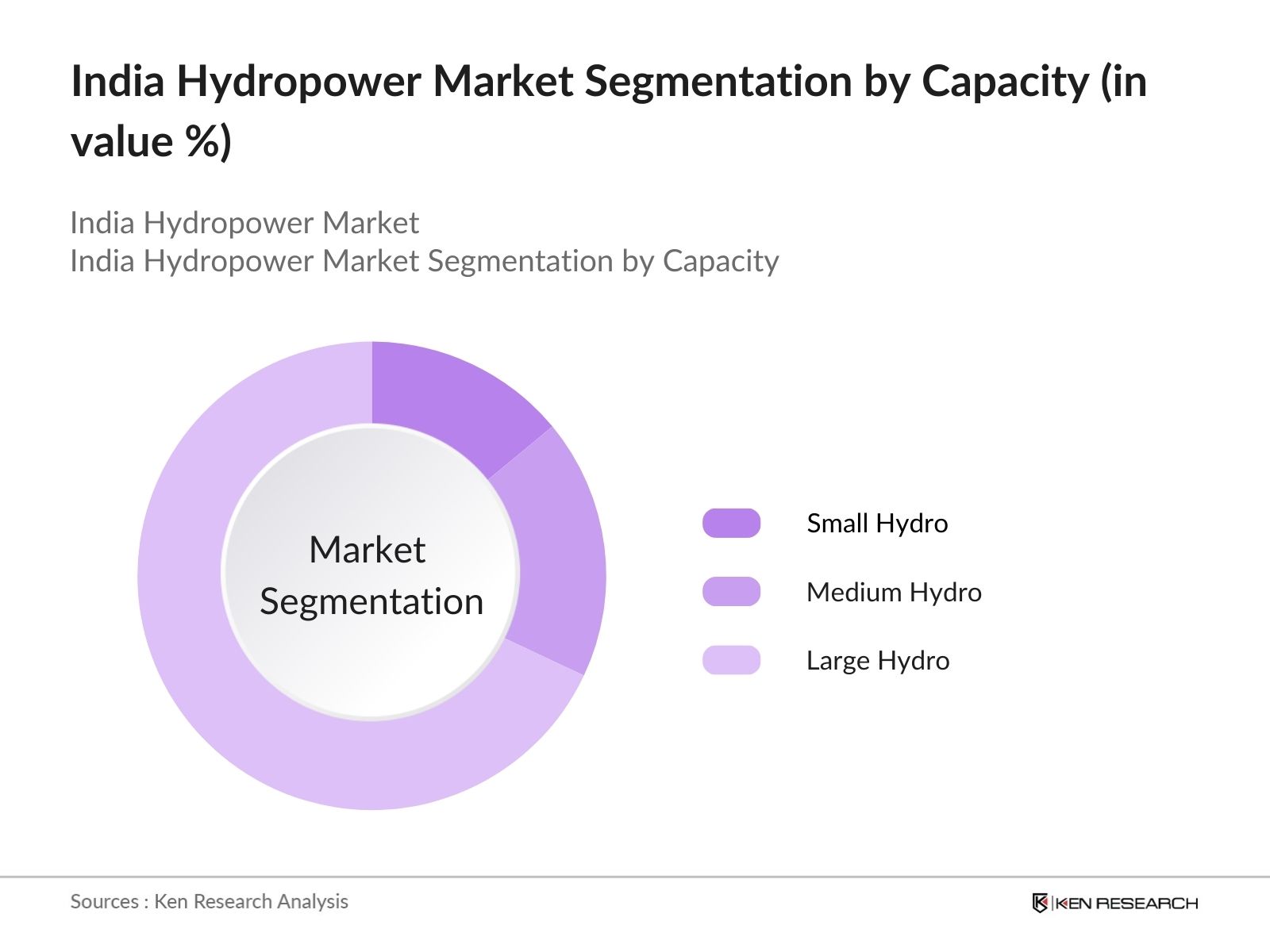

- By Capacity: The market is segmented into small hydro (up to 25 MW), medium hydro (25-100 MW), and large hydro (above 100 MW). In 2023, large hydropower projects dominated the market. Large hydro projects, such as the Bhakra Nangal Dam and the recently completed Tehri Dam Expansion, are crucial due to their scale and ability to provide significant power output. These large-scale projects also contribute to flood control and irrigation, making them central to India's hydropower infrastructure.

|

Segment |

Market Share (2023) |

|

Small Hydro |

14% |

|

Medium Hydro |

18% |

|

Large Hydro |

68% |

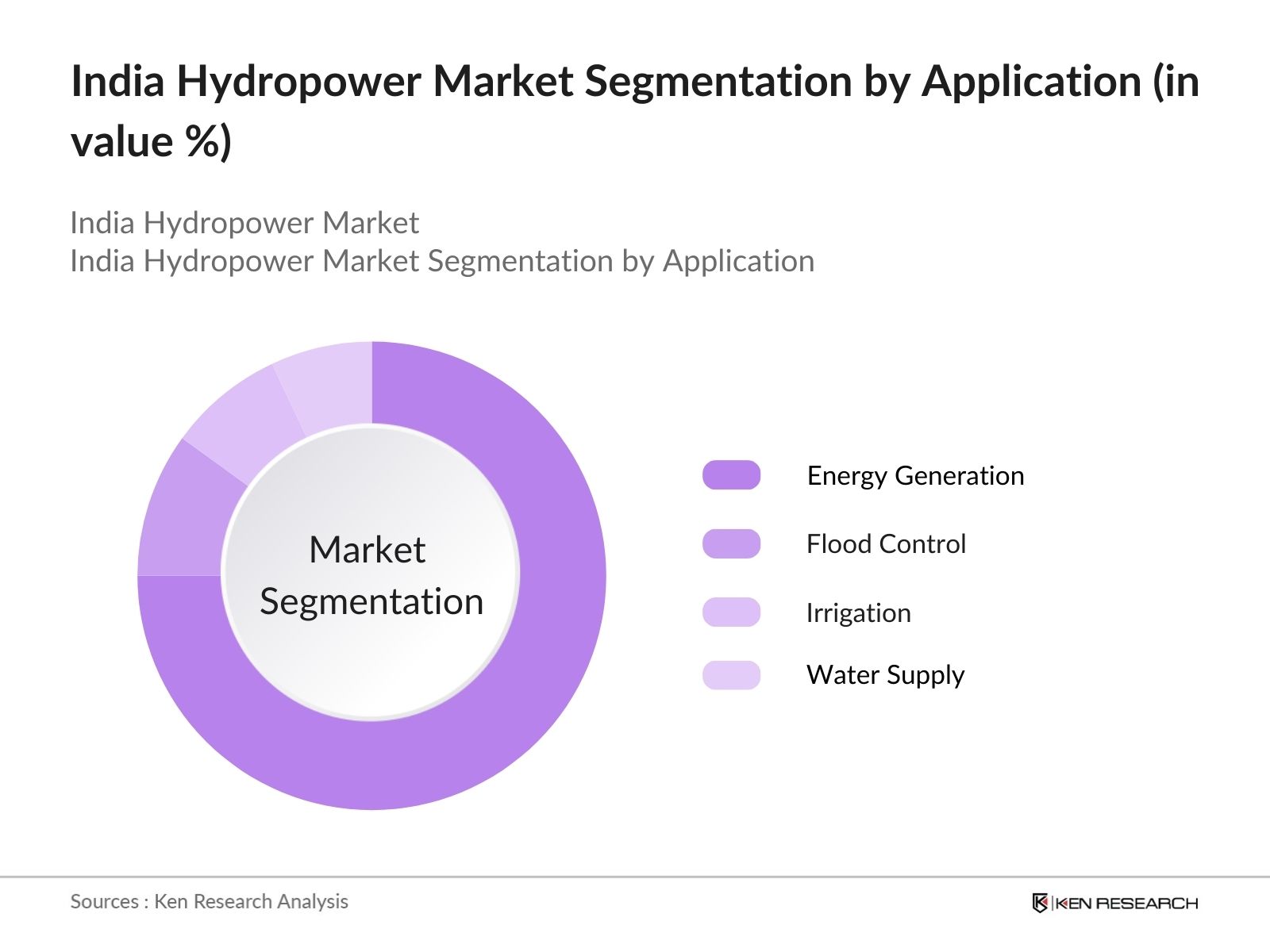

- By Application: The market is segmented into energy generation, flood control, irrigation, and water supply. In 2023, energy generation held a dominant market share. Hydropower's consistent contribution to base-load electricity generation and grid stability positions it as a vital component in India's energy transition. The Teesta-V Hydroelectric Project in Sikkim is an example of a project mainly focused on power generation, contributing 510 MW to the national grid and ensuring energy security.

|

Segment |

Market Share (2023) |

|

Energy Generation |

75% |

|

Flood Control |

10% |

|

Irrigation |

8% |

|

Water Supply |

7% |

- By Region: The market is Segmented into North, South, East, and West. In 2023, Northern region accounted for the highest market share. This is primarily due to the concentration of major rivers like the Yamuna, Sutlej, and Ganga, which offer abundant water resources for hydropower. States like Himachal Pradesh and Uttarakhand lead the region in hydropower development, with projects such as the Bhakra Dam and Tehri Dam contributing substantially to both regional and national grids.

India Hydropower Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|---|---|---|

|

NHPC Limited |

1975 |

Faridabad, Haryana |

|

SJVN Limited |

1988 |

Shimla, Himachal Pradesh |

|

Tata Power |

1915 |

Mumbai, Maharashtra |

|

JSW Energy |

1994 |

Mumbai, Maharashtra |

|

Reliance Power |

1995 |

Navi Mumbai, Maharashtra |

NHPC Limited (2023 Developments): In July 2023, NHPC Limited announced the commissioning of its 2,000 MW Subansiri Lower Hydroelectric Project on the Assam-Arunachal Pradesh border. This project is a significant step towards enhancing the hydropower capacity in the northeast. NHPC has also entered into agreements with Bhutan to develop joint ventures in the region, targeting an additional 500 MW capacity.

SJVN Limited (2024 Developments): SJVN Limited, in August 2024, commenced the construction of the 66 MW Dhaulasidh Hydro Electric Project in Himachal Pradesh. The project, costing 687 crore, will help SJVN expand its hydropower footprint in northern India. SJVN is also investing 300 crore in green energy storage solutions to ensure efficient utilization of hydropower.

India Hydropower Market Analysis

Growth Drivers

- Increased Government Investments in Hydropower Projects: The Indian government has significantly ramped up investments in hydropower development, contributing to sector growth. In 2024, the Ministry of Power allocated 15,000 crore for new hydropower projects and infrastructure improvements, such as the expansion of the Dibang Multipurpose Project in Arunachal Pradesh. This project is expected to add 2,880 MW of capacity, driving market growth by catering to increasing electricity demand in the region.

- Grid Modernization and Hydropower Integration: The ongoing grid modernization projects aim to integrate renewable sources like hydropower into the national grid more efficiently. In 2023, the government approved a 10,000 crore investment for modernizing the countrys energy infrastructure, particularly in regions like North India. This has enabled more hydropower plants to connect to the grid, ensuring stable energy output and addressing intermittent power supply issues.

- Renewable Energy Status for Large Hydropower Projects: The 2021 policy change, which granted large hydropower projects renewable energy status, has continued to drive growth in 2024. This designation has attracted public and private sector investments. The government reported a 40% increase in hydropower project approvals in 2024, particularly in the northeastern states, where abundant water resources provide ideal conditions for hydropower expansion.

Challenges

- Environmental and Social Opposition: Hydropower projects have faced increasing opposition due to their environmental and social impact. In 2024, over 35% of proposed hydropower projects were delayed due to environmental concerns, including deforestation and disruption of local ecosystems. The Dibang Project, for instance, faced protests in Arunachal Pradesh as it required the submergence of 5,000 hectares of forest, impacting local biodiversity.

- High Initial Capital Costs: The high upfront capital investment for hydropower projects remains a significant challenge in 2024. The average cost of developing a medium-scale hydropower project ranges from 6,000 to 7,000 crore, making it difficult for smaller players to enter the market. The Sorang Hydroelectric Project in Himachal Pradesh, which cost approximately 2,000 crore, highlights how capital-intensive even smaller projects can be, impacting the pace of new development.

Government Initiatives

- National Hydropower Development Plan 2023: The Indian government, in 2023, launched the Hydropower Development Plan 2023, aiming to add 30,000 MW of hydropower capacity by 2030. The government also plans to expedite clearance processes for new projects and has allocated 15,000 crore for grid modernization to integrate renewable energy, including hydropower, into the national grid more efficiently.

- Hydropower Purchase Obligation (HPO) Regulations: The government introduced HPO regulations in 2022, mandating that distribution companies (DISCOMs) source a percentage of their electricity from hydropower. In 2024, this obligation was increased to 11.5%, up from 8% in 2022, compelling DISCOMs to invest in hydropower to meet regulatory requirements. This has accelerated project development in regions like Himachal Pradesh and Arunachal Pradesh.

India Hydropower Market Future Outlook

The India Hydropower Market is projected to grow steadily, driven by government initiatives such as the National Hydropower Policy and increased focus on renewable energy. With significant untapped potential in the Himalayan region, the market will benefit from investments in small and large hydro projects, contributing to Indias clean energy goals and reducing reliance on fossil fuels.

Future Trends (Market Outlook 2028)

Growth in Small Hydropower Projects: By 2028, small hydropower projects are expected to see significant growth, particularly in rural areas where decentralized energy systems are necessary. The government plans to develop 5,000 MW of small hydropower projects by 2028, with projects like the Loktak Downstream Hydroelectric Project in Manipur leading this trend.

Increased Use of Digital and Smart Grid Technologies: By 2028, Indias hydropower market will increasingly integrate smart grid technologies to enhance efficiency and reduce transmission losses. Digitalization of hydropower plants, such as the Ranganadi Hydroelectric Plant in Arunachal Pradesh, will enable real-time monitoring and optimization of water flow, resulting in a projected 10% increase in operational efficiency across plants nationwide.

Scope of the Report

|

By Capacity |

Small Hydro Medium Hydro Large Hydro |

|

By Application |

Energy Generation Flood Control Irrigation Water Supply |

|

By Region |

North India South India East India West India |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Hydropower Project Developers and Operators

Renewable Energy Companies and Investors

Power Generation Equipment Manufacturers

Engineering, Procurement, and Construction (EPC) Companies

Electricity Distribution Companies (Discoms)

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (eg. NTPC, BHEL etc.)

Time-Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

NHPC Limited

SJVN Limited

Tata Power

NTPC Limited

Tehri Hydro Development Corporation (THDC) India Limited

North Eastern Electric Power Corporation (NEEPCO)

JSW Energy Limited

GMR Energy Limited

Reliance Power

Lanco Infratech Limited

Torrent Power

Greenko Group

Statkraft India

Satluj Jal Vidyut Nigam (SJVN)

Bharat Heavy Electricals Limited (BHEL)

Table of Contents

1. India Hydropower Market Overview

1.1. Definition and Scope

1.2. Market Growth Rate

1.3. Market Contribution to Indias Energy Matrix

1.4. Hydropower Role in Indias Renewable Energy Targets

1.5. Market Segmentation Overview

2. India Hydropower Market Size and Analysis

2.1. Historical Installed Capacity and Market Size

2.2. Year-on-Year Growth and Installed Capacity in 2023

2.3. Hydropowers Contribution to Energy Security and Grid Stability

2.4. Key Market Milestones and Developments in 2023

3. India Hydropower Market Dynamics

3.1. Growth Drivers

3.1.1. Government Investments in Large Hydropower Projects

3.1.2. Grid Modernization and Hydropower Integration

3.1.3. Renewable Energy Status for Large Hydropower Projects

3.2. Market Challenges

3.2.1. Environmental and Social Opposition

3.2.2. High Initial Capital Costs for Hydropower Projects

3.2.3. Delays in Project Approvals

3.3. Market Opportunities

3.3.1. Small Hydropower Development for Rural Electrification

3.3.2. Foreign Investments in Hydropower Projects

3.4. Recent Market Trends

3.4.1. Digitalization and Smart Grid Technology Integration

3.4.2. Growth in Pumped Storage Hydropower Projects

3.4.3. Modernization of Aging Hydropower Plants

4. India Hydropower Market Segmentation

4.1. By Capacity (Value %)

4.1.1. Small Hydro (Up to 25 MW)

4.1.2. Medium Hydro (25-100 MW)

4.1.3. Large Hydro (Above 100 MW)

4.2. By Application (Value %)

4.2.1. Energy Generation

4.2.2. Flood Control

4.2.3. Irrigation

4.2.4. Water Supply

4.3. By Region (Value %)

4.3.1. North

4.3.2. South

4.3.3. East

4.3.4. West

4.4. By Technology (Value %)

4.4.1. Pumped Storage Hydropower Plants

4.4.2. Run-of-River Hydropower Plants

4.5. By Operational Mode (Value %)

4.5.1. Base Load Hydropower Plants

4.5.2. Peaking Hydropower Plants

5. India Hydropower Market Competitive Landscape

5.1. Market Share Analysis and Key Players

5.2. Company Profiles

5.2.1. NHPC Limited

5.2.2. SJVN Limited

5.2.3. Tata Power

5.2.4. JSW Energy

5.2.5. Reliance Power

5.3. Strategic Initiatives and Developments

5.3.1. Mergers and Acquisitions

5.3.2. Investments in Renewable Energy Storage Solutions

5.3.3. Joint Ventures in Hydropower Projects

5.4. Competitive Strategies and Differentiators

6. India Hydropower Market Regulatory and Legal Framework

6.1. Environmental Regulations and Compliance

6.2. Hydropower Purchase Obligations (HPO)

6.3. Certification and Project Approval Procedures

6.4. Government Subsidies and Incentives for Hydropower Projects

7. India Hydropower Market Future Outlook

7.1. Market Growth Projections to 2028

7.2. Government Policies and Future Hydropower Projects

7.3. Increasing Investments in Small and Large Hydro Projects

7.4. Role of Smart Grid and Digital Technologies in Future Projects

7.5. Opportunities for Hydropower Expansion in Rural Areas

8. Future Market Segmentation

8.1. By Capacity (Value %)

8.2. By Application (Value %)

8.3. By Technology (Value %)

8.4. By Region (Value %)

8.5. By Operational Mode (Value %)

9. Analyst Recommendations and Strategic Insights

9.1. TAM (Total Addressable Market) and SAM (Serviceable Addressable Market) Analysis

9.2. Key Strategic Initiatives for Hydropower Market Penetration

9.3. White Space Opportunities and Investment Potential in Hydropower

9.4. Customer and Market Potential Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables

Ecosystem creation for all major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate market-level information.

Step 2: Market Building

Collating statistics on the India Hydropower Market over the years, analyzing the penetration of India Hydropower technologies, and computing the revenue generated for the market. This step also involves reviewing technology adoption rates and application effectiveness to ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing

Building market hypotheses and conducting CATIs with market experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research Output

Our team will approach multiple India Hydropower companies to understand the nature of technology segments, consumer preferences, and other parameters. This supports validating statistics derived through a bottom-to-top approach from these India Hydropower companies, ensuring accuracy and reliability in the report.

Frequently Asked Questions

01. How big is the India hydropower market?

The India hydropower market reached an installed capacity of 176 bn kWh in 2023, driven by increasing investments in renewable energy and infrastructure modernization. The governments commitment to adding 30,000 MW of capacity by 2030 will further enhance this market.

02. What are the challenges in the India hydropower market?

Challenges in the India hydropower market include high capital costs, environmental opposition, and delays in project approvals. For instance, projects like Subansiri Lower Hydroelectric Project faced significant delays due to environmental concerns, slowing overall market growth.

03. Who are the major players in the India hydropower market?

Key players in the India hydropower market include NHPC Limited, SJVN Limited, Tata Power, JSW Energy, and Reliance Power. These companies dominate due to their significant project portfolios and government-backed initiatives.

04. What are the growth drivers of the India hydropower market?

The India hydropower market is propelled by increased government investments, grid modernization, and the renewable energy status accorded to large hydropower projects. These factors have encouraged both public and private sector investments, particularly in northern and northeastern India.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.