India Lens Market Outlook to 2030

Region:Asia

Author(s):Rebecca Mary Reji

Product Code:KRO014

June 2025

90

About the Report

India Lens Market Overview

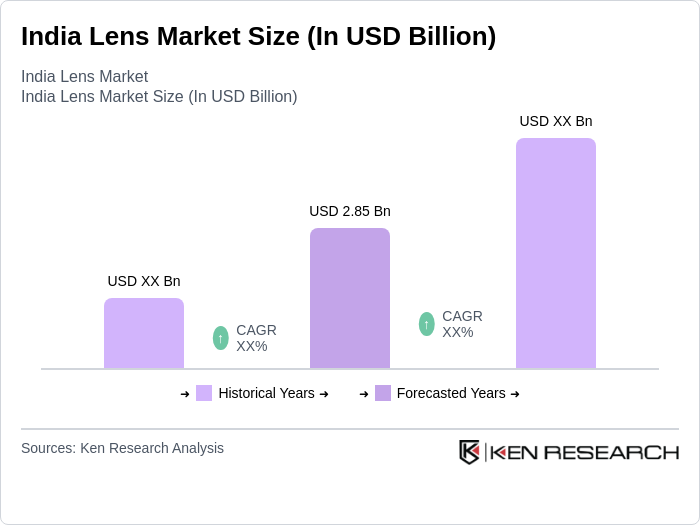

- The India Lens Market was valued at USD 2.85 billion in 2024, driven by robust growth in the construction and urbanization sectors, increasing consumer demand for decorative and protective coatings, and rising awareness of eye health. The market’s expansion is fueled by advancements in lens technology, growing disposable incomes, and changing lifestyles, with a significant shift towards high-quality vision correction solutions and eco-friendly products.

- Key cities dominating the India lens market include Mumbai, Delhi, and Bangalore. These urban centers feature high population density, a growing middle class, and a strong presence of optical retailers and healthcare facilities. The concentration of consumers with higher purchasing power, along with advanced optical services and increasing awareness of eye health, further strengthens their market dominance and drives demand for vision correction solutions.

- In 2024, the Indian government enhanced its National Health Policy by expanding eye care initiatives under Ayushman Bharat, focusing on increasing awareness, promoting regular eye screenings, and improving access to vision correction services. These efforts, including large-scale screening and cataract programs, are driving demand for lenses and eyewear products nationwide, supporting better eye health and accessibility.

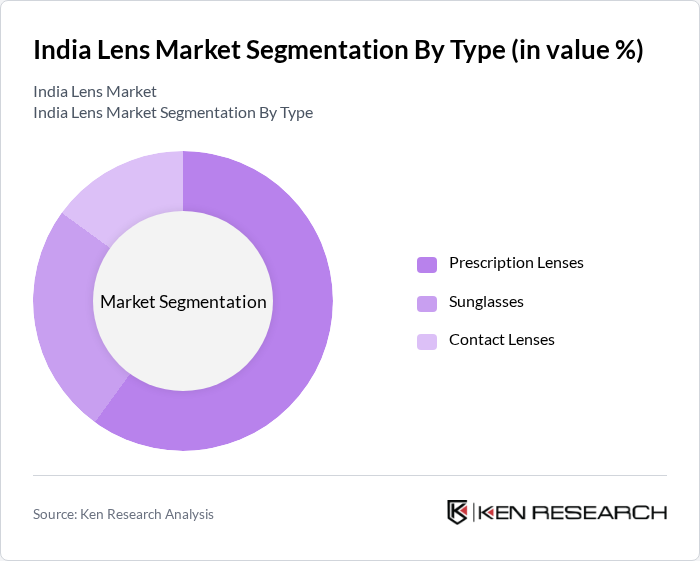

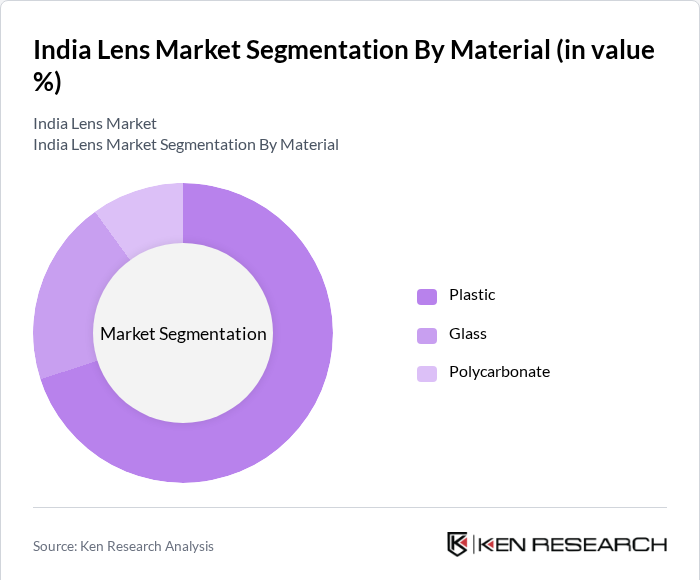

India Lens Market Segmentation

By Type: The lens market can be segmented into prescription lenses, sunglasses, and contact lenses. Among these, prescription lenses dominate the market due to the increasing prevalence of vision-related issues such as myopia and hyperopia. The growing trend of personalized eyewear, along with advancements in lens technology, has led to a surge in demand for high-quality prescription lenses. Consumers are increasingly opting for lenses that offer enhanced comfort and visual clarity, further solidifying the dominance of this sub-segment.

By Material: The lens market is segmented into plastic, glass, and polycarbonate materials. Plastic lenses are the most popular choice among consumers due to their lightweight nature and impact resistance. The increasing preference for durable and versatile eyewear has led to a significant rise in the adoption of plastic lenses. Additionally, advancements in lens coatings and treatments have further enhanced the appeal of plastic lenses, making them the preferred option for a majority of consumers.

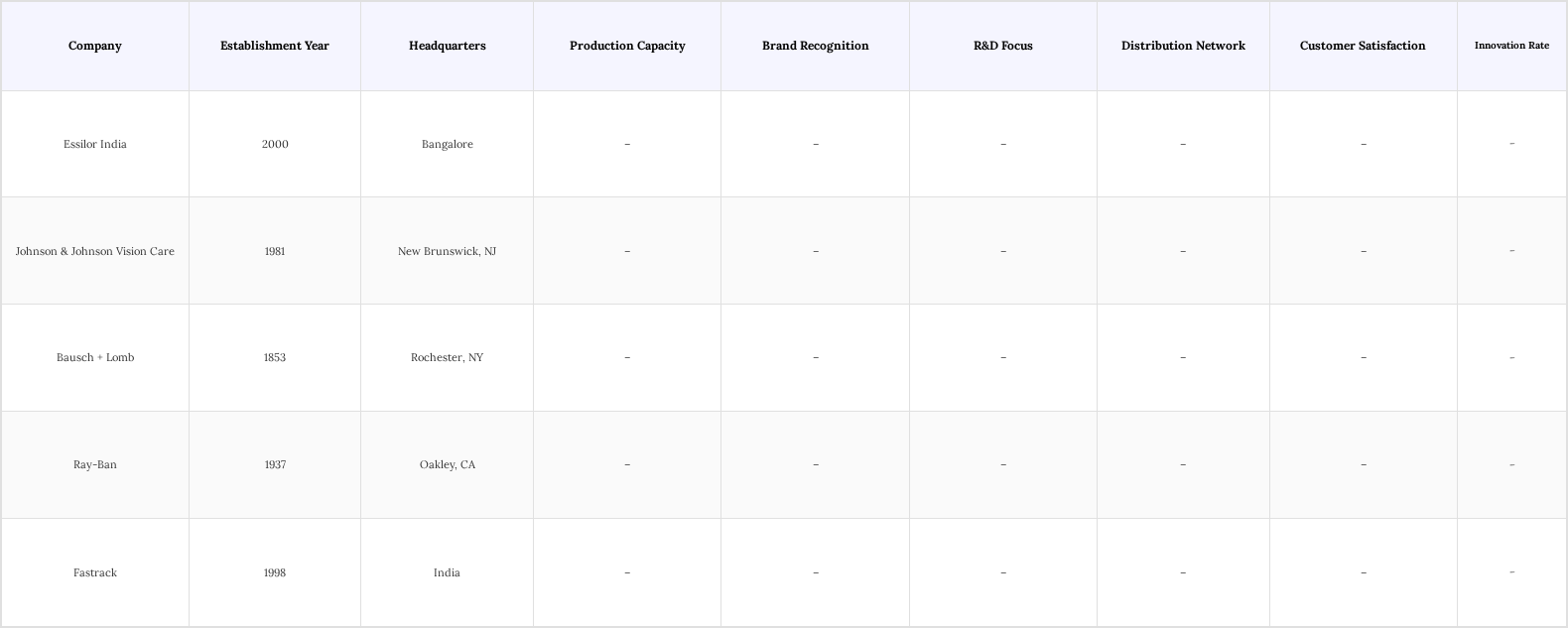

India Lens Market Competitive Landscape

The India Lens Market is characterized by a competitive landscape with several key players, including Essilor India, Johnson & Johnson Vision Care, and Bausch + Lomb. These companies are known for their innovative product offerings and strong distribution networks, which enhance their market presence. The competition is further intensified by the entry of new players and the continuous evolution of consumer preferences towards advanced lens technologies.

India Lens Market Industry Analysis

India Lens Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Vision Disorders: Vision disorders in India are rising, with an estimated 500 million people affected by refractive errors in 2023. The World Health Organization projects a 20% increase in individuals needing vision correction by 2024, highlighting the growing demand for corrective lenses. Factors such as rapid urbanization, increased screen time, and lifestyle changes are contributing to eye health issues. This trend underscores the urgent need for accessible and affordable eyewear solutions across the country.

- Rising Awareness About Eye Health: Awareness campaigns and health education initiatives in India have significantly improved public understanding of eye care. Recent reports suggest that awareness of vision correction options has increased to around 65% in 2024, up from approximately 50% in 2020. This growing awareness is motivating more individuals to seek professional eye care, driving higher demand for prescription lenses and eyewear products. Continued government focus on health education is expected to sustain and accelerate this positive trend.

- Expanding Optical Retail and E-Commerce Channels: The eyewear market in India is witnessing rapid growth through both physical retail expansion and digital platforms. In 2024, leading optical chains and startups have significantly broadened their reach, with e-commerce accounting for over 30% of eyewear sales. The convenience of online eye tests, virtual try-ons, and doorstep delivery has made vision correction more accessible, especially in Tier 2 and Tier 3 cities. This omni-channel growth is playing a key role in meeting the rising demand for affordable and stylish eyewear solutions across diverse consumer segments.

Market Challenges

- High Competition: The India lens market is characterized by intense competition, with numerous established and emerging players vying for market share. This saturation leads to price wars, which can erode profit margins. Major brands like Essilor and Johnson & Johnson dominate, making it challenging for new entrants to gain traction. The competitive landscape necessitates continuous innovation and marketing efforts, which can strain resources for smaller companies trying to establish their presence.

- Price Sensitivity Among Consumers: A significant portion of the Indian population remains price-sensitive, particularly in lower-income segments. Premium lens products often face sluggish sales due to affordability concerns. This price sensitivity can hinder the growth of high-end brands, forcing them to adjust their pricing strategies or risk losing market share. As a result, companies must find a balance between quality and affordability to cater to diverse consumer needs.

India Lens Market Future Outlook

The India lens market is poised for substantial growth, driven by technological advancements and evolving consumer preferences. The increasing integration of smart technology in lenses, such as augmented reality features, is expected to attract tech-savvy consumers. Additionally, the shift towards sustainable materials in lens production aligns with global environmental trends, appealing to eco-conscious buyers. As e-commerce continues to expand, it will facilitate greater access to a wider range of products, further stimulating market growth and innovation in the coming years.

Market Opportunities

- Expansion of E-commerce Platforms: The rise of e-commerce in India presents a significant opportunity for lens manufacturers. The overall Indian e-commerce market is enabling companies to access a broader audience. This shift enhances customer engagement and personalized marketing, driving sales growth and brand loyalty in the lens market. Leading players like Lenskart exemplify this trend with strong online sales growth.

- Technological Advancements in Manufacturing: Innovations in lens manufacturing, including 3D printing and advanced coating technologies, are driving product differentiation in India’s eyewear market. These advancements help reduce production costs and enhance product quality, enabling companies to offer customized and high-performance solutions. As consumer demand for unique, durable, and premium eyewear grows, businesses investing in such technologies are well-positioned to gain a competitive edge and capture greater market share.

Scope of the Report

| By Product Type |

Prescription Lenses Sunglasses Contact Lenses |

| By Material |

Plastic Glass Polycarbonate |

| By Distribution Channel |

Online Offline |

| By End User |

Adults Children |

| By Region |

North India South India East India West India |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Health and Family Welfare, Bureau of Indian Standards)

Manufacturers and Producers

Distributors and Retailers

Optometry Clinics and Eye Care Centers

Healthcare Providers and Hospitals

Industry Associations (e.g., All India Ophthalmological Society)

Financial Institutions

Companies

Players Mentioned in the Report:

Essilor India

Johnson & Johnson Vision Care

Bausch + Lomb

Ray-Ban

Fastrack

Visionary India

LensCraft Innovations

OptiMax India

ClearSight Solutions

EyeTech India

Table of Contents

1. India Lens Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Lens Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Lens Market Analysis

3.1. Growth Drivers

3.1.1. Increasing prevalence of vision disorders among the population

3.1.2. Rising awareness about eye health and vision correction options

3.1.3. Growth in disposable income leading to higher spending on eyewear

3.2. Market Challenges

3.2.1. High competition among established and emerging players

3.2.2. Price sensitivity among consumers affecting premium product sales

3.2.3. Regulatory hurdles and compliance issues in manufacturing

3.3. Opportunities

3.3.1. Expansion of e-commerce platforms for lens distribution

3.3.2. Technological advancements in lens manufacturing and design

3.3.3. Increasing demand for customized and fashionable eyewear

3.4. Trends

3.4.1. Growing popularity of blue light blocking lenses due to digital screen usage

3.4.2. Shift towards sustainable and eco-friendly lens materials

3.4.3. Rise in the adoption of smart lenses with integrated technology

3.5. Government Regulation

3.5.1. Standards for lens quality and safety set by regulatory bodies

3.5.2. Guidelines for advertising and marketing of eyewear products

3.5.3. Compliance with environmental regulations for manufacturing processes

3.5.4. Import/export regulations affecting lens trade in India

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. India Lens Market Segmentation

4.1. By Product Type

4.1.1. Prescription Lenses

4.1.2. Sunglasses

4.1.3. Contact Lenses

4.2. By Material

4.2.1. Plastic

4.2.2. Glass

4.2.3. Polycarbonate

4.3. By Distribution Channel

4.3.1. Online

4.3.2. Offline

4.4. By End User

4.4.1. Adults

4.4.2. Children

4.5. By Region

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Lens Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Essilor India

5.1.2. Johnson & Johnson Vision Care

5.1.3. Bausch + Lomb

5.1.4. Ray-Ban

5.1.5. Fastrack

5.1.6. Visionary India

5.1.7. LensCraft Innovations

5.1.8. OptiMax India

5.1.9. ClearSight Solutions

5.1.10. EyeTech India

5.2. Cross Comparison Parameters

5.2.1. Market Share

5.2.2. Product Range

5.2.3. Pricing Strategy

5.2.4. Distribution Network

5.2.5. Customer Service Quality

5.2.6. Brand Reputation

5.2.7. Innovation and R&D Investment

5.2.8. Marketing Strategies

6. India Lens Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. India Lens Market Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Lens Market Future Market Segmentation

8.1. By Product Type

8.1.1. Prescription Lenses

8.1.2. Sunglasses

8.1.3. Contact Lenses

8.2. By Material

8.2.1. Plastic

8.2.2. Glass

8.2.3. Polycarbonate

8.3. By Distribution Channel

8.3.1. Online

8.3.2. Offline

8.4. By End User

8.4.1. Adults

8.4.2. Children

8.5. By Region

8.5.1. North India

8.5.2. South India

8.5.3. East India

8.5.4. West India

9. India Lens Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Lens Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the India Lens Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India Lens Market.

Frequently Asked Questions

01. How big is the India Lens Market?

The India Lens Market is valued at USD 2.85 billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the India Lens Market?

Key challenges in the India Lens Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the India Lens Market?

Major players in the India Lens Market include Essilor India, Johnson & Johnson Vision Care, Bausch + Lomb, Ray-Ban, Fastrack, among others.

04. What are the growth drivers for the India Lens Market?

The primary growth drivers for the India Lens Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.