India Indoor Plant Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD10828

November 2024

94

About the Report

India Indoor Plant Market Overview

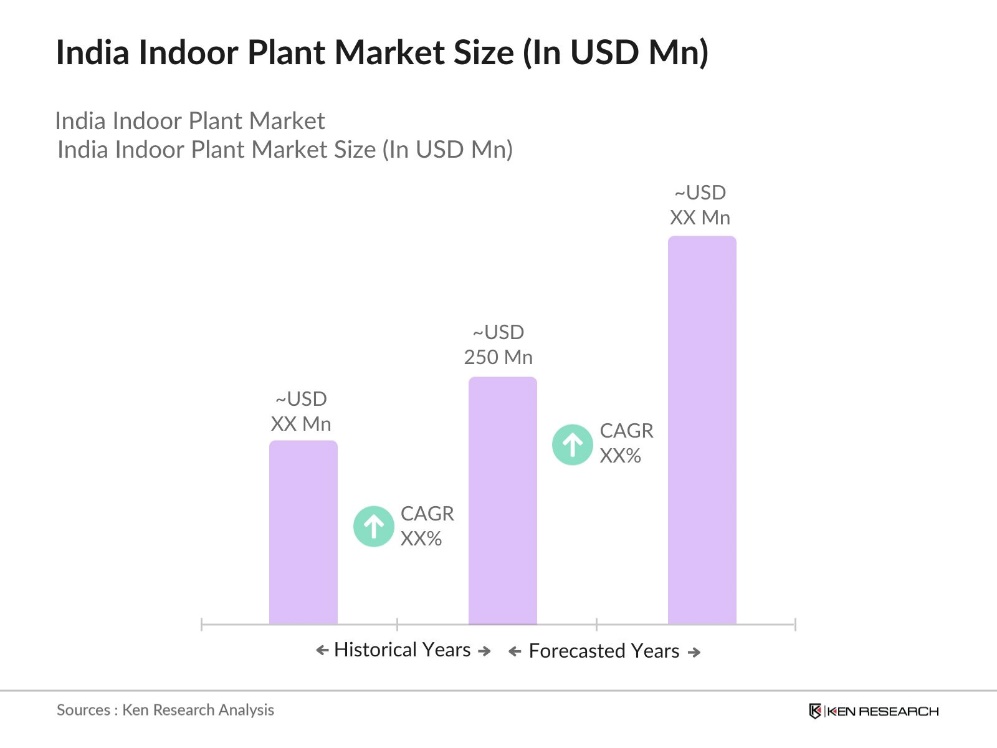

- The India Indoor Plant Market is valued at USD 250 million, based on a five-year historical analysis. This growth is primarily driven by a surge in urban population density and increased awareness regarding health and wellness benefits associated with indoor plants. The rising disposable incomes in urban areas have allowed consumers to invest in ornamental and air-purifying indoor plants.

- Indias metro cities, particularly Delhi, Mumbai, and Bengaluru, dominate the indoor plant market. Delhis dominance is primarily attributed to its air pollution issues, leading residents to adopt indoor plants for air purification. Mumbai and Bengaluru, known for their cosmopolitan lifestyles, witness high consumer demand for indoor plants to enhance living and workspaces aesthetically.

- Indias government has launched multiple policies under the National Horticulture Board to promote the growth of indoor and outdoor plants in 2023. These policies support plant nurseries and provide grants to increase indoor plant production, contributing to market growth. This initiative aids in meeting the rising demand for plant varieties across regions.

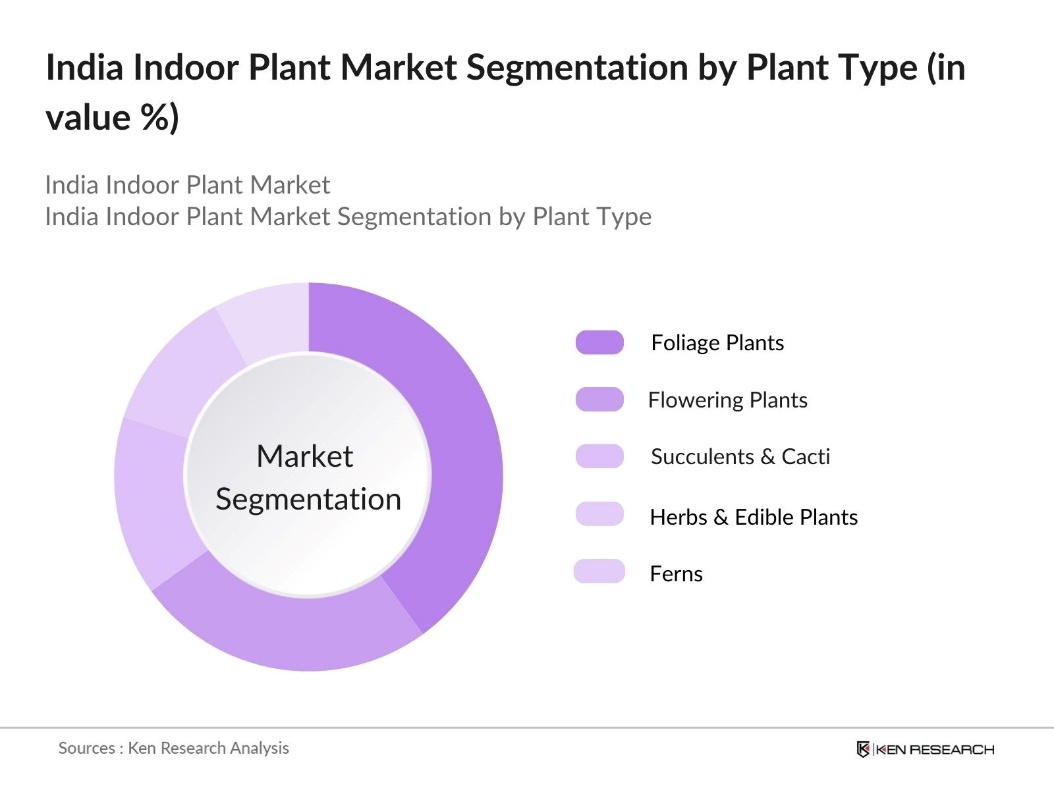

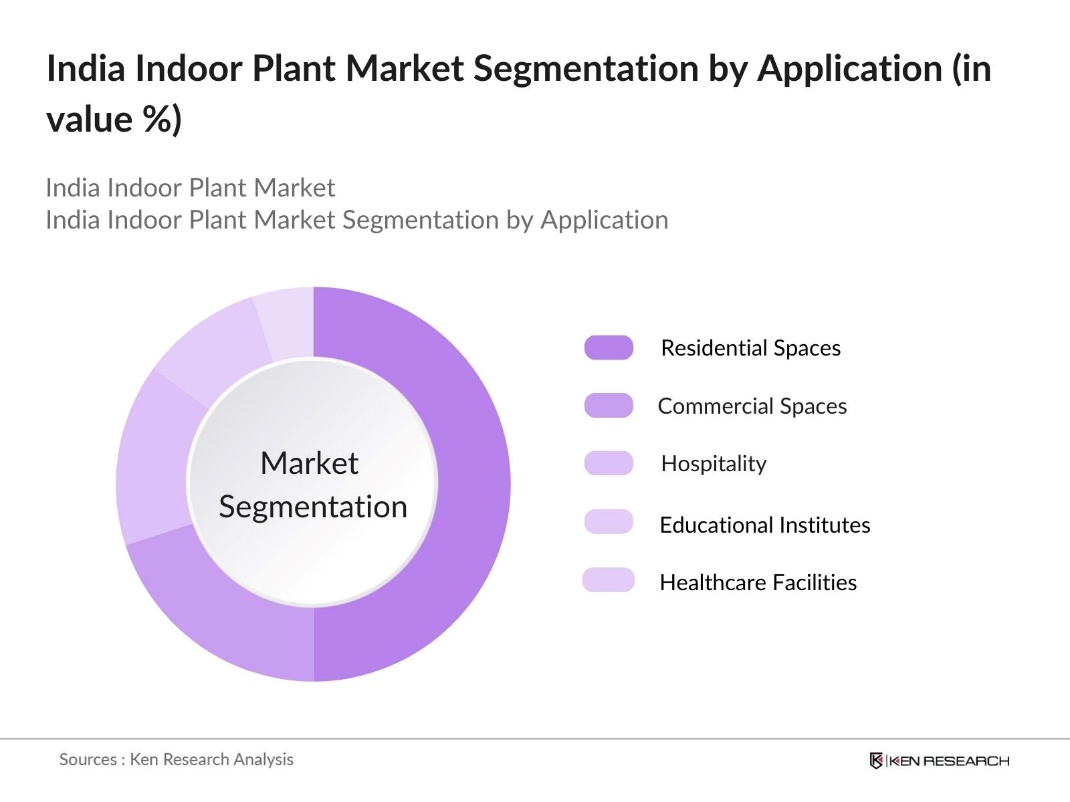

India Indoor Plant Market Segmentation

By Plant Type: The market is segmented by plant type into flowering plants, foliage plants, succulents and cacti, herbs and edible plants, and ferns. Currently, foliage plants hold a dominant share under this segmentation due to their low maintenance and high aesthetic appeal. Foliage plants, which require minimal watering and thrive in various indoor environments, are preferred by urban dwellers with busy lifestyles. Their popularity is further reinforced by air-purifying properties that address indoor pollution, especially in densely populated areas.

By Application: The market is segmented by application into residential spaces, commercial spaces, hospitality, educational institutes, and healthcare facilities. Residential spaces dominate this segment due to a high preference for decorative and air-purifying plants in homes. This trend is fueled by increasing urbanization, with a significant portion of the population moving to apartments in metro cities, creating a demand for greenery in compact living spaces. Additionally, residential consumers are increasingly adopting indoor plants for wellness benefits.

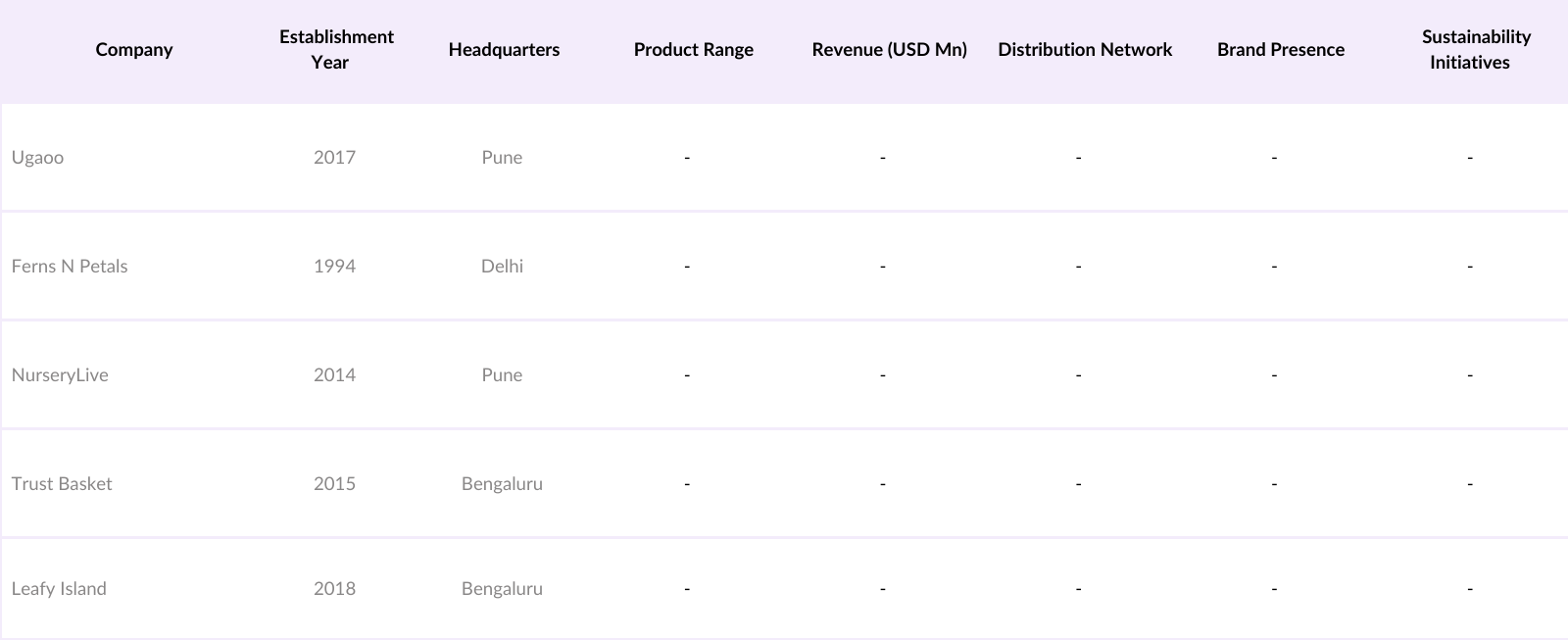

India Indoor Plant Market Competitive Landscape

The India Indoor Plant market is characterized by both established companies and smaller local players. The major players in this sector have leveraged their branding and extensive distribution channels to gain a substantial market share. Additionally, these companies have diversified their offerings to cater to various customer needs, from low-maintenance plants for beginners to exotic plant varieties for enthusiasts.

India Indoor Plant Industry Analysis

Growth Drivers

- Urban Population Growth: Indias urban population has seen consistent growth, with around 2.1672 % residing in cities as of 2023, contributing to a marked demand for indoor plants as urban dwellers seek greenery within limited space. The increase in urbanization fosters a surge in residential apartments and high-rise buildings, which incorporate indoor plants as part of modern decor and lifestyle. According to the Ministry of Housing and Urban Affairs, the governments urban expansion initiatives further facilitate an increase in residential projects, amplifying indoor plant demand.

- Increasing Real Estate Development (Residential, Commercial): Real estate expansion in India, valued at Rs 14 trillion in 2024-2026, drives demand for indoor plants as design components in both residential and commercial projects. Residential developers in metropolitan areas now incorporate plant spaces to attract environmentally conscious buyers. Office complexes, such as those in Bengaluru and Hyderabad, are also adopting greenery-focused designs, enhancing demand for indoor plants. This real estate trend has positively impacted plant nurseries and indoor gardening suppliers.

- Rise in Health and Wellness Trends: The rising focus on health and wellness in India has boosted the demand for indoor plants, valued for their ability to improve indoor air quality by reducing pollutants. Awareness campaigns emphasize these benefits, especially in urban areas with air quality challenges. As consumers increasingly prioritize healthier living environments, indoor plants have become popular for both their aesthetic appeal and their potential to create fresher, cleaner indoor spaces.

Market Challenges

- Limited Awareness in Rural Areas: Awareness about the benefits of indoor plants remains limited in rural India, where traditional agricultural practices dominate. While indoor plants have gained popularity in urban areas, rural households often lack understanding of their health and air-quality benefits. This gap in awareness affects the markets potential to penetrate rural areas, where the focus largely remains on outdoor agriculture rather than indoor plant cultivation.

- High Maintenance Costs: Maintaining indoor plants can be costly in urban India, particularly for species requiring specific humidity and light conditions. Advanced irrigation and humidity control devices, essential for some plant types, add to these maintenance expenses. This higher upkeep cost can impact the affordability of indoor plants, especially for middle-income urban households, creating a barrier to the sustained growth of the market in these regions.

India Indoor Plant Market Future Outlook

The India Indoor Plant Market is poised for growth in the coming years, supported by increased consumer awareness about the benefits of indoor plants and rising urbanization. Growing e-commerce platforms, coupled with affordable and accessible plant care products, are expected to drive market penetration across diverse demographic segments. Government policies promoting green cities and sustainable urban development further contribute to the favorable market outlook.

Market Opportunities

- Technological Advancements in Indoor Horticulture: Technological innovations, like LED growth lights and controlled humidity environments, have significantly boosted the indoor plant market, allowing urban homes to maintain plants in varied climates. These technologies make it easier for city dwellers to care for plants that thrive in low-light or require minimal maintenance. As consumers seek hassle-free ways to incorporate greenery into their homes, such advancements have made indoor gardening more accessible and attractive.

- Increased Popularity in Urban Households: Indoor plants have grown in popularity in urban households, fueled by rising incomes and evolving aesthetic preferences. As apartment living dominates city lifestyles, residents are increasingly drawn to plants that require minimal sunlight and fit within compact spaces. Indoor plants have become a staple of home decor, creating fresh, vibrant environments and enhancing living spaces, reflecting a significant opportunity for growth in the market.

Scope of the Report

|

By Plant Type |

Flowering Plants |

|

By Application |

Residential Spaces |

|

By Distribution Channel |

Online Retail |

|

By Maintenance Type |

Low Maintenance |

|

By Region |

North India |

Products

Key Target Audience

Online Plant Retail Platforms

Commercial Space Designers Companies

Horticulture and Landscape Service Providers

Plant Care Product Manufacturers

Government and Regulatory Bodies (e.g., Ministry of Environment, Forest and Climate Change, National Horticulture Board)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Ugaoo

Ferns N Petals

NurseryLive

Trust Basket

Leafy Island

Nurturing Green

Root Bridges

PlantsGuru

Kraft Seeds

Green Decor

Table of Contents

1. India Indoor Plant Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Annual Growth %, Volume Growth)

1.4. Market Segmentation Overview

2. India Indoor Plant Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Indoor Plant Market Analysis

3.1. Growth Drivers

3.1.1. Urban Population Growth

3.1.2. Rise in Health and Wellness Trends

3.1.3. Increasing Real Estate Development (Residential, Commercial)

3.1.4. Government Initiatives on Urban Greening

3.2. Market Challenges

3.2.1. Limited Awareness in Rural Areas

3.2.2. High Maintenance Costs

3.2.3. Inconsistent Supply Chain

3.3. Opportunities

3.3.1. Technological Advancements in Indoor Horticulture

3.3.2. Increased Popularity in Urban Households

3.3.3. Growth in E-commerce Platforms

3.4. Trends

3.4.1. Adoption of Hydroponic Techniques

3.4.2. Shift to Low-Light Indoor Plants

3.4.3. Use of Smart Irrigation Systems

3.5. Government Regulations

3.5.1. Horticulture Promotion Policies

3.5.2. Urban Afforestation Programs

3.5.3. Environmental Compliance for Nurseries

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. India Indoor Plant Market Segmentation

4.1. By Plant Type (In Volume %)

4.1.1. Flowering Plants

4.1.2. Foliage Plants

4.1.3. Succulents and Cacti

4.1.4. Herbs and Edible Plants

4.1.5. Ferns

4.2. By Application (In Value %)

4.2.1. Residential Spaces

4.2.2. Commercial Spaces (Offices, Malls)

4.2.3. Hospitality (Hotels, Restaurants)

4.2.4. Educational Institutes

4.2.5. Healthcare Facilities

4.3. By Distribution Channel (In Value %)

4.3.1. Online Retail

4.3.2. Offline Retail (Nurseries, Specialty Stores)

4.3.3. Supermarkets and Hypermarkets

4.4. By Maintenance Type (In Value %)

4.4.1. Low Maintenance

4.4.2. Medium Maintenance

4.4.3. High Maintenance

4.5. By Region (In Volume %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

4.5.5. Central

5. India Indoor Plant Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Ugaoo

5.1.2. Ferns N Petals

5.1.3. NurseryLive

5.1.4. Nurturing Green

5.1.5. Root Bridges

5.1.6. Trust Basket

5.1.7. PlantsGuru

5.1.8. The Plant Company

5.1.9. Kraft Seeds

5.1.10. Green Decor

5.1.11. Leafy Island

5.1.12. MyBageecha

5.1.13. Amazon India (Plant Segment)

5.1.14. Flipkart (Plant Segment)

5.1.15. Snapdeal (Plant Segment)

5.2. Cross Comparison Parameters (Employee Strength, Headquarters Location, Year Established, Revenue, Online vs. Offline Presence, Customer Satisfaction Index, Growth Strategy, Product Range)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants and Subsidies

5.8. Private Equity Investments

6. India Indoor Plant Market Regulatory Framework

6.1. Agricultural Import Regulations

6.2. Horticulture Certification Standards

6.3. Environmental Protection Compliance

6.4. Quality Assurance Policies

7. India Indoor Plant Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Indoor Plant Future Market Segmentation

8.1. By Plant Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Application (In Value %)

8.4. By Maintenance Type (In Value %)

8.5. By Region (In Value %)

9. India Indoor Plant Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Cohort Analysis

9.3. Marketing Strategies

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This stage involved mapping the India Indoor Plant Market ecosystem, identifying key stakeholders, and collecting data through a blend of primary and secondary research. The focus was to define critical variables impacting market demand and supply.

Step 2: Market Analysis and Construction

Historical data analysis was performed to assess the market's penetration and the performance of different plant categories. This phase included assessing plant type preferences and identifying key demographic and regional trends.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses were developed to understand the drivers and challenges of the India Indoor Plant market. These were validated through interviews with industry experts, gaining insights into operational practices, product trends, and distribution preferences.

Step 4: Research Synthesis and Final Output

Final data synthesis involved detailed interaction with plant nursery owners and e-commerce plant retailers. Insights gathered were used to validate our bottom-up approach to market analysis, ensuring accuracy and completeness in the report.

Frequently Asked Questions

01. How big is the India Indoor Plant Market?

The India Indoor Plant Market is valued at approximately USD 250 million, driven by factors like rising urbanization, increasing awareness of wellness, and the aesthetic appeal of indoor plants.

02. What are the challenges in the India Indoor Plant Market?

Challenges in India Indoor Plant Market include limited awareness of indoor plant benefits in rural areas, high maintenance costs for exotic plants, and inconsistent supply chains impacting the timely delivery of plants.

03. Who are the major players in the India Indoor Plant Market?

Key players in India Indoor Plant Market include Ugaoo, Ferns N Petals, NurseryLive, Trust Basket, and Leafy Island. These companies lead the market due to their extensive product range, online presence, and customer satisfaction.

04. What are the growth drivers of the India Indoor Plant Market?

The India Indoor Plant Market is driven by increasing urbanization, rising disposable incomes, and heightened awareness about indoor air quality, along with e-commerce growth facilitating easy access to plant purchases.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.