India Interior Doors Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD10112

November 2024

90

About the Report

India Interior Doors Market Overview

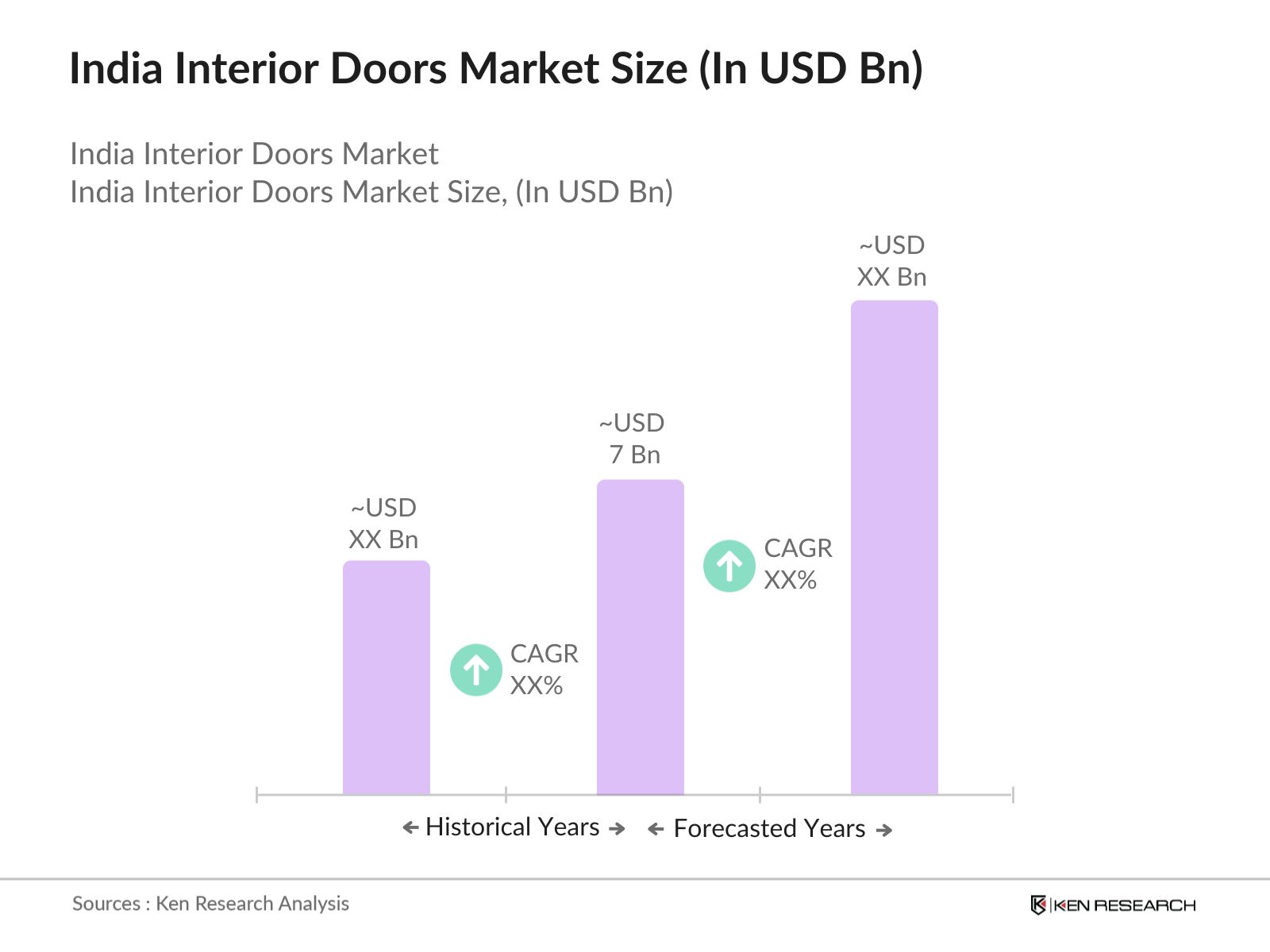

- The India Interior Doors market reached a valuation of USD 7 billion, underpinned by rising urbanization, growth in real estate investments, and a shift towards enhanced home aesthetics and functional designs. Demand has surged as consumers seek both energy-efficient and stylish options, contributing significantly to the market's value. Additionally, eco-conscious buyers are leaning towards sustainable materials, driving the popularity of eco-friendly interior door products.

- The market is primarily dominated by major cities, including Delhi, Mumbai, and Bangalore, due to the concentration of high-income consumers, luxury real estate developments, and a greater inclination towards premium interiors. These metropolitan regions serve as hubs for construction projects and renovations, boosting the demand for high-quality, customizable interior doors that align with urban aesthetics and lifestyle demands.

- The Indonesian government has established the National Air Quality Monitoring Program to systematically assess and manage air pollution levels across the country. Launched in 2022, the program aims to set up a comprehensive network of monitoring stations in urban and rural areas, with a target of establishing 200 new monitoring stations by 2025. This initiative emphasizes the government's commitment to improving air quality standards and public health by providing reliable data for policy-making and regulatory enforcement. The program also includes public reporting mechanisms to increase transparency and public engagement.

India Interior Doors Market Segmentation

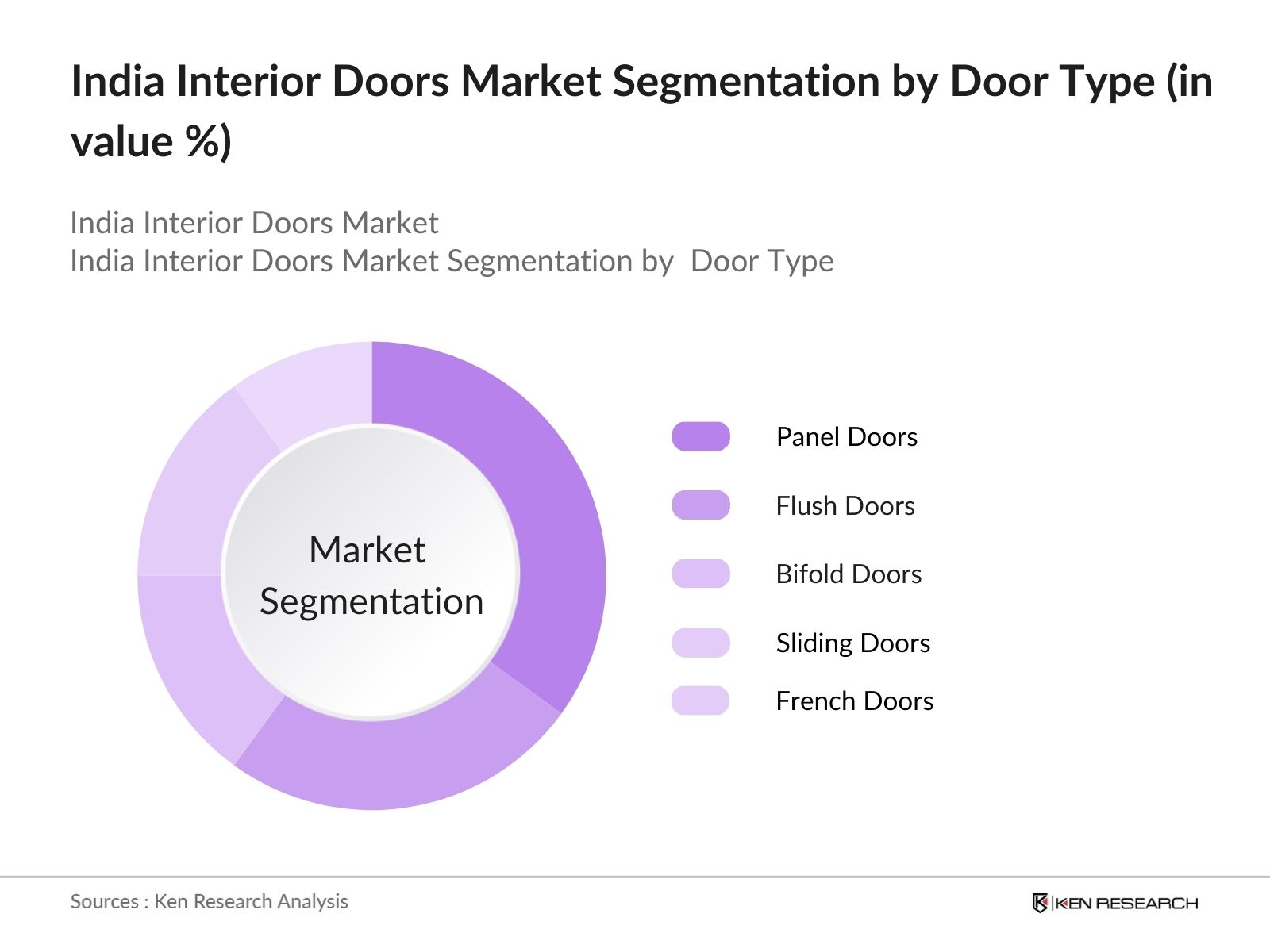

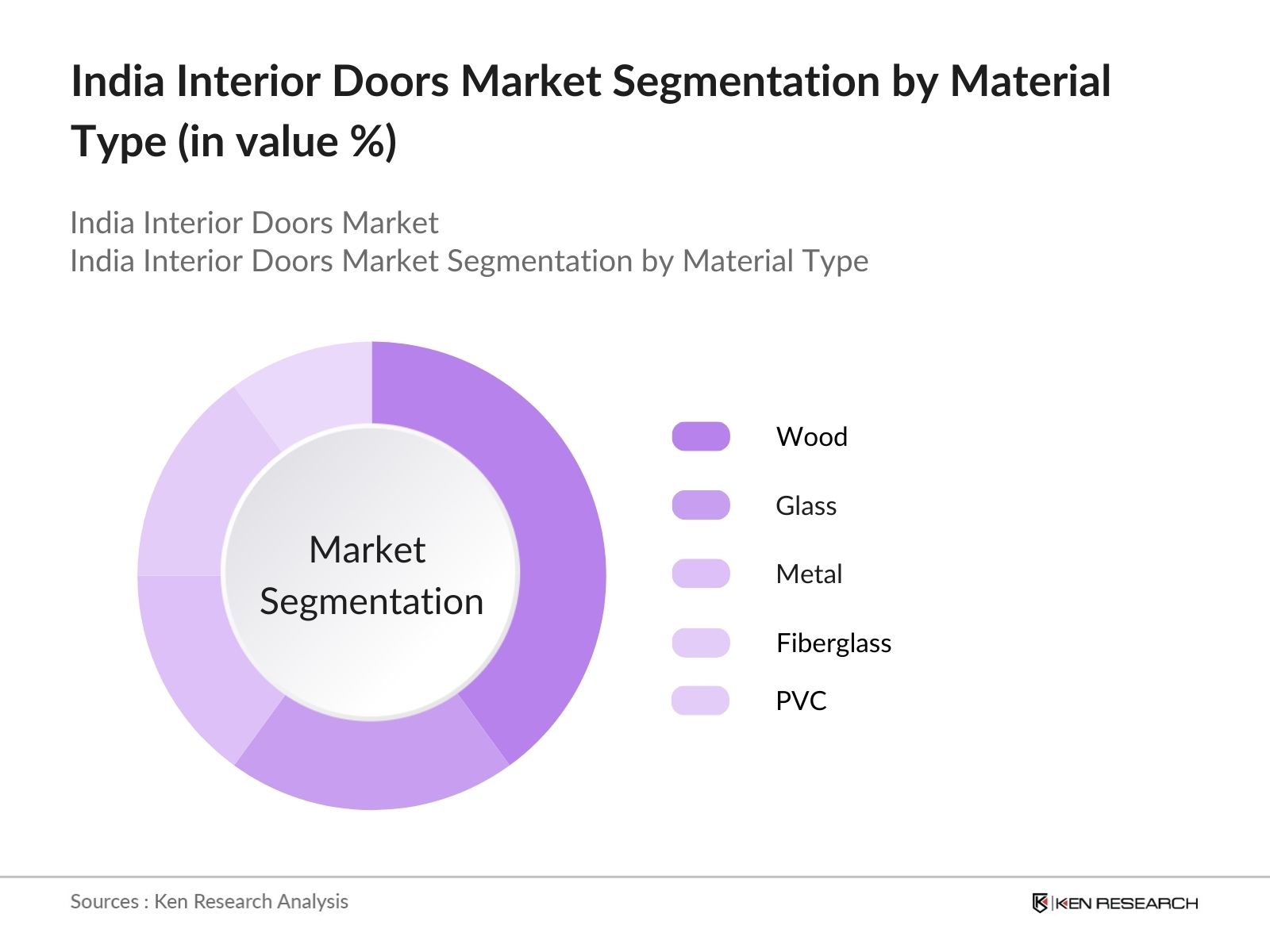

Indias interior doors market is segmented by door type and by material type.

- By Door Type: Indias interior doors market is segmented by door type into panel doors, flush doors, bifold doors, sliding doors, and French doors. Panel doors dominate the market due to their flexibility in design, durability, and their popularity in both residential and commercial applications. These doors offer a wide range of customization options, allowing homeowners to select varying materials, colors, and styles to match interior dcor trends.

- By Material Type: The market is also segmented by material type, including wood, glass, metal, fiberglass, and PVC. Wood is the dominant material due to its timeless appeal, durability, and versatility. Indian consumers often prefer wood for its traditional aesthetic, and it remains a popular choice in both high-end and mid-range interiors. Furthermore, wood's soundproofing properties add to its demand, especially in urban areas.

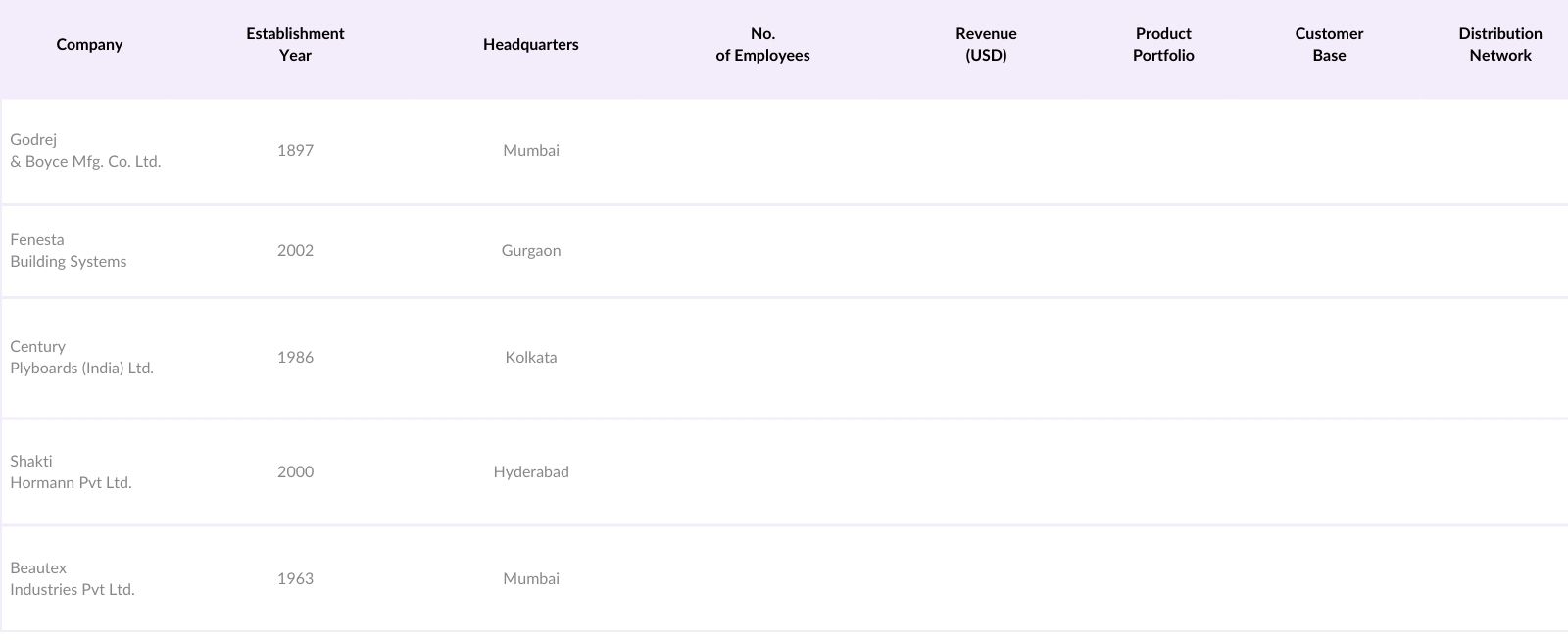

India Interior Doors Market Competitive Landscape

The India Interior Doors market is dominated by key players who leverage innovation, strategic partnerships, and an established distribution network to maintain their market presence. Companies such as Godrej & Boyce and Fenesta are market leaders, recognized for their expansive product lines and quality assurance.

India Interior Doors Industry Analysis

Growth Drivers

- Urbanization: Indonesia's urban population is projected to reach 169 million by 2025, increasing from approximately 150 million in 2022. This rapid urbanization leads to higher vehicle emissions and industrial activity, creating a critical need for effective air quality monitoring systems. Urban areas are also more susceptible to pollution-related health issues, prompting local governments to invest in monitoring solutions. For instance, Jakarta, the capital, has seen a rise in smog levels, with PM2.5 concentrations recorded at 45.4 g/m in 2022, necessitating urgent monitoring to safeguard public health.

- Industrialization: Indonesia's industrial output has shown significant growth, with a reported increase to IDR 2,588 trillion in 2022, up from IDR 2,491 trillion in 2021. This industrial growth contributes to rising emissions, thereby intensifying the need for comprehensive air quality monitoring. Industries, particularly manufacturing, are major contributors to air pollution, with the industrial sector accounting for over 30% of total emissions in urban regions. As industries expand, so does the demand for systems to monitor and manage air quality effectively, ensuring compliance with environmental standards. Statistics Indonesia

- Government Regulations: The Indonesian government has enacted various regulations to combat air pollution, including the National Ambient Air Quality Standard (NAQS), which sets limits for pollutants like PM10 and NO2. For instance, in 2022, the government mandated that new industries must implement monitoring systems before operational approval, leading to increased demand for air quality monitoring technology. Additionally, with the Ministry of Environment and Forestry's goal to reduce emissions by 29% by 2030 compared to a business-as-usual scenario, the emphasis on monitoring compliance will further drive market growth.

Market Challenges

- High Initial Costs: The adoption of air quality monitoring systems faces a significant challenge due to high initial investment costs, which can exceed IDR 1 billion for comprehensive installations. This financial barrier often limits the deployment of advanced monitoring technologies, particularly in smaller municipalities with constrained budgets. While ongoing operational costs are manageable, the upfront expenditure for high-quality sensors and data processing equipment is substantial. This situation is compounded by the need for consistent funding and financial support from the government to facilitate widespread implementation of these systems across the nation. Ministry of Finance Indonesia

- Technical Challenges: Implementing air quality monitoring systems involves various technical challenges, including the calibration of sensors and data reliability. Many regions in Indonesia experience harsh environmental conditions, which can affect sensor performance and data accuracy. Additionally, the integration of various monitoring technologies poses difficulties, as existing infrastructure may not be compatible with new systems. As a result, municipalities may encounter increased operational complexity, leading to potential data inaccuracies. These technical hurdles hinder the effective deployment of monitoring systems and delay the realization of intended benefits for air quality management.

India Interior Doors Market Future Outlook

Over the coming years, the India Interior Doors market is anticipated to expand steadily due to increased urbanization, rising disposable incomes, and a growing demand for energy-efficient and customizable doors. The market will also benefit from the trend towards eco-friendly and sustainable materials, as both builders and consumers shift towards greener choices. This growth will likely be supported by technological advancements and government regulations encouraging energy-efficient construction practices.

Market Opportunities

- Technological Advancements: The ongoing advancements in technology present substantial opportunities for the air quality monitoring system market in Indonesia. With the rise of low-cost, high-accuracy sensors, municipalities can now implement monitoring solutions that were previously economically unfeasible. For instance, in 2022, several startups introduced portable air quality sensors priced below IDR 5 million, significantly lowering the barrier to entry. Additionally, advancements in data analytics and cloud computing allow for real-time data processing, enabling municipalities to make informed decisions regarding air quality management and enhance public engagement in environmental health issues.

- International Collaborations: International collaborations present significant opportunities for Indonesia to enhance its air quality monitoring systems. In 2022, Indonesia entered into partnerships with several international organizations aimed at improving environmental governance. These collaborations facilitate knowledge transfer, funding, and the introduction of advanced monitoring technologies. For example, partnerships with the United Nations Development Programme (UNDP) are focused on bolstering air quality monitoring capabilities, allowing Indonesia to leverage international expertise to address local air quality challenges effectively. Such initiatives will undoubtedly contribute to the growth and enhancement of the monitoring systems in the country.

Scope of the Report

|

Panel Doors Flush Doors Bifold Doors Sliding Doors French Doors |

|

|

By Material Type |

Wood Glass Metal Fiberglass PVC |

|

By Application |

Residential Commercial Hospitality Healthcare Retail |

|

By Distribution Channel |

Direct Sales Retail Stores Online Sales Specialty Stores Wholesalers |

|

By Region |

North East West South |

Products

Key Target Audience

Residential Construction Companies

Commercial Builders and Contractors

Interior Design Firms

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Bureau of Indian Standards, Ministry of Housing and Urban Affairs)

Retailers and Wholesalers

Property Developers

Facility Management Companies

Companies

Players Mention in the Report:

Godrej & Boyce Mfg. Co. Ltd.

DORMA India Pvt Ltd.

Century Plyboards (India) Ltd.

Fenesta Building Systems

Beautex Industries Pvt Ltd.

Duroplast India Pvt Ltd.

Dorset Industries Pvt. Ltd.

Vidhyut Ply & Pack Pvt Ltd.

Hormann India Pvt Ltd.

Shakti Hormann Pvt Ltd.

Vijay Wood Industries

Jain Doors & Ply Pvt Ltd.

Kalpataru Ltd.

Ventura International Pvt Ltd.

Saint-Gobain India Pvt Ltd.

Table of Contents

1. India Interior Doors Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Interior Doors Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Interior Doors Market Analysis

3.1. Growth Drivers

- 3.1.1. Urbanization and Real Estate Expansion

- 3.1.2. Rising Consumer Spending on Home Decor

- 3.1.3. Energy-Efficient Doors Demand

- 3.1.4. Technological Advancements in Materials and Design

3.2. Market Challenges

- 3.2.1. High Initial Costs of Customization

- 3.2.2. Import Dependency for Raw Materials

- 3.2.3. High Competition from Local Players

- 3.2.4. Environmental Regulations on Materials

3.3. Opportunities

- 3.3.1. Eco-Friendly and Sustainable Door Options

- 3.3.2. Increased Renovation Activities

- 3.3.3. Expansion in Rural and Semi-Urban Markets

- 3.3.4. Smart and Automated Interior Doors

3.4. Trends

- 3.4.1. Minimalist and Contemporary Door Designs

- 3.4.2. Use of Eco-Friendly Materials

- 3.4.3. Rising Demand for Soundproof Doors

- 3.4.4. Smart Lock Integration

3.5. Government Regulation

- 3.5.1. Building Codes and Safety Standards

- 3.5.2. Environmental and Energy-Efficiency Standards

- 3.5.3. Import and Export Regulations

- 3.5.4. Subsidies for Sustainable Materials

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. India Interior Doors Market Segmentation

4.1. By Door Type (In Value %)

- 4.1.1. Panel Doors

- 4.1.2. Flush Doors

- 4.1.3. Bifold Doors

- 4.1.4. Sliding Doors

- 4.1.5. French Doors

4.2. By Material Type (In Value %)

- 4.2.1. Wood

- 4.2.2. Glass

- 4.2.3. Metal

- 4.2.4. Fiberglass

- 4.2.5. PVC

4.3. By Application (In Value %)

- 4.3.1. Residential

- 4.3.2. Commercial

- 4.3.3. Hospitality

- 4.3.4. Healthcare

- 4.3.5. Retail

4.4. By Distribution Channel (In Value %)

- 4.4.1. Direct Sales

- 4.4.2. Retail Stores

- 4.4.3. Online Sales

- 4.4.4. Specialty Stores

- 4.4.5. Wholesalers

4.5. By Region (In Value %)

- 4.5.1. North India

- 4.5.2. South India

- 4.5.3. East India

- 4.5.4. West India

- 4.5.5. Central India

5. India Interior Doors Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

- 5.1.1. Godrej & Boyce Mfg. Co. Ltd.

- 5.1.2. DORMA India Pvt Ltd.

- 5.1.3. Century Plyboards (India) Ltd.

- 5.1.4. Fenesta Building Systems

- 5.1.5. Beautex Industries Pvt Ltd.

- 5.1.6. Duroplast India Pvt Ltd.

- 5.1.7. Dorset Industries Pvt. Ltd.

- 5.1.8. Vidhyut Ply & Pack Pvt Ltd.

- 5.1.9. Hormann India Pvt Ltd.

- 5.1.10. Shakti Hormann Pvt Ltd.

- 5.1.11. Vijay Wood Industries

- 5.1.12. Jain Doors & Ply Pvt Ltd.

- 5.1.13. Kalpataru Ltd.

- 5.1.14. Ventura International Pvt Ltd.

- 5.1.15. Saint-Gobain India Pvt Ltd.

5.2. Cross Comparison Parameters

- Market Presence

- Product Portfolio Diversity

- Revenue

- Manufacturing Capacity

- Distribution Network

- Strategic Partnerships

- Customer Base

- Innovation in Door Materials

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Interior Doors Market Regulatory Framework

6.1. Safety Standards Compliance

6.2. Material Certification Processes

6.3. Environmental Standards

6.4. Manufacturing and Quality Compliance

7. India Interior Doors Future Market Size (In USD Billion)

7.1. Market Size Projections

7.2. Key Growth Factors

8. India Interior Doors Future Market Segmentation

8.1. By Door Type (In Value %)

8.2. By Material Type (In Value %)

8.3. By Application (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. India Interior Doors Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping the ecosystem of Indias interior doors market by analyzing stakeholders such as manufacturers, distributors, and end-users. Extensive desk research, using both proprietary databases and secondary sources, was conducted to outline market dynamics.

Step 2: Market Analysis and Construction

Historical data was compiled, evaluating metrics such as market penetration, consumer preferences, and product availability across regions. Quality analysis was included to validate revenue estimates and ensure data reliability.

Step 3: Hypothesis Validation and Expert Consultation

The research hypotheses were confirmed through interviews with industry experts from leading companies. Insights on operational practices, revenue generation, and consumer demand were collected to enhance data accuracy.

Step 4: Research Synthesis and Final Output

The final phase synthesized data from multiple sources, including consumer behavior studies and market trends. Direct insights from manufacturers refined the analysis, providing a comprehensive view of the India Interior Doors market.

Frequently Asked Questions

01. How big is the India Interior Doors Market?

The India Interior Doors Market was valued at USD 7 billion, primarily driven by urbanization, growth in residential real estate, and a demand for energy-efficient designs.

02. What are the challenges in the India Interior Doors Market?

India Interior Doors Market Challenges include high competition among local manufacturers, regulatory requirements for materials, and fluctuating raw material costs, which impact overall profitability.

03. Who are the major players in the India Interior Doors Market?

India Interior Doors Market Key players include Godrej & Boyce, Fenesta Building Systems, and Century Plyboards, which lead the market due to strong distribution networks, diverse portfolios, and quality standards.

04. What are the growth drivers of the India Interior Doors Market?

India Interior Doors Market Key growth drivers include a rising demand for aesthetically pleasing and durable doors, increasing construction activities, and consumer preferences for sustainable materials.

05. Which regions dominate the India Interior Doors Market?

India Interior Doors Market Major cities such as Delhi, Mumbai, and Bangalore dominate the market due to high disposable incomes, extensive construction activities, and a preference for premium interior dcor solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.