India Intravenous Solutions Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD10361

December 2024

94

About the Report

India Intravenous Solutions Market Overview

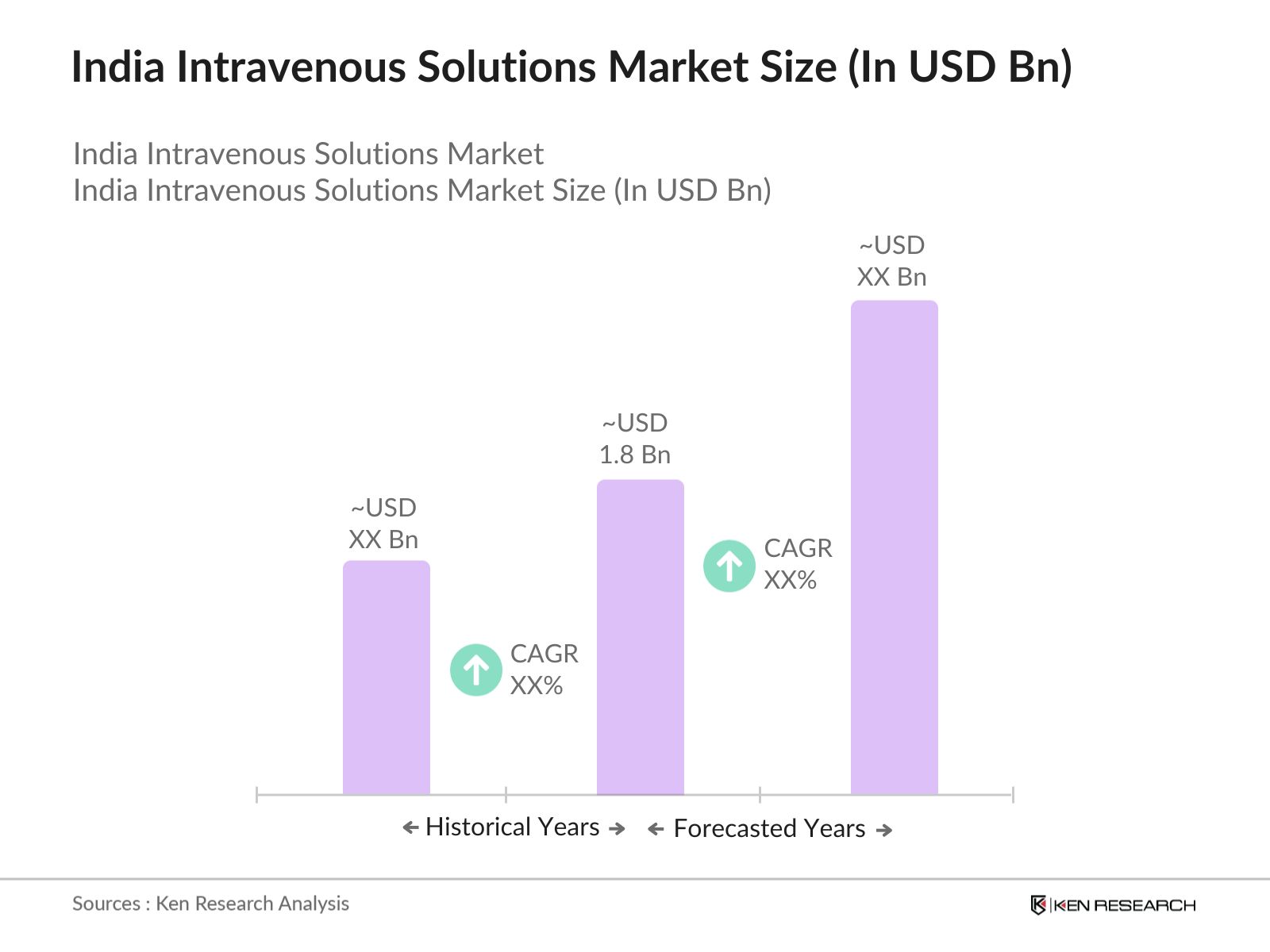

- The India Intravenous (IV) Solutions market is valued at USD 1.8 billion, based on a five-year historical analysis. This substantial market size is primarily driven by the increasing prevalence of chronic diseases, rising geriatric population, and advancements in healthcare infrastructure. The demand for IV solutions has escalated due to their critical role in patient care, particularly in managing dehydration, electrolyte imbalances, and delivering essential nutrients.

- Major metropolitan areas such as Mumbai, Delhi, and Bangalore dominate the market. These cities have a high concentration of healthcare facilities, advanced medical infrastructure, and a large patient base requiring intravenous therapies. The presence of leading hospitals and specialized clinics in these urban centers contributes significantly to the market's dominance in these regions.

- The National Pharmaceutical Pricing Authority (NPPA) regulates the pricing of essential drugs, including IV solutions, to ensure affordability. Recent adjustments to price ceilings on essential IV solutions aim to make them accessible to a broader population, with prices regulated across public hospitals in 2024. This measure ensures the cost of IV solutions remains manageable for public healthcare facilities.

India Intravenous Solutions Market Segmentation

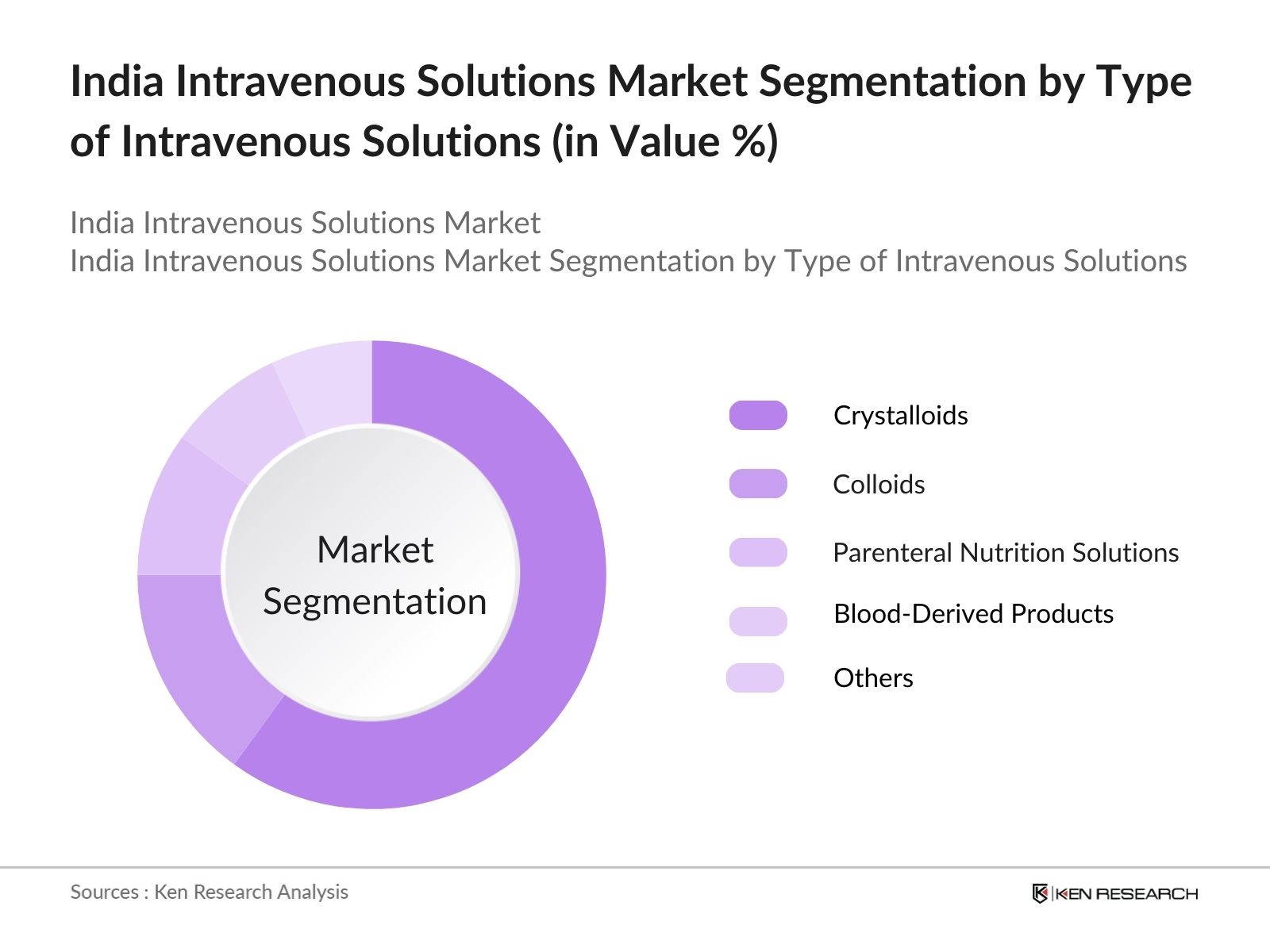

- By Type of Intravenous Solutions: The market is segmented by type into Crystalloids, Colloids, Parenteral Nutrition Solutions, Blood-Derived Products, and Others. Crystalloids hold a dominant market share due to their widespread use in fluid replacement therapy. Their cost-effectiveness, ease of availability, and suitability for treating dehydration and electrolyte imbalances make them the preferred choice in medical settings.

- By Application: The market is further segmented by application into Fluid Replacement Therapy, Electrolyte Imbalance Correction, Blood Transfusion, Parenteral Nutrition, Chemotherapy, and Rehydration. Fluid Replacement Therapy leads the market share, driven by its critical role in managing patients with dehydration, blood loss, and shock. The high incidence of conditions requiring fluid resuscitation contributes to the dominance of this segment.

India Intravenous Solutions Market Competitive Landscape

The India Intravenous Solutions market is characterized by the presence of several key players who contribute significantly to the market dynamics. These companies have established strong footholds through extensive product portfolios, strategic partnerships, and continuous innovation.

India Intravenous Solutions Market Analysis

Market Growth Drivers

- Rising Prevalence of Chronic Diseases: The prevalence of chronic diseases in India has been steadily increasing, with over 60 million people diagnosed with diabetes and around 50 million affected by cardiovascular diseases as of 2024. This surge is largely attributed to lifestyle changes, with chronic diseases now accounting for nearly 60% of all deaths in India (World Health Organization). The rise in non-communicable diseases has resulted in higher hospital admission rates and an increased demand for intravenous (IV) solutions, as these are essential for managing patient hydration and administering medication in controlled doses.

- Increasing Geriatric Population: India's elderly population (aged 60 and above) has reached over 140 million in 2024, representing a significant 10% of the total population. This age group is prone to illnesses that often require hospital stays and complex medication regimens, thus driving the demand for intravenous solutions. Increased life expectancy, now at 70 years, coupled with government focus on elder care, has bolstered the healthcare needs of the geriatric population. These demographic changes are crucial to the IV solutions market, as senior patients commonly require fluid and medication infusions for managing various age-related conditions.

- Advancements in Healthcare Infrastructure: India's healthcare infrastructure has seen substantial growth, with the number of government-funded healthcare facilities expanding to over 33,000 in 2024, providing enhanced accessibility to IV solutions. Major investments have enabled hospitals to adopt advanced medical technologies, and the bed-to-population ratio has reached 1.4 per 1,000 people. Such improvements are essential for efficient and widespread availability of IV solutions, which are indispensable in clinical treatments. Government funding in healthcare infrastructure has further amplified this demand by enabling the setting up of new medical facilities in both urban and rural areas.

Market Challenges

- High Cost of Intravenous Solutions: The cost of IV solutions, often influenced by raw material prices, remains a hurdle for hospitals and consumers. For example, the increased price of raw materials like dextrose and saline solutions has driven costs up by nearly 10% in 2024, as per the Indian Drug Manufacturers Association. This rise can strain healthcare budgets, especially in rural areas, impacting the affordability and accessibility of essential IV treatments, especially among lower-income populations.

- Stringent Regulatory Requirements: Regulations around the manufacturing and distribution of IV solutions in India are rigorous, with stringent protocols on sterility, packaging, and labelling enforced by the Central Drugs Standard Control Organization (CDSCO). Compliance with these standards, while crucial for patient safety, often necessitates costly manufacturing practices. Small-scale manufacturers struggle with these expenses, which may impact market entry and competition. For instance, in 2024, the CDSCO recorded a 15% increase in quality inspection requirements, emphasizing strict adherence to manufacturing protocols.

India Intravenous Solutions Market Future Outlook

Over the next five years, the India Intravenous Solutions market is expected to show growth driven by continuous government support, advancements in healthcare infrastructure, and increasing prevalence of chronic diseases. The rising demand for quality healthcare services, coupled with technological innovations in IV solutions, is anticipated to propel market expansion. Additionally, the focus on home healthcare and personalized medicine is likely to create new opportunities for market players.

Market Opportunities

- Expansion into Untapped Markets: Untapped markets in Tier-2 and Tier-3 cities present a significant growth opportunity for IV solutions. In 2024, the government reported an increase in healthcare spending in smaller cities, aiming to improve medical infrastructure and healthcare services accessibility. As a result, healthcare providers in these regions are enhancing their facilities to cater to the rising demand for IV solutions, driven by an expanding urban population and increased prevalence of chronic illnesses.

- Strategic Collaborations and Partnerships: Collaborations between domestic and international pharmaceutical firms are fostering the development and distribution of IV solutions in India. Such partnerships bring technological expertise and funding, making IV solutions more accessible across the country. For example, as of 2024, several Indian pharmaceutical companies have partnered with foreign firms to develop more efficient and accessible IV solutions, increasing product availability and supporting market growth.

Scope of the Report

|

Segment |

Sub-Segment |

|

By Type of Intravenous Solutions |

Crystalloids Colloids Parenteral Nutrition Solutions Blood-Derived Products Others |

|

By Application |

Fluid Replacement Therapy Electrolyte Imbalance Correction Blood Transfusion Parenteral Nutrition Chemotherapy Rehydration |

|

By End-User |

Hospitals Clinics Ambulatory Surgical Centres Home Healthcare Settings |

|

By Nutrient Composition |

Carbohydrates Salts and Electrolytes Minerals Vitamins Amino Acids |

|

By Region |

North West and Central South East |

Products

Key Target Audience

Hospitals and Healthcare Providers

Pharmaceutical Manufacturers

Medical Device Distributors

Government and Regulatory Bodies (e.g., Ministry of Health and Family Welfare)

Research and Development Organizations

Home Healthcare Service Providers

Investor and Venture Capitalist Firms

Healthcare Training Institutes

Companies

Players Mentioned in the Report

Baxter International Inc.

B. Braun Melsungen AG

Fresenius SE & Co. KGaA

Piramal Enterprises Limited

Hospira (Pfizer Inc.)

Amsino International Inc.

ICU Medical, Inc.

Sami Labs Limited

Troikaa Pharmaceuticals Ltd.

Neiss Labs Pvt. Ltd.

Table of Contents

1. India Intravenous Solutions Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Intravenous Solutions Market Size (In INR Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Intravenous Solutions Market Analysis

3.1. Growth Drivers

3.1.1. Rising Prevalence of Chronic Diseases

3.1.2. Increasing Geriatric Population

3.1.3. Advancements in Healthcare Infrastructure

3.1.4. Government Healthcare Initiatives

3.2. Market Challenges

3.2.1. High Cost of Intravenous Solutions

3.2.2. Stringent Regulatory Requirements

3.2.3. Limited Access in Rural Areas

3.3. Opportunities

3.3.1. Technological Innovations in IV Solutions

3.3.2. Expansion into Untapped Markets

3.3.3. Strategic Collaborations and Partnerships

3.4. Trends

3.4.1. Shift Towards Home Healthcare

3.4.2. Development of Customized IV Solutions

3.4.3. Adoption of Eco-friendly Packaging

3.5. Government Regulations

3.5.1. Drug Price Control Orders

3.5.2. Quality Standards and Certifications

3.5.3. Import and Export Policies

3.5.4. Public-Private Partnerships in Healthcare

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. India Intravenous Solutions Market Segmentation

4.1. By Type of Intravenous Solutions (In Value %)

4.1.1. Crystalloids

4.1.2. Colloids

4.1.3. Parenteral Nutrition Solutions

4.1.4. Blood-Derived Products

4.1.5. Others

4.2. By Application (In Value %)

4.2.1. Fluid Replacement Therapy

4.2.2. Electrolyte Imbalance Correction

4.2.3. Blood Transfusion

4.2.4. Parenteral Nutrition

4.2.5. Chemotherapy

4.2.6. Rehydration

4.3. By End-User (In Value %)

4.3.1. Hospitals

4.3.2. Clinics

4.3.3. Ambulatory Surgical Centres

4.3.4. Home Healthcare Settings

4.4. By Nutrient Composition (In Value %)

4.4.1. Carbohydrates

4.4.2. Salts and Electrolytes

4.4.3. Minerals

4.4.4. Vitamins

4.4.5. Amino Acids

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. West and Central India

4.5.3. South India

4.5.4. East India

5. India Intravenous Solutions Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Baxter International Inc.

5.1.2. B. Braun Melsungen AG

5.1.3. Fresenius SE & Co. KGaA

5.1.4. Piramal Enterprises Limited

5.1.5. Hospira (Pfizer Inc.)

5.1.6. Amsino International Inc.

5.1.7. ICU Medical, Inc.

5.1.8. Sami Labs Limited

5.1.9. Troikaa Pharmaceuticals Ltd.

5.1.10. Neiss Labs Pvt. Ltd.

5.1.11. Ketan Pharma

5.1.12. Abaris Healthcare Pvt. Ltd.

5.1.13. Parenteral Drugs (India) Ltd.

5.1.14. Arbro Pharmaceuticals Limited

5.1.15. Neon Laboratories Ltd.

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Market Share, R&D Investment, Distribution Network)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

6. India Intravenous Solutions Market Regulatory Framework

6.1. Drug Price Control Orders

6.2. Quality Standards and Certifications

6.3. Import and Export Policies

7. India Intravenous Solutions Future Market Size (In INR Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Intravenous Solutions Future Market Segmentation

8.1. By Type of Intravenous Solutions (In Value %)

8.2. By Application (In Value %)

8.3. By End-User (In Value %)

8.4. By Nutrient Composition (In Value %)

8.5. By Region (In Value %)

9. India Intravenous Solutions Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Intravenous Solutions Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the India Intravenous Solutions Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple intravenous solution manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the India Intravenous Solutions market.

Frequently Asked Questions

01. How big is the India Intravenous Solutions Market?

The India Intravenous Solutions market is valued at USD 1.8 billion, driven by the increasing prevalence of chronic diseases and rising demand for effective fluid replacement therapies in hospitals and home healthcare settings.

02. What are the primary growth drivers in the India Intravenous Solutions Market?

The market growth is propelled by factors such as the growing geriatric population, advancements in healthcare infrastructure, and the critical role of IV solutions in treating dehydration and electrolyte imbalances, among other medical needs.

03. Who are the major players in the India Intravenous Solutions Market?

Key players include Baxter International Inc., B. Braun Melsungen AG, Fresenius SE & Co. KGaA, Piramal Enterprises Limited, and Hospira (Pfizer Inc.), among others. Their strong product portfolios and strategic partnerships contribute to their market dominance.

04. What are the main challenges in the India Intravenous Solutions Market?

Challenges include stringent regulatory requirements, high costs of advanced IV solutions, and limited access in rural areas, which affect the penetration and accessibility of these solutions across various regions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.