India Interactive Whiteboard Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD8296

December 2024

80

About the Report

India Interactive Whiteboard Market Overview

- The India Interactive Whiteboard (IWB) market is valued at USD 178 million, based on a comprehensive analysis of its current trajectory and previous five-year growth. The increasing digitization of the education sector, driven by government initiatives such as the National Digital Educational Architecture (NDEAR), has substantially boosted the demand for interactive whiteboards across educational institutions.

- The dominant regions in the India IWB market are Southern and Northern India. Southern India leads due to the large concentration of educational institutions and the regional governments' emphasis on smart classrooms. Northern India follows closely, with robust government support and the presence of corporate hubs in Delhi and surrounding areas. These regions' prioritization of digital learning and technology adoption across schools and offices has driven their dominance in the market.

- As part of the Digital India initiative, the Indian government has allocated INR 10,000 crore in 2024 to enhance digital education infrastructure across the country. This includes installing interactive whiteboards in over 100,000 government schools and institutions to modernize the learning environment.

India Interactive Whiteboard Market Segmentation

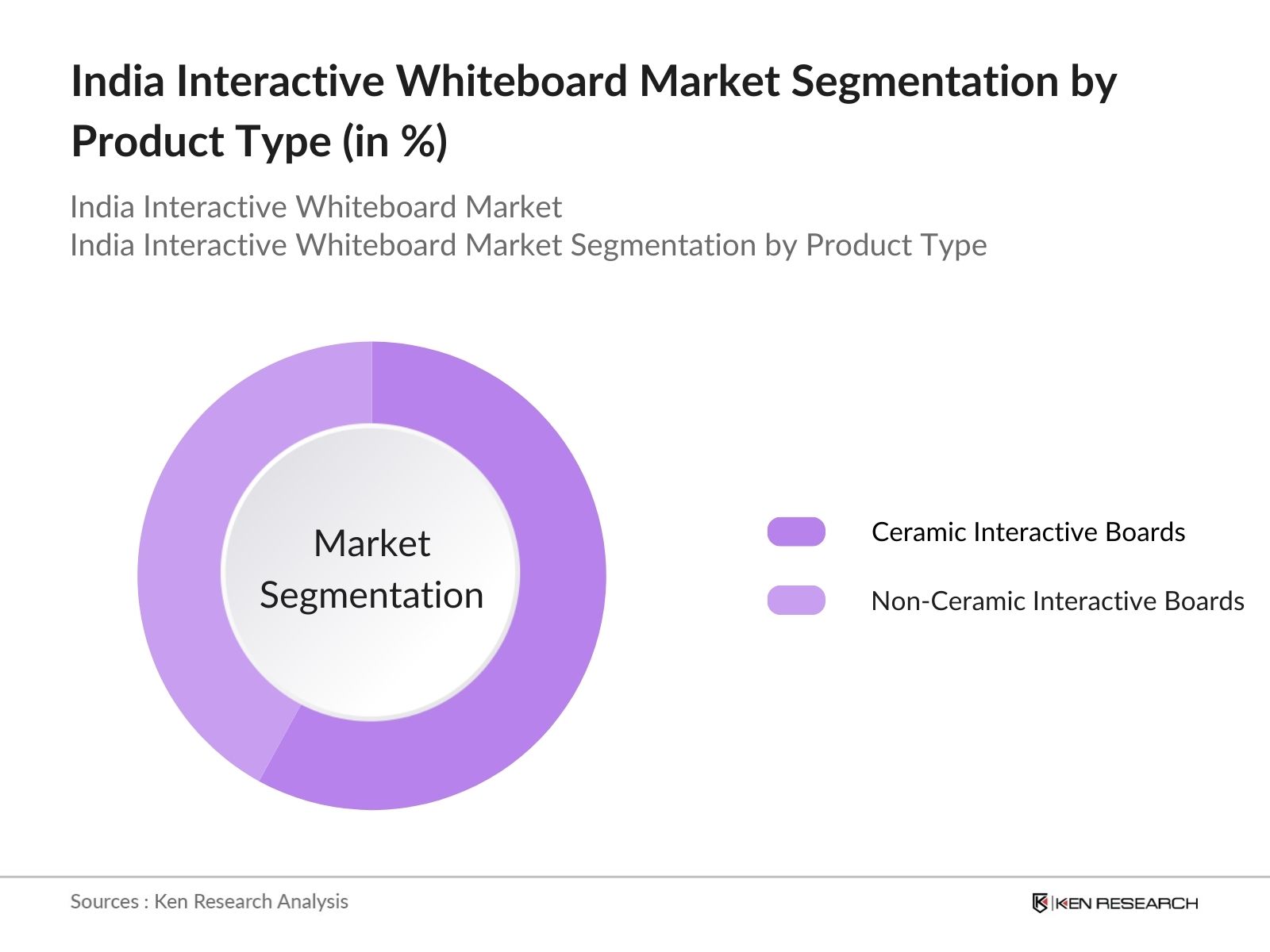

By Product Type: The market is segmented by product type into ceramic interactive whiteboards and non-ceramic interactive whiteboards. Recently, ceramic interactive whiteboards have captured a dominant market share due to their durability and better surface for writing, making them a preferred choice in both educational and corporate settings. Educational institutions, in particular, favor ceramic boards because they can withstand constant use and are more resistant to damage, ensuring long-term use without frequent replacements.

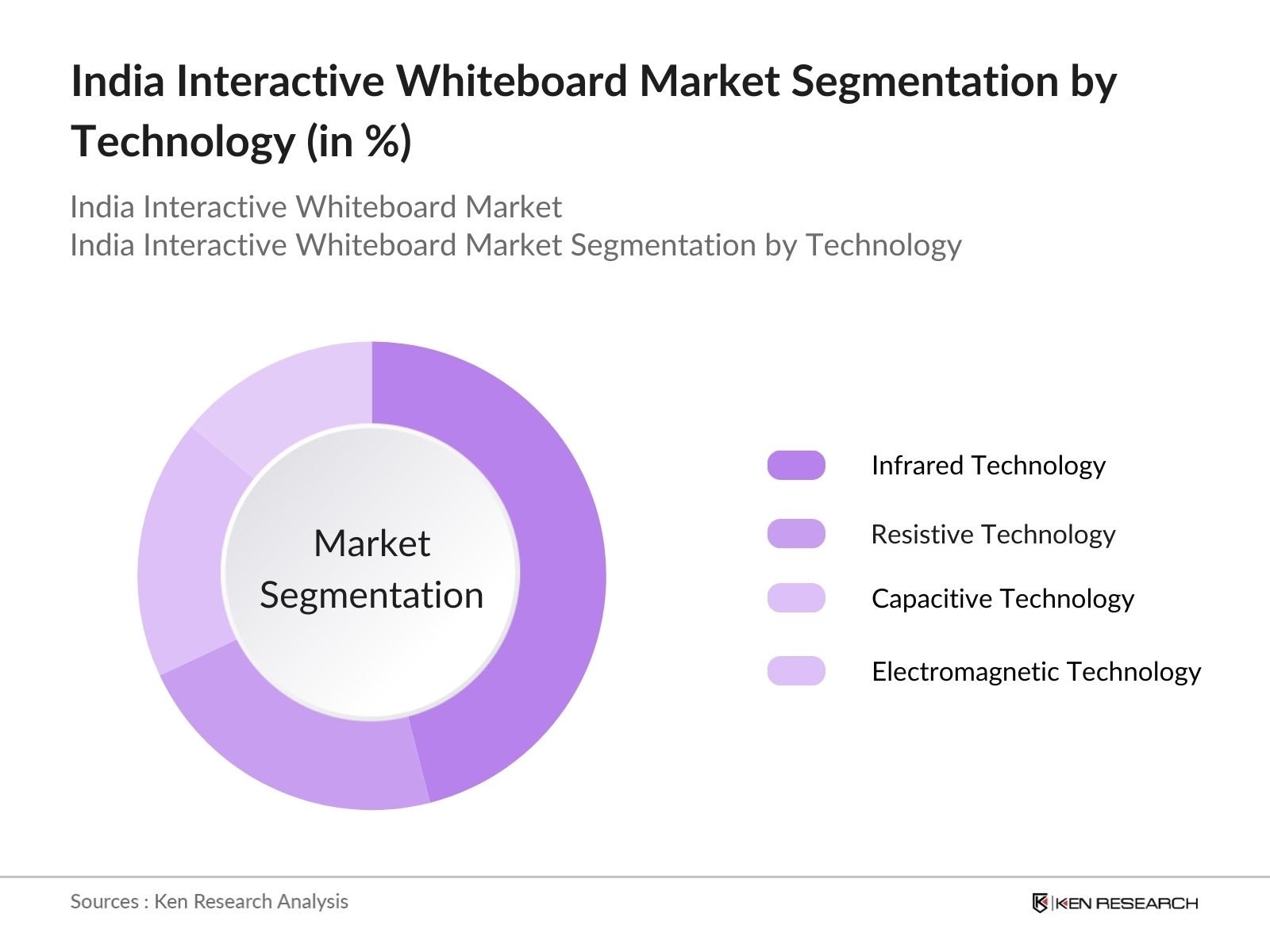

By Technology: Interactive whiteboards in India are also categorized by technology into infrared, resistive, capacitive, and electromagnetic technologies. Among these, infrared technology is currently the most widely adopted due to its accuracy and affordability. Infrared whiteboards allow for multiple touchpoints and can be operated with fingers or any object, making them ideal for educational and collaborative corporate environments. Furthermore, infrared whiteboards offer better resolution, which enhances the overall user experience.

India Interactive Whiteboard Market Competitive Landscape

The market is competitive, with several global and local players competing for market share. The market is dominated by both domestic players and well-established global brands that have invested in innovative product offerings and strong distribution networks.

|

Company Name |

Establishment Year |

Headquarters |

Market Position |

Product Portfolio |

Revenue (USD) |

Employee Count |

R&D Investments |

Technological Innovation |

Strategic Initiatives |

|

Hitachi India Pvt. Ltd. |

1930 |

Tokyo, Japan |

|||||||

|

Panasonic India Pvt. Ltd. |

1918 |

Osaka, Japan |

|||||||

|

SMART Technologies |

1987 |

Alberta, Canada |

|||||||

|

Sharp India Limited |

1912 |

Tokyo, Japan |

|||||||

|

Globus Infocom Limited |

2001 |

Noida, India |

India Interactive Whiteboard Market Analysis

Market Growth Drivers

- Rising adoption in education sector: The Indian education system has increasingly shifted toward digital learning, driving demand for interactive whiteboards. With over 1.5 million schools and more than 250 million students, the governments initiatives, such as the Digital India Program and Smart Classrooms, aim to transform traditional classrooms into digital hubs.

- Increased corporate demand for collaboration tools: Indias corporate sector has witnessed a surge in the adoption of interactive whiteboards for seamless remote collaboration, particularly in the post-pandemic hybrid work environment. With over 5 million businesses actively adopting modern collaboration tools, the demand for interactive whiteboards in office spaces has grown.

- Government push for e-learning platforms: In 2024, the Indian government allocated INR 2,000 crore toward expanding e-learning platforms in public schools and educational institutions. This initiative has directly boosted demand for interactive whiteboards, which play a key role in digital classrooms. With the launch of new online educational platforms like DIKSHA and SWAYAM, more than 50 million students are accessing digital content, requiring advanced tools like interactive whiteboards for engaging learning.

Market Challenges

- Lack of digital literacy in rural areas: Despite government initiatives, a substantial portion of Indias rural population still lacks the digital literacy needed to effectively use interactive whiteboards. As of 2024, more than 60% of schools in rural regions are yet to be equipped with smart classroom technologies due to a shortage of trained staff and digital learning resources.

- Inconsistent internet connectivity: In 2024, around 50 million people in rural areas still experience inconsistent or low-quality internet connectivity, which impacts the functionality of interactive whiteboards that rely on internet access for cloud-based learning platforms and collaboration tools.

India Interactive Whiteboard Market Future Outlook

Over the next five years, the India Interactive Whiteboard industry is expected to witness growth driven by government support for digital education, increased demand for hybrid learning models, and the corporate sectors focus on enhancing collaboration through technology.

Future Market Opportunities

- Corporate demand for remote collaboration solutions: The demand for remote and hybrid collaboration tools in Indias corporate sector is projected to grow exponentially over the next five years. By 2029, more than 500,000 meeting rooms across India will be equipped with interactive whiteboards, enabling seamless virtual collaboration.

- Increased government funding for digital education: Over the next five years, the Indian government is expected to increase funding for digital education initiatives, with an estimated INR 20,000 crore allocated for interactive learning solutions by 2029. This funding will support the installation of interactive whiteboards in over 200,000 public schools and institutions.

Scope of the Report

|

Product Type |

Ceramic Non-Ceramic |

|

Screen Size |

Up to 69 inches 70-90 inches Above 90 inches |

|

Technology |

Infrared Resistive Capacitive Electromagnetic |

|

End-User |

Education Corporate Government |

|

Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Banks and Financial Institution

Private Equity Firms

Government and Regulatory Bodies (Ministry of Electronics and IT, Digital India Initiatives)

Investor and Venture Capitalist Firms

Smart Classroom Solution Providers

EdTech Companies

Corporate Training Providers

Companies

Players Mentioned in the Report:

Hitachi India Pvt. Ltd.

Panasonic India Private Limited

Sharp India Limited

SMART Technologies

Globus Infocom Limited

BenQ Corporation

PolyVision Corporation

Newline Interactive

Vestel

Boxlight Corporation

Table of Contents

India Interactive Whiteboard Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Technological Classification, Applications)

1.3. Market Growth Rate (Education Sector, Corporate Sector, Government Sector)

1.4. Market Segmentation Overview (By Screen Size, Technology, and End-User)

India Interactive Whiteboard Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

India Interactive Whiteboard Market Analysis

3.1. Growth Drivers

3.1.1. Rising Adoption in Education (Digital Learning Initiatives)

3.1.2. Corporate Training and Collaboration Needs

3.1.3. Government Push for Digital Infrastructure

3.1.4. Cost Efficiency in Long-Term Operations

3.2. Market Challenges

3.2.1. High Initial Costs for Implementation

3.2.2. Resistance to Technological Adoption (Corporate and Government)

3.2.3. Limited Awareness and Training Gaps

3.3. Opportunities

3.3.1. Expansion into Rural Educational Sectors

3.3.2. Development of Smart Classrooms and Hybrid Learning

3.3.3. Integration with AI for Collaborative Learning

3.4. Trends

3.4.1. Growth of Portable Interactive Whiteboards

3.4.2. Integration of Augmented Reality and AI

3.4.3. Increasing Focus on Gamified Learning

India Interactive Whiteboard Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Ceramic Interactive Whiteboards

4.1.2. Non-Ceramic Interactive Whiteboards

4.2. By Screen Size (In Value %)

4.2.1. Up to 69 inches

4.2.2. 70 to 90 inches

4.2.3. Above 90 inches

4.3. By Technology (In Value %)

4.3.1. Infrared

4.3.2. Resistive

4.3.3. Capacitive

4.3.4. Electromagnetic

4.4. By End-User (In Value %)

4.4.1. Education

4.4.2. Corporate

4.4.3. Government

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

India Interactive Whiteboard Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Hitachi India Pvt. Ltd.

5.1.2. Sharp India Limited

5.1.3. Panasonic India Private Limited

5.1.4. SMART Technologies

5.1.5. Visual Display Solutions Pvt. Ltd.

5.1.6. Globus Infocom Limited

5.1.7. Digital Info Media Pvt. Ltd.

5.1.8. Supreme Global Trading Pvt. Ltd.

5.1.9. Title Display System Pvt. Ltd.

5.1.10. BenQ Corporation

5.1.11. PolyVision Corporation

5.1.12. Vestel

5.1.13. Promethean

5.1.14. Newline Interactive

5.1.15. Boxlight Corporation

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Revenue, Market Share, Product Portfolio, Technological Innovations)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, Collaborations, Product Launches)

5.5. Mergers and Acquisitions

5.6. Investment Analysis (Venture Capital, Private Equity)

India Interactive Whiteboard Market Regulatory Framework

6.1. Education Sector Regulations (Digital Infrastructure Policies)

6.2. Corporate Sector Compliance (Workplace Technology Integration)

6.3. Government Initiatives (NDEAR - National Digital Education Architecture)

India Interactive Whiteboard Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (E-learning Expansion, Corporate Training Needs, Government Programs)

India Interactive Whiteboard Future Market Segmentation

8.1. By Product Type

8.2. By Screen Size

8.3. By Technology

8.4. By End-User

8.5. By Region

India Interactive Whiteboard Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Go-to-Market Strategy Recommendations (Target Segments, Technology Prioritization)

9.3. White Space Opportunities (AI Integration, Portable Devices, Hybrid Learning Solutions)

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial step involved mapping all major stakeholders in the India Interactive Whiteboard Market ecosystem. Desk research using secondary databases was conducted to gather information on technological trends, market penetration, and growth dynamics. This phase focused on identifying key variables affecting market dynamics, such as technology adoption and market drivers.

Step 2: Market Analysis and Construction

Historical data for the interactive whiteboard market was compiled, including market revenue by product type and technology. This phase involved examining market trends, demand from educational and corporate sectors, and the performance of major players. Additionally, data accuracy was ensured by comparing multiple credible data sources.

Step 3: Hypothesis Validation and Expert Consultation

To validate the market findings, CATIs (Computer-Assisted Telephone Interviews) were conducted with industry experts from leading companies. This included product managers and sales heads from interactive whiteboard companies, who provided insights into the challenges, market trends, and innovations that influence the market.

Step 4: Research Synthesis and Final Output

The final stage involved synthesizing all research findings to produce an in-depth report. Primary insights from manufacturers were combined with desk research to ensure that the analysis covered all pertinent segments. A top-down and bottom-up approach was used to provide comprehensive market insights.

Frequently Asked Questions

01. How big is Indias Interactive Whiteboard Market?

The India interactive whiteboard market was valued at USD 178 million, driven by increased demand in educational and corporate sectors. The governments emphasis on digital classrooms and corporate collaboration has fueled this growth.

02. What are the challenges in the India Interactive Whiteboard Market?

Some challenges in the India interactive whiteboard market include the high initial setup costs and limited awareness about the technology, especially in rural areas. Additionally, there is resistance to adopting new technologies in traditional educational environments.

03. Who are the major players in the India Interactive Whiteboard Market?

Key players in the India interactive whiteboard market include Hitachi India, Panasonic India, Sharp India, SMART Technologies, and Globus Infocom. These companies dominate due to their extensive product portfolios and established presence in the market.

04. What are the growth drivers of the India Interactive Whiteboard Market?

The India interactive whiteboard market is driven by increased digitalization in education and corporations, government initiatives for smart classrooms, and advancements in IWB technologies like AI integration and multi-touch capabilities.

05. How is technology influencing the Interactive Whiteboard Market in India?

Technological advancements such as infrared touch and capacitive touch have revolutionized the IWB market by providing better user experience, enhancing collaborative work, and enabling more dynamic content delivery in educational institutions and corporations.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.