India Instant Noodles and Pasta Market Outlook to 2030

Slurping Growth, Instant Flavor Surge

Region:Asia

Author(s):Rebecca Mary Reji

Product Code:KROD346

May 2025

90

About the Report

India Instant Noodles and Pasta Market Overview

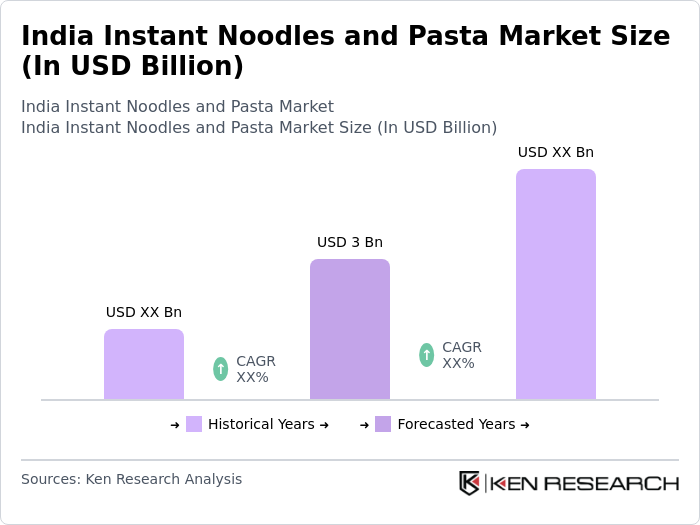

- The combined instant noodles and pasta market was valued at USD 3 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for convenient and quick meal options among the urban population, coupled with the rising trend of snacking. The market has seen a surge in product innovation, with various flavors and health-oriented options being introduced to cater to diverse consumer preferences.

- Key cities such as Mumbai, Delhi, and Bangalore dominate the market due to their large population density and fast-paced lifestyles. These urban centers have a higher concentration of working professionals and students, leading to increased consumption of instant noodles and pasta as convenient meal solutions. Additionally, the presence of major food manufacturers in these cities further strengthens their market position.

- Recent industry developments include increased emphasis on clean-label products and sodium reduction initiatives by manufacturers, aligning with global health trends.

India Instant Noodles and Pasta Market Segmentation

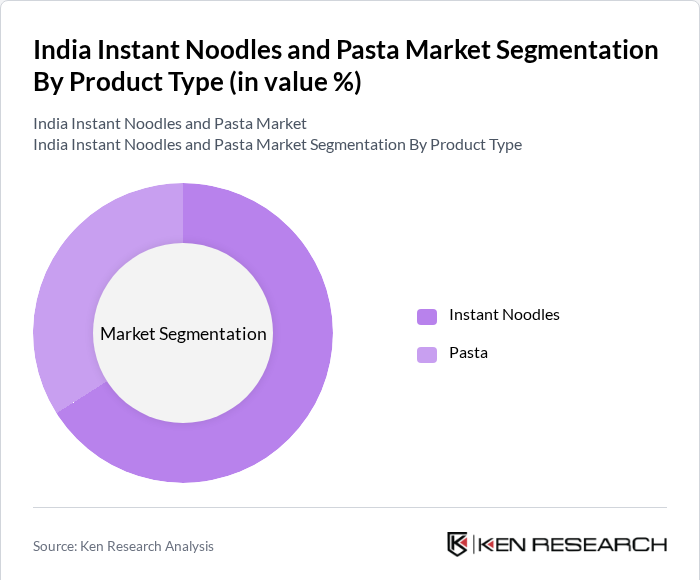

By Product Type: The market is segmented into instant noodles and pasta. Among these, instant noodles dominate the market due to their convenience and variety of flavors. The fast-paced lifestyle of consumers, particularly in urban areas, drives the demand for quick meal solutions. Instant noodles are often favored for their ease of preparation and affordability, making them a staple in many households. The trend of experimenting with different flavors and the introduction of healthier options have further boosted their popularity.

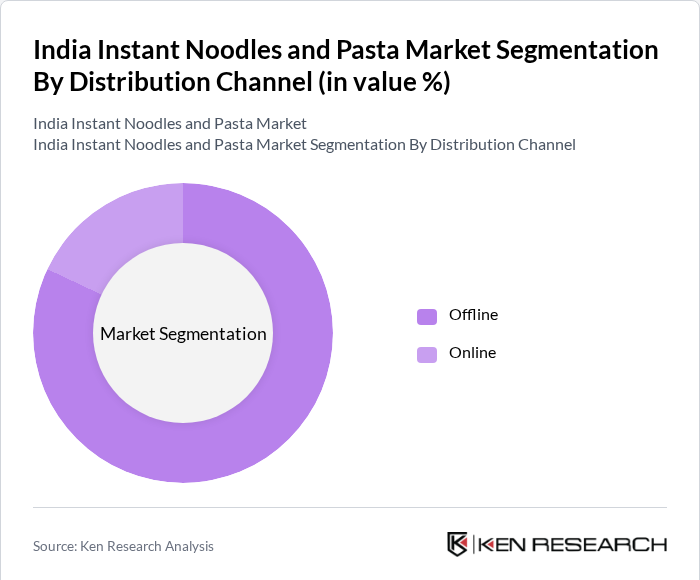

By Distribution Channel: The market is segmented into offline and online distribution channels. The offline segment, which includes supermarkets, hypermarkets, and local grocery stores, currently holds a significant share due to the traditional shopping habits of consumers. However, the online segment is rapidly gaining traction, especially among younger consumers who prefer the convenience of home delivery. The growth of e-commerce platforms and the increasing penetration of the internet in rural areas are contributing to the rise of online sales.

India Instant Noodles and Pasta Market Competitive Landscape

The India Instant Noodles and Pasta Market is characterized by a competitive landscape with several key players, including Nestlé India, ITC Limited, and Hindustan Unilever. These companies are known for their strong brand recognition and extensive distribution networks, which enable them to maintain a significant presence in the market. The competition is further intensified by the entry of new players offering innovative products and flavors, catering to the evolving preferences of consumers.

India Instant Noodles and Pasta Market Industry Analysis

Growth Drivers

- Increasing Urbanization and Changing Lifestyles: The rapid urbanization in India, with over 35% of the population living in urban areas as of 2024, is a significant driver for the instant noodles and pasta market. Urban areas are projected to grow by approximately 2.5% annually, leading to a higher demand for convenient food options. The changing lifestyles of urban dwellers, who often have busy schedules, have resulted in a shift towards quick meal solutions. According to the National Sample Survey Office (NSSO), around majority of urban households reported a preference for ready-to-eat meals, which includes instant noodles and pasta.

- Rising Demand for Convenient Food Options: The demand for convenient food options in India has surged, particularly among the working population and students. In 2024, the convenience food segment is expected to account for approximately 25% of the total food market, with instant noodles and pasta being key contributors. The increasing number of working professionals, estimated at 410 million, has led to a preference for quick meal solutions that require minimal preparation time. Furthermore, the COVID-19 pandemic has accelerated this trend, as more consumers have adopted cooking at home but still seek quick meal solutions.

- Expanding Distribution Channels: The expansion of distribution channels has significantly fueled the growth of the instant noodles and pasta market in India. As of 2024, supermarkets and hypermarkets remain the dominant retail formats due to their extensive product ranges and customer-friendly environments, making them the preferred choice for purchasing these convenience foods, especially in urban areas where consumers often buy them alongside daily groceries. Additionally, the rise of e-commerce platforms has enhanced accessibility, with major players like Nestlé and ITC strengthening their online presence to meet growing consumer demand.

Market Challenges

- Health Concerns Related to Instant Foods: One of the significant challenges facing the instant noodles and pasta market in India is the growing health concerns associated with instant foods. As consumers become more health-conscious, there is an increasing scrutiny of the nutritional content of these products. In 2024, approximately 42% of consumers expressed concerns about the high sodium content and preservatives found in instant noodles, according to a survey by the Indian Council of Medical Research (ICMR).

- Intense Competition Among Brands: The instant noodles and pasta market in India is characterized by intense competition, with numerous brands vying for market share. In 2024, the market is expected to have over 55 active brands, leading to price wars and aggressive marketing strategies. Major players like Nestlé and ITC dominate the market, holding a majority of market share. However, the entry of new players and local brands has intensified competition, making it challenging for established brands to maintain their market position.

India Instant Noodles and Pasta Market Future Outlook

The future of the instant noodles and pasta market in India appears promising, driven by evolving consumer preferences and the increasing adoption of technology in food distribution. As health-conscious trends continue to shape the market, brands that innovate with healthier options and sustainable practices are likely to thrive.

Market Opportunities

- Growing E-commerce Platforms: The rise of e-commerce platforms presents a significant opportunity for the instant noodles and pasta market in India. With online grocery shopping projected to grow rapidly in 2025, brands can leverage this trend to reach a broader audience. E-commerce allows for targeted marketing and personalized shopping experiences, catering to the preferences of tech-savvy consumers.

- Innovations in Product Flavors and Ingredients: There is a growing opportunity for innovation in product flavors and ingredients within the instant noodles and pasta market. As consumer preferences shift towards unique and diverse flavors, brands that introduce innovative products can capture the attention of a broader consumer base. In 2024, the demand for exotic flavors is expected to rise exceptionally, with consumers seeking new culinary experiences.

Scope of the Report

| By Product Type |

Instant Noodles Pasta |

| By Distribution Channel |

Online Offline |

| By Packaging Type |

Single-Serve Multi-Serve |

| By Flavor |

Spicy Non-Spicy Vegetarian Non-Vegetarian |

| By Region |

North India South India East India West India |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Food Safety and Standards Authority of India, Ministry of Food Processing Industries)

Manufacturers and Producers

Distributors and Retailers

Food Service Operators

Packaging Suppliers

Market Analysts and Industry Experts

Financial Institutions

Companies

Players Mentioned in the Report:

Nestlé India

ITC Limited

Hindustan Unilever

Barilla Group

Sunfeast (ITC)

NoodleNest India

PastaPalace Foods

QuickBite Noodles

InstantDelight Foods

SpiceWave Noodles

Table of Contents

1. India Instant Noodles and Pasta Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Instant Noodles and Pasta Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Instant Noodles and Pasta Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Urbanization and Changing Lifestyles

3.1.2. Rising Demand for Convenient Food Options

3.1.3. Expanding Distribution Channels

3.2. Market Challenges

3.2.1. Health Concerns Related to Instant Foods

3.2.2. Intense Competition Among Brands

3.2.3. Fluctuating Raw Material Prices

3.3. Opportunities

3.3.1. Growing E-commerce Platforms

3.3.2. Innovations in Product Flavors and Ingredients

3.3.3. Expansion into Tier II and III Cities

3.4. Trends

3.4.1. Increasing Popularity of Health-Conscious Options

3.4.2. Rise of Plant-Based and Organic Products

3.4.3. Adoption of Sustainable Packaging Solutions

3.5. Government Regulation

3.5.1. Food Safety and Standards Authority of India (FSSAI) Guidelines

3.5.2. Labeling and Nutritional Information Requirements

3.5.3. Import Regulations for Raw Materials

3.5.4. Environmental Regulations on Packaging Waste

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. India Instant Noodles and Pasta Market Segmentation

4.1. By Product Type

4.1.1. Instant Noodles

4.1.2. Pasta

4.2. By Distribution Channel

4.2.1. Online

4.2.2. Offline

4.3. By Packaging Type

4.3.1. Single-Serve

4.3.2. Multi-Serve

4.4. By Flavor

4.4.1. Spicy

4.4.2. Non-Spicy

4.4.3. Vegetarian

4.4.4. Non-Vegetarian

4.5. By Region

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Instant Noodles and Pasta Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Nestlé India

5.1.2. ITC Limited

5.1.3. Hindustan Unilever

5.1.4. Barilla Group

5.1.5. Sunfeast (ITC)

5.1.6. NoodleNest India

5.1.7. PastaPalace Foods

5.1.8. QuickBite Noodles

5.1.9. InstantDelight Foods

5.1.10. SpiceWave Noodles

5.2. Cross Comparison Parameters

5.2.1. Market Share

5.2.2. Product Range

5.2.3. Pricing Strategies

5.2.4. Distribution Network

5.2.5. Brand Loyalty

5.2.6. Marketing Strategies

5.2.7. Customer Reviews and Feedback

5.2.8. Innovation and R&D Investment

5.2.9. Sustainability Practices

5.2.10. Financial Performance

6. India Instant Noodles and Pasta Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. India Instant Noodles and Pasta Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Instant Noodles and Pasta Market Future Market Segmentation

8.1. By Product Type

8.1.1. Instant Noodles

8.1.2. Pasta

8.2. By Distribution Channel

8.2.1. Online

8.2.2. Offline

8.3. By Packaging Type

8.3.1. Single-Serve

8.3.2. Multi-Serve

8.4. By Flavor

8.4.1. Spicy

8.4.2. Non-Spicy

8.4.3. Vegetarian

8.4.4. Non-Vegetarian

8.5. By Region

8.5.1. North India

8.5.2. South India

8.5.3. East India

8.5.4. West India

9. India Instant Noodles and Pasta Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Instant Noodles and Pasta Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the India Instant Noodles and Pasta Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India Instant Noodles and Pasta Market.

Frequently Asked Questions

01. How big is the India Instant Noodles and Pasta Market?

The India Instant Noodles and Pasta Market is valued at USD 3 billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the India Instant Noodles and Pasta Market?

Key challenges in the India Instant Noodles and Pasta Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the India Instant Noodles and Pasta Market?

Major players in the India Instant Noodles and Pasta Market include Nestlé India, ITC Limited, Hindustan Unilever, Barilla Group, Sunfeast (ITC), among others.

04. What are the growth drivers for the India Instant Noodles and Pasta Market?

The primary growth drivers for the India Instant Noodles and Pasta Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.