India Linux Operating System Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD4585

December 2024

97

About the Report

India Linux Operating System Market Overview

- The India Linux Operating System market is valued at USD 540 million, driven by a strong open-source community and the growing need for secure, scalable operating systems across industries. The demand for Linux has increased, particularly in sectors such as IT, telecommunications, and government initiatives, where open-source software reduces costs and provides better control over systems. Linux's adaptability in cloud computing and enterprise applications further fuels market growth.

- Dominant cities in the India Linux Operating System market include Bengaluru and Hyderabad. These cities host a vast number of IT companies and startups, making them key contributors to the market. Additionally, strong government backing for open-source solutions in various public sector projects positions these cities as leaders in Linux deployment. The talent pool and tech infrastructure in these regions also contribute to their dominance in the market.

- Indias Open-Source Software (OSS) policy, introduced in 2020, mandates the adoption of OSS in all government systems to encourage transparency and cost-efficiency. By 2023, over 60% of government IT systems, including digital services and cloud-based platforms, were running on open-source software, primarily Linux. This policy has accelerated Linux adoption in various ministries and public-sector enterprises, establishing Linux as a key component in government IT infrastructure.

India Linux Operating System Market Segmentation

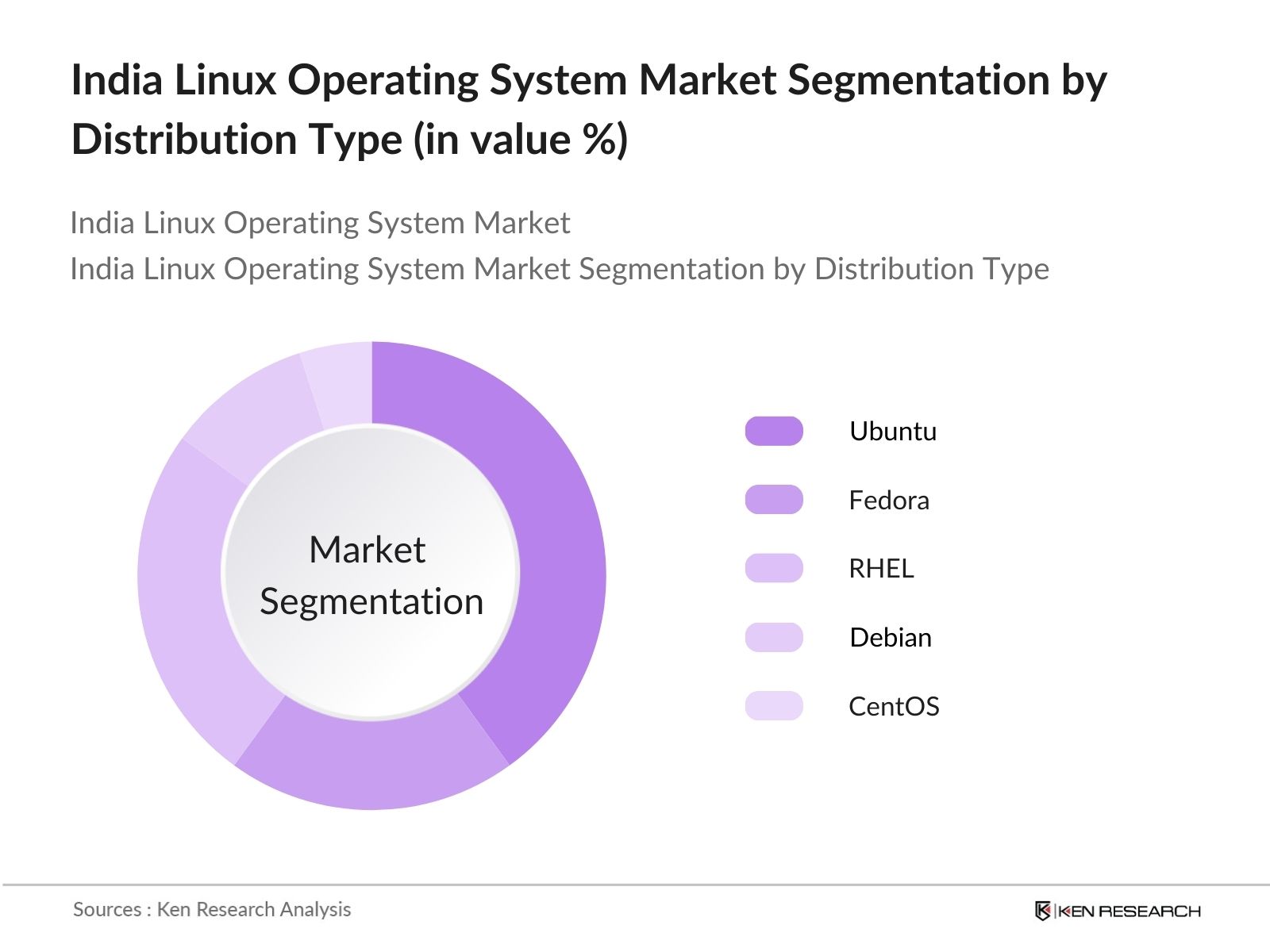

- By Distribution Type: Indias Linux Operating System market is segmented by distribution type into Ubuntu, Fedora, Red Hat Enterprise Linux (RHEL), Debian, and CentOS. Among these, Ubuntu holds the dominant market share due to its user-friendly nature, ease of deployment, and strong support system. Ubuntus widespread use in educational institutions, government projects, and startups makes it a popular choice in India. Its compatibility with a wide range of hardware also adds to its preference.

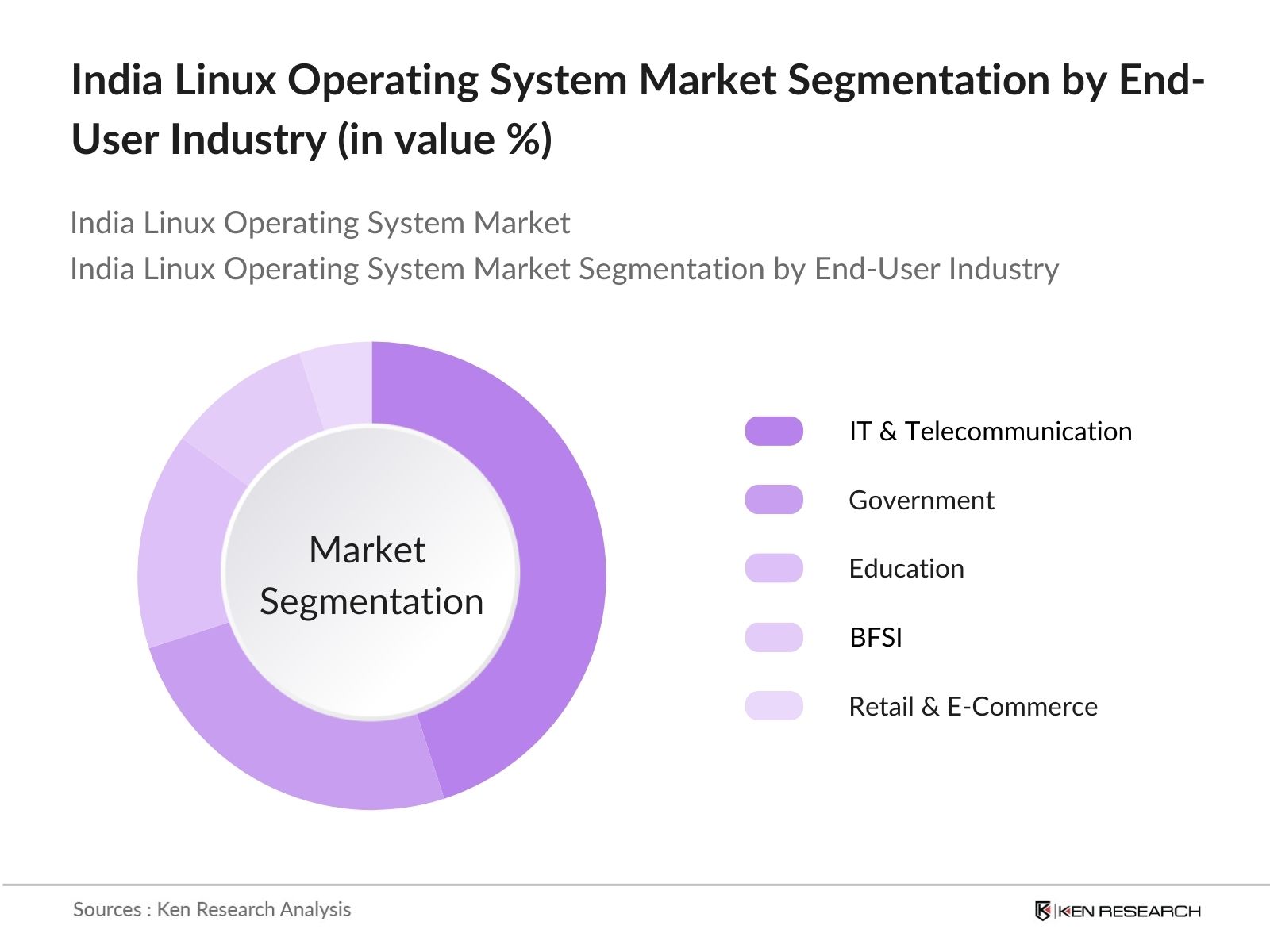

- By End-User Industry: The market is segmented by end-user industry into IT & Telecommunication, Government, Education, Banking, Financial Services, and Insurance (BFSI), and Retail & E-Commerce. The IT & Telecommunication segment dominates the market, largely due to the sectors reliance on open-source software for server management, cloud computing, and network infrastructure. Linuxs robustness and security features make it a favourite among IT professionals for enterprise applications.

India Linux Operating System Market Competitive Landscape

The India Linux Operating System market is dominated by several key players, both global and domestic. The market is highly competitive, with major players focusing on product innovation, integration with cloud technologies, and offering better support services to capture market share.

|

Company Name |

Establishment Year |

Headquarters |

License Type |

No. of Employees |

Key Partnerships |

Developer Community Size |

Adoption Rate |

Pricing Model |

|

Canonical Ltd. (Ubuntu) |

2004 |

London, UK |

- |

- |

- |

- |

- |

- |

|

Red Hat, Inc. (RHEL) |

1993 |

Raleigh, USA |

- |

- |

- |

- |

- |

- |

|

SUSE |

1992 |

Nuremberg, DE |

- |

- |

- |

- |

- |

- |

|

Oracle Corporation |

1977 |

Austin, USA |

- |

- |

- |

- |

- |

- |

|

IBM (LinuxONE) |

1911 |

New York, USA |

- |

- |

- |

- |

- |

- |

India Linux Operating System Market Analysis

India Linux Operating System Market Growth Drivers

- Open-Source Adoption: India's tech industry is witnessing a surge in the adoption of open-source solutions, driven by low-cost software alternatives and flexible development environments. Linux, being an open-source platform, offers cost advantages as there are no licensing fees associated with its usage, making it a popular choice for Indian businesses, especially SMEs. The push toward open-source systems align with Indias robust digital economy, which is expected to grow to over $1 trillion by 2025, according to World Bank projections. Linux's adaptability enables developers to tailor software to specific business needs, enhancing operational flexibility.

- Rise in Digital Transformation: Indias Digital Transformation initiatives, both in public and private sectors, have paved the way for the Linux OS. The Indian governments focus on digitizing operations and services under the Digital India program is driving demand for secure, scalable, and customizable operating systems like Linux. With over 80% of Indian enterprises undergoing digital transformation as reported by a national survey in 2023, the need for flexible operating systems has increased. Furthermore, digital services in India are expected to generate $150 billion by 2025, providing a fertile ground for Linux OS growth.

- Expanding Cloud Infrastructure: Indias rapidly growing cloud infrastructure is increasingly relying on Linux-based systems for their open-source advantages. With major cloud service providers like AWS, Google Cloud, and Microsoft Azure offering Linux integration, the demand for Linux OS in cloud-native applications has risen. India's cloud market is expected to reach $10 billion by 2025, with over 70% of cloud infrastructure running on Linux-based platforms due to their reliability and scalability. This growth is bolstered by Indias expanding data center network, which currently hosts over 500 MW of IT power.

India Linux Operating System Market Challenges

- Competition with Proprietary Systems: Despite the growth of Linux, proprietary systems, especially Microsoft Windows, maintain a dominant market share in India's operating system landscape. Windows is pre-installed on most new hardware and has strong brand recognition, making it difficult for Linux to capture notable market share. According to a 2023 report from the Ministry of Communications, Windows holds over 85% of the desktop OS market in India, which presents a challenge for Linux OS providers to compete in mainstream consumer and business markets.

- Perceived Technical Complexity: Linux operating systems are often perceived as technically complex, particularly for users accustomed to proprietary systems like Windows. This perceived complexity can slow down adoption rates among non-technical users. According to a survey conducted by the National Skill Development Corporation (NSDC) in 2023, over 60% of IT professionals in India indicated that lack of training and unfamiliarity with Linux interfaces was a major barrier to adoption. Furthermore, transitioning from proprietary software requires a steep learning curve, especially for government and educational institutions.

India Linux Operating System Market Future Outlook

The India Linux Operating System market is poised for substantial growth over the next five years, driven by an increasing reliance on open-source software in enterprise solutions, government backing for open-source projects, and growing digital transformation initiatives. The proliferation of cloud technologies, paired with the increased use of Linux in IoT and AI-based applications, will further boost market demand. The future of the Linux OS market in India looks promising as it continues to gain traction across both large enterprises and small-to-medium enterprises (SMEs).

India Linux Operating System Market Opportunities

- Cloud-Native Linux Deployments: Linux's compatibility with cloud-native technologies like Docker and Kubernetes offers substantial opportunities in Indias booming cloud services market. Over 90% of cloud-native applications in Indian data centers are built on Linux-based platforms, thanks to its scalability and integration with container orchestration tools. India's cloud market has expanded rapidly, with the National Association of Software and Service Companies (NASSCOM) predicting cloud services revenue to reach $13 billion by 2025. This growing demand for containerization and microservices makes Linux an essential component in modern cloud deployments.

- Rising Data Center Deployments: With the expansion of Indias data center network, Linux has become the operating system of choice for many providers due to its security features, cost-efficiency, and stability. By 2025, India will have over 600 MW of data center capacity, and the majority of new deployments are expected to run Linux-based systems. The flexibility of Linux in handling high-volume data workloads and integrating with cloud services makes it a preferred choice for data center operations, driving future adoption

Scope of the Report

|

By Distribution Type |

Ubuntu Fedora RHEL Debian CentOS |

|

By End-User Industry |

IT & Telecommunication Government Education BFSI Retail & E-Commerce |

|

By Deployment Mode |

On-Premise Cloud-Based |

|

By Enterprise Size |

SMEs Large Enterprises |

|

By Region |

North India South India East India West India |

Products

Key Target Audience

IT & Telecommunication Companies

Cloud Service Providers

Government and Regulatory Bodies (Ministry of Electronics & Information Technology)

Banking, Financial Services, and Insurance (BFSI) Sector

Educational Institutions (Universities, Technical Schools)

Open-Source Software Developers

Investor and Venture Capitalist Firms

System Integrators and Network Solution Providers

Companies

India Linux Operating System Market Major Players

Canonical Ltd. (Ubuntu)

Red Hat, Inc.

SUSE

Oracle Corporation

IBM (LinuxONE)

Zorin OS

Manjaro Linux

PCLinuxOS

Endless OS

Arch Linux

Elementary OS

ClearOS

Deepin Linux

CentOS

Rocky Linux

Table of Contents

1. India Linux Operating System Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Linux Operating System Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Linux Operating System Market Analysis

3.1. Growth Drivers

3.1.1. Open-Source Adoption (Low-cost solutions, flexibility)

3.1.2. Rise in Digital Transformation (Public and Private Sectors)

3.1.3. Government Push for Open-Source Adoption (Digital India Initiative)

3.1.4. Expanding Cloud Infrastructure (Integration with Open-Source Platforms)

3.2. Market Challenges

3.2.1. Competition with Proprietary Systems (Microsoft Windows dominance)

3.2.2. Perceived Technical Complexity (User adaptation and learning curves)

3.2.3. Vendor Lock-In (Migration and transition challenges)

3.3. Opportunities

3.3.1. Cloud-Native Linux Deployments (Docker, Kubernetes integrations)

3.3.2. Rising Data Center Deployments (Preference for Linux-based systems)

3.3.3. Collaboration with Indian Tech Firms (Custom Linux distributions)

3.4. Trends

3.4.1. Increasing Usage in IoT Devices (Embedded Linux systems)

3.4.2. Linux for AI and Machine Learning (Growing developer communities)

3.4.3. Expansion of Linux in Edge Computing (Real-time Linux)

3.5. Government Regulations

3.5.1. Open-Source Software Policy (Indian government policies)

3.5.2. Data Localization Laws (FOSS preference in India)

3.5.3. Cybersecurity Regulations (Linux security standards)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Developers, Corporates, SMEs)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. India Linux Operating System Market Segmentation

4.1. By Distribution Type (In Value %)

4.1.1. Ubuntu

4.1.2. Fedora

4.1.3. Red Hat Enterprise Linux (RHEL)

4.1.4. Debian

4.1.5. CentOS

4.2. By End-User Industry (In Value %)

4.2.1. IT & Telecommunication

4.2.2. Government

4.2.3. Education

4.2.4. Banking, Financial Services, and Insurance (BFSI)

4.2.5. Retail & E-Commerce

4.3. By Deployment Mode (In Value %)

4.3.1. On-Premise

4.3.2. Cloud-Based

4.4. By Enterprise Size (In Value %)

4.4.1. Small and Medium Enterprises (SMEs)

4.4.2. Large Enterprises

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Linux Operating System Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Canonical Ltd. (Ubuntu)

5.1.2. Red Hat, Inc.

5.1.3. SUSE

5.1.4. Oracle Corporation

5.1.5. IBM Corporation

5.1.6. Zorin OS

5.1.7. Manjaro Linux

5.1.8. PCLinuxOS

5.1.9. Endless OS

5.1.10. Arch Linux

5.1.11. Elementary OS

5.1.12. ClearOS

5.1.13. Deepin Linux

5.1.14. CentOS

5.1.15. Rocky Linux

5.2. Cross Comparison Parameters (Market Capitalization, Customer Base, License Type, Headquarters, Key Partnerships, Developer Community Size, Adoption Rate, Pricing Model)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Linux Operating System Market Regulatory Framework

6.1. Open-Source Licensing Regulations (GPL, MIT, Apache)

6.2. Software Compliance Requirements (Security patches, Support)

6.3. Data Protection and Privacy Laws (Implications for Linux OS)

7. India Linux Operating System Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Linux Operating System Future Market Segmentation

8.1. By Distribution Type (In Value %)

8.2. By End-User Industry (In Value %)

8.3. By Deployment Mode (In Value %)

8.4. By Enterprise Size (In Value %)

8.5. By Region (In Value %)

9. India Linux Operating System Market Analyst's Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research process began with the identification of critical variables affecting the India Linux Operating System Market. This involved constructing a comprehensive ecosystem map, which included open-source developers, enterprise users, and government stakeholders.

Step 2: Market Analysis and Construction

In this phase, historical data was analyzed to assess the penetration of Linux in different industries and its rate of adoption. Additionally, industry reports and government publications were referenced to provide accurate financial estimates for the Linux OS market.

Step 3: Hypothesis Validation and Expert Consultation

Market experts from the IT and telecommunications industries were consulted through interviews to validate our research hypotheses. These interviews provided valuable insights regarding operational trends, growth drivers, and market challenges.

Step 4: Research Synthesis and Final Output

Data gathered from both primary and secondary research was synthesized to produce a comprehensive analysis of the market. This phase involved verification of Linux's growth trajectory using both top-down and bottom-up approaches.

Frequently Asked Questions

01. How big is India Linux Operating System Market?

The India Linux Operating System market was valued at USD 540 million, with growth driven by its increased use in IT and telecommunications, government projects, and cloud applications.

02. What are the challenges in India Linux Operating System Market?

Key challenges include competition with proprietary systems such as Microsoft Windows, and the technical complexity associated with Linux deployments, especially for organizations without dedicated IT resources.

03. Who are the major players in the India Linux Operating System Market?

Major players include Canonical Ltd., Red Hat, SUSE, Oracle Corporation, and IBM, which dominate due to their enterprise offerings, partnerships, and established developer ecosystems.

04. What are the growth drivers of India Linux Operating System Market?

Growth drivers include increased adoption of open-source software, government initiatives promoting open-source solutions, and the rising use of Linux in cloud computing and data centers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.