India Life Insurance Market Outlook to 2030

Region:Asia

Author(s):Samanyu Maan

Product Code:KROD292

June 2024

100

About the Report

India Life Insurance Market Overview

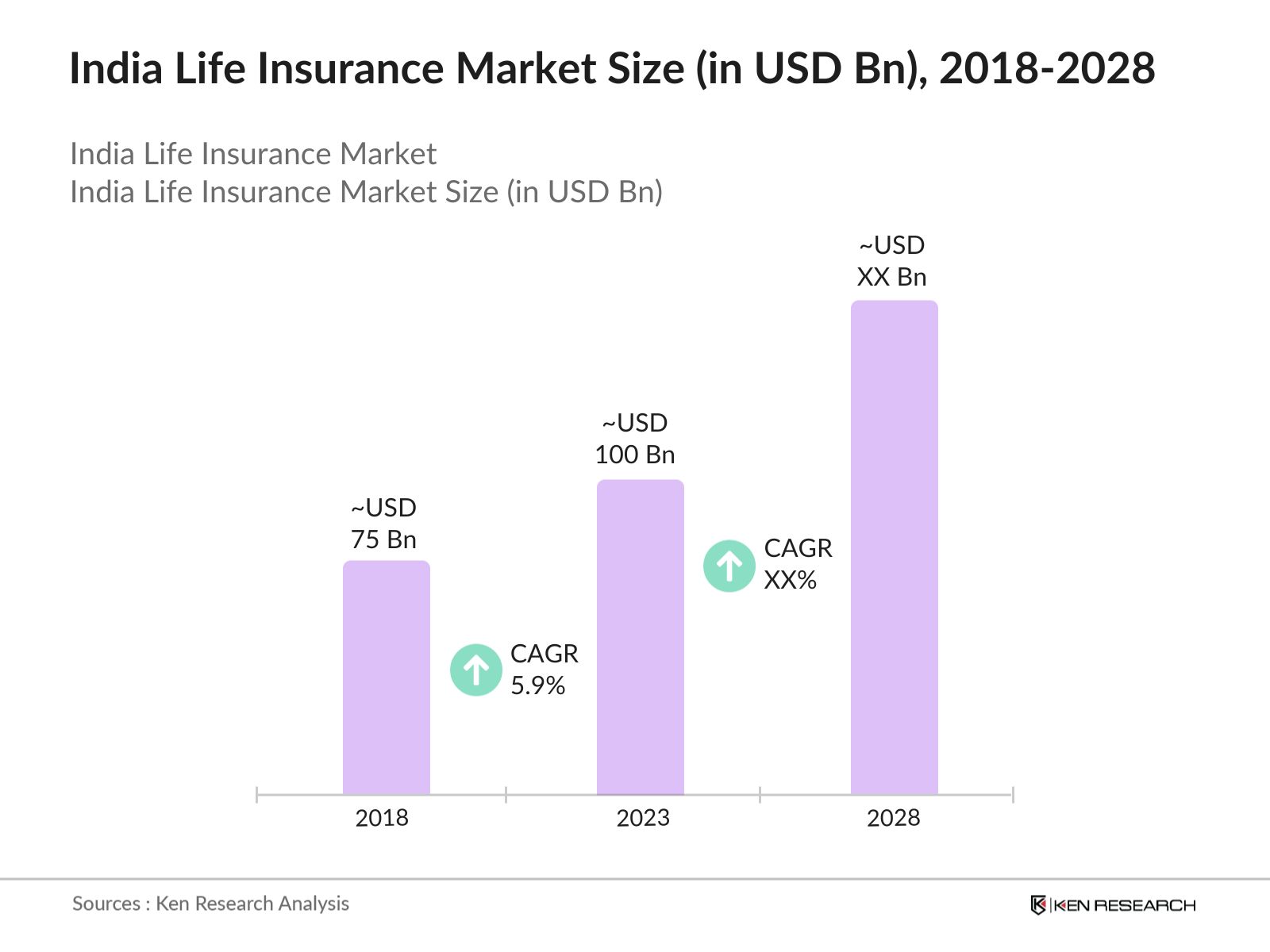

- The India life insurance market was valued at USD 100 Bn in 2023, driven by increasing awareness about financial security, rising disposable incomes, and favorable government policies like tax incentives under Section 80C.

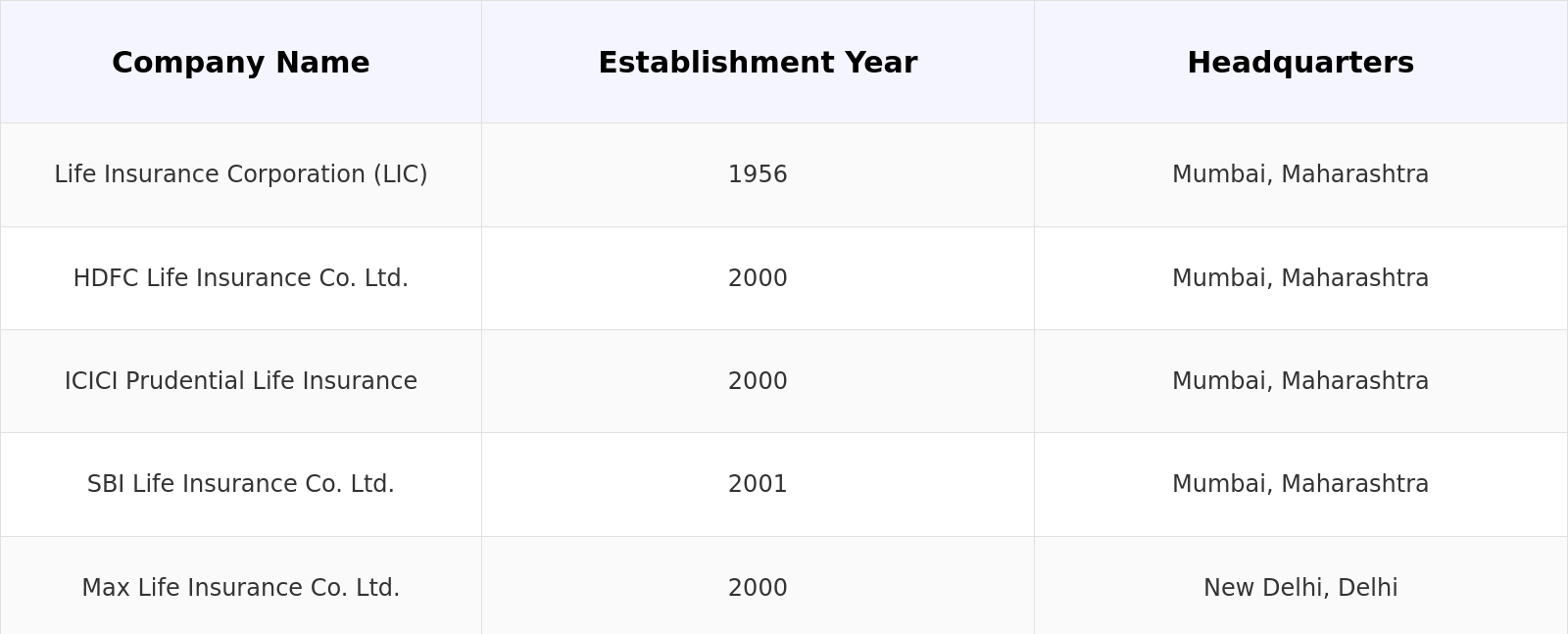

- Key players in the market include Life Insurance Corporation of India (LIC), HDFC Life, ICICI Prudential, SBI Life, and Max Life Insurance, dominating with extensive reach and comprehensive product offerings.

- Max Life's 2024 partnership with Axis Bank highlights bancassurance's growing importance. This collaboration aims to enhance customer reach and provide comprehensive financial solutions through the bank's extensive network.

- Major drivers include the increasing need for financial protection, the growth of the middle-class population, government initiatives like Pradhan Mantri Jeevan Jyoti Bima Yojana, and the development of digital platforms.

India Life Insurance Current Market Analysis

- The India life insurance market is embracing digital platforms, enhancing customer awareness, and introducing innovative products tailored to specific needs. This transformation is driven by technological advancements that simplify policy management and expand market accessibility.

- Term insurance is favored for its affordability and robust financial protection against unforeseen events, appealing to a broad spectrum of consumers seeking basic life coverage at lower premiums.

- Consumers prioritize insurance policies with flexible premium payment options, comprehensive coverage, and additional benefits like critical illness riders and accidental death benefits, reflecting a demand for customizable financial protection solutions.

- LIC (Life Insurance Corporation of India) dominates the market with its extensive agent network, longstanding brand trust, and diverse portfolio of insurance products, positioning itself as a trusted choice for millions of policyholders nationwide.

India Life Insurance Market Segmentation

The India Life Insurance Market can be segmented based on several factors:

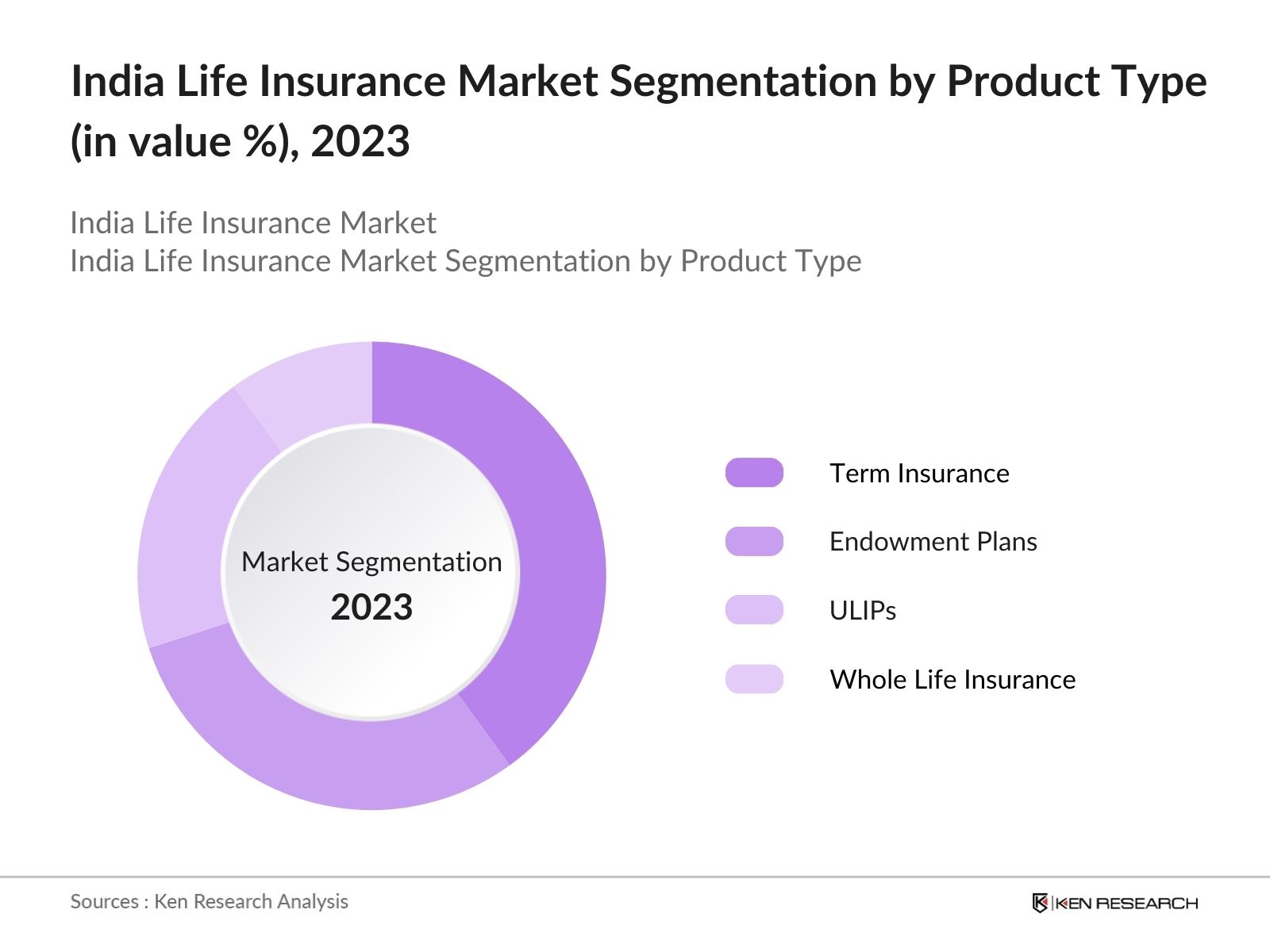

By Product Type: India life insurance market is segmented by product type is divided into term insurance, endowment plans, ULIPs and whole life insurance. Term insurance leads the India life insurance market in 2023 due to its simplicity, affordability, and high coverage amounts.

Consumers favor term insurance for its straightforward approach to pure risk protection, ensuring financial security for beneficiaries upon the policyholder's death.

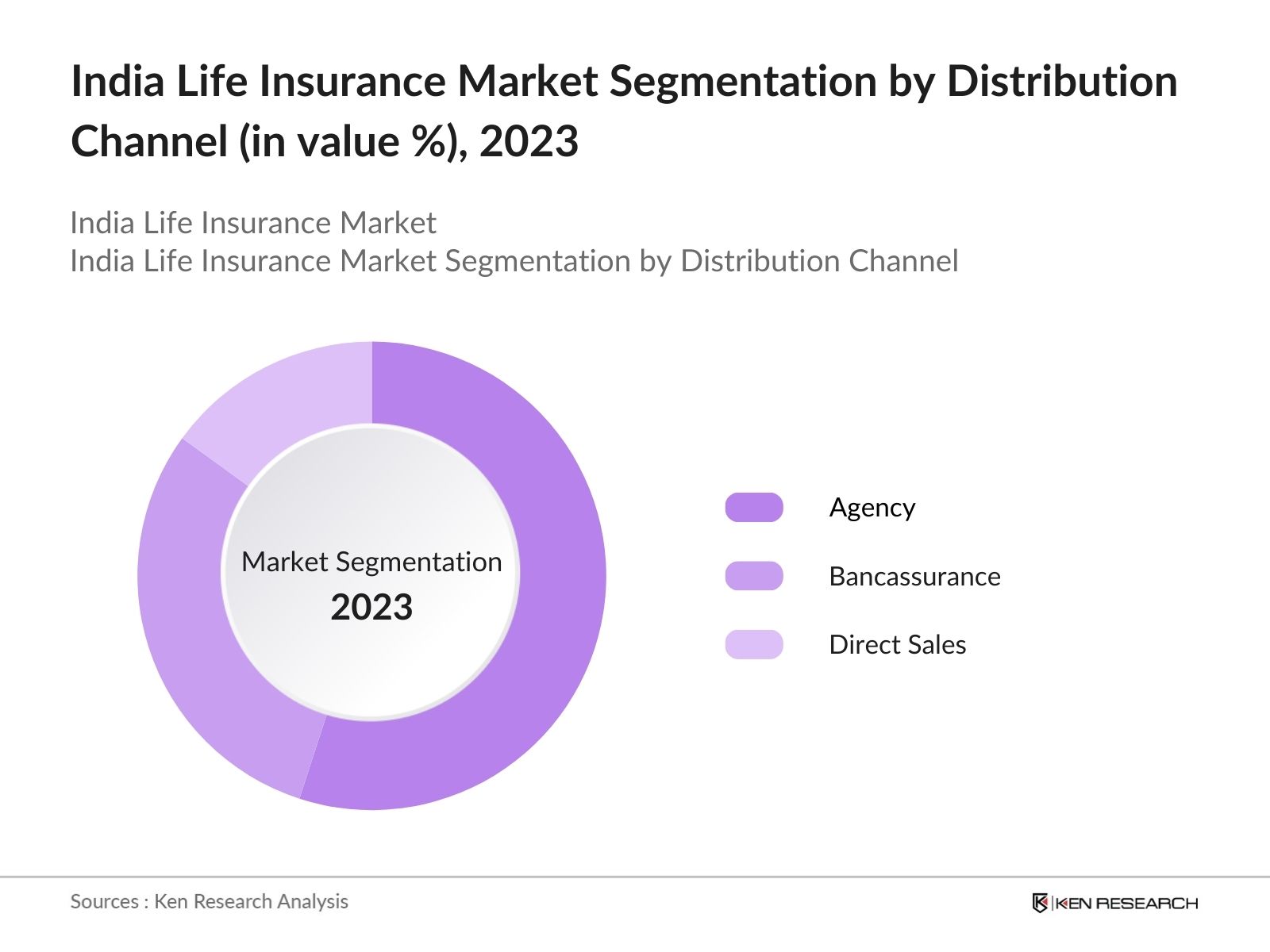

By Distribution Channel: India life insurance market segmentation by distribution channel is divided into agency, bancassurance and direct sales. The agency channel leads the India life insurance market in 2023 due to its extensive reach and personalized service. Agents are instrumental in educating consumers about insurance options and guiding them to choose policies that best suit their financial goals, fostering trust and satisfaction among customers.

By Customer Type: India life insurance market segmentation by customer is divided into individuals and group. Individual policies dominate the 2023 India life insurance market as they offer personalized financial protection and savings solutions tailored to consumers' specific needs. This customization meets varying life insurance requirements, appealing to individuals seeking comprehensive coverage aligned with their financial goals.

India Life Insurance Market Competitive Landscape

- Building and maintaining trust is crucial in the competitive life insurance market. Companies like LIC in India exemplify this with their long-standing presence and reliability.

- Merger of HDFC Life and Exide Life (2024): HDFC Life completed its merger with Exide Life in 2024, enhancing its distribution network and product portfolio. The merger is expected to improve market penetration and operational synergies, benefiting policyholders.

- Launch of AI-Based Claims Processing: In 2024, ICICI Prudential introduced an AI-driven claims settlement platform, reducing claims processing time by 30%. This innovation has led to higher customer satisfaction and trust in the claims process.

India Life Insurance Industry Analysis

India Life Insurance Market Growth Drivers:

- Increasing Disposable Income: India's rising disposable income levels have significantly boosted the life insurance market. In 2024, India's per capita income rose to approximately USD 2,500, enabling more individuals to invest in life insurance for financial security and long-term savings, particularly among the expanding middle class.

- Growing Awareness of Financial Planning: Awareness of financial planning and life insurance has grown due to educational campaigns by the IRDAI and insurance companies. A 2024 RBI report highlighted a significant increase in financial literacy related to life insurance, driving higher policy penetration, especially among young professionals.

- Favorable Demographic Profile: With 65% of India's population under 35 in 2024, the young demographic presents a significant opportunity for the life insurance market. As this group enters the workforce, their growing awareness of financial protection and wealth accumulation drives steady demand for life insurance products.

India Life Insurance Market Challenges:

- Regulatory Changes: Frequent regulatory changes pose challenges for the life insurance market in India. IRDAI's 2024 amendments to guidelines on commission structures and policyholder protection have increased compliance costs and operational disruptions for insurers, impacting efficiency and profitability.

- Low Insurance Penetration: Despite growth, insurance penetration in India remains low at around 3.5% of GDP in 2024. Factors such as lack of awareness, cultural aversion to discussing death, and limited rural access contribute to this challenge, making it difficult to reach the entire population.

- Competition from Informal Insurance Providers: Informal, unregulated insurance providers offering lower premiums pose a challenge to the formal life insurance market. According to the Ministry of Finance, many rural consumers rely on these schemes, which lack regulatory oversight and financial security, undermining the formal sector's growth.

India Life Insurance Market Government Initiatives:

- Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY): Launched in 2015, PMJJBY provides affordable life insurance coverage with over 50 million enrollments by 2024. Offering a life cover of INR 2 lakhs for an annual premium of INR 330, it has significantly increased insurance penetration among low-income individuals.

- IRDAI Reforms: IRDAI's 2024 reforms aimed at enhancing consumer protection included standardizing life insurance products, such as "Saral Jeevan Bima." These reforms ensure transparency and simplicity, increasing consumer confidence in life insurance products.

- Financial Literacy Campaigns: Government and financial institutions launched campaigns to educate the public about life insurance's importance. RBI reported significant increases in financial literacy in 2024, with more individuals understanding the need for financial planning and insurance.

India Life Insurance Future Market Outlook

The India Life Insurance Market is expected to show a significant growth riven by a rising middle class, enhanced distribution channels, and technological advancements, including online policy purchases.

Future Market Trends

- Rise of Term Insurance: Term insurance policies will gain significant popularity, offering high coverage at low premiums. IRDAI is expected to report a notable increase in term policy sales, driven by growing awareness of financial security benefits and additional riders like critical illness coverage.

- Integration of Technology and Digital Platforms: The use of digital platforms in the life insurance sector will increase significantly, offering convenience and faster processing. Technologies like AI and ML will be used for personalized policy recommendations and automated claims processing, improving customer experience and operational efficiency.

- Focus on Customer-Centric Products: Life insurers will increasingly develop customer-centric products, including customizable policies and flexible payment options. There will be a growing demand for combined protection and savings products, enhancing customer satisfaction and retention.

Scope of the Report

|

By Product Type |

Term Insurance Endowment Plans ULIPs Whole Life Insurance |

|

By Distribution Channel |

Agency Bancassurance Direct Sales |

|

By Customer Type |

Individual Group |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing this Report:

Insurance Companies and Providers

Insurance Agents and Brokers

Industry Associations and Trade Organizations

Life Insurance Companies

Reinsurance Companies

Government and Regulatory Bodies

Financial and Investment Institutions

Banks and Financial Services Companies

Small and Medium Enterprises (SMEs)

Individual Policyholders

Actuarial Firms

Underwriting Firms

Claims Management Companies

Healthcare Providers and Medical Institutions

Wealth Management Firms

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:Â

Life Insurance Corporation of India (LIC)

HDFC Life

ICICI Prudential

SBI Life

Max Life Insurance

Bajaj Allianz Life

Birla Sun Life

Tata AIA Life

Kotak Mahindra Life

PNB MetLife

Reliance Nippon Life

Exide Life Insurance

Future Generali India Life Insurance

Aviva Life Insurance

IDBI Federal Life Insurance

Star Union Dai-ichi Life Insurance

Bharti AXA Life Insurance

IndiaFirst Life Insurance

Edelweiss Tokio Life Insurance

Canara HSBC OBC Life Insurance

Table of Contents

1 India Life Insurance Market Overview

India Life Insurance Market Taxonomy

2 India Life Insurance Market Size (in USD Bn), 2018-2023

3 India Life Insurance Market Analysis

3.1 India Life Insurance Market Growth Drivers

3.2 India Life Insurance Market Challenges and Issues

3.3 India Life Insurance Market Trends and Development

3.4 India Life Insurance Market Government Regulation

3.5 India Life Insurance Market SWOT Analysis

3.6 India Life Insurance Market Stake Ecosystem

3.7 India Life Insurance Market Competition Ecosystem

4 India Life Insurance Market Segmentation, 2023

4.1 India Life Insurance Market Segmentation by Product Type (in value %), 2023

4.2 India Life Insurance Market Segmentation by Distribution Channel (in value %), 2023

4.3 India Life Insurance Market Segmentation by Customer Type (in value %), 2023

5 India Life Insurance Market Competition Benchmarking

5.1 India Life Insurance Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6 India Life Insurance Future Market Size (in USD Bn), 2023-2028

7 India Life Insurance Future Market Segmentation, 2028

7.1 India Life Insurance Market Segmentation by Product Type (in value %), 2028

7.2 India Life Insurance Market Segmentation by Distribution Channel (in value %), 2028

7.3 India Life Insurance Market Segmentation by Customer Type (in value %), 2028

8 India Life Insurance Market Analysts’ Recommendations

8.1 India Life Insurance Market TAM/SAM/SOM Analysis

8.2 India Life Insurance Market Customer Cohort Analysis

8.3 India Life Insurance Market Marketing Initiatives

8.4 India Life Insurance Market White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.Â

Step: 2 Market Building:

Collating statistics on India life insurance market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India life insurance market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.Â

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Step: 4 Research Output:

Our team will approach multiple life insurance companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from life insurance companies.

Frequently Asked Questions

01 How big is India Life Insurance Market?

The India Life Insurance Market was valued at USD 100 Bn in 2023, driven by increasing awareness about financial security, rising disposable incomes.

02 What are the key challenges faced in India Life Insurance Market?

The key challenges faced in India Life Insurance Market are low penetration in rural areas, competition from informal savings instruments like chit funds, and the complexity of insurance products.

03 Who are some of the major players in the India Life Insurance Market?

Some of the major players in the India Life Insurance Market include Life Insurance Corporation of India (LIC), HDFC Life, ICICI Prudential, SBI Life, and Max Life Insurance.

04 What are the key factors driving India life insurance market?

Major drivers include the increasing need for financial protection, the growth of the middle-class population, government initiatives.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.