India Lecithin Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD4586

November 2024

85

About the Report

India Lecithin Market Overview

- The India lecithin market is valued at USD 192 million, driven by its increasing demand across multiple industries such as food and beverages, pharmaceuticals, and cosmetics. The primary factor contributing to this market's expansion is the rising health consciousness among consumers, who seek natural emulsifiers over synthetic alternatives. Lecithin's multifunctional properties, including emulsifying, stabilizing, and lubricating, make it a preferred ingredient, especially in bakery products, dairy, and confectionery sectors.

- The dominant players in the Indian lecithin market include cities like Mumbai and Gujarat, where the presence of large food processing industries, coupled with access to abundant raw materials, strengthens their position in the market. Additionally, states like Maharashtra and Gujarat house major pharmaceutical manufacturers, driving the high demand for lecithin in drug delivery systems. This regional dominance is further bolstered by robust infrastructure and access to export markets.

- The FSSAI plays a critical role in regulating lecithin in India, particularly concerning food safety and quality standards. In 2024, the FSSAI enforced stricter guidelines regarding the inclusion of emulsifiers like lecithin in processed foods, affecting manufacturers' compliance costs and production timelines. These regulations aim to ensure consumer safety and product quality in Indias growing processed food sector.

India Lecithin Market Segmentation

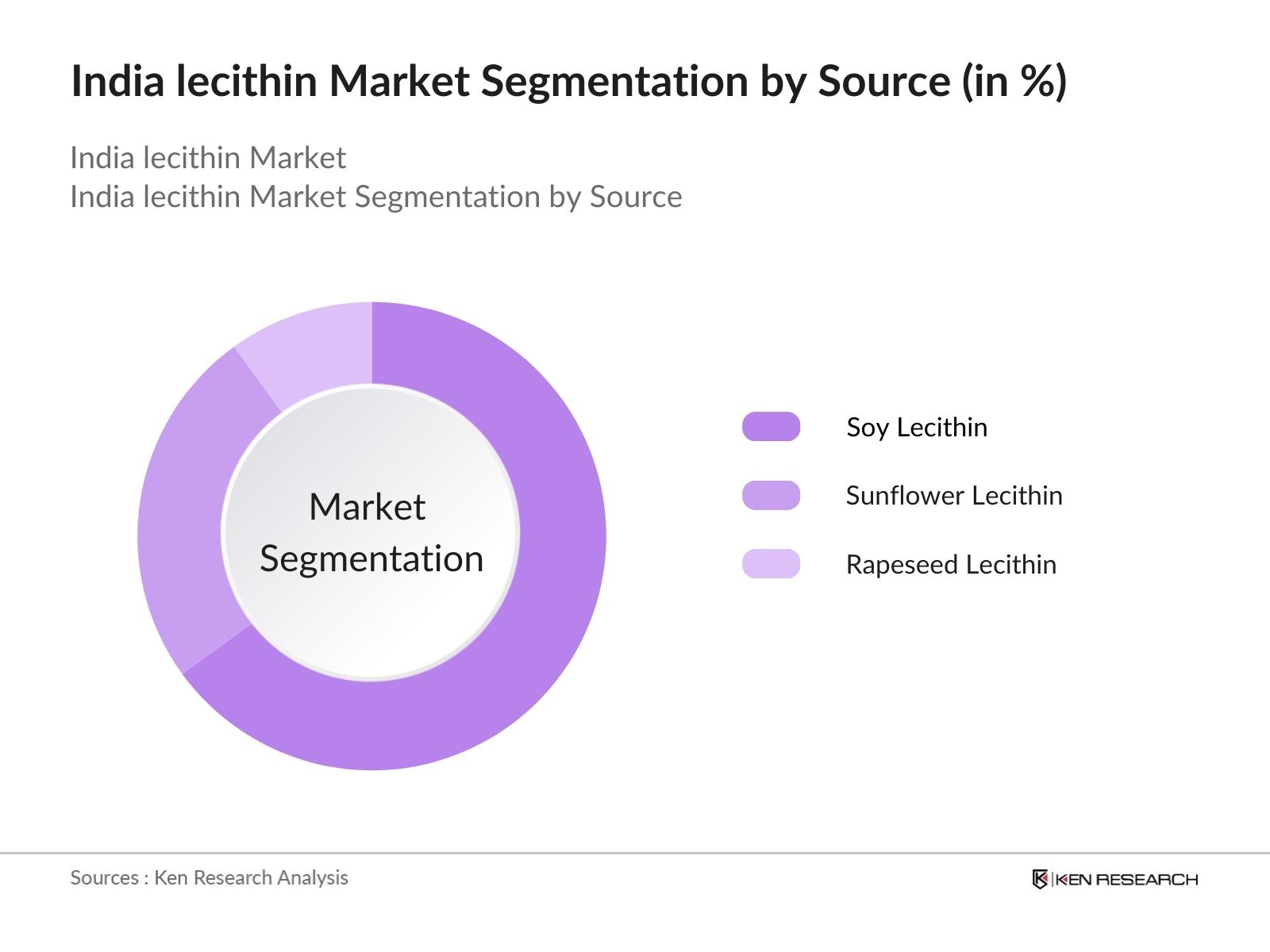

- By Source: The market is segmented by source into soy lecithin, sunflower lecithin, and rapeseed lecithin. Soy lecithin continues to dominate the market due to its widespread availability and cost-effectiveness, making it the preferred choice across industries. The ample supply of soybeans in India supports stable production, ensuring a continuous flow to meet the high demand in food and pharmaceutical sectors. Sunflower lecithin is gaining traction as a non-GMO alternative, particularly in health-conscious segments.

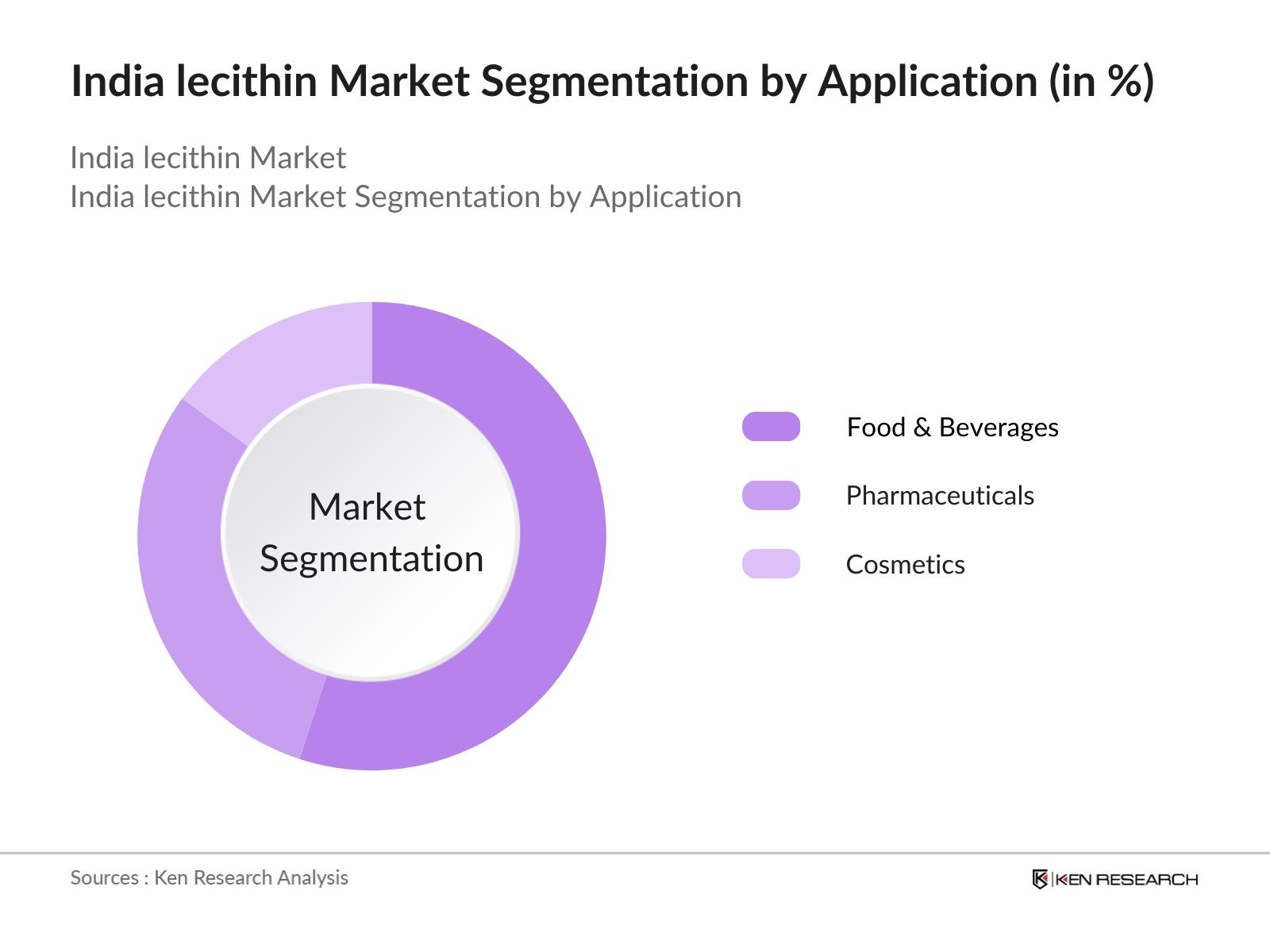

- By Application: The market is further segmented by application into food and beverages, pharmaceuticals, and cosmetics. Food and beverages represent the largest application sector, primarily driven by the bakery and confectionery segments where lecithin is widely used as an emulsifier and stabilizer. Its application in pharmaceuticals is also significant due to its role in drug delivery and as an excipient, boosting its usage in this sector.

India Lecithin Market Competitive Landscape

The Indian lecithin market is dominated by both domestic and international players, showcasing intense competition. This competition is driven by product diversification, technological advancements, and the ability to provide customized lecithin solutions to various industries.

|

Company |

Established |

Headquarters |

Product Portfolio |

R&D Investments |

Market Presence |

|

Cargill, Inc. |

1865 |

Minneapolis, USA |

|||

|

ADM (Archer Daniels Midland) |

1902 |

Illinois, USA |

|||

|

Sonic Biochem Extractions Ltd. |

1999 |

Indore, India |

|||

|

VAV Life Sciences Pvt. Ltd. |

2001 |

Mumbai, India |

|||

|

Wilmar International Ltd. |

1991 |

Singapore |

India Lecithin Industry Analysis

Growth Drivers

- Increasing Health Consciousness (Consumers preference for natural emulsifiers): The growing health consciousness among consumers in India is driving demand for natural emulsifiers like lecithin in 2024. Consumers are increasingly opting for products that avoid synthetic additives, and lecithin fits into this preference due to its natural origin from soybeans, sunflower, and other plants. In 2024, the Indian processed food sector, including the bakery and confectionery segments, has seen a rise in demand for natural emulsifiers. The Food and Agriculture Organization (FAO) estimates that India's food consumption per capita will rise by 2% annually, signaling growing consumer focus on health.

- Expansion of Processed Food Sector (Lecithin usage in confectioneries, bakery products): The processed food sector in India continues to expand rapidly, with the lecithin market benefiting significantly. The demand for lecithin in bakery products and confectioneries is projected to see substantial growth. In 2024, India's processed food industry is valued at USD 340 billion, according to FAO data. The expansion of this sector provides ample opportunities for lecithin usage as an emulsifier in food items such as chocolates, bakery products, and margarine.

- Rising Pharmaceutical Industry Demand (Lecithin as a natural emulsifier and excipient): Lecithin's use in the pharmaceutical industry, where it serves as a natural emulsifier and excipient, is another significant growth driver. As per Indias Ministry of Health and Family Welfare, the country's pharmaceutical market is expected to grow by 8.5% in 2024, driven by demand for natural additives like lecithin in drug formulation. Lecithin enhances the bioavailability of active pharmaceutical ingredients, making it essential in drug delivery systems.

Market Challenges

- Fluctuating Soybean Prices (Primary source of lecithin): Soybean is the primary source of lecithin in India, and its volatile prices pose a challenge to market stability. In 2024, global soybean production disruptions have led to price fluctuations, with Indian soybean prices ranging from INR 4,200 to INR 5,100 per quintal, according to the Department of Agriculture & Farmers Welfare. These price variations impact the lecithin industry, increasing production costs and squeezing margins.

- Regulatory Restrictions (Stringent food safety and labeling regulations): India's stringent food safety and labeling regulations, particularly those imposed by the Food Safety and Standards Authority of India (FSSAI), present challenges for the lecithin market. The FSSAI requires compliance with various food safety standards and labeling requirements, such as declarations for non-GMO lecithin. In 2024, FSSAI implemented stricter guidelines for organic certifications, which impacted lecithin suppliers and increased the cost of compliance.

India Lecithin Market Future Outlook

Over the next five years, the Indian lecithin market is expected to experience robust growth, primarily driven by the rising consumer demand for non-GMO and organic lecithin. Increased application in health-conscious food products, pharmaceuticals, and cosmetics will also fuel market expansion. Technological advancements in lecithin extraction and production techniques, alongside a growing trend toward sustainability, are likely to propel the market further.

Future Market Opportunities

- Growing Demand for Non-GMO Lecithin (Organic and health-conscious consumers): The demand for non-GMO lecithin has risen significantly in India due to growing consumer preference for organic products. In 2024, the Indian organic food market is valued at USD 1.36 billion, reflecting increased interest in non-GMO products like lecithin. This shift presents a substantial opportunity for lecithin manufacturers to capture a growing health-conscious demographic.

- Expanding Applications in Nutraceuticals (Functional foods and dietary supplements): Lecithin's expanding applications in the nutraceutical sector offer another major growth opportunity. The global demand for nutraceuticals is reflected in India's market, which reached USD 8.5 billion in 2024, as per data from the Ministry of Commerce and Industry. Lecithin is increasingly used in functional foods and dietary supplements for its health benefits, including improving cognitive functions and cholesterol management.

Scope of the Report

|

By Source |

Soy Lecithin Sunflower Lecithin Rapeseed Lecithin |

|

By Form |

Liquid Powder |

|

By Application |

Food & Beverages Pharmaceuticals Cosmetics |

|

By Functionality |

Emulsifier Dispersing Agent Wetting Agent |

|

By Region |

North East West South |

Products

Key Target Audience

Food & Beverage Manufacturers

Pharmaceutical Companies

Cosmetic Manufacturers

Banks and Financial Institutes

Nutraceutical Manufacturers

Industrial Lecithin Buyers

Government and Regulatory Bodies (FSSAI)

Investments and Venture Capitalist Firms

Raw Material Suppliers (Soybean and Sunflower Processors)

Companies

Major Players in the India Lecithin Market

Cargill, Inc.

ADM

Sonic Biochem Extractions Ltd.

VAV Life Sciences Pvt. Ltd.

Wilmar International Ltd.

Lecico GmbH

Bunge Limited

Sun Nutrafoods

Lipoid GmbH

Sternchemie GmbH & Co. KG

Ruchi Soya Industries Limited

Fismer Lecithin GmbH

Lasenor Emul, S.L.

AAK AB

AGD (Aceitera General Deheza)

Table of Contents

1. India Lecithin Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Lecithin Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Lecithin Market Analysis

3.1. Growth Drivers (Growing demand in food & beverage, pharmaceutical, and cosmetics industries)

3.1.1. Increasing Health Consciousness (Consumers preference for natural emulsifiers)

3.1.2. Expansion of Processed Food Sector (Lecithin usage in confectioneries, bakery products)

3.1.3. Rising Pharmaceutical Industry Demand (Lecithin as a natural emulsifier and excipient)

3.2. Market Challenges (Volatile raw material prices and supply chain issues)

3.2.1. Fluctuating Soybean Prices (Primary source of lecithin)

3.2.2. Regulatory Restrictions (Stringent food safety and labeling regulations)

3.2.3. Availability of Substitutes (Emerging competition from synthetic emulsifiers)

3.3. Opportunities (Innovations and diversification in lecithin products)

3.3.1. Growing Demand for Non-GMO Lecithin (Organic and health-conscious consumers)

3.3.2. Expanding Applications in Nutraceuticals (Functional foods and dietary supplements)

3.3.3. Export Opportunities (Rising demand in global markets)

3.4. Trends (Technological advancements and market shifts)

3.4.1. Adoption of Sunflower Lecithin (Alternative to soy-based lecithin)

3.4.2. Clean Labeling Initiatives (Impact on lecithin production and marketing)

3.4.3. Increasing Focus on Sustainability (Eco-friendly production processes)

3.5. Government Regulations (Impact of policies on the lecithin market)

3.5.1. Food Safety and Standards Authority of India (FSSAI) Regulations

3.5.2. Labeling Requirements (Non-GMO and organic certifications)

3.5.3. Import and Export Duties (Impact on raw material sourcing and product pricing)

3.6. SWOT Analysis

3.7. Value Chain Analysis (Suppliers, manufacturers, distributors)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. India Lecithin Market Segmentation

4.1. By Source (In Value %)

4.1.1. Soy Lecithin

4.1.2. Sunflower Lecithin

4.1.3. Rapeseed Lecithin

4.2. By Form (In Value %)

4.2.1. Liquid

4.2.2. Powder

4.3. By Application (In Value %)

4.3.1. Food & Beverages (Bakery, Confectionery, Dairy Products)

4.3.2. Pharmaceuticals (Drug delivery systems, Emulsifiers)

4.3.3. Cosmetics (Skincare, Haircare)

4.4. By Functionality (In Value %)

4.4.1. Emulsifier

4.4.2. Dispersing Agent

4.4.3. Wetting Agent

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

5. India Lecithin Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Cargill, Inc.

5.1.2. ADM

5.1.3. Soya International

5.1.4. VAV Life Sciences Pvt. Ltd.

5.1.5. Sonic Biochem Extractions Ltd.

5.1.6. Lecico GmbH

5.1.7. Bunge Limited

5.1.8. Sun Nutrafoods

5.1.9. Lipoid GmbH

5.1.10. Sternchemie GmbH & Co. KG

5.1.11. Ruchi Soya Industries Limited

5.1.12. Wilmar International Ltd.

5.1.13. Lasenor Emul, S.L.

5.1.14. Fismer Lecithin GmbH

5.1.15. Avanti Polar Lipids, Inc.

5.2. Cross Comparison Parameters (Revenue, Product Portfolio, Production Capacity, Geographic Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants

5.8. Venture Capital Funding

5.9. Private Equity Investments

6. India Lecithin Market Regulatory Framework

6.1. FSSAI Guidelines

6.2. Certification Requirements (Non-GMO, Organic Lecithin)

6.3. Trade Policies (Import/Export Regulations)

7. India Lecithin Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Lecithin Future Market Segmentation

8.1. By Source (In Value %)

8.2. By Form (In Value %)

8.3. By Application (In Value %)

8.4. By Functionality (In Value %)

8.5. By Region (In Value %)

9. India Lecithin Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research process begins by mapping out the entire India lecithin market ecosystem, identifying critical stakeholders and their roles. Extensive desk research and data collection are used to establish a comprehensive understanding of market dynamics and key variables, such as production volumes, import-export trends, and raw material supply chains.

Step 2: Market Analysis and Construction

Historical data on lecithin production, consumption, and application in different industries is analyzed. Revenue generation for various segments and service providers is assessed, and key performance indicators like production capacity, demand fluctuations, and consumer preferences are considered.

Step 3: Hypothesis Validation and Expert Consultation

Interviews with key market participants, including manufacturers, suppliers, and industry experts, validate initial hypotheses. These consultations provide insights into market shifts, emerging trends, and future growth potential, ensuring data reliability and accuracy.

Step 4: Research Synthesis and Final Output

Finally, data is synthesized to provide a complete market picture. Comprehensive interaction with lecithin producers helps refine market forecasts, and detailed assessments of segmentation trends, product performance, and geographic influences are included in the final report.

Frequently Asked Questions

01. How big is the India Lecithin Market?

The India lecithin market is valued at USD 192 million, with substantial growth driven by its widespread applications in the food and beverage, pharmaceutical, and cosmetic sectors.

02. What are the challenges in the India Lecithin Market?

Challenges include fluctuating raw material prices, regulatory hurdles regarding food safety and labeling, and the availability of synthetic emulsifiers as substitutes.

03. Who are the major players in the India Lecithin Market?

Key players include Cargill, Inc., ADM, Sonic Biochem Extractions Ltd., VAV Life Sciences Pvt. Ltd., and Wilmar International Ltd., with a strong presence in the food processing and pharmaceutical sectors.

04. What are the growth drivers of the India Lecithin Market?

Growth drivers include the rising consumer demand for natural emulsifiers, the expanding processed food industry, and increasing applications in drug delivery systems within the pharmaceutical sector.

05. Which segment dominates the India Lecithin Market?

The soy lecithin segment dominates the market due to its cost-effectiveness and high demand across various industries, including food and pharmaceuticals.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.