India Logistics Market Outlook to 2030

Region:Asia

Author(s):Shreya

Product Code:KROD3339

November 2024

100

About the Report

India Logistics Market Overview

The India logistics market is valued at USD 282 Billion, driven by the rapid growth of e-commerce, expansion of retail, and government initiatives such as the National Logistics Policy (NLP). This comprehensive framework aims to improve logistics infrastructure, reduce the cost of logistics from 13-14% of GDP to 8%, and enhance India's trade competitiveness. Significant investments in multi-modal transportation, warehousing, and last-mile connectivity are playing key roles in the markets expansion, especially as the country positions itself as a global manufacturing hub.

Major cities such as Mumbai, Delhi, Bengaluru, and Chennai dominate the logistics market due to their robust infrastructure, proximity to ports, and high levels of industrialization. These cities act as gateways for both domestic and international trade. Mumbais proximity to Jawaharlal Nehru Port Trust (JNPT) and Delhis strategic position near the NCR region have further enhanced their dominance. Additionally, Bengalurus thriving tech industry and Chennais automotive sector contribute to their significance in the logistics sector.

The National Logistics Policy, introduced in 2022, is aimed at reducing logistics costs, improving supply chain efficiency, and promoting sustainable growth in the logistics sector. It provides a framework for building an integrated logistics ecosystem by focusing on reducing inefficiencies in freight movement, improving last-mile connectivity, and enhancing multi-modal transport. By 2024, it is expected to streamline operations across all logistics sub-sectors, saving 6 lakh crores annually.

India Logistics Market Segmentation

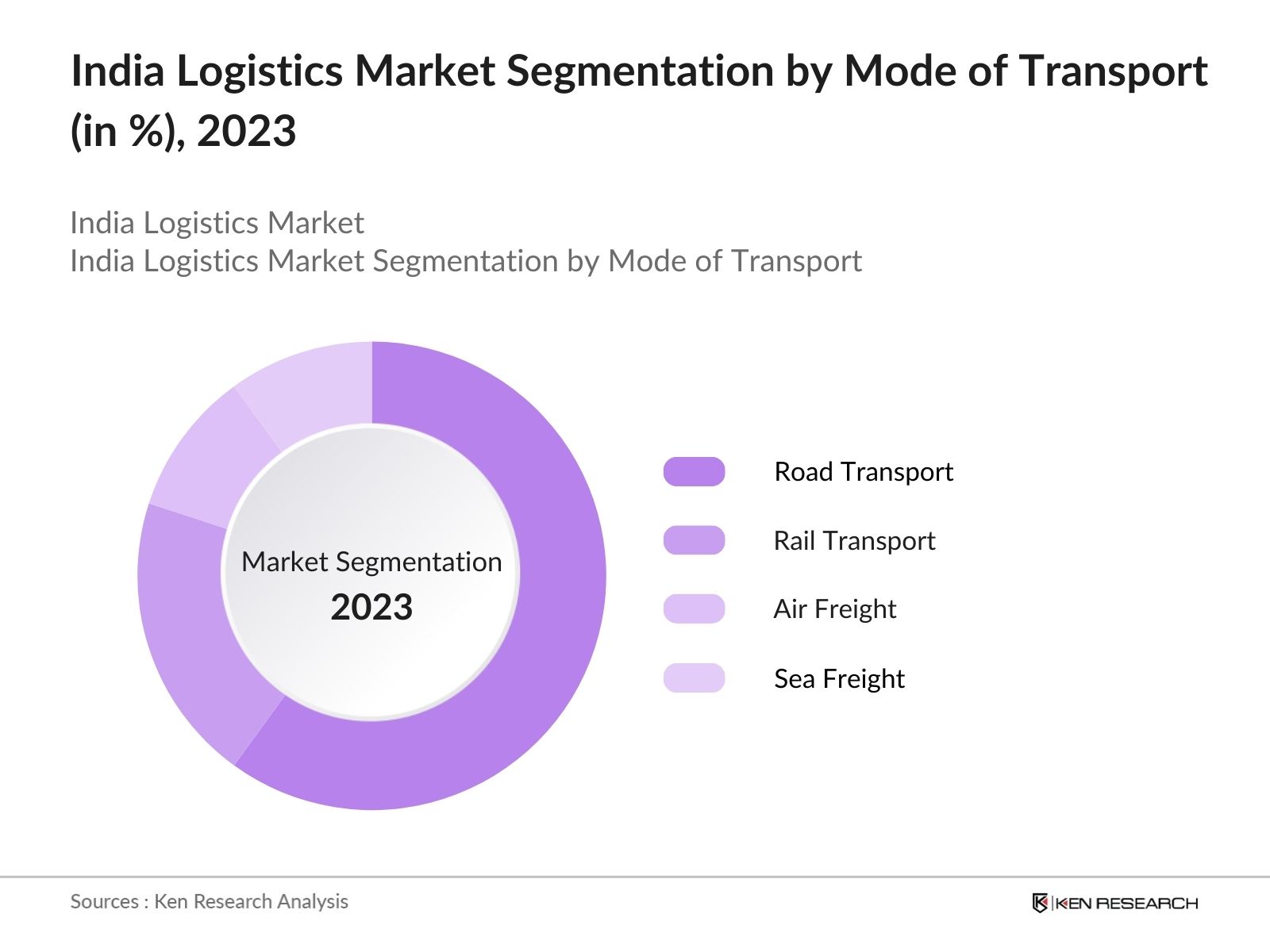

By Mode of Transport: The market is segmented by mode of transport into road, rail, air freight, and sea freight. Among these, road transport holds the dominant market share, primarily due to its flexibility, reach, and the fact that over 60% of India's freight moves by road. The road transport segment benefits from the governments ongoing investments in road infrastructure, including projects such as the Bharatmala project, which aims to enhance road connectivity across the country. Additionally, the high level of informal logistics players contributes to the segment's market share dominance.

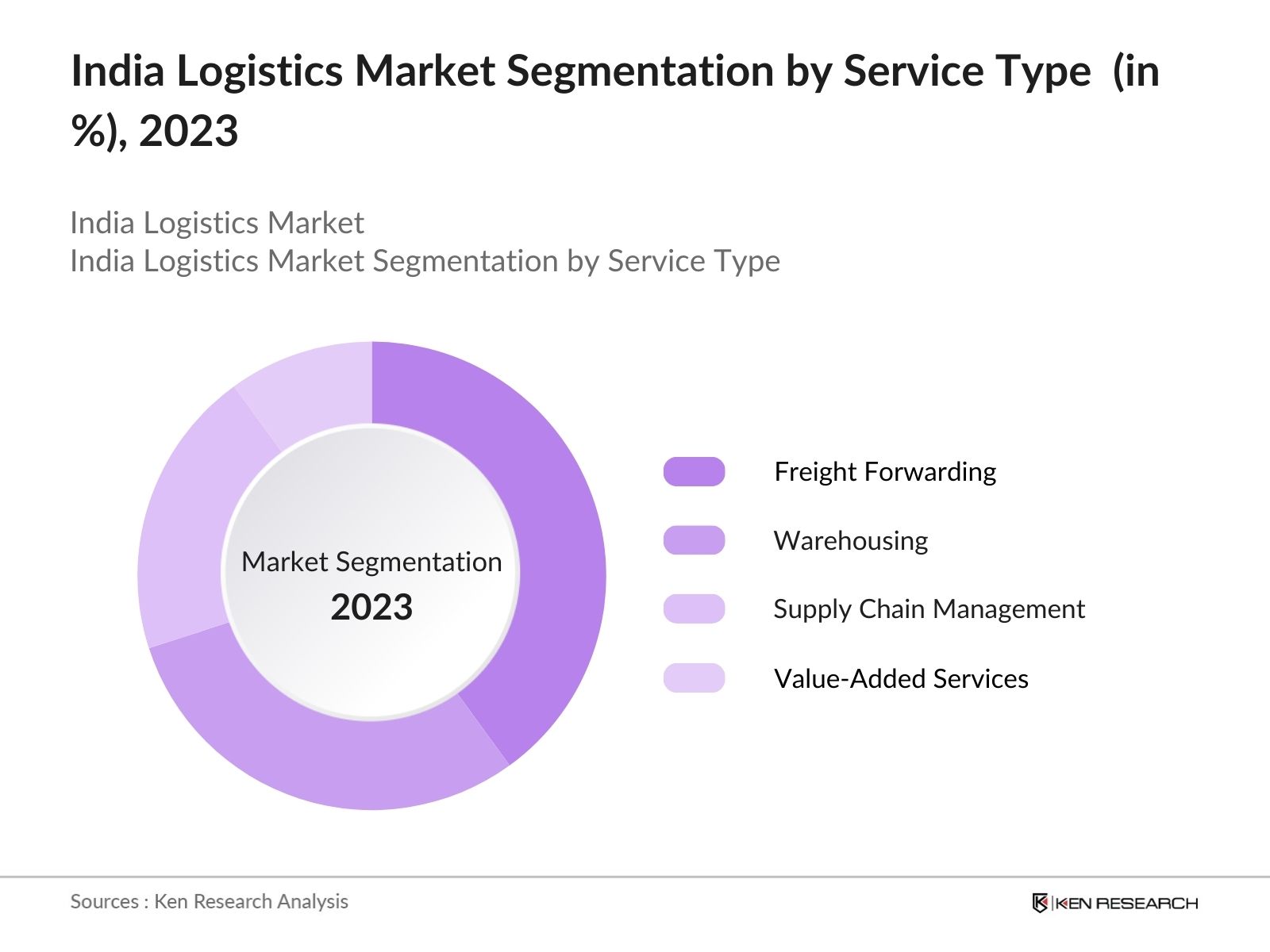

By Service Type: The market is further segmented by service type into freight forwarding, warehousing, supply chain management, and value-added services such as packaging and labeling. Freight forwarding dominates the service type segmentation, driven by the increasing complexity of logistics solutions required by various industries. With India's growing participation in global trade, freight forwarders play a critical role in ensuring smooth cross-border movements of goods. Leading companies in this segment are continuously improving their service portfolios through technology adoption, contributing to the segment's growth.

India Logistics Market Competitive Landscape

The India logistics market is highly competitive, with a mix of domestic and international players. These companies are investing heavily in technology and infrastructure to improve efficiency, lower costs, and cater to the evolving needs of industries such as e-commerce, automotive, and retail. The market is dominated by a few major players, including Blue Dart Express Ltd., Allcargo Logistics, and Gati Ltd., among others. Their dominance can be attributed to established infrastructure, extensive service portfolios, and significant capital investments in technology, including AI-driven logistics and automation in warehousing.

|

Company Name |

Established Year |

Headquarters |

Fleet Size |

No. of Warehouses |

Annual Revenue (INR) |

Technology Adoption |

Regions Covered |

Service Types |

Key Clients |

|---|---|---|---|---|---|---|---|---|---|

|

Blue Dart Express Ltd. |

1983 |

Mumbai |

|||||||

|

Allcargo Logistics |

1993 |

Mumbai |

|||||||

|

Gati Ltd. |

1989 |

Hyderabad |

|||||||

|

Delhivery Ltd. |

2011 |

Gurugram |

|||||||

|

Mahindra Logistics |

2000 |

Mumbai |

India Logistics Industry Analysis

Growth Drivers

Rapid E-commerce Growth: Indias e-commerce market is expanding rapidly, leading to a significant increase in logistics demand. With over 1.3 billion people, the penetration of online retail has surged. The number of online buyers is expected to reach over 500 million by the end of 2024. This massive growth in e-commerce is creating higher demand for efficient logistics solutions. According to India Post, the number of parcels handled in the country increased by 25% in 2023, with projections of further growth. This expansion places additional pressure on logistics firms to optimize delivery systems across the country.

Infrastructure Expansion: Indias logistics infrastructure is undergoing major upgrades, including the Sagarmala initiative, which aims to modernize over 574 ports. In 2023 alone, the Indian government approved 56 projects, worth 5,500 crores, to improve port infrastructure. Additionally, the Bharatmala Pariyojana project targets the construction of 65,000 km of highways by 2025. Improved road networks and upgraded ports will streamline freight movement across India, further driving the growth of the logistics sector. Railways are also expanding freight corridors with an expected 40% increase in capacity by 2025.

Increased Demand for Cold Chain Logistics: India's cold chain logistics sector is experiencing rapid growth, driven by demand in the pharmaceutical, agriculture, and FMCG sectors. In 2024, India's cold chain market is expected to have over 40 million metric tonnes of cold storage capacity, with significant investments into temperature-controlled logistics. With the pharmaceutical sector worth 1.5 trillion and perishable agricultural exports rising to $5.2 billion in 2023, cold chain logistics is becoming vital for maintaining the integrity of goods. This demand is leading to more robust cold chain networks across India.

Market Challenges

Complex Regulatory Environment: Indias logistics sector faces significant challenges due to its fragmented regulatory landscape, including state-level taxes and complex multi-modal policies. Despite the introduction of GST, which improved interstate movement, there are still discrepancies in regional taxation and compliance requirements. In 2023, the World Bank's Logistics Performance Index ranked India 38th, citing regulatory inefficiencies as a major hindrance to improving supply chain performance. Multiple clearances for cross-border and multi-modal transport remain barriers to seamless logistics in India.

Fragmented Market Structure: India's logistics market is fragmented, with over 80% of the sector operated by unorganized players. The lack of integration among regional logistics providers leads to inefficiencies in delivery times and costs. Regional disparities in infrastructure, particularly in rural areas, further complicate logistics operations. In 2023, the Indian logistics sector employed over 22 million people, yet over 70% of these workers operate in the unorganized sector, reducing standardization and contributing to delays and cost overruns.

India Logistics Market Future Outlook

Over the next five years, the India logistics market is expected to witness substantial growth driven by government initiatives, continued infrastructure development, and the rise of e-commerce. With the National Logistics Policy in place, the logistics sector will experience greater efficiency, cost reductions, and improved international trade. Moreover, advancements in logistics technology, such as AI, automation, and blockchain, will continue to shape the market's future. Additionally, the development of dedicated freight corridors and multi-modal logistics hubs is expected to enhance operational efficiency across the country.

Future Market Opportunities

Adoption of Technology: The logistics sector is embracing technological advancements like AI, automation, and blockchain to optimize supply chain management. AI-driven solutions for route optimization, coupled with automation in warehousing, have the potential to increase productivity by 20-25%. Blockchain technology is also gaining traction for enhancing transparency and reducing fraud in freight management. In 2023, India witnessed an increase in AI-based logistics startups, with over 300 new companies developing solutions for supply chain management. These technologies offer an opportunity for Indias logistics market to enhance efficiency and reduce operational costs.

Expansion of Warehousing Capacity: Indias warehousing sector is expanding at a fast pace, driven by demand from e-commerce and retail. In 2023, India had over 265 million sq. ft. of warehousing space, a figure expected to grow by 50% by 2025. Smart warehousing solutions, which include IoT-based systems, are being adopted for better inventory management. Additionally, green logistics is gaining importance, with more companies investing in eco-friendly warehousing solutions. The rise of solar-powered warehouses is helping logistics firms reduce their carbon footprint while enhancing operational efficiency.

Vertical Table for Segmentation

|

Segment |

Sub-Segments |

|

Mode of Transport |

Road Transport Rail Transport Air Freight Sea Freight |

|

Service Type |

Freight Forwarding Warehousing Value-added Services Supply Chain Management |

|

End-User Industry |

Retail, Manufacturing Healthcare & Pharmaceuticals FMCG Automotive |

|

Region |

North South West East |

Major Players in the India Logistics Market

- Blue Dart Express Ltd.

- Allcargo Logistics

- Gati Ltd.

- Delhivery Ltd.

- Mahindra Logistics

- VRL Logistics Ltd.

- Snowman Logistics

- Transport Corporation of India (TCI)

- Safexpress Pvt. Ltd.

- DHL Express India

- DTDC Express Ltd.

- Rivigo Services Pvt. Ltd.

- TVS Supply Chain Solutions

- Ecom Express

- Future Supply Chain Solutions

Products

Key Target Audience

Logistics service providers

E-commerce companies

Automotive manufacturers

Retail chains

Banks and Financial Institutes

FMCG companies

Government and regulatory bodies (Ministry of Road Transport and Highways, Ministry of Commerce and Industry)

Investments and venture capitalist firms

Warehousing and distribution companies

Table of Contents

1. India Logistics Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (Logistics Sector Growth, Economic Indicators)

1.4 Market Segmentation Overview

2. India Logistics Market Size (In INR Bn)

2.1 Historical Market Size (In Value and Volume)

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones (Infrastructure Developments, Policy Changes)

3. India Logistics Market Analysis

3.1 Growth Drivers

3.1.1 Rapid E-commerce Growth

3.1.2 Government Initiatives (National Logistics Policy, Gati Shakti)

3.1.3 Infrastructure Expansion (Port Development, Road Networks)

3.1.4 Increased Demand for Cold Chain Logistics

3.2 Market Challenges

3.2.1 High Fuel Costs

3.2.2 Complex Regulatory Environment (Taxation, Multi-modal Policies)

3.2.3 Fragmented Market Structure (Unorganized Players, Regional Disparities)

3.3 Opportunities

3.3.1 Adoption of Technology (AI, Automation, Blockchain)

3.3.2 Expansion of Warehousing Capacity (Smart Warehousing, Green Logistics)

3.3.3 Growth of 3PL and 4PL Providers

3.4 Trends

3.4.1 Multi-modal Logistics Integration (Road, Rail, Waterways)

3.4.2 Rise of E-commerce Fulfillment Centers

3.4.3 Shift towards Sustainability and Green Logistics

3.5 Government Regulations

3.5.1 National Logistics Policy Implementation

3.5.2 FDI Regulations in Logistics

3.5.3 GST Impact on Supply Chain Efficiency

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Shippers, Freight Forwarders, Customs)

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. India Logistics Market Segmentation

4.1 By Mode of Transport (In Value %)

4.1.1 Road Transport

4.1.2 Rail Transport

4.1.3 Air Freight

4.1.4 Sea Freight

4.2 By Service Type (In Value %)

4.2.1 Freight Forwarding

4.2.2 Warehousing

4.2.3 Value-added Services (Packaging, Labeling)

4.2.4 Supply Chain Management

4.3 By End-User Industry (In Value %)

4.3.1 Retail

4.3.2 Manufacturing

4.3.3 Healthcare & Pharmaceuticals

4.3.4 FMCG

4.3.5 Automotive

4.4 By Region (In Value %)

4.4.1 North India

4.4.2 South India

4.4.3 West India

4.4.4 East India

5. India Logistics Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1 Allcargo Logistics

5.1.2 Gati Ltd.

5.1.3 Blue Dart Express Ltd.

5.1.4 Transport Corporation of India (TCI)

5.1.5 Snowman Logistics

5.1.6 Mahindra Logistics

5.1.7 DHL Express India

5.1.8 Safexpress Pvt. Ltd.

5.1.9 VRL Logistics Ltd.

5.1.10 Delhivery Ltd.

5.1.11 DTDC Express Ltd.

5.1.12 Rivigo Services Pvt. Ltd.

5.1.13 TVS Supply Chain Solutions

5.1.14 Ecom Express

5.1.15 Future Supply Chain Solutions

5.2 Cross Comparison Parameters (Revenue, Fleet Size, No. of Warehouses, Technology Adoption, Headquarters, Market Share, Operational Regions, Value-added Services)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Partnerships, New Service Launches)

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

6. India Logistics Market Regulatory Framework

6.1 National Logistics Policy Guidelines

6.2 Compliance Requirements (Licensing, Permits)

6.3 GST and Taxation

6.4 Logistics Infrastructure Reforms

7. India Logistics Future Market Size (In INR Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. India Logistics Future Market Segmentation

8.1 By Mode of Transport (In Value %)

8.2 By Service Type (In Value %)

8.3 By End-User Industry (In Value %)

8.4 By Region (In Value %)

9. India Logistics Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase focuses on identifying key variables influencing the India logistics market, such as growth drivers, regulatory impacts, and supply chain efficiency. Extensive desk research was conducted, utilizing industry reports and government data to map out critical variables affecting market dynamics.

Step 2: Market Analysis and Construction

In this phase, we analyzed historical data related to logistics infrastructure, trade volumes, and market penetration. This involved the assessment of India's logistics cost, freight movement, and warehousing capacity, which were cross verified with government sources like the Ministry of Commerce and Industry.

Step 3: Hypothesis Validation and Expert Consultation

Through consultations with logistics experts and industry stakeholders, we validated market hypotheses. Interviews with key executives from major logistics companies provided insights into operational challenges and opportunities in the sector.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing data from various sources to deliver a comprehensive and validated market analysis. Direct engagement with logistics providers enabled the cross-verification of service trends, growth drivers, and technological advancements shaping the India logistics market.

Frequently Asked Questions

01. How big is the India Logistics Market?

The India logistics market is valued at USD 282 Billion, primarily driven by the expansion of e-commerce, retail, and government initiatives aimed at infrastructure development.

02. What are the challenges in the India Logistics Market?

Challenges in the India logistics market include high fuel costs, the fragmented nature of the logistics market, and inadequate infrastructure in rural areas, which hamper efficient goods movement.

03. Who are the major players in the India Logistics Market?

Key players in the India logistics market include Blue Dart Express Ltd., Gati Ltd., Allcargo Logistics, Delhivery Ltd., and Mahindra Logistics, all known for their vast network and advanced logistics solutions.

04. What are the growth drivers of the India Logistics Market?

Growth drivers in the India logistics market include government initiatives like the National Logistics Policy, increasing demand from the e-commerce sector, and significant investments in road and port infrastructure.

05. What are the trends in the India Logistics Market?

Key trends in the India logistics market include the rise of multi-modal logistics solutions, the adoption of AI and automation in supply chains, and the growing importance of sustainability and green logistics solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.