India Lidar Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD10451

December 2024

97

About the Report

India LiDar Market Overview

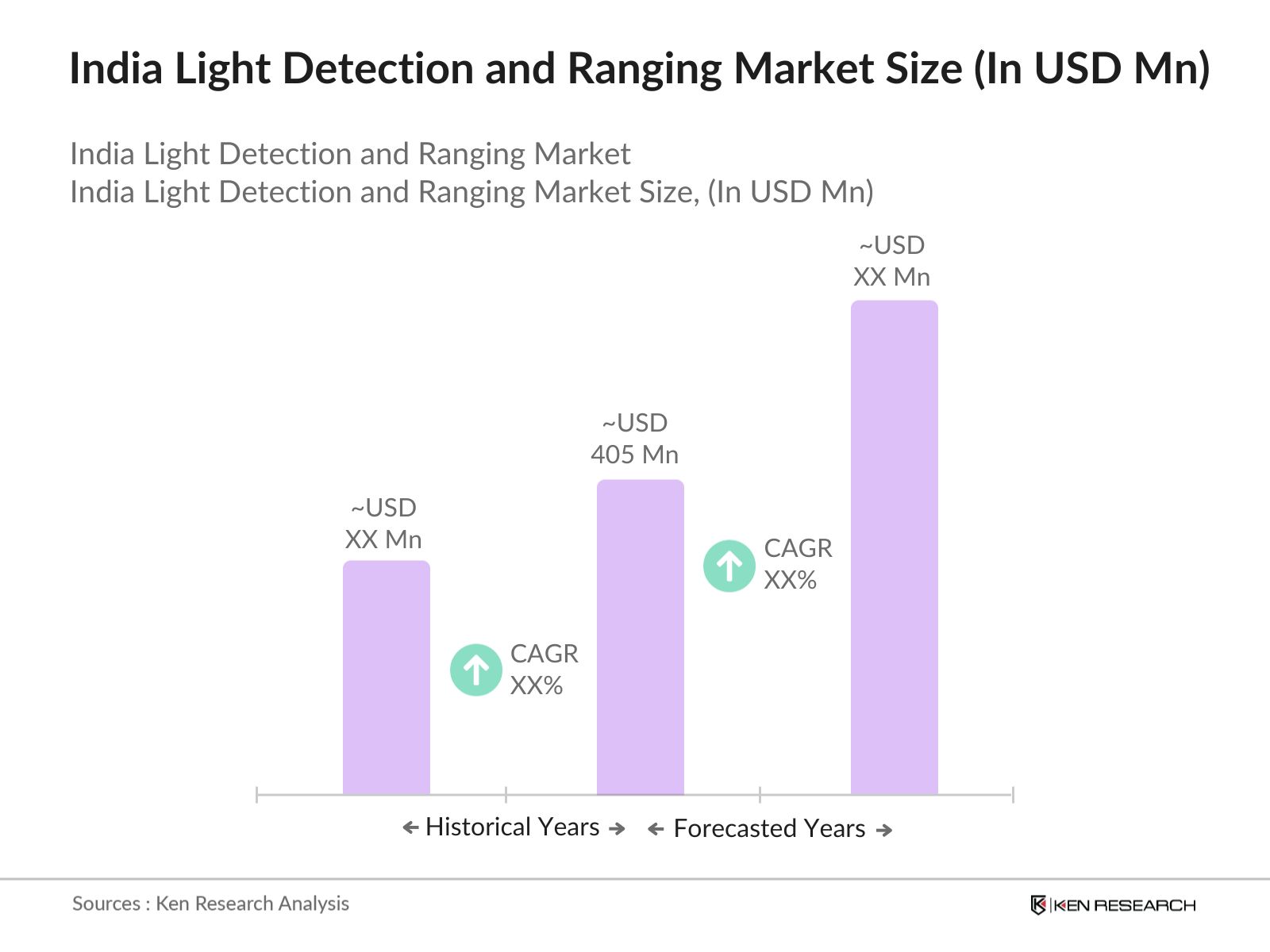

- The India LiDAR (Light Detection and Ranging) market, valued at USD 405 million, is experiencing significant growth driven by the enhanced spatial resolution provided by LiDAR-based digital terrain models. This technology improves accuracy in applications such as monitoring inland waterways, detecting changes on hillsides, and assessing water runoff in mining and agricultural areas.

- Major urban centers like Delhi, Mumbai, and Bangalore are leading the adoption of LiDAR technology in India. This dominance is attributed to their rapid urbanization, infrastructure development, and the implementation of smart city projects, which require precise geospatial data for planning and development.

- Drone technology adoption for LiDAR applications is growing, with the number of licensed drones in India surpassing 20,000 in 2024. This adoption supports cost-effective and accessible surveying options, especially in remote and challenging terrains.

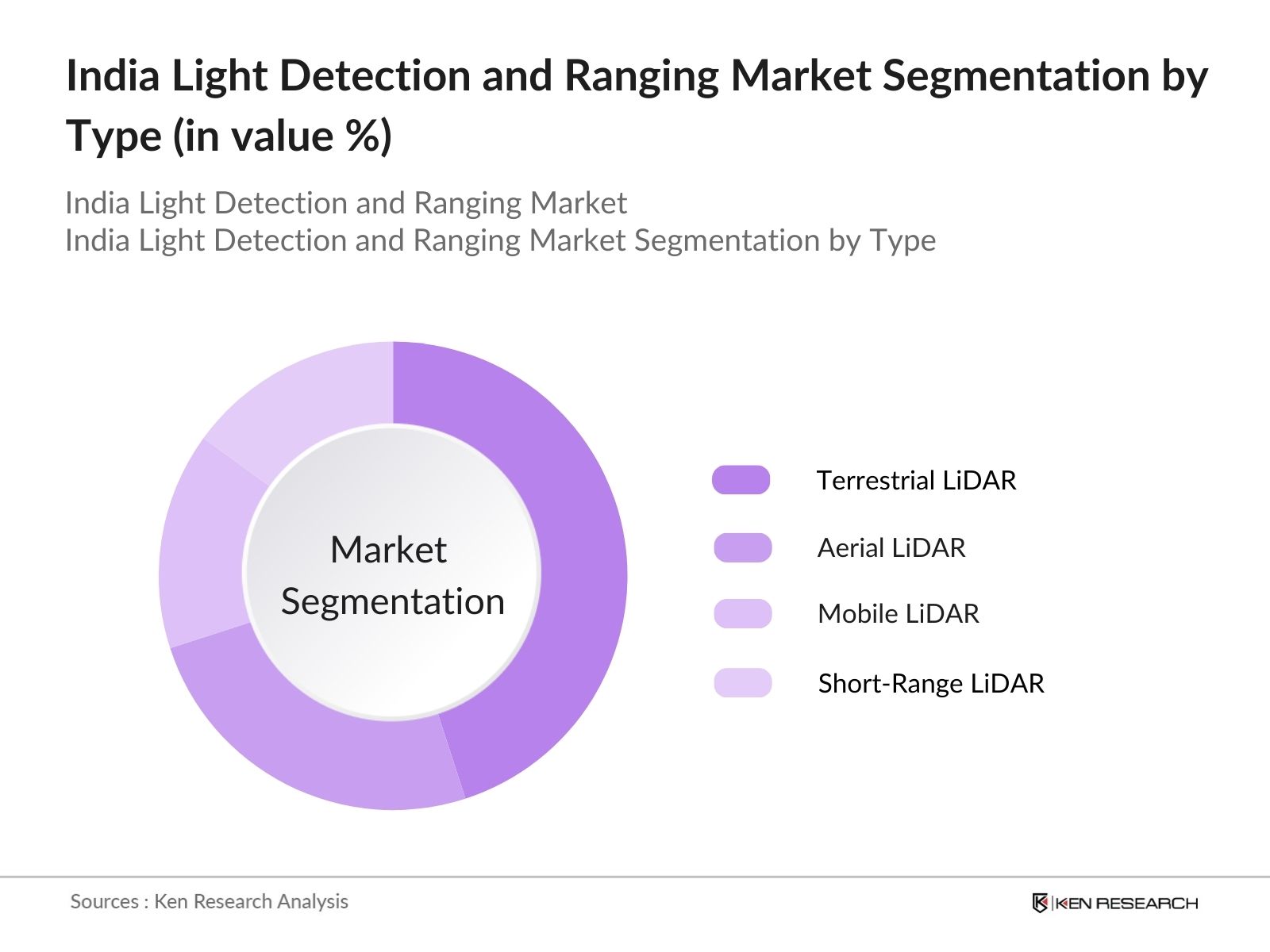

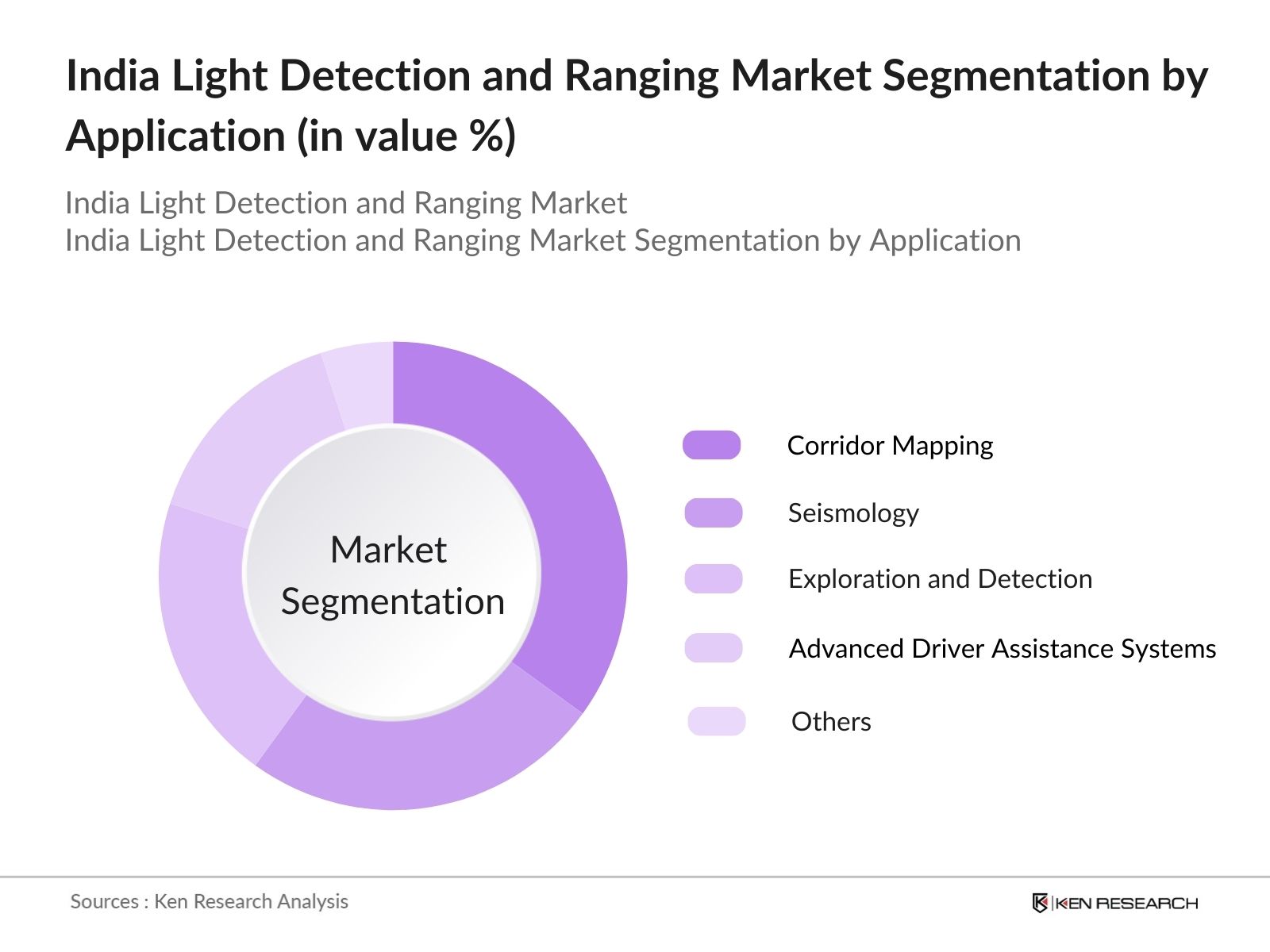

India LiDar Market Segmentation

By Type: The India LiDAR market is segmented by type into Terrestrial LiDAR, Aerial LiDAR, Mobile LiDAR, and Short-Range LiDAR. Among these, Terrestrial LiDAR holds a dominant market share due to its extensive use in topographic mapping, urban planning, and infrastructure development. Its ability to provide high-resolution data for ground-based surveys makes it indispensable for civil engineering and construction projects.

By Application: The market is also segmented by application into Corridor Mapping, Seismology, Exploration & Detection, Advanced Driver Assistance Systems (ADAS), and Others. Corridor Mapping leads this segment, driven by the need for accurate data in transportation infrastructure projects, including roadways, railways, and pipelines. LiDAR's precision in mapping linear features over large areas makes it essential for these applications.

India LiDar Market Competitive Landscape

The India LiDAR market is characterized by the presence of both domestic and international players, contributing to a competitive environment. Key companies are focusing on technological advancements and strategic partnerships to strengthen their market position.

India LiDAR Market Analysis

Growth Drivers

- Infrastructure Development Initiatives: India's government has earmarked substantial investments for infrastructure projects, particularly in transport and urban development. The National Infrastructure Pipeline (NIP) alone envisions projects worth 111 trillion by 2025. LiDAR technology is crucial in surveying, mapping, and monitoring these developments, supporting efficient project execution and reduced timeframes.

- Advancements in Autonomous Vehicle Technology: The push toward autonomous vehicles in India is accelerating the demand for precise environmental perception systems like LiDAR. By 2024, over 150,000 advanced driver-assistance systems (ADAS)-equipped vehicles are expected on Indian roads, a significant increase from prior years, requiring reliable LiDAR integration to enhance navigation and safety capabilities.

- Government Policies Promoting Geospatial Technologies: The Government of India's Geospatial Data Policy, revised in 2021, encourages private companies to produce and share geospatial data. This deregulation has opened a new arena for LiDAR technology, with over 300 companies now actively involved in geospatial solutions across India, creating a demand for accurate data collection and mapping.

Market Challenges

- High Initial Investment Costs: Implementing LiDAR systems incurs significant costs, with equipment prices averaging 1.5 million to 2 million for high-quality LiDAR devices. This initial expenditure often deters smaller enterprises from adopting the technology, as recovery timelines can be extended without large-scale projects.

- Technical Complexity and Skill Shortage: Operating LiDAR systems requires specialized knowledge, and India faces a shortage of trained professionals in this domain. Only about 20% of surveyed companies report having adequate technical expertise to operate LiDAR effectively, highlighting the need for training programs and technical education reforms to bridge the skills gap.

India LiDar Market Future Outlook

Over the next five years, the India LiDAR market is expected to witness substantial growth, driven by continuous government support, advancements in LiDAR technology, and increasing demand for precise geospatial data across various sectors. The integration of LiDAR with emerging technologies such as Artificial Intelligence (AI) and the Internet of Things (IoT) is anticipated to open new avenues for market expansion.

Market Opportunities

- Integration with Smart City Projects: Indias Smart City Mission, involving over 100 cities, is a major growth avenue for LiDAR. Cities like Varanasi and Pune are already leveraging LiDAR for urban planning and infrastructure management. As these projects progress, LiDAR will be essential for real-time urban mapping, resource optimization, and sustainable city planning.

- Expansion in Agricultural Applications: LiDAR is increasingly used to enhance precision farming, which is crucial as agriculture employs over 40% of India's workforce. Applications such as soil quality mapping and crop health monitoring have shown productivity improvements by nearly 15% in pilot projects across Punjab and Maharashtra, demonstrating LiDAR's potential in supporting sustainable agriculture.

Scope of the Report

|

By Type |

Terrestrial LiDAR |

|

By Component |

Laser Scanners |

|

By Application |

Corridor Mapping |

|

By End User |

Civil Engineering |

Products

Key Target Audience

Civil Engineering Firms

Archaeological Survey Organizations

Forestry and Agricultural Agencies

Mining Companies

Transportation Departments

Defense and Aerospace Agencies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Science and Technology, Survey of India)

Companies

Players Mentioned in the Report:

Geokno

FARO Technologies, Inc.

Trimble Inc.

RIEGL Laser Measurement Systems GmbH

Teledyne Optech

Leica Geosystems AG

Velodyne Lidar, Inc.

Quanergy Systems, Inc.

Innoviz Technologies Ltd.

LeddarTech Inc.

Table of Contents

1. India LiDAR Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. India LiDAR Market Size (In USD Million)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. India LiDAR Market Analysis

3.1 Growth Drivers

3.1.1 Infrastructure Development Initiatives

3.1.2 Advancements in Autonomous Vehicle Technology

3.1.3 Government Policies Promoting Geospatial Technologies

3.1.4 Rising Demand in Environmental Monitoring

3.2 Market Challenges

3.2.1 High Initial Investment Costs

3.2.2 Technical Complexity and Skill Shortage

3.2.3 Regulatory and Environmental Concerns

3.3 Opportunities

3.3.1 Integration with Smart City Projects

3.3.2 Expansion in Agricultural Applications

3.3.3 Technological Innovations in LiDAR Systems

3.4 Trends

3.4.1 Adoption of UAV-Based LiDAR Systems

3.4.2 Miniaturization and Cost Reduction of LiDAR Sensors

3.4.3 Increased Use in Disaster Management

3.5 Government Regulations

3.5.1 National Geospatial Policy

3.5.2 Environmental Protection Laws

3.5.3 Infrastructure Development Guidelines

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. India LiDAR Market Segmentation

4.1 By Type (In Value %)

4.1.1 Terrestrial LiDAR

4.1.2 Aerial LiDAR

4.1.3 Mobile LiDAR

4.1.4 Short-Range LiDAR

4.2 By Component (In Value %)

4.2.1 Laser Scanners

4.2.2 Inertial Navigation Systems

4.2.3 Cameras

4.2.4 GPS/GNSS

4.2.5 Micro-Electro-Mechanical Systems (MEMS)

4.3 By Application (In Value %)

4.3.1 Corridor Mapping

4.3.2 Seismology

4.3.3 Exploration & Detection

4.3.4 Advanced Driver Assistance Systems (ADAS)

4.3.5 Others

4.4 By End User (In Value %)

4.4.1 Civil Engineering

4.4.2 Archaeology

4.4.3 Forestry & Agriculture

4.4.4 Mining

4.4.5 Transportation

4.4.6 Defense & Aerospace

4.5 By Region (In Value %)

4.5.1 North India

4.5.2 South India

4.5.3 East India

4.5.4 West India

5. India LiDAR Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Geokno

5.1.2 FARO Technologies, Inc.

5.1.3 Trimble Inc.

5.1.4 RIEGL Laser Measurement Systems GmbH

5.1.5 Teledyne Optech

5.1.6 Leica Geosystems AG

5.1.7 Velodyne Lidar, Inc.

5.1.8 Quanergy Systems, Inc.

5.1.9 Innoviz Technologies Ltd.

5.1.10 LeddarTech Inc.

5.1.11 Luminar Technologies, Inc.

5.1.12 Ouster, Inc.

5.1.13 Topcon Corporation

5.1.14 Sick AG

5.1.15 YellowScan

5.2 Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Market Share, R&D Investment, Regional Presence)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.6.1 Venture Capital Funding

5.6.2 Government Grants

5.6.3 Private Equity Investments

6. India LiDAR Market Regulatory Framework

6.1 Geospatial Data Guidelines

6.2 Environmental Compliance Standards

6.3 Import and Export Regulations

6.4 Certification Processes

7. India LiDAR Future Market Size (In USD Million)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. India LiDAR Future Market Segmentation

8.1 By Type (In Value %)

8.2 By Component (In Value %)

8.3 By Application (In Value %)

8.4 By End User (In Value %)

8.5 By Region (In Value %)

9. India LiDAR Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India LiDAR Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the India LiDAR Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple LiDAR technology providers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India LiDAR market.

Frequently Asked Questions

01. How big is the India LiDAR Market?

The India LiDAR market is valued at USD 405 million, driven by the enhanced spatial resolution offered by LiDAR-based digital terrain models. This growth is attributed to its accuracy in applications such as topographic mapping, infrastructure planning, and environmental monitoring.

02. What are the challenges in the India LiDAR Market?

Challenges in the India LiDAR market include high initial investment costs, the technical complexity of LiDAR systems, a shortage of skilled professionals, and regulatory concerns that can limit widespread adoption in certain regions.

03. Who are the major players in the India LiDAR Market?

Key players in the India LiDAR market include Geokno, FARO Technologies, Trimble Inc., RIEGL Laser Measurement Systems, and Teledyne Optech. These companies lead the market due to their advanced technology offerings and extensive service networks.

04. What are the growth drivers for the India LiDAR Market?

The India LiDAR market is primarily driven by the growing demand for geospatial data in infrastructure projects, advancements in autonomous vehicle technology, and government support for digital terrain mapping. Increasing applications in smart city initiatives are also significant contributors to growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.