India LED Lighting Market Outlook to 2030

Region:Asia

Author(s):Shubham

Product Code:KROD2646

October 2024

88

About the Report

India LED Lighting Market Overview

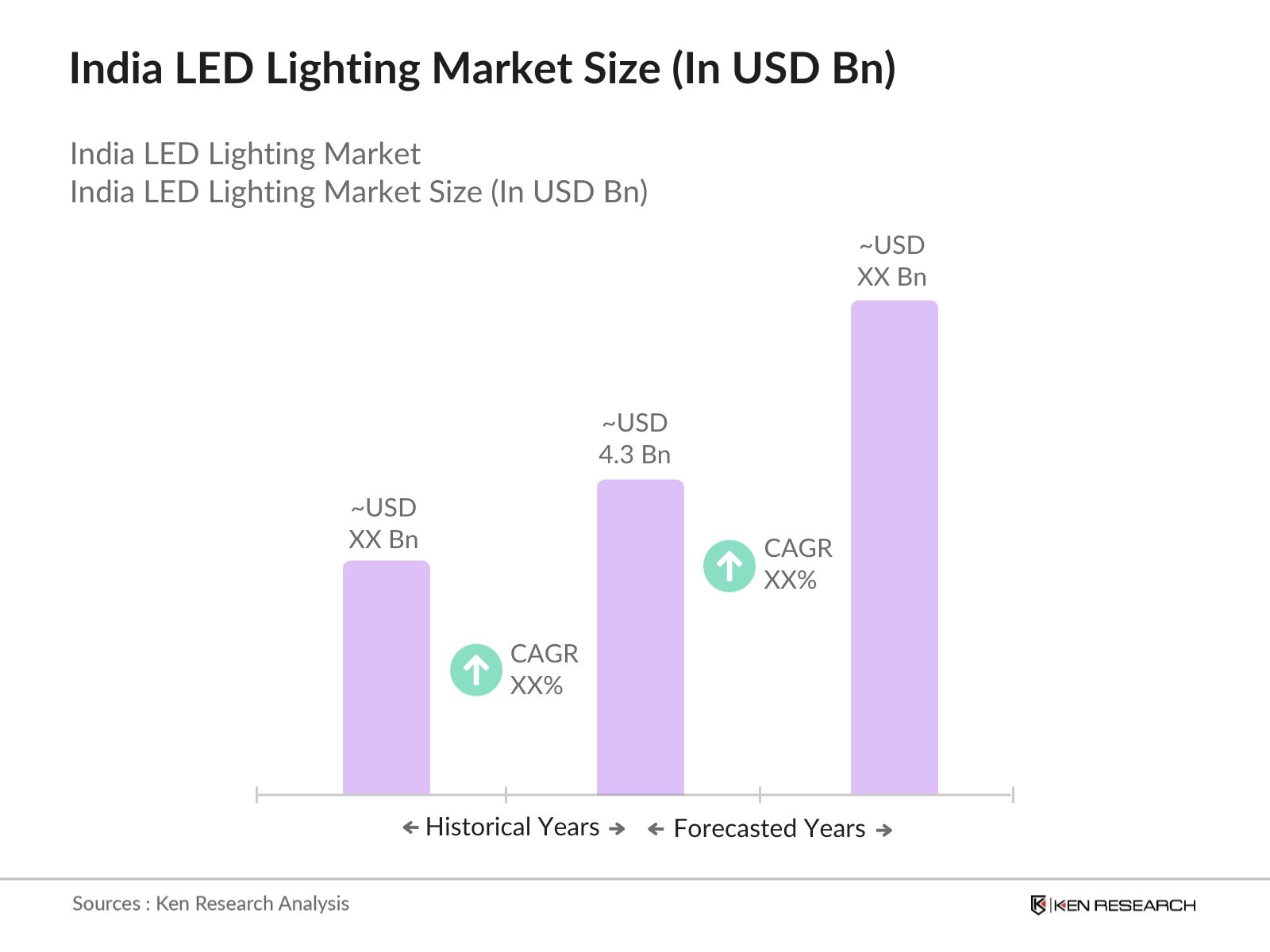

- The India LED Lighting market is valued at USD 4.3 billion based on a five-year historical analysis. This market growth is primarily driven by the increasing adoption of energy-efficient lighting solutions, government initiatives to promote sustainable energy, and rising consumer awareness of energy conservation. LED lighting has become the preferred choice for both commercial and residential use due to its longer lifespan, lower energy consumption, and declining prices.

- The market concentration is notably high in metropolitan cities such as Mumbai, Delhi, and Bengaluru, which are witnessing rapid urbanization and infrastructural development. These regions have advanced infrastructures, high consumer demand, and growing awareness of eco-friendly alternatives, fostering market expansion. The rural areas are also seeing an uptick in demand, thanks to government programs like the UJALA scheme that promote the distribution of affordable LED bulbs.

- The Indian government has played a pivotal role in shaping the LED lighting market through policies such as the National Lighting Program and incentives for the manufacturing of energy-efficient products. In 2023, the Bureau of Energy Efficiency (BEE) introduced new standards for LED products, ensuring better energy performance and quality. These regulatory frameworks have pushed manufacturers to comply with strict energy efficiency standards, fostering a competitive market.

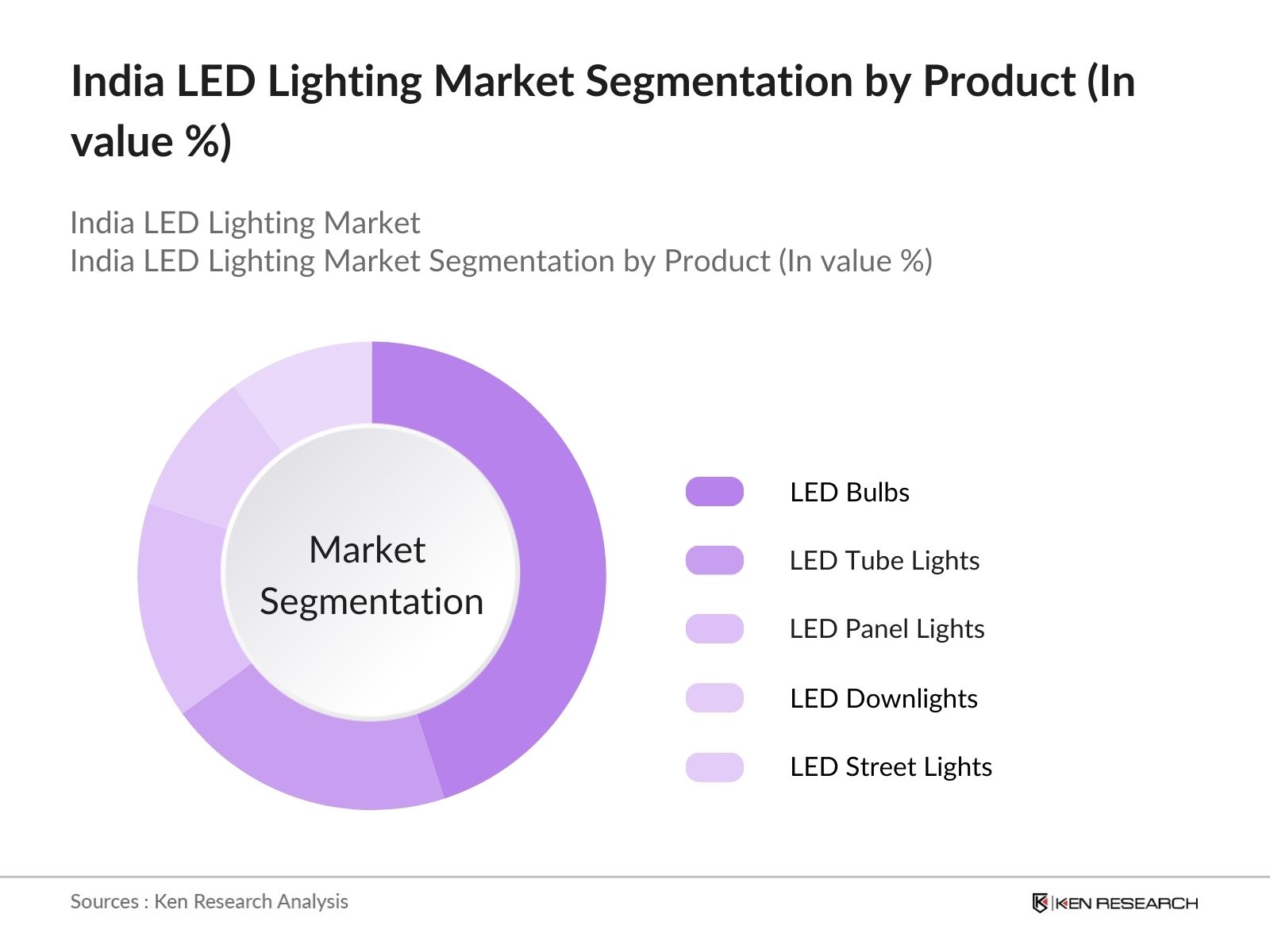

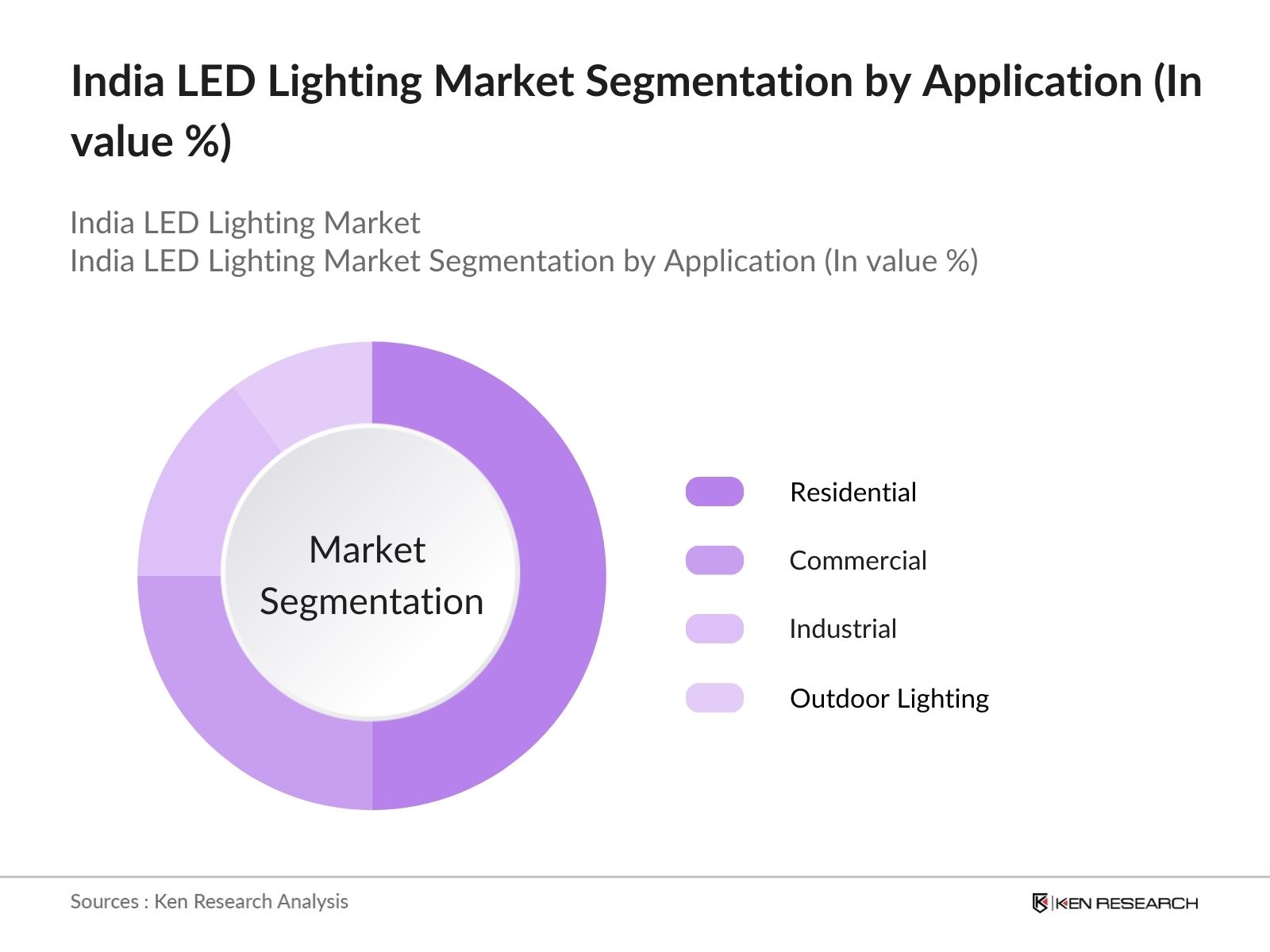

India LED Lighting Market Segmentation

- By Product: The market is segmented by product type into LED bulbs, LED tube lights, LED panel lights, LED streetlight, and LED downlights. LED bulbs dominate the market share due to their widespread use in both residential and commercial applications, largely driven by government distribution schemes like UJALA. LED tube lights are gaining traction in industrial and educational institutions, while LED panel lights and downlights are preferred for commercial office spaces due to their aesthetic appeal and energy efficiency.

- By Application: The market is segmented by application into residential, commercial, industrial, and outdoor lighting. The residential segment holds the largest market share, driven by increased adoption of LED bulbs in urban and rural households. The commercial segment is witnessing robust growth due to the rising construction of modern office spaces and retail outlets. Outdoor lighting, which includes streetlights and public lighting systems, is also on the rise due to government-led smart city initiatives.

India LED Lighting Market Competitive Landscape

The market is competitive, with both domestic and international players striving to maintain a foothold through innovation, pricing strategies, and government contracts. Leading companies such as Philips Lighting, Bajaj Electricals, and Havells India are dominating the market through extensive product portfolios and strong distribution networks. Chinese players are also making inroads due to their competitive pricing, challenging local players.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Employees |

Key Product |

R&D Investment |

Key Clients |

Partnerships |

|

Philips Lighting |

1891 |

Netherlands |

||||||

|

Bajaj Electricals |

1938 |

India |

||||||

|

Havells India |

1958 |

India |

||||||

|

Syska LED |

1989 |

India |

||||||

|

Surya Roshni |

1973 |

India |

India LED Lighting Industry Analysis

Growth Drivers:

- Urbanization and Infrastructure Development (Smart Cities, Real Estate Growth): With the Indian government targeting 100 smart cities, urbanization is propelling the growth of the LED lighting market. By 2024, more than 60 cities have been partially transformed under the Smart Cities Mission, requiring efficient lighting solutions. LED street lights can reduce energy consumption by 50-80% compared to traditional high-pressure sodium (HPS) or metal halide street lights. The growth of real estate also supports LED demand, with 4.74 lakh units sold in primary markets across major cities like Delhi-NCR, Mumbai, and Bengaluru, increasing the adoption of LED lighting in residential projects.

- Energy Efficiency Awareness (Rising Consumer Preference for LED over CFL): Consumer preference has sharply shifted toward LED lighting, driven by energy efficiency awareness campaigns led by the government and environmental bodies. In 2024, the Bureau of Energy Efficiency (BEE) recorded a substantial decline in compact fluorescent lamp (CFL) sales. LED products, by comparison, now comprise over 80% of Indias lighting market, often lasting up to 25,000 hours or more, which further supports their growing popularity as a preferred lighting solution. Initiatives such as the "Energy Conservation Building Code" are driving this shift, supporting LEDs for sustainability-focused constructions.

- Technological Advancements (Integration of IoT, Smart Lighting Solutions): India's LED market is experiencing a surge in technological advancements with the integration of Internet of Things (IoT) and smart lighting solutions. The Indian Ministry of Electronics and Information Technology estimates that millions IoT-enabled LED lights have been installed across various sectors by 2024. This growth is accelerated by smart city projects, which require intelligent lighting solutions for public spaces. As more cities adopt these technologies, smart lighting installations are expected to rise, with IoT applications improving energy management and reducing operational.

Market Challenges:

- High Initial Costs in Commercial and Industrial Projects: One of the significant challenges faced by the LED lighting industry is the high upfront cost associated with commercial and industrial LED projects. According to a 2024 report by the Ministry of Power, large-scale LED lighting systems for commercial and industrial use can be more expensive than traditional lighting solutions. While operational cost savings through energy efficiency are a long-term benefit, this initial expense is a deterrent for small and medium enterprises (SMEs) with limited capital investment.

- Limited Rural Penetration (Awareness and Affordability Gaps): Despite urban success, LED adoption in rural India remains sluggish due to awareness and affordability gaps. As of 2024, the National Sample Survey Office (NSSO) reported that rural households use less LED lights, compared to in urban areas. The lack of targeted awareness programs and affordability issues are primary hurdles, especially in low-income rural regions. Government initiatives are beginning to address this gap, but further efforts are needed to achieve equitable LED penetration across all socio-economic strata.

India LED Lighting Market Future Outlook

The India LED Lighting market is expected to witness substantial growth over the next five years, driven by the governments focus on energy conservation, falling product prices, and expanding applications in commercial, industrial, and public infrastructure projects. The integration of smart technologies into lighting systems, such as IoT-based lighting controls, is expected to further enhance market opportunities, especially in urban areas.

Market Opportunities:

- Expansion in Rural Electrification (Increasing Rural Electrification Initiatives): Indias rural electrification drive is creating new opportunities for LED lighting. By 2024, the Ministry of Power reports that more than 99% of rural villages have access to electricity, with the government continuing to enhance power grid infrastructure in rural areas. This presents a strong market for affordable and energy-efficient LED lighting solutions in rural households, where there is growing demand for cost-effective, long-lasting lighting products.

- Smart City Development (Integration of Smart LED Solutions in Urban Areas): Indias push for smart city development presents a vast opportunity for LED manufacturers. As of 2024, more than USD 86.43 billion has been invested in the Smart Cities Mission, with LED lighting being a central component of urban infrastructure upgrades. The deployment of smart lighting solutions in streetlights, public spaces, and transportation systems is accelerating. Opportunities exist for LED companies to collaborate with government bodies to provide smart, IoT-enabled solutions that reduce energy consumption and improve the operational efficiency of city infrastructure.

Scope of the Report

|

Product Type |

LED Bulbs LED Tube Lights LED Panel Lights LED Downlights LED Street Lights |

|

Application |

Residential Commercial Industrial Outdoor Lighting |

|

Distribution Channel |

Retail Stores Online Platforms Direct Sales (Government Contracts, B2B Sales) |

|

End-User |

Households Commercial Spaces Industrial Public Infrastructure |

|

Region |

North South East West |

Products

Key Target Audience

LED Product Manufacturers

Industrial Lighting Contractors

Energy Efficiency Consultants

Government and Regulatory Bodies (Bureau of Energy Efficiency, Ministry of Power)

Real Estate Developers

Smart City Project Consultants

Banks and Financial Institutes

Public Infrastructure Authorities (National Highways Authority of India)

Investment and Venture Capitalist Firms

Companies

Major Players in India LED Lighting Market

-

Philips Lighting

Bajaj Electricals

Havells India

Syska LED

Surya Roshni

Wipro Lighting

Osram India

Crompton Greaves

Eveready Industries India Ltd

Orient Electric

GE Lighting

Panasonic Life Solutions India

Goldwyn Ltd

Moser Baer

LEDvance

Table of Contents

1. India LED Lighting Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Energy Efficiency, Consumer Adoption Rate, Declining Price Trends)

1.4. Market Segmentation Overview (Product, Application, Distribution, End-User, Region)

2. India LED Lighting Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis (Urbanization Rate, Residential Adoption Rate)

2.3. Key Market Developments and Milestones (Government Initiatives, Smart City Projects, Green Building Policies)

3. India LED Lighting Market Analysis

3.1. Growth Drivers

3.1.1. Government Policies and Initiatives (National Lighting Program, UJALA Scheme)

3.1.2. Urbanization and Infrastructure Development (Smart Cities, Real Estate Growth)

3.1.3. Energy Efficiency Awareness (Rising Consumer Preference for LED over CFL)

3.1.4. Technological Advancements (Integration of IoT, Smart Lighting Solutions)

3.2. Market Challenges

3.2.1. High Initial Costs in Commercial and Industrial Projects

3.2.2. Limited Rural Penetration (Awareness and Affordability Gaps)

3.2.3. Unorganized Market Structure (Presence of Low-Cost, Low-Quality Products)

3.3. Opportunities

3.3.1. Expansion in Rural Electrification (Increasing Rural Electrification Initiatives)

3.3.2. Smart City Development (Integration of Smart LED Solutions in Urban Areas)

3.3.3. Collaborations with International Manufacturers (Technology Transfer, Joint Ventures)

3.4. Trends

3.4.1. Shift Towards Smart Lighting Solutions (IoT-Based Lighting, Energy Management)

3.4.2. Increased LED Penetration in Outdoor Lighting (Government Focus on Energy-Efficient Street Lighting)

3.4.3. Consumer Demand for Sustainable and Eco-Friendly Products (Green Building Certification, LEED Projects)

3.5. Government Regulation

3.5.1. Energy Efficiency Standards (Bureau of Energy Efficiency, LED Quality Standards)

3.5.2. Tax Incentives for Energy Conservation Products (GST Reductions on LED Products)

3.5.3. Import Duty Structures (Impact on Foreign LED Imports)

3.5.4. Public-Private Partnerships (PPP) in Infrastructure Projects

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, Suppliers, Distributors, End-Users)

3.8. Porters Five Forces

3.9. Competitive Landscape (Market Share Distribution, Key Players Analysis)

4. India LED Lighting Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. LED Bulbs

4.1.2. LED Tube Lights

4.1.3. LED Panel Lights

4.1.4. LED Downlights

4.1.5. LED Street Lights

4.2. By Application (In Value %)

4.2.1. Residential

4.2.2. Commercial

4.2.3. Industrial

4.2.4. Outdoor Lighting

4.3. By Distribution Channel (In Value %)

4.3.1. Retail Stores

4.3.2. Online Platforms

4.3.3. Direct Sales (Government Contracts, B2B Sales)

4.4. By End-User (In Value %)

4.4.1. Households

4.4.2. Commercial Spaces (Offices, Malls)

4.4.3. Industrial

4.4.4. Public Infrastructure (Street Lighting, Smart Cities)

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

5. India LED Lighting Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Philips Lighting

5.1.2. Bajaj Electricals

5.1.3. Havells India

5.1.4. Syska LED

5.1.5. Surya Roshni

5.1.6. Wipro Lighting

5.1.7. Osram India

5.1.8. Crompton Greaves

5.1.9. Eveready Industries India Ltd

5.1.10. Orient Electric

5.1.11. Moser Baer

5.1.12. Goldwyn Ltd

5.1.13. GE Lighting

5.1.14. Panasonic Life Solutions India

5.1.15. Orient Electric

5.2 Cross Comparison Parameters (Revenue, Product Portfolio, R&D Investments, Market Share, Key Clients, Number of Employees, Technology Adoption, Geographical Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives (New Product Launches, R&D Collaborations)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India LED Lighting Market Regulatory Framework

6.1. Energy Efficiency Standards (Bureau of Energy Efficiency, BIS Standards)

6.2. Compliance Requirements (E-Waste Disposal, Recycling Norms)

6.3. Certification Processes (Energy Star Ratings, Environmental Certifications)

7. India LED Lighting Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Smart City Expansion, Technology Integration, Consumer Demand for Sustainability)

8. India LED Lighting Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. India LED Lighting Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In the first phase, an ecosystem map is constructed to encompass all major stakeholders within the India LED lighting market. Desk research is conducted using secondary and proprietary databases to gather comprehensive information on the market dynamics. Key variables such as energy efficiency metrics, consumer demand trends, and regulatory frameworks are identified.

Step 2: Market Analysis and Construction

In this step, historical data is compiled and analyzed to assess the penetration of LED lighting products across different sectors. This includes reviewing key segments such as residential, commercial, and industrial sectors, and evaluating their revenue contributions. A close analysis of energy savings statistics is performed to ensure accuracy in the market projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through computer-assisted telephone interviews (CATIs) with industry professionals. These interviews provide valuable insights on operational and financial aspects of the market, helping refine the data. Consultations with key players in the market provide firsthand industry knowledge.

Step 4: Research Synthesis and Final Output

In the final phase, detailed engagements with manufacturers and distributors are conducted to verify and complement the gathered data. This bottom-up approach ensures that the final analysis is comprehensive, accurate, and reflects the actual market scenario. The final report provides a complete overview of the India LED lighting market.

Frequently Asked Questions

01. How big is the India LED Lighting Market?

The India LED lighting market is valued at USD 4.3 billion, driven by government initiatives, urbanization, and the growing demand for energy-efficient lighting solutions.

02. What are the challenges in the India LED Lighting Market?

Challenges in the India LED lighting market include high initial costs for commercial projects, limited penetration in rural areas, and the presence of unorganized market structures that offer low-quality products.

03. Who are the major players in the India LED Lighting Market?

Key players in the India LED lighting market include Philips Lighting, Bajaj Electricals, Havells India, Syska LED, and Surya Roshni. These companies dominate due to strong brand presence, technological innovations, and government collaborations.

04. What are the growth drivers of the India LED Lighting Market?

The India LED lighting market is driven by increasing urbanization, government energy efficiency programs, declining product prices, and rising consumer awareness of the benefits of energy-efficient lighting.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.