India Lead Acid Battery Market Outlook to 2030

Region:Asia

Author(s):Samanyu

Product Code:KROD3844

November 2024

93

About the Report

India Lead Acid Battery Market Overview

- The India Lead Acid Battery market is valued at USD 4.5 Bn, based on a five-year historical analysis. The primary driver behind this growth is the extensive adoption of lead acid batteries in the automotive industry, especially for vehicles like two-wheelers and commercial vehicles. Additionally, the telecom sector's expansion, with increased demand for uninterrupted power supply systems, has contributed to the market's upward trend. Furthermore, India's push for renewable energy and energy storage solutions continues to fuel this growth.

- Dominant cities and regions in India, such as Maharashtra, Tamil Nadu, and Gujarat, hold significant sway in the lead acid battery market. These regions dominate due to their well-established automotive manufacturing industries, robust industrial growth, and advanced infrastructure for energy storage solutions. In addition, states like Tamil Nadu and Gujarat, with their strong industrial bases and renewable energy projects, demand high storage capacity, further supporting their dominance in this sector.

- Maintenance-free lead-acid batteries are gaining traction in industrial applications, including UPS systems, telecom infrastructure, and renewable energy storage. The adoption of sealed maintenance-free batteries, particularly in data centers and critical infrastructure, increased by 15% in 2023. These batteries eliminate the need for regular electrolyte maintenance, making them an attractive option for industries requiring reliable, low-maintenance energy storage solutions.

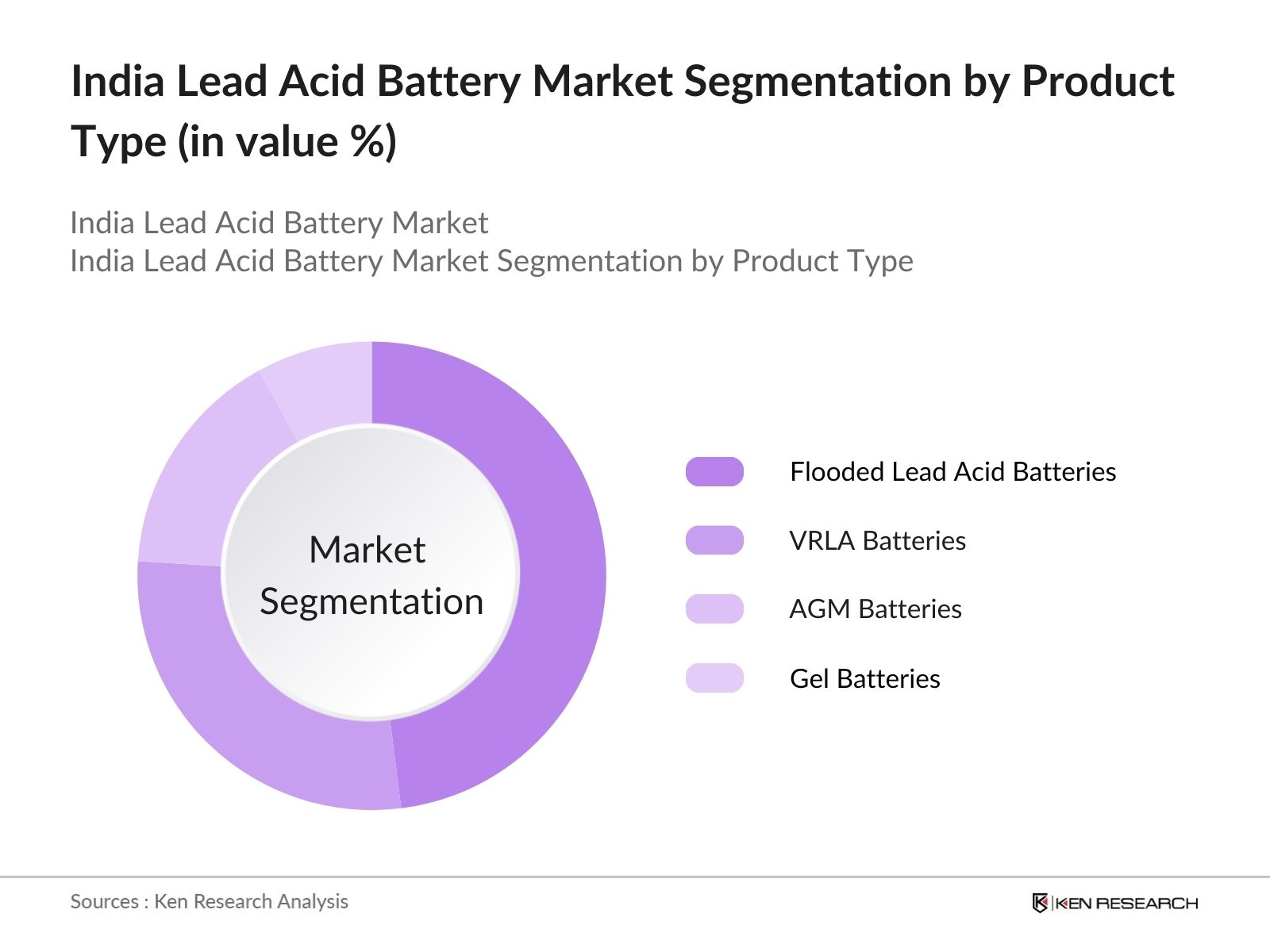

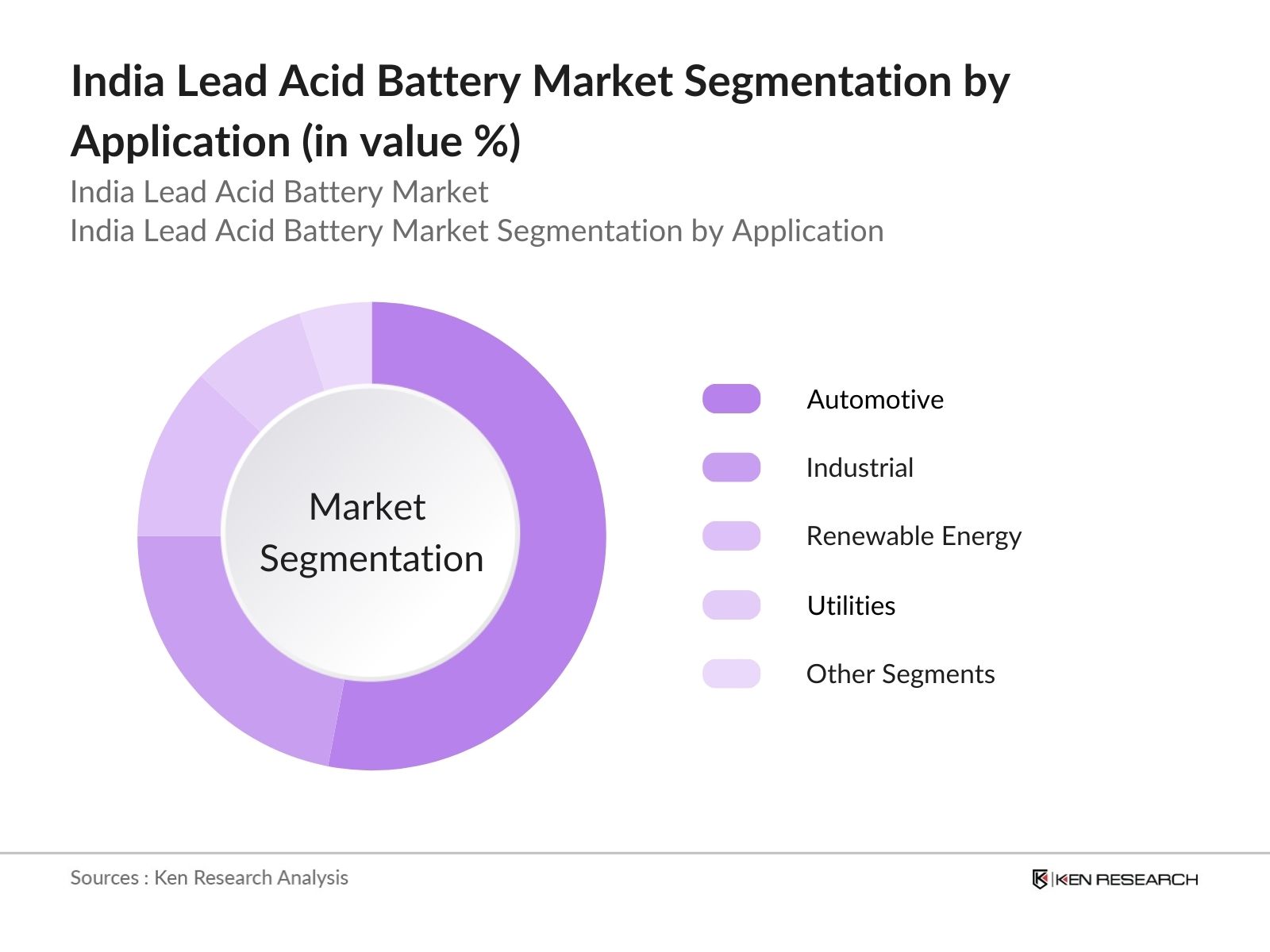

India Lead Acid Battery Market Segmentation

By Product Type: The market is segmented by product type into Flooded Lead Acid Batteries, VRLA (Valve Regulated Lead Acid) Batteries, AGM (Absorbed Glass Mat) Batteries, and Gel Batteries. Among these, Flooded Lead Acid Batteries maintain a dominant market share due to their long-established presence in the market and their continued application in automotive sectors. Despite the emergence of newer technologies, these batteries are preferred for their reliability, cost-effectiveness, and widespread availability, particularly in commercial vehicle and backup power supply systems.

By Application: The market is segmented by application into Automotive, Industrial, Renewable Energy, Utilities, and Other Segments (including E-rickshaws, Marine, Railways). The Automotive segment dominates the market due to the extensive use of lead acid batteries in two-wheelers, passenger vehicles, and commercial vehicles. With the rise in the automotive sector, especially in developing rural areas and the demand for electric vehicles (EVs) like e-rickshaws, the market continues to witness substantial demand for lead acid batteries.

India Lead Acid Battery Market Competitive Landscape

The India lead acid battery market is dominated by key local and international players, such as Exide Industries Ltd., Amara Raja Batteries Ltd., and Luminous Power Technologies Pvt. Ltd. These companies have established their dominance through extensive distribution networks, a strong focus on research and development, and competitive pricing strategies. Additionally, partnerships with automakers and industrial companies give them an edge in catering to growing market demands for backup energy solutions and electric mobility. International players focus on bringing advanced battery technologies to enhance efficiency and extend battery life.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Employees |

Key Product |

Production Capacity |

Key Clients |

Global Presence |

|

Exide Industries Ltd. |

1947 |

Kolkata, India |

||||||

|

Amara Raja Batteries Ltd. |

1985 |

Tirupati, India |

||||||

|

Luminous Power Technologies Pvt. Ltd. |

1988 |

New Delhi, India |

||||||

|

HBL Power Systems Ltd. |

1977 |

Hyderabad, India |

||||||

|

Su-Kam Power Systems Ltd. |

1998 |

Gurugram, India |

India Lead Acid Battery Industry Analysis

Growth Drivers

- Increasing Automotive Demand: The Indian automotive industry is experiencing a robust surge, with over 18 million two-wheelers sold in 2023, according to the Society of Indian Automobile Manufacturers (SIAM). The rapid adoption of electric vehicles (EVs), particularly in the two-wheeler segment, has led to increased demand for lead acid batteries as a cost-effective energy storage solution. India's EV market, projected to have a fleet of over 3 million electric two-wheelers by the end of 2024, highlights a strong need for conventional lead-acid batteries due to their affordability and compatibility with existing automotive infrastructure. Moreover, urbanization trends have increased personal vehicle ownership, further driving the demand for batteries in the automotive sector.

- Industrial Expansion: India's industrial growth is strongly linked to the expansion of sectors such as telecom, energy storage, and data centers. India had over 1.1 billion mobile connections in 2023, necessitating continuous energy supply for telecom towers, where lead acid batteries play a key role. Furthermore, the increase in renewable energy installations, which stood at 125 GW in 2022, requires energy storage solutions, driving lead acid battery demand. The Indian data center market, expected to grow substantially with an increase in IT infrastructure investments, also contributes to the demand for reliable backup energy storage systems provided by lead-acid batteries.

- Government Support for Renewable Energy: The Indian government has been heavily promoting renewable energy adoption, setting a target of achieving 500 GW of installed renewable energy capacity by 2030. In line with this, initiatives such as the Production-Linked Incentive (PLI) scheme for battery manufacturing are driving investments in energy storage solutions, particularly for solar and wind energy projects. Lead-acid batteries are currently being adopted for small-scale renewable energy storage projects due to their cost-effectiveness. As per data from the Ministry of New and Renewable Energy (MNRE), more than 30% of India's off-grid solar installations employ lead acid batteries for energy storage.

Market Challenges

- Competition from Lithium-ion Batteries: The rising popularity of lithium-ion batteries is impacting the lead acid battery market. By 2023, the Indian government had approved large-scale manufacturing facilities for lithium-ion batteries under the PLI scheme. Lithium-ion technology offers superior energy density, longer life cycles, and faster charging, leading to increased adoption in sectors like EVs and energy storage. As a result, lead-acid batteries face challenges in retaining market share, particularly in high-performance applications like electric vehicles and large-scale energy storage systems.

- Price Volatility in Raw Materials: The prices of raw materials, especially lead and sulfuric acid, have seen fluctuations due to supply chain disruptions and global geopolitical tensions. According to the World Banks Commodities Price Data, the average price of lead surged to $2,100 per ton in 2023, impacting the profitability of battery manufacturers. The volatility in raw material prices directly affects production costs, making it difficult for manufacturers to maintain competitive pricing in the market. This creates challenges for smaller players to compete against larger manufacturers with better economies of scale.

India Lead Acid Battery Market Future Outlook

Over the next five years, the India lead acid battery market is expected to grow substantially, driven by factors such as the expansion of renewable energy infrastructure, increasing penetration of electric vehicles (especially in the two-wheeler and e-rickshaw segments), and the growth of telecom infrastructure requiring reliable backup power. Furthermore, government incentives aimed at promoting renewable energy sources and the demand for cost-effective energy storage solutions will continue to support the markets upward trajectory. Continuous technological advancements, especially in battery efficiency and sustainability, will also enhance growth prospects.

Future Market Opportunities

- Demand from Renewable Energy Storage: The Indian renewable energy sector, with over 40 GW of solar installations by 2023, presents a significant opportunity for lead-acid battery adoption. While lithium-ion batteries are increasingly favored for large-scale projects, lead-acid batteries remain the preferred choice for smaller, cost-sensitive energy storage systems in rural solar installations. The Ministry of Power reports that over 60% of the off-grid solar energy storage in rural areas continues to rely on lead-acid batteries due to their affordability and established supply chains, offering substantial growth opportunities in the decentralized renewable energy sector.

- Emerging Markets for E-Rickshaws and Two-Wheelers: The rising popularity of electric rickshaws (e-rickshaws) and electric two-wheelers, especially in urban and semi-urban areas, presents a lucrative opportunity for the lead-acid battery market. In 2023, over 1.5 million e-rickshaws were operating across India, largely relying on lead-acid batteries due to their low upfront costs and widespread availability. According to the Ministry of Road Transport and Highways, the electric two-wheeler market continues to expand, with lead-acid batteries accounting for a significant share of the total battery market in this segment due to their compatibility with the low-cost vehicle options favored in the market.

Scope of the Report

|

By Product Type |

Flooded Lead Acid Batteries VRLA Batteries AGM Batteries Gel Batteries |

|

By Application |

Automotive Industrial Renewable Energy Utilities Other Segments |

|

By Technology |

Standard Lead Acid Batteries Enhanced Flooded Batteries (EFB) Absorbent Glass Mat (AGM) Gel Lead Acid Technology |

|

By Capacity |

Less than 50Ah 50Ah to 100Ah 100Ah to 200Ah Above 200Ah |

|

By Region |

North South West East |

Products

Key Target Audience

Automotive Manufacturers

Industrial Manufacturers

Renewable Energy Companies

Utilities and Power Grid Operators

Battery Manufacturers and Suppliers

Investments and Venture Capitalist Firms

Banks and Financial Institutes

Government and Regulatory Bodies (Ministry of Power, Bureau of Energy Efficiency)

Telecom Service Providers

Companies

Major Players

Exide Industries Ltd.

Amara Raja Batteries Ltd.

Luminous Power Technologies Pvt. Ltd.

HBL Power Systems Ltd.

Su-Kam Power Systems Ltd.

Base Corporation Ltd.

Okaya Power Pvt. Ltd.

Southern Batteries Pvt. Ltd.

True Power International Ltd.

Livguard Energy Technologies Pvt. Ltd.

Chloride Power Systems & Solutions Ltd.

TAFE Motors and Tractors Limited

HOPPECKE Batteries India Pvt. Ltd.

Eastman Auto & Power Ltd.

Rocket Batteries India Pvt. Ltd.

Table of Contents

1. India Lead Acid Battery Market Overview

1.1. Definition and Scope (Battery Chemistry, Application Types, Power Output Range)

1.2. Market Taxonomy (Automotive, Industrial, UPS, Renewable Energy)

1.3. Market Growth Rate (CAGR, Capacity Growth, Market Share Increase by Sector)

1.4. Market Segmentation Overview (Market Segmentation by Product Type, Application, Technology, Capacity, Region)

2. India Lead Acid Battery Market Size (In USD Bn and Million Units)

2.1. Historical Market Size (In Value & Volume)

2.2. Year-On-Year Growth Analysis (Y-o-Y Growth, Units Shipped, Revenue Trends)

2.3. Key Market Developments and Milestones (Technological Developments, Government Policy Shifts, Major Acquisitions)

3. India Lead Acid Battery Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Automotive Demand (EV Growth, Two-wheeler Penetration)

3.1.2. Industrial Expansion (Energy Storage, Telecom, Data Centers)

3.1.3. Government Support for Renewable Energy (Battery Storage Adoption, Policy Incentives)

3.1.4. Robust Growth in Telecom Infrastructure (5G Rollout, Rural Penetration)

3.2. Restraints

3.2.1. Environmental Regulations (Lead Pollution, Disposal Challenges)

3.2.2. Competition from Lithium-ion Batteries (Market Disruption, Performance Advantages)

3.2.3. Price Volatility in Raw Materials (Lead, Sulfuric Acid)

3.3. Opportunities

3.3.1. Demand from Renewable Energy Storage (Solar, Wind Energy)

3.3.2. Adoption of Smart Grids (Battery Storage for Grid Stabilization)

3.3.3. Emerging Markets for E-Rickshaws and Two-Wheelers

3.4. Trends

3.4.1. Adoption of Enhanced Flooded Batteries (EFB) in Automotive Sector

3.4.2. Rise of Maintenance-Free Batteries in Industrial Applications

3.4.3. Shift Towards Micro-Hybrid Vehicles (Start-Stop Functionality)

3.5. Government Regulations

3.5.1. Extended Producer Responsibility (EPR) Policies

3.5.2. Import Tariffs on Lead Acid Batteries

3.5.3. Energy Storage Mandates for Renewable Projects

3.5.4. Battery Waste Management and Recycling Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. India Lead Acid Battery Market Segmentation

4.1. By Product Type (In Value and Volume %)

4.1.1. Flooded Lead Acid Batteries

4.1.2. VRLA (Valve Regulated Lead Acid) Batteries

4.1.3. AGM (Absorbed Glass Mat) Batteries

4.1.4. Gel Batteries

4.2. By Application (In Value and Volume %)

4.2.1. Automotive (Passenger Cars, Commercial Vehicles, Two-Wheelers)

4.2.2. Industrial (Energy Storage, Telecom, UPS, Infrastructure)

4.2.3. Renewable Energy (Solar Power, Wind Power Storage)

4.2.4. Utilities (Power Grid Backup, Smart Grid Solutions)

4.2.5. Other Segments (E-rickshaws, Marine, Railways)

4.3. By Technology (In Value and Volume %)

4.3.1. Standard Lead Acid Batteries

4.3.2. Enhanced Flooded Batteries (EFB)

4.3.3. Absorbent Glass Mat (AGM) Technology

4.3.4. Gel Lead Acid Technology

4.4. By Capacity (In Value and Volume %)

4.4.1. Less than 50Ah

4.4.2. 50Ah to 100Ah

4.4.3. 100Ah to 200Ah

4.4.4. Above 200Ah

4.5. By Region (In Value and Volume %)

4.5.1. North

4.5.2. South

4.5.3. West

4.5.4. East

5. India Lead Acid Battery Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Exide Industries Ltd.

5.1.2. Amara Raja Batteries Ltd.

5.1.3. Luminous Power Technologies Pvt. Ltd.

5.1.4. HBL Power Systems Ltd.

5.1.5. Base Corporation Ltd.

5.1.6. Okaya Power Pvt. Ltd.

5.1.7. Su-Kam Power Systems Ltd.

5.1.8. Southern Batteries Pvt. Ltd.

5.1.9. True Power International Ltd.

5.1.10. Livguard Energy Technologies Pvt. Ltd.

5.1.11. Chloride Power Systems & Solutions Ltd.

5.1.12. TAFE Motors and Tractors Limited

5.1.13. HOPPECKE Batteries India Pvt. Ltd.

5.1.14. Eastman Auto & Power Ltd.

5.1.15. Rocket Batteries India Pvt. Ltd.

5.2. Cross Comparison Parameters (Production Capacity, Global Footprint, Technology Focus, Sustainability Initiatives, Revenue)

5.3. Market Share Analysis (Major Players by Volume and Value)

5.4. Strategic Initiatives (Partnerships, New Launches, Regional Expansion)

5.5. Mergers And Acquisitions

5.6. Investment Analysis (Infrastructure Investments, Factory Expansion)

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Lead Acid Battery Market Regulatory Framework

6.1. Environmental Standards (Recycling Mandates, Hazardous Waste Management)

6.2. Compliance Requirements (Certification Standards, ISO Regulations)

6.3. Certification Processes (Product Certification, Quality Testing Protocols)

7. India Lead Acid Battery Future Market Size (In USD Bn and Million Units)

7.1. Future Market Size Projections (Revenue Forecast, Volume Forecast)

7.2. Key Factors Driving Future Market Growth (Technological Advancements, Policy Support, Emerging Applications)

8. India Lead Acid Battery Future Market Segmentation

8.1. By Product Type (In Value and Volume %)

8.2. By Application (In Value and Volume %)

8.3. By Technology (In Value and Volume %)

8.4. By Capacity (In Value and Volume %)

8.5. By Region (In Value and Volume %)

9. India Lead Acid Battery Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis (Total Addressable Market, Serviceable Addressable Market, Serviceable Obtainable Market)

9.2. Customer Cohort Analysis (Demographic Focus, Usage Patterns)

9.3. Marketing Initiatives (Brand Positioning, Awareness Campaigns)

9.4. White Space Opportunity Analysis (Untapped Markets, New Application Segments)

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first stage involved mapping key stakeholders within the India lead acid battery market. Comprehensive desk research was conducted utilizing secondary and proprietary databases to gather industry-level information. The objective was to identify critical variables such as production capacity, demand drivers, and market trends.

Step 2: Market Analysis and Construction

In this phase, we collected and analyzed historical data regarding battery production, consumption trends, and application penetration within the Indian market. This included an evaluation of lead acid battery adoption across automotive, industrial, and renewable energy segments.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed based on the data collected and were validated through interviews with industry experts, including key players from battery manufacturers and energy storage firms. This step ensured the accuracy of market estimates.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing all data to generate a comprehensive report. This step included direct engagement with manufacturers to validate key findings, which were incorporated to ensure accurate market representation.

Frequently Asked Questions

01. How big is the India Lead Acid Battery Market?

The India lead acid battery market is valued at USD 4.5 Bn, driven by the expansion of the automotive, industrial, and renewable energy sectors. Demand for reliable backup power solutions and energy storage is also a key driver.

02. What are the challenges in the India Lead Acid Battery Market?

Challenges in India lead acid battery market include environmental regulations regarding lead pollution, competition from lithium-ion batteries, and price volatility of raw materials such as lead. These factors pose significant barriers to market growth.

03. Who are the major players in the India Lead Acid Battery Market?

Key players in India lead acid battery market include Exide Industries Ltd., Amara Raja Batteries Ltd., Luminous Power Technologies Pvt. Ltd., HBL Power Systems Ltd., and Su-Kam Power Systems Ltd. These companies dominate due to their strong distribution networks and advanced product offerings.

04. What are the growth drivers of the India Lead Acid Battery Market?

Growth drivers in India lead acid battery market include increasing demand from the automotive sector, the expansion of telecom infrastructure, and the push for renewable energy solutions. Government incentives for renewable energy storage are also fueling demand.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.