India Liver Health Supplements Market Outlook to 2030

Region:Asia

Author(s):Shreya

Product Code:KROD5743

December 2024

97

About the Report

India Liver Health Supplements Market Overview

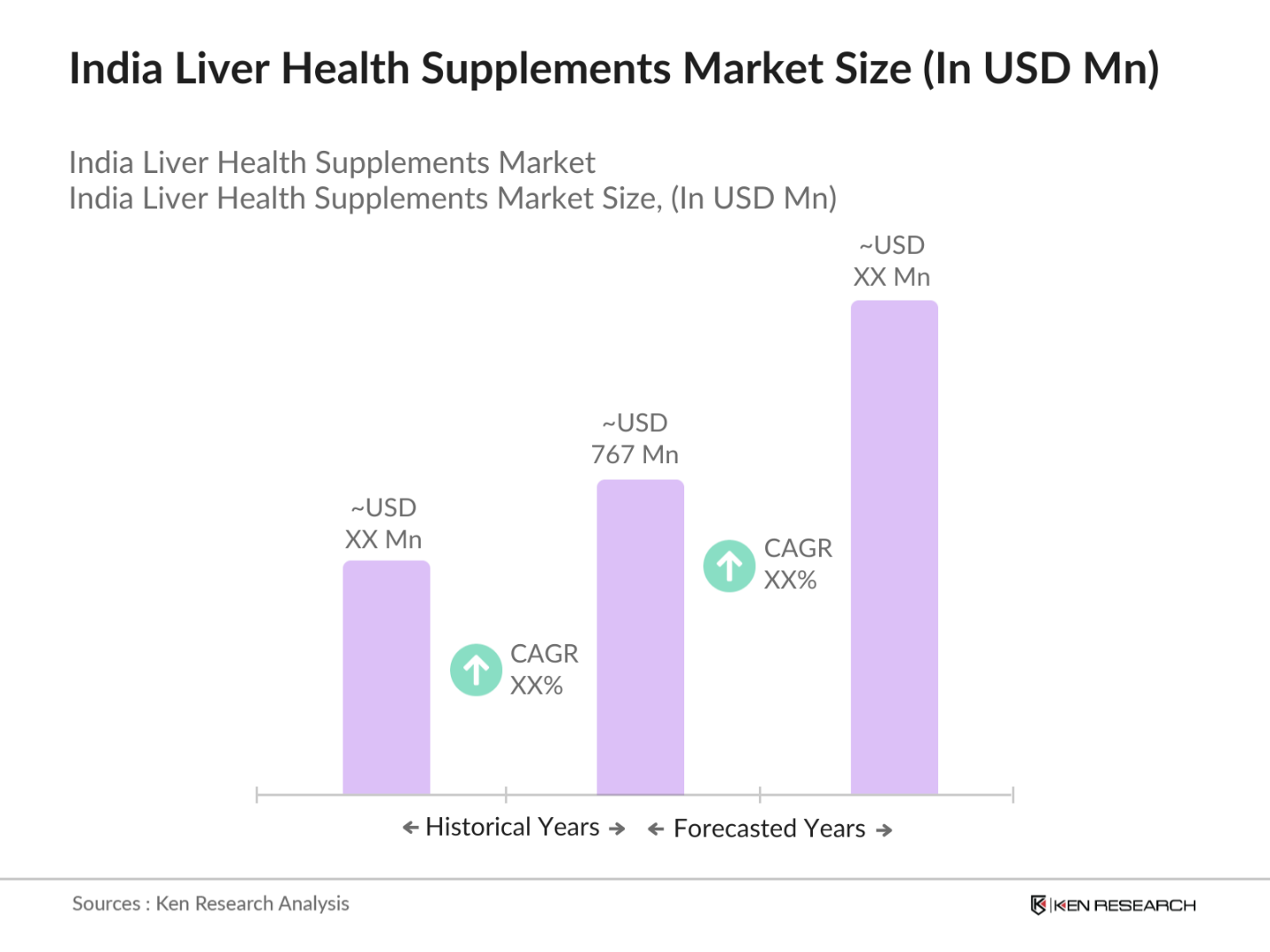

- The India liver health supplements market is valued at USD 767 million, based on a five-year historical analysis. This growth is primarily driven by the increasing prevalence of liver diseases, rising health consciousness among consumers, and a surge in alcohol consumption. Additionally, the expanding geriatric population and the growing trend of preventive healthcare contribute to the market's expansion.

- Major metropolitan areas such as Mumbai, Delhi, and Bangalore dominate the market. This dominance is attributed to higher health awareness, greater disposable incomes, and better access to healthcare facilities in these cities. The urban population's inclination towards preventive health measures and the availability of a wide range of supplements further bolster the market in these regions.

- The Food Safety and Standards Authority of India (FSSAI) sets regulations for dietary supplements, including liver health products. Manufacturers must comply with labeling, safety, and efficacy standards to ensure consumer protection.

India Liver Health Supplements Market Segmentation

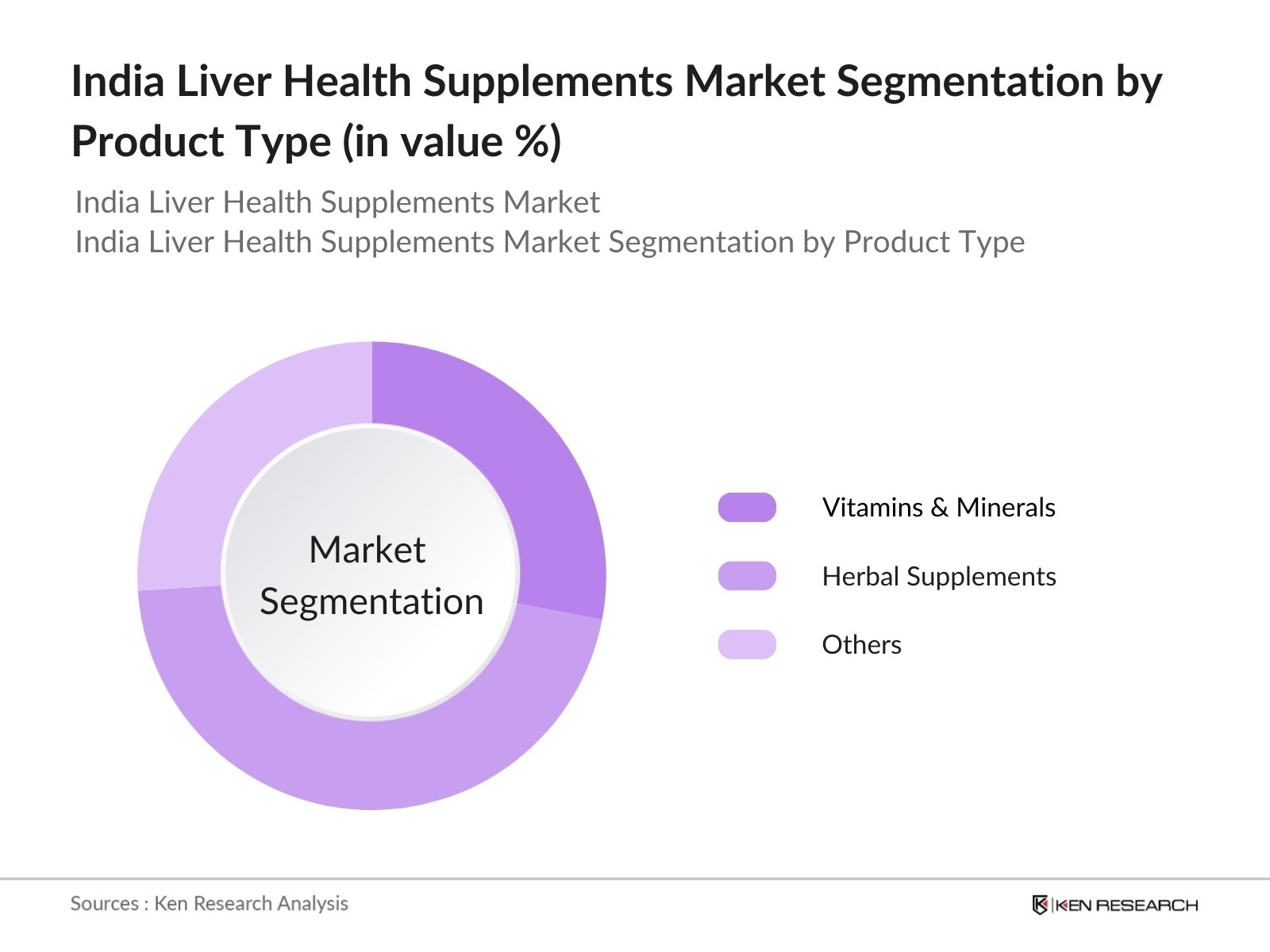

By Product Type: The market is segmented by product type into vitamins & minerals, herbal supplements, and others. Recently, herbal supplements have a dominant market share in India under the segmentation product type. This is due to the increasing consumer preference for natural and organic products, coupled with the traditional use of herbs in Indian medicine. Herbal supplements are perceived as safer alternatives with fewer side effects, leading to their widespread acceptance.

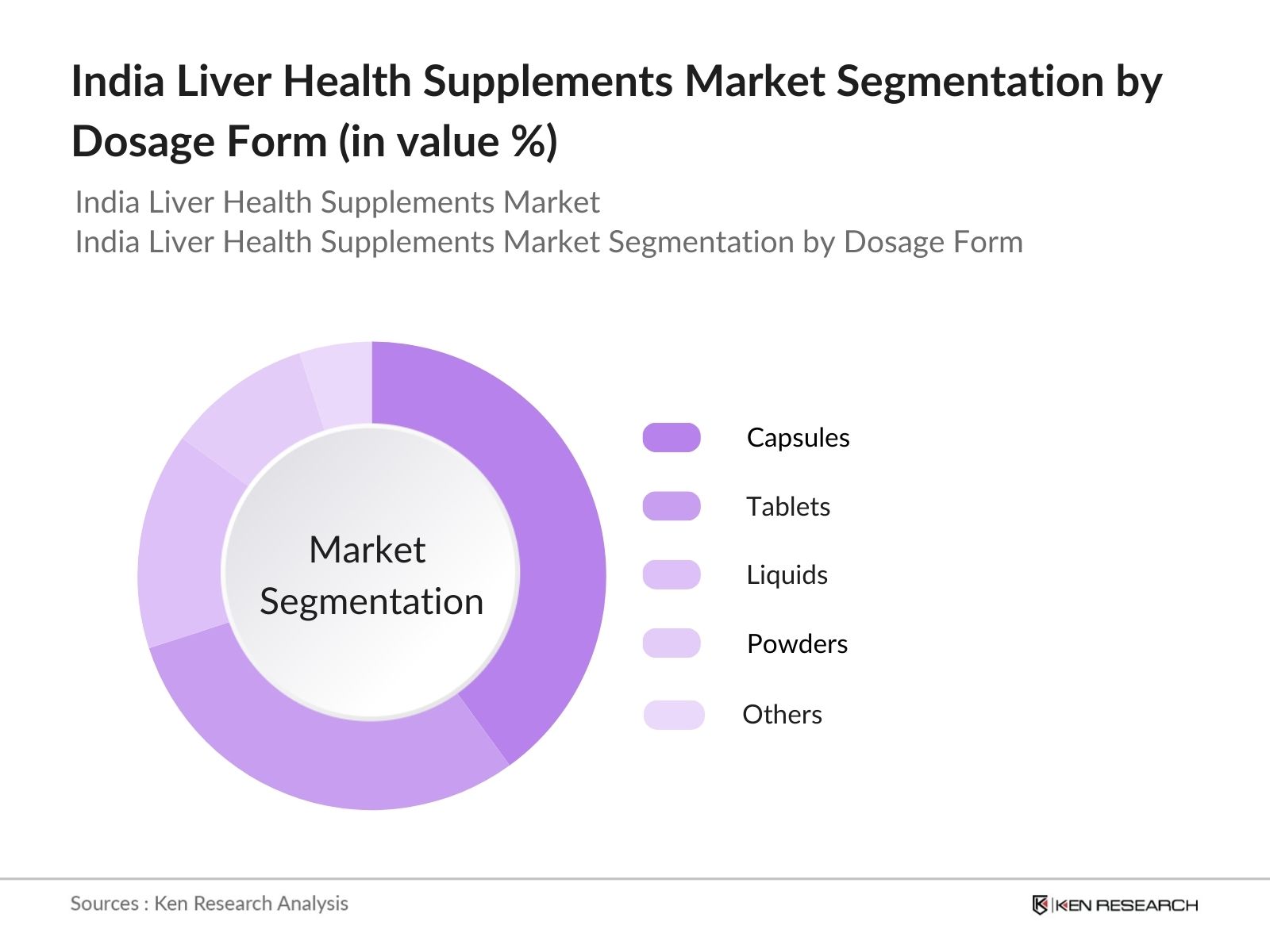

By Dosage Form: The market is also segmented by dosage form into capsules, tablets, liquids, powders, and others. Capsules hold the largest market share in this category. Their popularity stems from ease of consumption, precise dosage, and better bioavailability. Consumers often prefer capsules over other forms due to their convenience and the ability to mask unpleasant tastes associated with certain supplements.

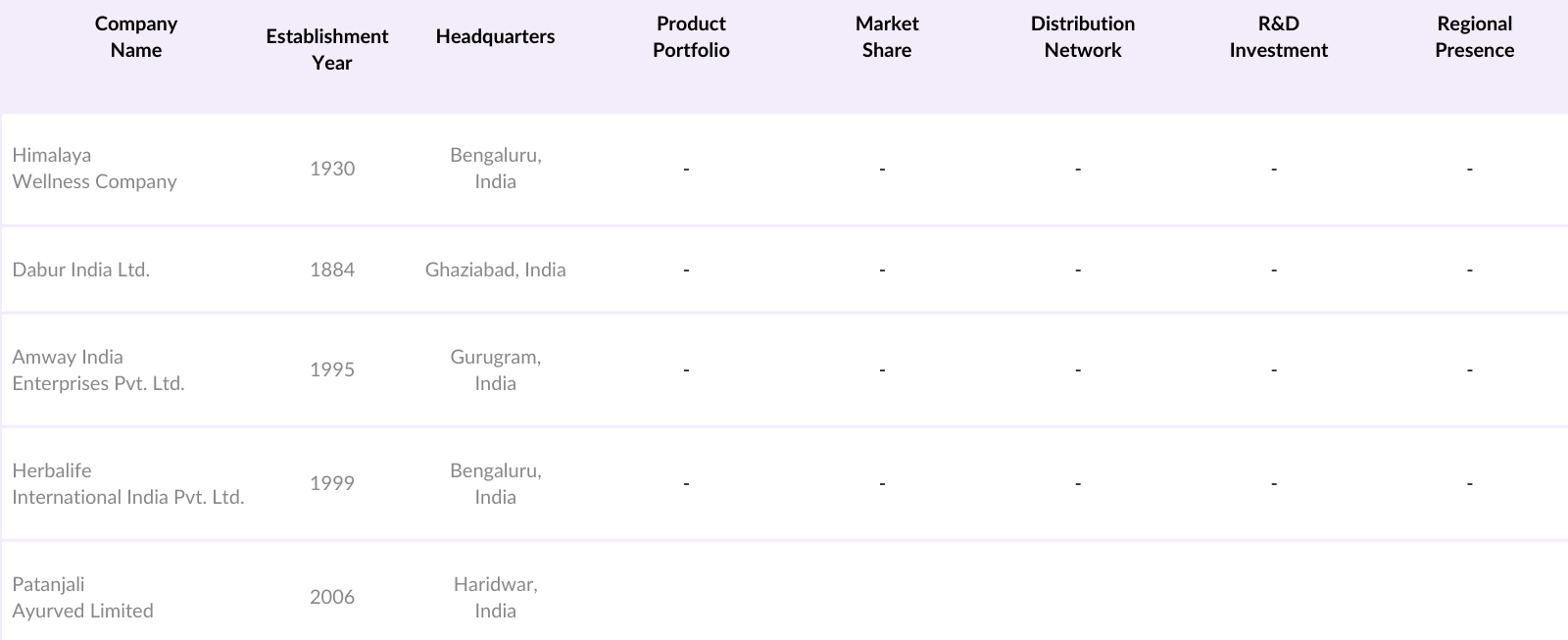

India Liver Health Supplements Market Competitive Landscape

The India liver health supplements market is characterized by the presence of several key players, both domestic and international. This competitive landscape is marked by continuous product innovation, strategic partnerships, and extensive marketing campaigns aimed at capturing a larger market share.

India Liver Health Supplements Industry Analysis

Growth Drivers

- Rising Prevalence of Liver Diseases: India has witnessed a significant increase in liver disease cases. In 2016, gastrointestinal and liver diseases accounted for approximately 490 million cases, with infectious diseases contributing to 454 million of these. Notably, liver cirrhosis and other chronic liver diseases were among the leading causes of mortality, highlighting the escalating health burden.

- Expanding Geriatric Population: India's elderly population is growing rapidly. As of 2021, there were over 138 million individuals aged 60 and above, representing a significant portion of the population. This demographic is more susceptible to liver-related ailments, thereby increasing the demand for liver health supplements.

- Surge in Alcohol Consumption: Alcohol consumption in India has been on the rise. In 2020, the country consumed about five billion liters of alcoholic beverages, with projections estimating an increase to approximately 6.21 billion liters by 2024. This surge contributes to a higher incidence of alcohol-related liver diseases, driving the need for liver health supplements.

Market Challenges

- Regulatory Hurdles: The liver health supplements market in India faces stringent regulations. The Food Safety and Standards Authority of India (FSSAI) oversees the approval and quality standards of dietary supplements, which can be a complex and time-consuming process for manufacturers.

- High Product Costs: The cost of liver health supplements remains a barrier for many consumers. Factors such as import duties on raw materials and the expenses associated with maintaining quality standards contribute to higher prices, limiting accessibility for a broader population.

India Liver Health Supplements Market Future Outlook

Over the next five years, the India liver health supplements market is expected to show significant growth driven by continuous consumer awareness, advancements in supplement formulations, and increasing demand for preventive healthcare solutions. The trend towards natural and herbal products is anticipated to continue, with companies focusing on product innovation and expanding their distribution networks to reach a broader audience. Additionally, the rise of e-commerce platforms is likely to play a crucial role in the market's expansion, providing consumers with easier access to a variety of products.

Future Market Opportunities

- Growth in E-commerce Platforms: The expansion of e-commerce in India offers a significant opportunity for liver health supplement manufacturers. With over 700 million internet users as of 2021, online platforms provide a vast market for reaching health-conscious consumers, facilitating wider distribution and accessibility.

- Introduction of Herbal and Natural Supplements: There is a growing preference for herbal and natural products among Indian consumers. The traditional use of Ayurvedic medicine in India supports the acceptance of herbal liver health supplements, presenting an opportunity for manufacturers to cater to this demand.

Scope of the Report

|

Product Type |

- Vitamins & Minerals |

|

Dosage Form |

- Capsules |

|

Distribution Channel |

- Hospital Pharmacies |

|

Nature |

- Organic |

|

Region |

- North |

Products

Key Target Audience

Nutraceutical Manufacturers

Pharmaceutical Companies

Healthcare Providers

Retail Pharmacies

Online Retailers

Government and Regulatory Bodies (e.g., FSSAI)

Investors and Venture Capitalist Firms

Research and Development Organizations

Companies

Major Players in the Market

Himalaya Wellness Company

Dabur India Ltd.

Amway India Enterprises Pvt. Ltd.

Herbalife International India Pvt. Ltd.

Patanjali Ayurved Limited

Abbott India Ltd.

Sanofi India Limited

GlaxoSmithKline Pharmaceuticals Ltd.

Sun Pharmaceutical Industries Ltd.

Lupin Limited

Zydus Wellness Ltd.

Baidyanath Group

Charak Pharma Pvt. Ltd.

Organic India Pvt. Ltd.

Hamdard Laboratories

Table of Contents

India Liver Health Supplements Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

India Liver Health Supplements Market Size (In USD Million)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

India Liver Health Supplements Market Analysis

3.1. Growth Drivers

3.1.1. Rising Prevalence of Liver Diseases

3.1.2. Increasing Health Consciousness

3.1.3. Expanding Geriatric Population

3.1.4. Surge in Alcohol Consumption

3.2. Market Challenges

3.2.1. Regulatory Hurdles

3.2.2. High Product Costs

3.2.3. Limited Consumer Awareness

3.3. Opportunities

3.3.1. Growth in E-commerce Platforms

3.3.2. Introduction of Herbal and Natural Supplements

3.3.3. Strategic Collaborations and Partnerships

3.4. Trends

3.4.1. Preference for Organic Products

3.4.2. Technological Advancements in Supplement Formulation

3.4.3. Personalized Nutrition Solutions

3.5. Government Regulations

3.5.1. FSSAI Guidelines

3.5.2. Import and Export Policies

3.5.3. Compliance and Certification Requirements

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

India Liver Health Supplements Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Vitamins & Minerals

4.1.2. Herbal Supplements

4.1.3. Others

4.2. By Dosage Form (In Value %)

4.2.1. Capsules

4.2.2. Tablets

4.2.3. Liquids

4.2.4. Powders

4.2.5. Others

4.3. By Distribution Channel (In Value %)

4.3.1. Hospital Pharmacies

4.3.2. Retail Pharmacies

4.3.3. Online Pharmacies

4.4. By Nature (In Value %)

4.4.1. Organic

4.4.2. Conventional

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

India Liver Health Supplements Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Himalaya Wellness Company

5.1.2. Dabur India Ltd.

5.1.3. Amway India Enterprises Pvt. Ltd.

5.1.4. Herbalife International India Pvt. Ltd.

5.1.5. Patanjali Ayurved Limited

5.1.6. Abbott India Ltd.

5.1.7. Sanofi India Limited

5.1.8. GlaxoSmithKline Pharmaceuticals Ltd.

5.1.9. Sun Pharmaceutical Industries Ltd.

5.1.10. Lupin Limited

5.1.11. Zydus Wellness Ltd.

5.1.12. Baidyanath Group

5.1.13. Charak Pharma Pvt. Ltd.

5.1.14. Organic India Pvt. Ltd.

5.1.15. Hamdard Laboratories

5.2. Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, Distribution Network, R&D Investment, Regional Presence, Strategic Initiatives, Brand Recognition)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

India Liver Health Supplements Market Regulatory Framework

6.1. FSSAI Standards and Regulations

6.2. Compliance Requirements

6.3. Certification Processes

India Liver Health Supplements Future Market Size (In USD Million)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

India Liver Health Supplements Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Dosage Form (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Nature (In Value %)

8.5. By Region (In Value %)

India Liver Health Supplements Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Liver Health Supplements Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the India Liver Health Supplements Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple supplement manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India Liver Health Supplements market.

Frequently Asked Questions

01. How big is the India Liver Health Supplements Market?

The India liver health supplements market is valued at USD 767 million, based on a five-year historical analysis.

02. What are the challenges in the India Liver Health Supplements Market?

Challenges in the India liver health supplements market include regulatory hurdles, high product costs, and limited consumer awareness about liver health supplements. Additionally, competition from unregulated local products poses a threat to market growth.

03. Who are the major players in the India Liver Health Supplements Market?

Key players in the India liver health supplements market include Himalaya Wellness Company, Dabur India Ltd., Amway India Enterprises Pvt. Ltd., Patanjali Ayurved Limited, and Herbalife International India Pvt. Ltd. These companies dominate due to their established distribution networks, trusted brand names, and a strong focus on natural and herbal formulations.

04. What are the growth drivers of the India Liver Health Supplements Market?

The market is propelled by increasing awareness of liver health, a rise in liver diseases, and growing consumer interest in preventive healthcare. Additionally, the preference for natural and herbal products among Indian consumers supports the growth of the liver health supplements market.

05. Which segment holds the largest share in the India Liver Health Supplements Market?

Herbal supplements hold the largest share in the India liver health supplements market, driven by a preference for natural remedies, which aligns with traditional Indian medicine practices. This trend is further supported by the presence of well-established herbal product brands.

06. What is the future outlook for the India Liver Health Supplements Market?

The India liver health supplements market is anticipated to witness growth due to increased health awareness, advancements in supplement formulations, and the expansion of e-commerce platforms, making liver health supplements more accessible to a broader consumer base.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.