India Lubricant Market Outlook to 2030

Region:Asia

Author(s):Samanyu

Product Code:KROD5236

October 2024

91

About the Report

India Lubricant Market Overview

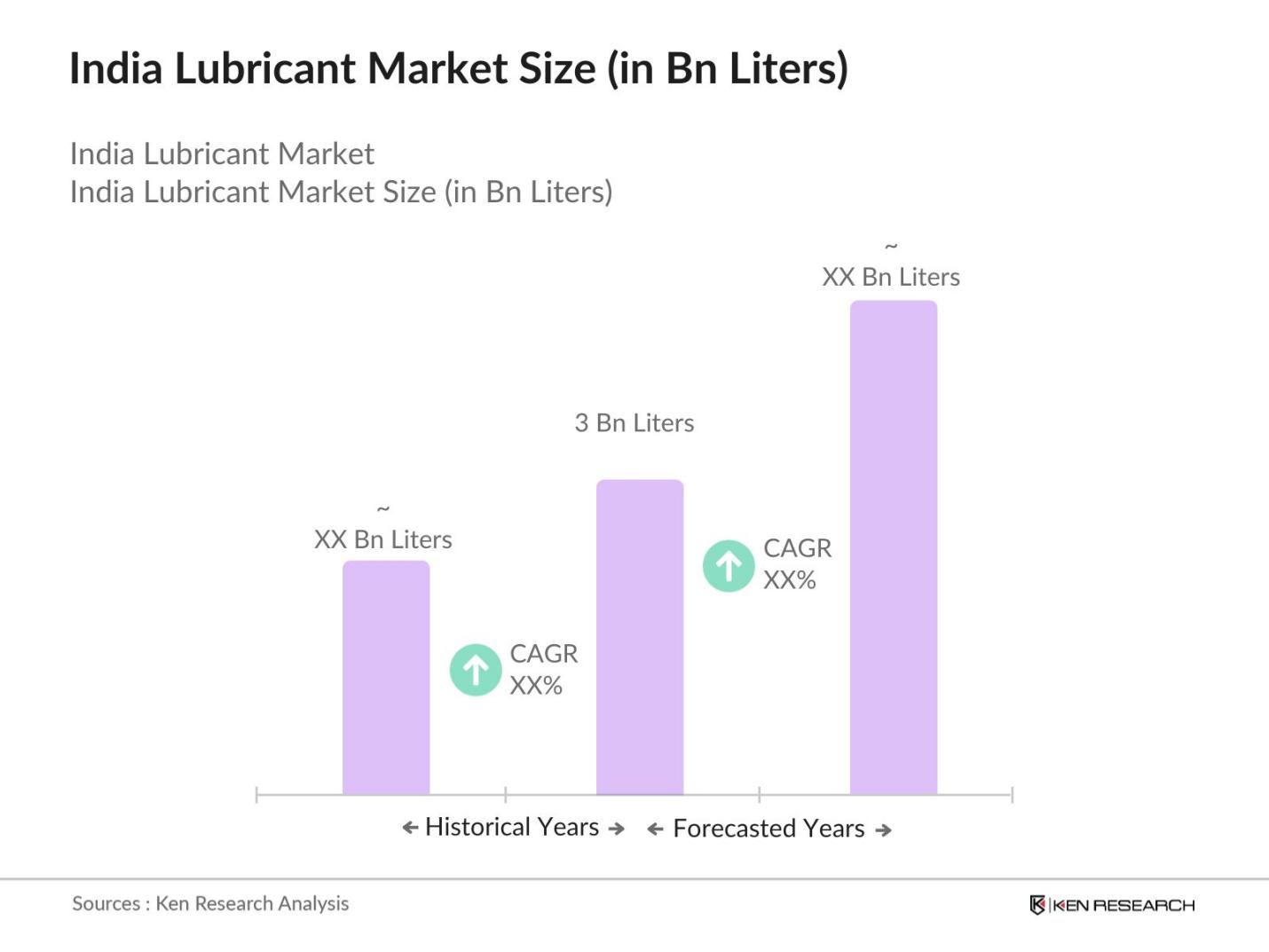

- The India Lubricant market is at 3 Bn Liters, driven by the rapid industrialization and expansion of the automotive sector. The demand for lubricants is bolstered by a growing consumer base, with a strong focus on enhancing the performance and longevity of vehicles and machinery. The rise of electric vehicles (EVs) and advancements in industrial automation further contribute to the demand for specialized lubricants. Based on historical trends, the lubricant market in India continues to expand as manufacturers seek higher efficiency and cost savings across various sectors.

- Dominant regions within India, including Mumbai, Delhi, and Gujarat, lead the lubricant market due to their strategic positioning in automotive and industrial hubs. Mumbai and Gujarat, with their developed ports and significant industrial presence, act as key distribution points for both domestic consumption and exports. Delhi, as the center of automotive activities, holds prominence due to its proximity to numerous OEMs and a vast service network. The concentration of industries in these regions makes them pivotal in sustaining lubricant demand.

- Indias shift to Bharat Stage VI (BS-VI) emission standards in 2020 brought the country on par with global emission norms. The BS-VI regulations have drastically reduced permissible emissions of nitrogen oxides and particulate matter in vehicles. This shift has necessitated the development of lubricants compatible with BS-VI engines, which demand low-sulfur and high-performance oils. The Central Pollution Control Board (CPCB) continues to monitor compliance, with the government planning stricter vehicle inspection programs by 2024 to enforce these standards. The new emission norms are driving innovation in the lubricant sector, pushing companies to develop cleaner, more efficient products.

India Lubricant Market Segmentation

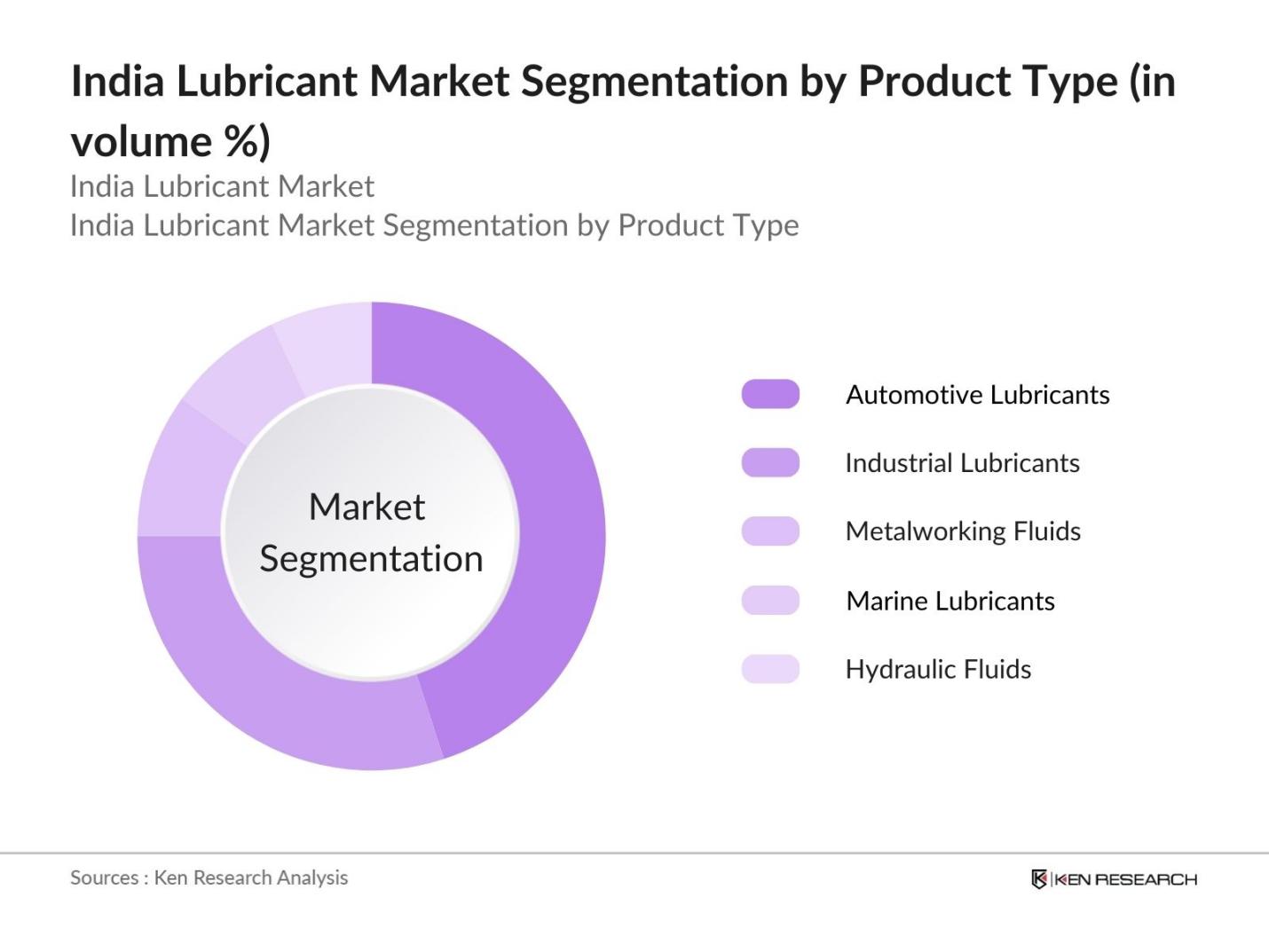

By Product Type: The market is segmented by product type into automotive lubricants, industrial lubricants, marine lubricants, metalworking fluids, and hydraulic fluids. Automotive lubricants dominate this segment, driven by Indias ever-expanding automotive industry and the increasing number of passenger vehicles on the roads. Within this segment, engine oils, particularly for two-wheelers and passenger cars, hold a leading position due to their regular use and replacement cycles. The rise in vehicle ownership, coupled with increased maintenance awareness, sustains the demand for high-performance automotive lubricants.

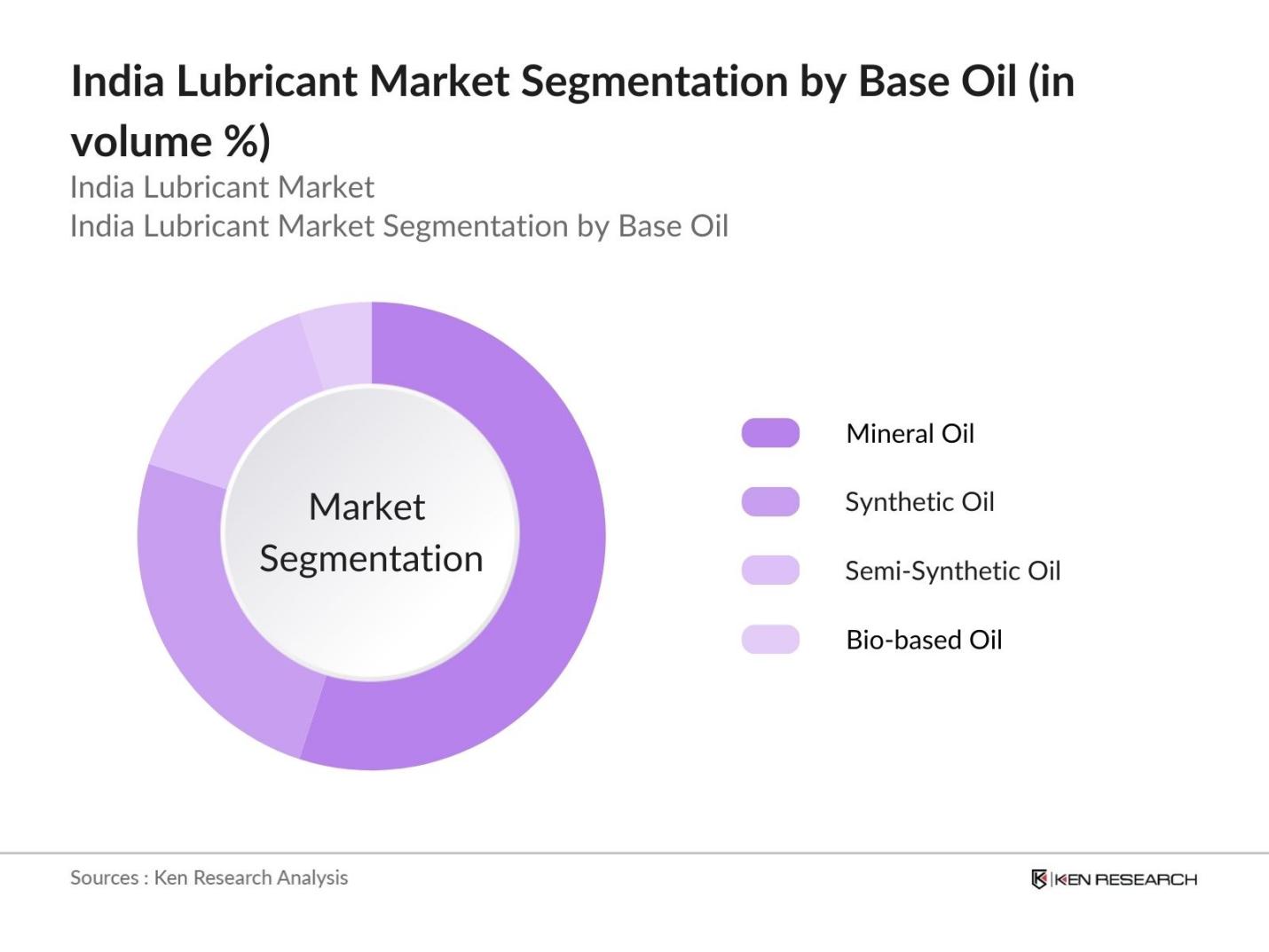

By Base Oil: The market is also segmented by base oil into mineral oil, synthetic oil, semi-synthetic oil, and bio-based oil. Mineral oils continue to dominate the Indian lubricant market, primarily due to their lower cost and widespread availability. Despite the shift towards synthetic and bio-based oils for higher efficiency, mineral oil remains the preferred choice for industrial and automotive applications, particularly in rural and price-sensitive areas. The affordability of mineral oil-based lubricants sustains their high demand in both automotive and industrial sectors.

India Lubricant Market Competitive Landscape

The India lubricant market is dominated by both domestic and international players. Large corporations like Indian Oil Corporation and Bharat Petroleum Corporation Limited leverage their extensive distribution networks to maintain a strong foothold. International players like Shell and ExxonMobil bring advanced technologies and premium products to the market, focusing on synthetic and high-performance lubricants.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Employees |

Key Product |

R&D Investment |

Key Clients |

Global Reach |

|

Indian Oil Corporation |

1959 |

New Delhi, India |

||||||

|

Bharat Petroleum Corporation |

1952 |

Mumbai, India |

||||||

|

Shell India Markets Pvt Ltd |

1907 |

Bengaluru, India |

||||||

|

Castrol India Limited |

1919 |

Mumbai, India |

||||||

|

ExxonMobil Lubricants Pvt Ltd |

1911 |

Gurugram, India |

India Lubricant Industry Analysis

Growth Drivers

-

Rising Demand in Automotive Sector: The Indian automotive sector, supported by government initiatives like the Production Linked Incentive (PLI) scheme, is a key driver for lubricant demand. With over 24 million vehicles manufactured in 2022, India is one of the largest automotive markets globally. The demand for lubricants in this sector is driven by the increased production of vehicles and the rising sales of passenger and commercial vehicles. The domestic vehicle fleet is also expected to exceed 250 million by 2024, necessitating more frequent oil changes, engine lubrication, and maintenance. The Society of Indian Automobile Manufacturers (SIAM) reported an annual increase in vehicle production, which directly correlates with lubricant consumption.

- Growth in Industrial Activities: India's industrial output is growing at a steady pace, driven by the governments push for infrastructure development and the "Make in India" initiative. In 2023, India generated approximately 1,500 terawatt-hours of electricity and saw a substantial increase in manufacturing output, with industrial production rising by 3.7% in the first half of the year (data from Indias Central Statistics Office). These sectors, particularly manufacturing and power generation, require large quantities of industrial lubricants, including greases and hydraulic fluids. The Indian construction industry is also booming, with over 6,000 km of highways constructed by mid-2024, further boosting lubricant demand.

- Increasing Awareness of Machinery Maintenance: Awareness of regular machinery maintenance and its impact on efficiency has grown significantly in Indias industrial sector. In 2023, India saw a 20% increase in maintenance budgets across key sectors like manufacturing, power generation, and automotive (data from the Indian National Productivity Council). Proper lubrication is critical to reducing downtime and enhancing operational efficiency in these industries, contributing to the rising consumption of lubricants. Companies are also adopting predictive maintenance technologies, driving demand for high-performance oils that extend the lifespan of equipment, further supported by government schemes aimed at promoting industrial efficiency.

Market Challenges

-

Volatile Raw Material Prices: The lubricant market is heavily reliant on base oils, which are derived from crude oil. Fluctuations in crude oil prices due to geopolitical tensions and production quotas have a direct impact on lubricant manufacturing costs. In 2023, the price of Brent crude ranged between $75 and $90 per barrel, influencing the cost of raw materials like base oils and additives. The volatility in raw material prices increases production costs for lubricant manufacturers and often leads to inconsistent pricing strategies. The Indian oil sector is particularly sensitive to international market conditions, further challenging profitability in the lubricant market.

- Availability of Substitutes: The growing availability and performance of synthetic and bio-based lubricants are influencing the market dynamics. India has seen a 5% increase in synthetic lubricant usage in the automotive and industrial sectors (Indian Oil Corporation data), as these alternatives offer better performance and longer service intervals. Bio-based lubricants, made from renewable resources, are also gaining traction due to their lower environmental impact. However, the higher upfront cost of these products, compared to conventional lubricants, deters price-sensitive consumers, thus limiting their widespread adoption despite government incentives for greener technologies.

India Lubricant Market Future Outlook

Over the next five years, the India lubricant market is expected to witness steady growth, driven by the expansion of the automotive and industrial sectors. Increased consumer awareness regarding fuel efficiency, enhanced vehicle performance, and regular maintenance practices will also contribute to market growth. The adoption of synthetic and bio-based lubricants is expected to rise, particularly as government regulations emphasize eco-friendly and sustainable solutions. The ongoing electrification of transportation and growth in the industrial automation sector will present new opportunities for lubricant manufacturers to innovate and diversify their product offerings.

Future Market Opportunities

-

Technological Innovations in Lubricants: Technological advancements in the lubricant sector present significant growth opportunities. In 2023, India began seeing the introduction of nano-lubricants, which offer superior friction reduction and wear protection. The use of nanoparticles in lubricants is expected to enhance performance in critical applications such as high-speed machinery and electric vehicles. Additionally, high-performance lubricants tailored for specific industrial and automotive applications are gaining prominence. For instance, advanced synthetic oils that can endure higher temperatures and pressures are becoming more popular in the aviation and defense sectors, where reliability is crucial.

- Increasing Demand for Synthetic and Bio-based Lubricants: The demand for synthetic and bio-based lubricants in India is growing, driven by their superior performance and lower environmental impact. As of 2023, bio-based lubricants accounted for about 4% of the total lubricant market, with their adoption supported by government policies promoting sustainable solutions. These lubricants offer longer life cycles, better thermal stability, and reduced emissions. Companies are increasingly investing in the development of bio-lubricants, driven by the growing focus on environmental sustainability and stringent emission regulations, which are expected to lead to increased market penetration of these alternatives.

Scope of the Report

|

By Product Type |

Automotive Lubricants Industrial Lubricants Marine Lubricants Metalworking Fluids Hydraulic Fluids |

|

By Base Oil |

Mineral Oil Synthetic Oil Semi-Synthetic Oil Bio-based Oil |

|

By Viscosity Grade |

Single Grade Multi Grade |

|

By Distribution Channel |

OEM Aftermarket E-Commerce |

|

By End-User |

Automotive Industrial Marine Aerospace Agriculture |

|

By Region |

North South East West |

Products

Key Target Audience

Automotive Manufacturers (OEMs)

Industrial Machinery Manufacturers

Marine & Shipping Companies

Power Generation Companies

Oil Refining Companies

Government and Regulatory Bodies (Ministry of Petroleum and Natural Gas, Bureau of Indian Standards)

Banks and Financial Institutes

Investments and Venture Capitalist Firms

Distribution and Retail Chains (Automotive Parts Retailers)

Companies

Players Mentioned in the Report:

Indian Oil Corporation

Bharat Petroleum Corporation

Castrol India Limited

Shell India Markets Pvt Ltd

ExxonMobil Lubricants Pvt Ltd

Valvoline Cummins Pvt Ltd

Gulf Oil Lubricants India Ltd

Total India

Hindustan Petroleum Corporation Limited

Apar Industries

Savita Oil Technologies

Tide Water Oil Co. India

Petronas Lubricants

Blaser Swisslube

Fuchs Lubricants

Table of Contents

1. India Lubricant Market Overview

1.1. Definition and Scope (Lubricant Types: Automotive, Industrial, Marine, etc.)

1.2. Market Taxonomy (Base Oil, Additives, End-user Applications, Distribution Channels)

1.3. Market Growth Rate (CAGR, Growth Drivers)

1.4. Market Segmentation Overview (Product Type, End-Use, Viscosity Grade, Base Oil, Distribution Channel)

2. India Lubricant Market Size (In USD Bn)

2.1. Historical Market Size (In USD Value, Volume in Kilotons)

2.2. Year-On-Year Growth Analysis (Consumption Trends, Revenue Growth)

2.3. Key Market Developments and Milestones (Product Innovations, Expansion Plans)

3. India Lubricant Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand in Automotive Sector

3.1.2. Growth in Industrial Activities (Manufacturing, Power Generation, Construction)

3.1.3. Increasing Awareness of Machinery Maintenance

3.1.4. Expansion in Automotive Aftermarket

3.2. Restraints

3.2.1. Environmental Concerns (Stringent Regulations, Disposal Issues)

3.2.2. Volatile Raw Material Prices (Crude Oil, Additives)

3.2.3. Availability of Substitutes (Synthetic Oils, Bio-based Lubricants)

3.3. Opportunities

3.3.1. Technological Innovations in Lubricants (Nano-lubricants, High-performance Oils)

3.3.2. Government Incentives for Energy-Efficient Solutions

3.3.3. Increasing Demand for Synthetic and Bio-based Lubricants

3.4. Trends

3.4.1. Shift Towards High-performance Lubricants

3.4.2. Increased Adoption of Eco-friendly Lubricants

3.4.3. Rising Integration of Digital Platforms in Distribution

3.5. Government Regulation

3.5.1. Indian Emission Standards (BS-VI, Euro Norms)

3.5.2. Policies Promoting Green Lubricants

3.5.3. Regulatory Framework on Recycling and Disposal

3.6. SWOT Analysis

3.7. Stake Ecosystem (OEMs, Suppliers, Distributors, End-users)

3.8. Porters Five Forces

3.8.1. Threat of New Entrants

3.8.2. Bargaining Power of Buyers

3.8.3. Bargaining Power of Suppliers

3.8.4. Threat of Substitutes

3.8.5. Competitive Rivalry

3.9. Competition Ecosystem (Market Players, Regional Influence)

4. India Lubricant Market Segmentation

4.1. By Product Type (In Value & Volume %)

4.1.1. Automotive Lubricants

4.1.2. Industrial Lubricants

4.1.3. Marine Lubricants

4.1.4. Metalworking Fluids

4.1.5. Hydraulic Fluids

4.2. By Base Oil (In Value %)

4.2.1. Mineral Oil

4.2.2. Synthetic Oil

4.2.3. Semi-Synthetic Oil

4.2.4. Bio-based Oil

4.3. By Viscosity Grade (In Value %)

4.3.1. Single Grade

4.3.2. Multi Grade

4.4. By Distribution Channel (In Value %)

4.4.1. OEM

4.4.2. Aftermarket

4.4.3. E-Commerce

4.5. By End-use Industry (In Value %)

4.5.1. Automotive (Passenger Cars, Commercial Vehicles)

4.5.2. Industrial (Manufacturing, Construction, Power Generation)

4.5.3. Marine

4.5.4. Aerospace

4.5.5. Agriculture

4.6 By Region

4.6.1 North

4.6.2 South

4.6.3 East

4.6.4 West

5. India Lubricant Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Indian Oil Corporation

5.1.2. Bharat Petroleum Corporation

5.1.3. Hindustan Petroleum Corporation Limited

5.1.4. Castrol India Limited

5.1.5. Shell India Markets Pvt Ltd

5.1.6. ExxonMobil Lubricants Pvt Ltd

5.1.7. Total India

5.1.8. Valvoline Cummins Pvt Ltd

5.1.9. Gulf Oil Lubricants India Ltd

5.1.10. Apar Industries

5.1.11. Savita Oil Technologies

5.1.12. Tide Water Oil Co. India

5.1.13. Petronas Lubricants

5.1.14. Blaser Swisslube

5.1.15. Fuchs Lubricants

5.2. Cross Comparison Parameters

5.2.1No. of Employees, Headquarters, Inception Year, Revenue, Global Presence,Product Portfolio

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.4.1. New Product Launches, Market Expansion, Technological Innovations

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Lubricant Market Regulatory Framework

6.1. Environmental Standards (Emission Regulations, Disposal Guidelines)

6.2. Compliance Requirements (API, ACEA, OEM Certifications)

6.3. Certification Processes (Bureau of Indian Standards, ISO Certifications)

7. India Lubricant Market Future Size (In USD Bn)

7.1. Future Market Size Projections (Base Oil Demand, Key Sectors)

7.2. Key Factors Driving Future Growth (Adoption of Synthetic Oils, Demand for Sustainable Lubricants)

8. India Lubricant Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Base Oil (In Value %)

8.3. By Viscosity Grade (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By End-use Industry (In Value %)

9. India Lubricant Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a comprehensive market ecosystem for the India lubricant market. This includes mapping key stakeholders, such as manufacturers, distributors, and end-users. Through desk research, we gather data on market trends, production volumes, and sales figures, using both secondary and proprietary databases. This ensures a well-rounded understanding of the key variables influencing market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data is compiled and analyzed to understand past market trends, consumption patterns, and key growth factors. A thorough analysis of the base oil market, product categories, and end-user segments will help provide accurate market forecasts. Service quality and competitive performance are evaluated to ensure reliability in revenue estimations.

Step 3: Hypothesis Validation and Expert Consultation

To validate market hypotheses, expert consultations are conducted with key players in the lubricant industry. Computer-assisted telephone interviews (CATI) with senior executives from major companies provide insights on market strategies, product innovations, and operational challenges. This step helps refine our analysis and ensures that the data reflects real-world market conditions.

Step 4: Research Synthesis and Final Output

In the final phase, data from various sources, including manufacturers and distributors, is synthesized into a cohesive report. This bottom-up approach ensures that all market segments, including product types, base oils, and end-user industries, are comprehensively analyzed. The final report provides a complete view of the India lubricant market, validated by industry professionals.

Frequently Asked Questions

01. How big is the India Lubricant Market?

The India lubricant market is valued at 3 Bn Liters, driven by the growth of the automotive sector and industrial activities. High demand for automotive lubricants continues to push market size upward.

02. What are the challenges in the India Lubricant Market?

Challenges include in Indian lubricant market are fluctuating crude oil prices, environmental regulations, and increasing competition from synthetic and bio-based lubricants. Additionally, counterfeit products in the lubricant market pose significant challenges.

03. Who are the major players in the India Lubricant Market?

Major players in Indian lubricant market include Indian Oil Corporation, Bharat Petroleum Corporation, Castrol India Limited, Shell India, and ExxonMobil. These companies dominate due to their strong distribution networks and focus on product innovation.

04. What are the growth drivers of the India Lubricant Market?

Growth in Indian lubricant market is driven by the rapid expansion of the automotive industry, rising awareness about the importance of vehicle maintenance, and the increasing industrialization of the country. The shift towards synthetic lubricants is another key driver.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.