India Industrial Valves Market Outlook to 2030

Region:Asia

Author(s):Sanjana

Product Code:KROD732

October 2024

90

About the Report

India Industrial Valves Market Overview

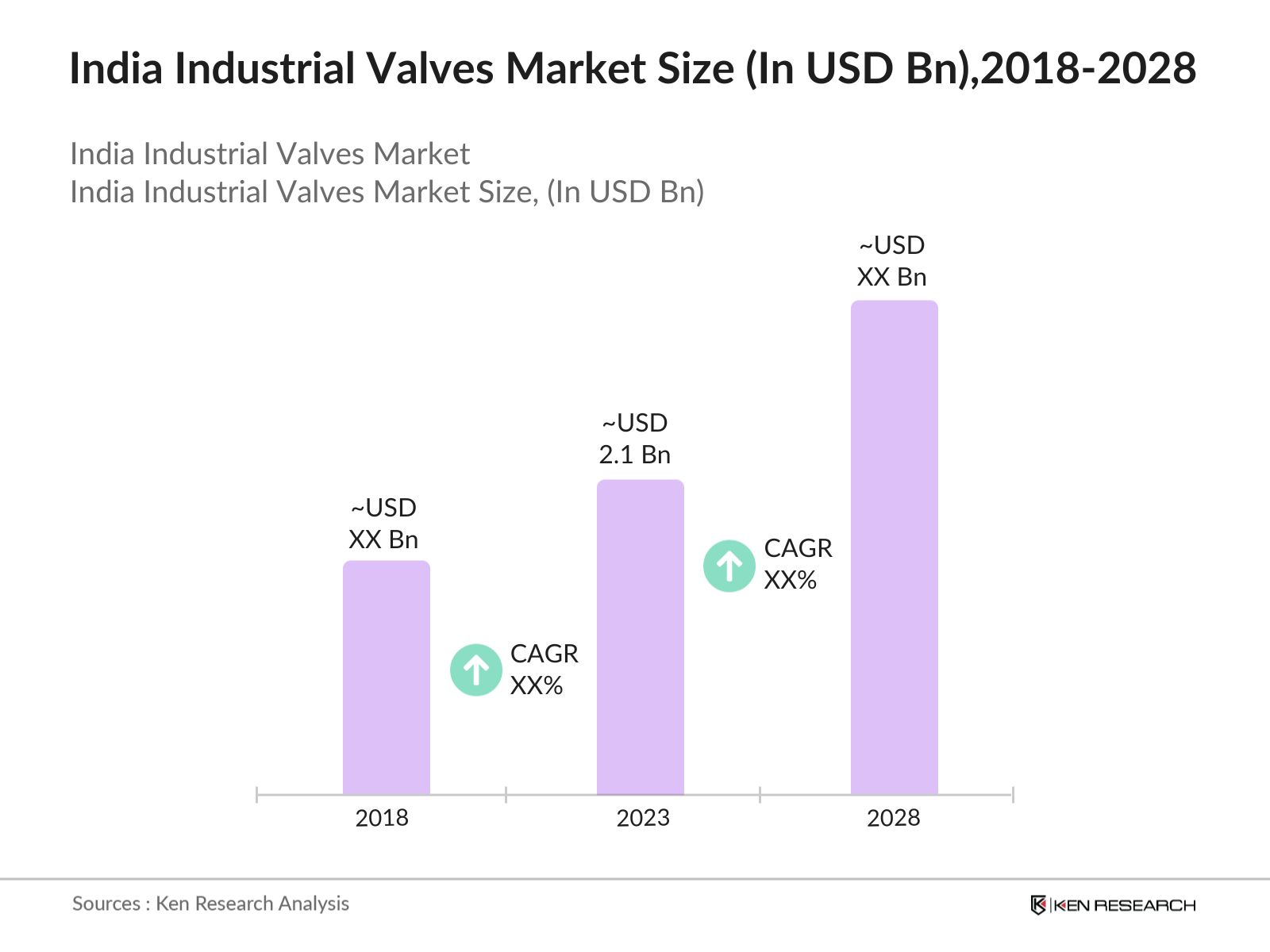

- India Industrial Valves Market was valued at USD 2.1 billion in 2023, driven primarily by the robust expansion of the oil and gas, power, and chemical industries. The increasing urbanization and industrialization have bolstered demand, with the growth in infrastructure projects and government initiatives further propelling the market.

- Key players in the India Industrial Valves Market include Larsen & Toubro Limited, Kirloskar Brothers Limited, AVK India, Neco Valves, and BHEL. These companies dominate due to their extensive product portfolios, strong distribution networks, and continuous investment in R&D. Their ability to offer customized solutions tailored to specific industry needs gives them a competitive edge.

- Cities like Mumbai, Chennai, and Pune dominate the industrial valves market in India. Mumbai and Chennai are major industrial hubs with significant oil and gas, and chemical industries, while Pune has a strong presence of automotive and manufacturing sectors. The strategic location of these cities with access to ports and robust infrastructure further enhances their dominance in the market.

- In 2024, Kirloskar Brothers Limited (KBL) has received the prestigious GreenPro Ecolabel certification for many products, including the End Suction Pump DBxe, Lowest Lifecycle Cost (LLCTM) Series Horizontal Axially Split Case Pumps. This certification exemplifies KBL's commitment to developing sustainable solutions that meet and exceed environmental standards in the industrial sector.

India Industrial Valves Market Segmentation

The India Industrial Valves Market can be segmented based on several factors:

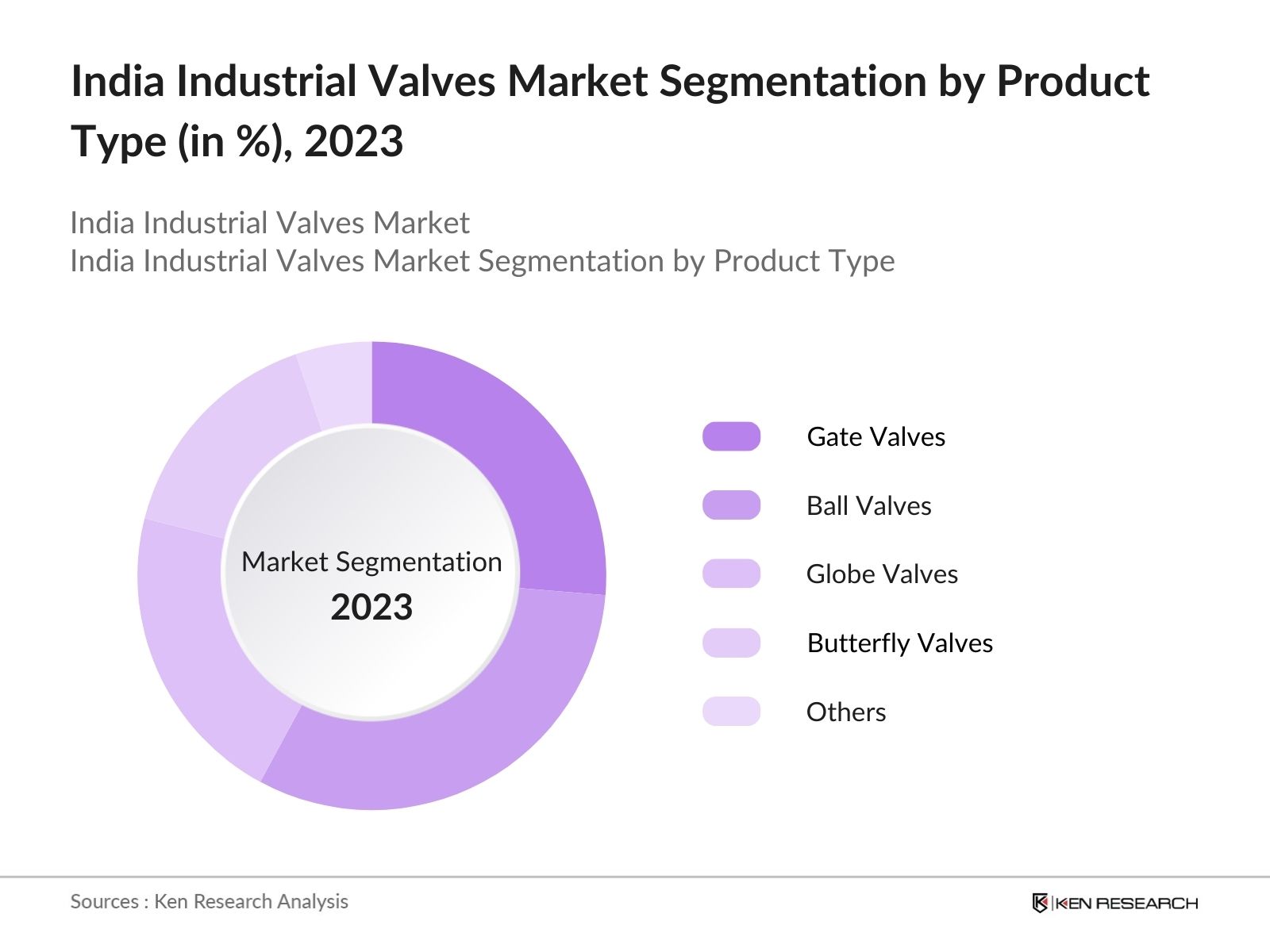

By Product Type: India Industrial Valves Market is segmented by product type into gate valves, ball valves, globe valves, butterfly valves, and others. In 2023, ball valves dominated this segment due to their extensive use in oil and gas and chemical industries for their efficient flow control and durability. The ability to handle high pressure and temperature makes ball valves a preferred choice in these industries.

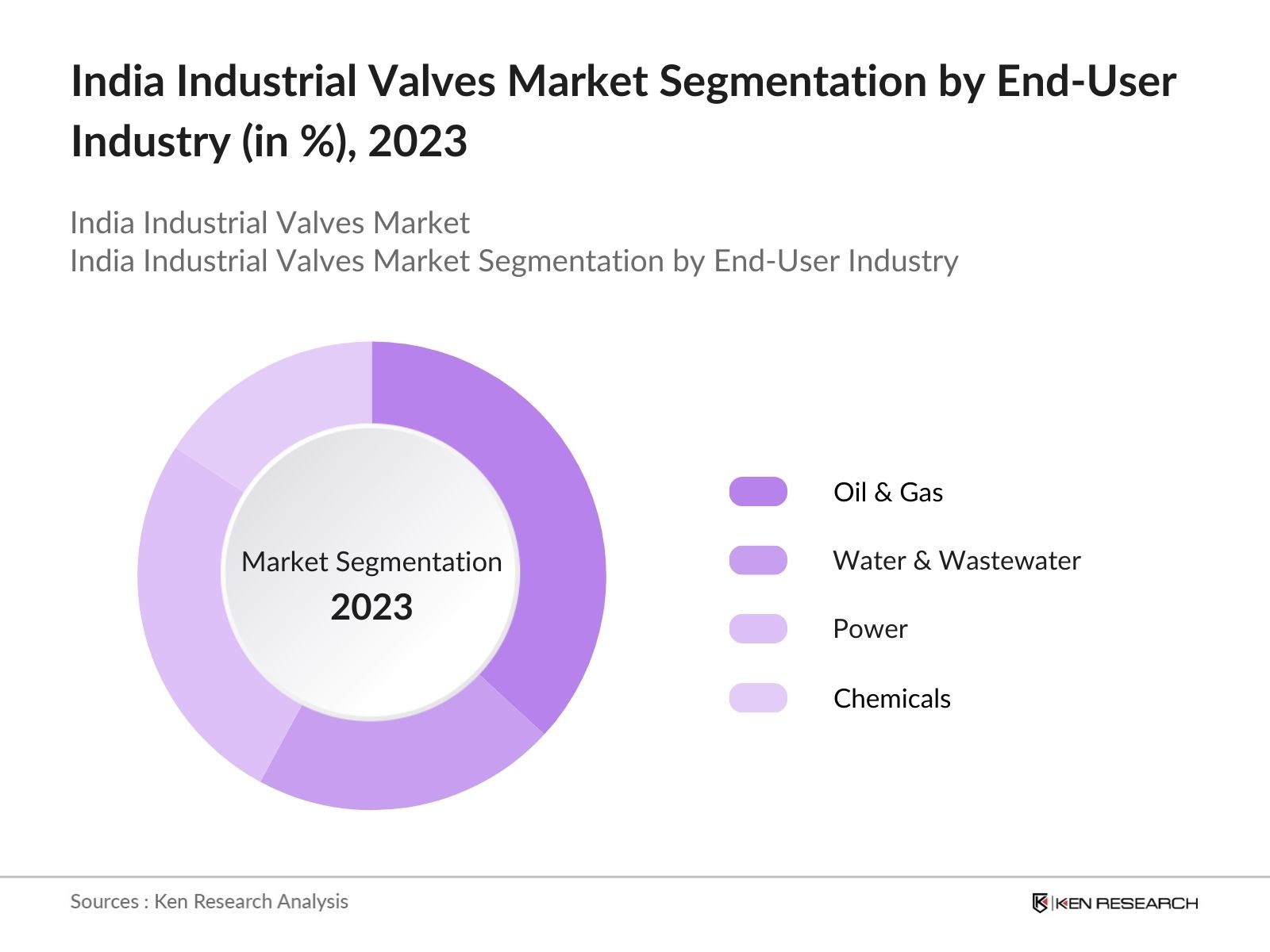

By End-User Industry: India Industrial Valves Market is segmented by end-user industry into oil & gas, water & wastewater, power and chemicals. In 2023, the oil & gas industry dominated this segment due to the significant investments in refinery expansions and new pipeline projects. The critical need for reliable flow control in upstream and downstream operations drives the demand for industrial valves in this sector.

By Region: India Industrial Valves Market is segmented by region into North, South, East, and West. In 2023, the West region dominated this segment due to the presence of key industrial hubs like Mumbai and Gujarat, which are major centers for oil and gas, chemical, and power industries. The region's robust industrial base and strategic location enhance its market dominance.

India Industrial Valves Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Larsen & Toubro Limited |

1938 |

Mumbai, Maharashtra |

|

Kirloskar Brothers Limited |

1888 |

Pune, Maharashtra |

|

AVK India |

1941 |

Chennai, Tamil Nadu |

|

Neco Valves |

1997 |

Nagpur, Maharashtra |

|

BHEL |

1964 |

New Delhi, Delhi |

- Larsen & Toubro Wins Transmission Orders: In 2023, Larsen & Toubro has secured significant power transmission orders worth up to 5,000 crore. This achievement reflects the company's ongoing strength in the infrastructure sector and its ability to capture large-scale projects in the energy domain. These orders span India, the Middle East, Malaysia, and Thailand, demonstrating L&T's global footprint and expertise in power transmission infrastructure.

- BHELs Inclusion with Government Initiatives: The Indian government has included BHEL in its plans for an 800-MW advanced ultra-supercritical power plant in collaboration with NTPC Ltd, as part of the Union Budget for FY2024-25. This initiative aims to promote indigenous technology and enhance thermal power capacity, alongside other measures for energy transition and sustainability

India Industrial Valves Industry Analysis

Growth Drivers:

- Expansion of Oil and Gas Industry: The oil and gas sector is a major driver for the industrial valves market in India. Indigenous crude oil and condensate production during December 2023 was 2.5 MMT. This growth necessitates high-quality industrial valves for efficient flow control and safety. The Indian government's push for energy security and increased production has led to numerous new projects, boosting demand for valves.

- Infrastructure Development Initiatives: India's extensive infrastructure projects, such as the Bharatmala Pariyojana, aimed at improving road connectivity, and the Smart Cities Mission, have significantly increased the demand for industrial valves. In Interim Budget 2024-25, capital investment outlay for infrastructure has been increased by USD 133.86 billion.

- Industrial Manufacturing Growth: The industrial manufacturing sector, including chemicals, pharmaceuticals, and food processing, has seen robust growth, driving the need for reliable valve solutions. The annual production growth rate in the manufacturing industry was 4.7 percent during fiscal year 2023. The demand for precise flow control in manufacturing processes fuels the growth of the industrial valves market.

India Industrial Valves Market Challenges:

- Stringent Regulatory Standards: Compliance with stringent regulatory standards and certifications required for industrial valves used in critical applications is a challenge. These standards ensure safety and efficiency but require significant investment in R&D and testing. In 2024, the Bureau of Indian Standards (BIS) introduced updated regulations for industrial valves, necessitating manufacturers to upgrade their products to meet these new requirements.

- High Competition and Price Sensitivity: The industrial valves market in India faces intense competition from both domestic and international players, leading to price sensitivity. This high competition often results in pressure on profit margins for manufacturers. For instance, the influx of low-cost Chinese valves has intensified competition, making it challenging for Indian manufacturers to maintain profitability while ensuring quality.

India Industrial Valves Market Government Initiatives:

- National Infrastructure Pipeline (NIP): The Indian governments National Infrastructure Pipeline (NIP) launched in 2019, with an investment of USD 1.5 trillion between 2020 to 2025, aims to develop critical infrastructure across sectors such as energy, transportation, and urban development. This initiative drives the demand for industrial valves used in these large-scale projects, boosting the market significantly.

- Smart Cities Mission: The Smart Cities Mission, initiated in 2015, aims to develop 100 smart cities with enhanced urban infrastructure and sustainable solutions. The mission's focus on modernizing water supply, sewage systems, and energy management systems significantly increases the demand for advanced industrial valves. The budget for the mission was extended to 14,100 crore in 2023, with a total proposed investment of 201,981 crore across the selected cities.

India Industrial Valves Future Market Outlook

India Industrial Valves Market is expected to witness substantial growth over the next five years, driven by increasing investments in infrastructure and the expansion of key industries such as oil and gas, power, and manufacturing.

Future Trends

- Integration of IoT and Smart Technologies: The future of the industrial valves market in India will see a significant shift towards the integration of IoT and smart technologies. These advanced valves will enable real-time monitoring, predictive maintenance, and improved operational efficiency, reducing downtime and enhancing productivity across industries.

- Increased Focus on Sustainability: Sustainability will become a key trend, with manufacturers focusing on eco-friendly materials and energy-efficient valve solutions. The demand for green valves, which minimize environmental impact and support sustainable industrial practices, will rise, driven by stringent environmental regulations and corporate sustainability goals.

Scope of the Report

|

By Product Type |

Gate Valves Ball Valves Globe Valves Butterfly Valves Others |

|

By End-User |

Oil & Gas Water & Wastewater Power Chemicals |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Oil & Gas Companies

Power Generation Companies

Construction Companies

Engineering, Procurement, and Construction (EPC) Companies

Manufacturers and Suppliers of Industrial Valves

Marine and Shipbuilding Companies

Investments & Venture Capitalist Firms

Government & Regulatory Bodies (CPCB, Ministry of Power)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Major Players Mentioned in the Report:

Larsen & Toubro Limited

Kirloskar Brothers Limited

AVK India

Neco Valves

BHEL

Emerson Electric Co.

Flowserve Corporation

CRI Pumps Private Limited

Weir Group

GE Oil & Gas

Table of Contents

Research Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Collating statistics on India Industrial Valves Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India Industrial Valves Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry exerts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Our team will approach multiple industrial valve suppliers and distributors companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from industrial valve suppliers and distributors companies.

Frequently Asked Questions

01 How big is India Industrial Valves Market?

India Industrial Valves Market was valued at USD 2.1 billion in 2023, driven primarily by the robust expansion of the oil and gas, power, and chemical industries.

02 What are the challenges in the India Industrial Valves Market?

Challenges of India Industrial Valves Market include high competition and price sensitivity among manufacturers, raw material price volatility, and the need to comply with stringent regulatory standards, which require significant investment in R&D and testing.

03 What are the growth drivers of the India Industrial Valves Market?

Growth drivers of India Industrial Valve Market include the expansion of the oil and gas industry, substantial infrastructure development initiatives like the Bharatmala Pariyojana & Smart Cities Mission, and extensive growth in industrial manufacturing sectors such as chemicals and pharmaceuticals.

04 Who are the major players in the India Industrial Valves Market?

Key players in the India Industrial Valves Market include Larsen & Toubro Limited, Kirloskar Brothers Limited, AVK India, Neco Valves, and BHEL. These companies dominate due to their extensive product portfolios, strong distribution networks, and continuous investment in R&D.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.